| |

UNITED

STATES |

|

| |

SECURITIES &

EXCHANGE COMMISSION |

|

| |

Washington,

D.C. 20549 |

|

| |

|

|

| |

SCHEDULE

13D |

|

Under the Securities Exchange Act of 1934

(Amendment No. 29)*

Monster Beverage

Corporation

(Name of Issuer)

Common Stock

(Title of Class of Securities)

61174X109

(CUSIP Number)

Rodney C. Sacks

1 Monster Way

Corona, California 92879

(951) 739-6200

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

December 27, 2023

(Date of Event which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ¨.

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See § 240.13d-7

for other parties to whom copies are to be sent.

*The remainder

of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class

of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information

required in the remainder of this cover page shall not be deemed to be "filed" for purpose of Section 18 of the Securities

Exchange Act of 1934 ("Act") or otherwise subject to the liabilities of that section of the Act but shall be subject to all

other provisions of the Act (however, see the Notes).

| CUSIP

No. 61174X109 |

13D/A |

|

| (1) |

Names of Reporting Persons

Brandon Limited Partnership No. 1 |

| |

| (2) |

Check

the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a) |

¨ |

| |

(b) |

¨ |

| |

| (3) |

SEC

Use Only |

| |

| (4) |

Source

of Funds (See Instructions)

WC (See Item 3) |

| |

| (5) |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| |

| (6) |

Citizenship

or Place of Organization

Cayman Islands |

| |

|

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

(7) |

Sole

Voting Power

0 |

| |

| (8) |

Shared

Voting Power

11,291,136 |

| |

| (9) |

Sole

Dispositive Power

0 |

| |

| (10) |

Shared

Dispositive Power

11,291,136 |

| |

|

| (11) |

Aggregate

Amount Beneficially Owned by Each Reporting Person

11,291,136 |

| |

| (12) |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

| (13) |

Percent

of Class Represented by Amount in Row (11)

1.1% |

| |

| (14) |

Type

of Reporting Person (See Instructions)

PN |

| CUSIP

No. 61174X109 |

13D/A |

|

| (1) |

Names of Reporting Persons

Brandon Limited Partnership No. 2 |

| |

| (2) |

Check

the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a) |

¨ |

| |

(b) |

¨ |

| |

| (3) |

SEC

Use Only |

| |

| (4) |

Source

of Funds (See Instructions)

WC (See Item 3) |

| |

| (5) |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| |

| (6) |

Citizenship

or Place of Organization

Cayman Islands |

| |

|

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

(7) |

Sole

Voting Power

0 |

| |

| (8) |

Shared

Voting Power

58,773,888 |

| |

| (9) |

Sole

Dispositive Power

0 |

| |

| (10) |

Shared

Dispositive Power

58,773,888 |

| |

|

| (11) |

Aggregate

Amount Beneficially Owned by Each Reporting Person

58,773,888 |

| |

| (12) |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

| (13) |

Percent

of Class Represented by Amount in Row (11)

5.6% |

| |

| (14) |

Type

of Reporting Person (See Instructions)

PN |

| CUSIP

No. 61174X109 |

13D/A |

|

| (1) |

Names of Reporting Persons

Rodney Cyril Sacks |

| |

| (2) |

Check

the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a) |

¨ |

| |

(b) |

¨ |

| |

| (3) |

SEC

Use Only |

| |

| (4) |

Source

of Funds (See Instructions)

PF (See Item 3) |

| |

| (5) |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| |

| (6) |

Citizenship

or Place of Organization

United States of America |

| |

|

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

(7) |

Sole

Voting Power

1,956,525 |

| |

| (8) |

Shared

Voting Power

78,939,306 |

| |

| (9) |

Sole

Dispositive Power

1,956,525 |

| |

| (10) |

Shared

Dispositive Power

78,939,306 |

| |

|

| (11) |

Aggregate

Amount Beneficially Owned by Each Reporting Person

80,895,831 |

| |

| (12) |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

| (13) |

Percent

of Class Represented by Amount in Row (11)

7.7% |

| |

| (14) |

Type

of Reporting Person (See Instructions)

IN |

| CUSIP

No. 61174X109 |

13D/A |

|

| (1) |

Names of Reporting Persons

Hilton Hiller Schlosberg |

| |

| (2) |

Check

the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a) |

¨ |

| |

(b) |

¨ |

| |

| (3) |

SEC

Use Only |

| |

| (4) |

Source

of Funds (See Instructions)

PF (See Item 3) |

| |

| (5) |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| |

| (6) |

Citizenship

or Place of Organization

United Kingdom |

| |

|

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

(7) |

Sole

Voting Power

2,976,981 |

| |

| (8) |

Shared

Voting Power

78,939,306 |

| |

| (9) |

Sole

Dispositive Power

2,976,981 |

| |

| (10) |

Shared

Dispositive Power

78,939,306 |

| |

|

| (11) |

Aggregate

Amount Beneficially Owned by Each Reporting Person

81,916,287 |

| |

| (12) |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

| (13) |

Percent

of Class Represented by Amount in Row (11)

7.8% |

| |

| (14) |

Type

of Reporting Person (See Instructions)

IN |

| CUSIP

No. 61174X109 |

13D/A |

|

| (1) |

Names of Reporting Persons

Hilrod Holdings IV, L.P. |

| |

| (2) |

Check

the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a) |

¨ |

| |

(b) |

¨ |

| |

| (3) |

SEC

Use Only |

| |

| (4) |

Source

of Funds (See Instructions)

PF (See Item 3) |

| |

| (5) |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| |

| (6) |

Citizenship

or Place of Organization

Delaware |

| |

|

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

(7) |

Sole

Voting Power

0 |

| |

| (8) |

Shared

Voting Power

106,868 |

| |

| (9) |

Sole

Dispositive Power

0 |

| |

| (10) |

Shared

Dispositive Power

106,868 |

| |

|

| (11) |

Aggregate

Amount Beneficially Owned by Each Reporting Person

106,868 |

| |

| (12) |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

| (13) |

Percent

of Class Represented by Amount in Row (11)

0.0% |

| |

| (14) |

Type

of Reporting Person (See Instructions)

PN |

| CUSIP

No. 61174X109 |

13D/A |

|

| (1) |

Names of Reporting Persons

Hilrod Holdings V, L.P. |

| |

| (2) |

Check

the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a) |

¨ |

| |

(b) |

¨ |

| |

| (3) |

SEC

Use Only |

| |

| (4) |

Source

of Funds (See Instructions)

PF (See Item 3) |

| |

| (5) |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| |

| (6) |

Citizenship

or Place of Organization

Delaware |

| |

|

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

(7) |

Sole

Voting Power

0 |

| |

| (8) |

Shared

Voting Power

218,570 |

| |

| (9) |

Sole

Dispositive Power

0 |

| |

| (10) |

Shared

Dispositive Power

218,570 |

| |

|

| (11) |

Aggregate

Amount Beneficially Owned by Each Reporting Person

218,570 |

| |

| (12) |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

| (13) |

Percent

of Class Represented by Amount in Row (11)

0.0% |

| |

| (14) |

Type

of Reporting Person (See Instructions)

PN |

| CUSIP

No. 61174X109 |

13D/A |

|

| (1) |

Names of Reporting Persons

Hilrod Holdings VI, L.P. |

| |

| (2) |

Check

the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a) |

¨ |

| |

(b) |

¨ |

| |

| (3) |

SEC

Use Only |

| |

| (4) |

Source

of Funds (See Instructions)

PF (See Item 3) |

| |

| (5) |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| |

| (6) |

Citizenship

or Place of Organization

Delaware |

| |

|

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

(7) |

Sole

Voting Power

0 |

| |

| (8) |

Shared

Voting Power

647,400 |

| |

| (9) |

Sole

Dispositive Power

0 |

| |

| (10) |

Shared

Dispositive Power

647,400 |

| |

|

| (11) |

Aggregate

Amount Beneficially Owned by Each Reporting Person

647,400 |

| |

| (12) |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

| (13) |

Percent

of Class Represented by Amount in Row (11)

0.1% |

| |

| (14) |

Type

of Reporting Person (See Instructions)

PN |

| CUSIP

No. 61174X109 |

13D/A |

|

| (1) |

Names of Reporting Persons

Hilrod Holdings VII, L.P. |

| |

| (2) |

Check

the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a) |

¨ |

| |

(b) |

¨ |

| |

| (3) |

SEC

Use Only |

| |

| (4) |

Source

of Funds (See Instructions)

PF (See Item 3) |

| |

| (5) |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| |

| (6) |

Citizenship

or Place of Organization

Delaware |

| |

|

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

(7) |

Sole

Voting Power

0 |

| |

| (8) |

Shared

Voting Power

0 |

| |

| (9) |

Sole

Dispositive Power

0 |

| |

| (10) |

Shared

Dispositive Power

0 |

| |

|

| (11) |

Aggregate

Amount Beneficially Owned by Each Reporting Person

0 |

| |

| (12) |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

| (13) |

Percent

of Class Represented by Amount in Row (11)

0.0% |

| |

| (14) |

Type

of Reporting Person (See Instructions)

PN |

| CUSIP

No. 61174X109 |

13D/A |

|

| (1) |

Names of Reporting Persons

Hilrod Holdings VIII, L.P. |

| |

| (2) |

Check

the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a) |

¨ |

| |

(b) |

¨ |

| |

| (3) |

SEC

Use Only |

| |

| (4) |

Source

of Funds (See Instructions)

PF (See Item 3) |

| |

| (5) |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| |

| (6) |

Citizenship

or Place of Organization

Delaware |

| |

|

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

(7) |

Sole

Voting Power

0 |

| |

| (8) |

Shared

Voting Power

579,956 |

| |

| (9) |

Sole

Dispositive Power

0 |

| |

| (10) |

Shared

Dispositive Power

579,956 |

| |

|

| (11) |

Aggregate

Amount Beneficially Owned by Each Reporting Person

579,956 |

| |

| (12) |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

| (13) |

Percent

of Class Represented by Amount in Row (11)

0.1% |

| |

| (14) |

Type

of Reporting Person (See Instructions)

PN |

| CUSIP

No. 61174X109 |

13D/A |

|

| (1) |

Names of Reporting Persons

Hilrod Holdings IX, L.P. |

| |

| (2) |

Check

the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a) |

¨ |

| |

(b) |

¨ |

| |

| (3) |

SEC

Use Only |

| |

| (4) |

Source

of Funds (See Instructions)

PF (See Item 3) |

| |

| (5) |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| |

| (6) |

Citizenship

or Place of Organization

Delaware |

| |

|

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

(7) |

Sole

Voting Power

0 |

| |

| (8) |

Shared

Voting Power

462,512 |

| |

| (9) |

Sole

Dispositive Power

0 |

| |

| (10) |

Shared

Dispositive Power

462,512 |

| |

|

| (11) |

Aggregate

Amount Beneficially Owned by Each Reporting Person

462,512 |

| |

| (12) |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

| (13) |

Percent

of Class Represented by Amount in Row (11)

0.0% |

| |

| (14) |

Type

of Reporting Person (See Instructions)

PN |

| CUSIP

No. 61174X109 |

13D/A |

|

| (1) |

Names of Reporting Persons

Hilrod Holdings X, L.P. |

| |

| (2) |

Check

the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a) |

¨ |

| |

(b) |

¨ |

| |

| (3) |

SEC

Use Only |

| |

| (4) |

Source

of Funds (See Instructions)

PF (See Item 3) |

| |

| (5) |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| |

| (6) |

Citizenship

or Place of Organization

Delaware |

| |

|

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

(7) |

Sole

Voting Power

0 |

| |

| (8) |

Shared

Voting Power

0 |

| |

| (9) |

Sole

Dispositive Power

0 |

| |

| (10) |

Shared

Dispositive Power

0 |

| |

|

| (11) |

Aggregate

Amount Beneficially Owned by Each Reporting Person

0 |

| |

| (12) |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

| (13) |

Percent

of Class Represented by Amount in Row (11)

0.0% |

| |

| (14) |

Type

of Reporting Person (See Instructions)

PN |

| CUSIP

No. 61174X109 |

13D/A |

|

| (1) |

Names of Reporting Persons

Hilrod Holdings XI, L.P. |

| |

| (2) |

Check

the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a) |

¨ |

| |

(b) |

¨ |

| |

| (3) |

SEC

Use Only |

| |

| (4) |

Source

of Funds (See Instructions)

PF (See Item 3) |

| |

| (5) |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| |

| (6) |

Citizenship

or Place of Organization

Delaware |

| |

|

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

(7) |

Sole

Voting Power

0 |

| |

| (8) |

Shared

Voting Power

0 |

| |

| (9) |

Sole

Dispositive Power

0 |

| |

| (10) |

Shared

Dispositive Power

0 |

| |

|

| (11) |

Aggregate

Amount Beneficially Owned by Each Reporting Person

0 |

| |

| (12) |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

| (13) |

Percent

of Class Represented by Amount in Row (11)

0.0% |

| |

| (14) |

Type

of Reporting Person (See Instructions)

PN |

| CUSIP

No. 61174X109 |

13D/A |

|

| (1) |

Names of Reporting Persons

Hilrod Holdings XII, L.P. |

| |

| (2) |

Check

the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a) |

¨ |

| |

(b) |

¨ |

| |

| (3) |

SEC

Use Only |

| |

| (4) |

Source

of Funds (See Instructions)

PF (See Item 3) |

| |

| (5) |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| |

| (6) |

Citizenship

or Place of Organization

Delaware |

| |

|

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

(7) |

Sole

Voting Power

0 |

| |

| (8) |

Shared

Voting Power

0 |

| |

| (9) |

Sole

Dispositive Power

0 |

| |

| (10) |

Shared

Dispositive Power

0 |

| |

|

| (11) |

Aggregate

Amount Beneficially Owned by Each Reporting Person

0 |

| |

| (12) |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

| (13) |

Percent

of Class Represented by Amount in Row (11)

0.0% |

| |

| (14) |

Type

of Reporting Person (See Instructions)

PN |

| CUSIP No.

61174X109 |

13D/A |

|

| (1) |

Names of Reporting Persons

Hilrod Holdings XIII, L.P. |

| |

| (2) |

Check

the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a) |

¨ |

| |

(b) |

¨ |

| |

| (3) |

SEC

Use Only |

| |

| (4) |

Source

of Funds (See Instructions)

PF (See Item 3) |

| |

| (5) |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| |

| (6) |

Citizenship

or Place of Organization

Delaware |

| |

|

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

(7) |

Sole

Voting Power

0 |

| |

| (8) |

Shared

Voting Power

0 |

| |

| (9) |

Sole

Dispositive Power

0 |

| |

| (10) |

Shared

Dispositive Power

0 |

| |

|

| (11) |

Aggregate

Amount Beneficially Owned by Each Reporting Person

0 |

| |

| (12) |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

| (13) |

Percent

of Class Represented by Amount in Row (11)

0.0% |

| |

| (14) |

Type

of Reporting Person (See Instructions)

PN |

| CUSIP No.

61174X109 |

13D/A |

|

| (1) |

Names of Reporting Persons

Hilrod Holdings XIV, L.P. |

| |

| (2) |

Check

the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a) |

¨ |

| |

(b) |

¨ |

| |

| (3) |

SEC

Use Only |

| |

| (4) |

Source

of Funds (See Instructions)

PF (See Item 3) |

| |

| (5) |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| |

| (6) |

Citizenship

or Place of Organization

Delaware |

| |

|

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

(7) |

Sole

Voting Power

0 |

| |

| (8) |

Shared

Voting Power

0 |

| |

| (9) |

Sole

Dispositive Power

0 |

| |

| (10) |

Shared

Dispositive Power

0 |

| |

|

| (11) |

Aggregate

Amount Beneficially Owned by Each Reporting Person

0 |

| |

| (12) |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

| (13) |

Percent

of Class Represented by Amount in Row (11)

0.0% |

| |

| (14) |

Type

of Reporting Person (See Instructions)

PN |

| CUSIP No.

61174X109 |

13D/A |

|

| (1) |

Names of Reporting Persons

Hilrod Holdings XV, L.P. |

| |

| (2) |

Check

the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a) |

¨ |

| |

(b) |

¨ |

| |

| (3) |

SEC

Use Only |

| |

| (4) |

Source

of Funds (See Instructions)

PF (See Item 3) |

| |

| (5) |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| |

| (6) |

Citizenship

or Place of Organization

Delaware |

| |

|

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

(7) |

Sole

Voting Power

0 |

| |

| (8) |

Shared

Voting Power

361,356 |

| |

| (9) |

Sole

Dispositive Power

0 |

| |

| (10) |

Shared

Dispositive Power

361,356 |

| |

|

| (11) |

Aggregate

Amount Beneficially Owned by Each Reporting Person

361,356 |

| |

| (12) |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

| (13) |

Percent

of Class Represented by Amount in Row (11)

0.0% |

| |

| (14) |

Type

of Reporting Person (See Instructions)

PN |

| CUSIP No.

61174X109 |

13D/A |

|

| (1) |

Names of Reporting Persons

Hilrod Holdings XVI, L.P. |

| |

| (2) |

Check

the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a) |

¨ |

| |

(b) |

¨ |

| |

| (3) |

SEC

Use Only |

| |

| (4) |

Source

of Funds (See Instructions)

PF (See Item 3) |

| |

| (5) |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| |

| (6) |

Citizenship

or Place of Organization

Delaware |

| |

|

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

(7) |

Sole

Voting Power

0 |

| |

| (8) |

Shared

Voting Power

771,392 |

| |

| (9) |

Sole

Dispositive Power

0 |

| |

| (10) |

Shared

Dispositive Power

771,392 |

| |

|

| (11) |

Aggregate

Amount Beneficially Owned by Each Reporting Person

771,392 |

| |

| (12) |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

| (13) |

Percent

of Class Represented by Amount in Row (11)

0.1% |

| |

| (14) |

Type

of Reporting Person (See Instructions)

PN |

| CUSIP No.

61174X109 |

13D/A |

|

| (1) |

Names of Reporting Persons

Hilrod Holdings XVIII, L.P. |

| |

| (2) |

Check

the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a) |

¨ |

| |

(b) |

¨ |

| |

| (3) |

SEC

Use Only |

| |

| (4) |

Source

of Funds (See Instructions)

PF (See Item 3) |

| |

| (5) |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| |

| (6) |

Citizenship

or Place of Organization

Delaware |

| |

|

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

(7) |

Sole

Voting Power

0 |

| |

| (8) |

Shared

Voting Power

927,656 |

| |

| (9) |

Sole

Dispositive Power

0 |

| |

| (10) |

Shared

Dispositive Power

927,656 |

| |

|

| (11) |

Aggregate

Amount Beneficially Owned by Each Reporting Person

927,656 |

| |

| (12) |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

| (13) |

Percent

of Class Represented by Amount in Row (11)

0.1% |

| |

| (14) |

Type

of Reporting Person (See Instructions)

PN |

| CUSIP No.

61174X109 |

13D/A |

|

| (1) |

Names of Reporting Persons

Hilrod Holdings XIX, L.P. |

| |

| (2) |

Check

the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a) |

¨ |

| |

(b) |

¨ |

| |

| (3) |

SEC

Use Only |

| |

| (4) |

Source

of Funds (See Instructions)

PF (See Item 3) |

| |

| (5) |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| |

| (6) |

Citizenship

or Place of Organization

Delaware |

| |

|

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

(7) |

Sole

Voting Power

0 |

| |

| (8) |

Shared

Voting Power

673,544 |

| |

| (9) |

Sole

Dispositive Power

0 |

| |

| (10) |

Shared

Dispositive Power

673,544 |

| |

|

| (11) |

Aggregate

Amount Beneficially Owned by Each Reporting Person

673,544 |

| |

| (12) |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

| (13) |

Percent

of Class Represented by Amount in Row (11)

0.1% |

| |

| (14) |

Type

of Reporting Person (See Instructions)

PN |

| CUSIP No.

61174X109 |

13D/A |

|

| (1) |

Names of Reporting Persons

Hilrod Holdings XX, L.P. |

| |

| (2) |

Check

the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a) |

¨ |

| |

(b) |

¨ |

| |

| (3) |

SEC

Use Only |

| |

| (4) |

Source

of Funds (See Instructions)

PF (See Item 3) |

| |

| (5) |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| |

| (6) |

Citizenship

or Place of Organization

Delaware |

| |

|

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

(7) |

Sole

Voting Power

0 |

| |

| (8) |

Shared

Voting Power

729,272 |

| |

| (9) |

Sole

Dispositive Power

0 |

| |

|

| (10) |

Shared

Dispositive Power

729,272 |

| |

|

| (11) |

Aggregate

Amount Beneficially Owned by Each Reporting Person

729,272 |

| |

| (12) |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

| (13) |

Percent

of Class Represented by Amount in Row (11)

0.1% |

| |

| (14) |

Type

of Reporting Person (See Instructions)

PN |

| CUSIP No.

61174X109 |

13D/A |

|

| (1) |

Names of Reporting Persons

Hilrod Holdings XXI, L.P. |

| |

| (2) |

Check

the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a) |

¨ |

| |

(b) |

¨ |

| |

| (3) |

SEC

Use Only |

| |

| (4) |

Source

of Funds (See Instructions)

PF (See Item 3) |

| |

| (5) |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| |

| (6) |

Citizenship

or Place of Organization

Delaware |

| |

|

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

(7) |

Sole

Voting Power

0 |

| |

| (8) |

Shared

Voting Power

729,272 |

| |

| (9) | Sole

Dispositive Power

0 |

| |

| (10) | Shared

Dispositive Power

729,272 |

| | |

| (11) | Aggregate

Amount Beneficially Owned by Each Reporting Person

729,272 |

| |

| (12) | Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

¨ |

| |

| (13) | Percent

of Class Represented by Amount in Row (11)

0.1% |

| |

| (14) | Type

of Reporting Person (See Instructions)

PN |

| CUSIP No.

61174X109 |

13D/A |

|

| (1) |

Names of Reporting Persons

Hilrod Holdings XXII, L.P. |

| |

| (2) |

Check

the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a) |

¨ |

| |

(b) |

¨ |

| |

| (3) |

SEC

Use Only |

| |

| (4) |

Source

of Funds (See Instructions)

PF (See Item 3) |

| |

| (5) |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| |

| (6) |

Citizenship

or Place of Organization

Delaware |

| |

|

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

(7) |

Sole

Voting Power

0 |

| |

| (8) |

Shared

Voting Power 0 |

| |

| (9) |

Sole

Dispositive Power

0 |

| |

| (10) |

Shared

Dispositive Power

0 |

| |

|

| (11) |

Aggregate

Amount Beneficially Owned by Each Reporting Person

0 |

| |

| (12) |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

| (13) |

Percent

of Class Represented by Amount in Row (11)

0.0% |

| |

| (14) |

Type

of Reporting Person (See Instructions)

PN |

| CUSIP No.

61174X109 |

13D/A |

|

| (1) |

Names of Reporting Persons

Hilrod Holdings XXIII, L.P. |

| |

| (2) |

Check

the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a) |

¨ |

| |

(b) |

¨ |

| |

| (3) |

SEC

Use Only |

| |

| (4) |

Source

of Funds (See Instructions)

PF (See Item 3) |

| |

| (5) |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| |

| (6) |

Citizenship

or Place of Organization

Delaware |

| |

|

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

(7) |

Sole

Voting Power

0 |

| |

| (8) |

Shared

Voting Power

1,464,320 |

| |

| (9) |

Sole

Dispositive Power

0 |

| |

| (10) |

Shared

Dispositive Power

1,464,320 |

| |

|

| (11) |

Aggregate

Amount Beneficially Owned by Each Reporting Person

1,464,320 |

| |

| (12) |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

| (13) |

Percent

of Class Represented by Amount in Row (11)

0.1% |

| |

| (14) |

Type

of Reporting Person (See Instructions)

PN |

| CUSIP No.

61174X109 |

13D/A |

|

| (1) |

Names of Reporting Persons

Hilrod Holdings XXIV, L.P. |

| |

| (2) |

Check

the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a) |

¨ |

| |

(b) |

¨ |

| |

| (3) |

SEC

Use Only |

| |

| (4) |

Source

of Funds (See Instructions)

PF (See Item 3) |

| |

| (5) |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| |

| (6) |

Citizenship

or Place of Organization

Delaware |

| |

|

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

(7) |

Sole

Voting Power

0 |

| |

| (8) |

Shared

Voting Power

489,124 |

| |

| (9) |

Sole

Dispositive Power

0 |

| |

| (10) |

Shared

Dispositive Power

489,124 |

| |

|

| (11) |

Aggregate

Amount Beneficially Owned by Each Reporting Person

489,124 |

| |

| (12) |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

| (13) |

Percent

of Class Represented by Amount in Row (11)

0.0% |

| |

| (14) |

Type

of Reporting Person (See Instructions)

PN |

| CUSIP No.

61174X109 |

13D/A |

|

| (1) |

Names of Reporting Persons

Hilrod Holdings XXV, L.P. |

| |

| (2) |

Check

the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a) |

¨ |

| |

(b) |

¨ |

| |

| (3) |

SEC

Use Only |

| |

| (4) |

Source

of Funds (See Instructions)

PF (See Item 3) |

| |

| (5) |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| |

| (6) |

Citizenship

or Place of Organization

Delaware |

| |

|

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

(7) |

Sole

Voting Power

0 |

| |

| (8) |

Shared

Voting Power

268,000 |

| |

| (9) |

Sole

Dispositive Power

0 |

| |

| (10) |

Shared

Dispositive Power

268,000 |

| |

|

| (11) |

Aggregate

Amount Beneficially Owned by Each Reporting Person

268,000 |

| |

| (12) |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

| (13) |

Percent

of Class Represented by Amount in Row (11)

0.0% |

| |

| (14) |

Type

of Reporting Person (See Instructions)

PN |

| CUSIP No.

61174X109 |

13D/A |

|

| (1) |

Names of Reporting Persons

Hilrod Holdings XXVI, L.P. |

| |

| (2) |

Check

the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a) |

¨ |

| |

(b) |

¨ |

| |

| (3) |

SEC

Use Only |

| |

| (4) |

Source

of Funds (See Instructions)

PF (See Item 3) |

| |

| (5) |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| |

| (6) |

Citizenship

or Place of Organization

Delaware |

| |

|

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

(7) |

Sole

Voting Power

0 |

| |

| (8) |

Shared

Voting Power

2,760,700 |

| |

| (9) |

Sole

Dispositive Power

0 |

| |

| (10) |

Shared

Dispositive Power

2,760,700 |

| |

|

| (11) |

Aggregate

Amount Beneficially Owned by Each Reporting Person

2,760,700 |

| |

| (12) |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

| (13) |

Percent

of Class Represented by Amount in Row (11)

0.3% |

| |

| (14) |

Type

of Reporting Person (See Instructions)

PN |

| CUSIP

No. 61174X109 |

13D/A |

|

Introduction

This Amendment No. 29 (“Amendment

No. 29”) amends the statement on Schedule 13D dated November 21, 1990 (the “Original Statement”),

as amended by Amendment No. 1 dated March 29, 1991 (“Amendment No. 1”), Amendment No. 2 dated

June 11, 1993 (“Amendment No. 2”), Amendment No. 3 dated August 29, 1994 (“Amendment

No. 3”), Amendment No. 4 dated November 22, 2004 (“Amendment No. 4”), Amendment No. 5

dated December 1, 2004 (“Amendment No. 5”), Amendment No. 6 dated December 29, 2005 (“Amendment

No. 6”), Amendment No. 7 dated January 13, 2006 (“Amendment No. 7”), Amendment No. 8

dated February 2, 2006 (“Amendment No. 8”), Amendment No. 9 dated February 23, 2010 (“Amendment

No. 9”), Amendment No. 10 dated November 23, 2010 (“Amendment No. 10”), Amendment No. 11

dated December 16, 2011 (“Amendment No. 11”), Amendment No. 12 dated April 24, 2012 (“Amendment

No. 12”), Amendment No. 13 dated May 21, 2012 (“Amendment No. 13”), Amendment No. 14

dated December 17, 2012 (“Amendment No. 14”), Amendment No. 15 dated March 18, 2013 (“Amendment

No. 15”), Amendment No. 16 dated July 29, 2013 (“Amendment No. 16”), Amendment No. 17

dated September 16, 2013 (“Amendment No. 17”), Amendment No. 18 dated December 17, 2013 (“Amendment

No. 18”), Amendment No. 19 dated August 18, 2014 (“Amendment No. 19”), Amendment No. 20

dated September 16, 2014 (“Amendment No. 20”), Amendment No. 21 dated December 16, 2014 (“Amendment

No. 21”), Amendment No. 22 dated March 17, 2015 (“Amendment No. 22”), Amendment No. 23

dated June 16, 2015 (“Amendment No. 23”), Amendment No. 24 dated May 10, 2016 (“Amendment

No. 24”), Amendment No. 25 dated June 15, 2016 (“Amendment No. 25”), Amendment

No. 26 dated December 14, 2017 (“Amendment No. 26”), Amendment No. 27 dated April 21, 2020

(“Amendment No. 27”), and Amendment No. 28 dated December 2, 2022 (“Amendment No. 28”)

(the Original Statement, Amendment No. 1, Amendment No. 2, Amendment No. 3, Amendment No. 4, Amendment No. 5,

Amendment No. 6, Amendment No. 7, Amendment No. 8, Amendment No. 9, Amendment No. 10, Amendment No. 11,

Amendment No. 12, Amendment No. 13, Amendment No. 14, Amendment No. 15, Amendment No. 16, Amendment No. 17,

Amendment No. 18, Amendment No. 19, Amendment No. 20, Amendment No. 21, Amendment No. 22, Amendment No. 23,

Amendment No. 24, Amendment No. 25, Amendment No. 26, Amendment No. 27, Amendment No. 28, and Amendment No. 29

are sometimes referred to herein collectively as this “statement on Schedule 13D”), relating to the common stock,

par value $0.005 per share (“Common Stock”), of Monster Beverage Corporation, a corporation organized under the laws

of the state of Delaware (the “Company”). This Amendment No. 29 reflects transactions and developments

through February 23, 2024, relating to such persons’ respective holdings of the Company. The Reporting Persons may be

deemed to constitute a “group” and, accordingly, jointly file this Amendment No. 29. A joint filing agreement by the

Reporting Persons is filed as an exhibit hereto.

Any capitalized terms used in this Amendment No. 29

and not otherwise defined herein shall have the meanings ascribed to such terms in the Original Statement, as amended by Amendment No. 1,

Amendment No. 2, Amendment No. 3, Amendment No. 4, Amendment No. 5, Amendment No. 6, Amendment No. 7, Amendment

No. 8, Amendment No. 9, Amendment No. 10, Amendment No. 11, Amendment No. 12, Amendment No. 13, Amendment

No. 14, Amendment No. 15, Amendment No. 16, Amendment No. 17, Amendment No. 18, Amendment No. 19, Amendment

No. 20, Amendment No. 21, Amendment No. 22, Amendment No. 23, Amendment No. 24, Amendment No. 25, Amendment

No. 26, Amendment No. 27, and Amendment No. 28.

This Amendment No. 29 is being filed to reflect

the change in percentage of beneficial ownership held by the Reporting Persons as a result of exercise of stock options, shares withheld

by the Company to satisfy the option exercise price and tax withholding obligations, gifting of shares by a Reporting Person and a change

in outstanding shares of Common Stock of the Company.

Item 2. Identity and Background

Item 2(a) is hereby amended by deleting

Item 2(a) in its entirety and inserting in lieu thereof the following:

(a) The reporting persons are Brandon Limited

Partnership No. 1, a limited partnership organized under the laws of the Cayman Islands (“Brandon No. 1”),

Brandon Limited Partnership No. 2, a limited partnership organized under the laws of the Cayman Islands (“Brandon No. 2”),

Rodney Cyril Sacks, a natural person in his individual capacity (“Mr. Sacks”), Hilton Hiller Schlosberg, a natural

person in his individual capacity (“Mr. Schlosberg”), Hilrod Holdings IV, L.P., a limited partnership organized

under the laws of the state of Delaware (“Hilrod IV”), Hilrod Holdings V, L.P., a limited partnership organized under

the laws of the state of Delaware (“Hilrod V”), Hilrod Holdings VI, L.P., a limited partnership organized under the

laws of the state of Delaware (“Hilrod VI”), Hilrod Holdings VII, L.P., a limited partnership organized under the

laws of the state of Delaware (“Hilrod VII”), Hilrod Holdings VIII, L.P., a limited partnership organized under the

laws of the state of Delaware (“Hilrod VIII”), Hilrod Holdings IX, L.P., a limited partnership organized under the

laws of the state of Delaware (“Hilrod IX”), Hilrod Holdings X, L.P., a limited partnership organized under the laws

of the state of Delaware (“Hilrod X”), Hilrod Holdings XI, L.P., a limited partnership organized under the laws of

the state of Delaware (“Hilrod XI”), Hilrod Holdings XII, L.P., a limited partnership organized under the laws of

the state of Delaware (“Hilrod XII”), Hilrod Holdings XIII, L.P., a limited partnership organized under the laws of

the state of Delaware (“Hilrod XIII”), Hilrod Holdings XIV, L.P., a limited partnership organized under the laws of

the state of Delaware (“Hilrod XIV”), Hilrod Holdings XV, L.P., a limited partnership organized under the laws of

the state of Delaware (“Hilrod XV”), Hilrod Holdings XVI, L.P., a limited partnership organized under the laws of

the state of Delaware (“Hilrod XVI”), Hilrod Holdings XVIII, L.P., a limited partnership organized under the laws

of the state of Delaware (“Hilrod XVIII”), Hilrod Holdings XIX, L.P., a limited partnership organized under the laws

of the state of Delaware (“Hilrod XIX”), Hilrod Holdings XX, L.P., a limited partnership organized under the laws

of the state of Delaware (“Hilrod XX”), Hilrod Holdings XXI, L.P., a limited partnership organized under the laws

of the state of Delaware (“Hilrod XXI”), Hilrod Holdings XXII, L.P., a limited partnership organized under the laws

of the state of Delaware (“Hilrod XXII”), Hilrod Holdings XXIII, L.P., a limited partnership organized under the laws

of the state of Delaware (“Hilrod XXIII”), Hilrod Holdings XXIV, L.P., a limited partnership organized under the laws

of the state of Delaware (“Hilrod XXIV”), Hilrod Holdings XXV, L.P., a limited partnership organized under the laws

of the state of Delaware (“Hilrod XXV”), and Hilrod Holdings XXVI, L.P., a limited partnership organized under the

laws of the state of Delaware (“Hilrod XXVI”).

The general partners of each of Brandon No. 1,

Brandon No. 2, Hilrod IV, Hilrod V, Hilrod VI, Hilrod VII, Hilrod VIII, Hilrod IX, Hilrod X, Hilrod XI, Hilrod XII, Hilrod XIII,

Hilrod XIV, Hilrod XV, Hilrod XVI, Hilrod XVIII, Hilrod XIX, Hilrod XX, Hilrod XXI, Hilrod XXII, Hilrod XXIII, Hilrod XXIV, Hilrod XXV

and Hilrod XXVI are Mr. Sacks and Mr. Schlosberg.

Item 5. Interest in Securities of the Issuer

Item 5 (a) through (c) is hereby

amended by deleting Item 5 (a) through (c) in its entirety and inserting in lieu thereof the following:

(a)-(b) See rows (7) through (10) of

the cover pages to this Amendment No. 29 for the number of shares of Common Stock as to which each Reporting Person has sole

or shared power to vote or direct the vote and sole or shared power to dispose or to direct the disposition. See rows (11) and

(13) of the cover pages to this Amendment No. 29 for the aggregate number and percentage of shares of Common Stock beneficially

owned by each of the Reporting Persons. Percentages calculated in this Amendment No. 29 with respect to Brandon No. 1, Brandon

No. 2, Hilrod IV, Hilrod V, Hilrod VI, Hilrod VII, Hilrod VIII, Hilrod IX, Hilrod X, Hilrod XI, Hilrod XII, Hilrod XIII, Hilrod

XIV, Hilrod XV, Hilrod XVI, Hilrod XVIII, Hilrod XIX, Hilrod XX, Hilrod XXI, Hilrod XXII, Hilrod XXIII, Hilrod XXIV, Hilrod XXV, and

Hilrod XXVI are based upon 1,040,636,235 shares of Common Stock outstanding as of February 15, 2024 (the “Aggregate Outstanding

Shares”). Percentages calculated in this Amendment No. 29 with respect to each of Mr. Sacks and Mr. Schlosberg

are based upon 1,043,969,263 shares of Common Stock, which is the sum of the Aggregate Outstanding Shares plus the 3,333,028 shares of

Common Stock that could be acquired within 60 days of February 23, 2024 by each of Mr. Sacks and Mr. Schlosberg upon the

exercise of options to purchase Common Stock and upon vesting of restricted stock units (“RSUs”).

As of February 23, 2024, the aggregate number

and percentage of shares of Common Stock beneficially owned by the Reporting Persons is 86,188,472 shares, or 8.2% of the outstanding

Common Stock. Percentages calculated in this Amendment No. 29 with respect to the Reporting Persons as a group are based upon

1,047,302,291 shares of Common Stock, which is the sum of the Aggregate Outstanding Shares plus the 6,666,056 aggregate shares of Common

Stock that could be acquired within 60 days of February 23, 2024 by the Reporting Persons upon the exercise of options to purchase

Common Stock and upon vesting of RSUs.

Each of the Reporting Persons disclaims

beneficial ownership of the Common Stock held by the other Reporting Persons, except for (a) with respect to Mr. Sacks:

(i) 939,157 shares of Common Stock beneficially held by him; (ii) 3,333,028 shares issuable upon exercise of options and

upon vesting of RSUs within 60 days of February 23,2024; (iii) 1,069 shares beneficially held by Hilrod IV because

Mr. Sacks is one of Hilrod IV’s general partners; (iv) 2,186 shares beneficially held by Hilrod V because

Mr. Sacks is one of Hilrod V’s general partners; (v) 6,474 shares beneficially held by Hilrod VI because

Mr. Sacks is one of Hilrod VI’s general partners; (vi) 5,800 shares beneficially held by Hilrod VIII because

Mr. Sacks is one of Hilrod VIII’s general partners; (vii) 4,625 shares beneficially held by Hilrod IX because

Mr. Sacks is one of Hilrod IX’s general partners; (viii) 3,614 shares beneficially held by Hilrod XV because

Mr. Sacks is one of Hilrod XV’s general partners; (ix) 7,714 shares beneficially held by Hilrod XVI because

Mr. Sacks is one of Hilrod XVI’s general partners; (x) 4,388 shares beneficially held by Hilrod XVIII because

Mr. Sacks is one of Hilrod XVIII’s general partners; (xi) 6,735 shares beneficially held by Hilrod XIX because

Mr. Sacks is one of Hilrod XIX’s general partners; (xii) 7,293 shares beneficially held by Hilrod XX because

Mr. Sacks is one of Hilrod XX’s general partners; (xiii) 7,293 shares beneficially held by Hilrod XXI because

Mr. Sacks is one of Hilrod XXI’s general partners;(xv) 826 shares beneficially held by Hilrod XXIII because

Mr. Sacks is one of Hilrod XXIII’s general partners; (xv) 4,891 shares beneficially held by Hilrod XXIV because

Mr. Sacks is one of Hilrod XXIV’s general partners; and (xvi) 2,680 shares beneficially held by Hilrod XXV because

Mr. Sacks is one of Hilrod XXV’s general partners; and (b) with respect to Mr. Schlosberg: (i) 1,959,613

shares of Common Stock beneficially held by him; (ii) 3,333,028 shares issuable upon exercise of options and upon vesting of

RSUs within 60 days of February 23, 2024; (iii) 1,069 shares beneficially held by Hilrod IV because Mr. Schlosberg is

one of Hilrod IV’s general partners; (iv) 2,186 shares beneficially held by Hilrod V because Mr. Schlosberg is one

of Hilrod V’s general partners; (v) 6,474 shares beneficially held by Hilrod VI because Mr. Schlosberg is one of

Hilrod VI’s general partners; (vi) 5,800 shares beneficially held by Hilrod VIII because Mr. Schlosberg is one of

Hilrod VIII’s general partners; (vii) 4,625 shares beneficially held by Hilrod IX because Mr. Schlosberg is one of

Hilrod IX’s general partners; (viii) 3,614 shares beneficially held by Hilrod XV because Mr. Schlosberg is one of

Hilrod XV’s general partners; (ix) 7,714 shares beneficially held by Hilrod XVI because Mr. Schlosberg is one of

Hilrod XVI’s general partners; (x) 4,388 shares beneficially held by Hilrod XVIII because Mr. Schlosberg is one of

Hilrod XVIII’s general partners; (xi) 6,735 shares beneficially held by Hilrod XIX because Mr. Schlosberg is one of

Hilrod XIX’s general partners; (xii) 7,293 shares beneficially held by Hilrod XX because Mr. Schlosberg is one of

Hilrod XX’s general partners; (xiii) 7,293 shares beneficially held by Hilrod XXI because Mr. Schlosberg is one of

Hilrod XXI’s general partners; (xiv) 826 shares beneficially held by Hilrod XXIII because Mr. Schlosberg is one of

Hilrod XXIII’s general partners; (xv) 4,891 shares beneficially held by Hilrod XXIV because Mr. Schlosberg is one of

Hilrod XXIV’s general partners; and (xvi) 2,680 shares beneficially held by Hilrod XXV because Mr. Schlosberg is one

of Hilrod XXV’s general partners.

(c) All

transactions effected by the Reporting Persons in the Company’s securities during the past 60 days are set forth in Schedule A

hereto.

Item 7. Material to be Filed as Exhibits.

| CUSIP

No. 61174X109 |

13D/A |

|

SIGNATURES

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

February 23, 2024

| |

BRANDON LIMITED PARTNERSHIP NO. 1 |

| |

|

|

| |

By: |

/s/

Rodney C. Sacks |

| |

|

Name: |

Rodney C. Sacks |

| |

|

Title: |

General Partner |

| |

|

|

| |

BRANDON LIMITED PARTNERSHIP NO. 2 |

| |

|

|

| |

By: |

/s/

Rodney C. Sacks |

| |

|

Name: |

Rodney C. Sacks |

| |

|

Title: |

General Partner |

| |

|

| |

Hilrod Holdings IV, L.P. |

| |

|

|

| |

By: |

/s/

Hilton H. Schlosberg |

| |

|

Name: |

Hilton H. Schlosberg |

| |

|

Title: |

General Partner |

| |

|

| |

Hilrod Holdings V, L.P. |

| |

|

|

| |

By: |

/s/

Hilton H. Schlosberg |

| |

|

Name: |

Hilton H. Schlosberg |

| |

|

Title: |

General Partner |

| |

|

| |

Hilrod Holdings VI, L.P. |

| |

|

|

| |

By: |

/s/

Hilton H. Schlosberg |

| |

|

Name: |

Hilton H. Schlosberg |

| |

|

Title: |

General Partner |

| |

|

| |

Hilrod Holdings VII, L.P. |

| |

|

|

| |

By: |

/s/

Hilton H. Schlosberg |

| |

|

Name: |

Hilton H. Schlosberg |

| |

|

Title: |

General Partner |

| |

|

| |

Hilrod Holdings VIII, L.P. |

| |

|

|

| |

By: |

/s/

Hilton H. Schlosberg |

| |

|

Name: |

Hilton H. Schlosberg |

| |

|

Title: |

General Partner |

| |

Hilrod Holdings IX, L.P. |

| |

|

|

| |

By: |

/s/

Hilton H. Schlosberg |

| |

|

Name: |

Hilton H. Schlosberg |

| |

|

Title: |

General Partner |

| |

|

| |

Hilrod Holdings X, L.P. |

| |

|

|

| |

By: |

/s/

Hilton H. Schlosberg |

| |

|

Name: |

Hilton H. Schlosberg |

| |

|

Title: |

General Partner |

| |

|

| |

Hilrod Holdings XI, L.P. |

| |

|

|

| |

By: |

/s/

Hilton H. Schlosberg |

| |

|

Name: |

Hilton H. Schlosberg |

| |

|

Title: |

General Partner |

| |

|

| |

Hilrod Holdings XII, L.P. |

| |

|

|

| |

By: |

/s/

Hilton H. Schlosberg |

| |

|

Name: |

Hilton H. Schlosberg |

| |

|

Title: |

General Partner |

| |

|

| |

Hilrod Holdings XIII, L.P. |

| |

|

|

| |

By: |

/s/

Hilton H. Schlosberg |

| |

|

Name: |

Hilton H. Schlosberg |

| |

|

Title: |

General Partner |

| |

|

| |

Hilrod Holdings XIV, L.P. |

| |

|

|

| |

By: |

/s/

Hilton H. Schlosberg |

| |

|

Name: |

Hilton H. Schlosberg |

| |

|

Title: |

General Partner |

| |

|

| |

Hilrod Holdings XV, L.P. |

| |

|

|

| |

By: |

/s/

Hilton H. Schlosberg |

| |

|

Name: |

Hilton H. Schlosberg |

| |

|

Title: |

General Partner |

| |

|

| |

Hilrod Holdings XVI, L.P. |

| |

|

|

| |

By: |

/s/

Hilton H. Schlosberg |

| |

|

Name: |

Hilton H. Schlosberg |

| |

|

Title: |

General Partner |

| |

Hilrod Holdings XVIII, L.P. |

| |

|

|

| |

By: |

/s/

Hilton H. Schlosberg |

| |

|

Name: |

Hilton H. Schlosberg |

| |

|

Title: |

General Partner |

| |

|

| |

Hilrod Holdings XIX, L.P. |

| |

|

|

| |

By: |

/s/

Hilton H. Schlosberg |

| |

|

Name: |

Hilton H. Schlosberg |

| |

|

Title: |

General Partner |

| |

|

| |

Hilrod Holdings XX, L.P. |

| |

|

|

| |

By: |

/s/

Hilton H. Schlosberg |

| |

|

Name: |

Hilton H. Schlosberg |

| |

|

Title: |

General Partner |

| |

|

| |

Hilrod Holdings XXI, L.P. |

| |

|

|

| |

By: |

/s/

Hilton H. Schlosberg |

| |

|

Name: |

Hilton H. Schlosberg |

| |

|

Title: |

General Partner |

| |

|

| |

Hilrod Holdings XXII, L.P. |

| |

|

| |

By: |

/s/

Hilton H. Schlosberg |

| |

|

Name: |

Hilton H. Schlosberg |

| |

|

Title: |

General Partner |

| |

|

| |

Hilrod Holdings XXIII, L.P. |

| |

|

|

| |

By: |

/s/

Hilton H. Schlosberg |

| |

|

Name: |

Hilton H. Schlosberg |

| |

|

Title: |

General Partner |

| |

|

|

| |

Hilrod Holdings XXIV, L.P. |

| |

|

|

| |

By: |

/s/

Hilton H. Schlosberg |

| |

|

Name: |

Hilton H. Schlosberg |

| |

|

Title: |

General Partner |

| |

|

| |

Hilrod Holdings XXV, L.P. |

| |

|

|

| |

By: |

/s/

Hilton H. Schlosberg |

| |

|

Name: |

Hilton H. Schlosberg |

| |

|

Title: |

General Partner |

| |

Hilrod Holdings XXVI, L.P. |

| |

|

|

| |

By: |

/s/

Hilton H. Schlosberg |

| |

|

Name: |

Hilton H. Schlosberg |

| |

|

Title: |

General Partner |

| |

/s/ Rodney C. Sacks |

| |

RODNEY C. SACKS |

| |

|

| |

/s/ Hilton H.

Schlosberg |

| |

HILTON H. SCHLOSBERG |

EXHIBIT INDEX

SCHEDULE A

The following are the transactions in the Company’s securities

within the past 60 days:

| |

Date

of Transaction |

No. of

Securities

Acquired/(Disposed Of) |

Average

Price Per

Security |

Range

of Prices Per

Security |

| Non-Derivative

Securities |

| Rodney

C. Sacks |

12/27/2023 |

8,562

(1) |

$11.68 |

N/A |

| Hilton

H. Schlosberg |

12/27/2023 |

8,562

(1) |

$11.68 |

N/A |

| Hilrod

Holdings XVI, L.P. |

12/27/2023 |

1,680,000

(1) |

$11.68 |

N/A |

| Hilrod

Holdings XVI, L.P. |

12/27/2023 |

(1,005,438)

(2) |

$57.34 |

N/A |

| Hilrod

Holdings XVI, L.P. |

12/27/2023 |

316,800

(1) |

$22.58 |

N/A |

| Hilrod

Holdings XVI, L.P. |

12/27/2023 |

(219,970)

(2) |

$57.34 |

N/A |

| Hilrod

Holdings XVIII, L.P. |

12/27/2023 |

617,208

(1) |

$11.68 |

N/A |

| Hilrod

Holdings XVIII, L.P. |

12/27/2023 |

(369,384)

(2) |

$57.34 |

N/A |

| Hilrod

Holdings XVIII, L.P. |

12/27/2023 |

624,744

(1) |

$22.58 |

N/A |

| Hilrod

Holdings XVIII, L.P. |

12/27/2023 |

(433,792)

(2) |

$57.34 |

N/A |

| Hilrod

Holdings XXIII, L.P. |

12/27/2023 |

205,668

(1) |

$11.68 |

N/A |

| Hilrod

Holdings XXIII, L.P. |

12/27/2023 |

(123,088)

(2) |

$57.34 |

N/A |

| Rodney

C. Sacks |

1/3/2024 |

(17,309)

(3) |

$0

(3) |

|

| Derivative

Securities* |

| Rodney

C. Sacks |

12/27/2023 |

(8,562)

(4) |

$0 |

N/A |

| Hilton

H. Schlosberg |

12/27/2023 |

(8,562)

(4) |

$0 |

N/A |

| Hilrod

Holdings XVI, L.P. |

12/27/2023 |

(1,680,000)

(4) |

$0 |

N/A |

| Hilrod

Holdings XVI, L.P. |

12/27/2023 |

(316,800)

(4) |

$0 |

N/A |

| Hilrod

Holdings XVIII, L.P. |

12/27/2023 |

(617,208)

(4) |

$0 |

N/A |

| Hilrod

Holdings XVIII, L.P. |

12/27/2023 |

(624,744)

(4) |

$0 |

N/A |

| Hilrod

Holdings XXIII, L.P. |

12/27/2023 |

(205,668)

(4) |

$0 |

N/A |

| (1) | Represents shares issued upon the exercise of vested stock options. |

| (2) | Represents shares withheld by the Company to satisfy the option

exercise price and tax withholding obligations. |

| (3) | Represents a gift of the Company’s common stock. |

| (4) | Represents the exercise of vested stock options. |

| * | Excludes performance share units that may vest on December 31,

2023 subject to the achievement of adjusted diluted earnings per share growth targets. |

null

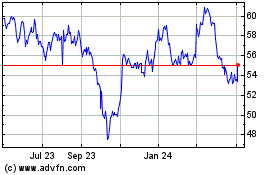

Monster Beverage (NASDAQ:MNST)

Historical Stock Chart

From Dec 2024 to Jan 2025

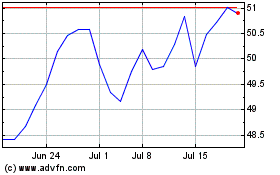

Monster Beverage (NASDAQ:MNST)

Historical Stock Chart

From Jan 2024 to Jan 2025