MiMedx Group, Inc. (Nasdaq: MDXG) (“MIMEDX” or the “Company”),

today announced operating and financial results for the fourth

quarter and full year 2024.

Joseph H. Capper, MIMEDX Chief Executive Officer,

commented, "We are pleased today to report solid fourth quarter and

full year 2024 results. With fourth quarter net sales growth of 7%

year-over-year, an Adjusted EBITDA margin of 21% of net sales and

yet another strong quarter of free cash flow, our business

continued to drive impressive results to close out the year, even

in the face of significant disruption caused by the ongoing

manipulation of the Medicare reimbursement system in the private

office."

Mr. Capper continued, "I am as confident as ever in

the enormous untapped clinical opportunities for our current and

future products. We remain actively engaged with stakeholders at

every level to adopt measures that will curb Medicare overpayments

for skin substitutes and refocus our industry on evidence-based

product innovation and patient outcomes."

"As we head into 2025, we plan to grow our Wound

and Surgical businesses by continuing to develop innovative

products, generating compelling clinical evidence and strengthening

our relationships with our customers. We are prepared to rapidly

adjust to changes in the market as they unfold and remain confident

MIMEDX has the ability to lead the market over both the short- and

long-term," concluded Mr. Capper.

Fourth Quarter and Full

Year 2024 Results Discussion

Net Sales

MIMEDX reported net sales for the three months

ended December 31, 2024 of $93 million, compared to $87 million for

the three months ended December 31, 2023, an increase of 7%. For

the full year 2024 MIMEDX reported net sales of $349 million,

compared to $321 million in the prior year period, reflecting

growth of 9%. In each case, the increase included contributions

from newer products, which were partially offset by some of the

lingering commercial challenges associated with sales team and

customer turnover from earlier in the year.

Gross Profit and Margin

Gross profit for the three months ended December

31, 2024, was $76 million, an increase of $3 million as compared to

the prior year period. Gross margin for the three months ended

December 31, 2024 was 82%, compared to 84% in the prior year

period. While fourth quarter 2024 gross margin was negatively

impacted by the amortization of distribution rights stemming from

acquisitions entered into during 2024, this impact was partially

offset by favorable product mix and continued execution on

improvements in manufacturing scale up, including reductions in

scrap. On an adjusted basis, fourth quarter 2024 gross margin was

84%, which reflects a roughly flat adjusted gross margin compared

to the prior year period.

For the full year 2024, gross profit was $289

million, reflecting an increase of $22 million compared to the

prior year period. Additionally, gross margin for the full year

2024 was 83%, compared to 83% for the full year 2023. On an

adjusted basis, gross margin for the full year 2024 was 84%

compared to 83% for the full year 2023.

Operating Expenses

Selling, general and administrative ("SG&A")

expenses for the three months ended December 31, 2024, were $61

million compared to $54 million for the three months ended December

31, 2023. The increase in SG&A was driven by year-over-year

increases in compensation related to higher salary and benefit

costs from merit raises, promotions, as well as commissions driven

by increases in sales and increases in effective commission rates.

Incremental spend from legal and regulatory disputes in the current

period also contributed to the increase.

For the full year 2024, SG&A expenses totaled

$225 million, compared to $211 million for the prior period,

reflecting a year over year increase of 7%.

Research and development ("R&D") expenses for

the three months ended December 31, 2024, were $4 million compared

to $2 million for the three months ended December 31, 2023. For the

full year 2024, research and development expenses remained

essentially flat at $12 million compared to 2023. R&D spend in

the quarter and year was driven, in part, by the randomized

controlled trial for EPIEFFECT and ongoing investments in the

development of future products in our pipeline.

Investigation, restatement and related expense for

the three months ended December 31, 2024, was immaterial compared

to $1 million of expense for the three months ended December 31,

2023. For the full year 2024, investigation, restatement and

related expenses totaled a benefit of $9 million compared to

expense of $5 million in 2023. The last material matter associated

with our historical Audit Committee investigation concluded during

2024. We do not expect activity to be material in future

periods.

Net income from continuing operations for the three

months and full year ended December 31, 2024 was $7 million and $42

million, respectively, compared to a net income from continuing

operations of $51 million and $67 million for the three months and

full year ended December 31, 2023, respectively. Net income from

continuing operations in 2023 was significantly impacted by a $37

million reversal of a valuation allowance against our deferred tax

assets.

Cash and Cash Equivalents

As of December 31, 2024, the Company had $104

million of cash and cash equivalents compared to $82 million as of

December 31, 2023 and $89 million as of September 30, 2024. As of

December 31, 2024, our cash position, net of debt on our balance

sheet, was $86 million, representing a sequential increase of $16

million.

Financial OutlookProvided that the

future effective LCDs go into effect as currently planned, MIMEDX

expects net sales growth of at least high single-digits as a

percentage and Adjusted EBITDA margin above 20% for the full-year

2025.

Longer-term, the Company continues to expect to

achieve annual net sales growth in the low double-digits as a

percentage with an Adjusted EBITDA margin above 20%.

Conference Call and Webcast

MIMEDX will host a conference call and webcast to

review its fourth quarter and full year 2024 results on Wednesday,

February 26, 2025, beginning at 4:30 p.m., Eastern Time. The call

can be accessed using the following information:

Webcast: Click here U.S.

Investors: 877-407-6184International Investors:

201-389-0877Conference ID: 13751444

A replay of the webcast will be available for

approximately 30 days on the Company’s website at

www.mimedx.com following the conclusion of the event.

Important Cautionary Statement

This press release and our investor conference call

include forward-looking statements, which reflect management's

current beliefs and expectations regarding future events and

operating performance and speak only as of the date hereof. These

forward-looking statements are not guarantees of future performance

and involve a number of risks and uncertainties. These statements

include statements regarding: (i) future sales, sales growth, and

Adjusted EBITDA margin; (ii) our longer term financial goals and

expectations for future financial results, including levels of net

sales, Adjusted EBITDA, and Adjusted EBITDA margin; (iii) our

expectations regarding the size of the market for our products;(iv)

our expectations regarding Medicare spending and timing of LCD

implementation, if any; (v) continued growth in different care

settings and different products; (vi) HELIOGEN to be a meaningful

contributor to growth in 2025; (vii) our expected outcomes relating

to improving workflow and strengthening bonds between the Company

and its customers; and (viii) LCD implementation on the Company’s

business. Additional forward-looking statements may be identified

by words such as "believe," "expect," "may," "plan," “goal,”

“outlook,” "potential," "will," "preliminary," and similar

expressions, and are based on management's current beliefs and

expectations.

Forward-looking statements are subject to risks and

uncertainties, and the Company cautions investors against placing

undue reliance on such statements. Actual results may differ

materially from those set forth in the forward-looking statements.

Factors that could cause actual results to differ from expectations

include: (i) future sales are uncertain and are affected by

competition, access to customers, patient access to healthcare

providers, the reimbursement environment and many other factors;

(ii) the Company may change its plans due to unforeseen

circumstances; (iii) the results of scientific research are

uncertain and may have little or no value; (iv) our ability to sell

our products in other countries depends on a number of factors

including adequate levels of reimbursement, market acceptance of

novel therapies, and our ability to build and manage a direct sales

force or third party distribution relationship; (v) the

effectiveness of amniotic tissue as a therapy for particular

indications or conditions is the subject of further scientific and

clinical studies; (vi) we may alter the timing and amount of

planned expenditures for research and development based on

regulatory developments; (vii) Medicare spending and delays in the

implementation of the LCDs, if any; and (viii) changes in the size

of the addressable market for our products. Additional factors that

could impact outcomes and our results include those described in

the Risk Factors section of our Annual Report on Form 10-K and our

Quarterly Reports on Form 10-Q. filed with the Securities and

Exchange Commission. Any forward-looking statements speak only as

of the date of this press release and the Company assumes no

obligation to update any forward-looking statement.

About MIMEDX

MIMEDX is a pioneer and leader focused on helping

humans heal. With more than a decade of helping clinicians manage

chronic and other hard-to-heal wounds, MIMEDX is dedicated to

providing a leading portfolio of products for applications in the

wound care, burn, and surgical sectors of healthcare. The Company’s

vision is to be the leading global provider of healing solutions

through relentless innovation to restore quality of life. For

additional information, please visit www.mimedx.com.

Contact:Matt NotarianniInvestor

Relations470.304.7291mnotarianni@mimedx.com

Selected Unaudited Financial

Information

|

|

|

MiMedx Group, Inc. |

|

Condensed Consolidated Balance Sheets |

|

(in thousands) Unaudited |

|

|

| |

|

December 31,2024 |

|

December 31,2023 |

|

ASSETS |

|

|

|

|

|

Current assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

104,416 |

|

|

$ |

82,000 |

|

|

Accounts receivable, net |

|

|

55,828 |

|

|

|

53,871 |

|

|

Inventory |

|

|

23,807 |

|

|

|

21,021 |

|

|

Prepaid expenses |

|

|

5,018 |

|

|

|

5,624 |

|

|

Other current assets |

|

|

2,817 |

|

|

|

1,745 |

|

|

Total current assets |

|

|

191,886 |

|

|

|

164,261 |

|

|

Property and equipment, net |

|

|

5,944 |

|

|

|

6,974 |

|

|

Right of use asset |

|

|

5,606 |

|

|

|

2,132 |

|

|

Deferred tax asset, net |

|

|

28,306 |

|

|

|

40,777 |

|

|

Goodwill |

|

|

19,441 |

|

|

|

19,441 |

|

|

Intangible assets, net |

|

|

11,626 |

|

|

|

5,257 |

|

|

Other assets |

|

|

1,106 |

|

|

|

205 |

|

|

Total assets |

|

$ |

263,915 |

|

|

$ |

239,047 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

Current portion of long term debt |

|

$ |

1,000 |

|

|

$ |

1,000 |

|

|

Accounts payable |

|

|

7,409 |

|

|

|

9,048 |

|

|

Accrued compensation |

|

|

23,667 |

|

|

|

22,353 |

|

|

Accrued expenses |

|

|

9,012 |

|

|

|

9,361 |

|

|

Current portion of Profit Share Payments |

|

|

1,421 |

|

|

|

— |

|

|

Current liabilities of discontinued operations |

|

|

— |

|

|

|

1,352 |

|

|

Other current liabilities |

|

|

3,086 |

|

|

|

2,894 |

|

|

Total current liabilities |

|

|

45,595 |

|

|

|

46,008 |

|

|

Long term debt, net |

|

|

17,830 |

|

|

|

48,099 |

|

|

Other liabilities |

|

|

7,383 |

|

|

|

2,223 |

|

|

Total liabilities |

|

$ |

70,808 |

|

|

$ |

96,330 |

|

|

Total stockholders' equity |

|

|

193,107 |

|

|

|

142,717 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

263,915 |

|

|

$ |

239,047 |

|

|

MiMedx Group, Inc. |

|

Condensed Consolidated Statements of

Operations |

|

(in thousands, except share and per share amounts) Unaudited |

|

|

|

|

|

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Net sales |

|

$ |

92,907 |

|

|

$ |

86,832 |

|

|

$ |

348,879 |

|

|

$ |

321,477 |

|

|

Cost of sales |

|

|

16,909 |

|

|

|

13,841 |

|

|

|

60,073 |

|

|

|

54,634 |

|

|

Gross profit |

|

|

75,998 |

|

|

|

72,991 |

|

|

|

288,806 |

|

|

|

266,843 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

|

61,043 |

|

|

|

54,352 |

|

|

|

225,087 |

|

|

|

211,124 |

|

|

Research and development |

|

|

3,571 |

|

|

|

2,434 |

|

|

|

12,341 |

|

|

|

12,665 |

|

|

Investigation, restatement and related |

|

|

43 |

|

|

|

524 |

|

|

|

(8,698 |

) |

|

|

5,176 |

|

|

Amortization of intangible assets |

|

|

194 |

|

|

|

192 |

|

|

|

765 |

|

|

|

762 |

|

|

Impairment of intangible assets |

|

|

94 |

|

|

|

— |

|

|

|

446 |

|

|

|

— |

|

|

Operating income |

|

|

11,053 |

|

|

|

15,489 |

|

|

|

58,865 |

|

|

|

37,116 |

|

|

Other expense, net |

|

|

|

|

|

|

|

|

|

Interest income (expense), net |

|

|

403 |

|

|

|

(1,593 |

) |

|

|

(1,006 |

) |

|

|

(6,457 |

) |

|

Other (expense) income, net |

|

|

(208 |

) |

|

|

16 |

|

|

|

(565 |

) |

|

|

(26 |

) |

|

Income from continuing operations before income tax provision |

|

|

11,248 |

|

|

|

13,912 |

|

|

|

57,294 |

|

|

|

30,633 |

|

|

Income tax provision |

|

|

(3,811 |

) |

|

|

37,375 |

|

|

|

(15,296 |

) |

|

|

36,806 |

|

|

Net income from continuing operations |

|

|

7,437 |

|

|

|

51,287 |

|

|

|

41,998 |

|

|

|

67,439 |

|

|

Income (loss) from discontinued operations, net of tax |

|

|

— |

|

|

|

2,189 |

|

|

|

421 |

|

|

|

(9,211 |

) |

|

Net income |

|

$ |

7,437 |

|

|

$ |

53,476 |

|

|

$ |

42,419 |

|

|

$ |

58,228 |

|

|

Net income available to common stockholders from continuing

operations |

|

$ |

7,437 |

|

|

$ |

44,829 |

|

|

$ |

41,998 |

|

|

$ |

55,796 |

|

|

Basic net income per common share: |

|

|

|

|

|

|

|

|

|

Continuing operations |

|

$ |

0.05 |

|

|

$ |

0.38 |

|

|

$ |

0.29 |

|

|

$ |

0.48 |

|

|

Discontinued operations |

|

$ |

— |

|

|

$ |

0.02 |

|

|

$ |

— |

|

|

$ |

(0.08 |

) |

|

Basic net income per common share |

|

$ |

0.05 |

|

|

$ |

0.40 |

|

|

$ |

0.29 |

|

|

$ |

0.40 |

|

|

Diluted net income per common share: |

|

|

|

|

|

|

|

|

|

Continuing operations |

|

$ |

0.05 |

|

|

$ |

0.31 |

|

|

|

0.28 |

|

|

|

0.43 |

|

|

Discontinued operations |

|

|

— |

|

|

|

0.01 |

|

|

|

— |

|

|

|

(0.06 |

) |

|

Diluted net income per common share |

|

$ |

0.05 |

|

|

$ |

0.32 |

|

|

$ |

0.28 |

|

|

$ |

0.37 |

|

|

Weighted average common shares outstanding - basic |

|

|

147,008,235 |

|

|

|

119,367,482 |

|

|

|

146,979,354 |

|

|

|

116,495,810 |

|

|

Weighted average common shares outstanding - diluted |

|

|

149,242,415 |

|

|

|

148,076,079 |

|

|

|

149,049,197 |

|

|

|

145,962,462 |

|

|

MiMedx Group, Inc. |

|

Condensed Consolidated Statements of Cash

Flows |

|

(in thousands) Unaudited |

|

|

| |

|

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Net cash flows provided by operating activities |

|

$ |

18,782 |

|

|

$ |

10,257 |

|

|

$ |

66,198 |

|

|

$ |

26,775 |

|

|

Net cash flows used in investing activities |

|

|

(2,767 |

) |

|

|

(481 |

) |

|

|

(9,583 |

) |

|

|

(2,155 |

) |

|

Net cash flows used in financing activities |

|

|

(400 |

) |

|

|

(8,940 |

) |

|

|

(34,199 |

) |

|

|

(8,570 |

) |

|

Net change in cash |

|

$ |

15,615 |

|

|

$ |

836 |

|

|

$ |

22,416 |

|

|

$ |

16,050 |

|

Reconciliation of Non-GAAP

Measures

In addition to our GAAP results, we provide certain

non-GAAP measures including Adjusted EBITDA, related margins, Free

Cash Flow, Adjusted Gross Profit, Adjusted Gross Margin and

Adjusted Net Income. We believe that the presentation of these

measures provides important supplemental information to management

and investors regarding our performance. These measures are not a

substitute for GAAP measures. Company management uses these

non-GAAP measures as aids in monitoring our ongoing financial

performance from quarter-to-quarter and year-to-year on a regular

basis and for benchmarking against comparable companies.

These non-GAAP financial measures reflect the

exclusion of the following items:

- Share-based

compensation expense – expense recognized related to awards to

employees and our board of directors pursuant to our share-based

compensation plans. This expense is reflected amongst cost of

sales, research and development expense, and selling, general, and

administrative expense in the unaudited condensed consolidated

statements of operations.

- Investigation,

restatement, and related (benefit) expense – expenses incurred

toward the legal defense of the Company and advanced on behalf of

certain former officers and directors, net of negotiated reductions

and settlements of amounts previously advanced, related to certain

legal matters. This expense is reflected in the line of the same

name in our unaudited condensed consolidated statements of

operations.

- Impairment of

intangible assets – reflects the impairment of intangibles.

This expense is reflected in the line of the same name in our

unaudited condensed consolidated statements of operations.

- Transaction-related

expenses – reflects expenses incrementally incurred resulting

from the consummation of material strategic transactions or the

integration of acquired assets or operations into our core

business. With respect to the three months and year ended December

31, 2024, this relates to our acquisition and integration of

exclusive distribution rights to HELIOGEN.

- Strategic legal and

regulatory expenses – With respect to the three months and

year ended December 31, 2024, this relates to litigation and

regulatory expenses. Litigation expenses incurred relate to suits

filed against former employees and their employers for violation of

non-compete and non-solicitation agreements and related matters.

Regulatory expenses relate to legal fees incurred stemming from

action taken against the United States Food & Drug

Administration ("FDA") surrounding the designation of one of our

products.

- Loss on

extinguishment of debt – reflects the excess of cash paid to

extinguish debt over the carrying value of the debt on our balance

sheet upon the repayment and termination of a loan agreement. With

respect to the year ended December 31, 2024, this relates to the

repayment and termination of the Company's loan agreement with

Hayfin. Amounts in this line reflect (i) prepayment premium paid

and (ii) write-offs of unamortized original issue discount and

deferred financing costs.

- Expenses related to

the Disbanding of Regenerative Medicine – incremental expenses

recognized or incurred directly as a result of our announcement to

disband our Regenerative Medicine segment.

- Amortization of

acquired intangible assets – reflects amortization expense

recognized solely related to assets which were acquired as part of

a transaction. With respect to the three months and year ended

December 31, 2024, this relates solely to the amortization of

distribution rights stemming from the TELA Bio, Inc. and Regenity

Biosciences agreements entered into during the first quarter of

2024. These expenses are reflected in cost of sales in our

consolidated statements of operations.

- Reorganization

expenses – reflects severance expense incurred arising from

separations from certain officers of the Company.

- Income Tax

Adjustment – for purposes of calculating Adjusted Net Income

and Adjusted Earnings Per Share, reflects our expectation of a

long-term effective tax rate, which is normalized and balance

sheet-agnostic. Actual reporting tax expense will be based on GAAP

earnings, and may differ from the expected long-term effective tax

rate due to a variety of factors, including the tax treatment of

various transactions included in GAAP net income and other

reconciling items that are excluded in determining Adjusted Net

Income and Adjusted EPS. The actual long-term normalized effective

tax rate was 25% for each of the years ended December 31, 2024 and

2023.

Adjusted EBITDA and Adjusted EBITDA margin

Adjusted EBITDA consists of GAAP net income

excluding: (i) depreciation, (ii) amortization of intangibles,

(iii) interest (income) expense, net, (iv) income tax provision,

(v) share-based compensation, (vi) investigation, restatement and

related expenses, (vii) expenses related to disbanding of the

Regenerative Medicine business unit, (viii) strategic legal and

regulatory expenses, (ix) transaction-related expenses, (x)

impairment of intangible assets, and (xi) reorganization

expenses.

Please refer to the tables at the beginning of this

press release for reconciliation to GAAP net income (loss).

| |

|

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Net Income |

|

$ |

7,437 |

|

|

$ |

53,476 |

|

|

$ |

42,419 |

|

|

$ |

58,228 |

|

|

Non-GAAP Adjustments: |

|

|

|

|

|

|

|

|

|

Depreciation expense |

|

|

564 |

|

|

|

611 |

|

|

|

2,279 |

|

|

|

2,665 |

|

|

Amortization of intangible assets |

|

|

2,426 |

|

|

|

192 |

|

|

|

3,762 |

|

|

|

762 |

|

|

Interest (income) expense, net |

|

|

(403 |

) |

|

|

1,593 |

|

|

|

1,006 |

|

|

|

6,457 |

|

|

Income tax provision |

|

|

3,811 |

|

|

|

(40,349 |

) |

|

|

15,296 |

|

|

|

(39,780 |

) |

|

Share-based compensation |

|

|

4,693 |

|

|

|

4,385 |

|

|

|

16,933 |

|

|

|

17,178 |

|

|

Investigation, restatement and related expenses |

|

|

44 |

|

|

|

524 |

|

|

|

(8,698 |

) |

|

|

5,176 |

|

|

Impairment of intangible assets |

|

|

94 |

|

|

|

— |

|

|

|

446 |

|

|

|

— |

|

|

Transaction related expenses |

|

|

(38 |

) |

|

|

— |

|

|

|

612 |

|

|

|

— |

|

|

Strategic legal and regulatory expenses |

|

|

1,140 |

|

|

|

— |

|

|

|

2,806 |

|

|

|

— |

|

|

Expenses related to disbanding of Regenerative Medicine Business

Unit |

|

|

— |

|

|

|

785 |

|

|

|

(421 |

) |

|

|

6,384 |

|

|

Reorganization expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,412 |

|

|

Adjusted EBITDA |

|

$ |

19,768 |

|

|

$ |

21,217 |

|

|

$ |

76,440 |

|

|

$ |

58,482 |

|

|

Adjusted EBITDA margin |

|

|

21.3 |

% |

|

|

24.4 |

% |

|

|

21.9 |

% |

|

|

18.2 |

% |

Adjusted Net Income and Adjusted Gross Margin

Adjusted Net Income provides a view of our

operating performance, exclusive of certain items which are

non-recurring or not reflective of our core operations.

Adjusted Net Income is defined as GAAP net income

plus (i) loss on extinguishment of debt, (ii) investigation

restatement and related expenses, (iii) impairment of intangible

assets, (iv) amortization of acquired intangible assets, (v)

transaction related expenses, (vi) strategic legal and regulatory

expenses, and (vii) expenses related to disbanding of our

Regenerative Medicine business unit, and (viii) the long-term

effective income tax rate adjustment.

Each of the adjustments to reconcile Adjusted Net

Income to GAAP net income affect individual financial statement

captions which are reflected in our consolidated statements of

operations, including gross profit. Adjusted Gross Profit is

therefore defined as GAAP gross profit plus (i) loss on

extinguishment of debt, (ii) investigation restatement and related

expenses, (iii) impairment of intangible assets, (iv) amortization

of acquired intangible assets, (v) transaction related expenses,

(vi) strategic legal and regulatory expenses, and (vii) expenses

related to disbanding of our Regenerative Medicine business unit,

and (viii) the long-term effective income tax rate adjustment., to

the extent that these adjustments impact GAAP gross profit.

Adjusted Gross Margin is calculated as Adjusted Gross Profit

divided by GAAP net sales.

A reconciliation of GAAP net income to Adjusted Net

Income appears in the table below (in thousands):

| |

|

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Net income |

|

$ |

7,437 |

|

|

$ |

53,476 |

|

|

$ |

42,419 |

|

|

$ |

58,228 |

|

|

Loss on extinguishment of debt |

|

|

— |

|

|

|

— |

|

|

|

1,401 |

|

|

|

— |

|

|

Investigation, restatement and related expenses |

|

|

43 |

|

|

|

524 |

|

|

|

(8,698 |

) |

|

|

5,176 |

|

|

Impairment of intangible assets |

|

|

94 |

|

|

|

— |

|

|

|

446 |

|

|

|

— |

|

|

Amortization of acquired intangible assets |

|

|

2,232 |

|

|

|

— |

|

|

|

2,997 |

|

|

|

— |

|

|

Transaction-related expenses |

|

|

(38 |

) |

|

|

— |

|

|

|

612 |

|

|

|

— |

|

|

Strategic legal and regulatory expenses |

|

|

1,140 |

|

|

|

— |

|

|

|

2,806 |

|

|

|

— |

|

|

Expenses related to disbanding of Regenerative Medicine Business

Unit |

|

|

— |

|

|

|

785 |

|

|

|

(421 |

) |

|

|

6,384 |

|

|

Reorganization expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,412 |

|

|

Long-term effective income tax rate adjustment |

|

|

130 |

|

|

|

(43,958 |

) |

|

|

1,082 |

|

|

|

(47,635 |

) |

|

Adjusted net income |

|

$ |

11,038 |

|

|

$ |

10,827 |

|

|

$ |

42,644 |

|

|

$ |

23,565 |

|

A reconciliation of various line items included in

our GAAP unaudited condensed consolidated statements of operations

to Adjusted Net Income, including Adjusted Gross Profit for the

three months and year ended December 31, 2024 and 2023 are

presented in the tables below (in thousands):

| |

|

Three Months Ended December 31, 2024 |

| |

|

Gross Profit |

|

Selling, General & Administrative Expense |

|

Research and Development Expense |

|

Net Income |

|

Reported GAAP Measure |

|

$ |

75,998 |

|

|

$ |

61,043 |

|

|

$ |

3,571 |

|

|

$ |

7,437 |

|

|

Investigation, restatement and related expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

43 |

|

|

Impairment of intangible assets |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

94 |

|

|

Amortization of acquired intangible assets |

|

|

2,232 |

|

|

|

— |

|

|

|

— |

|

|

|

2,232 |

|

|

Transaction-related expenses |

|

|

— |

|

|

|

(30 |

) |

|

|

— |

|

|

|

(38 |

) |

|

Strategic legal and regulatory expenses |

|

|

— |

|

|

|

(1,140 |

) |

|

|

— |

|

|

|

1,140 |

|

|

Expenses related to disbanding of Regenerative Medicine Business

Unit |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Long-term effective income tax rate adjustment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

130 |

|

|

Non-GAAP Measure |

|

$ |

78,230 |

|

|

$ |

59,873 |

|

|

$ |

3,571 |

|

|

$ |

11,038 |

|

| |

|

|

|

|

|

|

|

|

|

Gross Profit Margin |

|

|

81.8 |

% |

|

|

|

|

|

|

|

Adjusted Gross Profit Margin |

|

|

84.2 |

% |

|

|

|

|

|

|

| |

|

Three months ended December 31, 2023 |

| |

|

Gross Profit |

|

Selling, General & Administrative Expense |

|

Research and Development Expense |

|

Net Income |

|

Reported GAAP Measure |

|

$ |

72,991 |

|

|

$ |

54,352 |

|

|

$ |

2,434 |

|

|

$ |

53,476 |

|

|

Investigation, restatement and related expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

524 |

|

|

Amortization of acquired intangibles |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Expenses related to disbanding of Regenerative Medicine Business

Unit |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

785 |

|

|

Long-term effective income tax rate adjustment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(43,958 |

) |

|

Non-GAAP Measure |

|

$ |

72,991 |

|

|

$ |

54,352 |

|

|

$ |

2,434 |

|

|

$ |

10,827 |

|

| |

|

|

|

|

|

|

|

|

|

Gross Profit Margin |

|

|

84.1 |

% |

|

|

|

|

|

|

|

Adjusted Gross Profit Margin |

|

|

84.1 |

% |

|

|

|

|

|

|

| |

|

Year Ended December 31, 2024 |

| |

|

Gross Profit |

|

Selling, General & Administrative Expense |

|

Research and Development Expense |

|

Net Income |

|

Reported GAAP Measure |

|

$ |

288,806 |

|

|

$ |

225,087 |

|

|

$ |

12,341 |

|

|

$ |

42,419 |

|

|

Loss on extinguishment of debt |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,401 |

|

|

Investigation, restatement and related expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(8,698 |

) |

|

Impairment of intangible assets |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

446 |

|

|

Amortization of acquired intangible assets |

|

|

2,997 |

|

|

|

— |

|

|

|

— |

|

|

|

2,997 |

|

|

Transaction-related expenses |

|

|

— |

|

|

|

(551 |

) |

|

|

— |

|

|

|

612 |

|

|

Strategic legal and regulatory expenses |

|

|

— |

|

|

|

(2,806 |

) |

|

|

— |

|

|

|

2,806 |

|

|

Expenses related to disbanding of Regenerative Medicine Business

Unit |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(421 |

) |

|

Long-term effective income tax rate adjustment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,082 |

|

|

Non-GAAP Measure |

|

$ |

291,803 |

|

|

$ |

221,730 |

|

|

$ |

12,341 |

|

|

$ |

42,644 |

|

| |

|

|

|

|

|

|

|

|

|

Gross Profit Margin |

|

|

82.8 |

% |

|

|

|

|

|

|

|

Adjusted Gross Profit Margin |

|

|

83.6 |

% |

|

|

|

|

|

|

| |

|

Year Ended December 31, 2023 |

| |

|

Gross Profit |

|

Selling, General & Administrative Expense |

|

Research and Development Expense |

|

Net Income |

|

Reported GAAP Measure |

|

$ |

266,843 |

|

|

$ |

211,124 |

|

|

$ |

12,665 |

|

|

|

58,228 |

|

|

Investigation, restatement and related expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

5,176 |

|

|

Amortization of acquired intangible assets |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Expenses related to disbanding of Regenerative Medicine Business

Unit |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

6,384 |

|

|

Reorganization expenses |

|

|

— |

|

|

|

(1,412 |

) |

|

|

— |

|

|

|

1,412 |

|

|

Long-term effective income tax rate adjustment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(47,635 |

) |

|

Non-GAAP Measure |

|

$ |

266,843 |

|

|

$ |

209,712 |

|

|

$ |

12,665 |

|

|

$ |

23,565 |

|

| |

|

|

|

|

|

|

|

|

|

Gross Profit Margin |

|

|

83.0 |

% |

|

|

|

|

|

|

|

Adjusted Gross Profit Margin |

|

|

83.0 |

% |

|

|

|

|

|

|

Adjusted Earnings Per Share

Adjusted Earnings Per Share is intended to provide

a normalized view of earnings per share by removing items that may

be irregular, one-time, or non-recurring from net income. This

enables us to identify underlying trends in our business that could

otherwise be masked by such items. Adjusted Earnings Per Share

consists of GAAP diluted net income (loss) per common share

including adjustments for: (i) loss on extinguishment of debt, (ii)

investigation restatement and related expenses, (iii) impairment of

intangible assets, (iv) amortization of acquired intangible assets,

(v) transaction related expenses, (vi) strategic legal and

regulatory expenses, (vii) expenses related to disbanding of our

Regenerative Medicine business unit, (viii) reorganization

expenses, (ix) the long-term effective income tax rate adjustment,

and (x) the effect of antidilution. The effect of antidilution

reflects the changes resulting from the removal of the dilutive

impact of convertible securities which were dilutive for purposes

of calculating GAAP net income per common share, but are

antidilutive for non-GAAP purposes.

A reconciliation of GAAP diluted earnings per share

to Adjusted Earnings Per Share appears in the table below (per

diluted share):

| |

|

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| GAAP net income per common

share - diluted |

|

$ |

0.05 |

|

|

$ |

0.32 |

|

|

$ |

0.28 |

|

|

$ |

0.37 |

|

| Loss on extinguishment of

debt |

|

|

0.00 |

|

|

|

0.00 |

|

|

|

0.01 |

|

|

|

0.00 |

|

| Investigation, restatement and

related (benefit) expense |

|

|

0.00 |

|

|

|

0.00 |

|

|

|

(0.06 |

) |

|

|

0.04 |

|

| Impairment of intangible

assets |

|

|

0.00 |

|

|

|

0.00 |

|

|

|

0.00 |

|

|

|

0.00 |

|

| Amortization of acquired

intangible assets |

|

|

0.01 |

|

|

|

0.00 |

|

|

|

0.02 |

|

|

|

0.00 |

|

| Transaction-related

expenses |

|

|

0.00 |

|

|

|

0.00 |

|

|

|

0.00 |

|

|

|

0.00 |

|

| Strategic legal and regulatory

expenses |

|

|

0.01 |

|

|

|

0.00 |

|

|

|

0.02 |

|

|

|

0.00 |

|

| Expenses related to disbanding

of Regenerative Medicine business unit |

|

|

0.00 |

|

|

|

0.01 |

|

|

|

0.00 |

|

|

|

0.05 |

|

| Reorganization expenses |

|

|

0.00 |

|

|

|

0.00 |

|

|

|

0.00 |

|

|

|

0.01 |

|

| Long-term effective income tax

rate adjustment |

|

|

0.00 |

|

|

|

(0.36 |

) |

|

|

0.01 |

|

|

|

(0.40 |

) |

| Effects of antidilution |

|

|

0.00 |

|

|

|

0.07 |

|

|

|

0.00 |

|

|

|

0.03 |

|

| Adjusted Earnings Per

Share |

|

$ |

0.07 |

|

|

$ |

0.04 |

|

|

$ |

0.29 |

|

|

$ |

0.10 |

|

| |

|

|

|

|

|

|

|

|

| Weighted average common shares

outstanding - adjusted |

|

|

149,242,415 |

|

|

|

122,740,917 |

|

|

|

149,049,197 |

|

|

|

118,504,557 |

|

Free Cash Flow

Free Cash Flow is intended to provide a measure of

our ability to generate cash in excess of capital investments. It

provides management with a view of cash flows which can be used to

finance operational and strategic investments.

Free Cash Flow is defined as net cash provided by

operating activities less capital expenditures, including purchases

of equipment.

A reconciliation of GAAP net cash flows provided by

operating activities to Free Cash Flow appears in the table below

(in thousands):

| |

|

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Net cash flows provided by operating activities |

|

$ |

18,782 |

|

|

$ |

10,257 |

|

|

|

66,198 |

|

|

|

26,775 |

|

|

Capital expenditures, including purchases of equipment |

|

|

(263 |

) |

|

|

(427 |

) |

|

|

(1,683 |

) |

|

|

(1,987 |

) |

|

Free Cash Flow |

|

$ |

18,519 |

|

|

$ |

9,830 |

|

|

$ |

64,515 |

|

|

$ |

24,788 |

|

Other Information

Net Sales by Product Category by Quarter

Below is a summary of net sales by product category

(in thousands):

| |

|

2024 |

|

2023 |

| |

|

Q1 |

|

Q2 |

|

Q3 |

|

Q4 |

|

Q1 |

|

Q2 |

|

Q3 |

|

Q4 |

|

Wound |

|

$ |

57,049 |

|

|

$ |

57,547 |

|

|

$ |

55,052 |

|

|

$ |

61,357 |

|

|

$ |

45,206 |

|

|

$ |

53,318 |

|

|

$ |

51,156 |

|

|

$ |

55,980 |

|

|

Surgical |

|

|

27,660 |

|

|

|

29,660 |

|

|

|

29,005 |

|

|

|

31,550 |

|

|

|

26,470 |

|

|

|

27,939 |

|

|

|

30,556 |

|

|

|

30,852 |

|

|

Net sales |

|

$ |

84,709 |

|

|

$ |

87,207 |

|

|

$ |

84,057 |

|

|

$ |

92,907 |

|

|

$ |

71,676 |

|

|

$ |

81,257 |

|

|

$ |

81,712 |

|

|

$ |

86,832 |

|

Selling, General and Administrative

Below is the breakout of selling, general and

administrative expense by selling and marketing and general and

administrative (in thousands):

| |

|

2024 |

|

2023 |

| |

|

Q1 |

|

Q2 |

|

Q3 |

|

Q4 |

|

Q1 |

|

Q2 |

|

Q3 |

|

Q4 |

|

Selling and marketing |

|

$ |

44,477 |

|

|

$ |

41,725 |

|

|

$ |

41,721 |

|

|

$ |

47,638 |

|

|

$ |

39,158 |

|

|

$ |

40,239 |

|

|

$ |

40,441 |

|

|

$ |

42,000 |

|

|

General and administrative |

|

|

10,652 |

|

|

|

13,676 |

|

|

|

11,795 |

|

|

|

13,403 |

|

|

|

13,092 |

|

|

|

11,716 |

|

|

|

12,130 |

|

|

|

12,348 |

|

|

Selling, general and administrative |

|

$ |

55,129 |

|

|

$ |

55,401 |

|

|

$ |

53,516 |

|

|

$ |

61,041 |

|

|

$ |

52,250 |

|

|

$ |

51,955 |

|

|

$ |

52,571 |

|

|

$ |

54,348 |

|

________________________________¹ Adjusted EBITDA

is a Non-GAAP Measure. This press release contains this and other

Non-GAAP measures. For reconciliations of our Non-GAAP measures to

their nearest GAAP measure, refer to the section titled

"Reconciliation of Non-GAAP Measures" below.

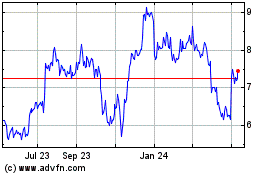

MiMedx (NASDAQ:MDXG)

Historical Stock Chart

From Feb 2025 to Mar 2025

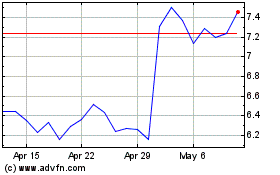

MiMedx (NASDAQ:MDXG)

Historical Stock Chart

From Mar 2024 to Mar 2025