Mesoblast Limited (Nasdaq:MESO; ASX:MSB), global leader in

allogeneic cellular medicines for inflammatory diseases, today

provided an operational update and reported financial results for

the period ended December 31, 2023.

Mesoblast Chief Executive Silviu Itescu said:

“We were very busy operationally during the last quarter and

continued to have positive engagement with the United States Food

and Drug Administration (FDA) across our lead programs. We have

strengthened our balance sheet while maintaining overall spending

constraint in line with our corporate objectives.

For our product Ryoncil® (remestemcel-L) for

life-threatening steroid-refractory acute graft-versus-host disease

(SR-aGVHD) ahead of our upcoming meeting in March we have provided

the FDA with new data from a second potency assay that provides

additional product characterization as requested by FDA.

“For our cardiovascular product Revascor®, we

had a very productive meeting with the FDA this month which

included discussion of a unifying mechanism of action across the

continuum of heart failure with inflammation in adults, and

potential approval pathways in these patients. The FDA will provide

written minutes from the meeting in March.

“We were also very pleased during this quarter

to have received both a Rare Pediatric Disease Designation and

Orphan Drug Designation from FDA for Revascor® in children with

hypoplastic left heart syndrome and plan to discuss the results of

the completed randomized controlled trial in the context of a

regulatory approval pathway.”

“Finally, our second Phase 3 back pain trial

with rexlemestrocel-L, aiming to confirm the durable pain reduction

that was seen in the first Phase 3 trial, is underway.”

FINANCIAL RESULTS FOR THE SIX MONTHS

ENDED DECEMBER 31, 2023 (FIRST HALF FY2024)

-

Strengthened balance sheet through delivering on

cost containment strategies and access to capital markets enacted

by management and the Board.

- Reduction

in net cash usage for operating activities:

- For the three

months ended December 31, 2023, net cash usage was US$12.3 million,

a 25% reduction versus the comparative quarter in FY2023.

- For the six months

ended December 31, 2023, net cash usage was US$26.6 million, a 14%

reduction versus the comparative period in FY2023.

- For FY2024, on

target to achieve a 23% reduction (US$15 million) in net cash usage

compared to FY2023, partially offset by investment in our Phase 3

programs for SR-aGVHD and CLBP.

- Cash

Reserves at December 31, 2023 were US$77.6 million

(A$113.5 million) after completing an Institutional Placement and

Entitlement Offer of A$60.3 million.1

GRAFT VERSUS HOST DISEASE – PEDIATRIC

AND ADULT PHASE 3 PROGRAMS

- Mesoblast has an

upcoming meeting scheduled for March with the United States Food

and Drug Administration (FDA) and has provided the agency with new

data from a second potency assay for its product Ryoncil®

(remestemcel-L) that provides additional product characterization

as requested by FDA.

- The new data show

that the RYONCIL product made with the current manufacturing

process that has undergone successful inspection by FDA,

demonstrates greater potency than the earlier generation product,

providing context to its greater impact on survival.

- Survival in adults

with SR-aGVHD who have failed at least one additional agent, such

as ruxolitinib, remains as low as 20-30% by 100 days.2,3 In

contrast, 100-day survival was 67% after RYONCIL treatment was used

under expanded access in 51 adults and children with SR-aGVHD who

failed to respond to at least one additional agent, such as

ruxolitinib.

- These additional

clinical data, together with the proposed Phase 3 trial protocol in

adults with SR-aGVHD have also been provided to FDA. Mesoblast is

collaborating with Blood and Marrow Transplant Clinical Trials

Network (BMT CTN) in the United States, a body that is funded by

the National Institutes of Health (NIH) and is responsible for

approximately 80% of all US allogeneic BMTs, to conduct a pivotal

trial in adults with SR-aGVHD.

PEDIATRIC CONGENITAL HEART DISEASE -

HYPOPLASTIC LEFT HEART SYNDROME (HLHS)

- During the quarter

FDA granted Mesoblast’s cardiovascular product, Revascor®

(rexlemestrocel-L), both Rare Pediatric Disease Designation (RPDD)

and Orphan-Drug Designation (ODD). This followed submission of

results from the randomized controlled trial in children with

hypoplastic left heart syndrome (HLHS), a potentially

life-threatening congenital heart condition.

- Results from a

blinded, randomized, placebo-controlled prospective trial of

REVASCOR conducted in the United States in children with HLHS were

published in the December 2023 issue of the peer reviewed The

Journal of Thoracic and Cardiovascular Surgery Open (JTCVS

Open).4

- In the HLHS trial

conducted in 19 children, a single intramyocardial administration

of REVASCOR at the time of staged surgery resulted in the desired

outcome of significantly larger increases in left ventricular (LV)

end-systolic and end-diastolic volumes over 12 months compared with

controls as measured by 3D echocardiography, (p=0.009 & p=0.020

respectively).

- These changes are

indicative of clinically important growth of the small left

ventricle, facilitating the ability to have a successful surgical

correction, known as full biventricular (BiV) conversion, which

allows for a normal two ventricle circulation with the surgically

repaired left ventricle taking over circulatory support to the

body. Without full BiV conversion the right heart chamber is under

excessive strain with increased risk of heart failure and

death.

- As noted in the

JTCVS publication the fact that 100% of REVASCOR-treated children

compared with 57% of controls had large enough LVs to accommodate

the full BiV conversion suggests that REVASCOR treatment may help

increase the ability to ‘better grow’ the HLHS LV after LV

recruitment surgery.

- The FDA’s ODD

Program provides orphan status to drugs and biologics which are

defined as those intended for the safe and effective treatment,

diagnosis or prevention of rare diseases. ODD qualifies the drug

for various development incentives, including eligibility for seven

years of market exclusivity upon regulatory approval, exemption

from FDA application fees, tax credits for qualified clinical

trials, and other potential assistance in the drug development

process.

- RPD Designation is

granted by the FDA for certain serious or life-threatening diseases

which primarily affect children. On FDA approval of a Biologics

Licensing Application (BLA) for REVASCOR for the treatment of HLHS,

Mesoblast may be eligible to receive a Priority Review Voucher

(PRV) that can be redeemed for any subsequent marketing application

or may be sold or transferred to a third party.

- Mesoblast plans to

meet with FDA to discuss the regulatory path to approval for

REVASCOR in children with this life-threatening condition.

FDA MEETING REGARDING REGULATORY PATH TO

APPROVAL FOR REXLEMESTROCEL-L IN ADULTS WITH CHRONIC HEART FAILURE

WITH REDUCED EJECTION FRACTION (HFrEF), INCLUDING END-STAGE

PATIENTS WITH A LEFT VENTRICULAR ASSIST DEVICE (LVAD)

- REVASCOR has shown

the potential to reduce major adverse cardiac events (MACE) such as

heart attack and cardiovascular death in high-risk patients with

HFrEF and inflammation.

- REVASCOR has also

shown the potential to improve major outcomes in high-risk patients

with end-stage HFrEF, inflammation and LVADs.

- Mesoblast met with

FDA this quarter to address potential pathways to approval for

REVASCOR under our Regenerative Medicine Advanced Therapies (RMAT)

designation. The discussion covered both Class II/III HFrEF

ischemic patients with inflammation from the Phase 3 DREAM-HF 565

patient study and Class IV ischemic LVAD patients with inflammation

from the 159 patient LVAD study.

- Mesoblast discussed

with FDA the mechanism of action by which REVASCOR is able to

improve major outcomes, including mortality, across the continuum

of heart failure with inflammation.

- Minutes of the

meeting are expected from FDA next month.

CHRONIC LOW BACK PAIN (CLBP) ASSOCIATED

WITH DEGENERATIVE DISK DISEASE (DDD)

- Product has been

manufactured for use in a pivotal study recruiting patients across

the United States to support potential marketing approval of

rexlemestrocel-L in chronic low back pain due to degenerative disc

disease.

- Primary endpoint is

reduction in pain at 12 months compared to placebo.

- Rexlemestrocel-L

has received Regenerative Medicine Advanced Therapy (RMAT)

designation for CLBP.

DETAILS OF FINANCIAL RESULTS FOR THE SIX

MONTHS ENDED DECEMBER 31, 2023 (FIRST HALF FY2024)

-

Royalties on sales of TEMCELL® HS Inj.5 sold in

Japan by our licensee for the first half FY2024 were, on a constant

currency basis, US$3.3 million, a growth of 3% compared with US$3.2

million for the comparative period in FY2023.6

- Research

& Development expenses reduced by US$0.8 million (6%),

down to US$12.6 million for the first half FY2024 compared with

US$13.4 million for the comparative period in FY2023. R&D

expenses primarily supported preparations for the remestemcel-L BLA

re-submission and preparations for pivotal studies for CLBP

associated with DDD and adult SR-aGVHD.

-

Manufacturing reduced by 47% for the six months

ended December 31, 2023, from US$12.8 million to US$6.7 million.

Costs in the current period include new potency and

characterization data for the remestemcel-L product, as requested

by FDA, which have been submitted ahead of our upcoming meeting

with FDA next month. During the prior comparative period costs were

elevated as we completed activities associated with the FDA

Pre-License Inspection (PLI) of the manufacturing process for

remestemcel-L.

- Management

and Administration expenses reduced by US$1.8 million, to

US$11.5 million for the first half FY2024.

-

Remeasurement of Contingent Consideration

recognized a minor loss of US$0.3 million in the first half FY2024

compared to a gain of US$6.0 million in the comparative period in

FY2023 reflecting a reduction in future third party payments.

- Fair value

movement of warrants recognized a gain of US$4.4 million

in the first half FY2024 on a revaluation of warrants to market

value compared to a minor loss of US$0.7 million in the comparative

period in FY2023.

- Other

operating income in the first half FY2024 was US$1.1

million compared with Nil in the comparative period in FY2023.

- Finance

Costs for borrowing arrangements include US$6.9 million of

non-cash expenditure for the first half FY2024 comprising accruing

interest and borrowing costs.

Loss after tax for the first

half FY2024 was US$32.5 million, a 21% reduction compared to

US$41.4 million for the comparative period in FY2023. The net loss

attributable to ordinary shareholders was 3.82 US cents per share

for the first half FY2024, compared with 5.64 US cents per share

for the comparative period in FY2023.

Conference CallThere will be a

webcast today, beginning at 9.00am AEST (Thursday, February 29);

5.00pm EST (Wednesday, February 28). It can be accessed via:

https://webcast.openbriefing.com/msb-hyr-2024/

The archived webcast will be available on the

Investor page of the Company’s website: www.mesoblast.com

About Mesoblast Mesoblast (the

Company) is a world leader in developing allogeneic (off-the-shelf)

cellular medicines for the treatment of severe and life-threatening

inflammatory conditions. The Company has leveraged its proprietary

mesenchymal lineage cell therapy technology platform to establish a

broad portfolio of late-stage product candidates which respond to

severe inflammation by releasing anti-inflammatory factors that

counter and modulate multiple effector arms of the immune system,

resulting in significant reduction of the damaging inflammatory

process.

Mesoblast has a strong and extensive global

intellectual property portfolio with protection extending through

to at least 2041 in all major markets. The Company’s proprietary

manufacturing processes yield industrial-scale, cryopreserved,

off-the-shelf, cellular medicines. These cell therapies, with

defined pharmaceutical release criteria, are planned to be readily

available to patients worldwide.

Mesoblast is developing product candidates for

distinct indications based on its remestemcel-L and

rexlemestrocel-L allogeneic stromal cell technology platforms.

Remestemcel-L is being developed for inflammatory diseases in

children and adults including steroid refractory acute graft versus

host disease, biologic-resistant inflammatory bowel disease, and

acute respiratory distress syndrome. Rexlemestrocel-L is in

development for advanced chronic heart failure and chronic low back

pain. Two products have been commercialized in Japan and Europe by

Mesoblast’s licensees, and the Company has established commercial

partnerships in Europe and China for certain Phase 3 assets.

Mesoblast has locations in Australia, the United

States and Singapore and is listed on the Australian Securities

Exchange (MSB) and on the Nasdaq (MESO). For more information,

please see www.mesoblast.com, LinkedIn: Mesoblast Limited and

Twitter: @Mesoblast

References / Footnotes

- Using Reserve Bank of Australia

(RBA) published exchange rate from December 31, 2023 of

1A$:0.6840US$.

- Jagasia M et al. Ruxolitinib for

the treatment of steroid-refractory acute GVHD (REACH1): a

multicenter, open-label phase 2 trial. Blood. 2020 May 14; 135(20):

1739–1749

- Abedin S, et al. Ruxolitinib

resistance or intolerance in steroid-refractory acute graft

versus-host disease — a real-world outcomes analysis. British

Journal of Haematology, 2021;195:429–43.

- Wittenberg RE, Gauvreau K, Leighton J, Moleon-Shea M, Borow KM,

Marx GR, Emani SM, Prospective randomized controlled trial of the

safety and feasibility of a novel mesenchymal precursor cell

therapy in hypoplastic left heart syndrome, JTCVS Open Volume 16,

Dec 2023, doi: https://doi.org/10.1016/j.xjon.2023.09.031

- TEMCELL® HS Inj. is a registered trademark of JCR

Pharmaceuticals Co. Ltd.

- TEMCELL sales by our Licensee are

recorded in Japanese Yen before being translated into USD for the

purposes of calculating the royalty paid to Mesoblast. Results have

been adjusted for the movement of the USD to Japanese Yen exchange

rate from 1USD:139.10 Yen for the six months ended December 31,

2022 to 1USD:146.94 Yen for the six months ended December 31,

2023.

Forward-Looking StatementsThis

press release includes forward-looking statements that relate to

future events or our future financial performance and involve known

and unknown risks, uncertainties and other factors that may cause

our actual results, levels of activity, performance or achievements

to differ materially from any future results, levels of activity,

performance or achievements expressed or implied by these

forward-looking statements. We make such forward-looking statements

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995 and other federal securities laws.

Forward-looking statements should not be read as a guarantee of

future performance or results, and actual results may differ from

the results anticipated in these forward-looking statements, and

the differences may be material and adverse. Forward-looking

statements include, but are not limited to, statements about: the

initiation, timing, progress and results of Mesoblast’s preclinical

and clinical studies, and Mesoblast’s research and development

programs; Mesoblast’s ability to advance product candidates into,

enroll and successfully complete, clinical studies, including

multi-national clinical trials; Mesoblast’s ability to advance its

manufacturing capabilities; the timing or likelihood of regulatory

filings and approvals (including our request to have a Type A

meeting with the FDA, the outcome of such a meeting, and any future

decision that the FDA may make on the BLA for remestemcel-L for

pediatric patients with SR-aGVHD), manufacturing activities and

product marketing activities, if any; the commercialization of

Mesoblast’s product candidates, if approved; regulatory or public

perceptions and market acceptance surrounding the use of stem-cell

based therapies; the potential for Mesoblast’s product candidates,

if any are approved, to be withdrawn from the market due to patient

adverse events or deaths; the potential benefits of strategic

collaboration agreements and Mesoblast’s ability to enter into and

maintain established strategic collaborations; Mesoblast’s ability

to establish and maintain intellectual property on its product

candidates and Mesoblast’s ability to successfully defend these in

cases of alleged infringement; the scope of protection Mesoblast is

able to establish and maintain for intellectual property rights

covering its product candidates and technology; estimates of

Mesoblast’s expenses, future revenues, capital requirements and its

needs for additional financing; Mesoblast’s financial performance;

developments relating to Mesoblast’s competitors and industry; and

the pricing and reimbursement of Mesoblast’s product candidates, if

approved. You should read this press release together with our risk

factors, in our most recently filed reports with the SEC or on our

website. Uncertainties and risks that may cause Mesoblast’s actual

results, performance or achievements to be materially different

from those which may be expressed or implied by such statements,

and accordingly, you should not place undue reliance on these

forward-looking statements. We do not undertake any obligations to

publicly update or revise any forward-looking statements, whether

as a result of new information, future developments or

otherwise.

Release authorized by the Chief Executive.

For more information, please contact:

|

Corporate Communications / Investors |

Media |

|

Paul Hughes |

BlueDot Media |

|

T: +61 3 9639 6036 |

Steve Dabkowski |

|

E: investors@mesoblast.com |

T: +61 419 880 486 |

|

|

E: steve@bluedot.net.au |

|

|

|

Consolidated Income Statement

|

|

|

Six Months EndedDecember 31, |

|

(in U.S. dollars, in thousands, except per share

amount) |

|

2023 |

|

2022 |

|

Revenue |

|

3,388 |

|

|

3,422 |

|

|

Research & development |

|

(12,647 |

) |

|

(13,430 |

) |

|

Manufacturing commercialization |

|

(6,746 |

) |

|

(12,760 |

) |

|

Management and administration |

|

(11,482 |

) |

|

(13,281 |

) |

|

Fair value remeasurement of contingent consideration |

|

(337 |

) |

|

5,989 |

|

|

Fair value remeasurement of warrant liability |

|

4,434 |

|

|

(712 |

) |

|

Other operating income and expenses |

|

1,068 |

|

|

(39 |

) |

|

Finance costs |

|

(10,319 |

) |

|

(10,685 |

) |

|

Loss before income tax |

|

(32,641 |

) |

|

(41,496 |

) |

|

Income tax benefit/(expense) |

|

102 |

|

|

126 |

|

|

Loss attributable to the owners of Mesoblast

Limited |

|

(32,539 |

) |

|

(41,370 |

) |

|

|

|

|

|

|

|

Losses per share from continuing operations attributable to

the ordinary equity holders of the Group: |

|

Cents |

|

Cents |

|

Basic - losses per share |

|

(3.82 |

) |

|

(5.64 |

) |

|

Diluted - losses per share |

|

(3.82 |

) |

|

(5.64 |

) |

|

|

|

|

|

|

|

|

Consolidated Statement of Comprehensive

Income

|

|

|

Six Months EndedDecember 31, |

|

(in U.S. dollars, in thousands) |

|

2023 |

|

2022 |

|

Loss for the period |

|

(32,539 |

) |

|

(41,370 |

) |

|

Other comprehensive (loss)/income |

|

|

|

|

|

Items that may be reclassified to profit and loss |

|

|

|

|

|

Exchange differences on translation of foreign operations |

|

1,164 |

|

|

100 |

|

|

Items that will not be reclassified to profit and loss |

|

|

|

|

|

Financial assets at fair value through other comprehensive

income |

|

(931 |

) |

|

192 |

|

|

Other comprehensive (loss)/income for the period, net of tax |

|

233 |

|

|

292 |

|

|

Total comprehensive losses attributable to the owners of

Mesoblast Limited |

|

(32,306 |

) |

|

(41,078 |

) |

|

|

|

|

|

|

|

|

Consolidated Balance Sheet

|

(in U.S. dollars, in thousands) |

|

As of December 31,

2023 |

|

As of June 30,

2023 |

|

Assets |

|

|

|

|

|

Current Assets |

|

|

|

|

|

Cash & cash equivalents |

|

77,554 |

|

|

71,318 |

|

|

Trade & other receivables |

|

3,998 |

|

|

6,998 |

|

|

Prepayments |

|

3,602 |

|

|

3,342 |

|

|

Total Current Assets |

|

85,154 |

|

|

81,658 |

|

|

|

|

|

|

|

|

Non-Current Assets |

|

|

|

|

|

Property, plant and equipment |

|

1,171 |

|

|

1,357 |

|

|

Right-of-use assets |

|

4,329 |

|

|

5,134 |

|

|

Financial assets at fair value through other comprehensive

income |

|

826 |

|

|

1,757 |

|

|

Other non-current assets |

|

2,241 |

|

|

2,326 |

|

|

Intangible assets |

|

576,564 |

|

|

577,183 |

|

|

Total Non-Current Assets |

|

585,131 |

|

|

587,757 |

|

|

Total Assets |

|

670,285 |

|

|

669,415 |

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

Current Liabilities |

|

|

|

|

|

Trade and other payables |

|

10,760 |

|

|

20,145 |

|

|

Provisions |

|

8,230 |

|

|

6,399 |

|

|

Borrowings |

|

8,534 |

|

|

5,952 |

|

|

Lease liabilities |

|

2,851 |

|

|

4,060 |

|

|

Warrant liability |

|

992 |

|

|

5,426 |

|

|

Total Current Liabilities |

|

31,367 |

|

|

41,982 |

|

|

|

|

|

|

|

|

Non-Current Liabilities |

|

|

|

|

|

Provisions |

|

17,073 |

|

|

16,612 |

|

|

Borrowings |

|

107,228 |

|

|

102,811 |

|

|

Lease liabilities |

|

3,386 |

|

|

3,672 |

|

|

Deferred consideration |

|

2,500 |

|

|

2,500 |

|

|

Total Non-Current Liabilities |

|

130,187 |

|

|

125,595 |

|

|

Total Liabilities |

|

161,554 |

|

|

167,577 |

|

|

Net Assets |

|

508,731 |

|

|

501,838 |

|

|

|

|

|

|

|

|

Equity |

|

|

|

|

|

Issued Capital |

|

1,286,229 |

|

|

1,249,123 |

|

|

Reserves |

|

75,846 |

|

|

73,520 |

|

|

(Accumulated losses) |

|

(853,344 |

) |

|

(820,805 |

) |

|

Total Equity |

|

508,731 |

|

|

501,838 |

|

|

|

|

|

|

|

|

|

Consolidated Statement of Cash Flow

|

|

|

Six Months EndedDecember 31, |

|

(in U.S. dollars, in thousands) |

|

2023 |

|

2022 |

|

Cash flows from operating activities |

|

|

|

|

|

Commercialization revenue received |

|

3,971 |

|

|

3,667 |

|

|

Government grants and tax incentives and credits received |

|

2,565 |

|

|

18 |

|

|

Payments to suppliers and employees (inclusive of goods and

services tax) |

|

(33,994 |

) |

|

(34,633 |

) |

|

Interest received |

|

887 |

|

|

207 |

|

|

Income taxes paid |

|

(1 |

) |

|

— |

|

|

Net cash (outflows) in operating activities |

|

(26,572 |

) |

|

(30,741 |

) |

|

|

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

|

Investment in fixed assets |

|

(194 |

) |

|

(187 |

) |

|

Receipts from investment in sublease |

|

116 |

|

|

— |

|

|

Payments for intellectual property |

|

(10 |

) |

|

(50 |

) |

|

Net cash (outflows) in investing activities |

|

(88 |

) |

|

(237 |

) |

|

|

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

|

Payment of transaction costs from borrowings |

|

(540 |

) |

|

(217 |

) |

|

Interest and other costs of finance paid |

|

(2,845 |

) |

|

(2,807 |

) |

|

Proceeds from issue of shares |

|

39,708 |

|

|

45,065 |

|

|

Payments for share issue costs |

|

(2,578 |

) |

|

(2,646 |

) |

|

Payments for lease liabilities |

|

(2,145 |

) |

|

(1,109 |

) |

|

Net cash inflows by financing activities |

|

31,600 |

|

|

38,286 |

|

|

|

|

|

|

|

| Net

increase in cash and cash equivalents |

|

4,940 |

|

|

7,308 |

|

|

Cash and cash equivalents at beginning of period |

|

71,318 |

|

|

60,447 |

|

| FX

gains/(losses) on the translation of foreign bank accounts |

|

1,296 |

|

|

(136 |

) |

|

Cash and cash equivalents at end of period |

|

77,554 |

|

|

67,619 |

|

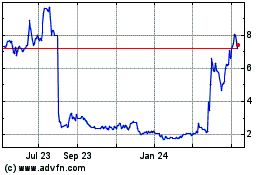

Mesoblast (NASDAQ:MESO)

Historical Stock Chart

From Nov 2024 to Dec 2024

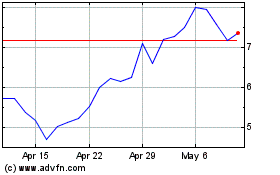

Mesoblast (NASDAQ:MESO)

Historical Stock Chart

From Dec 2023 to Dec 2024