UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed

by the Registrant ¨ Filed

by a Party other than the Registrant x

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted

by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting material Pursuant to §240.14a-12 |

Masimo Corporation

(Name of Registrant as Specified In Its Charter)

POLITAN CAPITAL MANAGEMENT LP

POLITAN CAPITAL MANAGEMENT GP LLC

POLITAN CAPITAL PARTNERS GP LLC

POLITAN CAPITAL NY LLC

POLITAN INTERMEDIATE LTD.

POLITAN CAPITAL PARTNERS MASTER FUND LP

POLITAN CAPITAL PARTNERS LP

POLITAN CAPITAL OFFSHORE PARTNERS LP

QUENTIN KOFFEY

MATTHEW HALL

AARON KAPITO

WILLIAM JELLISON

DARLENE SOLOMON

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per

Exchange Act Rules 14a-6(i)(1) and 0-11. |

On July 12, 2024, Politan Capital Management

LP, a Delaware limited partnership (“Politan”), updated its website, www.AdvanceMasimo.com (the “Site”), in connection

with the solicitation of stockholders of Masimo Corporation, a Delaware corporation (“Masimo”). Copies of the materials posted

to the Site, including two letters sent to the Masimo Board of Directors, are filed herewith.

106 West 56th Street, 10th Floor

New York, New York 10019

July 3, 2024

Via Email, U.S. Mail and Federal Express

The Board of Directors

c/o Masimo Corporation

52 Discovery

Irvine, CA 92618

Re: Empty

Voting

Dear Members of the Masimo Board of Directors:

I am writing this letter to express serious concerns

regarding a possible ongoing scheme to manipulate the outcome of the upcoming Annual Meeting of Stockholders.

We have observed that a brokerage firm associated

with an investor who is a friend of Mr. Kiani voted a major position – approximately 9.9 percent of the company’s outstanding

stock – in favor of the company’s nominees. The number of shares voted at this brokerage firm exceeded the shares publicly

reported to be owned by this investor by several multiples. That excess amount was accumulated at the brokerage in the period running

up to the record date and then disposed of out of the same brokerage right after the record date. These share movements corresponded almost

exactly with movements in and out of brokerages associated with firms that lend shares in the market. Further, in the same period of these

share movements, the short interest in Masimo stock increased by similar amounts.

Upon reviewing this data, which was first made

available to us on Monday, July 1, we believe it is likely that this investor has engaged in a pattern of trading that is known as

“record date capture” and “empty voting” that provides the investor the ability to vote shares of which they do

not have economic exposure. This trading strategy involves purchasing shares to be able to hold them on the record date and therefore

be entitled to vote them, while simultaneously borrowing and shorting an equivalent number of offsetting shares in order to eliminate

economic exposure to the stock. In these instances, the position is closed shortly after the record date, once the right to vote has been

secured. Empty voting at this scale threatens to distort corporate democracy at Masimo, as a stockholder whose votes are divorced from

their economic interests may not vote in a manner that is in the best interests of the company and all its stockholders.

In light of these circumstances, we ask the Board

to set a new record date for stockholders entitled to vote at the meeting. Based on the advice of counsel, we believe that if the Board

acts promptly, it can set a new record date without having to move the Annual Meeting. We also believe the Board should investigate what,

if any, contact Mr. Kiani has had with this investor. It is highly concerning that such a large position (just below the Section 16

threshold) should exist unknown to other shareholders and for just a brief period of time coinciding with the record date. It is also

suspicious that the position was held at a broker associated with a friend of Mr. Kiani and was voted in its entirety much earlier

than voting by third parties typically occurs (the only two major proxies that had been delivered as of Monday belonged to this investor

and Mr. Kiani). The Board should unambiguously direct that Mr. Kiani cannot participate in, or encourage, any schemes that

would undermine the ability of stockholders of the company to vote in a fair election.

Page 1 of 2

Finally, because this investor would have clearly

acquired over five percent of the company’s voting power with the intent to influence control by empty voting the shares, we believe

the investor should have filed a Schedule 13D with the SEC disclosing their intentions.

Given the severity of these matters and their

potential to materially impact the upcoming stockholder vote, we request that you look into these issues and take the appropriate actions

to address them immediately.

Thank you,

Quentin Koffey

Managing Member

Politan Capital Management

Page 2 of 2

106 West 56th Street, 10th Floor

New York, New York 10019

July 12, 2024

Via Email

The Board of Directors

c/o Masimo Corporation

52 Discovery

Irvine, CA 92618

Re: Letter

to Board of Directors on behalf of Politan Capital Management LP

Dear Members of the Board:

Last week I raised serious

concerns about an empty voting scheme we believe is being perpetrated by a friend of Joe Kiani to manipulate the outcome of the upcoming

annual meeting.

This investor, who it has

now come to light is RTW Investments based on Glass Lewis’s report and subsequent media reports, accumulated a 9.9% voting stake

through a trading strategy known as “record date capture” and “empty voting” that involves securing a large voting

position divorced from actual economic exposure.

RTW and Mr. Kiani were

the two earliest major investors to deliver proxies — well before other major holders voted. As Craig Reynolds, Masimo’s Lead

Independent Director and Chair of all three Board committees knows, RTW’s portfolio manager responsible for the Masimo investment

and Mr. Kiani are friends who have dinner together with their spouses and are both members of the Orange County community. This relationship

is underscored by Mr. Kiani being featured on RTW’s website praising the investment firm as a “trusted partner”

and noting that Mr. Kiani is an investor in RTW’s funds. A research firm has also reported on additional connectivity between

RTW’s CIO and Mr. Kiani.

Glass Lewis issued its recommendation

last night, and we are grateful that it decided to recommend that stockholders vote for both Politan nominees. We were also troubled by

the facts that emerged in the recommendation regarding RTW's effort to influence Glass Lewis by claiming they were a 9.9% holder. The

relevant discussion from Glass Lewis follows:

“We do note that on July 1,

2024, we received an inbound contact from RTW Investments (“RTW”) representing its ownership interest in Masimo as 9.9% and

expressing support for Masimo nominees Chavez and Kiani, opposition to Politan’s nominees and a willingness to engage further in

relation to such views. On July 8, 2024, we responded to RTW by offering engagement windows on July 9 and July 10, 2024.

To date, RTW has not responded to these offers. Per S&P Capital IQ, RTW was the owner of a 2.8% interest in Masimo as of March 31,

2024, indicating the ownership position communicated in the July 1, 2024, email represented an increase of approximately 3.6x by

RTW over the course of approximately three months.

Page 1 of 2

We are presently unable to ascertain RTW’s

current economic exposure and have no information regarding the presence of any agreements or understandings in relation to the voting

of RTW’s shares. We do, however, acknowledge the specified ownership interest and implied rate of accrual appear to align with certain

of the concerns raised by Politan in the letter filed with the SEC on July 8, 2024. If additional materials corroborating Politan’s

concerns subsequently emerge, whether prior to or following the forthcoming meeting, we would view such circumstances as a highly

inappropriate manipulation of the shareholder franchise and a severe indictment of Masimo's credibility and corporate governance.”

Unknown to Glass Lewis, at

the time of RTW’s solicitation to them, we believe RTW had already disposed of the vast majority of its position. Indeed, by July 1,

the brokerage firm associated with RTW held less than 2% of Masimo’s shares even though RTW retained its voting power and had cast

its 9.9% proxy for Mr. Kiani, in effect disenfranchising every other stockholder. Describing themselves to Glass Lewis as a 9.9%

owner is yet another instance of manipulation that benefits nobody other than Mr. Kiani.

The Board's refusal to do

the right thing here further underscores the critical need at Masimo for a majority of truly independent directors. Instead of conducting

any real inquiry or taking any action to protect stockholders from what we believe to be blatant manipulation and vote rigging, the Board

has refused to even meet to discuss the matter and has attacked Politan for raising the issue and proposing solutions. To protect the

integrity of the vote, Masimo should demand that RTW abstain from voting any shares that exceed its economic interest — or set a

record date that would allow stockholders to vote promptly in a fair election untainted by empty voting. The company should disclose any

and all contact it has had with RTW. We find the company’s categorical denials of any involvement to be difficult to believe. The

Board should also hire independent counsel to investigate the matter, determine if Mr. Kiani and RTW are a group and pursue disgorgement

of any Section 16 short-swing profits.

In light of the additional

information that has surfaced and the Board’s failure to take any action, we feel it is necessary to make this letter public so

investors understand the status of the situation and our heightened concern.

Thank you,

Quentin Koffey

Managing Member

Page 2 of 2

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

The information herein contains

“forward-looking statements.” Specific forward-looking statements can be identified by the fact that they do not relate

strictly to historical or current facts and include, without limitation, words such as “may,” “will,”

“expects,” “believes,” “anticipates,” “plans,” “estimates,”

“projects,” “potential,” “targets,” “forecasts,” “seeks,”

“could,” “should” or the negative of such terms or other variations on such terms or comparable terminology.

Similarly, statements that describe our objectives, plans or goals are forward-looking. Forward-looking statements are subject to

various risks and uncertainties and assumptions. There can be no assurance that any idea or assumption herein is, or will be proven,

correct. If one or more of the risks or uncertainties materialize, or if any of the underlying assumptions of Politan Capital

Management LP (“Politan”) or any of the other participants in the proxy solicitation described herein prove to be

incorrect, the actual results may vary materially from outcomes indicated by these statements. Accordingly, forward-looking

statements should not be regarded as a representation by Politan that the future plans, estimates or expectations contemplated will

ever be achieved. Certain statements and information included herein may have been sourced from third parties. Politan does not make

any representations regarding the accuracy, completeness or timeliness of such third party statements or information. Except as may

be expressly set forth herein, permission to cite such statements or information has neither been sought nor obtained from such

third parties. Any such statements or information should not be viewed as an indication of support from such third parties for the

views expressed herein.

Politan disclaims any obligation to update the

information herein or to disclose the results of any revisions that may be made to any projected results or forward-looking statements

herein to reflect events or circumstances after the date of such information, projected results or statements or to reflect the occurrence

of anticipated or unanticipated events.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Politan and the other Participants (as defined

below) have filed a definitive proxy statement and accompanying WHITE universal proxy card or voting instruction form with the Securities

and Exchange Commission (the “SEC”) to be used to solicit proxies for, among other matters, the election of its slate of director

nominees at the 2024 annual stockholders meeting (the “2024 Annual Meeting”) of Masimo Corporation, a Delaware corporation

(“Masimo”). Shortly after filing its definitive proxy statement with the SEC, Politan furnished the definitive proxy statement

and accompanying WHITE universal proxy card or voting instruction form to some or all of the stockholders entitled to vote at the 2024

Annual Meeting.

The participants in the proxy solicitation are

Politan, Politan Capital Management GP LLC (“Politan Management”), Politan Capital Partners GP LLC (“Politan GP”),

Politan Capital NY LLC (the “Record Stockholder”), Politan Intermediate Ltd., Politan Capital Partners Master Fund LP (“Politan

Master Fund”), Politan Capital Partners LP (“Politan LP”), Politan Capital Offshore Partners LP (“Politan Offshore”

and, collectively with Politan Master Fund and Politan LP, the “Politan Funds”), Quentin Koffey, Matthew Hall, Aaron Kapito

(all of the foregoing persons, collectively, the “Politan Parties”), William Jellison and Darlene Solomon (such individuals,

collectively with the Politan Parties, the “Participants”).

As of the date hereof, the Politan Parties in

this solicitation collectively own an aggregate of 4,713,518 shares (the “Politan Group Shares”) of common stock, par value

$0.001 per share, of Masimo (the “Common Stock”). Mr. Koffey may be deemed to own an aggregate of 4,714,746 shares of

Common Stock (the “Koffey Shares”), which consists of 1,228 restricted stock units (the “RSUs”) as well as the

Politan Group Shares. Politan, as the investment adviser to the Politan Funds, may be deemed to have the shared power to vote or direct

the vote of (and the shared power to dispose or direct the disposition of) the Politan Group Shares, and, therefore, Politan may be deemed

to be the beneficial owner of all of the Politan Group Shares. The Record Stockholder is the direct and record owner of 1,000 shares of

Common Stock that comprise part of the Politan Group Shares. Both the Politan Group Shares and the Koffey Shares represent approximately

8.9% of the outstanding shares of Common Stock based on 53,182,247 shares of Common Stock outstanding as of June 13, 2024, as reported

in Masimo’s definitive proxy statement filed on June 17, 2024. As the general partner of Politan, Politan Management may be

deemed to have the shared power to vote or direct the vote of (and the shared power to dispose or direct the disposition of) all of the

Politan Group Shares and, therefore, Politan Management may be deemed to be the beneficial owner of all of the Politan Group Shares. As

the general partner of the Politan Funds, Politan GP may be deemed to have the shared power to vote or to direct the vote of (and the

shared power to dispose or direct the disposition of) all of the Politan Group Shares, and therefore Politan GP may be deemed to be the

beneficial owner of all of the Politan Group Shares. Mr. Koffey, including by virtue of his position as the Managing Partner and

Chief Investment Officer of Politan and as the Managing Member of Politan Management and Politan GP, may be deemed to have the shared

power to vote or direct the vote of (and the shared power to dispose or direct the disposition of) all of the Koffey Shares.

IMPORTANT INFORMATION AND WHERE TO FIND IT

POLITAN

STRONGLY ADVISES ALL STOCKHOLDERS OF MASIMO TO READ ITS DEFINITIVE PROXY STATEMENT, ANY AMENDMENTS OR SUPPLEMENTS TO SUCH PROXY

STATEMENT AND OTHER PROXY MATERIALS FILED BY POLITAN WITH THE SEC AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEBSITE AT WWW.SEC.GOV. THE DEFINITIVE PROXY STATEMENT AND OTHER

RELEVANT DOCUMENTS ARE ALSO AVAILABLE ON THE SEC WEBSITE, FREE OF CHARGE, OR BY DIRECTING A REQUEST TO THE PARTICIPANTS’ PROXY SOLICITOR,

D.F. KING & CO., INC., 48 WALL STREET, 22ND FLOOR, NEW YORK, NEW YORK 10005. STOCKHOLDERS CAN CALL TOLL-FREE: (888) 628-8208.

Investor Contact

D.F. King &

Co., Inc.

Edward McCarthy / Gordon

Algernon / Dan Decea

MASI@dfking.com

Media Contacts

Dan Zacchei / Joe Germani

Longacre Square Partners

dzacchei@longacresquare.com / jgermani@longacresquare.com

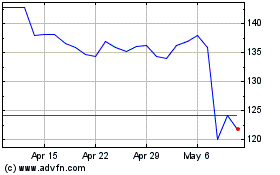

Masimo (NASDAQ:MASI)

Historical Stock Chart

From Jun 2024 to Jul 2024

Masimo (NASDAQ:MASI)

Historical Stock Chart

From Jul 2023 to Jul 2024