LIZHI INC. (“LIZHI” or the “Company” or “We”) (NASDAQ: LIZI), an

audio-based social and entertainment platform, today announced its

unaudited financial results for the first quarter ended March 31,

2022.

First Quarter 2022 Financial and

Operational Highlights

- Net revenues were

RMB516.7 million (US$81.5 million) in the first quarter of 2022,

representing a 4% increase from RMB495.1 million in the first

quarter of 2021.

- Average total mobile

MAUs1 in the first quarter of 2022 was

51.5 million, compared to 59.7 million in the first quarter of

2021.

- Average total monthly

paying users2 in the first quarter of

2022 reached 482.2 thousand, representing an increase of 2% from

474.7 thousand in the first quarter of 2021.

“In the first quarter of 2022, we’re pleased to

continue seeing the healthy improvement in our profitability,

posting revenue growth of 4% and gross profit growth of 34%

year-over-year,” said Mr. Jinnan (Marco) Lai, founder and CEO of

LIZHI. “During the quarter, our strategic initiatives remained

focused on optimizing operational efficiency and improving margins,

as well as harnessing our technological capabilities to strengthen

the competitiveness of our products and enrich the user experience.

Moreover, in our continuous efforts to enhance the vitality of our

audio community and boost user interactions, our average audio

entertainment mobile MAUs increased by 11% from 8.27 million in the

first quarter of 2021 to 9.14 million in the first quarter of 2022.

As we move forward, we will explore more commercialization avenues

in audio entertainment and social networking while also

concentrating on achieving a sustainable growth.

“On the global front, we progressed with

refining TIYA App’s features, introducing new functions to enhance

its social networking capabilities and further boost TIYA’s user

engagement, user activeness as well as its global appeal. In

addition, we worked diligently to upgrade our proprietary suite of

technologies, empowering us to persistently innovate and enrich

product features and functions to align with users’ diverse needs.

Looking ahead, we will steadfastly execute our globalization

strategy, continue our efforts in developing our in-house

technologies, and strive to advance product innovation. We believe

that we are well poised to capture a vast array of opportunities in

the global audio and social networking space and achieve greater

success,” Mr. Lai concluded.

Ms. Chengfang Lu, Acting Chief Financial Officer

of LIZHI, said, “Our first quarter results demonstrate our growth

trajectory. Driven by the continuous improvements in our operating

efficiency, in the first quarter, our gross margin grew to 32%, up

700 basis points year-over-year. More encouragingly, we achieved a

net income of RMB16.4 million in this quarter, representing an 84%

sequential increase. Going forward, we will carry on building a

more competitive audio ecosystem, pursuing diversified

commercialization avenues, and advancing our technology

capabilities. We are confident that these endeavors will strengthen

our core competencies and empower us to create greater value for

our users and shareholders.”

First Quarter 2022 Unaudited Financial

Results

Net revenues were RMB516.7

million (US$81.5 million) in the first quarter of 2022,

representing an increase of 4% from RMB495.1 million in the first

quarter of 2021, primarily due to the increases in the number of

paying users and the average amount of user spend on our audio

entertainment products, partially offset by the decrease in

advertising revenue which was mainly due to the decrease in the

number of advertising projects. While the COVID-19 resurgence in

various parts of the world continues, the extent to which the

pandemic impacts the Company’s operations beyond the first quarter

of 2022 depends on COVID-19’s future development in China and

across the globe, which is subject to change and substantial

uncertainty, and therefore cannot be predicted.

Cost of revenues was RMB348.6

million (US$55.0 million) in the first quarter of 2022,

representing a decrease of 6% from RMB370.0 million in the first

quarter of 2021, mainly attributable to a decrease in the revenue

sharing fees primarily due to the adjustment in revenue sharing

policies, resulting in a decrease in the percentage of the revenue

sharing fees in the first quarter of 2022.

Gross profit was RMB168.1

million (US$26.5 million) in the first quarter of 2022,

representing an increase of 34% from RMB125.1 million in the first

quarter of 2021.

Non-GAAP gross

profit3 was RMB170.7 million (US$26.9

million) in the first quarter of 2022, representing an increase of

34% from RMB127.7 million in the first quarter of 2021.

Gross margin in the first

quarter of 2022 was 32%, compared to 25% in the first quarter of

2021. Non-GAAP gross margin in the first quarter

of 2022 was 33%, compared to 26% in the first quarter of 2021.

Operating expenses were

RMB153.5 million (US$24.2 million) in the first quarter of 2022,

representing a decrease of 22% from RMB197.3 million in the first

quarter of 2021.

Research and development expenses were RMB71.1

million (US$11.2 million) in the first quarter of 2022,

representing an increase of 25% from RMB56.9 million in the first

quarter of 2021. The increase was primarily due to the higher

salary and welfare benefits expenses and rental expenses.

Selling and marketing expenses were RMB60.0

million (US$9.5 million) in the first quarter of 2022, representing

a decrease of 50% from RMB120.8 million in the first quarter of

2021, primarily attributable to the decrease in promotion and

marketing expenses, and partially offset by the increased salary

and welfare benefits expenses.

General and administrative expenses were RMB22.4

million (US$3.5 million) in the first quarter of 2022, representing

an increase of 14% from RMB19.6 million in the first quarter of

2021. The increase was mainly due to increased salary and welfare

benefits expenses and rental expenses.

Operating income was RMB14.6

million (US$2.3 million) in the first quarter of 2022, compared to

operating loss of RMB72.2 million in the first quarter of 2021.

Non-GAAP operating

income4 was RMB23.4 million (US$3.7

million) in the first quarter of 2022, compared to non-GAAP

operating loss of RMB64.0 million in the first quarter of 2021.

Net income was RMB16.4 million

(US$2.6 million) in the first quarter of 2022, compared to net loss

of RMB70.0 million in the first quarter of 2021.

Non-GAAP net income was RMB25.2

million (US$4.0 million) in the first quarter of 2022, compared to

non-GAAP net loss of RMB61.8 million in the first quarter of

2021.

Net income attributable to LIZHI

INC.’s ordinary shareholders was RMB16.4

million (US$2.6 million) in the first quarter of 2022, compared to

net loss attributable to LIZHI INC.’s ordinary shareholders of

RMB70.0 million in the first quarter of 2021.

Non-GAAP net income attributable to

LIZHI INC.’s ordinary

shareholders5 was RMB25.2 million (US$4.0

million) in the first quarter of 2022, compared to non-GAAP net

loss attributable to LIZHI INC.'s ordinary shareholders of RMB61.8

million in the first quarter of 2021.

Basic and diluted net income per

ADS6 were RMB0.32 (US$0.05) in the first

quarter of 2022, compared to basic and diluted net loss per ADS of

RMB1.50 in the first quarter of 2021.

Non-GAAP basic and diluted net income

per ADS7 were RMB0.49 (US$0.08) in the

first quarter of 2022, compared to non-GAAP basic and diluted net

loss of RMB1.33 per ADS in the first quarter of 2021.

Balance Sheets

As of March 31, 2022, the Company had cash and

cash equivalents, short-term investments and restricted cash of

RMB515.5 million (US$81.3 million).

Conference Call

The Company's management will host an earnings

conference call at 9:00 PM U.S. Eastern Time on May 26, 2022 (9:00

AM Beijing/Hong Kong Time on May 27, 2022).

For participants who wish to join the call,

please access the link provided below to complete the Direct Event

online registration and dial in 10 minutes prior to the scheduled

call start time.

|

Event Title: |

LIZHI INC. First Quarter 2022 Earnings Conference Call |

|

Conference ID: |

8376836 |

|

Registration Link: |

http://apac.directeventreg.com/registration/event/8376836 |

Upon registration, each participant will receive

a set of dial-in numbers by location, a Direct Event passcode, a

unique Registrant ID, and further detailed instructions, which will

be used to join the conference call.

Additionally, a live and archived webcast of the

conference call will be available on the Company's investor

relations website at http://ir.lizhi.fm.

A replay of the conference call will be

accessible approximately two hours after the conclusion of the call

until June 2, 2022, by dialing the following telephone numbers:

|

United States: |

+1-855-452-5696 |

|

International: |

+61-2-8199-0299 |

|

Hong Kong, China: |

800-963-117 |

|

Mainland, China: |

400-820-9035 |

|

Replay Access Code: |

8376836 |

About LIZHI INC.

LIZHI INC. has created a comprehensive

audio-based social ecosystem with a global presence. The Company

aims to cater to users’ interests in audio entertainment and social

networking through its product portfolios. LIZHI INC. envisions an

audio ecosystem where everyone can be connected and interact

through voices. LIZHI INC. has been listed on Nasdaq since January

2020.

For more information, please visit:

http://ir.lizhi.fm.

Use of Non-GAAP Financial

Measures

The unaudited condensed consolidated financial

information is prepared in conformity with accounting principles

generally accepted in the United States of America (“U.S.

GAAP”).

LIZHI uses non-GAAP gross profit, non-GAAP gross

margin, non-GAAP operating loss/income, non-GAAP net loss/income,

non-GAAP net loss/income attributable to LIZHI INC.’s ordinary

shareholders and non-GAAP basic and diluted net loss/income per

ADS, which are non-GAAP financial measures. Non-GAAP gross profit

is gross profit excluding share-based compensation expenses.

Non-GAAP gross margin is non-GAAP gross profit as a percentage of

net revenues. Non-GAAP operating loss/income is operating

loss/income excluding share-based compensation expenses. Non-GAAP

net loss/income is net loss/income, excluding share-based

compensation expenses. Non-GAAP net loss/income attributable to

LIZHI INC.’s ordinary shareholders is net loss/income attributable

to LIZHI INC.’s ordinary shareholders excluding accretions to

preferred shares redemption value and share-based compensation

expenses. Non-GAAP basic and diluted net loss/income per ADS is

non-GAAP net loss/income attributable to LIZHI INC.’s ordinary

shareholders divided by the weighted average number of ADS used in

the calculation of basic and diluted net loss/income per ADS. The

Company believes that separate analysis and exclusion of the

non-cash impact of the above reconciling items adds clarity to the

constituent parts of its performance. The Company reviews these

non-GAAP financial measures together with GAAP financial measures

to obtain a better understanding of its operating performance. It

uses the non-GAAP financial measure for planning, forecasting and

measuring results against the forecast. The Company believes that

non-GAAP financial measure is useful supplemental information for

investors and analysts to assess its operating performance without

the non-cash effect of accretions to preferred shares redemption

value and share-based compensation expenses.

However, the use of non-GAAP financial measures

has material limitations as an analytical tool. One of the

limitations of using non-GAAP financial measures is that they do

not include all items that impact the Company’s net income for the

period. In addition, because non-GAAP financial measures are not

measured in the same manner by all companies, they may not be

comparable to other similarly titled measures used by other

companies. In light of the foregoing limitations, you should not

consider non-GAAP financial measures in isolation from, superior

to, or as an alternative to the financial measure prepared in

accordance with U.S. GAAP.

The presentation of these non-GAAP financial

measures is not intended to be considered in isolation from, or as

a substitute for, the financial information prepared and presented

in accordance with U.S. GAAP. For more information on these

non-GAAP financial measures, please see the table captioned

“Unaudited Reconciliations of GAAP and Non-GAAP Results” near the

end of this release.

Exchange Rate Information

This announcement contains translations of

certain RMB amounts into U.S. dollars at a specified rate solely

for the convenience of the reader. Unless otherwise noted, all

translations from RMB to U.S. dollars and from U.S. dollars to RMB

are made at a rate of RMB6.3393 to US$1.00, the exchange rate on

March 31, 2022 set forth in the H.10 statistical release of the

Federal Reserve Board. The Company makes no representation that the

RMB or U.S. dollars amounts referred could be converted into U.S.

dollars or RMB, as the case may be, at any particular rate or at

all.

Safe Harbor Statement

This press release contains forward-looking

statements. These statements are made under the “safe harbor”

provisions of the U.S. Private Securities Litigation Reform Act of

1995. Statements that are not historical facts, including

statements about the Company’s beliefs and expectations, are

forward-looking statements. Forward-looking statements involve

inherent risks and uncertainties, and a number of factors could

cause actual results to differ materially from those contained in

any forward-looking statement, including but not limited to the

following: LIZHI’s goals and strategies; LIZHI’s future business

development, results of operations and financial condition; the

expected growth of the online audio market; the expectation

regarding the rate at which to gain active users, especially paying

users; LIZHI’s ability to monetize the user base; fluctuations in

general economic and business conditions in China and overseas

markets; the impact of the COVID-19 to LIZHI’s business operations

and the economy in China and elsewhere generally; any adverse

changes in laws, regulations, rules, policies or guidelines

applicable to LIZHI; and assumptions underlying or related to any

of the foregoing. In some cases, forward-looking statements can be

identified by words or phrases such as “may”, “will,” “expect,”

“anticipate,” “target,” “aim,” “estimate,” “intend,” “plan,”

“believe,” “potential,” “continue,” “is/are likely to” or other

similar expressions. Further information regarding these and other

risks, uncertainties or factors is included in the Company’s

filings with the Securities Exchange Commission. All information

provided in this press release is as of the date of this press

release, and the Company does not undertake any duty to update such

information, except as required under applicable law.

For investor and media inquiries, please

contact:In China:

LIZHI INC.IR DepartmentTel: +86 (20) 3866-4265E-mail:

ir@lizhi.fm

The Piacente Group, Inc.Jenny CaiTel: +86 (10) 6508-0677E-mail:

Lizhi@tpg-ir.com

In the United States:

The Piacente Group, Inc. Brandi PiacenteTel:

+1-212-481-2050E-mail: Lizhi@tpg-ir.com

LIZHI INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE

SHEETS(All amounts in thousands, except for share, ADS,

per share data and per ADS data)

|

|

|

December31,2021 |

|

March31,2022 |

|

March31,2022 |

|

|

|

RMB |

|

RMB |

|

US$ |

| ASSETS |

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

533,293 |

|

490,136 |

|

77,317 |

|

Short-term investments |

|

- |

|

20,000 |

|

3,155 |

|

Restricted cash |

|

4,155 |

|

5,327 |

|

840 |

|

Accounts receivable, net |

|

6,458 |

|

3,553 |

|

560 |

|

Prepayments and other current assets |

|

33,604 |

|

29,456 |

|

4,647 |

|

|

|

|

|

|

|

|

| Total current

assets |

|

577,510 |

|

548,472 |

|

86,519 |

|

|

|

|

|

|

|

|

| Non-current

assets |

|

|

|

|

|

|

|

Property, equipment and leasehold improvement, net |

|

33,391 |

|

33,787 |

|

5,330 |

|

Intangible assets, net |

|

2,245 |

|

1,792 |

|

283 |

|

Right-of-use assets, net |

|

28,941 |

|

31,479 |

|

4,966 |

|

Other non-current assets |

|

799 |

|

681 |

|

107 |

|

|

|

|

|

|

|

|

| Total non-current

assets |

|

65,376 |

|

67,739 |

|

10,686 |

|

|

|

|

|

|

|

|

|

TOTAL ASSETS |

|

642,886 |

|

616,211 |

|

97,205 |

|

|

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

|

Accounts payable |

|

80,793 |

|

63,033 |

|

9,943 |

|

Deferred revenue |

|

20,657 |

|

22,530 |

|

3,554 |

|

Salary and welfare payable |

|

123,075 |

|

104,630 |

|

16,505 |

|

Taxes payable |

|

5,564 |

|

5,549 |

|

875 |

|

Short-term loans |

|

68,999 |

|

50,000 |

|

7,887 |

|

Lease liabilities due within one year |

|

13,929 |

|

16,649 |

|

2,626 |

|

Accrued expenses and other current liabilities |

|

53,486 |

|

54,273 |

|

8,561 |

|

|

|

|

|

|

|

|

| Total current

liabilities |

|

366,503 |

|

316,664 |

|

49,951 |

|

|

|

|

|

|

|

|

| Non-current

liabilities |

|

|

|

|

|

|

|

Lease liabilities |

|

17,076 |

|

16,968 |

|

2,677 |

|

Other non-current liabilities |

|

4,452 |

|

4,225 |

|

666 |

|

|

|

|

|

|

|

|

| Total non-current

liabilities |

|

21,528 |

|

21,193 |

|

3,343 |

|

|

|

|

|

|

|

|

| TOTAL

LIABILITIES |

|

388,031 |

|

337,857 |

|

53,294 |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

LIZHI INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE

SHEETS (CONTINUED)(All amounts in thousands, except for

share, ADS, per share data and per ADS data)

| |

|

December31,2021 |

|

March31,2022 |

|

March31,2022 |

| |

|

RMB |

|

RMB |

|

US$ |

| |

|

|

|

|

|

|

| SHAREHOLDERS’

EQUITY |

|

|

|

|

|

|

| LIZHI Inc.’s

shareholders’ equity |

|

|

|

|

|

|

|

Class A Ordinary shares (US$0.0001 par value, 1,268,785,000 shares

authorized, 798,962,260 sharesissued and 782,801,250 shares

outstanding as of December 31, 2021; 1,268,785,000 shares

authorized, 818,962,260 sharesissued and 784,879,970 shares

outstanding as of March 31, 2022). |

|

530 |

|

|

543 |

|

|

86 |

|

| Class B Ordinary shares

(US$0.0001 par value, 231,215,000 shares authorized, issued

andoutstanding as of December 31, 2021 and March 31, 2022,

respectively). |

|

168 |

|

|

168 |

|

|

27 |

|

| Treasury stock |

|

(11 |

) |

|

(22 |

) |

|

(3 |

) |

| Additional paid in

capital |

|

2,630,456 |

|

|

2,638,753 |

|

|

416,253 |

|

| Accumulated deficit |

|

(2,366,531 |

) |

|

(2,350,103 |

) |

|

(370,720 |

) |

| Accumulated other

comprehensive loss |

|

(9,757 |

) |

|

(10,975 |

) |

|

(1,730 |

) |

| TOTAL LIZHI Inc.’s

shareholders’ equity |

|

254,855 |

|

|

278,364 |

|

|

43,913 |

|

| |

|

|

|

|

|

| Non-controlling interests |

|

- |

|

|

(10 |

) |

|

(2 |

) |

| |

|

|

|

|

|

|

| TOTAL SHAREHOLDERS’

EQUITY |

|

254,855 |

|

|

278,354 |

|

|

43,911 |

|

| |

|

|

|

|

|

|

| TOTAL LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

642,886 |

|

|

616,211 |

|

|

97,205 |

|

LIZHI INC.

UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS(All amounts in thousands, except

for share, ADS, per share data and per ADS data)

| |

|

Three Months Ended |

| |

|

March31,2021 |

|

December31,2021 |

|

March31,2022 |

|

March31,2022 |

| |

|

RMB |

|

RMB |

|

RMB |

|

US$ |

| |

|

|

|

|

|

|

|

|

| Net

revenues |

|

|

|

|

|

|

|

|

|

Audio entertainment revenues |

|

489,306 |

|

|

556,304 |

|

|

514,022 |

|

|

81,085 |

|

| Podcast, advertising and other

revenues |

|

5,747 |

|

|

4,028 |

|

|

2,691 |

|

|

424 |

|

| Total net

revenues |

|

495,053 |

|

|

560,332 |

|

|

516,713 |

|

|

81,509 |

|

| Cost of

revenues(1) |

|

(369,993 |

) |

|

(378,406 |

) |

|

(348,621 |

) |

|

(54,994 |

) |

| Gross

profit |

|

125,060 |

|

|

181,926 |

|

|

168,092 |

|

|

26,515 |

|

| |

|

|

|

|

|

|

|

|

| Operating

expenses(1) |

|

|

|

|

|

|

|

|

| Selling and marketing

expenses |

|

(120,790 |

) |

|

(70,859 |

) |

|

(60,009 |

) |

|

(9,466 |

) |

| General and administrative

expenses |

|

(19,617 |

) |

|

(32,192 |

) |

|

(22,378 |

) |

|

(3,530 |

) |

| Research and development

expenses |

|

(56,868 |

) |

|

(73,523 |

) |

|

(71,094 |

) |

|

(11,215 |

) |

| Total operating

expenses |

|

(197,275 |

) |

|

(176,574 |

) |

|

(153,481 |

) |

|

(24,211 |

) |

| |

|

|

|

|

|

|

|

|

| Operating

(loss)/income |

|

(72,215 |

) |

|

5,352 |

|

|

14,611 |

|

|

2,304 |

|

| |

|

|

|

|

|

|

|

|

| Interest expenses, net |

|

(248 |

) |

|

(154 |

) |

|

(55 |

) |

|

(9 |

) |

| Foreign exchange losses |

|

(149 |

) |

|

(311 |

) |

|

(386 |

) |

|

(61 |

) |

| Investment income |

|

407 |

|

|

- |

|

|

94 |

|

|

15 |

|

| Government grants |

|

2,917 |

|

|

3,832 |

|

|

2,626 |

|

|

414 |

|

| Others, net |

|

(749 |

) |

|

572 |

|

|

(429 |

) |

|

(68 |

) |

| |

|

|

|

|

|

|

|

|

| (Loss)/income before

income taxes |

|

(70,037 |

) |

|

9,291 |

|

|

16,461 |

|

|

2,595 |

|

| |

|

|

|

|

|

|

|

|

| Income tax expenses |

|

- |

|

|

(376 |

) |

|

(43 |

) |

|

(7 |

) |

| |

|

|

|

|

|

|

|

|

| Net

(loss)/income |

|

(70,037 |

) |

|

8,915 |

|

|

16,418 |

|

|

2,588 |

|

| |

|

|

|

|

|

|

|

|

| Net loss attributable to the

non-controlling interests shareholders |

|

- |

|

|

- |

|

|

10 |

|

|

2 |

|

| |

|

|

|

|

|

|

|

|

| Net (loss)/income

attributable to LIZHI INC.’s ordinary shareholders |

|

(70,037 |

) |

|

8,915 |

|

|

16,428 |

|

|

2,590 |

|

| |

|

|

|

|

|

|

|

|

LIZHI INC.

UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (CONTINUED)(All amounts in

thousands, except for share, ADS, per share data and per ADS

data)

| |

|

Three Months Ended |

| |

|

March31,2021 |

|

December31,2021 |

|

March31,2022 |

|

March31,2022 |

| |

|

RMB |

|

RMB |

|

RMB |

|

US$ |

| |

|

|

|

|

|

|

|

|

|

Net (loss)/income |

|

(70,037 |

) |

|

8,915 |

|

|

16,418 |

|

|

2,588 |

|

| |

|

|

|

|

|

|

|

|

| Other comprehensive

income/(loss): |

|

|

|

|

|

|

|

|

| Foreign currency translation

adjustments |

|

1,136 |

|

|

(5,152 |

) |

|

(1,218 |

) |

|

(192 |

) |

| Total comprehensive

(loss)/income |

|

(68,901 |

) |

|

3,763 |

|

|

15,200 |

|

|

2,396 |

|

| Comprehensive loss

attributable to non‑controlling interests shareholders |

|

- |

|

|

- |

|

|

10 |

|

|

2 |

|

| Comprehensive

(loss)/income attributable to LIZHI INC.’s ordinary

shareholders |

|

(68,901 |

) |

|

3,763 |

|

|

15,210 |

|

|

2,398 |

|

| |

|

|

|

|

|

|

|

|

| Net (loss)/income

attributable to LIZHI INC.’s ordinary shareholders per

share |

|

|

|

|

|

|

|

|

|

—Basic |

|

(0.08 |

) |

|

0.01 |

|

|

0.02 |

|

|

0.00 |

|

|

—Diluted |

|

(0.08 |

) |

|

0.01 |

|

|

0.02 |

|

|

0.00 |

|

| Weighted average

number of ordinary shares |

|

|

|

|

|

|

|

|

|

—Basic |

|

930,843,416 |

|

|

1,022,278,296 |

|

|

1,022,743,151 |

|

|

1,022,743,151 |

|

|

—Diluted |

|

930,843,416 |

|

|

1,026,331,428 |

|

|

1,027,560,107 |

|

|

1,027,560,107 |

|

| |

|

|

|

|

|

|

|

|

| Net (loss)/income

attributable to LIZHI INC.’s ordinary shareholders per

ADS |

|

|

|

|

|

|

|

|

|

—Basic |

|

(1.50 |

) |

|

0.17 |

|

|

0.32 |

|

|

0.05 |

|

|

—Diluted |

|

(1.50 |

) |

|

0.17 |

|

|

0.32 |

|

|

0.05 |

|

| Weighted average

number of ADS |

|

|

|

|

|

|

|

|

|

—Basic |

|

46,542,171 |

|

|

51,113,915 |

|

|

51,137,158 |

|

|

51,137,158 |

|

|

—Diluted |

|

46,542,171 |

|

|

51,316,571 |

|

|

51,378,005 |

|

|

51,378,005 |

|

LIZHI INC.

UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (CONTINUED)(All amounts in

thousands, except for share, ADS, per share data and per ADS

data)

(1) Share-based compensation was allocated in cost

of revenues and operating expenses as follows:

| |

|

Three Months Ended |

|

|

|

March31,2021 |

|

December31,2021 |

|

March31,2022 |

|

March31,2022 |

| |

|

RMB |

|

RMB |

|

RMB |

|

US$ |

| |

|

|

|

|

|

|

|

|

| Cost of revenues |

|

2,670 |

|

2,519 |

|

2,606 |

|

411 |

| Selling and marketing

expenses |

|

283 |

|

1,039 |

|

1,007 |

|

159 |

| General and administrative

expenses |

|

3,228 |

|

2,879 |

|

2,789 |

|

440 |

| Research and development

expenses |

|

2,064 |

|

2,898 |

|

2,361 |

|

372 |

| |

|

|

|

|

|

|

|

|

LIZHI INC.

UNAUDITED RECONCILIATIONS OF GAAP AND

NON-GAAP RESULTS(All amounts in thousands, except for

share, ADS, per share data and per ADS data)

| |

|

Three Months Ended |

| |

|

March31,2021 |

|

December31,2021 |

|

March31,2022 |

|

March31,2022 |

| |

|

RMB |

|

RMB |

|

RMB |

|

US$ |

| |

|

|

|

|

|

|

|

|

|

Gross profit |

|

125,060 |

|

|

181,926 |

|

168,092 |

|

26,515 |

| Share-based compensation

expenses |

|

2,670 |

|

|

2,519 |

|

2,606 |

|

411 |

| Non-GAAP gross

profit |

|

127,730 |

|

|

184,445 |

|

170,698 |

|

26,926 |

| |

|

|

|

|

|

|

|

|

| Operating

(loss)/income |

|

(72,215 |

) |

|

5,352 |

|

14,611 |

|

2,304 |

| Share-based compensation

expenses |

|

8,245 |

|

|

9,335 |

|

8,763 |

|

1,382 |

| Non-GAAP operating

(loss)/income |

|

(63,970 |

) |

|

14,687 |

|

23,374 |

|

3,686 |

| |

|

|

|

|

|

|

|

|

| Net

(loss)/income |

|

(70,037 |

) |

|

8,915 |

|

16,418 |

|

2,588 |

| Share-based compensation

expenses |

|

8,245 |

|

|

9,335 |

|

8,763 |

|

1,382 |

| Non-GAAP net

(loss)/income |

|

(61,792 |

) |

|

18,250 |

|

25,181 |

|

3,970 |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Net (loss)/income

attributable to LIZHI INC.’s ordinary shareholders |

|

(70,037 |

) |

|

8,915 |

|

16,428 |

|

2,590 |

| Share-based compensation

expenses |

|

8,245 |

|

|

9,335 |

|

8,763 |

|

1,382 |

| Non-GAAP net

(loss)/income attributable to LIZHI INC.’s ordinary

shareholders |

|

(61,792 |

) |

|

18,250 |

|

25,191 |

|

3,972 |

| |

|

|

|

|

|

|

|

|

| Non-GAAP

net (loss)/income attributable to LIZHI INC.’s

ordinary shareholders per share |

|

|

|

|

|

|

|

|

| —Basic |

|

(0.07 |

) |

|

0.02 |

|

0.02 |

|

0.00 |

| —Diluted |

|

(0.07 |

) |

|

0.02 |

|

0.02 |

|

0.00 |

| Weighted average

number of ordinary shares |

|

|

|

|

|

|

|

|

|

—Basic |

|

930,843,416 |

|

|

1,022,278,296 |

|

1,022,743,151 |

|

1,022,743,151 |

|

—Diluted |

|

930,843,416 |

|

|

1,026,331,428 |

|

1,027,560,107 |

|

1,027,560,107 |

| |

|

|

|

|

|

|

|

|

| Non-GAAP

net (loss)/income attributable to LIZHI INC.’s

ordinary shareholders per ADS |

|

|

|

|

|

|

|

|

| —Basic |

|

(1.33 |

) |

|

0.36 |

|

0.49 |

|

0.08 |

| —Diluted |

|

(1.33 |

) |

|

0.36 |

|

0.49 |

|

0.08 |

| Weighted average

number of ADS |

|

|

|

|

|

|

|

|

| —Basic |

|

46,542,171 |

|

|

51,113,915 |

|

51,137,158 |

|

51,137,158 |

| —Diluted |

|

46,542,171 |

|

|

51,316,571 |

|

51,378,005 |

|

51,378,005 |

| |

|

|

|

|

|

|

|

|

___________________________

1 Refers to the average monthly number of active

users across our platforms and Apps in a given period, calculated

by dividing (i) the sum of mobile active users for each month of

such period, by (ii) the number of months in the same period.2

Refers to the average monthly number of paying users in a given

period, calculated by dividing (i) the total number of paying users

in each month of such period by (ii) the number of months in the

same period.3 Non-GAAP gross profit is a non-GAAP financial

measure, which is defined as gross profit excluding share-based

compensation expenses. This adjustment amounted to RMB2.6 million

(US$0.4 million) in the first quarter of 2022. Please refer to the

section below titled “Unaudited Reconciliations of GAAP and

Non-GAAP Results” for details.4 Non-GAAP operating income is a

non-GAAP financial measure, which is defined as operating income

excluding share-based compensation expenses. This adjustment

amounted to RMB8.8 million (US$1.4 million) in the first quarter of

2022. Please refer to the section below titled “Unaudited

Reconciliations of GAAP and Non-GAAP Results” for details.5

Non-GAAP net income attributable to LIZHI INC.’s ordinary

shareholders is a non-GAAP financial measure, which is defined as

net income attributable to LIZHI INC.’s ordinary shareholders

excluding share-based compensation expenses. These adjustments

amounted to RMB8.8 million (US$1.4 million) and RMB8.2 million in

the first quarter of 2022 and 2021, respectively. Please refer to

the section below titled “Unaudited Reconciliations of GAAP and

Non-GAAP Results” for details.6 ADS refers to American Depositary

Share. Each ADS represents twenty Class A ordinary shares of the

Company. Basic and diluted net income per ADS is net income

attributable to LIZHI INC.’s ordinary shareholders divided by

weighted average number of ADS.7 Non-GAAP basic and diluted net

income per ADS is a non-GAAP financial measure, which is defined as

non-GAAP net income attributable to LIZHI INC.’s ordinary

shareholders divided by weighted average number of ADS used in the

calculation of basic and diluted net income per ADS.

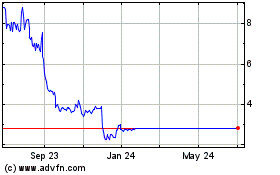

LIZHI (NASDAQ:LIZI)

Historical Stock Chart

From Aug 2024 to Sep 2024

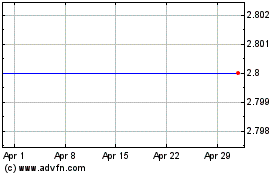

LIZHI (NASDAQ:LIZI)

Historical Stock Chart

From Sep 2023 to Sep 2024