Lilium N.V. (Nasdaq: LILM), a leading electric aircraft

manufacturer and pioneer in Regional Air Mobility (RAM), announces

that it has appointed KPMG to conduct an open, transparent and fair

M&A process. First investor briefings will start soon.

This followed the local court of Weilheim’s approval of the

insolvency filing of Lilium’s German subsidiaries and the court’s

granting of Lilium’s application for self-administration.

Preliminary insolvency proceedings under self-administration are

court-ordered restructuring proceedings aimed at preserving the

business. The management remains in charge and leads the business

through the proceedings, supported by restructuring experts.

The court has appointed to the German subsidiaries’ Boards of

Management with immediate effect two restructuring-experienced

lawyers, Prof. Dr. Gerrit Hölzle and Dr. Thorsten Bieg as Chief

Insolvency Officers (CIOs). Both have already successfully advised

a large number of companies in crisis situations. Most recently,

they worked for Senvion and The Social Chain AG, among others. They

will now oversee the reorganization of Lilium's German

subsidiaries.

The Local Court of Weilheim has also appointed attorney Mr.

Ivo-Meinert Willrodt, Managing Partner at PLUTA Rechtsanwalts GmbH,

as the provisional custodian. The restructuring expert is an

attorney and specialist lawyer for insolvency and restructuring law

and has already acted as trustee for the solar car start-up Sono

Motors and the drone manufacturer EMT, among others. His role is to

protect the interests of the creditors in the proceedings.

Lilium CEO Klaus Roewe welcomed the appointments: “With the

support of our appointed custodian and the restructuring experts,

we at Lilium remain fully focused on re-emerging following

restructuring, with fresh investment to support the all-electric

Lilium Jet’s path to certification and entry into service.”

Work at Lilium’s subsidiaries continues, with the more than

1,000 employees engaged in progressing towards the next significant

program milestone, first manned flight, having been informed on the

details of continued employee payment. The business has also

informed affected suppliers, outlining expectations and procedural

steps.

The first two Lilium Jets are currently on the final assembly

line, with the first aircraft having recently completed the initial

low-voltage power-on milestone and due to advance shortly into the

ground testing phase. The fuselage and wings of the third aircraft

are currently in assembly at aerostructures suppliers Aciturri and

Aernnova. End of October, Lilium engineers moved a fully assembled,

conforming Lilium Jet airframe into the static test rig for

structural testing, in a significant advance for the program. The

structural strength test is an essential part of the testing plan

for first manned flight and type certification.

The business’ current order pipeline consists of firm orders,

reservations, options, and memoranda of understanding for more than

780 Lilium Jets to operators in the U.S., South America, Europe,

Asia, and the Middle East.

Lilium has been notified by NASDAQ that trading of the company’s

shares and warrants will be suspended at the opening of business on

November 6. Following trading suspension, the Company’s

ordinary shares may commence trading over-the-counter, which may

result in significantly lower trading volumes and could further

depress the share price.

Lilium N.V.’s Board of Directors yesterday authorized Lilium’s

listed entity, the Netherlands-registered public limited liability

company (naamloze vennootschap) to file for insolvency.

Lilium Contact information for media: Rainer

Ohler +49 1724890353

Rainer.ohler@seniorstrategists.compress@lilium.com

Lilium Contact information for investors: Rama

Bondada Vice President, Investor Relations investors@lilium.com

About Lilium Lilium (NASDAQ: LILM) is creating

a sustainable and accessible mode of high-speed, regional

transportation for people and goods. Using the Lilium Jet, an

all-electric vertical take-off and landing jet, designed to offer

leading capacity, low noise, and high performance with zero

operating emissions, Lilium is accelerating the decarbonization of

air travel. Working with aerospace, technology, and infrastructure

leaders, and with announced sales and indications of interest in

Europe, the United States, China, Brazil, the UK, the United Arab

Emirates, and the Kingdom of Saudi Arabia, Lilium’s 1,000+ strong

team includes approximately 500 aerospace engineers and a

leadership team responsible for delivering some of the most

successful aircraft in aviation history. Founded in 2015, Lilium’s

headquarters and manufacturing facilities are in Munich, Germany,

with teams based across Europe and the U.S. To learn more, visit

www.lilium.com.

Lilium Forward Looking Statements This press

release contains certain forward-looking statements within the

meaning of the federal securities laws, including, but not limited

to, the goal and outcome of self-administration proceedings,

expected continuation of work towards program milestones (including

assembly of the first Lilium Jets and first manned flight), the

order pipeline and trading in shares following any suspension or

delisting of Lilium’s shares from Nasdaq. These forward-looking

statements generally are identified by the words “anticipate,”

“believe,” “could,” “expect,” “estimate,” “future,” “intend,”

“may,” “on track,” “plan,” “project,” “should,” “strategy,” “will,”

“would” and similar expressions. Forward-looking statements are

predictions, projections, and other statements about future events

that are based on management’s current expectations with respect to

future events and are based on assumptions and are subject to risk

and uncertainties that are subject to change at any time. Actual

events or results may differ materially from those contained in the

forward-looking statements. Factors that could cause actual future

events to differ materially from the forward-looking statements in

this press release include the risk that appropriate government

approvals for the financing will not be obtained, and the risk that

definitive documentation for the financing will not be agreed, as

well as those risks and uncertainties discussed in Lilium’s filings

with the U.S. Securities and Exchange Commission (the “SEC”),

including in the section titled “Risk Factors” in Exhibit 99.2 to

Lilium N.V.’s Report on Form 6-K filed on July 17, 2024, with the

SEC, which is available at www.sec.gov. Forward-looking statements

speak only as of the date they are made. You are cautioned not to

put undue reliance on forward-looking statements, and Lilium

assumes no obligation to, and does not intend to, update, or revise

these forward-looking statements, whether as a result of new

information, future events or otherwise.

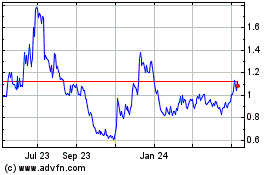

Lilium NV (NASDAQ:LILM)

Historical Stock Chart

From Dec 2024 to Jan 2025

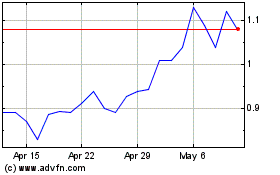

Lilium NV (NASDAQ:LILM)

Historical Stock Chart

From Jan 2024 to Jan 2025