false

0000814586

0000814586

2024-11-26

2024-11-26

0000814586

LWAY:CommonStockNoParValueMember

2024-11-26

2024-11-26

0000814586

LWAY:PreferredStockPurchaseRightsMember

2024-11-26

2024-11-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November

26, 2024

LIFEWAY FOODS, INC.

(Exact Name of Registrant as Specified in Charter)

| Illinois |

|

000-17363 |

|

36-3442829 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

6431 Oakton Street

Morton Grove, Illinois |

|

60053 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (847) 967-1010

N/A

(Former Name or Former Address, if Changed Since Last

Report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered or to be registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, no par value |

|

LWAY |

|

The NASDAQ Stock Market |

| Preferred Stock Purchase Rights |

|

n/a |

|

The NASDAQ Stock Market |

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation

FD Disclosure.

On November 26, 2024, Lifeway Foods, Inc., an

Illinois corporation (the “Company”), issued a press release announcing additional information regarding

the reasons the Company’s board of directors (the “Board”) rejected the revised unsolicited proposal

made on November 15, 2024 by Danone North America PBC (“Danone”) to acquire all the shares of the

Company’s common stock that it does not already own for $27.00 per share. Additionally, on November 25, 2024, the

Company’s counsel sent a letter on behalf of the Board to Danone’s counsel. The press release and letter are furnished as Exhibits 99.1 and 99.2, respectively, to this Current Report and incorporated herein by reference.

Item 9.01. Financial

Statements and Exhibits.

(d) Exhibits:

| Exhibit No. |

|

Description |

| 99.1 |

|

Press Release issued by the Company on November 26, 2024 |

| |

|

|

| 99.2 |

|

Letter from Company Counsel re: Proposed Acquisition of Lifeway Foods, Inc. and Stockholders’ Agreement, dated November 25, 2024 |

| |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

LIFEWAY FOODS, INC. |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| Date: November 26, 2024 |

|

By: |

/s/ Julie Smolyansky |

|

| |

|

|

Name: |

Julie Smolyansky |

|

| |

|

|

Title: |

Chief Executive Officer and Secretary |

|

LIFEWAY FOODS, INC. 8-K

Exhibit 99.1

Lifeway Provides Additional Information Regarding

Reasons

for Rejecting Danone’s Revised Proposal

MORTON GROVE, Ill. — November 26, 2024 — Lifeway Foods, Inc.

(NASDAQ: LWAY) (the “Company” or “Lifeway”), the leading U.S. supplier of kefir and fermented probiotic products

to support the microbiome, today provided additional information regarding the reasons that its Board of Directors rejected the revised

unsolicited proposal made on November 15, 2024 by Danone North America PBC (“Danone”) to acquire all the shares of Lifeway

that it does not already own for $27.00 per share.

The Board determined that Danone’s $27.00 per share proposal substantially

undervalues the Company. The Board is not, however, opposed to the sale of the Company at any price.

The Board has carefully evaluated the Company’s standalone plan and

believes it has strong potential to provide superior value to all shareholders as compared to Danone’s revised proposal. The Board

takes its fiduciary duties seriously and is committed to acting in the best interests of all of the Company’s shareholders and other

stakeholders.

Lifeway Foods is the number one kefir brand and is experiencing double-digit

growth, which is eclipsing much of the rest of the dairy and food industry. As Lifeway’s strong historical financial results

indicate, the Company has sustained momentum with runway for significant long-term growth and margin expansion. This growth

is being driven by an increasing recognition among consumers of the importance of the gut microbiome to overall health and the benefits

of the naturally available high-quality protein and probiotics contained in kefir. A growing body of scientific research supports these

benefits and speaks to the unique value proposition of Lifeway.

In reaching its determination regarding Danone’s revised proposal,

the Board also took into account the following:

| · | Lifeway has achieved 20 consecutive fiscal quarters of year-over-year topline

growth. |

| · | Over the past five years, Lifeway achieved a total shareholder return of

788% (as measured through September 23, 2024, the last full trading day before Danone’s initial unsolicited proposal was publicly

disclosed), far outperforming other high growth food and beverage peers as well as the S&P 500. |

| · | From 2019 to 2023, the Company’s annual revenue has grown from $94

million to $160 million, a 71% increase and a 14% cumulative annual growth rate (“CAGR”). |

| · | Over

that same five-year period, gross profit increased 92%, representing an 18% CAGR, with continued

Operating Income and Adjusted EBITDA1 margin expansion over the same period achieving

$17 million in Operating Income and $22 million in Adjusted EBITDA in 2023. |

| · | The Board and management believe that Lifeway has reached an inflection point,

with strong momentum in core kefir products, new product adjacencies and ongoing operational efficiency programs, which have rapidly improved

profitability and which the Company expects to continue to rapidly improve profitability. |

| · | Lifeway forecasts annual Adjusted EBITDA to grow from $22 million in 2023

to between $45 million and $50 million in 2027. |

| · | Based on the expected 2027 EBITDA range, the Danone proposal of $27 per share

implies a very low multiple of ~7.5x – 8.5x EBITDA, even prior to accounting for substantial synergies and additional operational

efficiencies that Danone (or another strategic acquirer) could realize. |

1Adjusted

EBITDA is a non-GAAP financial measure. Adjusted EBITDA is defined as Operating Income, as reported, plus Depreciation and Amortization,

plus Stock-Based Compensation. See the accompanying tables for reconciliations of Adjusted EBITDA to Operating Income.

The Company does not provide guidance for GAAP Operating Income,

nor a reconciliation of any forward-looking non-GAAP financial measures to the most directly comparable GAAP financial measures on a forward-looking

basis, because it is unable to predict certain items contained in the GAAP measures without unreasonable efforts. These forward-looking

non-GAAP financial measures do not include certain items, which may be significant, including, without limitation, non-recurring or non-operational

expenses such as stock-based compensation, gain/loss on sale of equipment, deferred revenue and gain/loss on investments prior to payment

of bonuses to employees.

Lifeway’s Board and management are committed to ensuring that

all shareholders are able to realize the full potential value of their investment.

Evercore is serving as a financial advisor to Lifeway, and Sidley

Austin LLP is serving as legal counsel to Lifeway.

About Lifeway Foods, Inc.

Lifeway Foods, Inc., which has been recognized as one of Forbes’ Best Small Companies, is America’s leading supplier of

the probiotic, fermented beverage known as kefir. In addition to its line of drinkable kefir, the company also produces a variety of cheeses

and a ProBugs line for kids. Lifeway’s tart and tangy fermented dairy products are now sold across the United States, Mexico, Ireland, South

Africa, United Arab Emirates and France. Learn how Lifeway is good for more than just you at lifewayfoods.com.

Forward-Looking Statements

This release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

Forward-looking statements include all statements that are not historical statements of fact and those regarding Lifeway’s intent,

belief, plans or expectations for Lifeway’s business, operations, financial performance or condition, including, without limitation,

statements regarding expected growth in profitability and forecasted Adjusted EBITDA. These statements use words such as “continue,”

“believe,” “expect,” “anticipate,” “plan,” “project,” “estimate,”

“outlook,” “potential,” “forecast” and similar expressions or future or conditional verbs such as

“will,” “should,” “would,” “may” and “could.” You are cautioned not to rely

on these forward-looking statements. These forward-looking statements are made as of the date of this press release, are based on current

expectations of future events and thus are inherently subject to a number of risks and uncertainties, many of which involve factors or

circumstances beyond Lifeway’s control. If underlying assumptions prove inaccurate or known or unknown risks or uncertainties materialize,

actual results could vary materially from Lifeway’s expectations and projections. These risks, uncertainties and other factors include:

price competition; the decisions of customers or consumers; the actions of competitors; changes in the pricing of commodities; the effects

of government regulation; possible delays in the introduction of new products; customer acceptance of products and services; and other

factors discussed in Part I, Item 1A “Risk Factors” of Lifeway’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2023 and Part II, Item 1A “Risk Factors” of Lifeway’s Quarterly Report on Form 10-Q for the fiscal quarter

ended September 30, 2024. Lifeway expressly disclaims any obligation to update any forward-looking statements (including, without limitation,

to reflect changed assumptions, the occurrence of anticipated or unanticipated events or new information), except as required by law.

Non-GAAP Financial Measures

This press release refers to Adjusted EBITDA, which is a financial

measure that has not been prepared in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”) and may exclude

items that are significant to understanding and assessing financial results. This non-GAAP measure is provided to enhance investors’

overall understanding of the Company’s financial performance. Non-GAAP financial measures should be considered as supplements to

GAAP measures reported, should not be considered replacements for, or superior to, GAAP measures reported and may not be comparable to

similarly named measures used by other companies. The Company’s calculation of non-GAAP financial measures may differ from methods

used by other companies. A reconciliation of non-GAAP measures to the most directly comparable GAAP measures is included in the accompanying

table.

Reconciliation of Non-GAAP Financial Measures to Reported Financial

Measures

Adjusted EBITDA*

| (In millions) | |

2019 | |

2020 | |

2021 | |

2022 | |

2023 |

| Operating Income (GAAP) | |

($1.9 | ) | |

$4.9 | | |

$5.9 | | |

$2.3 | | |

$17.0 | |

| Depreciation | |

3.1 | | |

3.1 | | |

2.8 | | |

2.4 | | |

2.6 | |

| Amortization | |

0.2 | | |

0.2 | | |

0.1 | | |

0.5 | | |

0.5 | |

| Stock-Based Compensation | |

0.8 | | |

0.4 | | |

1.1 | | |

1.1 | | |

1.5 | |

| Adjusted EBITDA (non-GAAP)** | |

$2.2 | | |

$8.6 | | |

$9.9 | | |

$6.4 | | |

$21.7 | |

* Adjusted EBITDA is defined as Operating Income, as reported, plus

Depreciation and Amortization, plus Stock-Based Compensation. Management believes that presentation of Adjusted EBITDA provides helpful

supplemental information to investors regarding the Company’s profitability. Adjusted EBITDA is used in the Company’s executive

compensation program as a means of incentivizing the driving of short-term and long-term growth.

** Totals may not sum due to rounding.

Contacts:

Derek Miller

Vice President of Communications, Lifeway Foods

Email: derekm@lifeway.net

OR

Longacre Square Partners

Joe Germani / Miller Winston

Email: LWAY@longacresquare.com

LIFEWAY FOODS, INC. 8-K

Exhibit 99.2

|

Sidley Austin LLP

One South Dearborn Street

Chicago, IL 60603

+1 312 853 7000

+1 312 853 7036 Fax |

+1 312 853 7621

jducayet@sidley.com |

November 25, 2024

By email

Mr. Ryan A. McLeod

Wachtell, Lipton, Rosen & Katz

51 West 52nd Street

New York, New York 10019

| |

Re: |

Danone’s Response to November 8, 2024 Letter Concerning Proposed Acquisition of Lifeway Foods, Inc. and Shareholder Agreement |

Dear Ryan:

I write in response to your November 15, 2024

letter concerning the proposed acquisition of Lifeway Foods, Inc. (“Lifeway” or the “Company”)

by Danone North America PBC (collectively with Danone Foods, Inc. and any successor or assignee thereof under the Shareholder Agreement

(as defined below), “Danone”) and the October 1, 1999 Stockholders’ Agreement (as amended on December

24, 1999 and as extended in certain respects in eight extensions executed by certain of the parties to the Stockholders’ Agreement,

the last of which was dated as of December 31, 2009, the “Shareholder Agreement”).

Your letter accuses Lifeway of “fundamentally

misunderstand[ing]” and “ignor[ing]” relevant Illinois law, namely, the Galler v. Galler decision. As discussed

below, the Galler case, which predates the Illinois statute at issue (805 ILCS 5/7.71) that was adopted effective January 1, 1991,

does not authorize shareholder agreements like the one at issue here. Instead, Galler was a careful attempt by the Illinois Supreme

Court to confirm the permissibility of shareholder agreements concerning company management in the close corporation context, where all

existing shareholders had consented to the arrangement. Thus, rather than supporting Danone’s argument, Galler illustrates

how much of a departure the Shareholder Agreement is from anything that has ever been permitted by Illinois courts or under Illinois statute.

To be clear: no shareholder agreement concerning the management of an Illinois public company has ever been upheld under the Illinois

statute or under Galler, much less one that is as wide-ranging and unlimited in duration as this one. That is because such non-unanimous

public company shareholder agreements simply are not permissible.1

| 1. | Galler Confirms That the Shareholder Agreement is Invalid. |

The principal assertion in your letter is that Lifeway

has fundamentally erred in failing to understand that under Illinois law, the statutory requirement of unanimity is a permissive “safe

harbor,” and “a shareholder’s agreement can be upheld either under the statute or under the doctrine of the Galler

case.” Resp. at 3 (quoting Ill. Prac. Business Organizations § 10:11 (2d ed.)). But the Galler case provides no assistance

to Danone. Its holding only applies in contexts that, unlike this one, are analogous to the close corporation, and only to agreements,

unlike the Shareholder Agreement, that do not prejudice non-signing minority shareholders in any respect.

| 1 | Additionally, you are mistaken that the “parties” to the Shareholder Agreement subsequently extended the Shareholder Agreement

eight times. As we noted in our letter, what purported to be extensions of certain portions of the Shareholder Agreement were executed

by only two of the Shareholder Agreement’s six parties—Lifeway and Danone—in direct contravention of the Shareholder

Agreement itself. See Shareholder Agreement, § 7.09 (providing in relevant part: “This Agreement may not be amended

or modified except . . . by an instrument in writing signed by, or on behalf of, the parties hereto[.]”). Such legal requirements

are not “makeweight” (Resp. at 2) and cannot simply be ignored when inconvenient to Danone. Neither can the Illinois law governing

the agreement. |

Sidley Austin LLP is a limited liability

partnership practicing in affiliation with other Sidley Austin partnerships.

Page 2

First, the Galler case expressly

held that it was appropriate for the court to depart from certain rules governing shareholder agreements in the close corporation context.

See, e.g., Galler v. Galler, 32 Ill.2d 16, 28 (1964) (“It is therefore necessary, we feel, to discuss the instant

case with the problems peculiar to the close corporation particularly in mind.”); id. at 27 (“[I]t should

be emphasized that we deal here with a so-called close corporation.”); id. at 29 (“[C]ourts have long ago quite

realistically, we feel, relaxed their attitudes concerning statutory compliance when dealing with close corporate behavior,

permitting ‘slight deviations’ from corporate ‘norms’ in order to give legal efficacy to common business practice.”)

(emphases added). In fact, the Galler Court explained that the close corporation context was unique and unlike any other

corporate context. See id. at 28 (“[T]here has been a definite, albeit inarticulate, trend toward eventual judicial

treatment of the close corporation as sui generis.”); id. at 30 (“This court has recognized, albeit sub silentio,

the significant conceptual differences between the close corporation and its public-issue counterpart[.]”); id.

at 31 (“[T]he courts can no longer fail to expressly distinguish between the close and public-issue corporation when

confronted with problems relating to either.”) (emphases added). The Galler Court also explained why the distinction between

close and public corporations is important when it comes to imposing limitations on shareholder agreements:

In a typical close corporation the

stockholders’ agreement is usually the result of careful deliberation among all initial investors. In the large public-issue

corporation, on the other hand, the ‘agreement’ represented by the corporate charter is not consciously agreed to by the investors;

they have no voice in its formulation, and very few ever read the certificate of incorporation. Preservation of the corporate

norms may there be necessary for the protection of the public investors.

Galler, 32 Ill.2d at 30 (emphasis

added) (quoting Hornstein, ‘Stockholders’ Agreements in the Closely Held Corporation’, 59 Yale L. Journal, 1040, 1056).

The Illinois Appellate Court has confirmed as

much, holding that the “principle thrust of the Galler decision” concerns agreements permissible by “those in control

of a close corporation” and that “the Supreme Court in Galler imposed limitations on the operation and use of

this general rule for close corporations.” Somers v. AAA Temporary Services, Inc., 5 Ill.App.3d 931, 934 (1972)

(emphases added).

Accordingly, as an initial matter, the doctrine

of the Galler case can only be understood as applicable to close corporations or, at most, circumstances similar to the close corporation

context where no voiceless shareholder interests are at stake. That is plainly not the case here.

Second, and relatedly, your letter misstates

the holding in Galler in multiple respects. For instance, you state that Galler “considered the validity of a non-unanimous

stockholders agreement.” Resp. at 2. While it is accurate that only 95% of the company at issue in Galler was owned by two

shareholders at the time of the relevant agreement that both shareholders signed, at the time the case was actually adjudicated, all

of the shares were owned by the two shareholders or their successors. Galler, 32 Ill.2d at 17-19. Indeed, the Galler

Court expressly relied upon the fact that “there are no shareholders here other than the parties to the contract,” and found

“the absence of an objecting minority interest” (because there was no minority interest at all) to be a “controlling

factor” in its decision. Galler, 32 Ill.2d at 34, 22.

Moreover, your letter misquotes the decision. You

have inserted the word “undue” into the standard for determining prejudice to a minority interest supposedly announced

in Galler. See Resp. at 2 (stating that Galler “ruled that stockholder agreements like it would be upheld

in the absence of fraud, undue prejudice to minority stockholders, injury to the public or creditors, or direct

conflict with mandatory statutory law”) (emphasis added). Compare, e.g., Galler, 32 Ill.2d at 32 (citing the

history of shareholder voting agreements, which are upheld “in the absence of fraud or prejudice to minority

interests or public policy”); id. at 33 (upholding shareholder agreement “so long as there exists no

detriment to minority stock interests, creditors or other public injury”) (emphases added). The words “undue

prejudice” do not appear anywhere in the Galler decision, much less in the minority shareholder context. Instead, and

consistent with its ruling applicable to the close corporation context (where no voiceless minority interest is harmed), to the

extent Galler permits shareholder agreements that are not unanimous, such agreements may only be entered in (1) the close

corporation context and (2) within that context, the limited circumstances where the agreement causes no harm whatsoever to

minority shareholders. That scenario is difficult to imagine in the public company context, as here.

Page 3

The Danone-Lifeway Shareholder Agreement plainly

causes minority shareholders “prejudice” within the meaning of Galler for all of the reasons set out in our November

8 letter. Your letter asserts that “of course” no minority interest can be impinged by the Shareholder Agreement and Danone’s

actions under it because Danone itself is a “minority stockholder” (Resp. at 3). That does not logically follow. Danone, in

its capacity as a potential buyer, seeks to acquire the Company while operating under a Shareholder Agreement that provides it a significant

advantage over any other potential bidder. That plainly impinges on the rights of the minority shareholders other than Danone to receive

a fair price, even if Danone is also itself a minority shareholder. The Shareholder Agreement also significantly limits the Company’s

freedom of action in numerous other ways, as discussed in our prior letter, also harming other shareholders.

| 2. | The Plain Text of Section 7.71 Confirms Lifeway’s Reading |

The Shareholder Agreement is also plainly barred

by Section 7.71 of the Illinois Business Corporation Act. Your reading of Section 7.71 as a “safe harbor” permitting an agreement

under either the statute or Illinois common law is incorrect.

First, your letter relies upon a reading

of the statute under which the term “may” in Section 7.71(a) means that Section 7.71 is permissive, rather than mandatory.

But the statute uses the term “may” because there is no mandatory requirement to enter into a shareholder agreement at all.

As such, substituting the term “shall” for “may” in the statute would be nonsensical. The interpretation in our

letter is consistent with how Illinois courts have interpreted similarly worded statutes in the past. See, e.g., Hampton v.

Vill. of Washburn, 317 Ill. App. 3d 439, 442–3 (2000) (holding that a statute providing in part that “an employee or applicant

for employment may commence an action in the circuit court to enforce the provisions of this Act . . . where efforts to resolve

the employee’s . . . complaint . . . have failed” was mandatory, not permissive, because, in context,

“may” applied to the initial decision to take action, not the options available once a party chose to act).

Second, you claim that the existence of

subsection (e)2 means that the Illinois legislature intended to permit shareholder agreements like this one, that are agreed

to by only a subset of a public company’s shareholders but impinge on the rights of all of them. Setting aside that there is no

Illinois statute or rule of Illinois common law that permits such agreements, the Galler case further demonstrates why this argument

is wrong. If the Illinois legislature intended to permit shareholder agreements of the type at issue here, despite Galler’s

cautious approach in permitting even a unanimous agreement among a company’s only two shareholders and despite the lack of any prior

case law suggesting such an agreement was permitted, it would have said so directly. Instead, the only logical reading of subsection (e)

is that it is intended to preserve corporate rules otherwise applicable—for instance that if an agreement provides a shareholder

with control of a company, that shareholder then must exercise fiduciary duties for the benefit of all shareholders. Ill. Prac., Business

Organizations § 10:2 (2d ed.). This is consistent with the provision applicable to shareholder agreements in close corporations.

That provision also requires unanimity. It also expressly includes a subsection that, similar to Section 7.71(e)’s preservation

of background rules such as the fiduciary duties imposed on controller shareholders, explains that if shareholders take up management

of the company by agreement, they will be subject to “the liability for managerial acts that is imposed by the laws of this State

upon directors.” 805 ILCS 5/2A.40.

Third, you argue that subsection (b) “expressly

contemplate[s]” that shareholder agreements under the statute will not always be unanimous because that subsection refers to “any

shareholder not party to the agreement.” That ignores the existence of transferees. Nor does your reading make sense in any event,

since it applies only to “[a]n agreement created pursuant to this Section”—and even under your own reading, agreements

created pursuant to Section 7.71 must be unanimous. See Resp. at 3 (“the purpose of the statute is to allow parties

to undertake voluntary additional steps (i.e., unanimity)”). See In re Hernandez, 918 F.3d 563, 569 (7th Cir. 2019), certified

question answered, 2020 IL 124661, 161 N.E.3d 135 (“Illinois law recognizes interpretive canons against surplusage and absurdity.”).

The actual purpose of subsection (b) is to ensure that agreements entered unanimously at a particular time do not harm later transferees,

by ensuring that transferees either have actual knowledge of the agreement or constructive knowledge by virtue of, for example, reference

to the agreement on the company’s stock certificates. See Ill. Prac., Business Organizations § 10:11 (2d ed.) (cited

Resp. at 3) (“Since the statute requires unanimity, this provision is probably aimed at the situation where a party to the agreement

transfers his or her shares.”). That step was not taken here and provides an additional basis on which the Shareholder Agreement

is void.3

| 2 | Subsection (e) provides that Section 7.71 “is cumulative and does not limit any statute or rule of common law that is otherwise

applicable to any corporation, whenever formed.” |

| 3 | Your letter makes reference to the fact that the Shareholder Agreement was publicly filed (Resp. at 5). But that is not

sufficient to provide notice under subsection (b), which requires actual knowledge or notation on a certificate (or a

notice for uncertified security). This fact further demonstrates that the statute simply was not intended for public

corporations. |

Page 4

Finally, your reference to the general contracting

power of corporations also misses the fundamental point: permitting a corporation to engage in external contracts does not authorize the

corporation or its shareholders to use contracts to fundamentally alter the internal governance arrangements set by state statute. Cf.

W. Palm Beach Firefighters’ Pension Fund v. Moelis & Co., 311 A.3d 809, 816–17, 823 (Del. Ch. 2024) (recognizing that

“the ability to engage in private ordering remains subject to the limitations imposed by the DGCL,” including “[t]he

immovable statutory object” of Section 141(a) which is contravened when “internal corporate governance arrangements [] do

not appear in the charter and deprive boards of a significant portion of their authority.”). That is why states impose guardrails

on such agreements like, in Illinois (and in states following the Model Business Corporation Act), unanimity. See Model Bus. Corp.

Act § 7.32(b) (Am. Bar Ass’n 2024) (permitting shareholder agreements that are, among other things, approved by all shareholders

at the time of the agreement and subject to amendment only by all persons who are shareholders at the time of the amendment); see also

Model Bus. Corp. Act § 7.32(b) cmt. (Am. Bar Ass’n 2024) (“Unanimity is required because an agreement authorized by section

7.32 can effect material organic changes in the corporation’s operation and structure, and in the rights and obligations of shareholders.”).

| 3. | The Shareholder Agreement is Anticompetitive and Works Public Harm |

Your letter also briefly disputes that the Shareholder

Agreement is anticompetitive. These arguments similarly fail. For example, you claim that Danone’s right of first refusal is “reasonable

on [its] face” because it “help[s] protect against legitimate concerns regarding dilution of Danone’s equity stake.”

Resp. at 4. But the right of first refusal persists even if Danone has no equity stake to dilute—demonstrating that the provision

is a nakedly anticompetitive tool enabling Danone to thwart transactions with competitors, not a narrowly tailored protection for a minority

shareholder. You also claim that the right of first refusal “add[s] additional safeguards preventing Lifeway from freely passing

along Danone’s sensitive business information to a competitor[.]” Id. Lifeway has no right of access to such information.

Danone has an ownership stake in Lifeway, not vice versa, and it is Danone that has asserted a right to have a representative on Lifeway’s

Board, not the other way around.

Finally, severability is not relevant here because

the fact that the Shareholder Agreement was not entered into by all of Lifeway’s shareholders at the time and the anticompetitive

nature of the Shareholder Agreement undermine the statutory authority permitting shareholders to enter into such a contract in the first

place. There is nothing to sever because the contract is void ab initio.

Lifeway continues to reserve all rights, and waives

none. If you would like to discuss this matter further, you can reach me at jducayet@sidley.com or (312)-853-7621.

| |

Very truly yours, |

|

| |

|

|

| |

|

|

| |

|

|

| |

/s/ James W. Ducayet |

|

| |

James W. Ducayet |

|

cc: Beth Berg

v3.24.3

Cover

|

Nov. 26, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 26, 2024

|

| Entity File Number |

000-17363

|

| Entity Registrant Name |

LIFEWAY FOODS, INC.

|

| Entity Central Index Key |

0000814586

|

| Entity Tax Identification Number |

36-3442829

|

| Entity Incorporation, State or Country Code |

IL

|

| Entity Address, Address Line One |

6431 Oakton Street

|

| Entity Address, City or Town |

Morton Grove

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60053

|

| City Area Code |

(847)

|

| Local Phone Number |

967-1010

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock, no par value |

|

| Title of 12(b) Security |

Common Stock, no par value

|

| Trading Symbol |

LWAY

|

| Security Exchange Name |

NASDAQ

|

| Preferred Stock Purchase Rights |

|

| Title of 12(b) Security |

Preferred Stock Purchase Rights

|

| Trading Symbol |

n/a

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=LWAY_CommonStockNoParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=LWAY_PreferredStockPurchaseRightsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

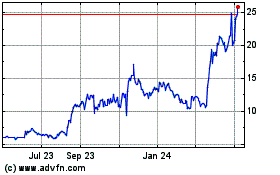

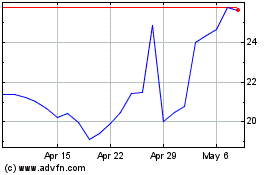

Lifeway Foods (NASDAQ:LWAY)

Historical Stock Chart

From Nov 2024 to Dec 2024

Lifeway Foods (NASDAQ:LWAY)

Historical Stock Chart

From Dec 2023 to Dec 2024