false

0000814586

0000814586

2024-11-20

2024-11-20

0000814586

LWAY:CommonStockNoParValueMember

2024-11-20

2024-11-20

0000814586

LWAY:PreferredStockPurchaseRightsMember

2024-11-20

2024-11-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 20, 2024

LIFEWAY FOODS, INC.

(Exact Name of Registrant as Specified in Charter)

| Illinois |

000-17363 |

36-3442829 |

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

6431 Oakton Street

Morton Grove, Illinois |

60053 |

| (Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (847) 967-1010

N/A

(Former Name or Former Address, if Changed Since Last Report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, no par value |

|

LWAY |

|

The NASDAQ Stock Market |

| Preferred Stock Purchase Rights |

|

n/a |

|

The NASDAQ Stock Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

EXPLANATORY

NOTE

This

Form 8-K/A (this “Amendment”) is being filed solely to correct the date of the press release attached

as Exhibit 99.1 to the Form 8-K filed on November 20, 2024 (the “Original 8-K”) from November 19, 2024

to November 20, 2024. Except for the aforementioned change, this Amendment does not amend, update or change any other items or

disclosures contained in the Original 8-K. This Amendment restates and replaces the Original 8-K in its entirety.

Item

7.01. Regulation FD Disclosure.

On

November 20, 2024, Lifeway Foods, Inc., an Illinois corporation (the “Company”), issued a press release

announcing the rejection by the Company’s board of directors (the “Board”) of the revised unsolicited

proposal received from Danone North America PBC (“Danone”) on November 15, 2024. A copy of that press

release is furnished as Exhibit 99.1 to this Current Report and incorporated herein by reference. A letter sent by the Company’s

Chief Executive Officer, on behalf of the Board, to Danone’s President and Chief Executive Officer and a letter sent by

the Company’s counsel, on behalf of the Board, to Danone’s counsel are furnished as Exhibits 99.2 and 99.3, respectively,

to this Current Report and incorporated herein by reference.

Item

9.01. Financial Statements and Exhibits.

(d) Exhibits:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| |

|

LIFEWAY

FOODS, INC. |

| |

|

|

| Date: November

20, 2024 |

|

By: |

/s/

Julie Smolyansky |

| |

|

|

Name:

Julie Smolyansky

Title:

Chief Executive Officer and Secretary |

| |

|

|

LIFEWAY FOODS, INC. 8-K/A

Exhibit

99.1

Lifeway

Foods Rejects Revised Unsolicited Proposal from Danone

MORTON

GROVE, Ill. — November 20, 2024 — Lifeway Foods, Inc. (NASDAQ: LWAY) (the “Company”), a leading U.S. supplier

of kefir and fermented probiotic products to support the microbiome, today announced that its Board of Directors has rejected

the revised unsolicited proposal made on November 15, 2024 by Danone North America PBC (“Danone”) to acquire all the

shares of Lifeway that it does not already own for $27.00 per share.

After

careful and thorough consideration, conducted in consultation with its independent financial and legal advisors, the Board determined

that Danone’s revised proposal substantially undervalues Lifeway and is not in the best interests of the Company and its

shareholders or other stakeholders.

Lifeway

remains focused on executing its strategic plan to bring kefir to more households while also expanding into adjacent categories.

The Company recently delivered its 20th consecutive quarter of growth, posting double-digit year-over-year revenue

growth and improved profit margins in the third quarter of 2024. Over the past five and three years, the Company has delivered

total shareholder returns of 788% and 270%, respectively, (as measured through September 23, 2024, the last full trading day before

Danone’s initial unsolicited proposal was publicly disclosed) far outperforming other high growth food and beverage peers

as well as the S&P 500.

The

Company plans to continue to build on its strong momentum to unlock additional shareholder value. The Board and management are

committed to acting in the best interests of all shareholders and ensuring that they are able to realize the full potential value

of their investment.

Evercore

is serving as a financial advisor to Lifeway and Sidley Austin LLP is serving as legal counsel to Lifeway.

About

Lifeway Foods, Inc.

Lifeway

Foods, Inc., which has been recognized as one of Forbes’ Best Small Companies, is America’s leading supplier of the probiotic,

fermented beverage known as kefir. In addition to its line of drinkable kefir, the company also produces a variety of cheeses

and a ProBugs line for kids. Lifeway’s tart and tangy fermented dairy products are now sold across the United States, Mexico,

Ireland, South Africa, United Arab Emirates and France. Learn how Lifeway is good for more than just you at lifewayfoods.com.

Forward-Looking

Statements

This

release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include all statements that are

not historical statements of fact and those regarding our intent, belief, plans or expectations for our business, operations,

financial performance or condition. These statements use words such as “continue,” “believe,” “expect,”

“anticipate,” “plan,” “project,” “estimate,” “outlook,” and similar

expressions or future or conditional verbs such as “will,” “should,” “would,” “may”

and “could.” You are cautioned not to rely on these forward-looking statements. These forward-looking statements are

made as of the date of this press release, are based on current expectations of future events and thus are inherently subject

to a number of risks and uncertainties, many of which involve factors or circumstances beyond Lifeway’s control. If underlying

assumptions prove inaccurate or known or unknown risks or uncertainties materialize, actual results could vary materially from

Lifeway’s expectations and projections. These risks, uncertainties and other factors include: price competition; the decisions

of customers or consumers; the actions of competitors; changes in the pricing of commodities; the effects of government regulation;

possible delays in the introduction of new products; customer acceptance of products and services; and other factors discussed

in Part I, Item 1A “Risk Factors” of Lifeway’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023

and Part II, Item 1A “Risk Factors” of Lifeway’s Quarterly Report on Form 10-Q for the fiscal quarter ended

September 30, 2024. Lifeway expressly disclaims any obligation to update any forward-looking statements (including, without limitation,

to reflect changed assumptions, the occurrence of anticipated or unanticipated events or new information), except as required

by law.

Contacts:

Derek

Miller

Vice

President of Communications, Lifeway Foods

Email:

derekm@lifeway.net

OR

Longacre

Square Partners

Joe

Germani / Miller Winston

Email:

LWAY@longacresquare.com

LIFEWAY FOODS, INC. 8-K/A

Exhibit 99.2

November 8, 2024

Mr. Shane Grant

Danone Deputy CEO

President & CEO of Danone

North America PBC

CEO Americas and EVP Dairy,

Plant-Based and Global Sales

1 Maple Avenue

White Plains, New York 10605

| Re: | September 23, 2024 Proposed Acquisition of Lifeway Foods, Inc. and Stockholders’ Agreement |

Dear Shane:

I am writing on behalf of the Board of Directors of Lifeway

Foods in connection with your September 23, 2024 letter to me concerning a proposed acquisition of the Company by Danone North

America PBC (collectively with Danone Foods, Inc. “Danone”). The Board retained Evercore, as well as Sidley Austin

as part of the its review of your proposal. As you know, after careful and thorough consideration and in consultation with its

independent advisors, the Board has determined that your proposal substantially undervalues Lifeway and is not in the best interests

of the Company, its shareholders or other stakeholders. The Board additionally has adopted a limited duration shareholder rights

plan in response to your proposal.

I write today concerning a matter related to the consideration

of the proposal and the Company’s ongoing relationship with Danone: the October 1, 1999 Stockholders’ Agreement. I

want to provide some perspectives from the Board on how the Stockholders’ Agreement has been used by Danone to impede the

Company’s ability to conduct its business and maximize value for all Lifeway shareholders. Sidley is sending your counsel

a separate letter on this topic as well.

As you know, the Stockholders’ Agreement was executed

in 1999 in connection with Danone’s initial purchase of 15% of Lifeway’s outstanding shares for $6,477,670. By the

end of 1999, Danone purchased an additional 5% interest from other shareholders to achieve a 20% stake. Although the Company was

publicly traded at the time, Danone had extraordinary bargaining power because of its size, financial resources, and market position.

Page 2

Danone’s investment came with promises of market support

and other incentives. In 1999, the parties also entered into a Support Agreement where Danone was supposed to have taken a variety

of steps to assist the Company by facilitating access to Danone’s distribution channel and Danone personnel with expertise

regarding distribution and marketing. None of this materialized—Danone failed to do anything to assist Lifeway.

Danone, on the other hand, has benefitted substantially—each

share originally purchased by Danone for $2.50 per share (after taking into account subsequent stock splits) was worth $21.24 as

of September 20, 2024 (the last full trading day before Danone made the Offer).1

Danone Continues to Destroy Lifeway Shareholder Value

Danone does not permit Lifeway to explore value-creating

alternatives. The Stockholders’ Agreement handcuffs the Company by prohibiting it from freely considering any acquisition

proposal or other similar transaction not involving Danone. The Stockholders’ Agreement effectively permits the Company to

engage only with Danone.

The Stockholders’ Agreement tilts the playing field so

far in Danone’s favor that even if Danone does not continue to hold a single share of Company common stock,

the holders of nearly 48% of the Company’s outstanding shares would be prohibited from selling those shares to a strategic

buyer without Danone’s consent and the Company would be prohibited from issuing or selling any shares (outside “a

widely disbursed underwritten public offering” in which (x) no person or group acquires more than 5% of the number of shares

[then outstanding] and (y) Danone is able to maintain is pro rata ownership) without first providing Danone with rights

of first refusal. This is because for both sales of shares by the shareholders party to the Stockholders’ Agreement and for

issuances and sales of shares by the Company, even if Danone does not exercise its rights of first refusal, the purchaser must

offer to purchase all of Danone’s Lifeway shares on the same terms, and the universe of permissible purchasers is extremely

limited by the Agreement (they essentially cannot be in any related business to Lifeway or in any business that competes with Danone).

You know that I am not writing about hypothetical situations.

To take just one recent example, after the Company satisfied all of the Stockholders’ Agreement’s procedural requirements

with respect to a proposed consideration of strategic alternatives (which included the Company’s spending at least $687,000,

including to obtain the required opinion from an investment bank), and after months of encouragement from a team at Danone, Danone

abruptly just said “no,” bringing the process to a grinding halt.

1

The Company underwent 2:1 stock splits in 2004 and again in 2006, so a single share purchased prior to the 2004 split would be

4 shares today. Thus, as of September 20, 2024, each share Danone purchased in 1999 for $10 per share was worth $84.96 ($21.24

* 4) per original share purchased.

Page 3

Danone restricts Lifeway from profitably running its business.

Furthermore, Danone exploited its position to impose other extremely draconian terms that negatively impact the management of the

Company. The Stockholders’ Agreement imposes significant limitations on the Company’s ability to issue shares, including

as part of its executive compensation program. For instance, under Section 6.03 of the Stockholders’ Agreement, the Company

is entirely prohibited from issuing options (or other rights convertible into Company capital stock)—whether for executive

compensation or any other reason—in any significant amount without Danone’s prior written consent.

Over the years, the Company has requested that Danone consent

to awarding equity-based compensation to the Company’s executives, consistent with best practice in the market. However,

Danone has continuously refused to award equity-based compensation to the Chief Executive Officer and has consented to the award

of equity-based compensation to other executive officers and employees in only paltry amounts. Danone’s refusal to consent

to reasonable requests for equity-based incentive compensation has created a situation where the Company cannot offer competitive

market compensation and cannot use equity to align the incentives of senior management and shareholders, making succession planning

for senior executive officers practically impossible.

Any purported concern regarding dilution would be completely

unreasonable given that repurchases of the Company’s shares by the Company have resulted in an increase in Danone’s

ownership increasing from 20% of the outstanding shares to 23.4% of the outstanding shares.

The Stockholders’ Agreement stands in the way of the Company’s

ability to grow its business. These restrictions in no way benefit the Company or its shareholders, they only benefit Danone. For

instance, if the Company wants to use its shares to acquire any other entity, it must offer Danone the right to purchase such shares

for $10 per share2 to keep its ownership

percentage despite the fact that the stock is trading far in excess of that amount. And even outside of a potential business combination,

Section 3.02 prohibits the Company from making or endorsing any new claims relating to the health benefits of its existing or future

products without the affirmative vote of the person Danone designates to serve on the Company’s Board (so long as Danone

beneficially owns at least 10% of the Company’s outstanding shares).

Danone has consistently and repeatedly used provisions of the

Stockholders’ Agreement to thwart the efforts of the Company to grow and manage the Company for the benefit of all shareholders

and other stakeholders. Danone has used the terms of the Stockholders’ Agreement to prevent the Company from taking steps

that would result in increased competition to Danone.

2

Or the average of the last reported sale price of the Company’s stock over the six months prior to any definitive agreement,

whichever is less.

Page 4

Danone Restricts Lifeway, While it Undercuts Lifeway Without

Consequences

While the Stockholders’ Agreement imposes onerous conditions

on the Company, it places no limits on Danone’s ability to compete with the Company, or use the terms of the Stockholders’

Agreement to gain an unfair advantage. For example, in 2017, Danone acquired WhiteWave Foods, which owned Wallaby Yogurt, a direct

competitor of Lifeway.

While pouring resources into a competitor, Danone simultaneously

interfered with the Company’s ability to compete by enforcing restrictive provisions of the Stockholders’ Agreement.

In particular, despite the obvious conflict that the WhiteWave acquisition created, Danone asserted that it had a right to a designee

on the Company’s board, through which Danone could access the Company’s confidential competitive information and trade

secrets. Danone even engaged in baseless, retaliatory accusations against major shareholders when the Company raised reasonable

concerns regarding Danone’s accessing the Company’s competitive information while owning a direct competitor of the

Company.

The Board believes that the Stockholders’ Agreement is

void and unenforceable, as discussed in the separate letter sent by Sidley to your attorneys. The Company hereby requests that

Danone irrevocably waive all of its rights under, and not seek to enforce any of its rights under the Stockholders’ Agreement.

Sidley has requested a response to this request by November 15, 2024. Should Danone fail to provide a response by such time, the

Company will assume that Danone will not agree to the requested waiver and will proceed accordingly.

I would be happy to discuss this matter further at your convenience.

| |

Sincerely,

/s/ Julie Smolyansky

Julie Smolyansky

|

LIFEWAY FOODS, INC. 8-K/A

Exhibit 99.3

|

Sidley

Austin LLP

One

South Dearborn Street

Chicago,

IL 60603

+1

312 853 7000

+1

312 853 7036 Fax

|

|

November

8, 2024

By email

Mr. Josh

Cammaker

Wachtell,

Lipton, Rosen & Katz

51 West

52nd Street

New York,

New York 10019

| Re: | September 23, 2024 Letter Concerning

Proposed Acquisition of Lifeway Foods, Inc. and Stockholders’ Agreement |

Dear Mr. Cammaker:

I am writing

on behalf of the Board of Directors (the “Board”) of Lifeway Foods, Inc. (“Lifeway”

or the “Company”) in connection with Shane Grant’s September 23, 2024 letter to the Company’s

Chief Executive Officer, Julie Smolyansky, concerning a proposed acquisition of the Company by Danone North America PBC (collectively

with Danone Foods, Inc. and any successor or assignee thereof under the Shareholder Agreement (as defined below), “Danone”)

(the “Offer”).

I write concerning

a matter related to the Board’s consideration of the Offer and the Company’s ongoing relationship with Danone: the

October 1, 1999 Stockholders’ Agreement (as amended on December 24, 1999 and as extended in certain respects in eight extensions

executed by certain of the parties to the Stockholders’ Agreement, the last of which was dated as of December 31, 2009 (the

“Shareholder Agreement”)) entered into by Danone, Lifeway, and certain Lifeway shareholders. The Shareholder

Agreement has harmed the Company, its shareholders and other stakeholders in numerous respects. It also lacks legal authority

under Illinois law.

Under Illinois

law, shareholder agreements concerning the management of a corporation are subject to legal requirements that differ significantly

from those in Delaware. See 835 ILCS 5/7.71(a) (“Shareholders may unanimously agree in writing as to matters concerning

the management of a corporation provided no fraud or apparent injury to the public or creditors is present, and no clearly prohibitory

statutory language is violated.”). As an initial matter, shareholders must have unanimously agreed in writing to such an

arrangement. Thus, shareholder agreements concerning the management of a corporation are functionally barred for publicly traded

companies such as Lifeway. Additionally, no “fraud or apparent injury to the public or creditors” may be present.

As discussed below, the Shareholder Agreement purports to address matters concerning the management of the Company, but the Shareholder

Agreement was not agreed to in writing by all shareholders at the time. It is also anti-competitive by its terms and in practice,

and, accordingly, creates public injury. As a result, the Shareholder Agreement does not satisfy the requirements of Section 7.71

in multiple respects.

Sidley Austin (DC) LLP is a Delaware limited liability partnership doing business as Sidley Austin LLP and practicing in affiliation with other Sidley Austin partnerships.

Page 2

Where, as

here, a contract lacks legal authority, the resulting contract is void ab initio. 1550 MP Rd. LLC v. Teamsters Loc.

Union No. 700, 433 Ill. Dec. 60, 68 (2019); Ill. State Bar Ass'n Mutual Ins. Co. v. Coregis Ins. Co., 355 Ill. App.

3d 156, 164 (2004). Because it is void, it cannot be enforced as drafted. Ill. State Bar Ass’n Mutual Ins. Co., 355

Ill. App. 3d at 164 (“[A] contract that is void ab initio is treated as though it never existed[.]”).

| 1. | The Shareholder Agreement

Is Void Because It Was Not Unanimously Approved |

Under Illinois

law, the board of directors is charged with management of, or oversight over management of, a corporation. See 835 ILCS 5/8.05

(“[T]he business and affairs of the corporation shall be managed by or under the direction of the board of directors.”).

In enacting Section 7.71, the Illinois legislature chose to limit the circumstances in which the board’s role in the management

of a company can be circumscribed through private ordering to those documented in written agreements to which all shareholders

are parties.

The

Shareholder Agreement plainly concerns the management of the Company. Among other things:

| ● | It

purportedly provides Danone with rights of first refusal over share transfers by the

shareholder parties to the Shareholder Agreement and over issuances and sales of shares

by the Company; |

| ● | The

Company purportedly cannot use its shares as acquisition currency unless Danone is offered

the right to purchase such shares for $10 per share (or the average of the last reported

sale price of the Company’s stock over the six months prior to any definitive agreement,

whichever is less) to keep its ownership percentage (regardless of the market price of

the Company’s shares at the time); |

| ● | The

Company purportedly is prohibited from any other issuance of shares outside of (1) a

“widely disbursed” underwritten public offering satisfying certain requirements

and (2) an issuance where Danone has the opportunity to purchase all of the shares on

the same terms, and if Danone does not exercise its right of first refusal, the proposed

purchaser of the issued shares must offer to purchase all of Danone’s Lifeway shares

on the same terms and the purchaser cannot be “(x) engaged in the business of producing

or selling any type of yogurt (set, blended or drinkable), or (y) engaged in the dairy

business, the health food business or the business of producing or distributing food

products containing pharmaceutical ingredients or any other business conducted by [Danone]

and having consolidated revenues in excess of $75 million” (as adjusted to account

for changes in the Consumer Price Index); and |

Page 3

| ● | The

Company purportedly is prohibited from issuing options, warrants, securities or other

rights convertible into Company capital stock (other than up to 5,000 options per calendar

year) without Danone’s prior written consent, which Danone may purportedly withhold

in its “sole discretion.” This means that the Company has not been able to

offer equity-based compensation to the Company’s executive officers and other employees

consistent with market practice, creating a situation where the Company cannot offer

competitive compensation, rendering it difficult to attract and retain talent and making

succession planning for the most senior executive officers practically impossible. |

None

of these rights ever terminate—even if Danone no longer beneficially owns Company common

stock. See, e.g., Shareholder Agreement, §§ 4.01, 4.05, 6.03.

The Company

was publicly traded in 1999. The Shareholder Agreement was signed by representatives of the Company and Danone itself, but it

was not entered into by all of the Company’s shareholders. Because it impinges upon the Board’s role in the management

of the Company and was not unanimously entered into by the Company’s shareholders at the outset, the Shareholder Agreement

is void and unenforceable under Illinois law. See 1550 MP Rd. LLC, 433 Ill. Dec. at 68; Ill. State Bar Ass’n Mutual

Ins. Co., 355 Ill. App. 3d at 164.

| 2. | The Shareholder Agreement

Is Void Because It Is Anti-Competitive And Injurious To The Public |

The Shareholder

Agreement is also void for a second, independent reason. The Shareholder Agreement’s right of first refusal and restrictions

on share issuance and other transactions (e.g., Shareholder Agreement, §§ 4.01, 4.05) purport to provide

Danone with the ability to block potential transactions that could benefit the Company and its shareholders, and the public at

large, but could increase competition against Danone. Specifically, even if Danone does not exercise its right of first refusal,

the purchaser (whether pursuant to a share issuance or transfer by a shareholder party) cannot be “(x) engaged in the business

of producing or selling any type of yogurt (set, blended or drinkable), or (y) engaged in the dairy business, the health food

business or the business of producing or distributing food products containing pharmaceutical ingredients or any other business

conducted by [Danone] and having consolidated revenues in excess of $75 million” (as adjusted to account for changes in

the Consumer Price Index). See Shareholder Agreement, §§ 4.01, 4.05. As noted above, these provisions are

not tied to Danone’s ownership stake in the Company, and therefore purportedly enable Danone to thwart competition-enhancing

transactions even if Danone no longer owns a single share in the Company.

Page 4

Moreover,

under the Shareholder Agreement, the Company purportedly may not “make or endorse any new claims relating to the health

benefits of its existing [or future] products . . . publicly, whether by means of advertising or otherwise without the affirmative

vote” of the person Danone designates to serve on the Company’s Board (so long as Danone retains at least 10% beneficial

ownership in the Company’s outstanding common stock). Shareholder Agreement, § 3.02.

Not only

were the onerous restrictions in the Shareholder Agreement not agreed to by all of the Company’s shareholders at the outset,

the terms—which are not a part of the Company’s articles of incorporation or by-laws nor described on stock certificates

or other evidences of share ownership by those not party to the Shareholder Agreement—have bound all shareholders since

the Shareholder Agreement was entered (and their transferees), regardless of whether they had actual knowledge of the Shareholder

Agreement, also in contravention of Illinois law. See 835 ILCS 5/7.71(b).

Additionally,

because such provisions work public injury on the Company’s shareholders and the public at large, they cannot be validly

adopted in a shareholder agreement. 835 ILCS 5/7.71(a). The Shareholder Agreement is void and unenforceable for this independent

reason. See 1550 MP Rd. LLC, 433 Ill. Dec. at 68; Ill. State Bar Ass’n Mutual Ins. Co., 355 Ill. App. 3d at

164.

* * *

Although

the Shareholder Agreement is void and unenforceable in full, the Company is willing to forgo litigation over this matter at this

time if Danone will agree to waive all of its rights under, and not seek to enforce any of its rights under, the Shareholder Agreement.

Please respond in writing to me by no later than 5:00 Eastern Time on November 15, 2024; should Danone fail to provide a response

by such time, the Company will assume that Danone will not agree to the requested waiver and will proceed accordingly. The Company

reserves all rights and waives none.

If you would

like to discuss this matter further, you can reach me at jducayet@sidley.com or (312)-853-7621.

| |

Very

truly yours,

/s/ James

W. Ducayet

James

W. Ducayet

|

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=LWAY_CommonStockNoParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=LWAY_PreferredStockPurchaseRightsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

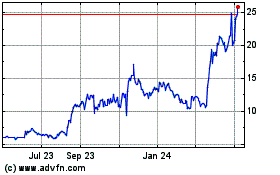

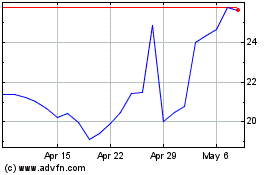

Lifeway Foods (NASDAQ:LWAY)

Historical Stock Chart

From Nov 2024 to Dec 2024

Lifeway Foods (NASDAQ:LWAY)

Historical Stock Chart

From Dec 2023 to Dec 2024