KANZHUN LIMITED (“BOSS Zhipin” or the “Company”) (Nasdaq: BZ; HKEX:

2076), a leading online recruitment platform in China, today

announced its unaudited financial results for the quarter ended

March 31, 2024.

First Quarter 2024

Highlights

-

Revenues for the first quarter of 2024 were

RMB1,703.8 million (US$236.0 million), an increase of 33.4% from

RMB1,277.5 million for the same quarter of 2023.

- Calculated

cash billings1 for the first quarter of

2024 were RMB2,050.7 million (US$284.0 million), an increase of

24.3% from RMB1,649.6 million for the same quarter of 2023.

- Average

monthly active users2 for the first

quarter of 2024 were 46.6 million, an increase of 17.4% from 39.7

million for the same quarter of 2023.

- Total paid

enterprise customers3 in the twelve

months ended March 31, 2024 were 5.7 million, an increase of 42.5%

from 4.0 million in the twelve months ended March 31, 2023.

- Net

income for the first quarter of 2024 was RMB241.7 million

(US$33.5 million), compared to RMB32.7 million for the same quarter

of 2023. Adjusted net income4 for

the first quarter of 2024 was RMB530.7 million (US$73.5 million),

an increase of 116.6% from RMB245.0 million for the same quarter of

2023.

Mr. Jonathan Peng Zhao, Founder, Chairman and

Chief Executive Officer of the Company, remarked, “We are pleased

to have achieved a strong start in the first quarter, with all

financial metrics exceeding management’s expectations. In the

meantime, our user scale and number of paid enterprise customers

continue to grow. This result indicates that the large bilateral

ecosystem of job seekers and recruiters on our platform can grow

healthily and efficiently. Furthermore, our services and technology

have proven our capability of covering all industries and user

categories, which will support our potential for long-term and

large-scale growth.”

Mr. Phil Yu Zhang, Chief Financial Officer,

elaborated: “We are delighted to report a strong financial

performance for this quarter, which reflects our good growth

momentum. Despite the first quarter typically being a high spending

season for marketing, our adjusted operating margin achieved 23%,

which once again proved our business model is highly

effective.”

_________________________________

1 Calculated cash billings is a non-GAAP

financial measure, derived by adding the change in deferred revenue

to revenues. For more information on the non-GAAP financial

measures, please see the section of “Non-GAAP Financial

Measures.”2 Monthly active users refer to the number of

verified user accounts, including both job seekers and enterprise

users, that logged on to our mobile application in a given month at

least once.3 Paid enterprise customers are defined as

enterprise users and company accounts from which we recognize

revenues for our online recruitment services.4 Adjusted net

income and adjusted basic and diluted net income per ADS

attributable to ordinary shareholders are non-GAAP financial

measures, excluding the impact of share-based compensation

expenses. For more information on the non-GAAP financial measures,

please see the section of “Non-GAAP Financial Measures.”

First Quarter 2024 Financial

Results

Revenues

Revenues were RMB1,703.8 million (US$236.0

million) for the first quarter of 2024, representing an increase of

33.4% from RMB1,277.5 million for the same period in 2023.

- Revenues from

online recruitment services to enterprise customers were RMB1,684.1

million (US$233.2 million) for the first quarter of 2024,

representing an increase of 33.6% from RMB1,260.1 million for the

same period in 2023. This increase was mainly driven by the user

growth and increased user engagement.

- Revenues from

other services, which mainly comprise paid value-added services

offered to job seekers, were RMB19.7 million (US$2.7 million) for

the first quarter of 2024, representing an increase of 12.6% from

RMB17.5 million for the same period in 2023, mainly benefiting from

expanded user base.

Operating cost and expenses

Total operating cost and expenses were

RMB1,612.8 million (US$223.4 million) for the first quarter of

2024, representing an increase of 17.4% from RMB1,373.7 million for

the same period of 2023. Total share-based compensation expenses

were RMB289.0 million (US$40.0 million) for the first quarter of

2024, representing an increase of 36.1% from RMB212.3 million for

the same period of 2023.

- Cost of

revenues was RMB295.4 million (US$40.9 million) for the

first quarter of 2024, representing an increase of 19.5% from

RMB247.2 million for the same period of 2023, primarily due to

increases in server and bandwidth cost, payment processing cost and

employee-related expenses.

- Sales and

marketing expenses were RMB579.3 million (US$80.2 million)

for the first quarter of 2024, representing a decrease of 7.9% from

RMB628.8 million for the same period of 2023, primarily due to

decreased advertising and marketing expenses, partially offset by

increased employee-related expenses.

- Research

and development expenses were RMB467.6 million (US$64.8

million) for the first quarter of 2024, representing an increase of

40.4% from RMB333.1 million for the same period of 2023, primarily

due to increased investments in technology as well as increased

employee-related expenses.

- General

and administrative expenses were RMB270.5 million (US$37.5

million) for the first quarter of 2024, representing an increase of

64.3% from RMB164.6 million for the same period of 2023, primarily

due to increased employee-related expenses.

Income/Loss from operations

Income from operations was RMB103.6 million

(US$14.3 million) for the first quarter of 2024, compared to loss

from operations of RMB77.3 million for the same period of 2023.

Net income and adjusted net

income

Net income was RMB241.7 million (US$33.5

million) for the first quarter of 2024, compared to RMB32.7 million

for the same period of 2023.

Adjusted net income was RMB530.7 million

(US$73.5 million) for the first quarter of 2024, representing an

increase of 116.6% from RMB245.0 million for the same quarter of

2023.

Net income per ADS and adjusted net

income per ADS

Basic and diluted net income per ADS

attributable to ordinary shareholders for the first quarter of 2024

were RMB0.56 (US$0.08) and RMB0.54 (US$0.07), respectively,

compared to basic and diluted net income per ADS of RMB0.08 and

RMB0.07 in the same period of 2023.

Adjusted basic and diluted net income per ADS

attributable to ordinary shareholders4 for the first quarter of

2024 were RMB1.21 (US$0.17) and RMB1.18 (US$0.16), respectively,

compared to adjusted basic and diluted net income per ADS of

RMB0.57 and RMB0.54 in the same period of 2023.

Net cash provided by operating

activities

Net cash provided by operating activities was

RMB905.5 million (US$125.4 million) for the first quarter of 2024,

representing an increase of 66.5% from RMB543.9 million in the same

period of 2023.

Cash position

Balance of cash and cash equivalents, short-term

time deposits and short-term investments was RMB11,901.6 million

(US$1,648.4 million) as of March 31, 2024.

Share Repurchase Program

In March 2024, the Company’s board of directors

authorized a new share repurchase program effective from March 20,

2024 for a 12-month period, under which the Company may repurchase

up to US$200 million of its shares (including in the form of

ADSs).

Outlook

For the second quarter of 2024, the Company currently expects

its total revenues to be between RMB1.91 billion and RMB1.96

billion, representing a year-on-year increase of 28.4% to 31.7%.

This forecast reflects the Company’s current views on the market

and operational conditions in China, which are subject to change

and cannot be predicted with reasonable accuracy as of the date

hereof.

Conference Call Information

The Company will host a conference call at

8:00AM U.S. Eastern Time on Tuesday, May 21, 2024 (8:00PM Beijing

Time on Tuesday, May 21, 2024) to discuss the financial

results.

Participants are required to pre-register for

the conference call

at:https://register.vevent.com/register/BI7c477a0afb7a48e1be8a336915dc3647

Upon registration, participants will receive an

email containing participant dial-in numbers and unique personal

PIN. This information will allow you to gain immediate access to

the call. Participants may pre-register at any time, including up

to and after the call start time.

Additionally, a live and archived webcast of the

conference call will be available on the Company's investor

relations website at https://ir.zhipin.com.

Exchange Rate

This announcement contains translations of

certain RMB amounts into U.S. dollar (“US$”) amounts at specified

rates solely for the convenience of the reader. Unless otherwise

stated, all translations from RMB to US$ were made at the exchange

rate of RMB7.2203 to US$1.00 on March 29, 2024 as set forth in the

H.10 statistical release of the Federal Reserve Board. The Company

makes no representation that the RMB or US$ amounts referred could

be converted into US$ or RMB, as the case may be, at any particular

rate or at all.

Non-GAAP Financial Measures

In evaluating the business, the Company

considers and uses non-GAAP financial measures, such as calculated

cash billings, adjusted net income, adjusted net income

attributable to ordinary shareholders, adjusted basic and diluted

net income per ordinary share attributable to ordinary shareholders

and adjusted basic and diluted net income per ADS attributable to

ordinary shareholders as supplemental measures to review and assess

operating performance. The Company derives calculated cash billings

by adding the change in deferred revenue to revenues. The Company

uses calculated cash billings to measure and monitor sales growth

because the Company generally bills its paid enterprise customers

at the time of sales, but may recognize a portion of the related

revenue ratably over time. The Company believes calculated cash

billings provides valuable insights into the cash generated from

sales and is a valuable measure for monitoring service demand and

financial performance. The Company defines adjusted net income and

adjusted net income attributable to ordinary shareholders by

excluding the impact of share-based compensation expenses, which

are non-cash expenses, from the related GAAP financial measures.

The Company believes that these non-GAAP financial measures help

identify underlying trends in the business that could otherwise be

distorted by the effect of certain expenses and facilitate

investors’ assessment of the Company’s operating performance.

The non-GAAP financial measures are not defined

under U.S. GAAP, and are not presented in accordance with U.S.

GAAP. The non-GAAP financial measures have limitations as

analytical tools and should not be considered in isolation or as a

substitute for most directly comparable GAAP financial measures.

The Company encourages investors and others to review its financial

information in its entirety and not rely on a single financial

measure.

A reconciliation of the non-GAAP financial

measures to the most directly comparable GAAP financial measures

has been provided in the table captioned “Unaudited Reconciliation

of GAAP and Non-GAAP Results” at the end of this press release.

Safe Harbor Statement

This press release contains statements that may

constitute “forward-looking” statements which are made pursuant to

the “safe harbor” provisions of the U.S. Private Securities

Litigation Reform Act of 1995. These forward-looking statements can

be identified by terminology such as “will,” “expects,”

“anticipates,” “aims,” “future,” “intends,” “plans,” “believes,”

“estimates,” “likely to,” and similar statements. The Company may

also make written or oral forward-looking statements in its

periodic reports to the U.S. Securities and Exchange Commission, in

announcements made on the website of The Stock Exchange of Hong

Kong Limited, in its interim and annual reports to shareholders, in

press releases and other written materials and in oral statements

made by its officers, directors or employees to third parties.

Statements that are not historical facts, including but not limited

to statements about the Company’s beliefs, plans, and expectations,

are forward-looking statements. Forward-looking statements involve

inherent risks and uncertainties. Further information regarding

these and other risks is included in the Company’s filings with the

U.S. Securities and Exchange Commission and The Stock Exchange of

Hong Kong Limited. All information provided in this press release

is as of the date of this press release, and the Company does not

undertake any obligation to update any forward-looking statement,

except as required under applicable law.

About KANZHUN LIMITED

KANZHUN LIMITED operates the leading online

recruitment platform BOSS Zhipin in China. The Company connects job

seekers and enterprise users in an efficient and seamless manner

through its highly interactive mobile app, a transformative product

that promotes two-way communication, focuses on intelligent

recommendations, and creates new scenarios in the online recruiting

process. Benefiting from its large and diverse user base, BOSS

Zhipin has developed powerful network effects to deliver higher

recruitment efficiency and drive rapid expansion.

For investor and media inquiries, please

contact:KANZHUN LIMITEDInvestor RelationsEmail:

ir@kanzhun.com

PIACENTE FINANCIAL COMMUNICATIONSEmail:

kanzhun@tpg-ir.com

|

KANZHUN LIMITEDUnaudited Condensed

Consolidated Statements of Operations(All amounts in

thousands, except for share and per share data) |

| |

| |

|

For the three months ended March 31, |

| |

|

2023 |

|

2024 |

| |

|

RMB |

|

RMB |

|

US$ |

| Revenues |

|

|

|

|

|

|

|

Online recruitment services to enterprise customers |

|

1,260,057 |

|

|

1,684,087 |

|

|

233,243 |

|

|

Others |

|

17,489 |

|

|

19,666 |

|

|

2,724 |

|

| Total

revenues |

|

1,277,546 |

|

|

1,703,753 |

|

|

235,967 |

|

| Operating cost and

expenses |

|

|

|

|

|

|

|

Cost of revenues(1) |

|

(247,164 |

) |

|

(295,439 |

) |

|

(40,918 |

) |

|

Sales and marketing expenses(1) |

|

(628,838 |

) |

|

(579,270 |

) |

|

(80,228 |

) |

|

Research and development expenses(1) |

|

(333,068 |

) |

|

(467,569 |

) |

|

(64,758 |

) |

|

General and administrative expenses(1) |

|

(164,586 |

) |

|

(270,472 |

) |

|

(37,460 |

) |

| Total operating cost and

expenses |

|

(1,373,656 |

) |

|

(1,612,750 |

) |

|

(223,364 |

) |

|

Other operating income, net |

|

18,811 |

|

|

12,590 |

|

|

1,744 |

|

| (Loss)/Income from

operations |

|

(77,299 |

) |

|

103,593 |

|

|

14,347 |

|

|

Interest and investment income, net |

|

127,393 |

|

|

156,056 |

|

|

21,614 |

|

|

Foreign exchange (loss)/gain |

|

(1,099 |

) |

|

30 |

|

|

4 |

|

|

Other income/(expenses), net |

|

5,642 |

|

|

(259 |

) |

|

(36 |

) |

| Income before income tax

expenses |

|

54,637 |

|

|

259,420 |

|

|

35,929 |

|

|

Income tax expenses |

|

(21,974 |

) |

|

(17,696 |

) |

|

(2,451 |

) |

| Net income |

|

32,663 |

|

|

241,724 |

|

|

33,478 |

|

|

Net loss attributable to non-controlling interests |

|

- |

|

|

3,227 |

|

|

447 |

|

| Net income attributable

to ordinary shareholders of KANZHUN LIMITED |

|

32,663 |

|

|

244,951 |

|

|

33,925 |

|

| Weighted average number

of ordinary shares used in computing net income per

share |

|

|

|

|

|

|

|

—Basic |

|

865,986,168 |

|

|

880,732,849 |

|

|

880,732,849 |

|

|

—Diluted |

|

907,404,032 |

|

|

907,305,397 |

|

|

907,305,397 |

|

| Net income per

ordinary share attributable to ordinary shareholders |

|

|

|

|

|

|

|

—Basic |

|

0.04 |

|

|

0.28 |

|

|

0.04 |

|

|

—Diluted |

|

0.04 |

|

|

0.27 |

|

|

0.04 |

|

| Net income per

ADS(2) attributable to ordinary

shareholders |

|

|

|

|

|

|

|

—Basic |

|

0.08 |

|

|

0.56 |

|

|

0.08 |

|

|

—Diluted |

|

0.07 |

|

|

0.54 |

|

|

0.07 |

|

(1) Include share-based compensation expenses

as follows:

|

|

|

For the three months ended March 31, |

|

|

|

2023 |

|

2024 |

|

|

|

RMB |

|

RMB |

|

US$ |

| Cost of revenues |

|

10,610 |

|

10,917 |

|

1,512 |

| Sales and marketing expenses |

|

60,463 |

|

70,472 |

|

9,760 |

| Research and development

expenses |

|

90,674 |

|

102,693 |

|

14,223 |

| General and administrative

expenses |

|

50,544 |

|

104,895 |

|

14,528 |

| |

|

212,291 |

|

288,977 |

|

40,023 |

(2) Each ADS represents two Class A ordinary

shares.

|

KANZHUN LIMITEDUnaudited Condensed

Consolidated Balance Sheets(All amounts in thousands) |

| |

| |

|

As of |

| |

|

December 31, 2023 |

|

March 31, 2024 |

|

|

|

RMB |

|

RMB |

|

US$ |

| ASSETS |

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

2,472,959 |

|

2,747,166 |

|

380,478 |

|

Short-term time deposits |

|

6,922,803 |

|

5,320,927 |

|

736,940 |

|

Short-term investments |

|

3,513,885 |

|

3,833,494 |

|

530,933 |

|

Accounts receivable, net |

|

16,727 |

|

25,641 |

|

3,551 |

|

Inventories |

|

- |

|

2,599 |

|

360 |

|

Amounts due from related parties |

|

3,966 |

|

6,353 |

|

880 |

|

Prepayments and other current assets |

|

442,697 |

|

678,589 |

|

93,983 |

| Total current

assets |

|

13,373,037 |

|

12,614,769 |

|

1,747,125 |

| Non-current

assets |

|

|

|

|

|

|

|

Property, equipment and software, net |

|

1,793,488 |

|

1,974,101 |

|

273,410 |

|

Intangible assets, net |

|

8,093 |

|

279,854 |

|

38,759 |

|

Goodwill |

|

5,690 |

|

6,528 |

|

904 |

|

Right-of-use assets, net |

|

282,612 |

|

263,953 |

|

36,557 |

|

Long-term time deposits |

|

- |

|

714,178 |

|

98,913 |

|

Long-term investments |

|

2,473,128 |

|

2,863,694 |

|

396,617 |

|

Other non-current assets |

|

4,000 |

|

- |

|

- |

| Total non-current

assets |

|

4,567,011 |

|

6,102,308 |

|

845,160 |

| Total

assets |

|

17,940,048 |

|

18,717,077 |

|

2,592,285 |

| LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

|

Accounts payable |

|

629,216 |

|

464,775 |

|

64,371 |

|

Deferred revenue |

|

2,794,075 |

|

3,141,003 |

|

435,024 |

|

Other payables and accrued liabilities |

|

779,046 |

|

710,525 |

|

98,407 |

|

Operating lease liabilities, current |

|

155,014 |

|

145,044 |

|

20,088 |

| Total current

liabilities |

|

4,357,351 |

|

4,461,347 |

|

617,890 |

|

Non-current liabilities |

|

|

|

|

|

|

|

Operating lease liabilities, non-current |

|

125,079 |

|

111,986 |

|

15,510 |

|

Deferred tax liabilities |

|

28,425 |

|

28,652 |

|

3,968 |

| Total non-current

liabilities |

|

153,504 |

|

140,638 |

|

19,478 |

| Total

liabilities |

|

4,510,855 |

|

4,601,985 |

|

637,368 |

| Total shareholders’

equity |

|

13,429,193 |

|

14,115,092 |

|

1,954,917 |

| Total liabilities and

shareholders’ equity |

|

17,940,048 |

|

18,717,077 |

|

2,592,285 |

|

KANZHUN LIMITEDUnaudited Condensed

Consolidated Statements of Cash Flows(All amounts in

thousands) |

|

|

|

|

|

|

|

For the three months ended March 31, |

|

|

|

2023 |

|

2024 |

|

|

|

RMB |

|

RMB |

|

US$ |

|

Net cash provided by operating activities |

|

543,910 |

|

|

905,541 |

|

|

125,416 |

|

| Net cash used in investing

activities |

|

(3,962,775 |

) |

|

(523,462 |

) |

|

(72,499 |

) |

| Net cash provided by/(used in)

financing activities |

|

45,789 |

|

|

(104,578 |

) |

|

(14,484 |

) |

| Effect of exchange rate

changes on cash and cash equivalents |

|

(124,176 |

) |

|

(3,294 |

) |

|

(456 |

) |

| Net

(decrease)/increase in cash and cash equivalents |

|

(3,497,252 |

) |

|

274,207 |

|

|

37,977 |

|

| Cash and cash equivalents at

beginning of the period |

|

9,751,824 |

|

|

2,472,959 |

|

|

342,501 |

|

| Cash and cash

equivalents at end of the period |

|

6,254,572 |

|

|

2,747,166 |

|

|

380,478 |

|

|

KANZHUN LIMITEDUnaudited Reconciliation of

GAAP and Non-GAAP Results (All amounts in thousands,

except for share and per share data) |

|

|

|

|

|

|

|

For the three months ended March 31, |

|

|

|

2023 |

|

2024 |

|

|

|

RMB |

|

RMB |

|

US$ |

| Revenues |

|

1,277,546 |

|

1,703,753 |

|

235,967 |

| Add: Change in deferred

revenue |

|

372,011 |

|

346,928 |

|

48,049 |

| Calculated cash

billings |

|

1,649,557 |

|

2,050,681 |

|

284,016 |

| |

|

|

|

|

|

|

| Net income |

|

32,663 |

|

241,724 |

|

33,478 |

| Add: Share-based compensation

expenses |

|

212,291 |

|

288,977 |

|

40,023 |

| Adjusted net

income |

|

244,954 |

|

530,701 |

|

73,501 |

| |

|

|

|

|

|

|

| Net income attributable to

ordinary shareholders of KANZHUN LIMITED |

|

32,663 |

|

244,951 |

|

33,925 |

| Add: Share-based compensation

expenses |

|

212,291 |

|

288,977 |

|

40,023 |

| Adjusted net income

attributable to ordinary shareholders of KANZHUN

LIMITED |

|

244,954 |

|

533,928 |

|

73,948 |

| Weighted average number

of ordinary shares used in computing adjusted net income per share

(Non-GAAP) |

|

|

|

|

|

|

|

—Basic |

|

865,986,168 |

|

880,732,849 |

|

880,732,849 |

|

—Diluted |

|

907,404,032 |

|

907,305,397 |

|

907,305,397 |

| Adjusted net income per

ordinary share attributable to ordinary shareholders |

|

|

|

|

|

|

|

—Basic |

|

0.28 |

|

0.61 |

|

0.08 |

|

—Diluted |

|

0.27 |

|

0.59 |

|

0.08 |

| Adjusted net income per

ADS attributable to ordinary shareholders |

|

|

|

|

|

|

|

—Basic |

|

0.57 |

|

1.21 |

|

0.17 |

|

—Diluted |

|

0.54 |

|

1.18 |

|

0.16 |

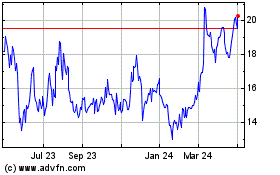

Kanzhun (NASDAQ:BZ)

Historical Stock Chart

From Dec 2024 to Jan 2025

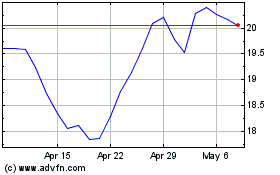

Kanzhun (NASDAQ:BZ)

Historical Stock Chart

From Jan 2024 to Jan 2025