Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-3

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ISUN,

INC.

(Exact

Name of Registrant as Specified in Its Charter)

| Delaware |

|

47-2150172

|

| (State

or other jurisdiction |

|

(I.R.S.

Employer |

| of

incorporation or organization) |

|

Identification

No.) |

400

Avenue D, Suite 10

Williston,

Vermont 05495

Telephone:

(802) 658-3378

(Address,

Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal

Executive

Offices)

Jeffrey

Peck

Chief

Executive Officer

iSun,

Inc.

400

Avenue D, Suite 10

Williston,

Vermont 05495

Telephone:

(802) 658-3378

(Name,

address, including zip code, and telephone number,

including

area code, of agent for service)

Copies

to:

H.

Kenneth Merritt, Jr., Esq.

Merritt

& Merritt

60

Lake Street, PO Box 5839

Burlington,

VT 05402

Telephone:

(802) 658-7830

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement, as

determined by market and other conditions.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box: ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box: ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer: ☐ |

|

Accelerated

filer: ☐ |

| Non-accelerated

filer: ☒ |

|

Smaller

reporting company: ☒ |

| |

|

Emerging

growth company ☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

THE

REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE

REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE

IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE

AS THE COMMISSION ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

EXPLANATORY

NOTE

This

Registration Statement contains:

| |

● |

a

Base Prospectus, which covers the offering, issuance and sales by us of up to $50,000,000 in the aggregate of our shares of Common

Stock from time to time in one or more offerings; and |

| |

|

|

| |

● |

a

Sales Agreement Prospectus covering the offer, issuance and sale by us of up to a maximum aggregate offering price of up to $39,500,000

of our Common Stock that may be issued and sold from time to time under a Sales Agreement with B. Riley Securities, Inc. (the “Sales

Agreement”). |

The

Base Prospectus immediately follows this explanatory note. The specific terms of any shares of our Common Stock to be offered pursuant

to the Base Prospectus will be specified in a Prospectus Supplement to the Base Prospectus. The Sales Agreement Prospectus immediately

follows the Base Prospectus. The $39,500,000 of shares of Common Stock that may be offered, issued and sold under the Sales Agreement

Prospectus is included in the $50,000,000 shares of Common Stock that may be offered, issued and sold by us under the Base Prospectus.

Upon termination of the Sales Agreement, any portion of the $39,500,000 included in the Sales Agreement Prospectus that is not sold pursuant

to the Sales Agreement will be available for sale in other offerings pursuant to the Base Prospectus, and if no shares are sold under

the Sales Agreement, the full $50,000,000 of shares of Common Stock may be sold in other offerings pursuant to the Base Prospectus.

The

information in this Prospectus is not complete and may be changed. We may not sell these securities under this Prospectus until the Registration

Statement of which it is a part and filed with the Securities and Exchange Commission is effective. This Prospectus is not an offer to

sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY

PROSPECTUS

SUBJECT

TO COMPLETION, DATED DECEMBER __, 2023

$50,000,000

iSUN,

INC.

Common

Stock

We

may offer and sell, from time to time in one or more offerings, shares of our Common Stock having an aggregate offering price not exceeding

$50,000,000.

Each

time we sell shares of Common Stock we will file a supplement to this Prospectus which may add, update or change information in this

Prospectus. You should read this Prospectus and any Prospectus Supplement, as well as the documents incorporated by reference or deemed

to be incorporated by reference into this Prospectus, carefully before you invest in our shares of Common Stock.

This

Prospectus may not be used to offer or sell our shares of Common Stock unless accompanied by a Prospectus Supplement relating to the

offered shares of Common Stock.

Our

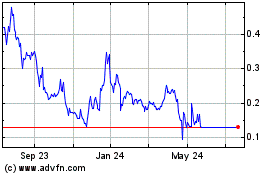

Common Stock is presently listed on The Nasdaq Capital Market, or Nasdaq, under the symbol “ISUN”. On December 7, 2023, the

last reported sale price of our Common Stock was $0.20. Each Prospectus Supplement will indicate if the shares of Common Stock offered

thereby will be listed on any securities exchange.

As

of December 7, 2023, the aggregate market value of our outstanding Common Stock held by non-affiliates, or public float, was approximately

$7.88 million, based on 39,397,369 shares of outstanding Common Stock held by non-affiliates as of the date of this Prospectus, at a

price of $0.20 per share, which was the last reported sale price of our Common Stock on The Nasdaq Capital Market on December 7, 2023.

Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell securities registered on the Registration Statement of which

this Prospectus is a part in a public primary offering with a value exceeding more than one-third of our public float in any 12-month

period so long as our public float remains below $75.0 million. As of the date of this Amendment, we have offered and sold shares of

Common Stock with an aggregate sales price of $8,238,788.16 pursuant to General Instruction I.B.6 to Form S-3 during the prior

12 calendar month period that ends on and includes the date hereof.

These

shares of Common Stock may be sold directly by us, through dealers or agents designated from time to time, to or through underwriters

or dealers or through a combination of these methods on a continuous or delayed basis. See “Plan of Distribution” in this

Prospectus. We may also describe the plan of distribution for any particular offering of our shares of Common Stock in a Prospectus Supplement.

If any agents, underwriters or dealers are involved in the sale of any shares of Common Stock in respect of which this Prospectus is

being delivered, we will disclose their names and the nature of our arrangements with them in a Prospectus Supplement. The net proceeds

we expect to receive from any such sale will also be included in a Prospectus Supplement.

Investing

in our Common Stock involves various risks. See “Risk Factors” beginning on page 2 of this Prospectus and in the

applicable Prospectus Supplement, and in the risks discussed in the documents incorporated by reference in this Prospectus and in

the applicable Prospectus Supplement, as they may be amended, updated or modified periodically in our reports filed with the

Securities and Exchange Commission. You should carefully read and consider these risk factors before you invest in our Common

Stock.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This

Prospectus is dated December 8, 2023

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

Prospectus is part of a shelf registration statement that we filed with the Securities and Exchange Commission (the “SEC”)

using a “shelf” registration process. Under this shelf registration process, we may sell the shares of Common Stock described

in this Prospectus in one or more offerings from time to time having an aggregate offering price of $50,000,000. This Prospectus provides

you with a general description of the shares of Common Stock we may offer. Each time we offer shares of Common Stock, we will provide

you with a Prospectus Supplement that describes the specific amounts, prices and any material information with respect to the shares

of Common Stock we offer. The Prospectus Supplement also may add, update or change information contained in this Prospectus. You should

read carefully both this Prospectus and any Prospectus Supplement together with additional information described below under the caption

“Where You Can Find More Information.”

This

Prospectus does not contain all the information provided in the Registration Statement we filed with the SEC. You should read both this

Prospectus, including the section titled “Risk Factors,” and the accompanying Prospectus Supplement, together with the additional

information described under the heading “Where You Can Find More Information.”

You

should rely only on the information contained or incorporated by reference in this Prospectus or a Prospectus Supplement. We have not

authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information,

you should not rely on it. This Prospectus is not an offer to sell securities, and it is not soliciting an offer to buy securities in

any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this Prospectus or any

Prospectus Supplement, as well as information we have previously filed with the SEC and incorporated by reference, is accurate as of

the date on the front of those documents only. Our business, financial condition, results of operations and prospects may have changed

since those dates.

OUR

COMPANY

This

summary highlights information contained in the documents incorporated herein by reference. Before making an investment decision, you

should read the entire Prospectus, and our other filings with the Securities and Exchange Commission, or the SEC, including those filings

incorporated herein by reference, carefully, including the sections entitled “Risk Factors” and “Cautionary Statement

Regarding Forward-Looking Statements.”

Overview

We

are one of the largest commercial solar engineering, procurement and construction (“EPC”) companies in the country and are

expanding across the Northeastern United States. We were a second-generation family business founded under the name Peck Electric Co.

in 1972 as a traditional electrical contractor. Our core values were and still are to align people, purpose, and profitability, and since

taking leadership in 1994, Jeffrey Peck, our Chief Executive Officer, has applied such core values to expand into the solar industry.

Today, we are guided by the mission to facilitate the reduction of carbon emissions through the expansion of clean, renewable energy

and we believe that leveraging such core values to deploy resources toward profitable business is the only sustainable strategy to achieve

these objectives.

The

world recognizes the need to transition to a reliable, renewable energy grid in the next 50 years. Vermont and Hawaii are leading the

way in the U.S. with renewable energy goals of 75% by 2032 and 100% by 2045, respectively. California committed to 100% carbon-free energy

by 2045. The majority of the other states in the U.S. also have renewable energy goals, regardless of current Federal solar policy. We

are a member of Renewable Energy Vermont, an organization that advocates for clean, practical and renewable solar energy. We intend to

use near-term incentives to take advantage of long-term, sustainable energy transformation with a commitment to the environment and to

our shareholders. Our triple bottom line, which is geared towards people, environment, and profit, has always been our guide since we

began installing renewable energy and we intend that it remain our guide over the next 50 years as we construct our energy future.

We

primarily provide EPC services to solar energy customers for projects ranging in size from several kilowatts for residential loads to

multi-megawatt systems for large commercial and utility projects. To date, we have installed over 400 megawatts of solar systems since

inception and are focused on profitable growth opportunities. We believe that we are well-positioned for what we believe to be the coming

transformation to an all renewable energy economy. We are expanding across the Northeastern United States to serve the fast-growing demand

for clean renewable energy. We are open to partnering with others to accelerate our growth process, and we are expanding our portfolio

of company-owned solar arrays to establish recurring revenue streams for many years to come. We have established a leading presence in

the market after five decades of successfully serving our customers, and we are now ready for new opportunities and the next five decades

of success. As part of our business strategy in 2021 we acquired iSun Energy, LLC, the intellectual property of Oakwood Construction

Services, Inc, SolarCommunities, Inc. d/b/a SunCommon and Liberty Electric, Inc in order to provide our full suite of services to the

residential, community, commercial, industrial and utility solar markets.

Corporate

Information

We

were incorporated on October 8, 2014 under the laws of the State of Delaware as Jensyn Acquisition Corp. On June 20, 2019, we changed

our name to The Peck Company Holdings, Inc. On January 19, 2021, we changed our name to iSun, Inc. Our executive offices are located

at 400 Avenue D, Suite 10, Williston, Vermont 05495 and our telephone number is (802) 658-3378. Our website address is www.isunenergy.com.

The information on our website is not part of this Prospectus. We have included our website address as a factual reference and do

not intend it to be active link to our website.

ABOUT

THIS OFFERING

We

may offer up to $50,000,000 in gross proceeds of the sale of Common Stock, in one or more offerings. This Prospectus provides you with

a general description of the shares of Common Stock we may offer.

We

have one class of Common Stock. The holders of Common Stock are entitled to one vote for each share held of record on all matters to

be voted on by stockholders. Subject to any preferential rights of any outstanding preferred stock, holders of our Common Stock are entitled

to receive ratably the dividends, if any, as may be declared from time to time by the board of directors out of legally available funds.

If there is a liquidation, dissolution or winding up of the Company, holders of our Common Stock would be entitled to share ratably in

our net assets legally available for distribution to stockholders after the payment of all our debts and liabilities and any preferential

rights of any outstanding preferred stock.

RISK

FACTORS

An

investment in our Common Stock involves significant risks. You should carefully consider the risk factors contained in this Prospectus,

any Prospectus Supplement and in our filings with the SEC, including our Annual Report on Form 10-K for the year ended December 31, 2022

filed on April 17, 2023, our Form 10-Q for the quarterly period ended March 31, 2023 filed on May 15, 2023, our Form 10-Q for the quarterly

period ended June 30, 2023, filed on August 10, 2023, our Form 10-Q for the quarterly period ended September 30, 2023, filed on November

14, 2023, each of which is incorporated by reference in this Prospectus in their entirety, as well as other information

contained in this Prospectus, any Prospectus Supplement, and the documents incorporated by reference herein or therein, before you decide

to invest in our Common Stock. Our business, prospects, financial condition and results of operations may be materially and adversely

affected as a result of any of such risks. The value of our Common Stock could decline as a result of any of these risks. You could lose

all or part of your investment in our Common Stock. Some of our statements in sections entitled “Risk Factors” are

forward-looking statements. The risks and uncertainties we have described are not the only ones we face. Additional risks and uncertainties

not presently known to us or that we currently deem immaterial may also affect our business, prospects, financial condition and results

of operations.

The

number of shares of Common Stock being registered for sale is significant in relation to the number of our outstanding shares of Common

Stock.

We

have filed a Registration Statement of which this Prospectus is a part to register the shares that may be offered hereunder for sale.

These shares represent a large number of shares of our Common Stock, and if sold publicly in the market all at once or in a short period

of time, could depress the market price of our Common Stock during the period the Registration Statement remains effective.

If

we are not able to comply with the applicable continued listing requirements or standards of Nasdaq, Nasdaq could delist our Common Stock.

Our

Common Stock is currently listed on Nasdaq. In order to maintain such listing, we must satisfy minimum financial and other continued

listing requirements and standards, including those regarding director independence and independent committee requirements, minimum stockholders’

equity, minimum share price, and certain corporate governance requirements. There can be no assurances that we will be able to comply

with the applicable listing standards. For example, we currently are not in compliance with the Nasdaq requirements for minimum bid price.

If

we are unable to satisfy these requirements or standards, or cure any deficiencies in accordance with the Nasdaq Listing Rules, we could

be subject to delisting, which would have a negative effect on the price of our Common Stock and would impair your ability to sell or

purchase our Common Stock when you wish to do so. In the event of a delisting, we would expect to take actions to restore our compliance

with the Nasdaq Listing Rules, but we can provide no assurance that any such action taken by us would allow our Common Stock to become

listed again, stabilize the market price or improve the liquidity of our Common Stock, prevent our Common Stock from dropping below the

minimum bid price requirement, or prevent future non-compliance with the listing requirements.

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This

Prospectus contains forward-looking statements. Such forward-looking statements include those that express plans, anticipation, intent,

contingency, goals, targets or future development and/or otherwise are not statements of historical fact. These forward-looking statements

are based on our current expectations and projections about future events and they are subject to risks and uncertainties known and unknown

that could cause actual results and developments to differ materially from those expressed or implied in such statements.

In

some cases, you can identify forward-looking statements by terminology, such as “expects,” “anticipates,” “intends,”

“estimates,” “plans,” “believes,” “seeks,” “may,” “should”, “could”

or the negative of such terms or other similar expressions. Accordingly, these statements involve estimates, assumptions and uncertainties

that could cause actual results to differ materially from those expressed in them. Any forward-looking statements are qualified in their

entirety by reference to the factors discussed throughout this Prospectus.

You

should read this Prospectus and any accompanying Prospectus Supplement and the documents that we reference herein and therein and

have filed as exhibits to the Registration Statement, of which this Prospectus is a part, completely and with the understanding that

our actual future results may be materially different from what we expect. You should assume that the information appearing in this

Prospectus and any accompanying Prospectus Supplement is accurate as of the date on the front cover of this Prospectus or such

Prospectus Supplement only. Because the risk factors referred to above, as well as the risk factors referred to on page 2 of this

Prospectus and incorporated herein by reference, could cause actual results or outcomes to differ materially from those expressed in

any forward-looking statements made by us or on our behalf, you should not place undue reliance on any forward-looking statements.

Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any

forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the

occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for us to predict which factors

will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or

combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We

qualify all of the information presented in this Prospectus and any accompanying Prospectus Supplement, and particularly our

forward-looking statements, by these cautionary statements.

USE

OF PROCEEDS

Except

as otherwise provided in the applicable Prospectus Supplement, we intend to use the net proceeds from the sale of the shares of Common

Stock offered by this Prospectus for working capital and general corporate purposes.

The

intended application of proceeds from the sale of any particular offering of shares of Common Stock using this Prospectus will be described

in the accompanying Prospectus Supplement relating to such offering. The precise amount and timing of the application of these proceeds

will depend on our funding requirements and the availability and costs of other funds.

THE

SHARES OF COMMON STOCK WE MAY OFFER

The

descriptions of the shares of Common Stock contained in this Prospectus, together with the applicable Prospectus Supplements, summarize

all the material terms and provisions of the shares of Common Stock that we may offer. We will describe in the applicable Prospectus

Supplement relating to the shares of Common Stock the particular terms of the shares of Common Stock offered by that Prospectus Supplement.

If we indicate in the applicable Prospectus Supplement, the terms of the shares of Common Stock may differ from the terms we have summarized

below. We will also include in the Prospectus Supplement information, where applicable, about the securities exchange, if any, on which

the shares of Common Stock will be listed.

We

may sell shares of our Common Stock from time to time, in one or more offerings.

The

terms of the shares of Common Stock we offer will be determined at the time of sale. When shares of Common Stock are offered, a Supplement

to this Prospectus will be filed with the SEC, which will describe the terms of the offering and sale of the shares of Common Stock offered.

DESCRIPTION

OF COMMON STOCK

The

following is a summary of all material characteristics of our Common Stock as set forth in our Certificate of Incorporation and By-laws,

each as amended. The summary does not purport to be complete and is qualified in its entirety by reference to our Certificate of Incorporation

and By-laws, each as amended, and to the provisions of the Delaware General Corporation Law.

Common

Stock

We

are authorized to issue up to 49,000,000 shares of our Common stock, par value $0.0001 per share. As of December 7, 2023, there were

43,778,493 shares of our Common Stock issued and outstanding. The outstanding shares of our Common Stock are validly issued, fully paid

and nonassessable.

Holders

of our Common Stock are entitled to one vote for each share on all matters submitted to a stockholder vote. Holders of our Common Stock

do not have cumulative voting rights. Therefore, holders of a majority of the shares of our Common Stock voting for the election of directors

collectively hold the voting power to elect all of the directors. Holders of our Common Stock representing a majority of the voting power

of our capital stock issued, outstanding and entitled to vote, represented in person or by proxy, are necessary to constitute a quorum

at any meeting of stockholders. A vote by the holders of two-thirds of our outstanding shares is required to effectuate certain fundamental

corporate changes such as dissolution, merger or an amendment to our Certificate of Incorporation, as amended.

Subject

to the rights of holders of shares of our Preferred Stock, if any, the holders of our Common Stock are entitled to share in all dividends

that our Board of Directors, in its discretion, declares on our Common Stock from legally available funds. In the event of a liquidation,

dissolution or winding up, each outstanding share of our Common Stock entitles its holder to participate pro rata in all assets that

remain after payment of liabilities and after providing for each class of stock, if any, having preference over our Common Stock. Our

Common Stock has no pre-emptive, subscription or conversion rights and there are no redemption provisions applicable to our Common Stock.

Transfer

Agent and Registrar

The

Transfer Agent and Registrar for our Common Stock is Continental Stock Transfer & Trust Company, 1 State Street, 30th

Floor, New York, NY 10004.

PLAN

OF DISTRIBUTION

We

may sell the shares of Common Stock being offered pursuant to this Prospectus through underwriters or dealers, through agents, or directly

to one or more purchasers or through a combination of these methods. The applicable Prospectus Supplement will describe the terms of

the offering of the shares of Common Stock, including:

| |

● |

the

name or names of any underwriters, if any, and if required, any dealers or agents; |

| |

● |

the

purchase price of the shares of Common Stock and the proceeds we will receive from the sale; |

| |

● |

any

underwriting discounts and other items constituting underwriters’ compensation; |

| |

● |

any

discounts or concessions allowed or reallowed or paid to dealers; and |

| |

● |

any

securities exchange or market on which the shares of Common Stock may be listed. |

We

may distribute the shares of Common Stock from time to time in one or more transactions at:

| |

● |

a

fixed price or prices, which may be changed; |

| |

● |

market

prices prevailing at the time of sale; |

| |

● |

prices

related to such prevailing market prices; or |

| |

● |

negotiated

prices. |

Only

underwriters named in the Prospectus Supplement are underwriters of the shares of Common Stock offered by the Prospectus Supplement.

If

underwriters are used in an offering, we will execute an underwriting agreement with such underwriters and will specify the name of each

underwriter and the terms of the transaction (including any underwriting discounts and other terms constituting compensation of the underwriters

and any dealers) in a Prospectus Supplement. The shares of Common Stock may be offered to the public either through underwriting syndicates

represented by managing underwriters or directly by one or more investment banking firms or others, as designated. If an underwriting

syndicate is used, the managing underwriter(s) will be specified on the cover of the Prospectus Supplement. If underwriters are used

in the sale, the shares of Common Stock offered will be acquired by the underwriters for their own accounts and may be resold from time

to time in one or more transactions, including negotiated transactions, at a fixed public offering price or at varying prices determined

at the time of sale. Any public offering price and any discounts or concessions allowed or reallowed or paid to dealers may be changed

from time to time. Unless otherwise set forth in the Prospectus Supplement, the obligations of the underwriters to purchase the shares

of Common Stock offered will be subject to conditions precedent and the underwriters will be obligated to purchase all of the shares

of Common Stock offered if any are purchased.

We

may grant to the underwriters options to purchase additional shares of Common Stock to cover over-allotments, if any, at the public offering

price, with additional underwriting commissions or discounts, as may be set forth in a related Prospectus Supplement. The terms of any

over-allotment option will be set forth in the Prospectus Supplement for those shares of Common Stock.

If

we use a dealer in the sale of the shares of Common Stock being offered pursuant to this Prospectus or any Prospectus Supplement, we

will sell the securities to the dealer, as principal. The dealer may then resell the securities to the public at varying prices to be

determined by the dealer at the time of resale. The names of the dealers and the terms of the transaction will be specified in a Prospectus

Supplement.

We

may sell the securities directly or through agents we designate from time to time. We will name any agent involved in the offering and

sale of securities and we will describe any commissions we will pay the agent in the Prospectus Supplement. Unless the Prospectus Supplement

states otherwise, any agent will act on a best-efforts basis for the period of its appointment.

We

may authorize agents or underwriters to solicit offers by institutional investors to purchase shares of Common Stock from us at the public

offering price set forth in the Prospectus Supplement pursuant to delayed delivery contracts providing for payment and delivery on a

specified date in the future. We will describe the conditions to these contracts and the commissions we must pay for solicitation of

these contracts in the Prospectus Supplement. In connection with the sale of shares of Common Stock, underwriters, dealers or agents

may receive compensation from us or from purchasers of the shares of Common Stock for whom they act as agents in the form of discounts,

concessions or commissions. Underwriters may sell the shares of Common Stock to or through dealers, and those dealers may receive compensation

in the form of discounts, concessions or commissions from the underwriters or commissions from the purchasers for whom they may act as

agents. Underwriters, dealers and agents that participate in the distribution of the shares of Common Stock, and any institutional investors

or others that purchase shares of Common Stock directly and then resell the shares of Common Stock, may be deemed to be underwriters,

and any discounts or commissions received by them from us and any profit on the resale of the shares of Common Stock by them may be deemed

to be underwriting discounts and commissions under the Securities Act.

We

may provide agents and underwriters with indemnification against particular civil liabilities, including liabilities under the Securities

Act, or contribution with respect to payments that the agents or underwriters may make with respect to such liabilities. Agents and underwriters

may engage in transactions with, or perform services for, us in the ordinary course of business.

In

addition, we may enter into derivative transactions with third parties (including the writing of options), or sell securities not covered

by this prospectus to third parties in privately negotiated transactions. If the applicable Prospectus Supplement indicates, in connection

with such a transaction, the third parties may, pursuant to this Prospectus and the applicable Prospectus Supplement, sell shares of

Common Stock covered by this Prospectus and the applicable Prospectus Supplement. If so, the third party may use securities borrowed

from us or others to settle such sales and may use securities received from us to close out any related short positions. We may also

loan or pledge shares of Common Stock covered by this Prospectus and the applicable Prospectus supplement to third parties, who may sell

the loaned shares of Common Stock securities or, in an event of default in the case of a pledge, sell the pledged shares of Common Stock

securities pursuant to this Prospectus and the applicable Prospectus Supplement. The third party in such sale transactions will be an

underwriter and will be identified in the applicable Prospectus Supplement or in a post-effective amendment.

To

facilitate an offering of shares of Common Stock, persons participating in the offering may engage in transactions that stabilize, maintain,

or otherwise affect the market price of the shares of Common Stock. This may include over-allotments or short sales of the shares of

Common Stock, which involves the sale by persons participating in the offering of more shares of Common Stock s than have been sold to

them by us. In those circumstances, such persons would cover such over-allotments or short positions by purchasing in the open market

or by exercising the over-allotment option granted to those persons. In addition, those persons may stabilize or maintain the price of

the shares of Common Stock by bidding for or purchasing shares of Common Stock in the open market or by imposing penalty bids, whereby

selling concessions allowed to underwriters or dealers participating in any such offering may be reclaimed if shares of Common Stock

sold by them are repurchased in connection with stabilization transactions. The effect of these transactions may be to stabilize or maintain

the market price of the shares of Common Stock at a level above that which might otherwise prevail in the open market. Such transactions,

if commenced, may be discontinued at any time. We make no representation or prediction as to the direction or magnitude of any effect

that the transactions described above, if implemented, may have on the price of our shares of Common Stock

The

shares of Common Stock being offered are authorized by our Certificate of Incorporation, as amended. Any agents or underwriters may make

a market in these shares of Common Stock, but will not be obligated to do so and may discontinue any market making at any time without

notice. We cannot guarantee the liquidity of the trading markets for our shares of Common Stock which is listed on The Nasdaq Capital

Market. Any underwriters to whom shares of Common Stock are sold by us for public offering and sale may make a market in the shares of

Common Stock but such underwriters will not be obligated to do so and may discontinue any market making at any time without notice.

In

order to comply with the securities laws of some states, if applicable, the shares of Common Stock offered pursuant to this Prospectus

will be sold in those states only through registered or licensed brokers or dealers. In addition, in some states securities may not be

sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification

requirement is available and complied with.

LEGAL

MATTERS

The

validity of the issuance and sale of the shares of Common Stock offered hereby will be passed upon for us by Merritt & Merritt, Burlington,

Vermont.

EXPERTS

The

consolidated financial statements of iSun, Inc. as of December 31, 2022 and 2021 and for each of the two years in the period ended December

31, 2022, have been audited by Marcum LLP, independent registered public accounting firm, as stated in their report, which is incorporated

herein by reference. Such consolidated financial statements of iSun, Inc. are incorporated in this prospectus by reference in reliance

on the report of such firm given upon their authority as experts in accounting and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

We

are subject to the reporting and information requirements of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and

as a result file periodic reports and other information with the SEC. These periodic reports and other information will be available

for inspection and copying at the SEC’s public reference room and the website of the SEC referred to below. We also make available

on our website under “SEC Filings,” free of charge, our Proxy Statements, Annual Reports on Form 10-K, Quarterly Reports

on Form 10-Q, Current reports on Form 8-K and amendments to those reports as soon as reasonably practicable after we electronically file

such materials with or furnish them to the SEC. Our website address is www.isunenergy.com. This reference to our website is an

inactive textual reference only, and is not a hyperlink. The contents of our website are not part of this Prospectus, and you should

not consider the contents of our website in making an investment decision with respect to the Common Stock offered hereby.

This

Prospectus constitutes a part of a Registration Statement on Form S-3 filed under the Securities Act. As permitted by the SEC’s

rules, this Prospectus and any Prospectus Supplement, which form a part of the Registration statement, do not contain all the information

that is included in the Registration Statement. You will find additional information about us in the Registration Statement. Any statements

made in this Prospectus or any Prospectus Supplement concerning legal documents are not necessarily complete and you should read the

documents that are filed as exhibits to the Registration Statement or otherwise filed with the SEC for a more complete understanding

of the document or matter.

We

file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read, without charge, and copy

the documents we file at the SEC’s public reference rooms in Washington, D.C. at 100 F Street, NE, Room 1580, Washington, DC 20549.

You can request copies of these documents by writing to the SEC and paying a fee for the copying cost. Please call the SEC at 1-800-SEC-0330

for further information on the public reference rooms. Our SEC filings are also available to the public at no cost from the SEC’s

website at http://www.sec.gov.

We

maintain a website at https://www.isunenergy.com. You may access our annual reports on Form 10-K, quarterly reports on Form 10-Q, current

reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act with the

SEC free of charge at our website as soon as reasonably practicable after such material is electronically filed with, or furnished to,

the SEC. The information contained in, or that can be accessed through, our website is not incorporated by reference in, and is not part

of, this prospectus.

INCORPORATION

OF DOCUMENTS BY REFERENCE

We

are “incorporating by reference” certain documents that we file with the SEC, which means that we can disclose important

information to you by referring you to those documents. The information in the documents incorporated by reference is considered to be

part of this Prospectus. Statements contained in documents that we file with the SEC and that are incorporated by reference in this Prospectus

will automatically update and supersede information contained in this Prospectus, including information in previously filed documents

or reports that have been incorporated by reference in this Prospectus, to the extent the new information differs from or is inconsistent

with the old information.

We

have filed the following documents with the SEC. These documents are incorporated herein by reference as of their respective dates of

filing:

(1)

Our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as filed with the SEC on April 17, 2023;

(2)

Our Quarterly Report on Form 10-Q for the quarter ended March 31, 2023, as filed with the SEC on May 15, 2023;

(3)

Our Quarterly Report on Form 10-Q for the quarter ended June 30, 2023, as filed with the SEC on August 10, 2023.

(4)

Our Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, as filed with the SEC on November 14, 2023.

(5)

Our Current Reports on Form 8-K and 8-K/A, as applicable, as filed with the SEC on January 25, 2023; January 31, 2023; March 31, 2023;

May 16, 2023; May 19, 2023; June 22, 2023; July 13, 2023; August 10, 2023; September 1, 2023; and November 17, 2023.

(6)

The description of our Common Stock contained in our Registration Statement on Form 8-A filed with the SEC on March 1, 2016, including

any amendments and reports filed for the purpose of updating such description.

All

documents filed by us pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act (1) after the date of the filing of the Registration

Statement of which this Prospectus forms a part and prior to its effectiveness and (2) until all of the Common Stock to which this Prospectus

relates has been sold or the offering is otherwise terminated, except in each case for information contained in any such filing where

we indicate that such information is being furnished and is not to be considered “filed” under the Exchange Act, will be

deemed to be incorporated by reference in this prospectus and any accompanying Prospectus Supplement and to be a part hereof from the

date of filing of such documents.

We

will provide a copy of the documents we incorporate by reference, at no cost, to any person who receives this Prospectus. To request

a copy of any or all of these documents, you should write or telephone us at 400 Avenue D, Suite 10, Williston, VT 05495, Attention:

Mr. John Sullivan, CFO, (802) 658-7738.

The

information contained in this Preliminary Prospectus is not complete and may be changed. These securities may not be sold until the Registration

Statement filed with the Securities and Exchange Commission is effective. This Preliminary Prospectus is not an offer to sell these securities

and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PROSPECTUS

(Subject to Completion) |

|

Dated

December __, 2023 |

$39,500,000

Common

Stock

On

June 21, 2021, iSun, Inc., a Delaware corporation (“iSun”, the “Company”, “we” or “us”)

entered into a certain Sales Agreement (“Sales Agreement”) with B. Riley Securities, Inc. (“B. Riley”), relating

to shares of our Common Stock offered by this Prospectus. In accordance with the terms of the Sales Agreement, we may offer and sell

shares of our Common Stock having an aggregate offering price of up to $39,500,000 from time to time through B. Riley, acting as our

agent.

Our

Common Stock is quoted on The Nasdaq Capital Market under the symbol “ISUN.” On December 7, 2023, the last reported sale

price of our Common Stock was $0.20 per share.

Sales

of our Common Stock, if any, under this Prospectus may be made in sales deemed to be “at the market offerings” as defined

in Rule 415 promulgated under the Securities Act of 1933, as amended, or the Securities Act. B. Riley is not required to sell any specific

number or dollar amount of securities, but will act as a sales agent using commercially reasonable efforts consistent with its normal

trading and sales practices, on mutually agreed terms between B. Riley and us. There is no arrangement for funds to be received in any

escrow, trust or similar arrangement.

The

compensation to B. Riley for sales of Common Stock sold pursuant to the Sales Agreement will be equal to 3.0% of the gross proceeds of

any shares of Common Stock sold under the Sales Agreement. In connection with the sale of the Common Stock on our behalf, B. Riley will

be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of B. Riley will be deemed

to be underwriting commissions or discounts. We have also agreed to provide indemnification and contribution to B. Riley with respect

to certain liabilities, including liabilities under the Securities Act or the Exchange Act of 1934, as amended, or the Exchange Act.

Investing

in our Common Stock involves risks. See “Risk Factors” beginning on page 2 of this Prospectus, and under similar

headings in the other documents that are incorporated by reference into this Prospectus Supplement.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

B.

Riley Securities

December

___, 2023

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

Prospectus relates to the offering of our Common Stock. Before buying any of the Common Stock that we are offering, we urge you to carefully

read this Prospectus, together with the accompanying Base Prospectus and the information incorporated by reference as described under

the headings “Where You Can Find More Information” and “Incorporation of Certain Information by Reference” in

this Prospectus, and any free writing Prospectus or Prospectus Supplement that we have authorized for use in connection with this offering.

These documents contain important information that you should consider when making your investment decision.

This

Prospectus describes the terms of this offering of Common Stock and also adds to and updates information contained in the documents incorporated

by reference into this Prospectus. To the extent there is a conflict between the information contained in this Prospectus, on the one

hand, and the information contained in any document incorporated by reference into this Prospectus that was filed with the Securities

and Exchange Commission, or SEC, before the date of this Prospectus, on the other hand, you should rely on the information in this Prospectus.

If any statement in one of these documents is inconsistent with a statement in another document having a later date — for example,

a document incorporated by reference into this Prospectus — the statement in the document having the later date modifies or supersedes

the earlier statement.

We

have not, and the sales agent has not, authorized anyone to provide you with information different than that contained or incorporated

by reference in this Prospectus and any free writing Prospectus or Prospectus supplement that we have authorized for use in connection

with this offering. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that

others may give you. You should assume that the information appearing in this Prospectus, the documents incorporated by reference herein,

and in any free writing Prospectus or Prospectus Supplement that we have authorized for use in connection with this offering is accurate

only as of the date of those respective documents. Our business, financial condition, results of operations and prospects may have changed

since those dates. You should read this Prospectus, the documents incorporated by reference herein, and any free writing Prospectus or

Prospectus Supplement that we have authorized for use in connection with this offering in their entirety before making an investment

decision.

We

are offering to sell, and are seeking offers to buy, the shares of Common Stock only in jurisdictions where such offers and sales are

permitted. The distribution of this Prospectus and the offering of the shares of Common Stock in certain jurisdictions or to certain

persons within such jurisdictions may be restricted by law. Persons outside the United States who come into possession of this Prospectus

must inform themselves about and observe any restrictions relating to the offering of the shares and the distribution of this Prospectus

outside the United States. This Prospectus does not constitute, and may not be used in connection with, an offer to sell, or a solicitation

of an offer to buy, any securities offered by this Prospectus by any person in any jurisdiction in which it is unlawful for such

person to make such an offer or solicitation.

We

own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our business.

This Prospectus may also contain trademarks, service marks and trade names of third parties, which are the property of their respective

owners. Our use or display of third parties’ trademarks, service marks, trade names or products in this prospectus is not intended

to, and does not imply a relationship with, or endorsement or sponsorship by us. Solely for convenience, the trademarks, service marks

and trade names referred to in this Prospectus may appear without the ®, TM or SM symbols, but such

references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights

or the right of the applicable licensor to these trademarks, service marks and trade names.

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This

Prospectus, including the documents that we incorporate by reference, contain forward-looking statements within the meaning of Section

27A of the Securities Act and Section 21E of the Exchange Act. Such forward-looking statements include those that express plans, anticipation,

intent, contingency, goals, targets or future development and/or otherwise are not statements of historical fact. These statements include,

but are not limited to, statements regarding:

| |

● |

our

limited operating history; |

| |

|

|

| |

● |

our

ability to raise additional capital to meet our objectives; |

| |

|

|

| |

● |

our

ability to compete in the solar power industry; |

| |

|

|

| |

● |

our

ability to sell solar power systems; |

| |

|

|

| |

● |

our

ability to arrange financing for our customers; |

| |

|

|

| |

● |

government

incentive programs related to solar energy; |

| |

|

|

| |

● |

our

ability to increase the size of our company and manage growth; |

| |

|

|

| |

● |

our

ability to acquire and integrate other businesses; |

| |

|

|

| |

● |

disruptions

to our supply chain from protective tariffs on imported components, supply shortages and/or fluctuations in pricing; |

| |

|

|

| |

● |

our

ability or inability to attract and/or retain competent employees; |

| |

|

|

| |

● |

relationships

with employees, consultants, customers, and suppliers; and |

| |

|

|

| |

● |

the

concentration of our business in one industry in limited geographic areas; |

These

forward-looking statements are based on our current expectations and projections about future events and they are subject to risks and

uncertainties known and unknown to us that could cause actual results and developments to differ materially from those expressed or implied

in such statements, including the risks described under “Risk Factors” in this Prospectus and our Annual Report on Form 10-K

for the year ended December 31, 2022, filed with the SEC on April 17, 2023, as updated by our subsequent filings under the Exchange Act,

each of which is incorporated by reference in this Prospectus in their entirety.

In

some cases, you can identify forward-looking statements by terminology, such as “expects,” “anticipates,” “intends,”

“estimates,” “plans,” “believes,” “seeks,” “may,” “should”, “could”

or the negative of such terms or other similar expressions. Accordingly, these statements involve estimates, assumptions and uncertainties

that could cause actual results to differ materially from those expressed in them. Any forward-looking statements are qualified in their

entirety by reference to the factors discussed throughout this Prospectus.

You

should read this Prospectus and the documents that we reference herein and therein, completely and with the understanding that our actual

future results may be materially different from what we expect. You should assume that the information appearing in this Prospectus and

the documents incorporated by reference is accurate as of their respective dates. Our business, financial condition, results of operations

and prospects may change. We may not update these forward-looking statements, even though our situation may change in the future, unless

required by law to update and disclose material developments related to previously disclosed information. We qualify all of the information

presented in this Prospectus, and particularly our forward-looking statements, by these cautionary statements.

PROSPECTUS

SUMMARY

The

following summary is qualified in its entirety by, and should be read together with, the more detailed information and financial statements

and related notes thereto appearing elsewhere or incorporated by reference in this Prospectus. Before you decide to invest in our shares

of Common Stock, you should read the entire Prospectus carefully, including the risk factors and the financial statements and related

notes included or incorporated by reference in this Prospectus.

Overview

We

are one of the largest commercial solar engineering, procurement and construction (“EPC”) companies in the country and are

expanding across the Northeastern United States. We were a second-generation family business founded under the name Peck Electric Co.

in 1972 as a traditional electrical contractor. Our core values were and still are to align people, purpose, and profitability, and since

taking leadership in 1994, Jeffrey Peck, our Chief Executive Officer, has applied such core values to expand into the solar industry.

Today, we are guided by the mission to facilitate the reduction of carbon emissions through the expansion of clean, renewable energy

and we believe that leveraging such core values to deploy resources toward profitable business is the only sustainable strategy to achieve

these objectives.

The

world recognizes the need to transition to a reliable, renewable energy grid in the next 50 years. Vermont and Hawaii are leading the

way in the U.S. with renewable energy goals of 75% by 2032 and 100% by 2045, respectively. California committed to 100% carbon-free energy

by 2045. The majority of the other states in the U.S. also have renewable energy goals, regardless of current Federal solar policy. We

are a member of Renewable Energy Vermont, an organization that advocates for clean, practical and renewable solar energy. We intend to

use near-term incentives to take advantage of long-term, sustainable energy transformation with a commitment to the environment and to

our shareholders. Our triple bottom line, which is geared towards people, environment, and profit, has always been our guide since we

began installing renewable energy and we intend that it remain our guide over the next 50 years as we construct our energy future.

We

primarily provide EPC services to solar energy customers for projects ranging in size from several kilowatts for residential loads to

multi-megawatt systems for large commercial and utility projects. To date, we have installed over 400 megawatts of solar systems since

inception and are focused on profitable growth opportunities. We believe that we are well-positioned for what we believe to be the coming

transformation to an all renewable energy economy. We are expanding across the Northeastern United States to serve the fast-growing demand

for clean renewable energy. We are open to partnering with others to accelerate our growth process, and we are expanding our portfolio

of company-owned solar arrays to establish recurring revenue streams for many years to come. We have established a leading presence in

the market after five decades of successfully serving our customers, and we are now ready for new opportunities and the next five decades

of success. As part of our business strategy in 2021 we acquired iSun Energy, LLC, the intellectual property of Oakwood Construction

Services, Inc, SolarCommunities, Inc. d/b/a SunCommon and Liberty Electric, Inc in order to provide our full suite of services to the

residential, community, commercial, industrial and utility solar markets.

Corporate

Information

We

were incorporated on October 8, 2014 under the laws of the State of Delaware as Jensyn Acquisition Corp. On June 20, 2019, we changed

our name to The Peck Company Holdings, Inc. On January 19, 2021, we changed our name to iSun, Inc. Our executive offices are located

at 400 Avenue D, Suite 10, Williston, Vermont 05495 and our telephone number is (802) 658-3378. Our website address is www.isunenergy.com.

The information on our website is not part of this Prospectus. We have included our website address as a factual reference and do

not intend it to be active link to our website.

The

Offering

| Common

Stock offered by us: |

Shares

of our Common Stock having an aggregate offering price of up to $39,500,000. |

| |

|

| Manner

of offering: |

“At

the market offering” that may be made from time to time through our sales agent, B. Riley See “Plan of Distribution”

on page S-3. |

| |

|

| Use

of proceeds: |

We

intend to use the net proceeds, if any, from this offering, for working capital and general corporate purposes. See “Use of

Proceeds” on page S-3. |

| |

|

| Risk

Factors: |

Investing

in our Common Stock involves significant risks. See “Risk Factors” beginning on page S-2 of this Prospectus Supplement

and other information included or incorporated by reference into this Prospectus Supplement for a discussion of factors you should

carefully consider before investing in our Common Stock. |

| |

|

| Nasdaq

Capital Market trading symbol: |

ISUN |

RISK

FACTORS

Investing

in our Common Stock involves a high degree of risk. Prior to making a decision about investing in our Common Stock, you should carefully

consider the specific risk factors discussed in the sections entitled “Risk Factors” contained in our Annual Report on Form

10-K for the fiscal year ended December 31, 2022 under the heading “Item 1A. Risk Factors,” and as described or may be described

in any subsequent quarterly report on Form 10-Q under the heading “Item 1A. Risk Factors,” as well as in any applicable Prospectus

Supplement and contained or to be contained in our filings with the SEC and incorporated by reference in this Prospectus, together with

all of the other information contained in this Prospectus, or any applicable Prospectus Supplement. For a description of these reports

and documents, and information about where you can find them, see “Where You Can Find More Information” and “Incorporation

of Certain Information by Reference.” If any of the risks or uncertainties described in our SEC filings or any Prospectus Supplement

or any additional risks and uncertainties actually occur, our business, financial condition and results of operations could be materially

and adversely affected.

Risks

Relating to this Offering

A

substantial number of shares of Common Stock may be sold in the market following this offering, which may depress the market price for

our Common Stock.

Sales

of a substantial number of shares of our Common Stock in the public market following this offering could cause the market price of our

Common Stock to decline. A substantial majority of the outstanding shares of our Common Stock are, and the shares of Common Stock offered

hereby will be, freely tradable without restriction or further registration under the Securities Act of 1933, as amended, or the Securities

Act.

We

may allocate the net proceeds from this offering in ways that you or other stockholders may not approve.

We

currently intend to use the net proceeds of this offering, if any, for working capital and general corporate purposes, which may include

capital expenditures and the financing of possible acquisitions or business expansions. This expected use of the net proceeds from this

offering represents our intentions based upon our current plans and business conditions. The amounts and timing of our actual expenditures

may vary significantly depending on numerous factors, including and any unforeseen cash needs. Because the number and variability of

factors that will determine our use of the proceeds from this offering, their ultimate use may vary substantially from their currently

intended use. As a result, our management will retain broad discretion over the allocation of the net proceeds from this offering and

could spend the proceeds in ways that do not necessarily improve our operating results or enhance the value of our Common Stock. See

“Use of Proceeds.”

If

we are not able to comply with the applicable continued listing requirements or standards of Nasdaq, Nasdaq could delist our Common Stock.

Our

Common Stock is currently listed on Nasdaq. In order to maintain such listing, we must satisfy minimum financial and other continued

listing requirements and standards, including those regarding director independence and independent committee requirements, minimum stockholders’

equity, minimum share price, and certain corporate governance requirements. There can be no assurances that we will be able to comply

with the applicable listing standards. We are currently in violation of Nasdaq’s minimum bid price requirement.

If

we are unable to satisfy these requirements or standards, or cure any deficiencies in accordance with the Nasdaq Listing Rules, we could

be subject to delisting, which would have a negative effect on the price of our Common Stock and would impair your ability to sell or

purchase our Common Stock when you wish to do so. In the event of a delisting, we would expect to take actions to restore our compliance

with the Nasdaq Listing Rules, but we can provide no assurance that any such action taken by us would allow our Common Stock to become

listed again, stabilize the market price or improve the liquidity of our Common Stock, prevent our Common Stock from dropping below the

minimum bid price requirement, or prevent future non-compliance with the listing requirements.

USE

OF PROCEEDS

We

currently intend to use the net proceeds from this offering, if any, for working capital and general corporate purposes.

The

timing and amount of our actual expenditures will be based on many factors, including cash flows from operations and the anticipated

growth of our business. As of the date of this Prospectus, we cannot specify with certainty all of the particular uses for the net proceeds

to us from this offering. As a result, our management will have broad discretion regarding the timing and application of the net proceeds

from this offering. Pending their ultimate use, we intend to invest the net proceeds in short-term, investment-grade, interest-bearing

instruments.

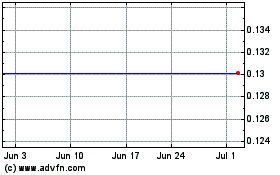

MARKET

PRICE OF OUR COMMON STOCK

Our

Common Stock is presently listed on The Nasdaq Capital Market under the symbol “ISUN”. On December 7, 2023, the last reported

sale price of our Common Stock was $0.20.

Holders

As

of December 7, 2023 we had 399 registered holders of record of our Common Stock. A substantially greater number of holders of our Common

Stock are “street name” or beneficial holders, whose shares of record are held through banks, brokers, other financial institutions

and registered clearing agencies.

DIVIDEND

POLICY

We

have never declared or paid cash dividends on our capital stock. We currently intend to retain our future earnings, if any, for use in

our business and therefore do not anticipate paying cash dividends in the foreseeable future. Payment of future dividends, if any, will

be at the discretion of our Board of Directors after taking into account various factors, including our financial condition, operating

results, current and anticipated cash needs and plans for expansion.

PLAN

OF DISTRIBUTION

We

have entered into the Sales Agreement with B. Riley under which we may issue and sell shares of our Common Stock from time to time up

to $39,500,000 to or through B. Riley, acting as our sales agent. The sales of our Common Stock, if any, under this Prospectus will be

made at market prices by any method deemed to be an “at the market offering” as defined in Rule 415(a)(4) under the Securities

Act.

Each

time that we wish to issue and sell shares of our Common Stock under the Sales Agreement, we will provide B. Riley with a placement notice

describing the amount of shares to be sold, the time period during which sales are requested to be made, any limitation on the amount

of shares of Common Stock that may be sold in any single day, any minimum price below which sales may not be made or any minimum price

requested for sales in a given time period and any other instructions relevant to such requested sales. Upon receipt of a placement notice,

B. Riley, acting as our sales agent, will use commercially reasonable efforts, consistent with its normal trading and sales practices

and applicable state and federal laws, rules and regulations and the rules of The Nasdaq Capital Market, to sell shares of our Common

Stock under the terms and subject to the conditions of the placement notice and the Sales Agreement. We or B. Riley may suspend the offering

of Common Stock pursuant to a placement notice upon notice and subject to other conditions.

Settlement

for sales of Common Stock, unless the parties agree otherwise, will occur on the second trading day following the date on which any sales

are made in return for payment of the net proceeds to us. There are no arrangements to place any of the proceeds of this offering in

an escrow, trust or similar account. Sales of our Common Stock as contemplated in this Prospectus will be settled through the facilities

of The Depository Trust Company or by such other means as we and B. Riley may agree upon.

We

will pay B. Riley commissions for its services in acting as our sales agent in the sale of our Common Stock pursuant to the Sales Agreement.

B. Riley will be entitled to compensation at a fixed commission rate of 3.0% of the gross proceeds from the sale of our Common Stock

on our behalf pursuant to the Sales Agreement. We have also agreed to reimburse B. Riley for its reasonable and documented out-of-pocket

expenses (including but not limited to the reasonable and documented fees and expenses of its legal counsel) in an amount not to exceed

$50,000, and reimbursement of B. Riley’s expenses in connection with any quarterly due diligence investigation of us, during the

term of the Sales Agreement, in an amount not to exceed $10,000 per year.

We

estimate that the total expenses for this offering, excluding compensation payable to B. Riley and certain expenses reimbursable to B.

Riley under the terms of the Sales Agreement, will be approximately $50,000. The remaining sales proceeds, after deducting any expenses

payable by us and any transaction fees imposed by any governmental, regulatory, or self-regulatory organization in connection with the

sales, will equal our net proceeds for the sale of such Common Stock.

Because

there are no minimum sale requirements as a condition to this offering, the actual total public offering price, commissions and net proceeds

to us, if any, are not determinable at this time. The actual dollar amount and number of shares of Common Stock we sell through this

Prospectus will be dependent, among other things, on market conditions and our capital raising requirements.

We

will report at least quarterly the number of shares of Common Stock sold through B. Riley under the Sales Agreement, the net proceeds

to us and the compensation paid by us to B. Riley in connection with the sales of Common Stock under the Sales Agreement.

In

connection with the sale of the shares of Common Stock on our behalf, B. Riley will be deemed to be an “underwriter” within

the meaning of the Securities Act, and the compensation of B. Riley will be deemed to be underwriting commissions or discounts. We have

agreed to provide indemnification and contribution to B. Riley against certain civil liabilities, including liabilities under the Securities

Act.

The

offering pursuant to the Sales Agreement will terminate upon the earlier of (i) the sale of all shares of Common Stock subject to the

Sales Agreement and (ii) termination of the Sales Agreement as permitted therein.

B.

Riley and/or its affiliates have provided, and may in the future provide, various investment banking and other financial services for

us, for which services they have received and may in the future receive customary fees. To the extent required by Regulation M, the Agent

will not engage in any market making activities involving our Common Stock while the offering is ongoing under this Prospectus

Supplement.

This

is a brief summary of the material provisions of the Sales Agreement and does not purport to be a complete statement of its terms and

conditions. The Sales Agreement will be filed with the SEC and will be incorporated by reference into this prospectus supplement.

LEGAL

MATTERS

The

validity of the shares of Common Stock offered by this Prospectus will be passed upon by Merritt & Merritt, Burlington, Vermont.

B. Riley Securities is being represented in connection with this offering by Duane Morris LLP, New York, New York.

EXPERTS

The

consolidated financial statements of iSun, Inc. as of December 31, 2022 and 2021 and for each of the two years in the period ended December

31, 2022, have been audited by Marcum LLP, independent registered public accounting firm, as stated in their report, which is incorporated

herein by reference. Such consolidated financial statements of iSun, Inc. are incorporated in this Prospectus by reference in

reliance on the report of such firm given upon their authority as experts in accounting and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

We

are subject to the reporting and information requirements of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and

as a result file periodic reports and other information with the SEC. These periodic reports and other information will be available

for inspection and copying at the SEC’s public reference room and the website of the SEC referred to below. We also make available

on our website under “SEC Filings,” free of charge, our Proxy Statements, Annual Reports on Form 10-K, Quarterly Reports

on Form 10-Q, Current reports on Form 8-K and amendments to those reports as soon as reasonably practicable after we electronically file

such materials with or furnish them to the SEC. Our website address is www.isunenergy.com. This reference to our website

is an inactive textual reference only, and is not a hyperlink. The contents of our website are not part of this Prospectus, and you should

not consider the contents of our website in making an investment decision with respect to the Common Stock offered hereby.

This

Prospectus is part of a Registration Statement on Form S-3 that we filed under the Securities Act with the SEC with respect to the shares

of our Common Stock offered by the Selling Stockholders through this Prospectus. This Prospectus is filed as a part of that Registration

Statement and does not contain all of the information contained in the Registration Statement and Exhibits. We refer you to our Registration

Statement and each Exhibit attached to it for a more complete description of matters involving us, and the statements that we have made

in this Prospectus are qualified in their entirety by reference to these additional materials.

The

SEC maintains a website that contains reports and other information about issuers, like us, who file electronically with the SEC. The

address of that website is http://www.sec.gov. This reference to the SEC’s website is an inactive textual reference only, and is

not a hyperlink.

INCORPORATION

OF DOCUMENTS BY REFERENCE

We

are “incorporating by reference” certain documents that we file with the SEC, which means that we can disclose important

information to you by referring you to those documents. The information in the documents incorporated by reference is considered to be

part of this Prospectus. Statements contained in documents that we file with the SEC and that are incorporated by reference in this Prospectus

will automatically update and supersede information contained in this Prospectus, including information in previously filed documents

or reports that have been incorporated by reference in this Prospectus, to the extent the new information differs from or is inconsistent

with the old information.

We