Current Report Filing (8-k)

June 02 2020 - 4:57PM

Edgar (US Regulatory)

0001425205

false

0001425205

2020-06-01

2020-06-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): June 2, 2020

IOVANCE BIOTHERAPEUTICS, INC.

(Exact Name of Registrant as Specified in

Charter)

|

Delaware

|

|

(State of Incorporation)

|

|

|

|

001-36860

|

|

75-3254381

|

|

Commission File Number

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

999 Skyway Road, Suite 150

|

|

|

|

San Carlos, California

|

|

94070

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

|

|

|

|

|

(650) 260-7120

|

|

(Registrant’s Telephone Number, Including Area Code)

|

|

|

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425).

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12).

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)).

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)).

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act

of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, par value $0.000041666 per share

|

IOVA

|

The Nasdaq Stock Market, LLC

|

Item 8.01. Other Events.

On June 2, 2020, Iovance

Biotherapeutics, Inc. (the “Company”) issued a press release announcing the closing of the sale of an aggregate of

19,475,806 shares of its common stock, $0.000041666 par value per share, in its previously disclosed public offering, including

2,540,322 shares issued pursuant to the exercise of the option granted to the underwriters, at a public offering price of $31.00

per share before underwriting discounts and commissions. The total net proceeds to the Company from the offering, including the

exercise of the option by the underwriters, are expected to be approximately $567.0 million after deducting the underwriting discounts

and commissions and estimated offering expenses payable by the Company.

A copy of the press

release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

Neither the disclosure

on this Current Report on Form 8-K nor the attached press release shall constitute an offer to sell or the solicitation of an offer

to buy these securities, nor shall there be any sale of these securities in any state or jurisdiction in which such an offer, solicitation

or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

Forward-Looking Statements

This Current Report on Form 8-K contains

forward-looking statements, all of which are subject to risks and uncertainties. Forward-looking statements can be identified by

the use of words such as “expects,” “plans,” “will,” “projects,” “intends,”

“estimates,” and other words of similar meaning. Each forward-looking statement is subject to risks and uncertainties

that could cause actual results to differ materially from those expressed or implied in such statement. Readers should carefully

consider any such statement and should understand that many factors could cause actual results to differ from these forward-looking

statements. These factors may include inaccurate assumptions and a broad variety of other risks and uncertainties, including some

that are known and some that are not. No forward-looking statement can be guaranteed, and actual future results may vary materially.

Except as required by law, the Company does not assume any obligation to update any forward-looking statement.

Item 9.01. Financial Statements and

Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the Company has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

Iovance Biotherapeutics, Inc.

|

|

|

|

|

|

|

|

|

|

Dated: June 2, 2020

|

By:

|

/s/ Maria Fardis

|

|

|

Name: Maria Fardis

|

|

|

Title: Chief Executive Officer

|

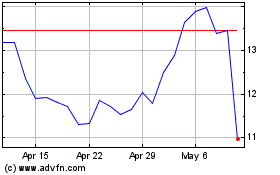

Iovance Biotherapeutics (NASDAQ:IOVA)

Historical Stock Chart

From Aug 2024 to Sep 2024

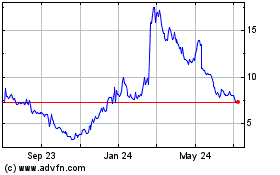

Iovance Biotherapeutics (NASDAQ:IOVA)

Historical Stock Chart

From Sep 2023 to Sep 2024