Intrusion Inc. to Appeal Nasdaq Delisting Notification

November 07 2003 - 4:39PM

PR Newswire (US)

Intrusion Inc. to Appeal Nasdaq Delisting Notification RICHARDSON,

Texas, Nov. 7 /PRNewswire-FirstCall/ -- Intrusion Inc. ,

("Intrusion") today announced that the Nasdaq Listing

Qualifications Department has notified the Company that it had not

regained compliance with the minimum $1.00 closing bid price per

share requirement for continued listing pursuant to Marketplace

Rule 4310(c)(4) by November 5, 2003. As a result, the Company's

securities are subject to delisting from The Nasdaq SmallCap Market

effective upon the opening of business on November 17, 2003.

Intrusion intends to appeal the Nasdaq Listing Qualifications

Department determination before a Nasdaq Listing Qualification

Panel. During the appeals process, the scheduled delisting will be

stayed and the Company's common stock will continue to trade on the

Nasdaq SmallCap Market, pending the Panel's decision. The hearing

date has not been set and is yet to be determined by Nasdaq. While

there can be no assurance that the Company's request for continued

listing on the Nasdaq SmallCap Market will be granted, the Company

is exploring all possible avenues to preserve the Nasdaq listing.

About Intrusion Inc. Intrusion Inc. is a leading global provider of

intrusion detection and security solutions for the

information-driven economy. Intrusion's suite of security products

for governments and enterprises help protect critical information

assets by quickly detecting, analyzing and responding to network-

and host-based attacks. The company's products include the

Intrusion SecureNet(TM) line of leading network intrusion detection

and the Intrusion PDS(TM) security appliances for Check Point

Software Technologies' market- leading VPN-1(R)/FireWall-1(R). For

more information, please visit http://www.intrusion.com/ . This

release, other than historical information, may include forward-

looking statements regarding future events or our future

performance, including, without limitation, statements relating to

our intention to appeal the Nasdaq's delisting determination and

pursue continued Nasdaq listing. These statements are made under

the "safe harbor" provisions of the Private Securities Litigation

Reform Act of 1995 and involve risks and uncertainties which could

cause actual results to differ materially from those in the forward

looking statements, including, without limitation, risks associated

with the uncertainty of our planned appeal to the Nasdaq Listing

Qualification Panel, our ability to remain listed on the Nasdaq

SmallCap Market, our ability to execute on any proposed compliance

plan and our ability to comply with all Nasdaq's continued listing

requirements in the future, as well as other risks and

uncertainties identified in our Annual Report on Form 10-K and

other filings with the Securities and Exchange Commission. Copies

of these filings can be obtained from our Investor Relations

department. Financial Contact Michael L. Paxton, VP, CFO

972.301.3658, Media Contact Ryon Packer, VP 972.664.8072,

http://www.newscom.com/cgi-bin/prnh/20030703/INTRUSIONLOGO

http://photoarchive.ap.org/ DATASOURCE: Intrusion Inc. CONTACT:

financial, Michael L. Paxton, VP, CFO, +1-972-301-3658, or , or

media, Ryon Packer, VP, +1-972-664-8072, or , both of Intrusion

Inc. Web site: http://www.intrusion.com/

Copyright

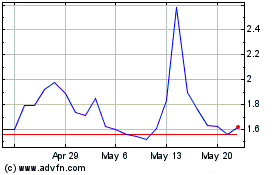

Intrusion (NASDAQ:INTZ)

Historical Stock Chart

From Jun 2024 to Jul 2024

Intrusion (NASDAQ:INTZ)

Historical Stock Chart

From Jul 2023 to Jul 2024