Intrusion Inc. Announces Third Quarter Results; Third Quarter

Revenue Increases 5% and Orders Increase 59% Sequentially

RICHARDSON, Texas, Oct. 29 /PRNewswire-FirstCall/ -- Intrusion Inc.

, ("Intrusion") today announced financial results for the three

months ended September 30, 2003. Revenue was $1.6 million for the

third quarter of 2003, compared to $1.5 million for the second

quarter 2003 and $2.4 million for the third quarter 2002. Orders

booked were $1.9 million in the third quarter of 2003 compared to

$1.2 million in the second quarter. Gross profit margin was 42% of

revenue in the third quarter of 2003 compared to 26% of revenue in

the second quarter. Operating expenses totaled $3.1 million in the

third quarter of 2003. Operating expenses, excluding a one-time

charge, as described below, and severance costs, totaled $2.5

million in the third quarter of 2003 compared to $3.3 million in

the second quarter. Intrusion's operating loss for the three months

ended September 30, 2003 was $2.5 million, or $0.12 per share.

Excluding the one-time charge, Intrusion's operating loss for the

three months ended September 30, 2003 was $2.0 million, or $0.10

per share, compared to an operating loss for the three months ended

June 30, 2003 of $3.0 million, or $0.15 per share, and an operating

loss of $3.7 million, or $0.18 per share, for the three months

ended September 30, 2002. As of September 30, 2003, Intrusion

reported cash, cash equivalents and investments of $4.6 million,

working capital of $3.7 million and no debt. The cash burn rate in

the third quarter of 2003 was $1.5 million compared to $2.1 million

in the second quarter of 2003. "The overall market conditions in

the third quarter continued to be very difficult," stated G. Ward

Paxton, Chairman, President and CEO of Intrusion. "However, we were

able to generate a small sequential revenue growth in the third

quarter when compared to the second quarter of this year." "We were

pleased with the 59% sequential growth in orders booked and the 5%

sequential growth in revenue. Approximately $0.6 million of the

orders booked during the quarter are scheduled to be billed in

2004." "We have continued to cut expenses through the year and

expect expenses to further decline in the fourth quarter of 2003

and first quarter of 2004 due to measures already taken." The

one-time charge mentioned above was a litigation settlement with a

supplier. The result of the settlement was a payment of $450

thousand in October 2003. This amount is accrued at September 30,

2003 and disclosed separately in the accompanying financial

statements. This charge represents 18% of the quarterly operating

loss reported above. During the third quarter, Intrusion booked

several noteworthy orders: -- Several orders totaling $1.0 million

both direct and through resellers to the U.S. government -- Orders

totaling $180 thousand with a large aerospace company -- An order

totaling $100 thousand for a large health insurance provider The

Intrusion SecureNet Network Intrusion Detection System, which

received Common Criteria Certification in December 2002 was the

first network IDS listed on the U.S. National Security Agency's

National Information Assurance Partnership certified products

website. Third quarter revenues include business resulting from

Common Criteria Certification and many new projects are now being

pursued with greater revenue expected during the fourth quarter and

beyond. Also during the third quarter, Intrusion made major

advancements in the company's flagship, Intrusion SecureNet System,

which include increased deployment flexibility and reduction of

total cost of ownership. The set-and- forget functionality for the

highly scalable SecureNet Provider Manager and the pinnacle release

of SecureNet Sensor 5.0 that heralded Intrusion's entry into the

intrusion prevention and multi-function security device market

space were both major advances. Intrusion SecureNet Sensor 5.0 - -

Intrusion has developed a new engine that it believes has the

required performance and accuracy to make network intrusion

prevention a reality. The new Sensor 5.0 includes the following

paramount features: -- Inline Deployment Capable - - The IPS can

function like a firewall, blocking access to or from the network.

Surpassing the capabilities of the firewall, which examines only

the header portion of the packet and very minimally any additional

information, the SecureNet IPS examines the entire packet,

providing the features of a firewall with the extended detection

capabilities of an intrusion detection/prevention system. --

Exclusive Network Anomaly Detection - - The Intrusion SecureNet 5.0

provides visibility and control over more than 300 anomalous

conditions in the network. Network anomaly detection supports

network quality of service efforts, flags potential misuse of the

network and can block information "spillage" -- to keep company

information assets inside the company. -- Passive Fingerprinting -

- Passive Fingerprinting is a new SecureNet feature which

dramatically reduces one of the biggest causes of false positives

to make the system more manageable and the data more valuable.

Fingerprinting allows the IDS/IPS to automatically and in real time

determine the type of service that produced the traffic -- so that

the exploits can be matched or excluded. Fingerprinting can reduce

the incidents of false positives by more than 50%. -- Intrusion

SecureNet IPS Taps - - Announced along with the Sensor 5.0, the IPS

Taps provide the critical uptime and high-availability features

required for inline devices that can stop network traffic. By using

a SecureNet IPS Tap, the network is protected from failures in the

Tap, the link to the IPS or the IPS itself. If any of these systems

fail, the IPS Tap will pass network traffic straight through, so

there is no single point of failure. SecureNet IPS Taps can be

configured for a single IPS, with dual IPSes for hot-standby

configuration and fully redundant high-availability deployments as

well. IPS Taps are available for 100-1,000 Mb/s copper and gigabit

fiber networks. Intrusion's management will host its regularly

scheduled quarterly conference call to discuss the Company's

financial and operational progress at 4:00 P.M., CST today.

Interested investors can access the call at 1-800-399-2043 (if

outside the United States, 1-706-634-5518). For those unable to

participate in the live conference call, a replay will be

accessible beginning today at 7:00 P.M., CST until November 5, 2003

by calling 1-800-642-1687 (if outside the United States,

1-706-645-9291). At the replay prompt, enter conference

identification number 3370956. Additionally, a live and archived

audio webcast of the conference call will be available at

http://www.intrusion.com/ . About Intrusion Inc. Intrusion Inc. is

a leading global provider of intrusion detection and security

solutions for the information-driven economy. Intrusion's suite of

security products for governments and enterprises help protect

critical information assets by quickly detecting, analyzing and

responding to network- and host-based attacks. The company's

products include the Intrusion SecureNet(TM) line of leading

network intrusion detection and the Intrusion PDS(TM) security

appliances for Check Point Software Technologies' market- leading

VPN-1(R)/FireWall-1(R). For more information, please visit

http://www.intrusion.com/ . This release, other than historical

information, may include forward- looking statements regarding

future events or the future financial performance of the Company.

These statements are made under the "safe harbor" provisions of the

Private Securities Litigation Reform Act of 1995 and involve risks

and uncertainties which could cause actual results to differ

materially from those in the forward-looking statements, including

but not limited to the following: the difficulties in forecasting

future sales caused by current economic and market conditions, the

effect of military actions on government and corporate spending on

information security products, the impact of our cost reduction

programs and our refocused product line, the difficulties and

uncertainties in successfully developing and introducing new

products, our ability to continue to meet operating expenses

through current cash flow or additional financings, the continuance

and strength of our relationship with Check Point, the highly

competitive market for our products, difficulties in accurately

estimating market growth, the consolidation of the information

security industry, the impact of changing economic conditions,

business conditions in the information security industry, our

ability to manage acquisitions effectively, our ability to manage

discontinued operations effectively, the impact of market peers and

their products as well as risks concerning future technology and

others identified in our Annual Report on Form 10-K and other

Securities and Exchange Commission filings. These filings can be

obtained by contacting Intrusion Investor Relations. This release

may include various non-GAAP financial measures (as defined by SEC

Regulation G), including operating expenses excluding one-time

charges and severance costs and operating loss excluding one-time

charges. The Company's management believes these measures provide

useful information to investors about the Company's financial

condition and results of operations for the period presented by

eliminating the effects of one-time and other transactions that can

distort underlying operational results in order to provide greater

comparability of the Company's quarterly financial performance on a

year-to-year basis. The most directly comparable GAAP financial

measures and reconciliation of the differences between the GAAP

financial measures can be found in the text of this release and the

Company's Condensed Consolidated Statement of Operations attached

to this release. INTRUSION INC. CONDENSED CONSOLIDATED BALANCE

SHEETS (In thousands except par value amounts) September 30,

December 31, 2003 2002 ASSETS (Unaudited) (Audited) Current Assets:

Cash and cash equivalents $1,691 $2,898 Short-term investments

2,950 7,825 Accounts receivable, net of allowance for doubtful

accounts of $620 in 2003 and $934 in 2002 824 2,363 Inventories

1,489 1,411 Other current assets 358 759 Total current assets 7,312

15,256 Property and equipment, net 492 1,597 Other assets 82 86

TOTAL ASSETS $7,886 $16,939 LIABILITIES AND STOCKHOLDERS' EQUITY

Current Liabilities: Accounts payable and accrued expenses $2,737

$2,905 Deferred revenue 893 1,650 Total current liabilities 3,630

4,555 Stockholders' Equity: Preferred stock, $.01 par value:

Authorized shares 5,000; No shares issued and outstanding --- ---

Common stock, $.01 par value: Authorized shares 80,000 Issued

shares - 20,690 in 2003 and 20,686 in 2002 Outstanding shares -

20,650 in 2003 and 20,646 in 2002 207 207 Common stock held in

Treasury, at cost: 40 shares (362) (362) Additional paid-in capital

47,371 47,371 Accumulated deficit (42,732) (34,604) Accumulated

other comprehensive loss (228) (228) Total stockholders' equity

4,256 12,384 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $7,886

$16,939 INTRUSION INC. CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (In thousands except per share amounts) (Unaudited)

Three Months Ended Nine Months Ended September 30, September 30,

2003 2002 2003 2002 Revenue $1,556 $2,394 $4,515 $6,373 Cost of

revenue 895 1,322 2,991 4,173 Gross profit 661 1,072 1,524 2,200

Operating expenses: Sales and marketing 1,313 2,507 5,099 9,606

Research and development 860 1,398 2,684 4,762 General and

administrative 374 693 1,222 2,016 Amortization of intangibles ---

199 --- 598 Litigation settlement 450 --- 450 --- Severance costs

119 --- 363 200 Operating loss (2,455) (3,725) (8,294) (14,982)

Interest income, net 43 83 156 281 Other income (expense) --- (7)

10 (7) Loss before income taxes (2,412) (3,649) (8,128) (14,708)

Income tax benefit --- --- --- 608 Loss from continuing operations

(2,412) (3,649) (8,128) (14,100) Gain from discontinued operations,

net of taxes --- --- --- 401 Net loss $(2,412) $(3,649) $(8,128)

$(13,699) Loss per share, continuing operations (basic and diluted)

$(0.12) $(0.18) $(0.39) $(0.68) Net loss per share (basic and

diluted) $(0.12) $(0.18) $(0.39) $(0.66) Weighted average shares

outstanding (basic and diluted) 20,650 20,645 20,649 20,640

Financial Contact Michael L. Paxton, VP, CFO 972.301.3658, Media

Contact Ryon Packer, VP 972.664.8072,

http://www.newscom.com/cgi-bin/prnh/20030703/INTRUSIONLOGO

http://photoarchive.ap.org/ DATASOURCE: Intrusion Inc. CONTACT:

financial, Michael L. Paxton, VP, CFO, +1-972-301-3658, or , or

media, Ryon Packer, VP, +1-972-664-8072, or , both of Intrusion

Inc. Web site: http://www.intrusion.com/

Copyright

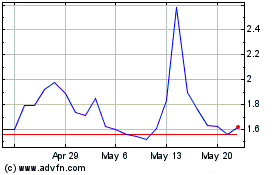

Intrusion (NASDAQ:INTZ)

Historical Stock Chart

From Jun 2024 to Jul 2024

Intrusion (NASDAQ:INTZ)

Historical Stock Chart

From Jul 2023 to Jul 2024