Hyperfine, Inc. Reports First Quarter 2024 Financial Results

May 13 2024 - 4:05PM

Hyperfine, Inc. (Nasdaq: HYPR), the groundbreaking health

technology company that has redefined brain imaging with the first

FDA-cleared portable magnetic resonance (MR) brain imaging

system—the Swoop® system—today announced first quarter 2024

financial results and provided a business update.

“We have kicked off 2024 strong. I am pleased with our

commercial progress shown by sales across US and international

accounts, as well as the important milestones we hit in Q1 by

commencing CARE PMR study enrollment in Alzheimer’s and launching

our 8th generation AI-powered software,” said Maria Sainz, Chief

Executive Officer and President of Hyperfine, Inc.

“Commercialization, Clinical Evidence, and Innovation remain our

three value drivers. In Q1, we demonstrated that our team is

capable of delivering on all three and doing so with strong

spending discipline.”

Recent Achievements and Business Highlights

- Initiated enrollment of CARE PMR

(Capturing ARIA Risk Equitably with Portable MR) study assessing

the clinical utility of the Swoop® System to scan Alzheimer’s

patients receiving amyloid-targeting therapy to detect ARIA.

- Exceeded 100 patients enrolled to date

in ACTION PMR (ACuTe Ischemic strOke detectioN with Portable MR),

an observational study assessing the use of portable brain imaging

to identify strokes and salvageable brain tissue.

- Launched 8th generation AI-powered

brain imaging software for enhanced image quality and

ease-of-use.

- Appointed distributors in key EU

markets to support expansion of commercial activity to

international markets.

- Portable Swoop Brain MR accepted and

featured prominently in key conferences with four abstracts at

International Stroke Conference and 17 at International Society for

Magnetic Resonance Medicine.

First Quarter 2024 Financial Results

- Revenues for the first quarter of 2024

were $3.30 million, up 25%, compared to $2.64 million in the first

quarter of 2023.

- Hyperfine, Inc. sold 13 commercial

Swoop® systems in the first quarter of 2024.

- Gross margin for the first quarter of

2024 was $1.35 million, compared to $1.16 million in the first

quarter of 2023.

- Research and development expenses for

the first quarter of 2024 were $5.57 million, compared to $5.46

million in the first quarter of 2023.

- Sales, marketing, general, and

administrative expenses for the first quarter of 2024 were $6.43

million, compared to $8.73 million in the first quarter of

2023.

- Net loss for the first quarter of 2024

was $9.85 million, equating to a net loss of $0.14 per share, as

compared to a net loss of $12.16 million, or a net loss of $0.17

per share, for the first quarter of 2023.

2024 Financial Guidance

- Management expects revenue for the full

year 2024 to be $12 to $15 million.

- Management expects cash burn for the

full year 2024 to be approximately $40 million.

Conference Call

Hyperfine, Inc. will host a conference call at 1:30 p.m. PT/

4:30 p.m. ET on Monday, May 13, 2024, to discuss its first quarter

2024 financial results and provide a business update. Those

interested in listening should register online by visiting

https://investors.hyperfine.io/. and clicking on News & Events.

Participants are encouraged to register more than 15 minutes before

the start of the call. A live and archived audio webcast will be

available through the Investors page of Hyperfine, Inc.’s corporate

website at https://investors.hyperfine.io/.

About Hyperfine, Inc. and the Swoop® Portable MR

Imaging® System

Hyperfine, Inc. (Nasdaq: HYPR) is the groundbreaking health

technology company that has redefined brain imaging with the Swoop®

system—the first FDA-cleared, portable, ultra-low-field, magnetic

resonance brain imaging system capable of providing imaging at

multiple points of care. The Swoop® system received initial U.S.

Food and Drug Administration (FDA) clearance in 2020 as a portable

magnetic resonance brain imaging device for producing images that

display the internal structure of the head where a full diagnostic

examination is not clinically practical. When interpreted by a

trained physician, these images provide information that can be

useful in determining a diagnosis. The Swoop® system has been

approved for brain imaging in several countries, including Canada

and Australia, has UKCA certification in the United Kingdom, CE

certification in the European Union, and is also available in New

Zealand.

The mission of Hyperfine, Inc. is to revolutionize patient care

globally through transformational, accessible, clinically relevant

diagnostic imaging and data solutions. Founded by Dr. Jonathan

Rothberg in a technology-based incubator called 4Catalyzer,

Hyperfine, Inc. scientists, engineers, and physicists developed the

Swoop® system out of a passion for redefining brain imaging

methodology and how clinicians can apply accessible diagnostic

imaging to patient care. Traditionally, access to costly,

stationary, conventional MRI technology can be inconvenient or not

available when needed most. With the portable, ultra-low-field

Swoop® system, Hyperfine, Inc. is redefining the neuroimaging

workflow by bringing brain imaging to the patient’s bedside. For

more information, visit hyperfine.io.

Hyperfine, Swoop, and Portable MR Imaging are registered

trademarks of Hyperfine, Inc.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995. Actual results of

Hyperfine, Inc. (the “Company”) may differ from its expectations,

estimates and projections and consequently, you should not rely on

these forward-looking statements as predictions of future events.

Words such as “expect,” “estimate,” “project,” “budget,”

“forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,”

“should,” “believes,” “predicts,” “potential,” “continue,” and

similar expressions (or the negative versions of such words or

expressions) are intended to identify such forward-looking

statements. These forward-looking statements include, without

limitation, expectations about the Company’s financial and

operating results, including, the Company’s expected revenue and

cash burn for the full year 2024, the Company’s goals and

commercial plans, the Company’s stroke observational clinical study

and Alzheimer’s feasibility study, the benefits of the Company’s

products and services, and the Company’s future performance and its

ability to implement its strategy. These forward-looking statements

involve significant risks and uncertainties that could cause the

actual results to differ materially from the expected results. Most

of these factors are outside of the Company’s control and are

difficult to predict. Factors that may cause such differences

include, but are not limited to: the success, cost and timing of

the Company’s product development and commercialization activities,

including the degree that the Swoop® system is accepted and used by

healthcare professionals; the inability to maintain the listing of

the Company’s Class A common stock on the Nasdaq Stock Market LLC;

the Company’s inability to grow and manage growth profitably and

retain its key employees; changes in applicable laws or

regulations; the inability of the Company to raise financing in the

future; the inability of the Company to obtain and maintain

regulatory clearance or approval for its products, and any related

restrictions and limitations of any cleared or approved product;

the inability of the Company to identify, in-license or acquire

additional technology; the inability of the Company to maintain its

existing or future license, manufacturing, supply and distribution

agreements and to obtain adequate supply of its products; the

inability of the Company to compete with other companies currently

marketing or engaged in the development of products and services

that the Company is currently marketing or developing; the size and

growth potential of the markets for the Company’s products and

services, and its ability to serve those markets, either alone or

in partnership with others; the pricing of the Company’s products

and services and reimbursement for medical procedures conducted

using the Company’s products and services; the Company’s inability

to successfully complete and generate positive data from the ACTION

PMR study and the CARE PMR study; the Company’s estimates regarding

expenses, revenue, capital requirements and needs for additional

financing; the Company’s financial performance; and other risks and

uncertainties indicated from time to time in Company’s filings with

the Securities and Exchange Commission, including those under “Risk

Factors” therein. The Company cautions readers that the foregoing

list of factors is not exclusive and that readers should not place

undue reliance upon any forward-looking statements which speak only

as of the date made. The Company does not undertake or accept any

obligation or undertaking to release publicly any updates or

revisions to any forward-looking statements to reflect any change

in its expectations or any change in events, conditions or

circumstances on which any such statement is based.

Investor ContactMarissa BychGilmartin Group

LLCmarissa@gilmartinir.com

| |

|

HYPERFINE, INC. AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(in thousands, except share and per share amounts) |

|

(Unaudited) |

| |

| |

March 31, 2024 |

|

|

December 31, 2023 |

|

| ASSETS |

|

|

|

|

|

| CURRENT ASSETS: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

63,204 |

|

|

$ |

75,183 |

|

|

Restricted cash |

|

— |

|

|

|

621 |

|

|

Accounts receivable, less allowance of $248 and $321 as of March

31, 2024 and December 31, 2023, respectively |

|

5,343 |

|

|

|

3,189 |

|

|

Unbilled receivables |

|

895 |

|

|

|

942 |

|

|

Inventory |

|

7,298 |

|

|

|

6,582 |

|

|

Prepaid expenses and other current assets |

|

2,950 |

|

|

|

2,391 |

|

| Total current assets |

|

79,690 |

|

|

|

88,908 |

|

|

Property and equipment, net |

|

3,706 |

|

|

|

2,999 |

|

|

Other long term assets |

|

2,047 |

|

|

|

2,292 |

|

| Total

assets |

$ |

85,443 |

|

|

$ |

94,199 |

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

| CURRENT LIABILITIES: |

|

|

|

|

|

|

Accounts payable |

$ |

2,532 |

|

|

$ |

1,214 |

|

|

Deferred grant funding |

|

— |

|

|

|

621 |

|

|

Deferred revenue |

|

1,527 |

|

|

|

1,453 |

|

|

Due to related parties |

|

45 |

|

|

|

61 |

|

|

Accrued expenses and other current liabilities |

|

4,663 |

|

|

|

5,419 |

|

| Total current liabilities |

|

8,767 |

|

|

|

8,768 |

|

|

Long term deferred revenue |

|

1,021 |

|

|

|

968 |

|

|

Other noncurrent liabilities |

|

17 |

|

|

|

64 |

|

| Total

liabilities |

|

9,805 |

|

|

|

9,800 |

|

| COMMITMENTS AND

CONTINGENCIES |

|

|

|

|

|

| STOCKHOLDERS'

EQUITY |

|

|

|

|

|

|

Class A Common stock, $.0001 par value; 600,000,000 shares

authorized; 56,952,666 and 56,840,949 shares issued and outstanding

at March 31, 2024 and December 31, 2023, respectively |

|

5 |

|

|

|

5 |

|

|

Class B Common stock, $.0001 par value; 27,000,000 shares

authorized; 15,055,288 shares issued and outstanding at March 31,

2024 and December 31, 2023, respectively |

|

2 |

|

|

|

2 |

|

|

Additional paid-in capital |

|

339,201 |

|

|

|

338,114 |

|

|

Accumulated deficit |

|

(263,570 |

) |

|

|

(253,722 |

) |

| Total stockholders'

equity |

|

75,638 |

|

|

|

84,399 |

|

| TOTAL LIABILITIES AND

STOCKHOLDERS' EQUITY |

$ |

85,443 |

|

|

$ |

94,199 |

|

| |

|

HYPERFINE, INC. AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE LOSS |

|

(in thousands, except share and per share amounts) |

|

(Unaudited) |

| |

| |

Three Months Ended March

31, |

|

| |

2024 |

|

|

2023 |

|

| Sales |

|

|

|

|

|

|

Device |

$ |

2,704 |

|

|

$ |

2,132 |

|

|

Service |

|

591 |

|

|

|

503 |

|

|

Total sales |

|

3,295 |

|

|

|

2,635 |

|

| Cost of sales |

|

|

|

|

|

|

Device |

|

1,499 |

|

|

|

1,071 |

|

|

Service |

|

442 |

|

|

|

409 |

|

|

Total cost of sales |

|

1,941 |

|

|

|

1,480 |

|

| Gross

margin |

|

1,354 |

|

|

|

1,155 |

|

| Operating Expenses: |

|

|

|

|

|

|

Research and development |

|

5,570 |

|

|

|

5,461 |

|

|

General and administrative |

|

4,430 |

|

|

|

6,182 |

|

|

Sales and marketing |

|

2,004 |

|

|

|

2,547 |

|

| Total operating

expenses |

|

12,004 |

|

|

|

14,190 |

|

| Loss from

operations |

|

(10,650 |

) |

|

|

(13,035 |

) |

|

Interest income |

|

796 |

|

|

|

869 |

|

|

Other income, net |

|

6 |

|

|

|

6 |

|

| Loss before provision

for income taxes |

|

(9,848 |

) |

|

|

(12,160 |

) |

| Provision for income

taxes |

|

— |

|

|

|

— |

|

| Net loss and

comprehensive loss |

$ |

(9,848 |

) |

|

$ |

(12,160 |

) |

|

Net loss per common share attributable to common stockholders,

basic and diluted |

$ |

(0.14 |

) |

|

$ |

(0.17 |

) |

|

Weighted-average shares used to compute net loss per share

attributable to common stockholders, basic and diluted |

|

71,934,045 |

|

|

|

70,864,226 |

|

|

|

|

HYPERFINE, INC. AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED STATEMENT OF CASH

FLOWS |

|

(in thousands) |

|

(Unaudited) |

|

|

|

|

Three Months Ended

March 31, |

|

|

|

2024 |

|

|

2023 |

|

| Cash flows from

operating activities: |

|

|

|

|

|

|

Net loss |

$ |

(9,848 |

) |

|

$ |

(12,160 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

Depreciation |

|

263 |

|

|

|

254 |

|

|

Stock-based compensation expense |

|

1,032 |

|

|

|

1,126 |

|

|

Payments received on net investment in lease |

|

34 |

|

|

|

2 |

|

|

Changes in assets and liabilities: |

|

|

|

|

|

|

Accounts receivable, net |

|

(2,154 |

) |

|

|

(915 |

) |

|

Unbilled receivables |

|

47 |

|

|

|

(259 |

) |

|

Inventory |

|

(833 |

) |

|

|

(1,122 |

) |

|

Prepaid expenses and other current assets |

|

(1,252 |

) |

|

|

272 |

|

|

Due from related parties |

|

— |

|

|

|

48 |

|

|

Prepaid inventory |

|

693 |

|

|

|

281 |

|

|

Other long term assets |

|

200 |

|

|

|

(18 |

) |

|

Accounts payable |

|

1,208 |

|

|

|

954 |

|

|

Deferred grant funding |

|

(621 |

) |

|

|

(58 |

) |

|

Deferred revenue |

|

127 |

|

|

|

(125 |

) |

|

Due to related parties |

|

(16 |

) |

|

|

64 |

|

|

Accrued expenses and other current liabilities |

|

(1,392 |

) |

|

|

(1,835 |

) |

|

Operating lease liabilities, net |

|

2 |

|

|

|

— |

|

|

Net cash used in operating activities |

|

(12,510 |

) |

|

|

(13,491 |

) |

| Cash flows from

investing activities: |

|

|

|

|

|

|

Purchases of property and equipment |

|

(145 |

) |

|

|

(61 |

) |

|

Net cash used in investing activities |

|

(145 |

) |

|

|

(61 |

) |

| Cash flows from

financing activities: |

|

|

|

|

|

|

Proceeds from exercise of stock options |

|

55 |

|

|

|

49 |

|

|

Net cash provided by financing activities |

|

55 |

|

|

|

49 |

|

| Net decrease in cash

and cash equivalents and restricted cash |

|

(12,600 |

) |

|

|

(13,503 |

) |

| Cash, cash equivalents and

restricted cash, beginning of period |

|

75,804 |

|

|

|

118,243 |

|

| Cash, cash equivalents

and restricted cash, end of period |

|

63,204 |

|

|

|

104,740 |

|

| Reconciliation of

cash, cash equivalents, and restricted cash reported in the balance

sheets |

|

|

|

|

|

|

Cash and cash equivalents |

|

63,204 |

|

|

|

104,027 |

|

|

Restricted cash |

|

— |

|

|

|

713 |

|

| Total cash, cash

equivalents and restricted cash |

$ |

63,204 |

|

|

$ |

104,740 |

|

| Supplemental disclosure of

noncash information: |

|

|

|

|

|

|

Unpaid purchase of property and equipment |

$ |

742 |

|

|

$ |

36 |

|

|

|

|

|

|

|

|

|

|

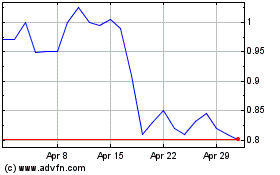

Hyperfine (NASDAQ:HYPR)

Historical Stock Chart

From Nov 2024 to Dec 2024

Hyperfine (NASDAQ:HYPR)

Historical Stock Chart

From Dec 2023 to Dec 2024