0000706129false00007061292024-04-242024-04-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 24, 2024

HORIZON BANCORP, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Indiana | 000-10792 | 35-1562417 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

515 Franklin Street

Michigan City, IN 46360

(Address of principal executive offices, including zip code)

(219) 879-0211

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, no par value | HBNC | The NASDAQ Stock Market, LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On July 24, 2024, Horizon Bancorp, Inc. (the “Company”) issued a press release announcing earnings and other financial results for the three–month period ended June 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this report and incorporated here by reference.

Item 7.01 Regulation FD Disclosure

Investor Presentation

The Company has prepared presentation materials (the “Investor Presentation”) that management intends to use during its previously announced Earnings Conference Call on Thursday, July 25, 2024 at 7:30 a.m. Central Time, and from time to time thereafter in presentations about the Company’s operations and performance. The Company may use the Investor Presentation, possibly with modifications, in presentations to current and potential investors, analysts, lenders, business partners, acquisition candidates, customers, employees and others with an interest in the Company and its business.

A copy of the Investor Presentation is furnished as Exhibit 99.2 to this report and incorporated here by reference. The Investor Presentation is also available on the Company’s investor website at www.horizonbank.com. Materials on the Company’s investor website are not part of or incorporated by reference into this report.

In accordance with General Instruction B.2 of Form 8–K, the information in this Current Report on Form 8–K, including Exhibits 99.1 and 99.2, shall not be deemed to be “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

| | | | | | | | | | | |

| (d) Exhibits | | |

| EXHIBIT INDEX |

| Exhibit No. | Description | Location |

| 99.1 | | Attached |

| 99.2 | | Attached |

| 104 | Cover Page Interactive Data File (Embedded within the Inline XBRL document) | Within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Date: | July 24, 2024 | HORIZON BANCORP, INC. |

| | | |

| | | |

| | By: | /s/ John R. Stewart, CFA |

| | | John R. Stewart, CFA |

| | | Executive Vice President & Chief Financial Officer |

| | | |

| | | |

| | | |

| | | |

Horizon Bancorp, Inc. Reports Second Quarter 2024 Results

| | | | | |

| Contact: | John R. Stewart, CFA |

| Chief Financial Officer |

| Phone: | (219) 814-5833 |

| Fax: | (219) 874–9280 |

| Date: | July 24, 2024 |

FOR IMMEDIATE RELEASE

Horizon Bancorp, Inc. Reports Second Quarter 2024 Results Including EPS of $0.32, Net Interest Margin Expansion, and Growth in Net Interest Income and Loans

Michigan City, Indiana, July 24, 2024 (GLOBE NEWSWIRE) – (NASDAQ GS: HBNC) – Horizon Bancorp, Inc. (“Horizon” or the “Company”), the parent company of Horizon Bank (the “Bank”), announced its unaudited financial results for the three and six months ended June 30, 2024.

Net income for the three months ended June 30, 2024 was $14.1 million, or $0.32 per diluted share, compared to net income of $14.0 million, or $0.32, for the first quarter of 2024 and compared to net income of $18.8 million, or $0.43 per diluted share, for the second quarter of 2023.

Net income for the six months ended June 30, 2024 was $28.1 million, or $0.64 per diluted share, compared to net income of $37.0 million, or $0.85, for the six months ended June 30, 2023.

Second Quarter 2024 Highlights

•Net interest income increased for the third consecutive quarter to $45.3 million, compared to $43.3 million in the linked quarter of 2024. Net interest margin, on a fully taxable equivalent ("FTE") basis1, expanded for the third consecutive quarter to 2.64%, compared to 2.50% in the linked quarter of 2024.

•Total loans held for investment ("HFI") were $4.8 billion at period end, increasing by 4.4% during the quarter, led by organic commercial loan growth of $154.8 million, or 5.6% in the quarter.

•Credit quality continues to perform well, with non-accrual loans declining $0.8 million, to $18.3 million at June 30, 2024 from March 31, 2024. Annualized net charge-offs remain low, at 0.05% of average loans during the second quarter. Provision for loan losses of $2.4 million primarily reflected continued loan growth in the quarter.

•Deposits totaled $5.6 billion at period end, increasing by 0.9% during the quarter. Non-interest bearing deposit balances at June 30, 2024 were relatively consistent with balances at March 31, 2024.

“We are proud of the Company's performance during the second quarter, which was highlighted by sequential growth in revenue and pre-tax pre-provision income resulting from the strategic shift of Horizon’s balance sheet toward a more profitable earning asset mix, and diligent expense management. Importantly, the previously discussed balance sheet efforts drove improving loan yields, which coupled with the relative stability of our funding costs, yielded 14 basis points of net interest margin expansion in the quarter,” President and Chief Executive Officer Thomas M. Prame said. “In-market businesses and consumers remain at the center of Horizon’s strong credit performance and low-cost deposit franchise, and our Indiana and Michigan markets continue to provide excellent opportunities for organic growth. We are pleased with our performance during the first half of 2024, and remain committed to enhancing our financial performance throughout 2024."

1 Non-GAAP financial metric. See non-GAAP reconciliation included herein for the most directly comparable GAAP measure.

Horizon Bancorp, Inc. Reports Second Quarter 2024 Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Financial Highlights |

| (Dollars in Thousands Except Share and Per Share Data and Ratios, Unaudited) |

| Three Months Ended |

| June 30, | | March 31, | | December 31, | | September 30, | | June 30, |

| 2024 | | 2024 | | 2023 | | 2023 | | 2023 |

| Income statement: | | | | | | | | | |

| Net interest income | $ | 45,279 | | | $ | 43,288 | | | $ | 42,257 | | | $ | 42,090 | | | $ | 46,160 | |

| Credit loss expense | 2,369 | | | 805 | | | 1,274 | | | 263 | | | 680 | |

| Non-interest income | 10,485 | | | 9,929 | | | (20,449) | | | 11,830 | | | 10,997 | |

| Non-interest expense | 37,522 | | | 37,107 | | | 39,330 | | | 36,168 | | | 36,262 | |

| Income tax expense | 1,733 | | | 1,314 | | | 6,419 | | | 1,284 | | | 1,452 | |

| Net income | $ | 14,140 | | | $ | 13,991 | | | $ | (25,215) | | | $ | 16,205 | | | $ | 18,763 | |

| | | | | | | | | |

| Per share data: | | | | | | | | | |

| Basic earnings per share | $ | 0.32 | | | $ | 0.32 | | | $ | (0.58) | | | $ | 0.37 | | | $ | 0.43 | |

| Diluted earnings per share | 0.32 | | | 0.32 | | | (0.58) | | | 0.37 | | | 0.43 | |

| Cash dividends declared per common share | 0.16 | | | 0.16 | | | 0.16 | | | 0.16 | | | 0.16 | |

| Book value per common share | 16.62 | | | 16.49 | | | 16.47 | | | 15.89 | | | 16.25 | |

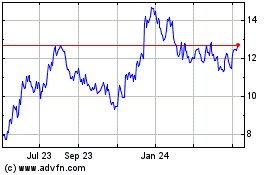

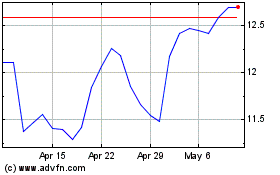

| Market value - high | 12.74 | | | 14.44 | | | 14.65 | | | 12.68 | | | 11.10 | |

| Market value - low | 11.29 | | | 11.75 | | | 9.33 | | | 9.90 | | | 7.75 | |

| Weighted average shares outstanding - Basic | 43,712,059 | | | 43,663,610 | | | 43,649,585 | | | 43,646,609 | | | 43,639,987 | |

| Weighted average shares outstanding - Diluted | 43,987,187 | | | 43,874,036 | | | 43,649,585 | | | 43,796,069 | | | 43,742,588 | |

| Common shares outstanding (end of period) | 43,712,059 | | | 43,726,380 | | | 43,652,063 | | | 43,648,501 | | | 43,645,216 | |

| | | | | | | | | |

| Key ratios: | | | | | | | | | |

| Return on average assets | 0.73 | % | | 0.72 | % | | (1.27) | % | | 0.81 | % | | 0.96 | % |

| Return on average stockholders' equity | 7.83 | | | 7.76 | | | (14.23) | | | 8.99 | | | 10.59 | |

| Total equity to total assets | 9.18 | | | 9.18 | | | 9.06 | | | 8.71 | | | 8.91 | |

| Total loans to deposit ratio | 85.70 | | | 82.78 | | | 78.01 | | | 76.52 | | | 74.85 | |

| Annualized non-interest expense to average assets | 1.94 | | | 1.90 | | | 1.98 | | | 1.81 | | | 1.86 | |

| Allowance for credit losses to HFI loans | 1.08 | | | 1.09 | | | 1.13 | | | 1.14 | | | 1.17 | |

Annualized net charge-offs of average total loans(1) | 0.05 | | | 0.04 | | | 0.07 | | | 0.07 | | | 0.04 | |

| Efficiency ratio | 67.29 | | | 69.73 | | | 180.35 | | | 67.08 | | | 63.44 | |

| | | | | | | | | |

Key metrics (Non-GAAP)(2) : | | | | | | | | | |

| Net FTE interest margin | 2.64 | % | | 2.50 | % | | 2.43 | % | | 2.41 | % | | 2.69 | % |

| Return on average tangible common equity | 10.18 | | | 10.11 | | | (18.76) | | | 11.79 | | | 13.94 | |

| Tangible common equity to tangible assets | 7.22 | | | 7.20 | | | 7.08 | | | 6.72 | | | 6.91 | |

| Tangible book value per common share | $ | 12.80 | | | $ | 12.65 | | | $ | 12.60 | | | $ | 12.00 | | | $ | 12.34 | |

| | | | | | | | | |

| | | | | | | | | |

(1) Average total loans includes loans held for investment and held for sale. |

(2) Non-GAAP financial metrics. See non-GAAP reconciliation included herein for the most directly comparable GAAP measures. |

Horizon Bancorp, Inc. Reports Second Quarter 2024 Results

Income Statement Highlights

Net Interest Income

Net interest income was $45.3 million in the second quarter of 2024, compared to $43.3 million in the first quarter of 2024, driven by net FTE interest margin expansion during the quarter. Horizon’s net FTE interest margin1 was 2.64% for the second quarter of 2024, compared to 2.50% for the first quarter of 2024, attributable to the favorable mix shift in average interest earning assets toward higher-yielding loans against relatively stable costs of interest bearing liabilities. Interest accretion from the fair value of acquired loans did not contribute significantly to the second quarter net interest income, or net FTE interest margin.

Provision for Credit Losses

During the second quarter of 2024, the Company recorded a provision for credit losses of $2.4 million. This compares to a provision for credit losses of $0.8 million during the first quarter of 2024, and $0.7 million during the second quarter of 2023. The increase in the provision for credit losses during the second quarter of 2024 when compared with the first quarter of 2024 was primarily attributable to loan growth.

For the second quarter of 2024, the allowance for credit losses included net charge-offs of $0.6 million, or an annualized 0.05% of average loans outstanding, compared to net charge-offs of $0.4 million, or an annualized 0.04% of average loans outstanding for the first quarter of 2024, and net charge-offs of $0.3 million, or an annualized 0.04% of average loans outstanding, in the second quarter of 2023.

The Company’s allowance for credit losses as a percentage of period-end loans HFI was 1.08% at June 30, 2024, compared to 1.09% at March 31, 2024 and 1.17% at June 30, 2023.

Non-Interest Income

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Quarter Ended | June 30, | | March 31, | | December 31, | | September 30, | | June 30, |

| (Dollars in Thousands) | 2024 | | 2024 | | 2023 | | 2023 | | 2023 |

| Non-interest Income | | | | | | | | | |

| Service charges on deposit accounts | $ | 3,130 | | | $ | 3,214 | | | $ | 3,092 | | | $ | 3,086 | | | $ | 3,021 | |

| Wire transfer fees | 113 | | | 101 | | | 103 | | | 120 | | | 116 | |

| Interchange fees | 3,826 | | | 3,109 | | | 3,224 | | | 3,186 | | | 3,584 | |

| Fiduciary activities | 1,372 | | | 1,315 | | | 1,352 | | | 1,206 | | | 1,247 | |

| Gains (losses) on sale of investment securities | — | | | — | | | (31,572) | | | — | | | 20 | |

| Gain on sale of mortgage loans | 896 | | | 626 | | | 951 | | | 1,582 | | | 1,005 | |

| Mortgage servicing income net of impairment | 450 | | | 439 | | | 724 | | | 631 | | | 640 | |

| Increase in cash value of bank owned life insurance | 318 | | | 298 | | | 658 | | | 1,055 | | | 1,015 | |

| Other income | 380 | | | 827 | | | 1,019 | | | 964 | | | 349 | |

| Total non-interest income | $ | 10,485 | | | $ | 9,929 | | | $ | (20,449) | | | $ | 11,830 | | | $ | 10,997 | |

Total non-interest income was $10.5 million in the second quarter of 2024, compared to $9.9 million in the first quarter of 2024, due primarily to increased interchange fees and higher realized gain on sale of mortgage loans.

1 Non-GAAP financial metric. See non-GAAP reconciliation included herein for the most directly comparable GAAP measure.

Horizon Bancorp, Inc. Reports Second Quarter 2024 Results

Non-Interest Expense

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Quarter Ended | June 30, | | March 31, | | December 31, | | September 30, | | June 30, |

| (Dollars in Thousands) | 2024 | | 2024 | | 2023 | | 2023 | | 2023 |

| Non-interest Expense | | | | | | | | | |

| Salaries and employee benefits | $ | 20,583 | | | $ | 20,268 | | | $ | 21,877 | | | $ | 20,058 | | | $ | 20,162 | |

| Net occupancy expenses | 3,192 | | 3,546 | | 3,260 | | 3,283 | | 3,249 |

| Data processing | 2,579 | | 2,464 | | 2,942 | | 2,999 | | 3,016 |

| Professional fees | 714 | | 607 | | 772 | | 707 | | 633 |

| Outside services and consultants | 3,058 | | 3,359 | | 2,394 | | 2,316 | | 2,515 |

| Loan expense | 1,038 | | 719 | | 1,345 | | 1,120 | | 1,397 |

| FDIC insurance expense | 1,315 | | 1,320 | | 1,200 | | 1,300 | | 840 |

| Core deposit intangible amortization | 844 | | 872 | | 903 | | 903 | | 903 |

| Other losses | 515 | | 16 | | 508 | | 188 | | 134 |

| Other expense | 3,684 | | 3,936 | | 4,129 | | 3,294 | | 3,413 |

| Total non-interest expense | $ | 37,522 | | | $ | 37,107 | | | $ | 39,330 | | | $ | 36,168 | | | $ | 36,262 | |

Income Taxes

Horizon's effective tax rate was 10.9% for the second quarter of 2024, as compared to 8.6% for the first quarter of 2024. The sequential increase in the effective tax rate brings the year-to-date effective tax rate to 9.8%, consistent with the Company's current estimated annual effective tax rate.

Balance Sheet

Total assets increased by $56.8 million, or 0.7%, to $7.91 billion as of June 30, 2024, from $7.86 billion as of March 31, 2024. The increase in total assets is primarily due to increases in gross loans HFI of $204.7 million, or 4.4%, to $4.8 billion as of June 30, 2024, compared to $4.6 billion as of March 31, 2024. Loan growth during the period was partially offset by a decrease in fed funds sold of $127.3 million, or 78.7%, to $34.5 million as of June 30, 2024, from $161.7 million as of March 31, 2024.

Total investment securities decreased $29.7 million, or 1.2%, to $2.4 billion as of June 30, 2024, from $2.5 billion as of March 31, 2024, primarily as a result of normal pay-downs and maturities. There were no purchases of investment securities during the second quarter of 2024.

Total loans HFI and loans held for sale increased to $4.8 billion as of June 30, 2024 compared to $4.6 billion as of March 31, 2024, led by organic commercial loan growth of $154.8 million.

Total deposit balances increased by $50.3 million, or 0.9%, to $5.6 billion on June 30, 2024 when compared to balances as of March 31, 2024.

All other interest bearing liabilities at June 30, 2024, primarily comprised of Federal Home Loan Bank of Indianapolis advances, remained relatively stable when compared to balances as of March 31, 2024.

Horizon Bancorp, Inc. Reports Second Quarter 2024 Results

Capital

The following table presents the consolidated regulatory capital ratios of the Company for the previous three quarters:

| | | | | | | | | | | | | | | | | | | | |

| For the Quarter Ended | | June 30, | | March 31, | | December 31, |

| | 2024* | | 2024** | | 2023** |

| Consolidated Capital Ratios | | | | | | |

| Total capital (to risk-weighted assets) | | 13.36 | % | | 13.75 | % | | 14.04 | % |

| Tier 1 capital (to risk-weighted assets) | | 11.56 | % | | 11.89 | % | | 12.13 | % |

| Common equity tier 1 capital (to risk-weighted assets) | | 10.60 | % | | 10.89 | % | | 11.11 | % |

| Tier 1 capital (to average assets) | | 8.98 | % | | 8.91 | % | | 8.61 | % |

| *Preliminary estimate - may be subject to change |

| **Prior periods have been revised (see disclosure below) |

During the second quarter of 2024 management corrected a prior computation of the Company’s total capital (to risk-weighted assets), Tier 1 capital (to risk-weighted assets), and Tier 1 capital (to average assets) ratios for purposes of the Company’s consolidated financial statements for holding companies filed with the Federal Reserve (the “Regulatory Filings”), which involved an incorrect classification of the Company’s subordinated notes as Tier 1 capital. The Company evaluated the effects of the incorrect classification to its previously filed Regulatory Filings and previously issued financial statements and determined the errors were not material to either of the prior periods noted above. The Company has amended its Regulatory Filings for the periods ended March 31, 2024 and December 31, 2023 to reclassify the subordinated notes balance from Tier 1 capital into Tier 2 capital. The correction of the classification had no effect on the Company’s consolidated balance sheets, statements of income, stockholders’ equity, or the amounts or disclosure of the regulatory capital ratios of the Bank as included in its call reports. The Company continues to exceed regulatory proxy ratios to be considered “well capitalized”, plus the capital conservation buffer, at June 30, 2024. The Company will reflect the reclassification of the subordinated notes described above in its Quarterly Report on Form 10-Q for the quarter ended June 30, 2024.

As of June 30, 2024, the ratio of total stockholders’ equity to total assets is 9.18%. Book value per common share was $16.62, increasing $0.13 during the second quarter of 2024.

Tangible common equity1 totaled $559.5 million at June 30, 2024, and the ratio of tangible common equity to tangible assets1 was 7.22% at June 30, 2024. Tangible book value, which excludes intangible assets from total equity, per common share1 was $12.80, increasing $0.15 during the second quarter of 2024.

Credit Quality

As of June 30, 2024, total non-accrual loans decreased by $0.8 million, or 4.1%, from March 31, 2024, to 0.38% of total loans HFI. Total non-performing assets increased $0.2 million, or 0.8%, to $20.5 million, compared to $20.3 million as of March 31, 2024. The ratio of non-performing assets to total assets was unchanged compared to the first quarter of 2024.

As of June 30, 2024, net charge-offs increased by $0.2 million to $0.6 million, compared to $0.4 million as of March 31, 2024, but remain low at 0.05% annualized of average loan balances.

Earnings Conference Call

As previously announced, Horizon will host a conference call to review its second quarter financial results and operating performance.

1 Non-GAAP financial metric. See non-GAAP reconciliation included herein for the most directly comparable GAAP measure.

Horizon Bancorp, Inc. Reports Second Quarter 2024 Results

Participants may access the live conference call on July 25, 2024 at 7:30 a.m. CT (8:30 a.m. ET) by dialing 833-974-2379 from the United States, 866-450-4696 from Canada or 1-412-317-5772 from international locations and requesting the “Horizon Bancorp Call.” Participants are asked to dial in approximately 10 minutes prior to the call.

A telephone replay of the call will be available approximately one hour after the end of the conference through August 2, 2024. The replay may be accessed by dialing 877-344-7529 from the United States, 855-669-9658 from Canada or 1–412–317-0088 from other international locations, and entering the access code 6800817.

About Horizon Bancorp, Inc.

Horizon Bancorp, Inc. (NASDAQ GS: HBNC) is the $7.9 billion-asset commercial bank holding company for Horizon Bank, which serve customers across diverse and economically attractive Midwestern markets through convenient digital and virtual tools, as well as its Indiana and Michigan branches. Horizon's retail offerings include prime residential and other secured consumer lending to in-market customers, as well as a range of personal banking and wealth management solutions. Horizon also provides a comprehensive array of in-market business banking and treasury management services, as well as equipment financing solutions for customers regionally and nationally, with commercial lending representing over half of total loans. More information on Horizon, headquartered in Northwest Indiana's Michigan City, is available at horizonbank.com and investor.horizonbank.com.

Use of Non-GAAP Financial Measures

Certain information set forth in this press release refers to financial measures determined by methods other than in accordance with GAAP. Specifically, we have included non-GAAP financial measures relating to net income, diluted earnings per share, pre-tax, pre-provision net income, net interest margin, tangible stockholders’ equity and tangible book value per share, efficiency ratio, the return on average assets, the return on average common equity, and return on average tangible equity. In each case, we have identified special circumstances that we consider to be non-recurring and have excluded them. We believe that this shows the impact of such events as acquisition-related purchase accounting adjustments and swap termination fees, among others we have identified in our reconciliations. Horizon believes these non-GAAP financial measures are helpful to investors and provide a greater understanding of our business and financial results without giving effect to the purchase accounting impacts and one-time costs of acquisitions and non–recurring items. These measures are not necessarily comparable to similar measures that may be presented by other companies and should not be considered in isolation or as a substitute for the related GAAP measure. See the tables and other information below and contained elsewhere in this press release for reconciliations of the non-GAAP information identified herein and its most comparable GAAP measures.

Forward Looking Statements

This press release may contain forward–looking statements regarding the financial performance, business prospects, growth and operating strategies of Horizon Bancorp, Inc. and its affiliates (collectively, “Horizon”). For these statements, Horizon claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Statements in this press release should be considered in conjunction with the other information available about Horizon, including the information in the filings we make with the Securities and Exchange Commission (the “SEC”). Forward-looking statements provide current expectations or forecasts of future events and are not guarantees of future performance. The forward-looking statements are based on management’s expectations and are subject to a number of risks and uncertainties. We have tried, wherever possible, to identify such statements by using words such as “anticipate,” “estimate,” “project,” “intend,” “plan,” “believe,” “will” and similar expressions in connection with any discussion of future operating or financial performance.

Although management believes that the expectations reflected in such forward-looking statements are reasonable, actual results may differ materially from those expressed or implied in such statements. Risks and uncertainties that could cause actual results to differ materially include: current financial conditions within the banking industry, including the effects of recent failures of other financial institutions, liquidity levels, and responses by the Federal Reserve, Department of the Treasury, and the Federal Deposit Insurance Corporation to address these issues; changes in the level and volatility of interest rates, changes in spreads on earning assets and changes in interest bearing liabilities; increased interest rate sensitivity; the ability of Horizon to remediate its material weaknesses in its internal control over financial reporting; continuing increases in inflation; loss of key Horizon personnel; increases in disintermediation; potential loss of fee income, including interchange fees, as new and emerging alternative payment

Horizon Bancorp, Inc. Reports Second Quarter 2024 Results

platforms take a greater market share of the payment systems; estimates of fair value of certain of Horizon’s assets and liabilities; changes in prepayment speeds, loan originations, credit losses, market values, collateral securing loans and other assets; changes in sources of liquidity; economic conditions and their impact on Horizon and its customers, including local and global economic recovery from the pandemic; legislative and regulatory actions and reforms; changes in accounting policies or procedures as may be adopted and required by regulatory agencies; litigation, regulatory enforcement, and legal compliance risk and costs; rapid technological developments and changes; cyber terrorism and data security breaches; the rising costs of cybersecurity; the ability of the U.S. federal government to manage federal debt limits; climate change and social justice initiatives; the inability to realize cost savings or revenues or to effectively implement integration plans and other consequences associated with mergers, acquisitions, and divestitures; acts of terrorism, war and global conflicts, such as the Russia and Ukraine conflict and the Israel and Hamas conflict; and supply chain disruptions and delays. These and additional factors that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in Horizon’s reports (such as the Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K) filed with the SEC and available at the SEC’s website (www.sec.gov). Undue reliance should not be placed on the forward–looking statements, which speak only as of the date hereof. Horizon does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions that may be made to update any forward-looking statement to reflect the events or circumstances after the date on which the forward–looking statement is made, or reflect the occurrence of unanticipated events, except to the extent required by law.

Horizon Bancorp, Inc. Reports Second Quarter 2024 Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Condensed Consolidated Statements of Income |

| (Dollars in Thousands Except Per Share Data, Unaudited) |

| Three Months Ended | | Six Months Ended |

| June 30, | | March 31, | | December 31, | | September 30, | | June 30, | | June 30, | June 30, |

| 2024 | | 2024 | | 2023 | | 2023 | | 2023 | | 2024 | 2023 |

| Interest Income | | | | | | | | | | | | |

| Loans receivable | $ | 71,880 | | | $ | 66,954 | | | $ | 65,583 | | | $ | 63,003 | | | $ | 60,594 | | | $ | 138,834 | | $ | 115,958 | |

| Investment securities - taxable | 7,986 | | | 7,362 | | | 8,157 | | | 8,788 | | | 8,740 | | | 15,348 | | 17,465 | |

| Investment securities - tax-exempt | 6,377 | | | 6,451 | | | 6,767 | | | 7,002 | | | 7,059 | | | 12,828 | | 14,615 | |

| Other | 738 | | | 4,497 | | | 3,007 | | | 1,332 | | | 475 | | | 5,235 | | 628 | |

| Total interest income | 86,981 | | | 85,264 | | | 83,514 | | | 80,125 | | | 76,868 | | | 172,245 | | 148,666 | |

| Interest Expense | | | | | | | | | | | | |

| Deposits | 28,447 | | | 27,990 | | | 27,376 | | | 24,704 | | | 18,958 | | | 56,437 | | 33,777 | |

| Borrowed funds | 11,213 | | | 11,930 | | | 11,765 | | | 11,224 | | | 9,718 | | | 23,143 | | 19,489 | |

| Subordinated notes | 829 | | | 831 | | | 870 | | | 880 | | | 881 | | | 1,660 | | 1,761 | |

| Junior subordinated debentures issued to capital trusts | 1,213 | | | 1,225 | | | 1,246 | | | 1,227 | | | 1,151 | | | 2,438 | | 2,241 | |

| Total interest expense | 41,702 | | | 41,976 | | | 41,257 | | | 38,035 | | | 30,708 | | | 83,678 | | 57,268 | |

| Net Interest Income | 45,279 | | | 43,288 | | | 42,257 | | | 42,090 | | | 46,160 | | | 88,567 | | 91,397 | |

| Provision for loan losses | 2,369 | | | 805 | | | 1,274 | | | 263 | | | 680 | | | 3,174 | | 922 | |

| Net Interest Income after Provision for Loan Losses | 42,910 | | | 42,483 | | | 40,983 | | | 41,827 | | | 45,480 | | | 85,393 | | 90,475 | |

| Non-interest Income | | | | | | | | | | | | |

| Service charges on deposit accounts | 3,130 | | | 3,214 | | | 3,092 | | | 3,086 | | | 3,021 | | | 6,344 | | 6,049 | |

| Wire transfer fees | 113 | | | 101 | | | 103 | | | 120 | | | 116 | | | 214 | | 225 | |

| Interchange fees | 3,826 | | | 3,109 | | | 3,224 | | | 3,186 | | | 3,584 | | | 6,935 | | 6,451 | |

| Fiduciary activities | 1,372 | | | 1,315 | | | 1,352 | | | 1,206 | | | 1,247 | | | 2,687 | | 2,522 | |

| Gains (losses) on sale of investment securities | — | | | — | | | (31,572) | | | — | | | 20 | | | — | | (480) | |

| Gain on sale of mortgage loans | 896 | | | 626 | | | 951 | | | 1,582 | | | 1,005 | | | 1,522 | | 1,790 | |

| Mortgage servicing income net of impairment | 450 | | | 439 | | | 724 | | | 631 | | | 640 | | | 889 | | 1,353 | |

| Increase in cash value of bank owned life insurance | 318 | | | 298 | | | 658 | | | 1,055 | | | 1,015 | | | 616 | | 1,996 | |

| Other income | 380 | | | 827 | | | 1,019 | | | 964 | | | 349 | | | 1,207 | | 711 | |

| Total non-interest income | 10,485 | | | 9,929 | | | (20,449) | | | 11,830 | | | 10,997 | | | 20,414 | | 20,617 | |

| Non-interest Expense | | | | | | | | | | | | |

| Salaries and employee benefits | 20,583 | | | 20,268 | | | 21,877 | | | 20,058 | | | 20,162 | | | 40,851 | | 38,874 | |

| Net occupancy expenses | 3,192 | | | 3,546 | | | 3,260 | | | 3,283 | | | 3,249 | | | 6,738 | | 6,812 | |

| Data processing | 2,579 | | | 2,464 | | | 2,942 | | | 2,999 | | | 3,016 | | | 5,043 | | 5,685 | |

| Professional fees | 714 | | | 607 | | | 772 | | | 707 | | | 633 | | | 1,321 | | 1,166 | |

| Outside services and consultants | 3,058 | | | 3,359 | | | 2,394 | | | 2,316 | | | 2,515 | | | 6,417 | | 5,232 | |

| Loan expense | 1,038 | | | 719 | | | 1,345 | | | 1,120 | | | 1,397 | | | 1,757 | | 2,515 | |

| FDIC insurance expense | 1,315 | | | 1,320 | | | 1,200 | | | 1,300 | | | 840 | | | 2,635 | | 1,380 | |

| Core deposit intangible amortization | 844 | | | 872 | | | 903 | | | 903 | | | 903 | | | 1,716 | | 1,806 | |

| Other losses | 515 | | | 16 | | | 508 | | | 188 | | | 134 | | | 531 | | 355 | |

| Other expense | 3,684 | | | 3,936 | | | 4,129 | | | 3,294 | | | 3,413 | | | 7,620 | | 6,961 | |

| Total non-interest expense | 37,522 | | | 37,107 | | | 39,330 | | | 36,168 | | | 36,262 | | | 74,629 | | 70,786 | |

| Income /(Loss) Before Income Taxes | 15,873 | | | 15,305 | | | (18,796) | | | 17,489 | | | 20,215 | | | 31,178 | | 40,306 | |

| Income tax expense | 1,733 | | | 1,314 | | | 6,419 | | | 1,284 | | | 1,452 | | | 3,047 | | 3,315 | |

| Net Income /(Loss) | $ | 14,140 | | | $ | 13,991 | | | $ | (25,215) | | | $ | 16,205 | | | $ | 18,763 | | | $ | 28,131 | | $ | 36,991 | |

| Basic Earnings /(Loss) Per Share | $ | 0.32 | | | $ | 0.32 | | | $ | (0.58) | | | $ | 0.37 | | | $ | 0.43 | | | $ | 0.64 | | $ | 0.85 | |

| Diluted Earnings/(Loss) Per Share | 0.32 | | | 0.32 | | | (0.58) | | | 0.37 | | | 0.43 | | | 0.64 | | 0.85 | |

Horizon Bancorp, Inc. Reports Second Quarter 2024 Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Condensed Consolidated Balance Sheets |

| (Dollars in Thousands) |

| June 30,

2024 | | March 31,

2024 | | December 31,

2023 | | September 30,

2023 | | June 30,

2023 |

| Assets | | | | | | | | | |

| Interest earning assets | | | | | | | | | |

| Federal funds sold | 34,453 | | | 161,704 | | | 401,672 | | | 71,576 | | | 115,794 | |

| Interest earning deposits | 6,672 | | | 10,893 | | | 14,276 | | | 6,925 | | | 6,295 | |

| Federal Home Loan Bank stock | 53,826 | | | 53,826 | | | 34,509 | | | 34,509 | | | 34,509 | |

| Investment securities, available for sale | 527,054 | | | 535,319 | | | 547,251 | | | 865,168 | | | 905,813 | |

| Investment securities, held to maturity | 1,904,281 | | | 1,925,725 | | | 1,945,638 | | | 1,966,483 | | | 1,983,496 | |

| Loans held for sale | 2,440 | | | 922 | | | 1,418 | | | 2,828 | | | 6,933 | |

| Gross loans held for investment (HFI) | 4,822,840 | | | 4,618,175 | | | 4,417,630 | | | 4,359,002 | | | 4,266,260 | |

| Total Interest earning assets | 7,351,566 | | | 7,306,564 | | | 7,362,394 | | | 7,306,491 | | | 7,319,100 | |

| Non-interest earning assets | | | | | | | | | |

| Allowance for credit losses | (52,215) | | | (50,387) | | | (50,029) | | | (49,699) | | | (49,976) | |

| Cash and due from banks | 106,691 | | | 100,206 | | | 112,772 | | | 98,843 | | | 109,349 | |

| Cash value of life insurance | 36,773 | | | 36,455 | | | 36,157 | | | 149,212 | | | 148,171 | |

| Other assets | 165,656 | | | 160,593 | | | 177,061 | | | 152,280 | | | 133,476 | |

| Goodwill | 155,211 | | | 155,211 | | | 155,211 | | | 155,211 | | | 155,211 | |

| Other intangible assets | 11,910 | | | 12,754 | | | 13,626 | | | 14,530 | | | 15,433 | |

| Premises and equipment, net | 93,695 | | | 94,303 | | | 94,583 | | | 94,716 | | | 95,053 | |

| Interest receivable | 43,240 | | | 40,008 | | | 38,710 | | | 37,850 | | | 37,536 | |

| Total non-interest earning assets | 560,961 | | | 549,143 | | | 578,091 | | | 652,943 | | | 644,253 | |

| Total assets | 7,912,527 | | | 7,855,707 | | | 7,940,485 | | | 7,959,434 | | | 7,963,353 | |

| Liabilities | | | | | | | | | |

| Savings and money market deposits | 3,364,726 | | | 3,350,673 | | | 3,369,149 | | | 3,322,788 | | | 3,289,474 | |

| Time deposits | 1,178,389 | | | 1,136,121 | | | 1,179,739 | | | 1,250,606 | | | 1,249,803 | |

| Borrowings | 1,229,165 | | | 1,219,812 | | | 1,217,020 | | | 1,214,016 | | | 1,186,407 | |

| Repurchase agreements | 128,169 | | | 139,309 | | | 136,030 | | | 142,494 | | | 165,632 | |

| Subordinated notes | 55,668 | | | 55,634 | | | 55,543 | | | 59,007 | | | 58,970 | |

| Junior subordinated debentures issued to capital trusts | 57,369 | | | 57,315 | | | 57,258 | | | 57,201 | | | 57,143 | |

| Total interest earning liabilities | 6,013,486 | | | 5,958,864 | | | 6,014,739 | | | 6,046,112 | | | 6,007,429 | |

| Non-interest bearing deposits | 1,087,040 | | | 1,093,076 | | | 1,116,005 | | | 1,126,703 | | | 1,170,055 | |

| Interest payable | 11,240 | | | 7,853 | | | 22,249 | | | 16,281 | | | 12,739 | |

| Other liabilities | 74,096 | | | 74,664 | | | 68,680 | | | 76,969 | | | 63,887 | |

| Total liabilities | 7,185,862 | | | 7,134,457 | | | 7,221,673 | | | 7,266,065 | | | 7,254,110 | |

| Stockholders’ Equity | | | | | | | | | |

| Preferred stock | — | | | — | | | — | | | — | | | — | |

| Common stock | — | | | — | | | — | | | — | | | — | |

| Additional paid-in capital | 357,673 | | | 356,599 | | | 356,400 | | | 355,478 | | | 354,953 | |

| Retained earnings | 442,977 | | | 435,927 | | | 429,021 | | | 461,325 | | | 452,209 | |

| Accumulated other comprehensive income (loss) | (73,985) | | | (71,276) | | | (66,609) | | | (123,434) | | | (97,919) | |

| Total stockholders’ equity | 726,665 | | | 721,250 | | | 718,812 | | | 693,369 | | | 709,243 | |

| Total liabilities and stockholders’ equity | $ | 7,912,527 | | | $ | 7,855,707 | | | $ | 7,940,485 | | | $ | 7,959,434 | | | $ | 7,963,353 | |

Horizon Bancorp, Inc. Reports Second Quarter 2024 Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Loans and Deposits | | | |

| (Dollars in Thousands, Unaudited) | | | |

| June 30, | | March 31, | | December 31, | | September 30, | | June 30, | | % Change |

| 2024 | | 2024 | | 2023 | | 2023 | | 2023 | | Q2'24 vs Q1'24 | Q2'24 vs Q2'23 |

| Commercial: | | | | | | | | | | | | |

| Commercial real estate | 2,117,772 | | | 1,984,723 | | | 1,962,097 | | | 1,916,056 | | | 1,859,285 | | | 7 | % | 14 | % |

| Commercial & Industrial | 786,788 | | | 765,043 | | | 712,863 | | | 673,188 | | | 646,994 | | | 3 | % | 22 | % |

| Total commercial | 2,904,560 | | | 2,749,766 | | | 2,674,960 | | | 2,589,244 | | | 2,506,279 | | | 6 | % | 16 | % |

| Residential Real estate | 797,956 | | | 782,071 | | | 681,136 | | | 675,399 | | | 674,751 | | | 2 | % | 18 | % |

| Mortgage warehouse | 68,917 | | | 56,548 | | | 45,078 | | | 65,923 | | | 82,345 | | | 22 | % | (16) | % |

| Consumer | 1,051,407 | | | 1,029,790 | | | 1,016,456 | | | 1,028,436 | | | 1,002,885 | | | 2 | % | 5 | % |

| Total loans held for investment | 4,822,840 | | | 4,618,175 | | | 4,417,630 | | | 4,359,002 | | | 4,266,260 | | | 4 | % | 13 | % |

| Loans held for sale | 2,440 | | | 922 | | | 1,418 | | | 2,828 | | | 6,933 | | | 165 | % | (65) | % |

| Total loans | 4,825,280 | | | 4,619,097 | | | 4,419,048 | | | 4,361,830 | | | 4,273,193 | | | 4 | % | 13 | % |

| | | | | | | | | | | | |

| Deposits: | | | | | | | | | | | | |

| Interest bearing deposits | | | | | | | | | | | | |

| Savings and money market deposits | 3,364,726 | | | 3,350,673 | | | 3,369,149 | | | 3,322,788 | | | 3,289,474 | | | — | % | 2 | % |

| Time deposits | 1,178,389 | | | 1,136,121 | | | 1,179,739 | | | 1,250,606 | | | 1,249,803 | | | 4 | % | (6) | % |

| Total Interest bearing deposits | 4,543,115 | | | 4,486,794 | | | 4,548,888 | | | 4,573,394 | | | 4,539,277 | | | 1 | % | — | % |

| Non-interest bearing deposits | | | | | | | | | | | | |

| Non-interest bearing deposits | 1,087,040 | | | 1,093,076 | | | 1,116,005 | | | 1,126,703 | | | 1,170,055 | | | (1) | % | (7) | % |

| Total deposits | 5,630,155 | | | 5,579,870 | | | 5,664,893 | | | 5,700,097 | | | 5,709,332 | | | 1 | % | (1) | % |

Horizon Bancorp, Inc. Reports Second Quarter 2024 Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Average Balance Sheet |

| (Dollars in Thousands, Unaudited) |

| Three Months Ended |

| June 30, 2024 | | March 31, 2024 | | June 30, 2023 |

| Average

Balance | Interest(4) | Average Rate(4) | | Average

Balance | Interest(4) | Average Rate(4) | | Average

Balance | Interest(4) | Average Rate(4) |

| Assets |

| Interest earning assets | | | | | | | | | | | |

| Federal funds sold | $ | 47,805 | | $ | 645 | | 5.43 | % | | $ | 322,058 | | $ | 4,387 | | 5.48 | % | | $ | 30,926 | | $ | 376 | | 4.88 | % |

| Interest earning deposits | 7,662 | | 93 | | 4.88 | % | | 9,025 | | 110 | | 4.90 | % | | 9,002 | | 99 | | 4.41 | % |

| Federal Home Loan Bank stock | 53,827 | | 1,521 | | 11.36 | % | | 37,949 | | 784 | | 8.31 | % | | 33,322 | | 508 | | 6.11 | % |

Investment securities - taxable (1) | 1,309,305 | | 6,465 | | 1.99 | % | | 1,326,246 | | 6,578 | | 1.99 | % | | 1,673,439 | | 8,232 | | 1.97 | % |

Investment securities - non-taxable (1) | 1,132,065 | | 8,072 | | 2.87 | % | | 1,149,957 | | 8,166 | | 2.86 | % | | 1,240,931 | | 8,935 | | 2.89 | % |

| Total investment securities | 2,441,370 | | 14,537 | | 2.39 | % | | 2,476,203 | | 14,744 | | 2.39 | % | | 2,914,370 | | 17,167 | | 2.36 | % |

Loans receivable (2) (3) | 4,662,124 | | 72,208 | | 6.23 | % | | 4,448,324 | | 67,307 | | 6.09 | % | | 4,225,020 | | 60,843 | | 5.78 | % |

| Total interest earning assets | 7,212,788 | | 89,004 | | 4.96 | % | | 7,293,559 | | 87,332 | | 4.82 | % | | 7,212,640 | | 78,993 | | 4.39 | % |

| Non-interest earning assets | | | | | | | | | | | |

| Cash and due from banks | 108,319 | | | | | 105,795 | | | | | 102,935 | | | |

| Allowance for credit losses | (50,334) | | | | | (49,960) | | | | | (49,481) | | | |

| Other assets | 508,555 | | | | | 486,652 | | | | | 573,932 | | | |

| Total average assets | $ | 7,779,328 | | | | | $ | 7,836,046 | | | | | $ | 7,840,026 | | | |

| | | | | | | | | | | |

| Liabilities and Stockholders' Equity |

| Interest bearing liabilities | | | | | | | | | | | |

| Interest bearing deposits | $ | 3,334,490 | | $ | 17,405 | | 2.10 | % | | $ | 3,323,227 | | $ | 15,889 | | 1.92 | % | | $ | 3,329,899 | | $ | 10,388 | | 1.25 | % |

| Time deposits | 1,134,590 | | 11,042 | | 3.91 | % | | 1,176,921 | | 12,101 | | 4.14 | % | | 1,115,175 | | 8,570 | | 3.08 | % |

| Borrowings | 1,184,172 | | 10,187 | | 3.46 | % | | 1,200,728 | | 10,904 | | 3.65 | % | | 1,176,702 | | 9,035 | | 3.08 | % |

| Repurchase agreements | 125,144 | | 1,026 | | 3.30 | % | | 138,052 | | 1,026 | | 2.99 | % | | 140,606 | | 683 | | 1.95 | % |

| Subordinated notes | 55,647 | | 829 | | 5.99 | % | | 55,558 | | 831 | | 6.02 | % | | 58,946 | | 881 | | 5.99 | % |

| Junior subordinated debentures issued to capital trusts | 57,335 | | 1,213 | | 8.51 | % | | 57,279 | | 1,225 | | 8.60 | % | | 57,110 | | 1,151 | | 8.08 | % |

| Total interest bearing liabilities | 5,891,378 | | 41,702 | | 2.85 | % | | 5,951,765 | | 41,976 | | 2.84 | % | | 5,878,438 | | 30,708 | | 2.10 | % |

| Non-interest bearing liabilities |

| Demand deposits | 1,080,676 | | | | | 1,077,183 | | | | | 1,186,520 | | | |

| Accrued interest payable and other liabilities | 80,942 | | | | | 82,015 | | | | | 64,115 | | | |

| Stockholders' equity | 726,332 | | | | | 725,083 | | | | | 710,953 | | | |

| Total average liabilities and stockholders' equity | $ | 7,779,328 | | | | | $ | 7,836,046 | | | | | $ | 7,840,026 | | | |

Net FTE interest income (non-GAAP) (5) | | $ | 47,302 | | | | | $ | 45,356 | | | | | $ | 48,285 | | |

Less FTE adjustments (4) | | (2,023) | | | | | (2,068) | | | | | (2,125) | | |

| Net Interest Income | | $ | 45,279 | | | | | $ | 43,288 | | | | | $ | 46,160 | | |

Net FTE interest margin (Non-GAAP) (4)(5) | | | 2.64 | % | | | | 2.50 | % | | | | 2.69 | % |

(1) Securities balances represent daily average balances for the fair value of securities. The average rate is calculated based on the daily average balance for the amortized cost of securities. |

(2) Includes fees on loans held for sale and held for investment. The inclusion of loan fees does not have a material effect on the average interest rate. |

(3) Non-accruing loans for the purpose of the computation above are included in the daily average loan amounts outstanding. Loan totals are shown net of unearned income and deferred loan fees. |

(4) Management believes fully taxable equivalent, or FTE, interest income is useful to investors in evaluating the Company's performance as a comparison of the returns between a tax-free investment and a taxable alternative. The Company adjusts interest income and average rates for tax-exempt loans and securities to an FTE basis utilizing a 21% tax rate |

(5) Non-GAAP financial metric. See non-GAAP reconciliation included herein for the most directly comparable GAAP measure. |

Horizon Bancorp, Inc. Reports Second Quarter 2024 Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Credit Quality | | | |

| (Dollars in Thousands Except Ratios, Unaudited) | | | |

| Quarter Ended | | | |

| June 30, | | March 31, | | December 31, | | September 30, | | June 30, | | % Change |

| 2024 | | 2024 | | 2023 | | 2023 | | 2023 | | 2Q24 vs 1Q24 | 2Q24 vs 2Q23 |

| Non-accrual loans | | | | | | | | | | | | |

| Commercial | $ | 4,321 | | | $ | 5,493 | | | $ | 7,362 | | | $ | 6,919 | | | $ | 8,275 | | | (21) | % | (48) | % |

| Residential Real estate | 8,489 | | | 8,725 | | | 8,058 | | | 7,644 | | | 7,927 | | | (3) | % | 7 | % |

| Mortgage warehouse | — | | | — | | | — | | | — | | | — | | | — | % | — | % |

| Consumer | 5,453 | | | 4,835 | | | 4,290 | | | 4,493 | | | 4,594 | | | 13 | % | 19 | % |

| Total non-accrual loans | $ | 18,263 | | | $ | 19,053 | | | $ | 19,710 | | | $ | 19,056 | | | $ | 20,796 | | | (4) | % | (7) | % |

| 90 days and greater delinquent - accruing interest | $ | 1,058 | | | $ | 108 | | | $ | 559 | | | $ | 392 | | | $ | 1,313 | | | 880 | % | (19) | % |

| Total non-performing loans | $ | 19,321 | | | $ | 19,161 | | | $ | 20,269 | | | $ | 19,448 | | | $ | 22,109 | | | 1 | % | (5) | % |

| | | | | | | | | | | | |

| Other real estate owned | | | | | | | | | | | | |

| Commercial | $ | 1,111 | | | $ | 1,124 | | | $ | 1,124 | | | $ | 1,287 | | | $ | 1,567 | | | (1) | % | (29) | % |

| Residential Real estate | — | | | — | | | 182 | | | 32 | | | 107 | | | — | % | (100) | % |

| Mortgage warehouse | — | | | — | | | — | | | — | | | — | | | — | % | — | % |

| Consumer | 57 | | | 50 | | | 205 | | | 72 | | | 7 | | | 14 | % | 714 | % |

| Total other real estate owned | $ | 1,168 | | | $ | 1,174 | | | $ | 1,511 | | | $ | 1,391 | | | $ | 1,681 | | | (1) | % | (31) | % |

| | | | | | | | | | | | |

| Total non-performing assets | $ | 20,489 | | | $ | 20,335 | | | $ | 21,780 | | | $ | 20,839 | | | $ | 23,790 | | | 1 | % | (14) | % |

| | | | | | | | | | | | |

| Loan data: | | | | | | | | | | | | |

| Accruing 30 to 89 days past due loans | 19,785 | | | 15,154 | | | 16,595 | | | 13,089 | | | 10,913 | | | 31 | % | 81 | % |

| Substandard loans | $ | 51,221 | | | $ | 47,469 | | | $ | 49,526 | | | $ | 47,563 | | | $ | 41,484 | | | 8 | % | 23 | % |

| Net charge-offs (recoveries) | | | | | | | | | | | | |

| Commercial | 54 | | | (57) | | | 233 | | | 142 | | | 101 | | | 195 | % | (47) | % |

| Residential Real estate | (5) | | | (5) | | | 21 | | | (39) | | | (10) | | | — | % | 50 | % |

| Mortgage warehouse | — | | | — | | | — | | | — | | | — | | | — | % | — | % |

| Consumer | 535 | | | 488 | | | 531 | | | 619 | | | 183 | | | 10 | % | 192 | % |

| Total net charge-offs | $ | 584 | | | $ | 426 | | | $ | 785 | | | $ | 722 | | | $ | 274 | | | 37 | % | 113 | % |

| | | | | | | | | | | | |

| Allowance for credit losses | | | | | | | | | | | | |

| Commercial | 31,941 | | | 30,514 | | | 29,736 | | | 29,472 | | | 30,354 | | | 5 | % | 5 | % |

| Residential Real estate | 2,588 | | | 2,655 | | | 2,503 | | | 2,794 | | | 3,648 | | | (3) | % | (29) | % |

| Mortgage warehouse | 736 | | | 659 | | | 481 | | | 714 | | | 893 | | | 12 | % | (18) | % |

| Consumer | 16,950 | | | 16,559 | | | 17,309 | | | 16,719 | | | 15,081 | | | 2 | % | 12 | % |

| Total allowance for credit losses | $ | 52,215 | | | $ | 50,387 | | | $ | 50,029 | | | $ | 49,699 | | | $ | 49,976 | | | 4 | % | 4 | % |

| | | | | | | | | | | | |

| Credit quality ratios | | | | | | | | | | | | |

| Non-accrual loans to HFI loans | 0.38 | % | | 0.41 | % | | 0.45 | % | | 0.44 | % | | 0.49 | % | | | |

| Non-performing assets to total assets | 0.26 | % | | 0.26 | % | | 0.27 | % | | 0.26 | % | | 0.30 | % | | | |

| Annualized net charge-offs of average total loans | 0.05 | % | | 0.04 | % | | 0.07 | % | | 0.07 | % | | 0.04 | % | | | |

| Allowance for credit losses to HFI loans | 1.08 | % | | 1.09 | % | | 1.13 | % | | 1.14 | % | | 1.17 | % | | | |

Horizon Bancorp, Inc. Reports Second Quarter 2024 Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non–GAAP Reconciliation of Net Fully-Taxable Equivalent ("FTE") Interest Margin |

| (Dollars in Thousands, Unaudited) |

| | Three Months Ended |

| | June 30, | | March 31, | | December 31, | | September 30, | | June 30, |

| | 2024 | | 2024 | | 2023 | | 2023 | | 2023 |

| Interest income (GAAP) | (A) | $ | 86,981 | | | $ | 85,264 | | | $ | 83,514 | | | $ | 80,125 | | | $ | 76,868 | |

| Taxable-equivalent adjustment: | | | | | | | | | | |

Investment securities - tax exempt (1) | | $ | 1,695 | | | $ | 1,715 | | | $ | 1,799 | | | $ | 1,861 | | | $ | 1,876 | |

Loan receivable (2) | | $ | 328 | | | $ | 353 | | | $ | 314 | | | $ | 251 | | | $ | 249 | |

| Interest income (non-GAAP) | (B) | $ | 89,004 | | | $ | 87,332 | | | $ | 85,627 | | | $ | 82,237 | | | $ | 78,993 | |

| Interest expense (GAAP) | (C) | $ | 41,702 | | | $ | 41,976 | | | $ | 41,257 | | | $ | 38,035 | | | $ | 30,708 | |

| Net interest income (GAAP) | (D) =(A) - (C) | $ | 45,279 | | | $ | 43,288 | | | $ | 42,257 | | | $ | 42,090 | | | $ | 46,160 | |

| Net FTE interest income (non-GAAP) | (E) = (B) - (C) | $ | 47,302 | | | $ | 45,356 | | | $ | 44,370 | | | $ | 44,202 | | | $ | 48,285 | |

| Average interest earning assets | (F) | 7,212,788 | | | 7,293,559 | | | 7,239,034 | | | 7,286,611 | | | 7,212,640 | |

| Net FTE interest margin (non-GAAP) | (G) = (E*) / (F) | 2.64 | % | | 2.50 | % | | 2.43 | % | | 2.41 | % | | 2.69 | % |

| | | | | | | | | | |

(1) The following represents municipal securities interest income for investment securities classified as available-for-sale and held-to-maturity |

(2) The following represents municipal loan interest income for loan receivables classified as held for sale and held for investment |

| *Annualized |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non–GAAP Reconciliation of Return on Average Tangible Common Equity |

| (Dollars in Thousands, Unaudited) |

| | Three Months Ended | | |

| | June 30, | | March 31, | | December 31, | | September 30, | | June 30, | | | | |

| | 2024 | | 2024 | | 2023 | | 2023 | | 2023 | | | | |

| | | | | | | | | | | | | | |

| Net income (loss) (GAAP) | (A) | $ | 14,140 | | | $ | 13,991 | | | $ | (25,215) | | | $ | 16,205 | | | $ | 18,763 | | | | | |

| | | | | | | | | | | | | | |

| Average stockholders' equity | (B) | $ | 726,332 | | | $ | 725,083 | | | $ | 702,793 | | | $ | 715,485 | | | $ | 710,953 | | | | | |

| Average intangible assets | (C) | 167,659 | | | 168,519 | | | 169,401 | | | 170,301 | | | 171,177 | | | | | |

| Average tangible equity (Non-GAAP) | (D) = (B) - (C) | $ | 558,673 | | | $ | 556,564 | | | $ | 533,392 | | | $ | 545,184 | | | $ | 539,776 | | | | | |

| Return on average tangible common equity ("ROACE") (non-GAAP) | (E) = (A*) / (D) | 10.18 | % | | 10.11 | % | | (18.76) | % | | 11.79 | % | | 13.94 | % | | | | |

| *Annualized | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non–GAAP Reconciliation of Tangible Common Equity to Tangible Assets |

| (Dollars in Thousands, Unaudited) |

| | Three Months Ended |

| | June 30, | | March 31, | | December 31, | | September 30, | | June 30, |

| | 2024 | | 2024 | | 2023 | | 2023 | | 2023 |

| Total stockholders' equity (GAAP) | (A) | $ | 726,665 | | | $ | 721,250 | | | $ | 718,812 | | | $ | 693,369 | | | $ | 709,243 | |

| Intangible assets (end of period) | (B) | 167,121 | | | 167,965 | | | 168,837 | | | 169,741 | | | 170,644 | |

| Total tangible common equity (non-GAAP) | (C) = (A) - (B) | $ | 559,544 | | | $ | 553,285 | | | $ | 549,975 | | | $ | 523,628 | | | $ | 538,599 | |

| | | | | | | | | | |

| Total assets (GAAP) | (D) | 7,912,527 | | | 7,855,707 | | | 7,940,485 | | | 7,959,434 | | | 7,963,353 | |

| Intangible assets (end of period) | (B) | 167,121 | | | 167,965 | | | 168,837 | | | 169,741 | | | 170,644 | |

| Total tangible assets (non-GAAP) | (E) = (D) - (B) | $ | 7,745,406 | | | $ | 7,687,742 | | | $ | 7,771,648 | | | $ | 7,789,693 | | | $ | 7,792,709 | |

| | | | | | | | | | |

| Tangible common equity to tangible assets (Non-GAAP) | (G) = (C) / (E) | 7.22 | % | | 7.20 | % | | 7.08 | % | | 6.72 | % | | 6.91 | % |

Horizon Bancorp, Inc. Reports Second Quarter 2024 Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non–GAAP Reconciliation of Tangible Book Value Per Share |

| (Dollars in Thousands, Unaudited) |

| | Three Months Ended |

| | June 30, | | March 31, | | December 31, | | September 30, | | June 30, |

| | 2024 | | 2024 | | 2023 | | 2023 | | 2023 |

| Total stockholders' equity (GAAP) | (A) | $ | 726,665 | | | $ | 721,250 | | | $ | 718,812 | | | $ | 693,369 | | | $ | 709,243 | |

| Intangible assets (end of period) | (B) | 167,121 | | | 167,965 | | | 168,837 | | | 169,741 | | | 170,644 | |

| Total tangible common equity (non-GAAP) | (C) = (A) - (B) | $ | 559,544 | | | $ | 553,285 | | | $ | 549,975 | | | $ | 523,628 | | | $ | 538,599 | |

| Common shares outstanding | (D) | 43,712,059 | | | 43,726,380 | | | 43,652,063 | | | 43,648,501 | | | 43,645,216 | |

| | | | | | | | | | |

| Tangible book value per common share (non-GAAP) | (E) = (C) / (D) | $ | 12.80 | | | $ | 12.65 | | | $ | 12.60 | | | $ | 12.00 | | | $ | 12.34 | |

Beyond ordinary banking Investor Presentation H o r i z o n B a n c o r p , I n c . ( N A S D A Q : H B N C ) S e c o n d Q u a r t e r E n d e d J u n e 3 0 , 2 0 2 4 J u l y 2 4 , 2 0 2 4

Important Information Forward-Looking Statements 2 This presentation may contain forward–looking statements regarding the financial performance, business prospects, growth and operating strategies of Horizon Bancorp, Inc. and its affiliates (collectively, “Horizon”). For these statements, Horizon claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Statements in this press release should be considered in conjunction with the other information available about Horizon, including the information in the filings we make with the Securities and Exchange Commission (the “SEC”). Forward-looking statements provide current expectations or forecasts of future events and are not guarantees of future performance. The forward-looking statements are based on management’s expectations and are subject to a number of risks and uncertainties. We have tried, wherever possible, to identify such statements by using words such as “anticipate,” “estimate,” “project,” “intend,” “plan,” “believe,” “will” and similar expressions in connection with any discussion of future operating or financial performance. Although management believes that the expectations reflected in such forward-looking statements are reasonable, actual results may differ materially from those expressed or implied in such statements. Risks and uncertainties that could cause actual results to differ materially include: current financial conditions within the banking industry, including the effects of recent failures of other financial institutions, liquidity levels, and responses by the Federal Reserve, Department of the Treasury, and the Federal Deposit Insurance Corporation to address these issues; changes in the level and volatility of interest rates, changes in spreads on earning assets and changes in interest bearing liabilities; increased interest rate sensitivity; the ability of Horizon to remediate its material weaknesses in its internal control over financial reporting; continuing increases in inflation; loss of key Horizon personnel; increases in disintermediation; potential loss of fee income, including interchange fees, as new and emerging alternative payment platforms take a greater market share of the payment systems; estimates of fair value of certain of Horizon’s assets and liabilities; changes in prepayment speeds, loan originations, credit losses, market values, collateral securing loans and other assets; changes in sources of liquidity; economic conditions and their impact on Horizon and its customers, including local and global economic recovery from the pandemic; legislative and regulatory actions and reforms; changes in accounting policies or procedures as may be adopted and required by regulatory agencies; litigation, regulatory enforcement, and legal compliance risk and costs; rapid technological developments and changes; cyber terrorism and data security breaches; the rising costs of cybersecurity; the ability of the U.S. federal government to manage federal debt limits; climate change and social justice initiatives; the inability to realize cost savings or revenues or to effectively implement integration plans and other consequences associated with mergers, acquisitions, and divestitures; acts of terrorism, war and global conflicts, such as the Russia and Ukraine conflict and the Israel and Hamas conflict; and supply chain disruptions and delays. These and additional factors that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in Horizon’s reports (such as the Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K) filed with the SEC and available at the SEC’s website (www.sec.gov). Undue reliance should not be placed on the forward–looking statements, which speak only as of the date hereof. Horizon does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions that may be made to update any forward-looking statement to reflect the events or circumstances after the date on which the forward– looking statement is made, or reflect the occurrence of unanticipated events, except to the extent required by law.

Seasoned Management Team 3 Kathie A. DeRuiter EVP & Senior Operations Officer • 35 Years of banking and operational experience • 24 Years as Senior Bank Operations Officer • 27 Years with Horizon Todd A. Etzler EVP & Corporate Secretary & General Counsel • 33 Years of corporate legal experience and 14 years of General Counsel experience • 7 Years with Horizon Lynn M. Kerber EVP & Chief Commercial Banking Officer • 34 Years of banking experience • 7 Years with Horizon Thomas M. Prame President & Chief Executive Officer • 30 Years of banking experience • 3 Years with Horizon Mark E. Secor EVP & Chief Administration Officer • 36 Years of banking and public accounting experience • 17 Years with Horizon John R. Stewart, CFA EVP & Chief Financial Officer • 22 Years of banking, investment management and corporate finance experience • Joined Horizon in 2024

Second Quarter 2024 4 ($000S EXCEPT PER SHARE DATA) 2Q24 1Q24 INCOME STATEMENT Net interest income $45,279 $43,288 NIM (FTE)* 2.64% 2.50% Provision $2,369 $805 Non-interest income $10,485 $9,929 Non-interest expense $37,522 $37,107 Net income $14,140 $13,991 Diluted EPS $0.32 $0.32 BALANCE SHEET (period end) Total loans held for investment $4,822,840 $4,618,175 Total deposits $ 5,630,154 $5,579,870 CREDIT QUALITY NPA/total assets ratio 0.26% 0.26% Annualized net charge-offs to avg. loans 0.05% 0.04% H I G H L I G H T S & D E V E L O P M E N T S • NIM expansion o +14 bps to 2.64% (FTE)* o Continued strategic shift to more profitable asset mix • Loan growth o Growth of 4.4% in the quarter, led by organic commercial growth of 5.6% • Deposit stability o ~1% growth in the quarter o Continued focus on core commercial and consumer deposit gathering • Excellent credit metrics o Provision primarily attributed to quality loan growth in high performing segments o Continued low NPAs and NCOs • Well capitalized regulatory ratios o Capital levels remain well in excess of well capitalized benchmarks * Net Fully-Taxable Equivalent Interest Margin is a Non-GAAP measure. Please see appendix for reconciliations of non-GAAP information to its most comparable GAAP measures.

Balanced Loan Growth Data as of most-recent quarter (MRQ) end unless stated otherwise. *Total loans held for investment. 22% 17% 16% 44% 1% Total Loans* $4.8B MRQ end Consumer Residential C&I CRE Mortgage Warehouse 5 2 Q 2 4 H I G H L I G H T S & D E V E L O P M E N T S • Total loan growth of $205MM or 17.8% annualized o Maintaining highly diverse residential, consumer, C&I and CRE portfolios • New production continues shift of loan mix to enhance portfolio profitability o Average 2Q24 new production coupon of 7.93%

30% 14% 18% 17% 8% 8% 5% Geography $2.9B MRQ end Central Indiana Northern Indiana Western Michigan Southwest Michigan Northern Michigan Eastern Michigan Other Diversified Commercial Portfolio 49% 22% 27% 2% Mix $2.9B MRQ end CRE (non-owner occ.) CRE (owner occ.) C&I Other*** 2 Q 2 4 H I G H L I G H T S & D E V E L O P M E N T S * The sum of construction & land development loans, multifamily property loans, non-owner occupied non-farm non- residential property loans and loans to finance CRE not secured by real estate divided by Tier 1 Capital plus Allowance ** UBPR Peer Group 3 *** Land development and spec home loans 6 $40.5 $41.6 $47.5 $44.1 $46.1 $647.0 $673.2 $712.9 $765.0 $786.8 $619.6 $630.1 $640.7 $653.1 $632.2 $1,199.2 $1,244.4 $1,273.8 $1,287.5 $1,439.5 $2,506.3 $2,589.2 $2,675.0 $2,749.8 $2,904.6 2Q23 3Q23 4Q23 1Q24 2Q24 Commercial Loans (period end) Other*** C&I CRE (owner occ.) CRE (non-owner occ.) $m ill io ns • Commercial loan balances grew organically o Up $155MM or 22.6% annualized • Well balanced geographies, product mix and industry o No segment exceeds 6.0% of total loans o CRE represents 180%* of RBC versus 240% for peers**, with 20% three-year growth versus 55% for peers** Data as of MRQ unless stated otherwise

Well-Managed CRE Maturities $m ill io ns $197 $93 9% 4% All rates <7% rates Loans Outstanding % of Total Adjusted CRE* 2024 Maturities Remaining Average Rate 6.37% $m ill io ns $191 $118 9% 6% All rates <7% rates Loans Outstanding % of Total Adjusted CRE* 2025 Maturities Average Rate 5.73% Data as of MRQ end. * Adjusted CRE excludes loans closed, non-accrual and matured prior to 2024. 7

Prime Consumer & Residential Lending 2 Q 2 4 H I G H L I G H T S & D E V E L O P M E N T S 43% 30% 21% 6% Mix $1.8B MRQ end Mortgage Home Equity Indirect Auto Direct Installment HOME EQUITY MORTGAGE CREDIT SCORE 749 760 DEBT-TO-INCOME 42% 34% LOAN-TO-VALUE 73% 70% Data as of MRQ unless stated otherwise. 8 • Consumer portfolio o Grew $22MM or 8.4% annualized • Mortgage portfolio o Grew $16MM or 8.1% annualized o Consistent higher quality borrowers, significant capacity to pay and low LTV $1,002.9 $1,028.4 $1,016.5 $1,029.8 $1,051.4 $674.8 $675.4 $681.1 $782.1 $798.0 $1,677.6 $1,703.8 $1,697.6 $1,811.9 $1,849.4 2Q23 3Q23 4Q23 1Q24 2Q24 Consumer Residential $m ill io ns Consumer & Residential Loans (period end)

Strong Asset Quality Metrics $0.3 $0.7 $0.8 $0.4 $0.6 0.04% 0.07% 0.07% 0.04% 0.05% 2Q23 3Q23 4Q23 1Q24 2Q24 Net Charge Offs Consumer Mortgage Warehouse Commercial Total Annualized NCOs/ Av. Loans $m ill io ns $22.1 $19.4 $20.3 $19.2 $19.3 0.52% 0.45% 0.46% 0.41% 0.40% 2Q23 3Q23 4Q23 1Q24 2Q24 Non-Performing Loans (period end) Commercial Resi Real Estate Consumer Total NPLs / Loans HFI $m ill io ns $m ill io ns $50.0 $49.7 $50.0 $50.4 $52.2 1.17% 1.14% 1.13% 1.09% 1.08% 2Q23 3Q23 4Q23 1Q24 2Q24 ACL ACL / Loans HFI Allowance for Credit Losses (period end) $m ill io ns $41.5 $47.6 $49.5 $47.5 $51.2 0.97% 1.09% 1.12% 1.03% 1.06% 2Q23 3Q23 4Q23 1Q24 2Q24 Substandard Loans Substandard Loans / Loans HFI Substandard Loans (period end) 9

Data as of period end unless stated otherwise Relationship Based Core Deposits $m ill io ns $5,709 $5,700 $5,665 $5,580 $5,630 74.9% 76.5% 78.0% 82.8% 85.7% 2Q23 3Q23 4Q23 1Q24 2Q24 Deposits Loans/Deposits Ample Deposits to Fund Additional Loan Growth 10 2 Q 2 4 H I G H L I G H T S & D E V E L O P M E N T S • Consumer and Commercial Deposits o Well managed pricing disciplines providing benefit o Treasury management team investments gaining traction expanding core relationships • Public Deposits o Maintaining value add relationships while evaluating cost/duration of production and portfolio 26.9% 27.3% 26.0% 23.7% 25.4% 28.9% 28.4% 29.5% 30.0% 30.1% 44.1% 44.3% 44.5% 46.3% 44.6% $1,538 $1,556 $1,473 $1,324 $1,428 $1,652 $1,621 $1,670 $1,673 $1,693 $2,520 $2,524 $2,522 $2,583 $2,509 2Q23 3Q23 4Q23 1Q24 2Q24 Stable Consumer and Commercial Deposits Public Commercial Consumer $m ill io ns

Granular and Tenured Deposits 11 Seasoned, Core Deposit Base • Consumer: $6K avg. account balance 11 year avg. tenure • Commercial: $54K avg. account balance 10 year avg. tenure • Public: $288K avg. account balance 11 year avg. tenure 51% of Balances in Checking Accounts • Daily operating accounts of clients • Long tenured relationships of 11 years 81% of Balances Insured/Collateralized • Significant portion of deposits covered by FDIC, Collateralized or IntraFi • Additional coverage through Indiana Public Deposit Insurance Fund (PDIF) 56% 25% 19% Total Deposits $5.6B MRQ End FDIC Insured <$250K, Collateralized and/or Third-Party Insured (e.g., IntraFi and Indiana PDIF) Other deposits 81% Data as of most-recent quarter (MRQ) end unless stated otherwise.

Stable Investment Securities 12 2 Q 2 4 H I G H L I G H T S & D E V E L O P M E N T S 2Q23 3Q23 4Q23 1Q24 2Q24 ROLL-OFF/CASH FLOW $41 $26 $28 $27 $26 SALES $24 – $383 – – DURATION (YEARS) 6.41 6.70 6.97 6.92 6.80 AVERAGE RATE ON INVESTMENT SECURITIES (FTE)* 2.36% 2.35% 2.39% 2.39% 2.39% $m ill io ns $30 $29 $28 $33 2.63% 1.88% 2.14% 2.33% 3Q24 4Q24 1Q25 2Q25 Projected Cash Flows and Roll-Off Yield Cash Flows** Yield Roll-Off (FTE) at Period End* • No new investments in the quarter • High credit quality treasuries, agencies, municipals and mortgage-backed securities • Cash flows to support funding of higher yielding loans All dollar amounts in millions * The Company adjusts average rates for tax-exempt securities to an FTE basis utilizing a 21% tax rate. ** Excludes securities sales.

NIM Expansion 13 * Net Fully-Taxable Equivalent Interest Margin is a Non-GAAP measure. Please see appendix for reconciliations of non-GAAP information to its most comparable GAAP measures. ** Commercial lending fees recognized in interest income. 2 Q 2 4 H I G H L I G H T S & D E V E L O P M E N T S • NIM expansion driven by continued, intentional shift in earning asset mix, combined with improving loan yields • Relatively stable cost of interest-bearing liabilities

Stable Non-Interest Income 2 Q 2 4 H I G H L I G H T S & D E V E L O P M E N T S 14 Non-interest Income $6.7 $6.4 $6.4 $6.4 $7.1 $1.2 $1.2 $1.4 $1.3 $1.4 $1.6 $2.2 $1.7 $1.1 $1.3 $1.4 $2.0 $1.7 $1.1 $0.7 -$31.6 $11.0 $11.8 $9.9 $10.5 2Q23 3Q23 4Q23* 1Q24 2Q24 Gain (loss) on securities sales All Other Mortgage related income Fiduciary activities Service, wire transfer and interchange fees Data as of MRQ unless stated otherwise. * 4Q23 includes the loss of $31.6MM on the sale of $382.7MM in available-for-sale (“AFS”) securities as part of a balance sheet repositioning announced in December 2023. • $10.5MM in non-interest income o Interchange fees, including merchant services, continued to see positive momentum o Seasonal origination activity reflected in higher mortgage-related income o Private wealth management provides stable contributions $m ill io ns -$20.4

Diligent Expense Management 2 Q 2 4 H I G H L I G H T S & D E V E L O P M E N T S 15 Non-interest Expense $20.2 $20.1 $21.9 $20.3 $20.6 $16.1 $16.1 $17.5 $16.8 $16.9 $36.3 $36.2 $39.3 $37.1 $37.5 1.86% 1.81% 1.98% 1.90% 1.94% 2Q23 3Q23 4Q23 1Q24 2Q24 All Other Non-interest Expense Salaries & Employee Benefits Annualized Non-Interest Expense to Average Assets Data as of MRQ unless stated otherwise. • Diligent expense management o Continued annualized non-interest expense to average assets <2% • $37.5MM in non-interest expense o Well managed expenses across the franchise in salaries and third-party services • Operating expenses inclusive of investments in revenue generating roles o C&I, CRE, equipment finance and treasury management capabilities $m ill io ns

7.08% 7.20% 7.22% $12.60 $12.65 $12.80 4Q23 1Q24 2Q24 11.11% 10.89% 10.60% 4Q23 1Q24 2Q24*** TCE/TA* CET1 Ratio Capital Position Provides Flexibility * The tangible common equity to tangible common assets (TCE/TA) ratio and tangible book value per share (TBVPS) are non-GAAP measures. Please see appendix for reconciliations of non-GAAP information to its most comparable GAAP measures. ** Prior periods have been revised (see disclosure below) During the second quarter of 2024, management corrected a prior computation of the Company’s total capital (to risk-weighted assets), Tier 1 capital (to risk-weighted assets), and Tier 1 capital (to average assets) ratios for purposes of the Company’s consolidated financial statements for holding companies filed with the Federal Reserve (the “Regulatory Filings”), which involved an incorrect classification of the Company’s subordinated notes as tier 1 capital. The Company evaluated the effects of the incorrect classification to its previously filed Regulatory Filings and previously issued financial statements and determined the errors were not material to either of the prior periods noted above. *** Preliminary estimate – may be subject to change 8.61% 8.91% 8.98% 4Q23** 1Q24** 2Q24*** 14.04% 13.75% 13.36% 4Q23** 1Q24** 2Q24*** Leverage Ratio Total RBC Ratio 16 HBNC RatioHBNC TBVPS*

2024 Guidance Summary 17 Loans • Period-end total loan balances to grow low to mid single digits for remainder of 2024 • Continued positive shift in mix toward higher-yielding commercial loans Deposits • Period-end total deposit balances and mix to remain relatively stable for remainder of 2024 NII and NIM • Upper single digit increase in net interest income for second half of 2024 relative to first half of 2024 • Net interest margin for the second half of 2024 to continue with modest expansion • Includes one 25 basis point reduction in the Fed Funds target rate mid-Q4 2024 Non-Interest Income • Quarterly non-interest income in the $10.5-11.0 million range for second half of 2024 Non-Interest Expense • Quarterly non-interest expense run-rate to show modest growth compared with Q2 2024 • Non-interest expense to remain at <2.00% of average assets Tax Rate • Estimated full-year effective tax rate in the 9.50-10.00% range

Why Horizon? 18 P R O V E N O P E R A T O R Constant, High Quality Loan Growth Positive momentum with annualized loan growth of 17.8%, led by commercial platform Liquidity to continue to reinvest in core lending platforms to improve financial performance A proven history of excellent credit metrics A proven history of excellent credit metrics: 5 basis points of annualized net charge- offs and 1.08% allowance for credit losses Tenured And Stable Deposit Base With Significant Liquidity Stable, granular deposit base, average account tenure 10+ years Disciplined pricing management, creating shareholder value Well balanced portfolio of consumer, commercial and public deposits, providing stability and low risk profile, with 81% deposits insured/ collateralized Well Managed Operating Culture Consistent expense results of <2.00% operating expenses to average assets Key investments focused on increasing shareholder value by expanding relationship based revenue teams (Commercial/Leasing, Treasury Management, Wealth) Compelling Value Supported By Commitment To Dividend P/EPS of 11.77x 4.2% dividend yield, and targeted dividend payout ratio of 30-40% aligned with capital retention strategy 30+ year record of uninterrupted quarterly cash dividends to shareholders. Horizon financial data as of MRQ unless stated otherwise. Price multiples as of 7/18/2024.

Appendix

Highly Attractive Midwestern Markets 20 D I S T R I B U T I O N I N E X C E L L E N T G R O W T H M A R K E T S Economically Attractive Horizon’s branches are located strategically in markets with attractive business environments, tax rates, housing affordability, infrastructure and quality of life. Our markets are stable and strong with reduced volatility compared to major metropolitan markets. Major Brands Horizon’s markets are home to multi-national companies, flourishing ecosystems of suppliers, spin-offs and professional services firms, and thriving college towns. These regional economic engines include global leaders in medical devices, pharmaceuticals, semiconductors, AI datacenters, agribusiness, automotive/mobility, alternative energy, and high-tech manufacturing, as well as world-renowned universities like Notre Dame, Purdue, Indiana, Michigan, Michigan State, and Grand Valley State. Diverse Opportunities Horizon’s Commercial and Retail Banking offerings are complimented by well-developed Treasury Management, Wealth, Mortgage Banking platforms. Horizon’s core deposit franchise is grounded in the long tenure of its clients, significant market share, and its relationship based banking model. Loans $2.1B Loans $2.0B Deposits $1.7B Deposits $4.0B Data as of most-recent quarter (MRQ). Loans outstanding by state exclude mortgage warehouse and acquired loans.

Diverse Commercial Lending Portfolio 21 COMMERCIAL LOANS BY INDUSTRY 6/30/24 BALANCE ($millions) % OF COMMERCIAL PORTFOLIO % OF TOTAL LOAN PORTFOLIO Lessors - Residential Multi $289 9.9% 6.0% Health Care, Educational Social Assist. 231 8.0% 4.8% NOO- Warehouse/Industrial 216 7.4% 4.5% NOO- Office (except medical) 178 6.1% 3.7% NOO- Retail 177 6.1% 3.7% Manufacturing 150 5.2% 3.1% Real Estate Rental & Leasing 149 5.1% 3.1% NOO- Motel 160 5.5% 3.3% Individuals and Other Services 142 4.9% 2.9% Finance & Insurance 132 4.5% 2.7% Lessors Student Housing 123 4.2% 2.5% Construction 110 3.8% 2.3% Retail Trade 92 3.2% 1.9% NOO- Mini Storage 84 2.9% 1.7% NOO- Medical Office 83 2.9% 1.7% Lessors - Residential 1-4 72 2.5% 1.5% Restaurants 67 2.3% 1.4% Government 62 2.1% 1.3% Transportation & Warehousing 57 2.0% 1.2% Leisure and Hospitality 51 1.8% 1.1% Wholesale Trade 50 1.7% 1.0% Nursing Home and Assisted Living Facilities 46 1.6% 1.0% Professional & Technical Services 46 1.6% 1.0% Farm Land 33 1.1% 0.7% Agriculture 25 0.9% 0.5% Development Loans 24 0.8% 0.5% Other 56 1.9% 1.2% Total $2,905 100.0% 60.3% S T R O N G A N D T R A D I T I O N A L C O M M E R C I A L L E N D I N G • Multi-family represents 6.0% of loans o No major metros outside Indiana and Michigan, other than Columbus, OH o Zero rent regulated/stabilized originated or in portfolio o $2MM average loan size • Non-owner-occupied office represents 3.7% of total loans o All in Indiana and Michigan o $1MM average loan size • Nursing Home and Assisted Living Facilities represents 1.0% of loans Data as of most-recent quarter (MRQ) unless stated otherwise.

Use of Non-GAAP Financial Measures 22 Certain information set forth in this presentation refers to financial measures determined by methods other than in accordance with GAAP. In each case, we have identified special circumstances that we consider to be non-recurring and have excluded them. We believe that this shows the impact of such events as acquisition-related purchase accounting adjustments and swap termination fees, among others we have identified in our reconciliations. Horizon believes these non-GAAP financial measures are helpful to investors and provide a greater understanding of our business and financial results without giving effect to the purchase accounting impacts and one-time costs of acquisitions and non–recurring items. These measures are not necessarily comparable to similar measures that may be presented by other companies and should not be considered in isolation or as a substitute for the related GAAP measure. See the tables and other information below and contained elsewhere in this presentation for reconciliations of the non-GAAP information identified herein and its most comparable GAAP measures.

Non-GAAP Reconciliation 23

Non-GAAP Reconciliation 24

Non-GAAP Reconciliation 25