By Paul Page

Sign up: With one click, get this newsletter delivered to your

inbox.

U.S. seaports with a close-up look at the impact of the world's

rising sea levels are starting to take their first steps to address

the potential impacts on operations. The Port of Virginia is

starting to move some critical equipment higher off the ground and

other coastal areas are considering similar protections, the WSJ

Logistics Report's Erica E. Phillips writes, as they respond to new

assessments that project sharp increases in water levels and

stronger storm surges in the coming decades. The actions are

relatively limited so far, but infrastructure experts expect plans

to accelerate as longer-term master plans are written. Virginia is

already seeing storm surges and tidal flooding, raising concerns at

commercial freight and military facilities in the low-lying

Tidewater region. Boston is preparing irs own big infrastructure

resilience plan . Other ports like Houston say their docks are high

enough to give them ample time to cope with rising waters.

Higher prices are moving through supply chains toward consumers

amid signs that last year's skyrocketing transportation costs are

coming back to earth. Suppliers of household staples like diapers

to toilet paper are raising prices again this year after hiking

prices in 2018, the WSJ's Aisha Al-Muslim writes, hoping to offset

rising commodity prices and boost profits. The new increases may

revive a supply chain tug-of-war over prices from last year, when

suppliers sought to pass along rising costs while retailers worried

about a consumer backlash. Shoppers have accepted some of those

higher prices for consumer staples, however, and in the meantime

some logistics costs appear to be receding. Measures of trucking

rates have been slipping this year as capacity has grown ahead of

demand. Todd Tranausky of research group FTR says lower fuel costs

and rising capacity signal "a much better 2019 than shippers

expected during much of 2018."

Tesla Inc. is facing a new supply-chain problem now that it's

shifting manufacturing and delivery of its Model 3 sedans into a

higher gear. As the Silicon Valley auto maker's U.S. sales approach

those of other luxury auto makers, the WSJ's Tim Higgins reports

Tesla is facing growing challenges getting spare parts in place to

maintain and repair the growing electric-car fleet. Car owners have

faced waits measured in weeks and months for repairs as service

centers await spare parts, underlining Tesla's difficulty in

getting its post-sale supply chain moving efficiently and with the

urgency of its assembly line. Tesla Chief Executive Elon Musk says

the company has been "very silly" about managing parts, storing

them at distribution warehouses rather than holding stock at

service centers, for instance. Getting the logistics right is

crucial given Tesla is targeting a $35,000 threshold to take its

Model 3 mainstream.

ECONOMY & TRADE

U.S. tariffs on imported steel are moving through manufacturing

supply chains on different tracks. Ohio- based Byer Steel Co.

pointed to the support from higher prices in reporting stronger

results last year and even handed out bonuses to workers, while St.

Louis-based manufacturer Laclede Chain Manufacturing Co. is focused

on cutting costs and reducing investment after rising materials

costs cut short a growth spurt. The WSJ's Ruth Simon reports the

varying responses are part of the complicated impact that the

tariffs on steel and aluminum imports have had on the industrial

economy, creating opportunities for some and challenges for others.

Both companies say business has stabilized since the trade conflict

ratcheted up last summer but that planning remains difficult amid

uncertainties about U.S. trade policy over the long term.

Steelmakers' profits are up, although foreign steel still accounts

for a significant share of the U.S. market.

QUOTABLE

IN OTHER NEWS

The U.K. economy grew at the slowest pace in six years in 2018.

(WSJ)

Canada added a net 66,800 jobs in January, the biggest one-month

private-sector hiring spree on record. (WSJ)

Amazon.com Inc. is re-evaluating a planned campus in New York

City amid a backlash to its billions of dollars in tax incentives.

(WSJ)

Engineering and regulatory complications are expected to delay

safety fixes covering Boeing Co. 737 MAX jets until at least April.

(WSJ)

Honeywell International Inc. is introducing aircraft flight-data

recorders that can provide accident information in real time.

(WSJ)

Soaring palladium prices are triggering rising theft of

automotive catalytic converters that use the metal in

exhaust-control systems. (WSJ)

Hasbro Inc. and Mattel Inc. posted steep quarterly sales

declines as last year's liquidation of Toys "R" Us disrupted the

key holiday season. (WSJ)

Brazilian regulators are preparing to toughen mining safety

rules following the deadly disaster that killed more than 150

people. (WSJ)

The United States will resume an anti-dumping investigation into

Mexican tomatoes. (Reuters)

Cosmetics firm Coty Inc. says it has solved many of its supply

chain problems but still has more work to do. (MarketWatch)

Chemicals and plastics producer Sasol Ltd. is pushing back the

launch of a Louisiana plant because of rising capital costs.

(Bloomberg)

PepsiCo is seeking to promote more women in its supply chain

management operations. (Industry Week)

The U.K. scrapped a Brexit-related ferry contract with a freight

company without ferries. (BBC)

Several Chinese electric-vehicle battery makers are likely to

fail after Beijing ends its subsidy program next year. (Nikkei

Asian Review)

The U.S. Postal Service lost $1.5 billion in its fiscal first

quarter despite a 2.9% gain in revenue. (DC Velocity)

Trucker Averitt Express is laying off 98 workers in Smyrna,

Tenn., after the loss of a Nissan Motor Corp. contract. (Nashville

Post)

Container shipping lines face a backlash from customers after

sharply increasing rates last year. (Lloyd's List)

U.S. East Coast ports are investing in rail transport after rail

lifts rose 7% last year. (Journal of Commerce)

Vietnam's Vinalines Logistics is expanding warehousing for Honda

Motor Corp. and adding new refrigerated facilities. (Viet Nam

News)

Seaport cargo terminal operator DP World plans to launch a

hyperloop project in India. (CNBC)

Hapag-Lloyd AG has developed a steel-floor container it says can

carry more weight than conventional shipping containers. (Splash

247)

A Canadian judge cleared a bulk-ship operator of environmental

charges stemming from an oil spill off Vancouver. (Maritime

Executive)

Amazon is considering placing a distribution center in South

Bend, Ind. (South Bend Tribune)

European regulators approved CMA CGM SA's proposed takeover of

Ceva Logistics. (Splash 247)

FedEx Corp. is integrating its European express deliveries into

TNT's road operations. (Post & Parcel)

More than 7,800 European truck operators are claiming

compensation from truck manufacturers found to be operating a price

fixing cartel. (Logistics Manager)

Canadian supply chain software company Tecsys acquired Danish

transport technology firm Pcsys A/S. (Modern Materials

Handling)

The U.K.'s Guardian newspaper switched to recyclable packaging

made from potato starch. (The Guardian)

ABOUT US

Paul Page is editor of WSJ Logistics Report. Follow him at

@PaulPage, and follow the entire WSJ Logistics Report team:

@CostasParis , @jensmithWSJ and @EEPhillips_WSJ. Follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

February 11, 2019 10:00 ET (15:00 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

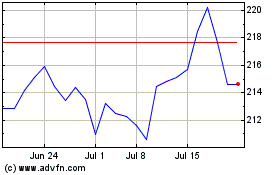

Honeywell (NASDAQ:HON)

Historical Stock Chart

From Feb 2025 to Mar 2025

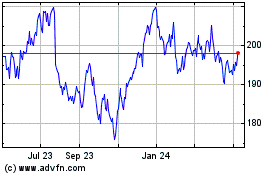

Honeywell (NASDAQ:HON)

Historical Stock Chart

From Mar 2024 to Mar 2025