0000818033falseHERON THERAPEUTICS, INC. /DE/00008180332024-08-062024-08-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 6, 2024

Heron Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware |

|

001-33221 |

|

94-2875566 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

|

4242 Campus Point Court, Suite 200, San Diego, CA |

|

92121 |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code (858) 251-4400

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, par value $0.01 per share |

|

HRTX |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 6, 2024, Heron Therapeutics, Inc. (“Company”) issued a press release announcing its financial results for the three and six months ended June 30, 2024 (“Earnings Press Release”). A copy of the Earnings Press Release is furnished as Exhibit 99.1.

This Item 2.02 and the Earnings Press Release attached hereto as Exhibit 99.1, insofar as they disclose information regarding the Company’s results of operations or financial condition for the three and six months ended June 30, 2024, are being furnished to the Securities and Exchange Commission.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Heron Therapeutics, Inc. |

|

Date: August 6, 2024 |

|

|

/s/ Ira Duarte |

|

|

|

Ira Duarte |

|

|

|

Executive Vice President, Chief Financial Officer |

Heron Therapeutics Announces Second Quarter 2024 Financial Results and Narrows Financial Guidance

•Second quarter Net Product Sales of $36.0 million, which increased from $31.8 million for the same period in 2023

•ZYNRELEF® Vial Access Needle (“VAN”) PDUFA goal date set for September 23, 2024

•ZYNRELEF included in the proposed 2025 Non-Opioid Policy for Pain Relief (“NOPAIN Act”)

SAN DIEGO, August 6, 2024 /PRNewswire/ -- Heron Therapeutics, Inc. (Nasdaq: HRTX) (“Heron” or the “Company”), a commercial-stage biotechnology company, today announced financial results for the three and six months ended June 30, 2024, and highlighted recent corporate updates.

"We have had an exciting start to 2024 with many encouraging milestones that provide the foundation for ongoing commercial success. We are improving the financial efficiency of the business by growing revenues, improving margins, and reducing expenses. Regarding ZYNRELEF, we continue to expand our partnership with CrossLink and progress our regulatory activities in anticipation of a fourth quarter launch of the VAN," said Craig Collard, Chief Executive Officer of Heron.

Business Highlights

▪The range for adjusted operating expenses guidance for 2024 is being narrowed from $108.0 million to $116.0 million to a revised $107.0 million to $111.0 million. Additionally, the range for adjusted EBITDA guidance is being narrowed from $(22.0) million to $3.0 million to a revised $(10) million to $3.0 million.

▪The ZYNRELEF VAN PDUFA goal date is set for September 23, 2024. The VAN is designed to allow for easier and more efficient preparation and administration of ZYNRELEF in the operating room, with anticipated launch before year-end.

▪Our development program for the ZYNRELEF Prefilled Syringe (“PFS”), which will allow for immediate use of ZYNRELEF, continues to progress with an expected U.S. Food and Drug Administration (“FDA”) submission for approval in 2026.

▪ZYNRELEF is included in the proposed 2025 NOPAIN Act under the Medicare hospital Outpatient Prospective Payment System (“OPPS”) and the Medicare Ambulatory Surgical Center (“ASC”) payment system (the “Proposed Rule”) as a qualifying product effective April 1, 2025. The Proposed Rule's April 1, 2025 effective date for ZYNRELEF is expected to allow ZYNRELEF to maintain separate reimbursement in the HOPD and ASC settings without disruption.

▪The training and integration of CrossLink sales representatives to promote ZYNRELEF to orthopedic surgeons continues its rapid progress. To date, 561 CrossLink sales representatives have completed training and are building the foundation for increased adoption.

Financial Guidance for 2024

The Company narrows its full-year 2024 guidance for Adjusted Operating Expenses and Adjusted EBITDA:

|

|

|

Product Revenues, Net |

$138.0 to $158.0 million |

Adjusted Operating Expenses

|

Original Revised $108.0 to $116.0 million $107.0 to $111.0 million |

Adjusted EBITDA

|

Original Revised $(22.0) to $3.0 million $(10.0) to $3.0 million |

Acute Care Franchise

•Acute Care Franchise Net Product Sales: For the three and six months ended June 30, 2024, acute care franchise Net Product Sales were $6.8 million and $12.3 million, respectively, which increased from $4.5 million and $8.3 million, respectively, for the same period in 2023.

•ZYNRELEF Net Product Sales: Net Product Sales of ZYNRELEF (bupivacaine and meloxicam) extended-release solution for the three and six months ended June 30, 2024 were $5.8 million and $10.8 million, respectively, which increased from $4.2 million and $7.7 million, respectively, for the same period in 2023.

•APONVIE® Net Product Sales: Net Product Sales of APONVIE for the three and six months ended June 30, 2024 were $1.0 million and $1.5 million, respectively, which increased from $0.3 million and $0.6 million, respectively, for the same period in 2023.

Oncology Care Franchise

•Oncology Care Franchise Net Product Sales: For the three and six months ended June 30, 2024, oncology care franchise Net Product Sales were $29.2 million and $58.4 million, respectively, which increased from $27.3 million and $53.1 million for the same period in 2023.

•CINVANTI® Net Product Sales: Net Product Sales of CINVANTI (aprepitant) injectable emulsion for the three and six months ended June 30, 2024 were $24.9 million and $50.5 million, which increased from $24.5 million and $47.3 million for the same period in 2023.

•SUSTOL® Net Product Sales: Net Product Sales of SUSTOL (granisetron) extended-release injection for the three and six months ended June 30, 2024 were $4.3 million and $7.9 million, respectively, which increased from $2.8 million and $5.8 million, respectively, for the same period in 2023.

Conference Call and Webcast

Heron will host a conference call and webcast on August 6, 2024 at 4:30 p.m. ET. The conference call can be accessed by dialing (646) 307-1963 for domestic callers and (800) 715-9871 for international callers. Please provide the operator with the passcode 1737564 to join the conference call. The conference call will also be available via webcast under the Investor Relations section of Heron’s website at www.herontx.com. An archive of the teleconference and webcast will also be made available on Heron’s website for sixty days following the call.

About ZYNRELEF for Postoperative Pain

ZYNRELEF is the first and only dual-acting local anesthetic that delivers a fixed-dose combination of the local anesthetic bupivacaine and a low dose of nonsteroidal anti-inflammatory drug meloxicam. ZYNRELEF is the first and only extended-release local anesthetic to demonstrate in Phase 3 studies significantly reduced pain and significantly increased proportion of patients requiring no opioids through the first 72 hours following surgery compared to bupivacaine solution, the current standard-of-care local anesthetic for postoperative pain control. ZYNRELEF was initially approved by the FDA in May 2021 for use in adults for soft tissue or periarticular instillation to produce postsurgical analgesia for up to 72 hours after bunionectomy, open inguinal herniorrhaphy and total knee arthroplasty. In December 2021, the FDA approved an expansion of ZYNRELEF’s indication to include foot and ankle, small-to-medium open abdominal, and lower extremity total joint arthroplasty surgical procedures. On January 23, 2024, the FDA approved ZYNRELEF for soft tissue and orthopedic surgical procedures including foot and ankle, and other procedures in which direct exposure to articular cartilage is avoided. Safety and efficacy have not been established in highly vascular surgeries, such as intrathoracic, large multilevel spinal, and head and neck procedures.

Please see full prescribing information, including Boxed Warning, at www.ZYNRELEF.com.

About APONVIE for Postoperative Nausea and Vomiting (PONV)

APONVIE is a substance NK1 Receptor Antagonist (RA), indicated for the prevention of PONV in adults. Delivered via a 30-second IV push, APONVIE 32 mg was demonstrated to be bioequivalent to oral aprepitant 40 mg with rapid achievement of therapeutic drug levels. APONVIE is the same formulation as Heron’s approved drug product CINVANTI. APONVIE is supplied in a single-dose vial that delivers the full 32 mg dose for PONV. APONVIE was approved by the FDA in September 2022 and became commercially available in the U.S. on March 6, 2023.

Please see full prescribing information at www.APONVIE.com.

About CINVANTI for Chemotherapy Induced Nausea and Vomiting (CINV) Prevention

CINVANTI, in combination with other antiemetic agents, is indicated in adults for the prevention of acute and delayed nausea and vomiting associated with initial and repeat courses of highly emetogenic cancer chemotherapy (HEC) including high-dose cisplatin as a single-dose regimen, delayed nausea and vomiting associated with initial and repeat courses of moderately emetogenic cancer chemotherapy (MEC) as a single-dose regimen, and nausea and vomiting associated with initial and repeat courses of MEC as a 3-day regimen. CINVANTI is an IV formulation of aprepitant, an NK1 RA. CINVANTI is the first IV formulation to directly deliver aprepitant, the active ingredient in EMEND® capsules. Aprepitant (including its prodrug, fosaprepitant) is a single-agent NK1 RA to significantly reduce nausea and vomiting in both the acute phase (0–24 hours after chemotherapy) and the delayed phase (24–120 hours after chemotherapy). The FDA-approved dosing administration included in the U.S. prescribing information for CINVANTI include 100 mg or 130 mg administered as a 30-minute IV infusion or a 2-minute IV injection.

Please see full prescribing information at www.CINVANTI.com.

About SUSTOL for CINV Prevention

SUSTOL is indicated in combination with other antiemetics in adults for the prevention of acute and delayed nausea and vomiting associated with initial and repeat courses of moderately emetogenic chemotherapy (MEC) or anthracycline and cyclophosphamide (AC) combination chemotherapy regimens. SUSTOL is an extended-release, injectable 5-hydroxytryptamine type 3 RA that utilizes Heron’s Biochronomer® drug delivery technology to maintain therapeutic levels of granisetron for ≥5 days. The SUSTOL global Phase 3 development program was comprised of two, large, guideline-based clinical studies that evaluated SUSTOL’s efficacy and safety in more than 2,000 patients with cancer. SUSTOL’s efficacy in preventing nausea and vomiting was evaluated in both the acute phase (0–24 hours after chemotherapy) and delayed phase (24–120 hours after chemotherapy).

Please see full prescribing information at www.SUSTOL.com.

About Heron Therapeutics, Inc.

Heron Therapeutics, Inc. is a commercial-stage biotechnology company focused on improving the lives of patients by developing and commercializing therapeutic innovations that improve medical care. Our advanced science, patented technologies, and innovative approach to drug discovery and development have allowed us to create and commercialize a portfolio of products that aim to advance the standard-of-care for acute care and oncology patients. For more information, visit www.herontx.com.

Non-GAAP Financial Measures

To supplement our financial results presented on a GAAP basis, we have included information about certain non-GAAP financial measures. We believe the presentation of these non-GAAP financial measures, when viewed with our results under GAAP, provide analysts, investors, lenders, and other third parties with insights into how we evaluate normal operational activities, including our ability to generate cash from operations, on a comparable year-over-year basis and manage our budgeting and forecasting.

In our quarterly and annual reports, earnings press releases and conference calls, we may discuss the following financial measures that are not calculated in accordance with GAAP, to supplement our consolidated financial statements presented on a GAAP basis.

Adjusted EBITDA

Adjusted EBITDA is a non-GAAP financial measure that represents GAAP net income or loss adjusted to exclude interest expense, interest income, the benefit from or provision for income taxes, depreciation, amortization, stock-based compensation, and other adjustments to reflect changes that occur in our business but do not represent ongoing operations. Adjusted EBITDA, as used by us, may be calculated differently from, and therefore may not be comparable to, similarly titled measures used by other companies.

There are several limitations related to the use of adjusted EBITDA rather than net income or loss, which is the nearest GAAP equivalent, such as:

•adjusted EBITDA excludes depreciation and amortization and, although these are non-cash expenses, the assets being depreciated or amortized may have to be replaced in the future, the cash requirements for which are not reflected in adjusted EBITDA;

•we exclude stock-based compensation expense from adjusted EBITDA although: (i) it has been, and will continue to be for the foreseeable future, a significant recurring expense for our business and an important part of our compensation strategy; and (ii) if we did not pay out a portion of our compensation in the form of stock-based compensation, the cash salary expense included in operating expenses would be higher, which would affect our cash position;

•we exclude impairment of long-lived assets, the amount and/or frequency of which are not part of our underlying business.

•we exclude inventory write-downs (and write-ups should they occur), the amount and/or frequency of which are not part of our underlying business.

•adjusted EBITDA does not reflect changes in, or cash requirements for, working capital needs;

•adjusted EBITDA does not reflect the benefit from or provision for income taxes or the cash requirements to pay taxes;

•adjusted EBITDA does not reflect historical cash expenditures or future requirements for capital expenditures or contractual commitments; and

•we exclude restructuring expenses from adjusted EBITDA. Restructuring expenses primarily include employee severance and contract termination costs that are not related to acquisitions. The amount and/or frequency of these restructuring expenses are not part of our underlying business.

Adjusted Operating Expenses

Adjusted operating expenses is a non-GAAP financial measure that represents GAAP operating expenses adjusted to exclude stock-based compensation expense, depreciation and amortization, and other adjustments to reflect changes that occur in our business but do not represent ongoing operations.

The Company has not provided a reconciliation of its full-year 2024 guidance for adjusted EBITDA or adjusted operating expenses to the most directly comparable forward-looking GAAP measures, in reliance on the unreasonable efforts exception provided under Item 10(e)(1)(i)(B) of Regulation S-K, because the Company is unable to predict, without unreasonable efforts, the timing and amount of items that would be included in such a reconciliation, including, but not limited to, stock-based compensation expense, acquisition related expense and litigation settlements. These items are uncertain and depend on various factors that are outside of the Company’s control or cannot be reasonably predicted. While the Company is unable to address the probable significance of these items, they could have a material impact on GAAP net income and operating expenses for the guidance period.

Forward-looking Statements

This news release contains “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995. Heron cautions readers that forward-looking statements are based on management’s expectations and assumptions as of the date of this news release and are subject to certain risks and uncertainties that could cause actual results to differ materially. Therefore, you should not place undue reliance on forward-looking statements. Examples of forward-looking statements include, among others, statements we make regarding the potential market opportunities for ZYNRELEF, APONVIE, CINVANTI and SUSTOL; revenue, adjusted EBITDA and other financial guidance provided by the Company; the results of the commercial launch of APONVIE; the potential additional market opportunity for the expanded U.S. label for ZYNRELEF or inclusion of ZYNRELEF under the OPPS and the ASC payment system; the timing of the Company’s development of the VAN program and receipt of required regulatory approvals; our ability to establish and maintain successful commercial arrangements like our co-promotion agreement with CrossLink Life Sciences; the outcome of the Company’s pending ANDA litigation; whether the Company is required to write-off any additional inventory in the future; the expected future balances of Heron’s cash, cash equivalents and short-term investments; the expected duration over which Heron’s cash, cash equivalents and short-term investments balances will fund its operations and the risk that future equity financings may be needed; any inability or delay in achieving profitability. Important factors that could cause actual results to differ materially from those in the forward-looking statements are set forth in our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q, and in our other reports filed with the Securities and Exchange Commission, including under the caption “Risk Factors.” Forward-looking statements reflect our analysis only on their stated date, and Heron takes no obligation to update or revise these statements except as may be required by law.

Heron Therapeutics, Inc.

Consolidated Statements of Operations

(In thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

Revenues: |

(unaudited) |

Net product sales |

$ 36,024 |

|

$ 31,762 |

|

$ 70,694 |

|

$ 61,377 |

Cost of product sales |

10,518 |

|

20,158 |

|

18,962 |

|

37,012 |

Gross Profit |

25,506 |

|

11,604 |

|

51,732 |

|

24,365 |

Operating expenses: |

|

|

|

|

|

|

|

Research and development |

4,432 |

|

13,210 |

|

9,040 |

|

22,046 |

General and administrative |

13,905 |

|

19,592 |

|

28,879 |

|

35,426 |

Sales and marketing |

13,614 |

|

21,205 |

|

25,056 |

|

42,359 |

Total operating expenses |

31,951 |

|

54,007 |

|

62,975 |

|

99,831 |

Loss from operations |

(6,445) |

|

(42,403) |

|

(11,243) |

|

(75,466) |

Other (expense) income, net |

(2,790) |

|

344 |

|

(1,152) |

|

639 |

Net loss |

$ (9,235) |

|

$ (42,059) |

|

$ (12,395) |

|

$ (74,827) |

Basic and diluted net loss per share |

$ (0.06) |

|

$ (0.35) |

|

$ (0.08) |

|

$ (0.63) |

Weighted average common shares outstanding, basic and diluted |

152,305 |

|

119,719 |

|

151,900 |

|

119,484 |

Heron Therapeutics, Inc.

Consolidated Balance Sheets

(in thousands)

|

|

|

|

|

June 30,

2024 |

|

December 31,

2023 |

|

(Unaudited) |

|

|

ASSETS |

|

|

|

Current assets: |

|

|

|

Cash and cash equivalents |

$ 18,386 |

|

$ 28,677 |

Short-term investments |

48,961 |

|

51,732 |

Accounts receivable, net |

73,708 |

|

60,137 |

Inventory |

42,864 |

|

42,110 |

Prepaid expenses and other current assets |

7,249 |

|

6,118 |

Total current assets |

191,168 |

|

188,774 |

Property and equipment, net |

15,900 |

|

20,166 |

Right-of-use lease assets |

4,138 |

|

5,438 |

Other assets |

6,930 |

|

8,128 |

Total assets |

$ 218,136 |

|

$ 222,506 |

LIABILITIES AND STOCKHOLDERS’ DEFICIT |

|

|

|

Current liabilities: |

|

|

|

Accounts payable |

$ 10,226 |

|

$ 3,240 |

Accrued clinical and manufacturing liabilities |

17,554 |

|

22,291 |

Accrued payroll and employee liabilities |

7,085 |

|

9,224 |

Other accrued liabilities |

42,258 |

|

41,855 |

Current lease liabilities |

3,194 |

|

3,075 |

Total current liabilities |

80,317 |

|

79,685 |

Non-current lease liabilities |

1,289 |

|

2,800 |

Non-current notes payable, net |

24,634 |

|

24,263 |

Non-current convertible notes payable, net |

149,595 |

|

149,490 |

Other non-current liabilities |

241 |

|

241 |

Total liabilities |

256,076 |

|

256,479 |

Stockholders’ deficit: |

|

|

|

Common stock |

1,516 |

|

1,503 |

Additional paid-in capital |

1,878,961 |

|

1,870,525 |

Accumulated other comprehensive (loss) income |

(8) |

|

13 |

Accumulated deficit |

(1,918,409) |

|

(1,906,014) |

Total stockholders’ deficit |

(37,940) |

|

(33,973) |

Total liabilities and stockholders’ deficit |

$ 218,136 |

|

$ 222,506 |

Investor Relations and Media Contact:

Ira Duarte

Executive Vice President, Chief Financial Officer

Heron Therapeutics, Inc.

iduarte@herontx.com

858-251-4400

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

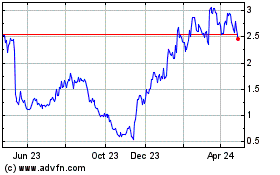

Heron Therapeautics (NASDAQ:HRTX)

Historical Stock Chart

From Nov 2024 to Dec 2024

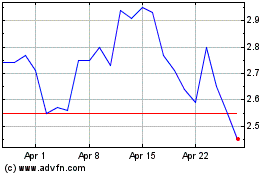

Heron Therapeautics (NASDAQ:HRTX)

Historical Stock Chart

From Dec 2023 to Dec 2024