Current Report Filing (8-k)

February 02 2023 - 6:03AM

Edgar (US Regulatory)

0001892480false00018924802023-01-302023-01-30iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

_____________________

FORM 8-K

_____________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 30, 2023

Hempacco Co., Inc. |

(Exact name of registrant as specified in its charter) |

001-41487 | | 83-4231457 |

(Commission File Number) | | (IRS Employer Identification Number) |

9925 Airway Road, San Diego, CA | | 92154 |

(Address of Principal Executive Offices) | | (Zip Code) |

(619) 779-0715

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

Common Stock, par value $0.001 | | HPCO | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

Effective January 30, 2023, Hempacco Co., Inc. (the “Company”) entered into a joint venture operating agreement (the “Operating Agreement”) with Alfalfa Holdings, LLC (“Alfalfa”), a California limited liability company, to operate a joint venture entity (the “Joint Venture”) in California, HPDG, LLC, which will market and sell hemp smokables products. Pursuant to the Operating Agreement, the Joint Venture will be owned 50% by each of the Company and Alfalfa, the Company is required to fund $10,000 to the Joint Venture, manufacture Joint Venture product, and provide accounting, inventory management, staff training, and trade show and marketing services for the Joint Venture. Alfalfa is required to provide online marketing and promotion, design and branding, and brand management and development services to the Joint Venture, as well as Snoop Dogg attendance and appearances at Joint Venture events subject to professional availability, and subject to a separate Talent License and Services Agreement between the Joint Venture and Alfalfa as described below (the “Services Agreement”).

In connection with the Operating Agreement, effective January 30, 2023, the Joint Venture entered into the Services Agreement with Spanky’s Clothing, Inc., and Calvin Broadus, Jr. p/k/a “Snoop Dogg” (collectively “Talent”), pursuant to which Talent will endorse the Joint Venture’s smokable hemp products and serve as a spokesperson for the products in the United States, and the Joint Venture shall (i) pay Talent’s legal expenses of $7,500 in connection with entering into the Operating Agreement and Services Agreement; (ii) cause the Company to issue to Talent a fully vested warrant to acquire 450,000 shares of Company common stock at a strike price of $1.00 per share (the “Talent Warrants”); (iii) cause the Company to issue to Talent’s designee a fully vested warrant to acquire 50,000 shares of Company common stock at a strike price of $1.00 per share (the “Talent Designee Warrants”); and (iv) pay Talent royalties of 10% of Joint Venture gross revenue, with minimum annual royalty payments of $450,000 by the end of the first two years of the initial term of the Services Agreement, an additional $600,000 by the end of the third year of the initial term, and an additional $1,200,000 by the end of the fourth year of the initial term. On or about January 30, 2023, the Company issued the Talent Warrants and Talent Designee Warrants as required by the Services Agreement.

The foregoing descriptions of the Operating Agreement and Services Agreement do not purport to be complete and are qualified in their entirety by reference to the full text of the Operating Agreement and Services Agreement filed as Exhibit 10.1 hereto and incorporated herein by reference (with the Services Agreement attached as Exhibit B to the Operating Agreement).

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunder duly authorized.

| HEMPACCO CO., INC. | |

| | | |

Dated: February 1, 2023 | By: | /s/ Sandro Piancone | |

| | Sandro Piancone | |

| | Chief Executive Officer | |

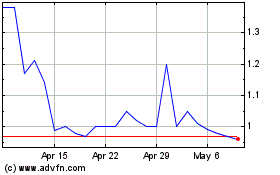

Hempacco (NASDAQ:HPCO)

Historical Stock Chart

From Aug 2024 to Sep 2024

Hempacco (NASDAQ:HPCO)

Historical Stock Chart

From Sep 2023 to Sep 2024