Glacier Bancorp, Inc. Receives Regulatory Approval for Acquisition of Six Montana Branches From HTLF Bank

April 18 2024 - 4:37PM

Glacier Bancorp, Inc. (NYSE: GBCI) today announced that its banking

subsidiary, Glacier Bank, has received all regulatory approvals

required to complete its previously announced acquisition of six

Montana branch locations of HTLF Bank (the “Branches”), the bank

subsidiary of Heartland Financial USA, Inc. (NASDAQ: HTLF). The

transaction is expected to be completed in July 2024, subject to

customary closing conditions.

The six branches Glacier Bank will acquire

are:

- 2615 King Ave. W, Billings, MT

- 2929 3rd Ave. N, Billings, MT

- 2901 W Main St., Bozeman, MT

- 115 E First Ave, Plentywood,

MT

- 220 Main St., Stevensville, MT

- 101 E Legion St., Whitehall,

MT

As of March 31, 2024, the Branches had

approximately $463 million in local deposits and $296 million in

loans. The transaction is projected to be approximately $0.03 per

share, or 1.6%, accretive to Glacier’s 2024 estimated earnings per

share, given the expected partial year impact and excluding

one-time transaction-related expenses, and approximately $0.07 per

share, or 3.1%, accretive to Glacier’s 2025 estimated earnings per

share.

“We are pleased to have quickly received the

required regulatory approvals for this transaction and excited to

be further expanding our Montana franchise with the strategic

addition of these six branch locations across the state,” stated

Randy Chesler, President and CEO of GBCI and Glacier Bank. Chesler

added, "This provides us the unique opportunity to further

strengthen our leading presence in the state. In addition, the

transaction provides immediate liquidity and will be meaningfully

accretive to GBCI's earnings per share.”

Upon closing of the transaction, Glacier Bank

intends that the Branches will join Glacier Bank divisions

operating in Montana, including First Bank of Montana, First

Security Bank of Bozeman, First Security Bank of Missoula, Valley

Bank of Helena, and Western Security Bank.

About Glacier Bancorp, Inc.

Glacier Bancorp, Inc. is the parent company for

Glacier Bank and its bank divisions: Altabank (American Fork, UT),

Bank of the San Juans (Durango, CO), Citizens Community Bank

(Pocatello, ID), Collegiate Peaks Bank (Buena Vista, CO), First

Bank of Montana (Lewistown, MT), First Bank of Wyoming (Powell,

WY), First Community Bank Utah (Layton, UT), First Security Bank

(Bozeman, MT), First Security Bank of Missoula (Missoula, MT),

First State Bank (Wheatland, WY), Glacier Bank (Kalispell, MT),

Heritage Bank of Nevada (Reno, NV), Mountain West Bank (Coeur

d’Alene, ID), The Foothills Bank (Yuma, AZ), Valley Bank of Helena

(Helena, MT), Western Security Bank (Billings, MT), and Wheatland

Bank (Spokane, WA).

Visit GBCI’s website at

www.glacierbancorp.com.

Important Information and Where You Can

Find It

This communication relates to the proposed

branch purchase and assumption transaction involving Glacier Bank

and HTLF Bank. This communication does not constitute an offer to

sell or the solicitation of an offer to buy any securities.

Forward-Looking Statements

This news release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements can be identified by

words such as “anticipate,” “estimate,” “expect,” “will,”

“projects,” and similar references to future periods. Such

forward-looking statements include but are not limited to

statements regarding the expected closing of the transaction and

the potential benefits of the purchase and assumption transaction

involving Glacier Bank and the Branches, including future financial

and operating results, the anticipated effects on GBCI’s earnings

per share and liquidity, Glacier Bank’s plans, objectives,

expectations and intentions, and other statements that are not

historical facts. These forward-looking statements are subject to

risks and uncertainties, many of which are outside of our control,

that may cause actual results or events to differ materially from

those expected or projected, including but not limited to the

following: risks that the transaction will not close when expected

or at all because conditions to closing are not satisfied on a

timely basis or at all; risks that the benefits from the

transaction may not be fully realized or may take longer to realize

than expected, including as a result of changes in deposit levels

at the Branches prior to closing, losses of customers or key

employees following announcement of the transaction or between the

date of this release and closing, general economic and market

conditions, regulatory considerations, changes or trends in

interest rates, monetary policy, laws and regulations and their

enforcement, and the degree of competition in the geographic and

business areas in which Glacier Bank and the Branches operate;

uncertainties regarding the ability of Glacier Bank to promptly and

effectively integrate the assets and deposit liabilities of the

Branches; changes in business and operational strategies that may

occur between signing and closing; uncertainties regarding the

reaction to the transaction of Glacier Bank’s and the Branches’

respective customers, employees, and counterparties; and risks

relating to the diversion of management time on transaction-related

issues. Readers are cautioned not to place undue reliance on the

forward-looking statements, which speak only as of the date on

which they are made and reflect management’s current estimates,

projections, expectations and beliefs. GBCI undertakes no

obligation to publicly revise or update the forward-looking

statements to reflect events or circumstances that arise after the

date of this report. For more information, see the risk factors

described in GBCI’s Annual Report on Form 10-K, Quarterly Reports

on Form 10-Q and other filings with the SEC.

CONTACT: Randall M. Chesler(406) 751-4722

Ron J. Copher(406) 751-7706

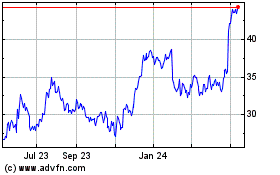

Heartland Financial USA (NASDAQ:HTLF)

Historical Stock Chart

From Dec 2024 to Jan 2025

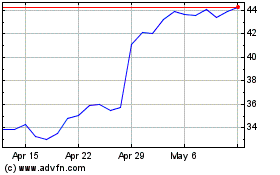

Heartland Financial USA (NASDAQ:HTLF)

Historical Stock Chart

From Jan 2024 to Jan 2025