HBT Financial, Inc. Completes Acquisition of NXT Bancorporation, Inc.

October 01 2021 - 4:05PM

HBT Financial, Inc. (NASDAQ:HBT) (“HBT” or “HBT Financial”), the

holding company for Heartland Bank and Trust Company (“Heartland

Bank”), today announced that it has completed its acquisition of

NXT Bancorporation, Inc. (“NXT”), the holding company for NXT Bank.

As of June 30, 2021, NXT Bank had $238 million in assets, $199

million in loans, and $184 million in deposits.

The completion of the transaction extends HBT’s footprint into

Eastern Iowa with four locations in Central City, Marion, Waterloo,

and Coralville that will begin operating as branches of Heartland

Bank following the merger of NXT Bank into Heartland Bank

anticipated in December. Nathan Koch, currently NXT Bank’s

President and CEO, will serve as the Iowa Market President for

Heartland Bank when the banks merge in December.

Fred Drake, Chairman and CEO of HBT Financial, said, “We are

excited to welcome NXT’s customers, employees and shareholders to

the HBT family. Since the announcement of the acquisition in June,

we have worked closely with Nate and his team to coordinate a

smooth transition for our new customers and employees. Working

collaboratively with our new colleagues, we will be able to build

on the strengths of each organization to offer customers a superior

banking experience, a greater selection of products and services to

meet their financial needs, and an increased ability to accommodate

clients with larger, more complex borrowing requirements. We look

forward to fully capitalizing on the synergies created from the

combination of our institutions and further enhancing the value of

the HBT franchise.”

“We will continue to operate with the same commitment to

relationship banking and outstanding customer service that helped

us to build NXT into a highly successful community bank,” said

Nathan Koch. “With the additional resources, financial strength,

and expertise provided by HBT, we believe that we will be able to

accelerate our growth and elevate our profile in Iowa in the coming

years by attracting additional banking talent and pursuing

relationships with larger commercial clients.”

About HBT Financial, Inc.

HBT Financial, Inc. is headquartered in Bloomington, Illinois

and is the holding company for Heartland Bank and Trust Company.

HBT provides a comprehensive suite of business, commercial, wealth

management, and retail banking products and services to

individuals, businesses and municipal entities throughout Central

and Northeastern Illinois and Eastern Iowa through 61 branches. As

of June 30, 2021, HBT had total assets of $4.0 billion, total

loans of $2.2 billion, and total deposits of $3.4 billion. HBT is a

longstanding Central Illinois company, with banking roots that can

be traced back to 1920.

Forward-Looking Statements

Readers should note that in addition to the historical

information contained herein, this press release includes

"forward-looking statements" within the meanings of the Private

Securities Litigation Reform Act of 1995, Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, including but not

limited to statements about the Company’s expected benefits,

synergies, results and growth resulting from the acquisition of NXT

and NXT Bank, and the Company’s plans, objectives, future

performance, goals, future earnings levels and future loan growth.

These statements are subject to many risks and uncertainties, that

could cause actual results to differ materially from those

anticipated in the forward-looking statements. Factors that could

cause actual results to differ materially from these

forward-looking statements include, but are not limited to: the

timing, outcome and results of integrating the operations of NXT

into those of HBT; the possibility that expected benefits,

synergies and results from the acquisition are delayed or not

achieved; the effects of the merger on HBT’s future financial

condition, results of operations, strategy and plans; potential

adverse reactions or changes to customer or employee relationships

resulting from the completion of the transaction; the diversion of

management time on integration-related issues; the severity,

magnitude and duration of the COVID-19 pandemic; the direct and

indirect impacts of the COVID-19 pandemic and governmental

responses to the pandemic on our operations and our customers’

businesses; the continued disruption of global, national, state and

local economies associated with the COVID-19 pandemic, which could

affect our capital levels and earnings, impair the ability of our

borrowers to repay outstanding loans, impair collateral values and

further increase our allowance for credit losses; our asset quality

and any loan charge-offs; changes in interest rates and general

economic, business and political conditions in the United States

generally or in Illinois in particular, including in the financial

markets; changes in business plans as circumstances warrant; risks

relating to other acquisitions; and other risks detailed from time

to time in filings made by the Company with the Securities and

Exchange Commission. Readers should note that the forward-looking

statements included in this press release are not a guarantee of

future events, and that actual events may differ materially from

those made in or suggested by the forward-looking statements.

Forward-looking statements generally can be identified by the use

of forward-looking terminology such as "will," "propose," "may,"

"plan," "seek," "expect," "intend," "estimate," "anticipate,"

"believe" or "continue," or similar terminology. Any

forward-looking statements presented herein are made only as of the

date of this press release, and the Company does not undertake any

obligation to update or revise any forward-looking statements to

reflect changes in assumptions, the occurrence of unanticipated

events, or otherwise.

CONTACT:Matthew KeatingHBTIR@hbtbank.com(310)

622-8230

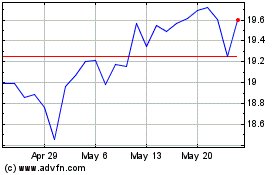

HBT Financial (NASDAQ:HBT)

Historical Stock Chart

From Oct 2024 to Nov 2024

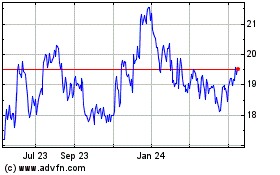

HBT Financial (NASDAQ:HBT)

Historical Stock Chart

From Nov 2023 to Nov 2024