HBT Financial, Inc. (NASDAQ: HBT) (the “Company” or “HBT

Financial”), the holding company for Heartland Bank and Trust

Company and State Bank of Lincoln, today reported net income of

$16.1 million, or $0.61 diluted earnings per share, for the fourth

quarter of 2019. This compares to net income of $17.4 million, or

$0.97 diluted earnings per share, for the third quarter of 2019,

and net income of $11.9 million, or $0.66 diluted earnings per

share, for the fourth quarter of 2018.

Fred L. Drake, Chairman and Chief Executive Officer of HBT

Financial, said, “Our 2019 performance is a result of strong

execution on the strategies that have made HBT Financial a

consistently high performing company. HBT Financial has an

attractive core deposit base, strong capital levels and solid asset

quality. We are pleased to initiate a quarterly cash dividend

to enhance the total return we deliver for shareholders.

During 2019, we had continued momentum on our earnings and organic

loan growth. We are pleased to have completed our initial

public offering and are well positioned for the future, and we

expect to continue to enhance the value of our franchise through

both organic and acquisition growth strategies.”

C Corp Equivalent Net Income and Adjusted C Corp

Equivalent Net Income

The Company has historically operated as an S Corporation for

U.S. federal and state income tax purposes. Following the

completion of the initial public offering during the fourth quarter

of 2019, the Company was treated as a C Corporation (“C Corp”) for

federal and state income tax purposes. For comparison, the Company

reports its C Corp equivalent financial results, which does not

reflect the additional shares issued in the initial public offering

(the “IPO”) for periods prior to the IPO.

For the fourth quarter of 2019, the Company reported C Corp

equivalent net income of $15.1 million, or $0.58 diluted earnings

per share. This compares to C Corp equivalent net income of $13.1

million, or $0.73 diluted earnings per share, for the third quarter

of 2019, and C Corp equivalent net income of $9.2 million, or $0.51

diluted earnings per share, for the fourth quarter of 2018.

In addition to reporting C Corp equivalent results, the Company

believes adjusted C Corp equivalent results, which adjust for

mortgage servicing rights (“MSR”) fair value adjustments, gains

(losses) on sales of securities, and certain non-recurring items,

provide investors with additional insight into its operational

performance. The Company reported adjusted C Corp equivalent net

income of $14.4 million, or $0.55 diluted earnings per share, for

the fourth quarter of 2019. This compares to adjusted C Corp

equivalent net income of $14.3 million, or $0.80 diluted earnings

per share, for the third quarter of 2019, and adjusted C Corp

equivalent net income of $10.9 million, or $0.60 diluted earnings

per share, for the fourth quarter of 2018 (see "Reconciliation of

Non-GAAP Financial Measures" tables).

Net Interest Income and Net Interest

Margin

Net interest income for the fourth quarter of 2019 was $32.3

million, a decrease of 2.6% from $33.1 million for the third

quarter of 2019. The decrease was primarily attributable to a

decline in net interest margin, partially offset by an increase in

average interest-earning assets.

Relative to the fourth quarter of 2018, net interest income

decreased $0.8 million, or 2.4%. The decline was primarily

attributable to a lower net interest margin, partially offset by an

increase in average interest-earning assets.

Net interest margin for the fourth quarter of 2019 was 4.12%,

including 2 basis points attributable to acquired loan discount

accretion, compared to 4.31%, including 4 basis points attributable

to acquired loan discount accretion, for the third quarter of 2019.

The decrease was primarily attributable to a decline in average

loan yields, lower average loan balances, and an increase in

lower-yielding cash balances.

Relative to the fourth quarter of 2018, net interest margin

decreased from 4.29%, including 9 basis points attributable to

acquired loan discount accretion, due primarily to lower loan

yields and an increase in lower-yielding cash balances.

The increase in lower yielding cash balances during the fourth

quarter of 2019 was primarily due to higher balances for a small

number of retail deposit accounts. These funds were mainly

invested in lower yielding cash balances, resulting in a $0.2

million increase in net interest income and a 4 basis point

reduction in the net interest margin for the quarter.

The Federal Open Market Committee lowered its target federal

funds rate for the first time in 11 years on July 31, 2019 and then

again in September 2019 and October 2019. The Company expects the

cumulative decrease of 75 basis points in the target federal funds

rate in 2019 to continue placing downward pressure on its net

interest margin in 2020.

Noninterest Income

Noninterest income for the fourth quarter of 2019 was $10.3

million, an increase of 36.3% from $7.6 million for the third

quarter of 2019. Fourth quarter 2019 results benefitted from a $0.6

million gain on the fair value adjustment of the MSR asset compared

to a negative $0.9 million MSR fair value adjustment in the third

quarter of 2019. Gains on foreclosed assets and fees on

customer-related interest rate swaps, included in other noninterest

income, also contributed to noninterest income growth.

Relative to the fourth quarter of 2018, noninterest income

increased 60.8% from $6.4 million. The growth was primarily

attributable to lower securities losses, gains on foreclosed

assets, and higher other income.

Noninterest Expense

Noninterest expense for the fourth quarter of 2019 was $22.0

million, compared with $22.3 million for the third quarter of 2019.

The decrease was primarily attributable to lower employee benefits

expense, as third quarter of 2019 results included a $0.8 million

charge for the supplemental executive retirement plan (SERP) which

was terminated in June 2019. The SERP liability varies

inversely with interest rates, therefore there was a $0.4 million

credit in the fourth quarter of 2019. The SERP will be

liquidated in June 2020. FDIC insurance expense was lower in the

fourth quarter of 2019 due to the application of small bank

assessment credits. Other noninterest and occupancy expenses were

also lower in the fourth quarter of 2019, but were more than offset

by higher salaries, marketing, and furniture and equipment

costs.

Relative to the fourth quarter of 2018, noninterest expense

decreased 6.4% from $23.4 million. The decrease was primarily due

to lower other, FDIC insurance, employee benefits, and occupancy

expenses.

Loan Portfolio

Total loans, before allowance for loan losses outstanding were

$2.16 billion at December 31, 2019, compared with $2.17

billion at September 30, 2019 and $2.14 billion at December

31, 2018. The $7.2 million decline in loans from September 30, 2019

was primarily due to a $41.2 million reduction in loan

participations resulting primarily from the payoff of five loans,

offset by organic loan growth primarily in commercial real estate –

non-owner occupied and construction and development. The five loan

participations that paid off included $22.3 million in commercial

and industrial, $4.8 million in CRE – non-owner occupied, $8.8

million in multi-family and $3.6 million in municipal, consumer and

other. Loan participations make up a small portion of the

Company’s loan portfolio totaling $71.7 million at

December 31, 2019 compared to $112.9 million at

September 30, 2019 and $131.4 million at December 31,

2018.

Based on loan trends experienced in 2019 and a healthy loan

pipeline, the Company expects low-single digit loan growth in

2020.

Deposits

Total deposits were $2.78 billion at December 31, 2019, compared

with $2.70 billion at September 30, 2019, and $2.80 billion at

December 31, 2018. The $72.8 million increase in total deposits

from September 30, 2019 was broad-based with growth in

noninterest-bearing, interest-bearing demand, money market and

savings balances more than offsetting a decline in time

deposits.

The deposit growth in the fourth quarter of 2019 included

approximately $40.2 million in increased balances in a small number

of retail deposit accounts. The changes in these accounts included

a $4.2 million increase in non-interest bearing, a $3.0 million

decrease in interest bearing demand, a $31.1 million increase in

money market, and a $8.0 million increase in savings. The

Company expects some outflow in these deposits during the first

quarter of 2020.

Asset Quality

Nonperforming loans totaled $19.0 million, or 0.88% of total

loans, at December 31, 2019, compared with $19.1 million, or 0.88%

of total loans, at September 30, 2019, and $15.9 million, or 0.74%

of total loans, at December 31, 2018.

Net charge-offs for the fourth quarter of 2019 were $0.6

million, or 0.11% of average loans on an annualized basis.

The Company recorded a provision for loan losses of $0.1 million

for the fourth quarter of 2019, compared with $0.7 million for the

third quarter of 2019. The reduction in provision for loan losses

was primarily due to a reduction in specific reserves on two

credits as a result of improved collateral positions. The Company’s

allowance for loan losses was 1.03% of total loans and 117.06% of

nonperforming loans at December 31, 2019, compared with 1.05% of

total loans and 119.34% of nonperforming loans at September 30,

2019.

Capital

At December 31, 2019, the Company exceeded all regulatory

capital requirements under Basel III and was considered to be

‘‘well-capitalized’’, as summarized in the following table:

|

|

|

|

|

|

|

December 31, |

Well Capitalized |

|

|

2019 |

Regulatory Requirements |

|

Total capital to risk-weighted assets |

14.54 |

% |

10.00% |

|

Tier 1 capital to risk-weighted assets |

13.64 |

% |

8.00% |

|

Tier 1 leverage ratio |

10.38 |

% |

5.00% |

|

Common equity tier 1 capital ratio |

12.15 |

% |

6.50% |

|

Total stockholders' equity to total assets |

10.26 |

% |

NA |

|

Tangible common equity to tangible assets (1) |

9.49 |

% |

NA |

_____________________(1) See "Reconciliation of Non-GAAP

Financial Measures" below for reconciliation of non-GAAP financial

measures to their most comparable GAAP financial measures.

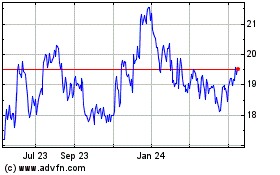

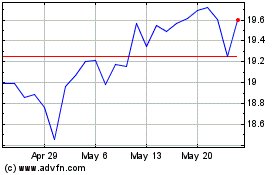

Completion of Initial Public

Offering

On October 10, 2019, the Company priced its initial public

offering (the “IPO”), and issued 8,300,000 shares of its common

stock at a price to the public of $16.00 per share on October 11,

2019. On October 29, 2019, the underwriters purchased an

additional 1,129,794 shares pursuant to the exercise of their

option to purchase additional shares from HBT Financial at the

initial public offering price, less underwriting discounts and

commissions. In total, HBT sold 9,429,794 shares of common stock in

the initial public offering, raising total net proceeds, after

deducting estimated underwriting discounts and commissions and

offering expenses payable by the Company, of approximately $138

million.

On October 22, 2019, the Company paid a $170 million

distribution to its pre-IPO stockholders, using the net proceeds of

the initial public offering and the proceeds of dividends from

Heartland Bank and Trust Company and State Bank of Lincoln.

About HBT Financial, Inc.

HBT Financial, Inc. is headquartered in Bloomington, Illinois

and is the holding company for Heartland Bank and Trust Company and

State Bank of Lincoln. The banks provide a comprehensive suite of

business, commercial, wealth management and retail banking

products and services to businesses, families and local governments

throughout Central and Northeastern Illinois through 64 branches.

As of December 31, 2019, HBT had total assets of $3.2 billion,

total loans of $2.2 billion, and total deposits of $2.8 billion.

HBT is a longstanding Central Illinois company, with banking roots

that can be traced back nearly 100 years.

Non-GAAP Financial

Measures

Some of the financial measures included in this press release

are not measures of financial performance recognized in accordance

with GAAP. These non-GAAP financial measures include net

interest income (tax-equivalent basis), net interest margin

(tax-equivalent basis), originated loans and acquired loans,

efficiency ratio (tax-equivalent basis), tangible common equity to

tangible assets, adjusted C Corp equivalent net income, adjusted C

Corp equivalent return on average assets, adjusted C Corp

equivalent return on average stockholders' equity, and adjusted C

Corp equivalent return on average tangible common equity. Our

management uses these non-GAAP financial measures, together with

the related GAAP financial measures, in its analysis of our

performance and in making business decisions. Management believes

that it is a standard practice in the banking industry to present

these non-GAAP financial measures, and accordingly believes that

providing these measures may be useful for peer comparison

purposes. These disclosures should not be viewed as substitutes for

the results determined to be in accordance with GAAP; nor are they

necessarily comparable to non-GAAP financial measures that may be

presented by other companies. See our reconciliation of non-GAAP

financial measures to their most directly comparable GAAP financial

measures in the "Reconciliation of Non-GAAP Financial Measures"

tables.

Forward-Looking Statements

Readers should note that in addition to the historical

information contained herein, this press release includes

"forward-looking statements" within the meanings of the Private

Securities Litigation Reform Act of 1995, Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, including but not

limited to statements about the Company’s plans, objectives, future

performance, goals, future earnings levels, and future loan

growth. These statements are subject to many risks and

uncertainties, including changes in interest rates and other

general economic, business and political conditions, including

changes in the financial markets; changes in business plans as

circumstances warrant; risks relating to acquisitions; and other

risks detailed from time to time in filings made by the Company

with the Securities and Exchange Commission. Readers should

note that the forward-looking statements included in this press

release are not a guarantee of future events, and that actual

events may differ materially from those made in or suggested by the

forward-looking statements. Forward-looking statements

generally can be identified by the use of forward-looking

terminology such as "will," "propose," "may," "plan," "seek,"

"expect," "intend," "estimate," "anticipate," "believe" or

"continue," or similar terminology. Any forward-looking

statements presented herein are made only as of the date of this

press release, and the Company does not undertake any obligation to

update or revise any forward-looking statements to reflect changes

in assumptions, the occurrence of unanticipated events, or

otherwise.

CONTACT:Matthew

KeatingHBTIR@hbtbank.com(310) 622-8230

|

|

|

HBT Financial, Inc. |

|

Consolidated Financial Summary |

|

Consolidated Statements of Income |

|

|

| |

Three Months Ended |

| |

December 31, 2019 |

|

September 30, 2019 |

|

June 30, 2019 |

|

March 31, 2019 |

|

December 31, 2018 |

| |

(dollars in thousands, except per share

amounts) |

| INTEREST AND

DIVIDEND INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans, including fees: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable |

$ |

28,039 |

|

|

$ |

29,308 |

|

|

$ |

29,886 |

|

|

$ |

30,063 |

|

|

$ |

28,625 |

|

|

Federally tax exempt |

|

716 |

|

|

|

684 |

|

|

|

736 |

|

|

|

710 |

|

|

|

704 |

|

|

Securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable |

|

3,559 |

|

|

|

3,572 |

|

|

|

3,801 |

|

|

|

3,922 |

|

|

|

3,655 |

|

|

Federally tax exempt |

|

1,269 |

|

|

|

1,395 |

|

|

|

1,512 |

|

|

|

1,552 |

|

|

|

1,670 |

|

|

Interest-bearing deposits in bank |

|

1,003 |

|

|

|

662 |

|

|

|

599 |

|

|

|

687 |

|

|

|

580 |

|

|

Other interest and dividend income |

|

14 |

|

|

|

15 |

|

|

|

16 |

|

|

|

15 |

|

|

|

14 |

|

|

Total interest and dividend

income |

|

34,600 |

|

|

|

35,636 |

|

|

|

36,550 |

|

|

|

36,949 |

|

|

|

35,248 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INTEREST

EXPENSE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits |

|

1,838 |

|

|

|

2,000 |

|

|

|

2,111 |

|

|

|

1,983 |

|

|

|

1,672 |

|

|

Securities sold under agreements to repurchase |

|

24 |

|

|

|

17 |

|

|

|

17 |

|

|

|

14 |

|

|

|

16 |

|

|

Borrowings |

|

2 |

|

|

|

— |

|

|

|

4 |

|

|

|

3 |

|

|

|

8 |

|

|

Subordinated debentures |

|

460 |

|

|

|

478 |

|

|

|

487 |

|

|

|

497 |

|

|

|

476 |

|

|

Total interest expense |

|

2,324 |

|

|

|

2,495 |

|

|

|

2,619 |

|

|

|

2,497 |

|

|

|

2,172 |

|

|

Net interest income |

|

32,276 |

|

|

|

33,141 |

|

|

|

33,931 |

|

|

|

34,452 |

|

|

|

33,076 |

|

| PROVISION FOR

LOAN LOSSES |

|

138 |

|

|

|

684 |

|

|

|

1,806 |

|

|

|

776 |

|

|

|

3,906 |

|

|

Net interest income after provision for loan

losses |

|

32,138 |

|

|

|

32,457 |

|

|

|

32,125 |

|

|

|

33,676 |

|

|

|

29,170 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NONINTEREST

INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Card income |

|

1,952 |

|

|

|

1,985 |

|

|

|

1,996 |

|

|

|

1,832 |

|

|

|

1,954 |

|

|

Service charges on deposit accounts |

|

2,065 |

|

|

|

2,111 |

|

|

|

1,931 |

|

|

|

1,763 |

|

|

|

2,078 |

|

|

Wealth management fees |

|

1,911 |

|

|

|

1,676 |

|

|

|

1,493 |

|

|

|

2,047 |

|

|

|

2,087 |

|

|

Mortgage servicing |

|

801 |

|

|

|

795 |

|

|

|

818 |

|

|

|

729 |

|

|

|

861 |

|

|

Mortgage servicing rights fair value adjustment |

|

582 |

|

|

|

(860 |

) |

|

|

(1,120 |

) |

|

|

(1,002 |

) |

|

|

355 |

|

|

Gains on sale of mortgage loans |

|

915 |

|

|

|

992 |

|

|

|

660 |

|

|

|

525 |

|

|

|

666 |

|

|

Gains (losses) on securities |

|

(47 |

) |

|

|

(73 |

) |

|

|

36 |

|

|

|

79 |

|

|

|

(2,813 |

) |

|

Gains (losses) on foreclosed assets |

|

808 |

|

|

|

(20 |

) |

|

|

169 |

|

|

|

(17 |

) |

|

|

(479 |

) |

|

Gains (losses) on other assets |

|

— |

|

|

|

(29 |

) |

|

|

368 |

|

|

|

605 |

|

|

|

580 |

|

|

Title insurance activity |

|

— |

|

|

|

— |

|

|

|

38 |

|

|

|

129 |

|

|

|

276 |

|

|

Other noninterest income |

|

1,349 |

|

|

|

1,005 |

|

|

|

957 |

|

|

|

797 |

|

|

|

864 |

|

|

Total noninterest income |

|

10,336 |

|

|

|

7,582 |

|

|

|

7,346 |

|

|

|

7,487 |

|

|

|

6,429 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NONINTEREST

EXPENSE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salaries |

|

13,006 |

|

|

|

12,335 |

|

|

|

11,597 |

|

|

|

12,407 |

|

|

|

13,091 |

|

|

Employee benefits |

|

1,250 |

|

|

|

2,224 |

|

|

|

4,731 |

|

|

|

1,359 |

|

|

|

1,522 |

|

|

Occupancy of bank premises |

|

1,607 |

|

|

|

1,785 |

|

|

|

1,638 |

|

|

|

1,837 |

|

|

|

1,776 |

|

|

Furniture and equipment |

|

763 |

|

|

|

545 |

|

|

|

716 |

|

|

|

789 |

|

|

|

693 |

|

|

Data processing |

|

1,547 |

|

|

|

1,471 |

|

|

|

1,390 |

|

|

|

1,162 |

|

|

|

1,299 |

|

|

Marketing and customer relations |

|

1,036 |

|

|

|

801 |

|

|

|

1,103 |

|

|

|

933 |

|

|

|

1,125 |

|

|

Amortization of intangible assets |

|

336 |

|

|

|

335 |

|

|

|

376 |

|

|

|

376 |

|

|

|

390 |

|

|

FDIC insurance |

|

(237 |

) |

|

|

8 |

|

|

|

208 |

|

|

|

219 |

|

|

|

214 |

|

|

Loan collection and servicing |

|

732 |

|

|

|

547 |

|

|

|

612 |

|

|

|

742 |

|

|

|

720 |

|

|

Foreclosed assets |

|

151 |

|

|

|

196 |

|

|

|

165 |

|

|

|

164 |

|

|

|

100 |

|

|

Other noninterest expense |

|

1,759 |

|

|

|

2,056 |

|

|

|

2,025 |

|

|

|

2,224 |

|

|

|

2,510 |

|

|

Total noninterest expense |

|

21,950 |

|

|

|

22,303 |

|

|

|

24,561 |

|

|

|

22,212 |

|

|

|

23,440 |

|

| INCOME BEFORE

INCOME TAX EXPENSE |

|

20,524 |

|

|

|

17,736 |

|

|

|

14,910 |

|

|

|

18,951 |

|

|

|

12,159 |

|

| INCOME TAX

EXPENSE |

|

4,437 |

|

|

|

299 |

|

|

|

305 |

|

|

|

215 |

|

|

|

239 |

|

| NET

INCOME |

$ |

16,087 |

|

|

$ |

17,437 |

|

|

$ |

14,605 |

|

|

$ |

18,736 |

|

|

$ |

11,920 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EARNINGS PER

SHARE - BASIC |

$ |

0.61 |

|

|

$ |

0.97 |

|

|

$ |

0.81 |

|

|

$ |

1.04 |

|

|

$ |

0.66 |

|

| EARNINGS PER

SHARE - DILUTED |

$ |

0.61 |

|

|

$ |

0.97 |

|

|

$ |

0.81 |

|

|

$ |

1.04 |

|

|

$ |

0.66 |

|

| WEIGHTED

AVERAGE SHARES OF COMMON STOCK OUTSTANDING |

|

26,211,282 |

|

|

|

18,027,512 |

|

|

|

18,027,512 |

|

|

|

18,027,512 |

|

|

|

18,027,512 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C CORP EQUIVALENT

INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Historical income before income tax expense |

$ |

20,524 |

|

|

$ |

17,736 |

|

|

$ |

14,910 |

|

|

$ |

18,951 |

|

|

$ |

12,159 |

|

|

C Corp equivalent income tax expense |

|

5,436 |

|

|

|

4,614 |

|

|

|

3,784 |

|

|

|

4,915 |

|

|

|

2,965 |

|

|

C Corp equivalent net income |

$ |

15,088 |

|

|

$ |

13,122 |

|

|

$ |

11,126 |

|

|

$ |

14,036 |

|

|

$ |

9,194 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| C CORP

EQUIVALENT EARNINGS PER SHARE - BASIC |

$ |

0.58 |

|

|

$ |

0.73 |

|

|

$ |

0.62 |

|

|

$ |

0.78 |

|

|

$ |

0.51 |

|

| C CORP

EQUIVALENT EARNINGS PER SHARE - DILUTED |

$ |

0.58 |

|

|

$ |

0.73 |

|

|

$ |

0.62 |

|

|

$ |

0.78 |

|

|

$ |

0.51 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HBT Financial, Inc. |

|

Consolidated Financial Summary |

|

Consolidated Balance Sheets |

|

|

| |

As of |

| |

December 31, 2019 |

|

September 30, 2019 |

|

June 30, 2019 |

|

March 31, 2019 |

|

December 31, 2018 |

| |

(dollars in thousands) |

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

Cash and due from banks |

$ |

22,112 |

|

|

$ |

19,969 |

|

|

$ |

17,151 |

|

|

$ |

17,984 |

|

|

$ |

21,343 |

|

|

Interest-bearing deposits with banks |

|

261,859 |

|

|

|

134,972 |

|

|

|

124,575 |

|

|

|

142,518 |

|

|

|

165,536 |

|

|

Cash and cash equivalents |

|

283,971 |

|

|

|

154,941 |

|

|

|

141,726 |

|

|

|

160,502 |

|

|

|

186,879 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing time deposits with banks |

|

248 |

|

|

|

248 |

|

|

|

248 |

|

|

|

248 |

|

|

|

248 |

|

|

Securities available-for-sale, at fair value |

|

592,404 |

|

|

|

618,120 |

|

|

|

651,967 |

|

|

|

681,233 |

|

|

|

679,526 |

|

|

Securities held-to-maturity |

|

88,477 |

|

|

|

99,861 |

|

|

|

108,829 |

|

|

|

116,745 |

|

|

|

121,715 |

|

|

Equity securities |

|

4,389 |

|

|

|

4,436 |

|

|

|

4,030 |

|

|

|

3,994 |

|

|

|

3,261 |

|

|

Restricted stock, at cost |

|

2,425 |

|

|

|

2,425 |

|

|

|

2,425 |

|

|

|

2,719 |

|

|

|

2,719 |

|

|

Loans held for sale |

|

4,531 |

|

|

|

7,608 |

|

|

|

5,303 |

|

|

|

2,496 |

|

|

|

2,800 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans, before allowance for loan losses |

|

2,163,826 |

|

|

|

2,171,014 |

|

|

|

2,203,096 |

|

|

|

2,183,322 |

|

|

|

2,144,257 |

|

|

Allowance for loan losses |

|

(22,299 |

) |

|

|

(22,761 |

) |

|

|

(22,542 |

) |

|

|

(21,013 |

) |

|

|

(20,509 |

) |

|

Loans, net of allowance for loan losses |

|

2,141,527 |

|

|

|

2,148,253 |

|

|

|

2,180,554 |

|

|

|

2,162,309 |

|

|

|

2,123,748 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank premises and equipment, net |

|

53,987 |

|

|

|

54,105 |

|

|

|

53,993 |

|

|

|

54,185 |

|

|

|

54,736 |

|

|

Bank premises held for sale |

|

121 |

|

|

|

121 |

|

|

|

149 |

|

|

|

208 |

|

|

|

749 |

|

|

Foreclosed assets |

|

5,099 |

|

|

|

6,574 |

|

|

|

9,707 |

|

|

|

10,151 |

|

|

|

9,559 |

|

|

Goodwill |

|

23,620 |

|

|

|

23,620 |

|

|

|

23,620 |

|

|

|

23,620 |

|

|

|

23,620 |

|

|

Core deposit intangible assets, net |

|

4,030 |

|

|

|

4,366 |

|

|

|

4,701 |

|

|

|

5,077 |

|

|

|

5,453 |

|

|

Mortgage servicing rights, at fair value |

|

8,518 |

|

|

|

7,936 |

|

|

|

8,796 |

|

|

|

9,916 |

|

|

|

10,918 |

|

|

Investments in unconsolidated subsidiaries |

|

1,165 |

|

|

|

1,165 |

|

|

|

1,165 |

|

|

|

1,165 |

|

|

|

1,165 |

|

|

Accrued interest receivable |

|

13,951 |

|

|

|

14,816 |

|

|

|

14,609 |

|

|

|

15,256 |

|

|

|

15,300 |

|

|

Other assets |

|

16,640 |

|

|

|

18,018 |

|

|

|

12,338 |

|

|

|

7,843 |

|

|

|

7,173 |

|

|

Total assets |

$ |

3,245,103 |

|

|

$ |

3,166,613 |

|

|

$ |

3,224,160 |

|

|

$ |

3,257,667 |

|

|

$ |

3,249,569 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES

AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest-bearing |

$ |

689,116 |

|

|

$ |

649,316 |

|

|

$ |

662,405 |

|

|

$ |

661,527 |

|

|

$ |

664,876 |

|

|

Interest-bearing |

|

2,087,739 |

|

|

|

2,054,742 |

|

|

|

2,111,363 |

|

|

|

2,159,916 |

|

|

|

2,131,094 |

|

|

Total deposits |

|

2,776,855 |

|

|

|

2,704,058 |

|

|

|

2,773,768 |

|

|

|

2,821,443 |

|

|

|

2,795,970 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities sold under agreements to repurchase |

|

44,433 |

|

|

|

32,267 |

|

|

|

35,646 |

|

|

|

40,528 |

|

|

|

46,195 |

|

|

Subordinated debentures |

|

37,583 |

|

|

|

37,566 |

|

|

|

37,550 |

|

|

|

37,533 |

|

|

|

37,517 |

|

|

Other liabilities |

|

53,314 |

|

|

|

43,786 |

|

|

|

37,326 |

|

|

|

29,570 |

|

|

|

29,491 |

|

|

Total liabilities |

|

2,912,185 |

|

|

|

2,817,677 |

|

|

|

2,884,290 |

|

|

|

2,929,074 |

|

|

|

2,909,173 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stockholders'

Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock |

|

275 |

|

|

|

181 |

|

|

|

181 |

|

|

|

181 |

|

|

|

181 |

|

|

Surplus |

|

190,524 |

|

|

|

32,288 |

|

|

|

32,288 |

|

|

|

32,288 |

|

|

|

32,288 |

|

|

Retained earnings |

|

134,287 |

|

|

|

311,055 |

|

|

|

302,984 |

|

|

|

298,131 |

|

|

|

315,234 |

|

|

Accumulated other comprehensive income (loss) |

|

7,832 |

|

|

|

8,431 |

|

|

|

7,436 |

|

|

|

1,012 |

|

|

|

(4,288 |

) |

|

Less cost of treasury stock held |

|

— |

|

|

|

(3,019 |

) |

|

|

(3,019 |

) |

|

|

(3,019 |

) |

|

|

(3,019 |

) |

|

Total stockholders’ equity |

|

332,918 |

|

|

|

348,936 |

|

|

|

339,870 |

|

|

|

328,593 |

|

|

|

340,396 |

|

|

Total liabilities and stockholders’

equity |

$ |

3,245,103 |

|

|

$ |

3,166,613 |

|

|

$ |

3,224,160 |

|

|

$ |

3,257,667 |

|

|

$ |

3,249,569 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SHARE INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ending number shares of common

stock outstanding |

|

27,457,306 |

|

|

|

18,027,512 |

|

|

|

18,027,512 |

|

|

|

18,027,512 |

|

|

|

18,027,512 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HBT Financial, Inc. |

|

Consolidated Financial Summary |

|

|

| |

December 31, 2019 |

|

September 30, 2019 |

|

June 30, 2019 |

|

March 31, 2019 |

|

December 31, 2018 |

| |

(dollars in thousands) |

|

LOANS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commercial and industrial |

$ |

307,175 |

|

$ |

340,650 |

|

$ |

352,326 |

|

$ |

363,918 |

|

$ |

360,501 |

| Agricultural and farmland |

|

207,776 |

|

|

205,041 |

|

|

208,923 |

|

|

207,817 |

|

|

209,875 |

| Commercial real estate - owner

occupied |

|

231,162 |

|

|

239,805 |

|

|

244,954 |

|

|

250,274 |

|

|

255,074 |

| Commercial real estate -

non-owner occupied |

|

579,757 |

|

|

552,262 |

|

|

543,444 |

|

|

556,386 |

|

|

533,910 |

| Multi-family |

|

179,073 |

|

|

191,646 |

|

|

191,734 |

|

|

146,374 |

|

|

135,925 |

| Construction and land

development |

|

224,887 |

|

|

210,939 |

|

|

236,902 |

|

|

223,489 |

|

|

237,275 |

| One-to-four family

residential |

|

313,580 |

|

|

321,947 |

|

|

323,135 |

|

|

321,224 |

|

|

313,108 |

| Municipal, consumer, and

other |

|

120,416 |

|

|

108,724 |

|

|

101,678 |

|

|

113,840 |

|

|

98,589 |

|

Total loans, before allowance for loan

losses |

$ |

2,163,826 |

|

$ |

2,171,014 |

|

$ |

2,203,096 |

|

$ |

2,183,322 |

|

$ |

2,144,257 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

December 31, 2019 |

|

September 30, 2019 |

|

June 30, 2019 |

|

March 31, 2019 |

|

December 31, 2018 |

| |

(dollars in thousands) |

|

DEPOSITS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noninterest-bearing |

$ |

689,116 |

|

$ |

649,316 |

|

$ |

662,405 |

|

$ |

661,527 |

|

$ |

664,876 |

| Interest-bearing demand |

|

814,639 |

|

|

800,471 |

|

|

815,770 |

|

|

819,313 |

|

|

856,919 |

| Money market |

|

477,765 |

|

|

463,444 |

|

|

472,738 |

|

|

453,117 |

|

|

427,730 |

| Savings |

|

438,927 |

|

|

426,707 |

|

|

428,439 |

|

|

435,353 |

|

|

421,698 |

| Time |

|

356,408 |

|

|

364,120 |

|

|

394,416 |

|

|

452,133 |

|

|

424,747 |

|

Total deposits |

$ |

2,776,855 |

|

$ |

2,704,058 |

|

$ |

2,773,768 |

|

$ |

2,821,443 |

|

$ |

2,795,970 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HBT Financial, Inc. |

|

Consolidated Financial Summary |

|

|

|

|

Three Months Ended |

| |

December 31, 2019 |

|

September 30, 2019 |

|

December 31, 2018 |

| |

Average |

|

|

|

* |

|

Average |

|

|

|

* |

|

Average |

|

|

|

* |

| |

Balance |

|

Interest |

|

Yield/Cost |

|

Balance |

|

Interest |

|

Yield/Cost |

|

Balance |

|

Interest |

|

Yield/Cost |

| |

(dollars in thousands) |

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans |

$ |

2,162,975 |

|

|

$ |

28,755 |

|

5.32 |

% |

|

$ |

2,191,230 |

|

|

$ |

29,992 |

|

5.47 |

% |

|

$ |

2,138,839 |

|

|

$ |

29,329 |

|

5.48 |

% |

|

Securities |

|

700,441 |

|

|

|

4,828 |

|

2.76 |

% |

|

|

745,532 |

|

|

|

4,967 |

|

2.67 |

% |

|

|

812,469 |

|

|

|

5,325 |

|

2.62 |

% |

|

Deposits with banks |

|

265,237 |

|

|

|

1,003 |

|

1.51 |

% |

|

|

136,635 |

|

|

|

662 |

|

1.94 |

% |

|

|

132,614 |

|

|

|

580 |

|

1.75 |

% |

|

Other |

|

2,425 |

|

|

|

14 |

|

2.39 |

% |

|

|

2,425 |

|

|

|

15 |

|

2.37 |

% |

|

|

2,719 |

|

|

|

14 |

|

2.20 |

% |

|

Total interest-earning assets |

|

3,131,078 |

|

|

$ |

34,600 |

|

4.42 |

% |

|

|

3,075,822 |

|

|

$ |

35,636 |

|

4.63 |

% |

|

|

3,086,641 |

|

|

$ |

35,248 |

|

4.57 |

% |

|

Allowance for loan losses |

|

(22,766 |

) |

|

|

|

|

|

|

|

(22,326 |

) |

|

|

|

|

|

|

|

(20,863 |

) |

|

|

|

|

|

|

Noninterest-earning assets |

|

152,961 |

|

|

|

|

|

|

|

|

149,146 |

|

|

|

|

|

|

|

|

151,767 |

|

|

|

|

|

|

|

Total assets |

$ |

3,261,273 |

|

|

|

|

|

|

|

$ |

3,202,642 |

|

|

|

|

|

|

|

$ |

3,217,545 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES

AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing deposits: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing demand |

$ |

820,390 |

|

|

$ |

299 |

|

0.15 |

% |

|

$ |

812,526 |

|

|

$ |

347 |

|

0.17 |

% |

|

$ |

820,754 |

|

|

$ |

414 |

|

0.20 |

% |

|

Money market |

|

486,288 |

|

|

|

481 |

|

0.40 |

% |

|

|

468,139 |

|

|

|

497 |

|

0.42 |

% |

|

|

426,864 |

|

|

|

194 |

|

0.18 |

% |

|

Savings |

|

434,241 |

|

|

|

71 |

|

0.07 |

% |

|

|

428,447 |

|

|

|

70 |

|

0.07 |

% |

|

|

424,011 |

|

|

|

70 |

|

0.07 |

% |

|

Time |

|

359,731 |

|

|

|

987 |

|

1.10 |

% |

|

|

383,070 |

|

|

|

1,086 |

|

1.13 |

% |

|

|

432,902 |

|

|

|

994 |

|

0.92 |

% |

|

Total interest-bearing deposits |

|

2,100,650 |

|

|

|

1,838 |

|

0.35 |

% |

|

|

2,092,182 |

|

|

|

2,000 |

|

0.38 |

% |

|

|

2,104,531 |

|

|

|

1,672 |

|

0.32 |

% |

|

Securities sold under agreements to repurchase |

|

46,028 |

|

|

|

24 |

|

0.21 |

% |

|

|

35,757 |

|

|

|

17 |

|

0.19 |

% |

|

|

49,907 |

|

|

|

16 |

|

0.13 |

% |

|

Borrowings |

|

272 |

|

|

|

2 |

|

2.60 |

% |

|

|

33 |

|

|

|

— |

|

2.42 |

% |

|

|

1,326 |

|

|

|

8 |

|

2.40 |

% |

|

Subordinated debentures |

|

37,577 |

|

|

|

460 |

|

4.90 |

% |

|

|

37,561 |

|

|

|

478 |

|

5.09 |

% |

|

|

37,512 |

|

|

|

476 |

|

5.08 |

% |

|

Total interest-bearing liabilities |

|

2,184,527 |

|

|

$ |

2,324 |

|

0.43 |

% |

|

|

2,165,533 |

|

|

$ |

2,495 |

|

0.46 |

% |

|

|

2,193,276 |

|

|

$ |

2,172 |

|

0.40 |

% |

|

Noninterest-bearing deposits |

|

699,373 |

|

|

|

|

|

|

|

|

651,085 |

|

|

|

|

|

|

|

|

659,009 |

|

|

|

|

|

|

|

Noninterest-bearing liabilities |

|

45,589 |

|

|

|

|

|

|

|

|

37,274 |

|

|

|

|

|

|

|

|

28,146 |

|

|

|

|

|

|

|

Total liabilities |

|

2,929,489 |

|

|

|

|

|

|

|

|

2,853,892 |

|

|

|

|

|

|

|

|

2,880,431 |

|

|

|

|

|

|

| Stockholders'

Equity |

|

331,784 |

|

|

|

|

|

|

|

|

348,750 |

|

|

|

|

|

|

|

|

337,114 |

|

|

|

|

|

|

|

Total liabilities and stockholders’

equity |

$ |

3,261,273 |

|

|

|

|

|

|

|

$ |

3,202,642 |

|

|

|

|

|

|

|

$ |

3,217,545 |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income/Net

interest margin (3) |

|

|

|

$ |

32,276 |

|

4.12 |

% |

|

|

|

|

$ |

33,141 |

|

4.31 |

% |

|

|

|

|

$ |

33,076 |

|

4.29 |

% |

| Tax-equivalent adjustment

(2) |

|

|

|

|

534 |

|

0.07 |

% |

|

|

|

|

|

559 |

|

0.07 |

% |

|

|

|

|

|

641 |

|

0.08 |

% |

| Net interest income

(tax-equivalentbasis)/Net interest margin (tax-equivalent basis)

(1) (2) |

|

|

|

$ |

32,810 |

|

4.19 |

% |

|

|

|

|

$ |

33,700 |

|

4.38 |

% |

|

|

|

|

$ |

33,717 |

|

4.37 |

% |

| Net interest rate spread

(4) |

|

|

|

|

|

|

3.99 |

% |

|

|

|

|

|

|

|

4.17 |

% |

|

|

|

|

|

|

|

4.17 |

% |

| Net interest-earning assets

(5) |

$ |

946,551 |

|

|

|

|

|

|

|

$ |

910,289 |

|

|

|

|

|

|

|

$ |

893,365 |

|

|

|

|

|

|

| Ratio of interest-earning

assets to interest-bearing liabilities |

|

1.43 |

|

|

|

|

|

|

|

|

1.42 |

|

|

|

|

|

|

|

|

1.41 |

|

|

|

|

|

|

| Cost of deposits |

|

|

|

|

|

|

0.26 |

% |

|

|

|

|

|

|

|

0.29 |

% |

|

|

|

|

|

|

|

0.24 |

% |

_____________________* Annualized measure.(1) See

"Reconciliation of Non-GAAP Financial Measures" below for

reconciliation of non-GAAP financial measures to their most

comparable GAAP financial measures.(2) On a C Corp tax-equivalent

basis assuming a federal income tax rate of 21% and a state income

tax rate of 9.5%.(3) Net interest margin represents net interest

income divided by average total interest-earning assets.(4) Net

interest rate spread represents the difference between the yield on

average interest-earning assets and the cost of average

interest-bearing liabilities(5) Net interest-earning assets

represents total interest-earning assets less total

interest-bearing liabilities.

|

|

|

HBT Financial, Inc. |

|

Consolidated Financial Summary |

|

|

| |

Year Ended |

| |

December 31, 2019 |

|

December 31, 2018 |

| |

Average |

|

|

|

|

|

|

Average |

|

|

|

|

|

| |

Balance |

|

Interest |

|

Yield/Cost |

|

Balance |

|

Interest |

|

Yield/Cost |

| |

(dollars in thousands) |

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans |

$ |

2,178,897 |

|

|

$ |

120,142 |

|

5.51 |

% |

|

$ |

2,131,512 |

|

|

$ |

114,034 |

|

5.35 |

% |

|

Securities |

|

759,479 |

|

|

|

20,582 |

|

2.71 |

% |

|

|

860,804 |

|

|

|

21,613 |

|

2.51 |

% |

|

Deposits with banks |

|

164,986 |

|

|

|

2,951 |

|

1.79 |

% |

|

|

114,202 |

|

|

|

1,717 |

|

1.50 |

% |

|

Other |

|

2,501 |

|

|

|

60 |

|

2.41 |

% |

|

|

2,771 |

|

|

|

68 |

|

2.47 |

% |

|

Total interest-earning assets |

|

3,105,863 |

|

|

$ |

143,735 |

|

4.63 |

% |

|

|

3,109,289 |

|

|

$ |

137,432 |

|

4.42 |

% |

|

Allowance for loan losses |

|

(21,704 |

) |

|

|

|

|

|

|

|

(20,046 |

) |

|

|

|

|

|

|

Noninterest-earning assets |

|

149,227 |

|

|

|

|

|

|

|

|

158,355 |

|

|

|

|

|

|

|

Total assets |

$ |

3,233,386 |

|

|

|

|

|

|

|

$ |

3,247,598 |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES

AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing deposits: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing demand |

$ |

821,480 |

|

|

$ |

1,474 |

|

0.18 |

% |

|

$ |

824,910 |

|

|

$ |

1,378 |

|

0.17 |

% |

|

Money market |

|

463,233 |

|

|

|

1,837 |

|

0.40 |

% |

|

|

442,872 |

|

|

|

685 |

|

0.15 |

% |

|

Savings |

|

430,220 |

|

|

|

278 |

|

0.06 |

% |

|

|

433,661 |

|

|

|

283 |

|

0.07 |

% |

|

Time |

|

396,560 |

|

|

|

4,343 |

|

1.10 |

% |

|

|

442,569 |

|

|

|

3,541 |

|

0.80 |

% |

|

Total interest-bearing deposits |

|

2,111,493 |

|

|

|

7,932 |

|

0.38 |

% |

|

|

2,144,012 |

|

|

|

5,887 |

|

0.27 |

% |

|

Securities sold under agreements to repurchase |

|

41,177 |

|

|

|

72 |

|

0.18 |

% |

|

|

40,725 |

|

|

|

48 |

|

0.12 |

% |

|

Borrowings |

|

351 |

|

|

|

9 |

|

2.60 |

% |

|

|

14,946 |

|

|

|

260 |

|

1.74 |

% |

|

Subordinated debentures |

|

37,553 |

|

|

|

1,922 |

|

5.12 |

% |

|

|

37,487 |

|

|

|

1,795 |

|

4.79 |

% |

|

Total interest-bearing liabilities |

|

2,190,574 |

|

|

$ |

9,935 |

|

0.45 |

% |

|

|

2,237,170 |

|

|

$ |

7,990 |

|

0.36 |

% |

|

Noninterest-bearing deposits |

|

666,055 |

|

|

|

|

|

|

|

|

653,885 |

|

|

|

|

|

|

|

Noninterest-bearing liabilities |

|

35,213 |

|

|

|

|

|

|

|

|

26,329 |

|

|

|

|

|

|

|

Total liabilities |

|

2,891,842 |

|

|

|

|

|

|

|

|

2,917,384 |

|

|

|

|

|

|

| Stockholders'

Equity |

|

341,544 |

|

|

|

|

|

|

|

|

330,214 |

|

|

|

|

|

|

|

Total liabilities and stockholders’

equity |

$ |

3,233,386 |

|

|

|

|

|

|

|

$ |

3,247,598 |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income/Net

interest margin (3) |

|

|

|

$ |

133,800 |

|

4.31 |

% |

|

|

|

|

$ |

129,442 |

|

4.16 |

% |

| Tax-equivalent adjustment

(2) |

|

|

|

|

2,309 |

|

0.07 |

% |

|

|

|

|

|

2,661 |

|

0.09 |

% |

| Net interest income

(tax-equivalent basis)/Net interest margin (tax-equivalent basis)

(1) (2) |

|

|

|

$ |

136,109 |

|

4.38 |

% |

|

|

|

|

$ |

132,103 |

|

4.25 |

% |

| Net interest rate spread

(4) |

|

|

|

|

|

|

4.18 |

% |

|

|

|

|

|

|

|

4.06 |

% |

| Net interest-earning assets

(5) |

$ |

915,289 |

|

|

|

|

|

|

|

$ |

872,119 |

|

|

|

|

|

|

| Ratio of interest-earning

assets to interest-bearing liabilities |

|

1.42 |

|

|

|

|

|

|

|

|

1.39 |

|

|

|

|

|

|

| Cost of deposits |

|

|

|

|

|

|

0.29 |

% |

|

|

|

|

|

|

|

0.21 |

% |

_____________________(1) See "Reconciliation of Non-GAAP

Financial Measures" below for reconciliation of non-GAAP financial

measures to their most comparable GAAP financial measures.(2) On a

C Corp tax-equivalent basis assuming a federal income tax rate of

21% and a state income tax rate of 9.5%.(3) Net interest margin

represents net interest income divided by average total

interest-earning assets.(4) Net interest rate spread represents the

difference between the yield on average interest-earning assets and

the cost of average interest-bearing liabilities(5) Net

interest-earning assets represents total interest-earning assets

less total interest-bearing liabilities.

|

|

|

HBT Financial, Inc. |

|

Consolidated Financial Summary |

|

|

| |

December 31, 2019 |

|

September 30, 2019 |

|

June 30, 2019 |

|

March 31, 2019 |

|

December 31, 2018 |

| |

(dollars in thousands) |

| NONPERFORMING

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nonaccrual |

$ |

19,019 |

|

|

$ |

18,977 |

|

|

$ |

25,051 |

|

|

|

13,877 |

|

|

|

15,876 |

|

| Past due 90 days or more,

still accruing (1) |

|

30 |

|

|

|

95 |

|

|

|

2 |

|

|

|

53 |

|

|

|

37 |

|

| Total

nonperforming loans |

|

19,049 |

|

|

|

19,072 |

|

|

|

25,053 |

|

|

|

13,930 |

|

|

|

15,913 |

|

| Foreclosed assets |

|

5,099 |

|

|

|

6,574 |

|

|

|

9,707 |

|

|

|

10,151 |

|

|

|

9,559 |

|

| Total

nonperforming assets |

$ |

24,148 |

|

|

$ |

25,646 |

|

|

$ |

34,760 |

|

|

$ |

24,081 |

|

|

$ |

25,472 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NONPERFORMING

ASSETS (Originated) (2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Nonaccrual |

$ |

10,811 |

|

|

$ |

11,268 |

|

|

$ |

15,985 |

|

|

|

8,619 |

|

|

|

10,329 |

|

| Past due 90 days or more,

still accruing |

|

30 |

|

|

|

95 |

|

|

|

2 |

|

|

|

53 |

|

|

|

37 |

|

| Total

nonperforming loans |

|

10,841 |

|

|

|

11,363 |

|

|

|

15,987 |

|

|

|

8,672 |

|

|

|

10,366 |

|

| Foreclosed assets |

|

1,022 |

|

|

|

1,048 |

|

|

|

1,510 |

|

|

|

1,439 |

|

|

|

1,395 |

|

| Total

nonperforming (originated) |

$ |

11,863 |

|

|

$ |

12,411 |

|

|

$ |

17,497 |

|

|

$ |

10,111 |

|

|

$ |

11,761 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NONPERFORMING

ASSETS (Acquired) (2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Nonaccrual |

$ |

8,208 |

|

|

$ |

7,709 |

|

|

$ |

9,066 |

|

|

$ |

5,258 |

|

|

$ |

5,547 |

|

| Past due 90 days or more,

still accruing (1) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Total

nonperforming loans |

|

8,208 |

|

|

|

7,709 |

|

|

|

9,066 |

|

|

|

5,258 |

|

|

|

5,547 |

|

| Foreclosed assets |

|

4,077 |

|

|

|

5,526 |

|

|

|

8,197 |

|

|

|

8,712 |

|

|

|

8,164 |

|

| Total

nonperforming assets (acquired) |

$ |

12,285 |

|

|

$ |

13,235 |

|

|

$ |

17,263 |

|

|

$ |

13,970 |

|

|

$ |

13,711 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Allowance for loan losses |

$ |

22,299 |

|

|

$ |

22,761 |

|

|

$ |

22,542 |

|

|

$ |

21,013 |

|

|

$ |

20,509 |

|

| Total loans, before allowance

for loan losses |

|

2,163,826 |

|

|

|

2,171,014 |

|

|

|

2,203,096 |

|

|

|

2,183,322 |

|

|

|

2,144,257 |

|

| Total loans, before allowance

for loan losses (originated) (2) |

|

1,998,496 |

|

|

|

1,987,265 |

|

|

|

2,005,250 |

|

|

|

1,974,840 |

|

|

|

1,923,859 |

|

| Total loans, before allowance

for loan losses (acquired) (2) |

|

165,330 |

|

|

|

183,749 |

|

|

|

197,846 |

|

|

|

208,482 |

|

|

|

220,398 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CREDIT QUALITY

RATIOS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Allowance for loan losses to

total loans, before allowance for loan losses |

|

1.03 |

% |

|

|

1.05 |

% |

|

|

1.02 |

% |

|

|

0.96 |

% |

|

|

0.96 |

% |

| Allowance for loan losses to

nonperforming loans |

|

117.06 |

% |

|

|

119.34 |

% |

|

|

89.98 |

% |

|

|

150.85 |

% |

|

|

128.88 |

% |

| Nonperforming loans to total

loans, before allowance for loan losses |

|

0.88 |

% |

|

|

0.88 |

% |

|

|

1.14 |

% |

|

|

0.64 |

% |

|

|

0.74 |

% |

| Nonperforming assets to total

assets |

|

0.74 |

% |

|

|

0.81 |

% |

|

|

1.08 |

% |

|

|

0.74 |

% |

|

|

0.78 |

% |

| Nonperforming assets to total

loans, before allowance for loan losses and foreclosed assets |

|

1.11 |

% |

|

|

1.18 |

% |

|

|

1.57 |

% |

|

|

1.10 |

% |

|

|

1.18 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CREDIT QUALITY

RATIOS (Originated) (2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Nonperforming loans to total

loans, before allowance for loan losses |

|

0.54 |

% |

|

|

0.57 |

% |

|

|

0.80 |

% |

|

|

0.44 |

% |

|

|

0.54 |

% |

| Nonperforming assets to total

loans, before allowance for loan losses and foreclosed assets |

|

0.59 |

% |

|

|

0.62 |

% |

|

|

0.87 |

% |

|

|

0.51 |

% |

|

|

0.61 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CREDIT QUALITY

RATIOS (Acquired) (2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Nonperforming loans to total

loans, before allowance for loan losses |

|

4.96 |

% |

|

|

4.20 |

% |

|

|

4.58 |

% |

|

|

2.52 |

% |

|

|

2.52 |

% |

| Nonperforming assets to total

loans, before allowance for loan losses and foreclosed assets |

|

7.25 |

% |

|

|

6.99 |

% |

|

|

8.38 |

% |

|

|

6.43 |

% |

|

|

6.00 |

% |

_____________________(1) Excludes loans acquired with

deteriorated credit quality that are past due 90 or more days,

still accruing totaling $0.1 million, $0.7 million, $0.5 million,

$2.5 million, and $2.7 million as of December 31, 2019,

September 30, 2019, June 30, 2019, March 31, 2019,

and December 31, 2018, respectively.(2) Originated loans and

acquired loans along with the related credit quality ratios such as

net charge-offs to average loans (originated and acquired),

nonperforming loans to total loans (originated and acquired), and

nonperforming assets to total loans and foreclosed assets

(originated and acquired) are non-GAAP financial measures.

Originated loans represent loans initially originated by the