Great Elm Capital Corp. (“we,” “our,” the “Company” or “GECC”)

(NASDAQ: GECC), a business development company, today announced its

financial results for the first quarter ended March 31, 2024.

First Quarter and Other Recent

Highlights:

- In February 2024, the Company

raised $24 million of equity at Net Asset Value from a special

purchase vehicle (“SPV”), supported by a $6 million investment by

Great Elm Group (“GEG”) into the SPV.

- In April 2024, the Company issued

$34.5 million of 8.50% notes due 2029 (the “GECCI Notes”) to

further bolster liquidity and provide balance sheet

flexibility.

- Net investment income (“NII”) for

the quarter ended March 31, 2024 was $3.2 million, or $0.37 per

share, as compared to $3.3 million, or $0.43 per share, for the

quarter ended December 31, 2023.

- Fifth consecutive quarter of NII

per share covering the base dividend.

- Net assets were $118.8 million, or

$12.57 per share, on March 31, 2024, as compared to $98.7 million,

or $12.99 per share, on December 31, 2023.

- NAV adversely impacted by $0.55 per

share in the quarter from write-downs on certain investments in

illiquid assets originated by prior management.

- GECC’s asset coverage ratio

improved to 180.2% as of March 31, 2024, as compared to 169.0% as

of December 31, 2023, and 159.8% as of March 31, 2023.

- Asset coverage ratio pro forma for

April bond issuance of approximately 166.9%.

- The Board of Directors approved a

quarterly dividend of $0.35 per share for the second quarter of

2024, equating to a 13.5% annualized yield on the Company’s closing

market price on May 1, 2024 of $10.36.

Management

Commentary “With 2024 underway, we were

pleased to generate NII that covered the dividend for the fifth

consecutive quarter,” said Matt Kaplan, GECC’s Chief Executive

Officer. “NAV in the quarter was negatively impacted by 55 cents

per share from illiquid investments in two portfolio companies

which we inherited from prior management. We also successfully

completed a Notes offering shortly after quarter-end, which

provides us with additional capital to deploy into quality

investments that offer attractive risk-adjusted returns for our

shareholders. Additionally, we recently announced a JV to invest in

CLO entities and related warehouse facilities. We expect the CLO JV

will start receiving quarterly distributions in the third quarter

and are targeting mid-teens to low-20% IRRs over time. Looking

ahead, we expect NII to ramp in the second half of the year as we

deploy capital from our recent issuances and generate income from

new investments, including our CLO JV, leaving us well positioned

to cover our dividend.”

Financial Highlights – Per Share

Data

|

|

Q1/2023 |

Q2/2023 |

Q3/2023 |

Q4/2023 |

Q1/2024 |

|

Earnings Per Share (“EPS”) |

$1.07 |

$0.68 |

$1.02 |

$0.55 |

($0.05) |

|

Net Investment Income (“NII”) Per Share |

$0.37 |

$0.44 |

$0.40 |

$0.43 |

$0.37 |

|

Pre-Incentive Net Investment Income Per Share |

$0.47 |

$0.56 |

$0.50 |

$0.54 |

$0.46 |

|

Net Realized and Unrealized Gains / (Losses) Per Share |

$0.70 |

$0.24 |

$0.62 |

$0.12 |

($0.42) |

|

Net Asset Value Per Share at Period End |

$11.88 |

$12.21 |

$12.88 |

$12.99 |

$12.57 |

|

Distributions Paid / Declared Per Share |

$0.35 |

$0.35 |

$0.35 |

$0.45 |

$0.35 |

|

|

|

|

|

|

|

Portfolio and Investment

Activity

As of March 31, 2024, GECC held total

investments of $262.9 million at fair value, as follows:

- 44 debt

investments in corporate credit, totaling approximately $184.5

million and representing 70.2% of the fair market value of the

Company’s total investments. Secured debt investments comprised a

substantial majority of the fair market value of the Company’s debt

investments.

- An investment in

Great Elm Specialty Finance comprised of 1 debt investment totaling

approximately $28.7 million and 1 equity investment totaling

approximately $15.9 million and representing 10.9% and 8.1%,

respectively, of the fair market value of the Company’s total

investments.

- 3 dividend

paying equity investments, including our CLO investment, totaling

approximately $21.2 million, representing 8.1% of the fair market

value of the Company’s total investments.

- Other equity investments, totaling

approximately $12.5 million, representing 4.8% of the fair market

value of the Company’s total investments.

As of March 31, 2024, the weighted average

current yield on the Company’s debt portfolio was 13.1%. Floating

rate instruments comprised approximately 69% of the fair market

value of debt investments (up from 67% as of December 31, 2023) and

the Company’s fixed rate debt investments had a weighted average

maturity of 2.2 years.

During the quarter ended March 31, 2024, we

deployed approximately $64.2 million into 29 investments(1) at a

weighted average current yield of 12.5%.

During the quarter ended March 31, 2024, we

monetized, in part or in full, 33 investments for approximately

$28.9 million(2), at a weighted average current yield of 11.4%.

Monetizations include $16.5 million of mandatory debt paydowns and

redemptions at a weighted average current yield of 12.2%. Sales

aggregated to $12.4 million at a weighted average current yield of

9.7%.

Financial Review Total

investment income for the quarter ended March 31, 2024 was $8.9

million, or $1.03 per share. Net expenses for the quarter ended

March 31, 2024 were approximately $5.7 million, or $0.66 per

share.

Net realized and unrealized losses for the

quarter ended March 31, 2024 were approximately $3.7 million, or

$0.42 per share.

Liquidity and Capital

ResourcesAs of March 31, 2024, cash and money market

securities totaled approximately $8.7 million.

As of March 31, 2024, total debt outstanding

(par value) was $148.1 million, comprised of 6.75% senior notes due

January 2025 (NASDAQ: GECCM), 5.875% senior notes due June 2026

(NASDAQ: GECCO), 8.75% senior notes due September 2028 (NASDAQ:

GECCZ), and $5.0 million outstanding on the $25.0 million revolving

credit facility due May 2027.

Subsequent to quarter-end, the Company issued

$34.5 million in aggregate principal amount of 8.50% notes due June

2029 (NASDAQ: GECCI), and repaid $5.0 million of the outstanding

balance on the revolving line of credit, leaving no borrowings

outstanding under the revolving line.

DistributionsThe Company’s

Board of Directors has approved a quarterly cash distribution of

$0.35 per share for the quarter ending June 30, 2024. The second

quarter distribution will be payable on June 28, 2024 to

stockholders of record as of June 14, 2024.

The distribution equates to a 13.5% annualized

dividend yield on the Company’s closing market price on May 1, 2024

of $10.36 and an 11.1% annualized dividend yield on the Company’s

March 31, 2024 NAV of $12.57 per share.

Conference Call and WebcastGECC

will discuss these results in a conference call today at 5:00 p.m.

ET.

| Conference Call Details |

|

Date/Time: |

|

Thursday, May

2, 2024 – 5:00 p.m. ET |

| |

|

|

| Participant Dial-In Numbers: |

|

|

| (United States): |

|

800-717-1738 |

| (International): |

|

646-307-1865 |

| |

|

|

To access the call, please dial-in approximately

five minutes before the start time and, when asked, provide the

operator with passcode “GECC”. An accompanying slide presentation

will be available in pdf format via the “Events and Presentations”

section of Great Elm Capital Corp.’s website here after the

issuance of the earnings release.

Webcast

The call and presentation will also be

simultaneously webcast over the internet via the Events and

Presentations section of GECC’s website or by clicking on the

conference call link here.

About Great Elm Capital

Corp.

GECC is an externally managed business

development company that seeks to generate current income and

capital appreciation by investing in debt and income generating

equity securities, including investments in specialty finance

businesses. http://www.greatelmcc.com

Cautionary Statement Regarding

Forward-Looking Statements Statements in this

communication that are not historical facts are “forward-looking”

statements within the meaning of the federal securities laws. These

statements are often, but not always, made through the use of words

or phrases such as “expect,” “anticipate,” “should,” “will,”

“estimate,” “designed,” “seek,” “continue,” “upside,” “potential”

and similar expressions. All such forward-looking statements

involve estimates and assumptions that are subject to risks,

uncertainties and other factors that could cause actual results to

differ materially from the results expressed in the statements.

Among the key factors that could cause actual results to differ

materially from those projected in the forward-looking statements

are: conditions in the credit markets, rising interest rates,

inflationary pressure, the price of GECC common stock and the

performance of GECC’s portfolio and investment manager. Information

concerning these and other factors can be found in GECC’s Annual

Report on Form 10-K and other reports filed with the Securities and

Exchange Commission. GECC assumes no obligation to, and expressly

disclaims any duty to, update any forward-looking statements

contained in this communication or to conform prior statements to

actual results or revised expectations except as required by law.

Readers are cautioned not to place undue reliance on these

forward-looking statements that speak only as of the date

hereof.

This press release does not constitute an offer

of any securities for sale.

Endnotes:(1) This includes new

deals, additional fundings (inclusive of those on revolving credit

facilities), refinancings and capitalized PIK income. Amounts

included herein do not include investments in short-term

securities, including United States Treasury Bills.(2) This

includes scheduled principal payments, prepayments, sales and

repayments (inclusive of those on revolving credit facilities).

Amounts included herein do not include investments in short-term

securities, including United States Treasury Bills.

Media & Investor Contact:

Investor

Relations investorrelations@greatelmcap.com

| |

| GREAT ELM

CAPITAL CORP.CONSOLIDATED STATEMENTS OF ASSETS AND

LIABILITIES Dollar amounts in thousands (except

per share amounts) |

| |

| |

|

March 31, 2024 |

|

|

December 31, 2023 |

|

| Assets |

|

|

|

|

|

|

| Investments |

|

|

|

|

|

|

|

Non-affiliated, non-controlled investments, at fair value

(amortized cost of $217,882 and $179,626, respectively) |

|

$ |

218,060 |

|

|

$ |

183,335 |

|

|

Non-affiliated, non-controlled short-term investments, at fair

value (amortized cost of $8,335 and $10,807, respectively) |

|

|

8,335 |

|

|

|

10,807 |

|

|

Affiliated investments, at fair value (amortized cost of $13,420

and $13,423, respectively) |

|

|

214 |

|

|

|

1,067 |

|

|

Controlled investments, at fair value (amortized cost of $46,300

and $46,300, respectively) |

|

|

44,586 |

|

|

|

46,210 |

|

| Total investments |

|

|

271,195 |

|

|

|

241,419 |

|

| |

|

|

|

|

|

|

| Cash and cash equivalents |

|

|

334 |

|

|

|

953 |

|

| Receivable for investments

sold |

|

|

2,595 |

|

|

|

840 |

|

| Interest receivable |

|

|

3,827 |

|

|

|

2,105 |

|

| Dividends receivable |

|

|

763 |

|

|

|

1,001 |

|

| Due from portfolio

company |

|

|

38 |

|

|

|

37 |

|

| Deferred financing costs |

|

|

311 |

|

|

|

335 |

|

| Prepaid expenses and other

assets |

|

|

64 |

|

|

|

135 |

|

| Total

assets |

|

$ |

279,127 |

|

|

$ |

246,825 |

|

| |

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

| Notes payable (including

unamortized discount of $2,641 and $2,896, respectively) |

|

$ |

140,469 |

|

|

$ |

140,214 |

|

| Revolving credit facility |

|

|

5,000 |

|

|

|

- |

|

| Payable for investments

purchased |

|

|

10,411 |

|

|

|

3,327 |

|

| Interest payable |

|

|

37 |

|

|

|

32 |

|

| Accrued incentive fees

payable |

|

|

1,466 |

|

|

|

1,431 |

|

| Distributions payable |

|

|

- |

|

|

|

760 |

|

| Due to affiliates |

|

|

1,560 |

|

|

|

1,195 |

|

| Accrued expenses and other

liabilities |

|

|

1,389 |

|

|

|

1,127 |

|

| Total

liabilities |

|

$ |

160,332 |

|

|

$ |

148,086 |

|

| |

|

|

|

|

|

|

| Commitments and

contingencies |

|

$ |

- |

|

|

$ |

- |

|

| |

|

|

|

|

|

|

| Net

Assets |

|

|

|

|

|

|

| Common stock, par value $0.01

per share (100,000,000 shares authorized, 9,452,382 shares issued

and outstanding and 7,601,958 shares issued and outstanding,

respectively) |

|

$ |

94 |

|

|

$ |

76 |

|

| Additional paid-in

capital |

|

|

307,599 |

|

|

|

283,795 |

|

| Accumulated losses |

|

|

(188,898 |

) |

|

|

(185,132 |

) |

| Total net

assets |

|

$ |

118,795 |

|

|

$ |

98,739 |

|

| Total liabilities and

net assets |

|

$ |

279,127 |

|

|

$ |

246,825 |

|

| Net asset value per

share |

|

$ |

12.57 |

|

|

$ |

12.99 |

|

| |

| GREAT ELM

CAPITAL CORP.CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)Dollar amounts in thousands (except per

share amounts) |

| |

| |

|

For the Three Months Ended March 31, |

|

| |

|

2024 |

|

|

2023 |

|

| Investment

Income: |

|

|

|

|

|

|

| Interest income from: |

|

|

|

|

|

|

|

Non-affiliated, non-controlled investments |

|

$ |

5,987 |

|

|

$ |

5,476 |

|

|

Non-affiliated, non-controlled investments (PIK) |

|

|

630 |

|

|

|

449 |

|

|

Affiliated investments |

|

|

33 |

|

|

|

30 |

|

|

Controlled investments |

|

|

931 |

|

|

|

442 |

|

|

Controlled investments (PIK) |

|

|

- |

|

|

|

233 |

|

| Total interest income |

|

|

7,581 |

|

|

|

6,630 |

|

| Dividend income from: |

|

|

|

|

|

|

|

Non-affiliated, non-controlled investments |

|

|

386 |

|

|

|

318 |

|

|

Controlled investments |

|

|

385 |

|

|

|

616 |

|

| Total dividend income |

|

|

771 |

|

|

|

934 |

|

| Other commitment fees from

non-affiliated, non-controlled investments |

|

|

525 |

|

|

|

802 |

|

| Other income from: |

|

|

|

|

|

|

|

Non-affiliated, non-controlled investments |

|

|

32 |

|

|

|

44 |

|

| Total other income |

|

|

32 |

|

|

|

44 |

|

|

Total investment income |

|

$ |

8,909 |

|

|

$ |

8,410 |

|

|

|

|

|

|

|

|

|

|

Expenses: |

|

|

|

|

|

|

| Management fees |

|

$ |

940 |

|

|

$ |

869 |

|

| Incentive fees |

|

|

798 |

|

|

|

710 |

|

| Administration fees |

|

|

385 |

|

|

|

295 |

|

| Custody fees |

|

|

36 |

|

|

|

22 |

|

| Directors’ fees |

|

|

54 |

|

|

|

52 |

|

| Professional services |

|

|

388 |

|

|

|

536 |

|

| Interest expense |

|

|

2,807 |

|

|

|

2,821 |

|

| Other expenses |

|

|

303 |

|

|

|

238 |

|

|

Total expenses |

|

$ |

5,711 |

|

|

$ |

5,543 |

|

| Net investment income before

taxes |

|

$ |

3,198 |

|

|

$ |

2,867 |

|

|

Excise tax |

|

$ |

5 |

|

|

$ |

28 |

|

| Net investment income |

|

$ |

3,193 |

|

|

$ |

2,839 |

|

| |

|

|

|

|

|

|

| Net realized and

unrealized gains (losses): |

|

|

|

|

|

|

| Net realized gain (loss) on

investment transactions from: |

|

|

|

|

|

|

|

Non-affiliated, non-controlled investments |

|

$ |

2,356 |

|

|

$ |

1,845 |

|

| Total net realized gain

(loss) |

|

|

2,356 |

|

|

|

1,845 |

|

| Net change in

unrealized appreciation (depreciation) on investment transactions

from: |

|

|

|

|

|

Non-affiliated, non-controlled investments |

|

|

(3,533 |

) |

|

|

2,781 |

|

|

Affiliated investments |

|

|

(850 |

) |

|

|

163 |

|

|

Controlled investments |

|

|

(1,624 |

) |

|

|

532 |

|

| Total net change in unrealized

appreciation (depreciation) |

|

|

(6,007 |

) |

|

|

3,476 |

|

| Net realized and unrealized

gains (losses) |

|

$ |

(3,651 |

) |

|

$ |

5,321 |

|

| Net increase

(decrease) in net assets resulting from operations |

|

$ |

(458 |

) |

|

$ |

8,160 |

|

| |

|

|

|

|

|

|

| Net investment income per

share (basic and diluted): |

|

$ |

0.37 |

|

|

$ |

0.37 |

|

| Earnings per share (basic and

diluted): |

|

$ |

(0.05 |

) |

|

$ |

1.07 |

|

| Weighted average shares

outstanding (basic and diluted): |

|

|

8,659,344 |

|

|

|

7,601,958 |

|

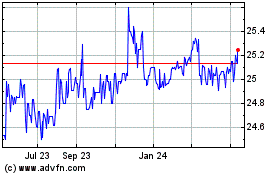

Great Elm Capital (NASDAQ:GECCM)

Historical Stock Chart

From Nov 2024 to Dec 2024

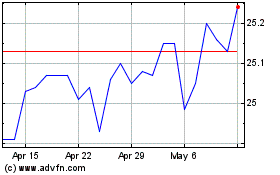

Great Elm Capital (NASDAQ:GECCM)

Historical Stock Chart

From Dec 2023 to Dec 2024