0000849399false00008493992023-11-072023-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): November 7, 2023

Gen Digital Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | | | | |

Delaware (State or other jurisdiction of incorporation or organization) | 000-17781 (Commission File Number) | 77-0181864 (I.R.S. Employer Identification Number) |

60 E. Rio Salado Parkway, | Suite 1000, | |

| Tempe, | Arizona | 85281 | |

(Address of principal executive offices and zip code) |

| (650) | 527-8000 | |

(Registrant's telephone number, including area code) |

___________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | |

Title of each class | Trading Symbol | Name of each exchange on which registered |

Common Stock, | par value $0.01 per share | GEN | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter)

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Conditions

On November 7, 2023, Gen Digital Inc. (the Company) issued a press release announcing financial results for the second quarter ended September 29, 2023. The Company also posted supplemental financial information to its website. A copy of the press release is furnished as Exhibit 99.01 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Item 2.02, including Exhibit 99.01 hereto, shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained in this Item 2.02, including Exhibit 99.01 hereto, shall not be incorporated by reference into any registration statement or other document filed with the Securities and Exchange Commission by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits

(d) The following exhibits are being filed herewith:

| | | | | | | | |

| Exhibit No. | | Exhibit Title or Description |

| | |

104 | | The cover page of this Current Report on Form 8-K, formatted in Inline XBRL. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized on this 7th day of November, 2023.

| | | | | |

| Gen Digital Inc. |

| |

By: | /s/ Natalie Derse |

| Natalie Derse |

| Chief Financial Officer |

PRESS RELEASE

| | | | | | | | |

Investor Contact Jason Starr | | Media Contact Jenna Torluemke |

| Gen | | Gen |

IR@GenDigital.com | | Press@GenDigital.com |

Gen Reports Q2 FY24 Results and Confirms Annual Guidance Within Range

Gen hosts first investor update sharing a detailed outlook into the business

TEMPE, Ariz. & PRAGUE, Nov. 7, 2023 – Gen Digital Inc. (NASDAQ: GEN), a global leader dedicated to powering Digital Freedom, released its results for its fiscal year 2024 second quarter, which ended September 29, 2023.

“We created Gen just one year ago, knowing that NortonLifeLock and Avast together would be the company to deliver Cyber Safety to everyone. Our digital lives keep expanding and, unfortunately, cyber threats do too. With our integrated platform and technology, our global reach directly or through partners, and our commitment to serve and win, Gen is best positioned to lead this dynamic and expanding market,” said Vincent Pilette, CEO of Gen. “Every day we focus on meeting the needs of consumers, executing with discipline, and we won’t rest until we deliver Digital Freedom to everyone.”

Q2 Financial Highlights and Commentary YoY

Q2 GAAP revenue was $948 million, up 27%. Q2 GAAP diluted EPS was $0.23, compared to $0.12 a year ago. Q2 GAAP operating margin was 2.6%, down 30 points. Q2 operating cash flow was $125 million.

Q2 Non-GAAP YoY

•Revenue of $948 million, up 27% in USD and 28% in CC

•Bookings of $923 million, up 28% in USD and 27% in CC

•Operating Income of $549 million, up 41% in USD and 43% in CC

•Operating Margin of 57.9%, up 600 basis points

•Diluted EPS of $0.47, up 4% in USD and up 9% in CC

“Our Q2 results demonstrate the Gen team’s consistent commitment to driving sustainable and profitable growth,” said Natalie Derse, CFO of Gen. “In Q2 we returned to sequential customer count growth up 380,000 while we also grew ARPU and improved retention. We see a great opportunity to continue this momentum, further extending our market leadership in Cyber Safety and driving significant value for our customers and shareholders.”

Q3 FY24 Non-GAAP Guidance

•Q3 FY24 Revenue expected to be in the range of $950 to $960 million

•Q3 FY24 EPS expected to be in the range of $0.49 to $0.51

Fiscal Year 2024 Non-GAAP Annual Guidance

•FY24 Revenue expected to be in the range of $3.810 to $3.835 billion

•FY24 EPS expected to be in the range of $1.95 to $2.00

Quarterly Cash Dividend

Gen's Board of Directors has approved a regular quarterly cash dividend of $0.125 per common share to be paid on December 13, 2023, to all shareholders of record as of the close of business on November 20, 2023.

For additional details regarding Gen’s results and outlook, as well as the company’s FY24 Q2 Investor Letter, please visit Investor.GenDigital.com.

Gen's 1st Anniversary Investor Update

On its first anniversary as Gen, Company will host an Investor Update today, November 7, 2023, from 10:30 a.m. to 1:00 p.m. EST. Gen leadership will offer a detailed look into the business, review the company’s market opportunity and priorities and its long-term model. The FY24 Q2 Results Q&A session will be held in combination with the Investor Update Q&A.

A live video webcast of the presentation and Q&A can be accessed at Investor.GenDigital.com in the Events section. A replay of this event and presentation materials will be posted following the event’s conclusion.

###

About Gen

GenTM (NASDAQ: GEN) is a global company dedicated to powering Digital Freedom through its trusted Cyber Safety brands, Norton, Avast, LifeLock, Avira, AVG, ReputationDefender and CCleaner. The Gen family of consumer brands is rooted in providing safety for the first digital generations. Now, Gen empowers people to live their digital lives safely, privately, and confidently today and for generations to come. Gen brings award-winning products and services in cybersecurity, online privacy and identity protection to nearly 500 million users in more than 150 countries. Learn more at GenDigital.com.

Forward-Looking Statements

This press release contains statements which may be considered forward-looking within the meaning of the U.S. federal securities laws. In some cases, you can identify these forward-looking statements by the use of terms such as "expect," "will," "continue," or similar expressions, and variations or negatives of these words, but the absence of these words does not mean that a statement is not forward-looking. All statements other than statements of historical fact are statements that could be deemed forward-looking statements, including, but not limited to, the quotes under "Q2 Non-GAAP YoY" including expectations relating to achievement of long-term objectives, and the statements under "Q3 FY24 Non-GAAP Guidance" and "Fiscal Year 2024 Non-GAAP Annual Guidance" including expectations relating

to Q3 FY24 and FY24 non-GAAP revenue and non-GAAP EPS, and any statements of assumptions underlying any of the foregoing. These statements are subject to known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to differ materially from results expressed or implied in this press release. Such risk factors include, but are not limited to, those related to: the consummation of or anticipated impacts of acquisitions (including our ability to achieve synergies and associated cost savings from the merger with Avast); divestitures, restructurings, stock repurchases, financings, debt repayments and investment activities; difficulties in executing the operating model for the consumer Cyber Safety business; lower than anticipated returns from our investments in direct customer acquisition; difficulties in retaining our existing customers and converting existing non-paying customers to paying customers; difficulties and delays in reducing run rate expenses and monetizing underutilized assets; the successful development of new products and upgrades and the degree to which these new products and upgrades gain market acceptance; our ability to maintain our customer and partner relationships; the anticipated growth of certain market segments; fluctuations and volatility in our stock price; our ability to successfully execute strategic plans; the vulnerability of our solutions, systems, websites and data to intentional disruption by third parties; changes to existing accounting pronouncements or taxation rules or practices; and general business and macroeconomic changes in the U.S. and worldwide, including economic recessions, the impact of inflation, fluctuations in foreign currency exchange rates, changes in interest rates or tax rates, and conflicts including Russia's invasion of Ukraine. Additional information concerning these and other risk factors is contained in the Risk Factors sections of our most recent reports on Form 10-K and Form 10-Q. We encourage you to read those sections carefully. There may also be other factors that have not been anticipated or are not described in our periodic filings, generally because we did not believe them to be significant at the time, which could cause actual results to differ materially from our projections and expectations. All forward-looking statements should be evaluated with the understanding of their inherent uncertainty. We assume no obligation, and do not intend, to update these forward-looking statements as a result of future events or developments.

Use of Non-GAAP Financial Information

We use non-GAAP measures of operating margin, operating income, net income and earnings per share, which are adjusted from results based on GAAP and exclude certain expenses, gains and losses. We also provide the non-GAAP metrics of revenues, and constant currency revenues. These non-GAAP financial measures are provided to enhance the user's understanding of our past financial performance and our prospects for the future. Our management team uses these non-GAAP financial measures in assessing Gen's performance, as well as in planning and forecasting future periods. These non-GAAP financial measures are not computed according to GAAP and the methods we use to compute them may differ from the methods used by other companies. Non-GAAP financial measures are supplemental, should not be considered a substitute for financial information presented in accordance with GAAP and should be read only in conjunction with our condensed consolidated financial statements prepared in accordance with GAAP. Readers are encouraged to review the reconciliation of our non-GAAP financial measures to the comparable GAAP results, which is attached to our quarterly earnings release, and which can be found, along with other financial information including the Earnings Presentation, on the investor relations page of our website at Investor.GenDigital.com. No reconciliation of the forecasted range for non-GAAP revenues and EPS guidance is included in this release because most non-GAAP adjustments pertain to

events that have not yet occurred. It would be unreasonably burdensome to forecast, therefore we are unable to provide an accurate estimate.

GEN DIGITAL INC.

Condensed Consolidated Balance Sheets

(Unaudited, in millions)

| | | | | | | | | | | |

| September 29, 2023 | | March 31, 2023 |

| ASSETS |

| Current assets: | | | |

| Cash and cash equivalents | $ | 629 | | | $ | 750 | |

| | | |

| Accounts receivable, net | 147 | | | 168 | |

| Other current assets | 278 | | | 284 | |

| Assets held for sale | 22 | | | 31 | |

| Total current assets | 1,076 | | | 1,233 | |

| Property and equipment, net | 75 | | | 76 | |

| Operating lease assets | 39 | | | 43 | |

| Intangible assets, net | 2,859 | | | 3,097 | |

| Goodwill | 10,199 | | | 10,217 | |

| Other long-term assets | 2,163 | | | 1,281 | |

| Total assets | $ | 16,411 | | | $ | 15,947 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) |

| Current liabilities: | | | |

| Accounts payable | $ | 66 | | | $ | 77 | |

| Accrued compensation and benefits | 61 | | | 102 | |

| Current portion of long-term debt | 175 | | | 233 | |

| Contract liabilities | 1,599 | | | 1,708 | |

| Current operating lease liabilities | 19 | | | 26 | |

| Other current liabilities | 540 | | | 703 | |

| Total current liabilities | 2,460 | | | 2,849 | |

| Long-term debt | 9,333 | | | 9,529 | |

| Long-term contract liabilities | 73 | | | 80 | |

| Deferred income tax liabilities | 256 | | | 395 | |

| Long-term income taxes payable | 1,213 | | | 820 | |

| Long-term operating lease liabilities | 31 | | | 31 | |

| Other long-term liabilities | 631 | | | 43 | |

| Total liabilities | 13,997 | | | 13,747 | |

| Total stockholders’ equity (deficit) | 2,414 | | | 2,200 | |

| Total liabilities and stockholders’ equity (deficit) | $ | 16,411 | | | $ | 15,947 | |

GEN DIGITAL INC.

Condensed Consolidated Statements of Operations

(Unaudited, in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| September 29, 2023 | | September 30, 2022 | | September 29, 2023 | | September 30, 2022 |

| Net revenues | $ | 948 | | | $ | 748 | | | $ | 1,894 | | | $ | 1,455 | |

| Cost of revenues | 180 | | | 119 | | | 359 | | | 221 | |

| Gross profit | 768 | | | 629 | | | 1,535 | | | 1,234 | |

| Operating expenses: | | | | | | | |

| Sales and marketing | 187 | | | 167 | | | 368 | | | 323 | |

| Research and development | 85 | | | 73 | | | 175 | | | 134 | |

| General and administrative | 393 | | | 110 | | | 449 | | | 214 | |

| Amortization of intangible assets | 61 | | | 29 | | | 122 | | | 50 | |

| Restructuring and other costs | 17 | | | 9 | | | 34 | | | 11 | |

| Total operating expenses | 743 | | | 388 | | | 1,148 | | | 732 | |

| Operating income (loss) | 25 | | | 241 | | | 387 | | | 502 | |

| Interest expense | (173) | | | (48) | | | (343) | | | (79) | |

| Other income (expense), net | 7 | | | 2 | | | 19 | | | 1 | |

| Income (loss) before income taxes | (141) | | | 195 | | | 63 | | | 424 | |

| Income tax expense (benefit) | (290) | | | 126 | | | (275) | | | 155 | |

| Net income (loss) | $ | 149 | | | $ | 69 | | | $ | 338 | | | $ | 269 | |

| | | | | | | |

| Net income (loss) per share - basic | $ | 0.23 | | | $ | 0.12 | | | $ | 0.53 | | | $ | 0.46 | |

| Net income (loss) per share - diluted | $ | 0.23 | | | $ | 0.12 | | | $ | 0.52 | | | $ | 0.45 | |

| | | | | | | |

Weighted-average shares outstanding: | | | | | | | |

| Basic | 640 | | | 590 | | | 640 | | | 583 | |

| Diluted | 644 | | | 595 | | | 644 | | | 599 | |

GEN DIGITAL INC.

Condensed Consolidated Statements of Cash Flows

(Unaudited, in millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| September 29, 2023 | | September 30, 2022 | | September 29, 2023 | | September 30, 2022 |

| OPERATING ACTIVITIES: | | | | | | | |

| Net income (loss) | $ | 149 | | | $ | 69 | | | $ | 338 | | | $ | 269 | |

| Adjustments: | | | | | | | |

| Amortization and depreciation | 125 | | | 49 | | | 250 | | | 78 | |

| Impairments and write-offs of current and long-lived assets | — | | | (5) | | | — | | | (5) | |

| Stock-based compensation expense | 35 | | | 29 | | | 72 | | | 53 | |

| Deferred income taxes | (917) | | | (19) | | | (976) | | | (51) | |

| Loss (gain) on extinguishment of debt | — | | | 9 | | | — | | | 9 | |

| Gain on sale of property | — | | | — | | | (4) | | | — | |

| Non-cash operating lease expense | 5 | | | 7 | | | 11 | | | 11 | |

| Other | (1) | | | (19) | | | 17 | | | (45) | |

| Changes in operating assets and liabilities, net of acquisitions: | | | | | | | |

| Accounts receivable, net | (4) | | | 4 | | | 16 | | | 17 | |

| Accounts payable | (3) | | | (27) | | | (15) | | | (18) | |

| Accrued compensation and benefits | 1 | | | 35 | | | (41) | | | 3 | |

| Contract liabilities | (31) | | | (32) | | | (99) | | | (85) | |

| Income taxes payable | 389 | | | (151) | | | 417 | | | (91) | |

| Other assets | 6 | | | 9 | | | (21) | | | 9 | |

| Other liabilities | 371 | | | (46) | | | 386 | | | (27) | |

| Net cash provided by (used in) operating activities | 125 | | | (88) | | | 351 | | | 127 | |

| INVESTING ACTIVITIES: | | | | | | | |

| Purchases of property and equipment | (5) | | | (2) | | | (9) | | | (4) | |

| Payments for acquisitions, net of cash acquired | — | | | (6,550) | | | — | | | (6,550) | |

| Proceeds from the maturities and sales of short-term investments | — | | | — | | | — | | | 4 | |

| Proceeds from the sale of property | 13 | | | — | | | 13 | | | — | |

| Other | 1 | | | 2 | | | (1) | | | 4 | |

| Net cash provided by (used in) investing activities | 9 | | | (6,550) | | | 3 | | | (6,546) | |

| FINANCING ACTIVITIES: | | | | | | | |

| Repayments of debt | (58) | | | (2,328) | | | (266) | | | (2,738) | |

| Proceeds from issuance of debt, net of issuance costs | — | | | 8,954 | | | — | | | 8,954 | |

| Net proceeds from sales of common stock under employee stock incentive plans | 6 | | | 6 | | | 6 | | | 6 | |

| Tax payments related to vesting of stock units | (2) | | | — | | | (20) | | | (16) | |

| Dividends and dividend equivalents paid | (81) | | | (72) | | | (164) | | | (153) | |

| Repurchases of common stock | — | | | (104) | | | (41) | | | (404) | |

| Net cash provided by (used in) financing activities | (135) | | | 6,456 | | | (485) | | | 5,649 | |

| Effect of exchange rate fluctuations on cash and cash equivalents | 7 | | | (14) | | | 10 | | | (22) | |

| Change in cash and cash equivalents | 6 | | | (196) | | | (121) | | | (792) | |

| Beginning cash and cash equivalents | 623 | | | 1,291 | | | 750 | | | 1,887 | |

| Ending cash and cash equivalents | $ | 629 | | | $ | 1,095 | | | $ | 629 | | | $ | 1,095 | |

GEN DIGITAL INC.

Reconciliation of Selected GAAP Measures to Non-GAAP Measures (1) (2)

(Unaudited, in millions, except per share amounts) | | | | | | | | | | | | | | | |

| Three Months Ended | | |

| September 29, 2023 | | September 30, 2022 | | | | |

| Operating income (loss) | $ | 25 | | | $ | 241 | | | | | |

| | | | | | | |

| Stock-based compensation | 35 | | | 29 | | | | | |

| Amortization of intangible assets | 119 | | | 45 | | | | | |

| Restructuring and other costs | 17 | | | 9 | | | | | |

| Acquisition and integration costs | 6 | | | 58 | | | | | |

| Litigation costs | 347 | | | 7 | | | | | |

| Other | — | | | (1) | | | | | |

| Operating income (loss) (Non-GAAP) | $ | 549 | | | $ | 388 | | | | | |

| | | | | | | |

| Operating margin | 2.6 | % | | 32.2 | % | | | | |

| Operating margin (Non-GAAP) | 57.9 | % | | 51.9 | % | | | | |

| | | | | | | |

| Net income (loss) | $ | 149 | | | $ | 69 | | | | | |

| Adjustments to net income (loss): | | | | | | | |

| | | | | | | |

| Stock-based compensation | 35 | | | 29 | | | | | |

| Amortization of intangible assets | 119 | | | 45 | | | | | |

| Restructuring and other costs | 17 | | | 9 | | | | | |

| Acquisition and integration costs | 6 | | | 58 | | | | | |

| Litigation costs | 347 | | | 7 | | | | | |

| Other | (1) | | | (10) | | | | | |

| Non-cash interest expense | 6 | | | 3 | | | | | |

| Loss (gain) on extinguishment of debt | — | | | 9 | | | | | |

| | | | | | | |

| Total adjustments to GAAP income (loss) before income taxes | 529 | | | 150 | | | | | |

| Adjustment to GAAP provision for income taxes | (375) | | | 50 | | | | | |

| Total adjustment to income (loss), net of taxes | 154 | | | 200 | | | | | |

| Net income (loss) (Non-GAAP) | $ | 303 | | | $ | 269 | | | | | |

| | | | | | | |

| Diluted net income (loss) per share | $ | 0.23 | | | $ | 0.12 | | | | | |

| Adjustments to diluted net income (loss) per share: | | | | | | | |

| | | | | | | |

| Stock-based compensation | 0.05 | | | 0.05 | | | | | |

| Amortization of intangible assets | 0.18 | | | 0.08 | | | | | |

| Restructuring and other costs | 0.03 | | | 0.02 | | | | | |

| Acquisition and integration costs | 0.01 | | | 0.10 | | | | | |

| Litigation costs | 0.54 | | | 0.01 | | | | | |

| Other | (0.00) | | | (0.02) | | | | | |

| Non-cash interest expense | 0.01 | | | 0.01 | | | | | |

| Loss (gain) on extinguishment of debt | — | | | 0.02 | | | | | |

| | | | | | | |

| Total adjustments to GAAP income (loss) before income taxes | 0.82 | | | 0.25 | | | | | |

| Adjustment to GAAP provision for income taxes | (0.58) | | | 0.08 | | | | | |

| Total adjustment to income (loss), net of taxes | 0.24 | | | 0.34 | | | | | |

| | | | | | | |

| Diluted net income (loss) per share (Non-GAAP) | $ | 0.47 | | | $ | 0.45 | | | | | |

| | | | | | | |

| Diluted weighted-average shares outstanding | 644 | | | 595 | | | | | |

| | | | | | | |

| Diluted weighted-average shares outstanding (Non-GAAP) | 644 | | | 595 | | | | | |

(1) This presentation includes non-GAAP measures. Non-GAAP financial measures are supplemental and should not be considered a substitute for financial information presented in accordance with GAAP. For a detailed explanation of these non-GAAP measures, see Appendix A.

(2) Amounts may not add due to rounding.

GEN DIGITAL INC.

Constant Currency Adjusted Revenues and Cyber Safety Metrics

(Unaudited, in millions, except per user data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Constant Currency Adjusted Revenues (Non-GAAP) | | | | | | | | | | | |

| Three Months Ended | | |

| September 29, 2023 | | September 30, 2022 | | Variance in % | | | | | | |

| Revenues | $ | 948 | | | $ | 748 | | | 27 | % | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Exclude foreign exchange impact (1) | 7 | | | | | | | | | | | |

| Constant currency adjusted revenues (Non-GAAP) | $ | 955 | | | $ | 748 | | | 28 | % | | | | | | |

| | | | | | | | | | | | | | | | | |

| Cyber Safety Metrics | | | | | | | | | |

| Three Months Ended (2) | | |

| September 29, 2023 (3) | | | | September 30, 2022 (3) | | | | |

| Direct customer revenues | $ | 837 | | | | | $ | 660 | | | | | |

| Partner revenues | $ | 95 | | | | | $ | 74 | | | | | |

| Total Cyber Safety revenues | $ | 932 | | | | | $ | 734 | | | | | |

| Legacy revenues | $ | 16 | | | | | $ | 14 | | | | | |

| | | | | | | | | |

| Direct customer count (at quarter end) | 38.5 | | | | | 38.6 | | | | | |

| Direct average revenue per user (ARPU) | $ | 7.28 | | | | | $ | 6.98 | | | | | |

| | | | | | | | | |

(1) Calculated using year ago foreign exchange rates.

(2) From time to time, changes in our product hierarchy cause changes to the revenue channels above. When changes occur, we recast historical amounts to match the current revenue channels. Direct revenues currently includes Mobile App Store customers, and legacy revenues includes revenues from products or solutions that are no longer in operations in exited markets, have been discontinued or identified to be discontinued, or remain in maintenance mode as a result of integration and product portfolio decisions. As such, the changes to historical revenue amounts and the other performance metrics, including direct customer count and ARPU, are reflected for all periods presented above.

(3) The performance metrics for the three months ended September 29, 2023 and September 30, 2022 include the revenues earned and customers acquired through our acquisition with Avast. ARPU is based on average customer count and assumes full quarter of revenue for both companies.

GEN DIGITAL INC.

Appendix A

Explanation of Non-GAAP Measures and Other Items

Objective of non-GAAP measures: We believe our presentation of non-GAAP financial measures, when taken together with corresponding GAAP financial measures, provides meaningful supplemental information regarding the Company’s operating performance for the reasons discussed below. Our management team uses these non-GAAP financial measures in assessing our performance, as well as in planning and forecasting future periods. Due to the importance of these measures in managing the business, we use non-GAAP measures in the evaluation of management’s compensation. These non-GAAP financial measures are not computed according to GAAP and the methods we use to compute them may differ from the methods used by other companies. Non-GAAP financial measures are supplemental and should not be considered a substitute for financial information presented in accordance with GAAP and should be read only in conjunction with our consolidated financial statements prepared in accordance with GAAP.

Stock-based compensation: This consists of expenses for employee restricted stock units, performance-based awards, stock options and our employee stock purchase plan, determined in accordance with GAAP. We evaluate our performance both with and without these measures because stock-based compensation is a non-cash expense and can vary significantly over time based on the timing, size, nature and design of the awards granted, and is influenced in part by certain factors that are generally beyond our control, such as the volatility of the market value of our common stock. In addition, for comparability purposes, we believe it is useful to provide a non-GAAP financial measure that excludes stock-based compensation to facilitate the comparison of our results to those of other companies in our industry.

Amortization of intangible assets: Amortization of intangible assets consists of amortization of acquisition-related intangibles assets such as developed technology, customer relationships and trade names acquired in connection with business combinations. We record charges relating to the amortization of these intangibles within both cost of revenues and operating expenses in our GAAP financial statements. Under purchase accounting, we are required to allocate a portion of the purchase price to intangible assets acquired and amortize this amount over the estimated useful lives of the acquired intangible assets. However, the purchase price allocated to these assets is not necessarily reflective of the cost we would incur to internally develop the intangible asset. Further, amortization charges for our acquired intangible assets are inconsistent in size and are significantly impacted by the timing and valuation of our acquisitions. We eliminate these charges from our non-GAAP operating results to facilitate an evaluation of our current operating performance and provide better comparability to our past operating performance.

Restructuring and other costs: Restructuring charges are costs associated with a formal restructuring plan and are primarily related to employee severance and benefit arrangements, contract termination costs, and assets write-offs, as well as other exit and disposal costs. Included in other exit and disposal costs are costs to exit and consolidate facilities in connection with restructuring events. We exclude restructuring and other costs from our non-GAAP results as we believe that these costs are incremental to core activities that arise in the ordinary course of our business and do not reflect our current operating performance, and that excluding these charges facilitates a more meaningful evaluation of our current operating performance and comparisons to our past operating performance.

Acquisition-related and integration costs: These represent the transaction and business integration costs related to significant acquisitions that are charged to operating expense in our GAAP financial statements. These costs include incremental expenses incurred to affect these business combinations such as advisory, legal, accounting, valuation, and other professional or consulting fees. We exclude these costs from our non-GAAP results as they have no direct correlation to the operation of our business, and because we believe that the non-GAAP financial measures excluding these costs provide meaningful supplemental information regarding the spending trends of our business. In addition, these costs vary, depending on the size and complexity of the acquisitions, and are not indicative of costs of future acquisitions.

Litigation costs: We may periodically incur charges or benefits related to litigation settlements, legal contingency accruals and third-party legal costs related to certain legal matters. We exclude these charges and benefits when associated with a significant matter because we do not believe they are reflective of ongoing business and operating results.

Non-cash interest expense and amortization of debt issuance costs: In accordance with GAAP, we separately account for the value of the conversion feature on our convertible notes as a debt discount that reflects our assumed non-convertible debt borrowing rates. We amortize the discount and debt issuance costs over the term of the related debt. We exclude the difference between the imputed interest expense, which includes the amortization of the conversion feature and of the issuance costs, and the coupon interest payments. We extinguished our remaining convertible debt on August 15, 2022. During fiscal 2023, we also started amortizing the debt issuance costs associated with our senior credit facilities, which were secured upon close of the Merger with Avast. We believe that excluding these costs provides meaningful supplemental information regarding the cash cost of our debt instruments and enhance investors’ ability to view the Company’s results from management’s perspective.

Gain (loss) on extinguishment of debt: We record gains or losses on extinguishment of debt. Gains or losses represent the difference between the fair value of the exchange consideration and the carrying value of the liability component of the debt at the date of extinguishment. We exclude the gain or loss on debt extinguishment in our non-GAAP results because they are not reflective of our ongoing business.

Gain (loss) on equity investments: We record gains or losses, unrealized and realized, on equity investments in privately-held companies. We exclude the net gains or losses because we do not believe they are reflective of our ongoing business.

Gain (loss) on sale of properties: We periodically recognize gains or losses from the disposition of land and buildings. We exclude such gains or losses because they are not reflective of our ongoing business and operating results.

Income tax effects and adjustments: We use a non-GAAP tax rate that excludes (1) the discrete impacts of changes in tax legislation, (2) most other significant discrete items, (3) unrealized gains or losses from remeasurement of a foreign currency denominated deferred

tax asset with no cash tax impact and (4) the income tax effects of the non-GAAP adjustment to our operating results described above. We believe making these adjustments facilitates a better evaluation of our current operating performance and comparisons to past operating results. Our tax rate is subject to change for a variety of reasons, such as significant changes in the geographic earnings mix due to acquisition and divestiture activities or fundamental tax law changes in major jurisdictions where we operate.

Diluted GAAP and non-GAAP weighted-average shares outstanding: Diluted GAAP and non-GAAP weighted-average shares outstanding are generally the same, except in periods when there is a GAAP loss from continuing operations. In accordance with GAAP, we do not present dilution for GAAP in periods in which there is a loss from continuing operations. However, if there is non-GAAP net income, we present dilution for non-GAAP weighted-average shares outstanding in an amount equal to the dilution that would have been presented had there been GAAP income from continuing operations for the period.

Bookings: Bookings are defined as customer orders received that are expected to generate net revenues in the future. We present the operational metric of bookings because it reflects customers' demand for our products and services and to assist readers in analyzing our performance in future periods.

Free cash flow: Free cash flow is defined as cash flows from operating activities less purchases of property and equipment. Free cash flow is not a measure of financial condition under GAAP and does not reflect our future contractual commitments and the total increase or decrease of our cash balance for a given period, and thus should not be considered as an alternative to cash flows from operating activities or as a measure of liquidity.

(Unlevered) Free cash flow: Free cash flow is defined as cash flows from operating activities less purchases of property and equipment. Unlevered free cash flow excludes cash interest expense payments. Free cash flow is not a measure of financial condition under GAAP and does not reflect our future contractual commitments and the total increase or decrease of our cash balance for a given period, and thus should not be considered as an alternative to cash flows from operating activities or as a measure of liquidity.

Constant currency adjusted revenues (Non-GAAP): Non-GAAP constant currency adjusted revenues are defined as revenues adjusted for the fair value of acquired contract liabilities and foreign exchange impact, calculated by translating current period revenue using the year ago currency conversion rate.

Direct customer count: Direct customers is a metric designed to represent active paid users of our products and solutions who have a direct billing and/or registration relationship with us at the end of the reported period. Average direct customer count presents the average of the total number of direct customers at the beginning and end of the applicable period. We exclude users on free trials from our direct customer count. Users who have indirectly purchased and/or registered for our products or solutions through partners are excluded unless such users convert or renew their subscription directly with us or sign up for a paid membership through our web stores or third-party app stores. While these numbers are based on what we believe to be reasonable estimates of our user base for the applicable period of measurement, there are inherent challenges in measuring usage of our products and solutions across brands, platforms, regions, and internal systems, and therefore, calculation methodologies may differ. The methodologies used to measure these metrics require judgment and are also susceptible to algorithms or other technical errors. We continually seek to improve our estimates of our user base, and these estimates are subject to change due to improvements or revisions to our methodology. From time to time, we review our metrics and may discover inaccuracies or make adjustments to improve their accuracy, which can result in adjustments to our historical metrics. Our ability to recalculate our historical metrics may be impacted by data limitations or other factors that require us to apply different methodologies for such adjustments. We generally do not intend to update previously disclosed metrics for any such inaccuracies or adjustments that are deemed not material.

Direct average revenues per user (ARPU): ARPU is calculated as estimated direct customer revenues for the period divided by the average direct customer count for the same period, expressed as a monthly figure. We monitor ARPU because it helps us understand the rate at which we are monetizing our consumer customer base.

Annual retention rate: Annual retention rate is defined as the number of direct customers who have more than a one-year tenure as of the end of the most recently completed fiscal period divided by the total number of direct customers as of the end of the period from one year ago. We monitor annual retention rate to evaluate the effectiveness of our strategies to improve renewals of subscriptions.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

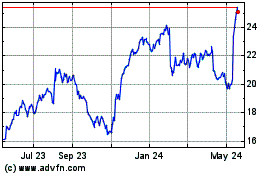

Gen Digital (NASDAQ:GEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

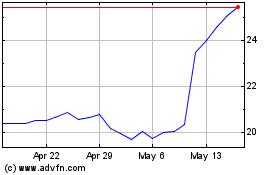

Gen Digital (NASDAQ:GEN)

Historical Stock Chart

From Apr 2023 to Apr 2024