- Revenue growth was 1% year-over-year; Organic revenue growth*

was 1%

- Net income margin was 9.7% versus 7.8% for the prior year;

Adjusted earnings before interest and taxes (EBIT) margin* was

16.3% versus 15.4%

- Diluted earnings per share (EPS) were $1.02 versus $0.83 for

the prior year; Adjusted EPS* was $1.14 versus $0.99

- Cash flow from operating activities was $742 million versus

$650 million for the prior year; Free cash flow* was $651 million

versus $570 million

- Company raises low end of full-year 2024 Adjusted EBIT margin*

and Adjusted EPS* guidance with continued execution; trending

toward the lower end of Organic revenue growth* range

GE HealthCare (Nasdaq: GEHC) today reported financial results

for the third quarter ended September 30, 2024.

GE HealthCare President and CEO Peter Arduini said, “In the

third quarter, we reported sales and orders growth of 1% globally.

Both sales and orders grew in the mid-single digits excluding

China, with particular strength in the U.S. across all segments.

Pharmaceutical Diagnostics also delivered solid performance, driven

by healthy procedure volumes. Ongoing lean initiatives across the

organization are delivering better value to patients and customers

and have resulted in robust margin expansion.”

Third quarter 2024 total company financial

performance

- Revenues of $4.9 billion increased 1% on both a reported and

Organic* basis year-over-year. Positive revenue growth in the U.S.

and in Pharmaceutical Diagnostics (PDx) was offset by continued

market softness in China.

- Total company book-to-bill was 1.04 times. Total company orders

increased 1% organically year-over-year.

- Net income attributable to GE HealthCare was $470 million

versus $375 million for the prior year, and Adjusted EBIT* was $795

million versus $744 million.

- Net income margin was 9.7% versus 7.8% for the prior year, up

190 basis points (bps). Adjusted EBIT margin* was 16.3% versus

15.4%, up 90 bps as both measures saw benefits from productivity

and price.

- Diluted EPS was $1.02 versus $0.83, up $0.20 from the prior

year. Adjusted EPS* was $1.14 versus $0.99, up $0.15 from the prior

year as both measures saw improved EBIT and lower tax expense.

- Cash flow from operating activities was $742 million, up $92

million year-over-year. Free cash flow* was $651 million, up $81

million year-over-year.

Third quarter 2024 segment financial performance

(Unaudited)

Effective July 1, 2024, Image Guided Therapies, previously part

of the Imaging segment, was realigned to the Ultrasound segment to

better match its clinical usage and realize stronger business and

customer impact by providing the right image guidance in the right

care setting. The Ultrasound segment was subsequently renamed

Advanced Visualization Solutions (AVS). Historical segment

financial information presented herein has been recast to conform

to the new reportable segments structure. The Company is providing

recast financial information for fiscal years 2022, 2023, and the

six months ended 2024 via a Form 8-K filed today with the U.S.

Securities and Exchange Commission.

Segment ($ in

millions)

Imaging

Advanced Visualization

Solutions

Patient Care Solutions

Pharmaceutical

Diagnostics

Segment Revenues

$2,229

$1,216

$779

$625

YoY % change

—%

—%

2%

6%

YoY % Organic* change

(1)%

—%

2%

7%

Segment EBIT

$287

$232

$82

$193

YoY % change

18%

(9)%

3%

16%

Segment EBIT Margin

12.9%

19.0%

10.6%

30.9%

YoY change

200 bps

(190) bps

10 bps

270 bps

YoY refers to year-over-year comparison on

a recast basis

Growth and innovation

Mr. Arduini continued, “The recent FDA approval of our Flyrcado™

(flurpiridaz F18) injection in the U.S. is an important moment in

molecular imaging as we continue to address unmet patient needs and

advance more precise, personalized care. Flyrcado is a

first-of-its-kind PET myocardial perfusion imaging (MPI) agent for

the detection of coronary artery disease. This milestone

achievement has the potential to expand clinical and patient access

to PET MPI.”

Recent innovation and commercial highlights

- GE HealthCare announces AI Innovation Lab showcasing five new

research projects

- GE HealthCare announces CareIntellect for Oncology, harnessing

AI to give clinicians an easy way to see the patient journey in a

single view

- GE HealthCare unveils its first CT scanner production line in

France and announces the installation of the first scanner made in

France at the Montargis Hospital Center

- A New Theranostics Center of Excellence in Europe: GE

HealthCare and University Medicine Essen collaborate to advance

Theranostics and personalized medicine

- GE HealthCare takes key role in new consortium to revolutionize

cancer care, advancing precision medicine for patients in

Europe

- GE HealthCare’s MIM Software announces FDA clearance of Monte

Carlo dosimetry for Theranostics

- GE HealthCare announces FDA approval of Flyrcado injection PET

radiotracer for enhanced diagnosis of coronary artery disease

- GE HealthCare showcases the latest AI-enhanced radiation

therapy solutions at ASTRO 2024

- GE HealthCare introduces elevated Venue point of care

ultrasound solutions and new tablet-based Venue Sprint

- GE HealthCare’s MIM Software announces FDA Clearance of new

Centiloid scaling tool to quantify amyloid plaque in brain

imaging

- Clinical study shows targeted End-tidal Control Anesthesia

Delivery improves efficiency and accuracy to help optimize patient

care

2024 Guidance

Today, the Company updates full-year 2024 guidance as

follows:

- Organic revenue growth* trending toward the lower end of the

range of 1% to 2% year-over-year, given the continued China market

softness

- Adjusted EBIT margin* in the range of 15.8% to 16.0%,

reflecting an expansion of 70 to 90 basis points versus 2023

Adjusted EBIT margin* of 15.1%; this compares to prior guidance of

15.7% to 16.0%

- Adjusted effective tax rate (ETR)* trending toward the lower

end of the 23% to 25% range, given additional tax incentives

recognized in third quarter 2024

- Adjusted EPS* in the range of $4.25 to $4.35, representing 8%

to 11% growth versus Adjusted EPS* of $3.93 for 2023; this compares

with prior range of $4.20 to $4.35

- Free cash flow* of approximately $1.8 billion

The Company provides its outlook on a non-GAAP basis. Refer to

the Non-GAAP Financial Measures in Outlook section below for more

details.

Financial rounding

Certain columns and rows in this document may not sum due to the

use of rounded numbers. Percentages presented are calculated from

the underlying whole-dollar amounts.

Condensed Consolidated Statements of

Income (Unaudited)

For the three months ended

September 30

For the nine months ended

September 30

(In millions, except per share

amounts)

2024

2023

2024

2023

Sales of products

$

3,201

$

3,186

$

9,454

$

9,530

Sales of services

1,662

1,636

4,899

4,816

Total revenues

4,863

4,822

14,353

14,346

Cost of products

2,033

2,076

6,045

6,197

Cost of services

805

811

2,378

2,383

Gross profit

2,026

1,935

5,930

5,766

Selling, general, and administrative

1,034

996

3,139

3,130

Research and development

316

322

967

890

Total operating expenses

1,350

1,318

4,106

4,020

Operating income

676

617

1,824

1,746

Interest and other financial charges –

net

130

138

383

411

Non-operating benefit (income) costs

(102

)

(94

)

(306

)

(332

)

Other (income) expense – net

(9

)

(63

)

(1

)

(85

)

Income from continuing operations

before income taxes

658

636

1,747

1,752

Benefit (provision) for income taxes

(168

)

(250

)

(435

)

(550

)

Net income from continuing

operations

490

386

1,312

1,202

Income (loss) from discontinued

operations, net of taxes

—

(4

)

—

(4

)

Net income

490

382

1,312

1,198

Net (income) loss attributable to

noncontrolling interests

(19

)

(7

)

(40

)

(33

)

Net income attributable to GE

HealthCare

470

375

1,272

1,165

Deemed preferred stock dividend of

redeemable noncontrolling interest

—

—

—

(183

)

Net income attributable to GE

HealthCare common stockholders

$

470

$

375

$

1,272

$

982

Earnings per share from continuing

operations attributable to GE HealthCare common

stockholders:

Basic

$

1.03

$

0.83

$

2.79

$

2.17

Diluted

1.02

0.83

2.77

2.16

Earnings per share attributable to GE

HealthCare common stockholders:

Basic

$

1.03

$

0.82

$

2.79

$

2.16

Diluted

1.02

0.82

2.77

2.15

Weighted-average number of shares

outstanding:

Basic

457

455

456

455

Diluted

459

458

459

458

Condensed Consolidated Statements of

Financial Position (Unaudited)

As of

(In millions, except share and per

share amounts)

September 30, 2024

December 31, 2023

Cash, cash equivalents, and restricted

cash

$

3,568

$

2,504

Receivables – net of allowances of $104

and $98

3,418

3,525

Due from related parties

6

32

Inventories

2,124

1,960

Contract and other deferred assets

1,046

1,000

All other current assets

476

389

Current assets

10,638

9,410

Property, plant, and equipment – net

2,539

2,500

Goodwill

13,138

12,936

Other intangible assets – net

1,132

1,253

Deferred income taxes

4,309

4,474

All other non-current assets

2,098

1,881

Total assets

$

33,855

$

32,454

Short-term borrowings

$

1,007

$

1,006

Accounts payable

2,911

2,947

Due to related parties

7

99

Contract liabilities

1,915

1,918

Current compensation and benefits

1,422

1,518

All other current liabilities

1,409

1,493

Current liabilities

8,670

8,981

Long-term borrowings

9,306

8,436

Non-current compensation and benefits

5,388

5,782

Deferred income taxes

59

68

All other non-current liabilities

1,920

1,877

Total liabilities

25,343

25,144

Commitments and contingencies

Redeemable noncontrolling

interests

177

165

Common stock, par value $0.01 per share,

1,000,000,000 shares authorized, 457,144,443 shares issued as of

September 30, 2024; 455,342,290 shares issued as of December 31,

2023

5

5

Treasury stock, at cost, 291,053 shares as

of September 30, 2024 and 0 shares as of December 31, 2023

(25

)

—

Additional paid-in capital

6,551

6,493

Retained earnings

2,558

1,326

Accumulated other comprehensive income

(loss) – net

(771

)

(691

)

Total equity attributable to GE

HealthCare

8,317

7,133

Noncontrolling interests

18

12

Total equity

8,335

7,145

Total liabilities, redeemable

noncontrolling interests, and equity

$

33,855

$

32,454

Condensed Consolidated Statements of

Cash Flows (Unaudited)

For the nine months ended

September 30

(In millions)

2024

2023

Net income

$

1,312

$

1,198

Less: Income (loss) from discontinued

operations, net of taxes

—

(4

)

Net income from continuing

operations

$

1,312

$

1,202

Adjustments to reconcile Net income from

continuing operations to Cash from (used for) operating

activities

Depreciation of property, plant, and

equipment

203

188

Amortization of intangible assets

237

278

Gain on fair value remeasurement of

contingent consideration

(19

)

(17

)

Net periodic postretirement benefit plan

(income) expense

(271

)

(291

)

Postretirement plan contributions

(257

)

(259

)

Share-based compensation

92

81

Provision for income taxes

435

550

Cash paid during the year for income

taxes

(375

)

(375

)

Changes in operating assets and

liabilities, excluding the effects of acquisitions:

Receivables

83

(82

)

Due from related parties

24

9

Inventories

(157

)

(85

)

Contract and other deferred assets

(33

)

(75

)

Accounts payable

3

(93

)

Due to related parties

(72

)

(87

)

Contract liabilities

(25

)

69

Current compensation and benefits

(97

)

37

All other operating activities - net

(41

)

1

Cash from (used for) operating

activities – continuing operations

1,042

1,051

Cash flows – investing

activities

Additions to property, plant and equipment

and internal-use software

(299

)

(293

)

Dispositions of property, plant, and

equipment

—

1

Purchases of businesses, net of cash

acquired

(259

)

(147

)

Purchases of investments

(33

)

(21

)

All other investing activities - net

(83

)

(10

)

Cash from (used for) investing

activities – continuing operations

(674

)

(470

)

Cash flows – financing

activities

Net increase (decrease) in borrowings

(maturities of 90 days or less)

—

(9

)

Newly issued debt, net of debt issuance

costs (maturities longer than 90 days)

994

2,020

Repayments and other reductions

(maturities longer than 90 days)

(162

)

(9

)

Dividends paid to stockholders

(41

)

(28

)

Redemption of noncontrolling interests

—

(211

)

Net transfers (to) from GE

—

(1,317

)

Proceeds from stock issued under employee

benefit plans

31

31

Taxes paid related to net share settlement

of equity awards

(90

)

(31

)

All other financing activities - net

(28

)

(24

)

Cash from (used for) financing

activities – continuing operations

704

422

Cash from (used for) operating activities

– discontinued operations

(4

)

—

Effect of foreign currency rate changes on

cash, cash equivalents, and restricted cash

(2

)

(34

)

Increase (decrease) in cash, cash

equivalents, and restricted cash

1,066

969

Cash, cash equivalents, and restricted

cash at beginning of year

2,506

1,451

Cash, cash equivalents, and restricted

cash as of September 30

$

3,572

$

2,420

Supplemental disclosure of cash flows

information

Cash paid during the year for interest

$

(339

)

$

(318

)

Non-cash investing activities

Acquired but unpaid property, plant, and

equipment

$

72

$

80

Non-GAAP Financial Measures

The non-GAAP financial measures presented in this press release

are supplemental measures of GE HealthCare’s performance and its

liquidity that the Company believes will help investors understand

its financial condition, cash flows, and operating results, and

assess its future prospects. When read in conjunction with the

Company’s U.S. GAAP results, these non-GAAP financial measures

provide a baseline for analyzing trends in GE HealthCare’s

underlying businesses and can be used by management as one basis

for making financial, operational, and planning decisions.

Descriptions of the reported non-GAAP measures are included

below.

The Company reports Organic revenue and Organic revenue growth

rate to provide management and investors with additional

understanding and visibility into the underlying revenue trends of

the Company’s established, ongoing operations, as well as provide

insights into overall demand for its products and services. To

calculate these measures, the Company excludes the effect of

acquisitions, dispositions, and foreign currency rate

fluctuations.

The Company reports EBIT, Adjusted EBIT, Adjusted EBIT margin,

Adjusted net income, Adjusted net income margin, and Adjusted

earnings per share to provide management and investors with

additional understanding of its business by highlighting the

results from ongoing operations and the underlying profitability

factors, on a normalized basis. To calculate these measures the

Company excludes, and reflects in the detailed reconciliations

below, the following adjustments as applicable: Interest and other

financial charges - net, Net (income) loss attributable to

noncontrolling interests, Non-operating benefit (income) costs,

Benefit (provision) for income taxes and certain tax related

adjustments, and certain non-recurring and/or non-cash items. GE

HealthCare may from time to time consider excluding other

non-recurring items to enhance comparability between periods.

Adjusted EBIT margin and Adjusted net income margin are calculated

by taking Adjusted EBIT, or Adjusted net income, divided by Total

revenues for the same period.

The Company reports Adjusted tax expense and Adjusted effective

tax rate (“Adjusted ETR”) to provide investors with a better

understanding of the normalized tax rate applicable to the business

and provide more consistent comparability across periods. Adjusted

tax expense excludes the income tax related to the pre-tax income

adjustments included as part of Adjusted net income and certain

income tax adjustments, such as adjustments to deferred tax assets

or liabilities. The Company may from time to time consider

excluding other non-recurring tax items to enhance comparability

between periods. Adjusted ETR is Adjusted tax expense divided by

income before income taxes less the pre-tax income adjustments

referenced above.

The Company reports Free cash flow and Free cash flow conversion

to provide management and investors with an important measure of

the ability to generate cash on a normalized basis and provide

insight into the Company’s flexibility to allocate capital. Free

cash flow is Cash from (used for) operating activities - continuing

operations including cash flows related to the additions and

dispositions of property, plant, and equipment (“PP&E”) and

additions of internal-use software. Free cash flow does not

represent residual cash flows available for discretionary

expenditures, due to the fact that the measure does not deduct the

capital required for debt repayments. Free cash flow conversion is

calculated by taking Free cash flow divided by Adjusted net

income.

Management recognizes that these non-GAAP financial measures

have limitations, including that they may be calculated differently

by other companies or may be used under different circumstances or

for different purposes. In order to compensate for the discussed

limitations, management does not consider these measures in

isolation from or as alternatives to the comparable financial

measures determined in accordance with U.S. GAAP. The detailed

reconciliations of each non-GAAP financial measure to the most

directly comparable U.S. GAAP financial measure are provided below,

and no single financial measure should be relied on to evaluate our

business.

Non-GAAP Financial Reconciliations

Organic Revenue*

Unaudited

For the three months ended

September 30

For the nine months ended

September 30

($ in millions)

2024

2023

% change

2024

2023

% change

Imaging revenues

$

2,229

$

2,236

—

%

$

6,462

$

6,552

(1

)%

Less: Acquisitions(1)

16

—

29

—

Less: Dispositions(2)

—

—

—

—

Less: Foreign currency exchange

(8

)

—

(65

)

—

Imaging Organic revenue*

$

2,220

$

2,236

(1

)%

$

6,497

$

6,552

(1

)%

AVS revenues

$

1,216

$

1,214

—

%

$

3,692

$

3,712

(1

)%

Less: Acquisitions(1)

—

—

—

—

Less: Dispositions(2)

—

—

—

—

Less: Foreign currency exchange

(2

)

—

(22

)

—

AVS Organic revenue*

$

1,218

$

1,214

—

%

$

3,713

$

3,712

—

%

PCS revenues

$

779

$

764

2

%

$

2,298

$

2,315

(1

)%

Less: Acquisitions(1)

—

—

—

—

Less: Dispositions(2)

—

—

—

—

Less: Foreign currency exchange

—

—

(4

)

—

PCS Organic revenue*

$

779

$

764

2

%

$

2,302

$

2,315

(1

)%

PDx revenues

$

625

$

589

6

%

$

1,862

$

1,715

9

%

Less: Acquisitions(1)

—

—

—

—

Less: Dispositions(2)

—

—

—

—

Less: Foreign currency exchange

(5

)

—

(13

)

—

PDx Organic revenue*

$

630

$

589

7

%

$

1,876

$

1,715

9

%

Other revenues

$

15

$

19

(22

)%

$

39

$

52

(25

)%

Less: Acquisitions(1)

—

—

—

—

Less: Dispositions(2)

—

—

—

—

Less: Foreign currency exchange

—

—

—

—

Other Organic revenue*

$

15

$

19

(21

)%

$

39

$

52

(25

)%

Total revenues

$

4,863

$

4,822

1

%

$

14,353

$

14,346

—

%

Less: Acquisitions(1)

16

—

29

—

Less: Dispositions(2)

—

—

—

—

Less: Foreign currency exchange

(15

)

—

(104

)

—

Organic revenue*

$

4,863

$

4,822

1

%

$

14,427

$

14,346

1

%

(1)

Represents revenues attributable to

acquisitions from the date the Company completed the transaction

through the end of four quarters following the transaction.

(2)

Represents revenues attributable to

dispositions for the four quarters preceding the disposition

date.

Adjusted EBIT*

Unaudited

For the three months ended

September 30

For the nine months ended

September 30

($ in millions)

2024

2023

% change

2024

2023

% change

Net income attributable to GE

HealthCare

$

470

$

375

25

%

$

1,272

$

1,165

9

%

Add: Interest and other financial charges

– net

130

138

383

411

Add: Non-operating benefit (income)

costs

(102

)

(94

)

(306

)

(332

)

Less: Benefit (provision) for income

taxes

(168

)

(250

)

(435

)

(550

)

Less: Income (loss) from discontinued

operations, net of taxes

—

(4

)

—

(4

)

Less: Net (income) loss attributable to

noncontrolling interests

(19

)

(7

)

(40

)

(33

)

EBIT*

$

685

$

680

1

%

$

1,825

$

1,831

—

%

Add: Restructuring costs(1)

22

3

90

34

Add: Acquisition and disposition-related

charges (benefits)(2)

(4

)

(14

)

(7

)

(15

)

Add: Spin-Off and separation costs(3)

56

45

182

175

Add: (Gain) loss on business and asset

dispositions(4)

1

—

—

—

Add: Amortization of acquisition-related

intangible assets

34

32

100

95

Add: Investment revaluation (gain)

loss(5)

1

(2

)

26

(1

)

Adjusted EBIT*

$

795

$

744

7

%

$

2,217

$

2,119

5

%

Net income margin

9.7

%

7.8

%

190 bps

8.9

%

8.1

%

70 bps

Adjusted EBIT margin*

16.3

%

15.4

%

90 bps

15.4

%

14.8

%

70 bps

(1)

Consists of severance, facility closures,

and other charges associated with restructuring programs.

(2)

Consists of legal, consulting, and other

transaction and integration fees, and adjustments to contingent

consideration, as well as other purchase accounting related charges

and other costs directly related to the transactions.

(3)

Costs incurred in the Spin-Off and

separation from GE, including system implementations, audit and

advisory fees, legal entity separation, Founders Grant equity

awards, separation agreements with GE, and other one-time

costs.

(4)

Consists of gains and losses resulting

from the sale of assets and investments.

(5)

Primarily relates to valuation adjustments

for equity investments.

Adjusted Net Income*

Unaudited

For the three months ended

September 30

For the nine months ended

September 30

($ in millions)

2024

2023

% change

2024

2023

% change

Net income attributable to GE

HealthCare

$

470

$

375

25

%

$

1,272

$

1,165

9

%

Add: Non-operating benefit (income)

costs

(102

)

(94

)

(306

)

(332

)

Add: Restructuring costs(1)

22

3

90

34

Add: Acquisition and disposition-related

charges (benefits)(2)

(4

)

(14

)

(7

)

(15

)

Add: Spin-Off and separation costs(3)

56

45

182

175

Add: (Gain) loss on business and asset

dispositions(4)

1

—

—

—

Add: Amortization of acquisition-related

intangible assets

34

32

100

95

Add: Investment revaluation (gain)

loss(5)

1

(2

)

26

(1

)

Add: Tax effect of reconciling

items(6)

(3

)

(4

)

(26

)

(3

)

Add: Spin-Off and other tax

adjustments(7)

46

106

60

136

Less: Income (loss) from discontinued

operations, net of taxes

—

(4

)

—

(4

)

Adjusted net income*

$

521

$

451

16

%

$

1,393

$

1,258

11

%

Adjusted net income margin*

10.7

%

9.4

%

140 bps

9.7

%

8.8

%

90 bps

(1)

Consists of severance, facility closures,

and other charges associated with restructuring programs.

(2)

Consists of legal, consulting, and other

transaction and integration fees, and adjustments to contingent

consideration, as well as other purchase accounting related charges

and other costs directly related to the transactions.

(3)

Costs incurred in the Spin-Off and

separation from GE, including system implementations, audit and

advisory fees, legal entity separation, Founders Grant equity

awards, separation agreements with GE, and other one-time

costs.

(4)

Consists of gains and losses resulting

from the sale of assets and investments.

(5)

Primarily relates to valuation adjustments

for equity investments.

(6)

The tax effect of reconciling items is

calculated using the statutory tax rate, taking into consideration

the nature of the items and the relevant taxing jurisdiction.

(7)

Consists of certain income tax

adjustments, including the accrual of a deferred tax liability on

the prior period earnings of certain of the Company’s foreign

subsidiaries for which the Company is no longer permanently

reinvested, the impact of adjusting deferred tax assets and

liabilities to stand-alone GE HealthCare tax rates, and the impact

of tax legislation changes. As of the third quarter of 2024 this

line additionally includes discrete tax impacts resulting from the

Spin-Off and separation from GE previously reported under Tax

effect of reconciling items.

Adjusted Earnings Per Share*

Unaudited

For the three months ended

September 30

For the nine months ended

September 30

(In dollars, except shares outstanding

presented in millions)

2024

2023

$ change

2024

2023

$ change

Diluted earnings per share – continuing

operations

$

1.02

$

0.83

$

0.20

$

2.77

$

2.16

$

0.61

Add: Deemed preferred stock dividend of

redeemable noncontrolling interest

—

—

—

0.40

Add: Non-operating benefit (income)

costs

(0.22

)

(0.21

)

(0.67

)

(0.73

)

Add: Restructuring costs(1)

0.05

0.01

0.20

0.07

Add: Acquisition and disposition-related

charges (benefits)(2)

(0.01

)

(0.03

)

(0.02

)

(0.03

)

Add: Spin-Off and separation costs(3)

0.12

0.10

0.40

0.38

Add: (Gain) loss on business and asset

dispositions(4)

0.00

—

—

—

Add: Amortization of acquisition-related

intangible assets

0.08

0.07

0.22

0.21

Add: Investment revaluation (gain)

loss(5)

0.00

(0.00

)

0.06

(0.00

)

Add: Tax effect of reconciling

items(6)

(0.01

)

(0.01

)

(0.06

)

(0.01

)

Add: Spin-Off and other tax

adjustments(7)

0.10

0.23

0.13

0.30

Adjusted earnings per share*

$

1.14

$

0.99

$

0.15

$

3.04

$

2.75

$

0.29

Diluted weighted-average shares

outstanding

459

458

459

458

(1)

Consists of severance, facility closures,

and other charges associated with restructuring programs.

(2)

Consists of legal, consulting, and other

transaction and integration fees, and adjustments to contingent

consideration, as well as other purchase accounting related charges

and other costs directly related to the transactions.

(3)

Costs incurred in the Spin-Off and

separation from GE, including system implementations, audit and

advisory fees, legal entity separation, Founders Grant equity

awards, separation agreements with GE, and other one-time

costs.

(4)

Consists of gains and losses resulting

from the sale of assets and investments.

(5)

Primarily relates to valuation adjustments

for equity investments.

(6)

The tax effect of reconciling items is

calculated using the statutory tax rate, taking into consideration

the nature of the items and the relevant taxing jurisdiction.

(7)

Consists of certain income tax

adjustments, including the accrual of a deferred tax liability on

the prior period earnings of certain of the Company’s foreign

subsidiaries for which the Company is no longer permanently

reinvested, the impact of adjusting deferred tax assets and

liabilities to stand-alone GE HealthCare tax rates, and the impact

of tax legislation changes. As of the third quarter of 2024 this

line additionally includes discrete tax impacts resulting from the

Spin-Off and separation from GE previously reported under Tax

effect of reconciling items.

Adjusted Tax Expense* and Adjusted

ETR*

Unaudited

For the three months ended

September 30

For the nine months ended

September 30

($ in millions)

2024

2023

2024

2023

Benefit (provision) for income

taxes

$

(168

)

$

(250

)

$

(435

)

$

(550

)

Add: Tax effect of reconciling

items(1)

(3

)

(4

)

(26

)

(3

)

Add: Spin-Off and other tax

adjustments(2)

46

106

60

136

Adjusted tax expense*

$

(124

)

$

(148

)

$

(401

)

$

(417

)

Effective tax rate

25.5

%

39.3

%

24.9

%

31.4

%

Adjusted effective tax rate*

18.7

%

24.4

%

21.9

%

24.4

%

(1)

The tax effect of reconciling items is

calculated using the statutory tax rate, taking into consideration

the nature of the items and the relevant taxing jurisdiction.

(2)

Consists of certain income tax

adjustments, including the accrual of a deferred tax liability on

the prior period earnings of certain of the Company’s foreign

subsidiaries for which the Company is no longer permanently

reinvested, the impact of adjusting deferred tax assets and

liabilities to stand-alone GE HealthCare tax rates, and the impact

of tax legislation changes. As of the third quarter of 2024 this

line additionally includes discrete tax impacts resulting from the

Spin-Off and separation from GE previously reported under Tax

effect of reconciling items.

Free Cash Flow*

Unaudited

For the three months ended

September 30

For the nine months ended

September 30

($ in millions)

2024

2023

% change

2024

2023

% change

Cash from (used for) operating

activities – continuing operations

$

742

$

650

14

%

$

1,042

$

1,051

(1

)%

Add: Additions to PP&E and

internal-use software

(90

)

(80

)

(299

)

(293

)

Add: Dispositions of PP&E

—

—

—

1

Free cash flow*

$

651

$

570

14

%

$

743

$

759

(2

)%

Non-GAAP Financial Measures in Outlook

GE HealthCare calculates forward-looking non-GAAP financial

measures, including Organic revenue growth, Adjusted EBIT margin,

Adjusted ETR, Adjusted EPS, and Free cash flow based on internal

forecasts that omit certain amounts that would be included in GAAP

financial measures. GE HealthCare does not provide reconciliations

of these forward-looking non-GAAP financial measures to the

respective GAAP metrics as it is unable to predict with reasonable

certainty and without unreasonable effort certain items such as the

impact of changes in currency exchange rates, impacts associated

with business acquisitions or dispositions, timing and magnitude of

restructuring activities, and revaluation of strategic investments,

amongst other items. The timing and amounts of these items are

uncertain and could have a substantial impact on GE HealthCare’s

results in accordance with GAAP.

Key Performance Indicators

Management uses the following metrics to provide a leading

indicator of current business demand from customers for products

and services.

- Organic orders growth: Rate of change period-over-period of

contractual commitments with customers to provide specified goods

or services for an agreed upon price, and excluding the effects of:

(1) recent acquisitions and dispositions with less than a full year

of comparable orders; and (2) foreign currency exchange rate

fluctuations in order to present orders on a constant currency

basis.

- Book-to-bill: Total orders divided by Total revenues within a

given financial period (e.g., quarter or FY).

Conference Call and Webcast Information

GE HealthCare will discuss its results during its live earnings

call today, October 30, 2024 at 8:30 am ET/7:30 am CT. The webcast

and accompanying slide presentation containing financial

information can be accessed by visiting the investor section of the

website at https://investor.gehealthcare.com/news-events/events. An

archived version of the webcast will be available on the website

after the call.

Forward-looking Statements

This release contains forward-looking statements. These

forward-looking statements might be identified by words, and

variations of words, such as “will,” “expect,” “may,” “would,”

“could,” “plan,” “believe,” “anticipate,” “intend,” “estimate,”

“potential,” “position,” “forecast,” “target,” “guidance,”

“outlook,” and similar expressions. These forward-looking

statements may include, but are not limited to, statements about

our business and expected financial performance, financial

condition, and results of operations, including revenue, revenue

growth, profit, taxes, earnings per share, and cash flows, and the

Company’s outlook; and the Company’s strategy, innovation, and

investments. These forward-looking statements involve risks and

uncertainties, many of which are beyond the Company’s control.

Factors that could cause the Company’s actual results to differ

materially from those described in its forward-looking statements

include, but are not limited to, operating in highly competitive

markets; the Company’s ability to successfully complete strategic

transactions; the actions or inactions of third parties with whom

the Company partners and the various collaboration, licensing, and

other partnerships and alliances the Company has with third

parties; demand for the Company’s products, services, or solutions

and factors that affect that demand; management of the Company’s

supply chain and the Company’s ability to cost-effectively secure

the materials it needs to operate its business; disruptions in the

Company’s operations; changes in third-party and government

reimbursement processes, rates, contractual relationships, and mix

of public and private payers, including related to government

shutdowns; the delayed China stimulus and the ongoing

anti-corruption campaign; the Company’s ability to attract and/or

retain key personnel and qualified employees; global geopolitical

and economic instability, including as a result of the conflict

between Ukraine and Russia, the conflict in the Middle East, and

the actions in the Red Sea region; public health crises, epidemics,

and pandemics and their effects on the Company’s business;

maintenance and protection of the Company’s intellectual property

rights, as well as maintenance of successful research and

development efforts with respect to commercially successful

products and technologies; the impact of potential information

technology, cybersecurity or data security breaches; compliance

with the various legal, regulatory, tax, privacy, and other laws to

which the Company is subject, such as the Foreign Corrupt Practices

Act and similar anti-corruption and anti-bribery laws globally, and

related changes, claims, inquiries, investigations, or actions; the

Company’s ability to control increases in healthcare costs and any

subsequent effect on demand for the Company’s products, services,

or solutions; the impacts related to the Company’s increasing focus

on and investment in cloud, edge, artificial intelligence, and

software offerings; the impact of potential product liability

claims; environmental, social, and governance matters; the

Company’s ability to operate effectively as an independent,

publicly-traded company; and the Company’s level of indebtedness,

as well as its general ability to comply with covenants under its

debt instruments and any related effect on the Company’s business.

Please also see the “Risk Factors” section of the Company’s Annual

Report on Form 10-K for the fiscal year ended December 31, 2023

filed with the U.S. Securities and Exchange Commission and any

updates or amendments it makes in future filings. There may be

other factors not presently known to the Company or which it

currently considers to be immaterial that could cause the Company’s

actual results to differ materially from those projected in any

forward-looking statements the Company makes. The Company does not

undertake any obligation to update or revise its forward-looking

statements except as required by applicable law or regulation.

About GE HealthCare Technologies Inc.

GE HealthCare is a leading global medical technology,

pharmaceutical diagnostics, and digital solutions innovator,

dedicated to providing integrated solutions, services, and data

analytics to make hospitals more efficient, clinicians more

effective, therapies more precise, and patients healthier and

happier. Serving patients and providers for more than 125 years, GE

HealthCare is advancing personalized, connected, and compassionate

care, while simplifying the patient’s journey across the care

pathway. Together our Imaging, Advanced Visualization Solutions,

Patient Care Solutions, and Pharmaceutical Diagnostics businesses

help improve patient care from diagnosis, to therapy, to

monitoring. We are a $19.6 billion business with approximately

51,000 colleagues working to create a world where healthcare has no

limits.

Follow us on LinkedIn, X, Facebook, Instagram, and Insights for

the latest news, or visit our website https://www.gehealthcare.com

for more information.

* Non-GAAP financial measure.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241029247090/en/

Investor Relations Contact: Carolynne Borders

+1-631-662-4317 carolynne.borders@gehealthcare.com

Media Contact: Jennifer Fox +1-414-530-3027

jennifer.r.fox@gehealthcare.com

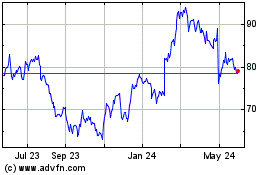

GE HealthCare Technologies (NASDAQ:GEHC)

Historical Stock Chart

From Oct 2024 to Nov 2024

GE HealthCare Technologies (NASDAQ:GEHC)

Historical Stock Chart

From Nov 2023 to Nov 2024