G-III Apparel Group, Ltd. (NasdaqGS: GIII) today reported results

for the third quarter of fiscal 2025 ended October 31, 2024.

Morris Goldfarb, G-III’s Chairman and Chief

Executive Officer, said, “I am very pleased with our strong third

quarter results, with earnings per diluted share exceeding our

expectations, driven by over 30% organic growth of our key owned

brands DKNY, Karl Lagerfeld, Donna Karan and Vilebrequin. The power

of our transforming business model is delivering margin expansion

and bottom-line outperformance. Our teams continue to demonstrate

strong execution despite a challenging consumer environment,

unseasonable weather and supply chain disruptions. As we have

progressed into the fourth quarter, we have experienced

strengthening sell-throughs across our brands, and our inventories

are well-positioned to support demand for the remaining holiday and

early Spring season.”

Mr. Goldfarb concluded, “Looking at the

remainder of the year, given our significant third quarter earnings

outperformance, we are once again raising our earnings per diluted

share guidance for fiscal 2025. Our proven track record of success

and our strong balance sheet give us ample flexibility to invest in

long-term opportunities to expand our business, while delivering on

our commitment to drive long-term sustainable growth and

shareholder value.”

Results of Operations

Third Quarter Fiscal 2025 Financial Results

Net sales for the third quarter

ended October 31, 2024 increased 1.8% to $1.09 billion compared to

$1.07 billion in the prior year’s third quarter.

Net income for the third

quarter ended October 31, 2024 was $114.8 million, or $2.55 per

diluted share, compared to $127.6 million, or $2.74 per diluted

share, in the prior year’s third quarter.

Non-GAAP net income per diluted

share was $2.59 for the third quarter ended October 31,

2024 compared to $2.78 in the same period last year. Non-GAAP net

income per diluted share excludes (i) in the third quarter of

fiscal 2025, a $1.6 million write-off of deferred financing costs

related to the redemption of our senior secured notes (the

“Notes”), (ii) in the third quarter of fiscal 2025, $0.5 million in

one-time severance expenses related to a closed warehouse, (iii) in

the third quarter of fiscal 2024, incentive compensation expenses

of $1.8 million related to the Karl Lagerfeld transaction, (iv) in

the third quarter of fiscal 2024, non-cash imputed interest expense

of $0.7 million related to the note issued to seller as part of the

consideration for the acquisition of Donna Karan International and

(v) in the third quarter of fiscal 2024, asset impairments of $0.2

million. The aggregate effect of these exclusions was equal to

$0.04 per diluted share in the third quarter of this year and $0.04

per diluted share in last year’s third quarter.

Balance Sheet as of Third Quarter Fiscal

2025

Inventories decreased 10% to

$532.5 million at the end of this year’s third quarter compared to

$591.5 million in the third quarter of last year.

Total debt decreased 52% to

$224.2 million at the end of this year’s third quarter compared to

$461.9 million in the third quarter of last year. In August 2024, a

$400.7 million payment was made to voluntarily redeem the entire

$400 million principal amount of the Notes at a redemption price

equal to 100% of the principal amount of the Notes plus accrued and

unpaid interest. The payment was made with cash on hand and

borrowings from the revolving credit facility.

Outlook

The Company today updated its outlook for the

fiscal year ending January 31, 2025. This outlook anticipates the

current macroeconomic and consumer environment, as well as the

unseasonable weather. The outlook further includes approximately

$55.0 million (prior approximately $60.0 million) in incremental

expenses, primarily associated with the launches of Donna Karan,

Nautica and Halston. Approximately 60% of these expenses are

related to marketing initiatives to support the Donna Karan and

DKNY brands. The remaining costs are principally related to talent

and technology to expand operational capabilities.

Fiscal 2025

Net sales are expected to

increase by approximately 2% to approximately $3.15 billion (prior

approximately $3.20 billion), compared to net sales of $3.10

billion for fiscal 2024.

Net income is expected to be

between $185.0 million and $190.0 million (prior $179.0 million and

$184.0 million), or diluted earnings per share between $4.08 and

$4.18 (prior $3.94 and $4.04). This compares to net income of

$176.2 million, or $3.75 per diluted share, for fiscal 2024.

Non-GAAP net income for fiscal

2025 is expected to be between $186.0 million and $191.0 million

(prior $180.0 and $185.0 million), or diluted earnings per share

between $4.10 and $4.20 (prior $3.95 and $4.05). This compares to

non-GAAP net income of $189.8 million, or diluted earnings per

share of $4.04 for fiscal 2024.

Adjusted EBITDA for fiscal 2025

is expected to be between $309.0 million and $314.0 million (prior

$305.0 million and $310.0 million) compared to adjusted EBITDA of

$324.1 million in fiscal 2024.

Net interest expense is

expected to be approximately $20.4 million, including a $1.6

million non-GAAP charge related to the write-off of deferred

financing costs associated with the redemption of the Notes.

We estimate a tax rate of 28.6% for fiscal

2025.

Non-GAAP Financial Measures

Reconciliations of GAAP net income to non-GAAP

net income, GAAP net income per diluted share to non-GAAP net

income per diluted share and GAAP net income to adjusted EBITDA are

presented in tables accompanying the financial statements included

in this release and provide useful information to evaluate the

Company’s operational performance. A description of the amounts

excluded on a non-GAAP basis are provided in conjunction with these

tables. Non-GAAP net income, non-GAAP net income per diluted share

and adjusted EBITDA should be evaluated in light of the Company’s

financial statements prepared in accordance with GAAP.

About G-III Apparel Group, Ltd.

G-III Apparel Group, Ltd., a global leader in

fashion with expertise in design, sourcing and marketing, owns and

licenses a portfolio of over 30 preeminent brands. The Company is

differentiated across unique brand propositions, product categories

and consumer touch points. G-III owns ten iconic brands including,

DKNY, Karl Lagerfeld, Donna Karan and Vilebrequin, and licenses

over 20 brands including Calvin Klein, Tommy Hilfiger, Nautica,

Halston, Converse and National Sports leagues, among others.

Statements concerning G-III's business outlook

or future economic performance, anticipated revenues, expenses or

other financial items; product introductions and plans and

objectives related thereto; and statements concerning assumptions

made or expectations as to any future events, conditions,

performance or other matters are "forward-looking statements" as

that term is defined under the federal securities laws.

Forward-looking statements are subject to risks, uncertainties and

factors which include, but are not limited to, risks related to the

reliance on licensed product, risks relating to G-III’s ability to

increase revenues from sales of its other products, new acquired

businesses or new license agreements as licenses for Calvin Klein

and Tommy Hilfiger product expire on a staggered basis, reliance on

foreign manufacturers, risks of doing business abroad, supply chain

disruptions, risks related to acts of terrorism and the effects of

war, the current economic and credit environment risks related to

our indebtedness, the nature of the apparel industry, including

changing customer demand and tastes, customer concentration,

seasonality, risks of operating a retail business, risks related to

G-III’s ability to reduce the losses incurred in its retail

operations, customer acceptance of new products, the impact of

competitive products and pricing, dependence on existing

management, possible disruption from acquisitions, the impact on

G-III’s business of the imposition of tariffs by the United States

government and business and general economic conditions, including

inflation and higher interest rates, as well as other risks

detailed in G-III's filings with the Securities and Exchange

Commission. G-III assumes no obligation to update the information

in this release.

|

G-III APPAREL GROUP, LTD. AND

SUBSIDIARIES(Nasdaq:

GIII)CONSOLIDATED STATEMENTS OF INCOME(In

thousands, except per share amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended October 31, |

|

Nine Months Ended October 31, |

|

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

1,086,759 |

|

|

$ |

1,067,110 |

|

|

$ |

2,341,261 |

|

|

$ |

2,333,460 |

|

|

Cost of goods sold |

|

|

654,628 |

|

|

|

633,697 |

|

|

|

1,374,363 |

|

|

|

1,373,594 |

|

|

Gross profit |

|

|

432,131 |

|

|

|

433,413 |

|

|

|

966,898 |

|

|

|

959,866 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses |

|

|

259,240 |

|

|

|

236,308 |

|

|

|

724,891 |

|

|

|

703,476 |

|

|

Depreciation and amortization |

|

|

6,556 |

|

|

|

6,595 |

|

|

|

20,704 |

|

|

|

19,130 |

|

|

Asset impairments |

|

|

— |

|

|

|

222 |

|

|

|

— |

|

|

|

222 |

|

|

Operating profit |

|

|

166,335 |

|

|

|

190,288 |

|

|

|

221,303 |

|

|

|

237,038 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (loss) |

|

|

942 |

|

|

|

(3,129 |

) |

|

|

(2,233 |

) |

|

|

(1,964 |

) |

|

Interest and financing charges, net |

|

|

(6,358 |

) |

|

|

(11,024 |

) |

|

|

(16,658 |

) |

|

|

(32,666 |

) |

|

Income before income taxes |

|

|

160,919 |

|

|

|

176,135 |

|

|

|

202,412 |

|

|

|

202,408 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax expense |

|

|

46,151 |

|

|

|

48,755 |

|

|

|

57,903 |

|

|

|

55,651 |

|

| Net

income |

|

|

114,768 |

|

|

|

127,380 |

|

|

|

144,509 |

|

|

|

146,757 |

|

|

Less: Loss attributable to noncontrolling interests |

|

|

— |

|

|

|

(260 |

) |

|

|

(273 |

) |

|

|

(557 |

) |

| Net

income attributable to G-III Apparel Group, Ltd. |

|

$ |

114,768 |

|

|

$ |

127,640 |

|

|

$ |

144,782 |

|

|

$ |

147,314 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

income attributable to G-III Apparel Group, Ltd. per common

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

2.62 |

|

|

$ |

2.79 |

|

|

$ |

3.24 |

|

|

$ |

3.21 |

|

|

Diluted |

|

$ |

2.55 |

|

|

$ |

2.74 |

|

|

$ |

3.17 |

|

|

$ |

3.13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

43,885 |

|

|

|

45,723 |

|

|

|

44,640 |

|

|

|

45,904 |

|

|

Diluted |

|

|

44,954 |

|

|

|

46,560 |

|

|

|

45,719 |

|

|

|

46,992 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selected Balance Sheet Data (in thousands): |

|

As of October 31, |

|

|

|

2024 |

|

2023 |

|

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

104,686 |

|

$ |

197,391 |

|

Working capital |

|

|

980,899 |

|

|

1,110,793 |

|

Inventories |

|

|

532,463 |

|

|

591,530 |

|

Total assets |

|

|

2,783,611 |

|

|

2,749,333 |

|

Total debt |

|

|

224,175 |

|

|

461,945 |

|

Operating lease liabilities |

|

|

302,313 |

|

|

239,419 |

|

Total stockholders' equity |

|

|

1,648,726 |

|

|

1,503,220 |

|

G-III APPAREL GROUP, LTD. AND

SUBSIDIARIESRECONCILIATION OF GAAP NET INCOME TO

NON-GAAP NET INCOME (In thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

October 31, 2024 |

|

October 31, 2023 |

|

October 31, 2024 |

|

October 31, 2023 |

|

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP net income attributable to G-III Apparel Group, Ltd. |

|

$ |

114,768 |

|

|

$ |

127,640 |

|

|

$ |

144,782 |

|

|

$ |

147,314 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Excluded from non-GAAP: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Write-off of deferred financing costs |

|

|

1,598 |

|

|

|

— |

|

|

|

1,598 |

|

|

|

— |

|

|

One-time warehouse related severance expenses |

|

|

530 |

|

|

|

— |

|

|

|

559 |

|

|

|

— |

|

|

Gain on forgiveness of liabilities |

|

|

— |

|

|

|

— |

|

|

|

(600 |

) |

|

|

— |

|

|

Expenses related to Karl Lagerfeld acquisition |

|

|

— |

|

|

|

1,847 |

|

|

|

— |

|

|

|

5,517 |

|

|

Non-cash imputed interest |

|

|

— |

|

|

|

682 |

|

|

|

— |

|

|

|

3,585 |

|

|

Asset impairments |

|

|

— |

|

|

|

222 |

|

|

|

|

|

|

222 |

|

|

Income tax impact of non-GAAP adjustments |

|

|

(610 |

) |

|

|

(761 |

) |

|

|

(446 |

) |

|

|

(2,563 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP net income attributable to G-III Apparel Group, Ltd., as

defined |

|

$ |

116,286 |

|

|

$ |

129,630 |

|

|

$ |

145,893 |

|

|

$ |

154,075 |

|

Non-GAAP net income is a “non-GAAP financial

measure” that excludes (i) in the third quarter of fiscal 2025, the

write-off of deferred financing costs related to the redemption of

the Notes, (ii) in the third quarter of fiscal 2025, one-time

severance expenses related to a closed warehouse, (iii) in the

second quarter of fiscal 2025, the gain on the forgiveness of

certain liabilities related to the acquisition of the minority

interest of our DKNY business in China that we did not already own,

(iv) in the third quarter of fiscal 2024, incentive compensation

expenses related to the Karl Lagerfeld transaction, (v) in the

third quarter of fiscal 2024, non-cash imputed interest expense and

(vi) in the third quarter of fiscal 2024, asset impairments. The

income tax impact of non-GAAP adjustments is calculated using the

effective tax rate for the period. Management believes that these

non-GAAP financial measures provide meaningful supplemental

information regarding our performance by excluding items that are

not indicative of our core business operating results. Management

uses these non-GAAP financial measures to assess our performance on

a comparative basis and believes that they are also useful to

investors to enable them to assess our performance on a comparative

basis across historical periods and facilitate comparisons of our

operating results to those of our competitors. The presentation of

this financial information is not intended to be considered in

isolation or as a substitute for, or superior to, the financial

information prepared and presented in accordance with GAAP.

|

G-III APPAREL GROUP, LTD. AND

SUBSIDIARIESRECONCILIATION OF GAAP NET INCOME PER

SHARE TO NON-GAAP NET INCOME PER SHARE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

October 31, 2024 |

|

October 31, 2023 |

|

October 31, 2024 |

|

October 31, 2023 |

|

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP diluted net income attributable to G-III Apparel Group, Ltd.

per common share |

|

$ |

2.55 |

|

|

$ |

2.74 |

|

|

$ |

3.17 |

|

|

$ |

3.13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Excluded from non-GAAP: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Write-off of deferred financing costs |

|

|

0.04 |

|

|

|

— |

|

|

|

0.03 |

|

|

|

— |

|

|

One-time warehouse related severance expenses |

|

|

0.01 |

|

|

|

— |

|

|

|

0.01 |

|

|

|

— |

|

|

Gain on forgiveness of liabilities |

|

|

— |

|

|

|

— |

|

|

|

(0.01 |

) |

|

|

— |

|

|

Expenses related to Karl Lagerfeld acquisition |

|

|

— |

|

|

|

0.04 |

|

|

|

— |

|

|

|

0.12 |

|

|

Non-cash imputed interest |

|

|

— |

|

|

|

0.01 |

|

|

|

— |

|

|

|

0.08 |

|

|

Asset impairments |

|

|

— |

|

|

|

0.01 |

|

|

|

— |

|

|

|

— |

|

|

Income tax impact of non-GAAP adjustments |

|

|

(0.01 |

) |

|

|

(0.02 |

) |

|

|

(0.01 |

) |

|

|

(0.05 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP diluted net income attributable to G-III Apparel Group,

Ltd. per common share, as defined |

|

$ |

2.59 |

|

|

$ |

2.78 |

|

|

$ |

3.19 |

|

|

$ |

3.28 |

|

Non-GAAP diluted net income per common share is

a “non-GAAP financial measure” that excludes (i) in the third

quarter of fiscal 2025, the write-off of deferred financing costs

related to the redemption of the Notes, (ii) in the third quarter

of fiscal 2025, one-time severance expenses related to a closed

warehouse, (iii) in the second quarter of fiscal 2025, the gain on

the forgiveness of certain liabilities related to the acquisition

of the minority interest of our DKNY business in China that we did

not already own, (iv) in the third quarter of fiscal 2024,

incentive compensation expenses related to the Karl Lagerfeld

transaction, (v) in the third quarter of fiscal 2024, non-cash

imputed interest expense and (vi) in the third quarter of fiscal

2024, asset impairments. The income tax impact of non-GAAP

adjustments is calculated using the effective tax rate for the

period. Management believes that these non-GAAP financial measures

provide meaningful supplemental information regarding our

performance by excluding items that are not indicative of our core

business operating results. Management uses these non-GAAP

financial measures to assess our performance on a comparative basis

and believes that they are also useful to investors to enable them

to assess our performance on a comparative basis across historical

periods and facilitate comparisons of our operating results to

those of our competitors. The presentation of this financial

information is not intended to be considered in isolation or as a

substitute for, or superior to, the financial information prepared

and presented in accordance with GAAP.

|

G-III APPAREL GROUP, LTD. AND

SUBSIDIARIESRECONCILIATION OF FORECASTED AND

ACTUAL NET INCOME TO FORECASTED AND ACTUAL ADJUSTED

EBITDA(In thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Forecasted Twelve |

|

Actual Twelve |

|

|

|

Three Months Ended |

|

Months Ending |

|

Months Ended |

|

|

|

October 31, 2024 |

|

October 31, 2023 |

|

January 31, 2025 |

|

January 31, 2024 |

|

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

income attributable to G-III Apparel Group, Ltd. |

|

$ |

114,768 |

|

$ |

127,640 |

|

$ |

185,000 - 190,000 |

|

$ |

176,168 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One-time warehouse related severance expenses |

|

|

530 |

|

|

— |

|

|

559 |

|

|

|

— |

|

|

Gain on forgiveness of liabilities |

|

|

— |

|

|

— |

|

|

(600 |

) |

|

|

— |

|

|

Asset impairments |

|

|

— |

|

|

222 |

|

|

— |

|

|

|

6,758 |

|

|

Expenses related to Karl Lagerfeld acquisition |

|

|

— |

|

|

1,847 |

|

|

— |

|

|

|

6,115 |

|

|

One-time expenses primarily related to our DKNY business in

China |

|

|

— |

|

|

— |

|

|

— |

|

|

|

3,138 |

|

|

Change in fair value of earnout liability |

|

|

— |

|

|

— |

|

|

— |

|

|

|

(1,041 |

) |

|

Depreciation and amortization |

|

|

6,556 |

|

|

6,595 |

|

|

29,000 |

|

|

|

27,523 |

|

|

Interest and financing charges, net |

|

|

6,358 |

|

|

11,024 |

|

|

20,000 |

|

|

|

39,595 |

|

|

Income tax expense |

|

|

46,151 |

|

|

48,755 |

|

|

75,041 |

|

|

|

65,859 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA, as defined |

|

$ |

174,363 |

|

$ |

196,083 |

|

$ |

309,000 - 314,000 |

|

$ |

324,115 |

|

Adjusted EBITDA is a “non-GAAP financial

measure” which represents earnings before depreciation and

amortization, interest and financing charges, net and income tax

expense and excludes in fiscal 2025, (i) one-time severance

expenses related to a closed warehouse, (ii) the gain on the

forgiveness of certain liabilities related to the acquisition of

the minority interest of our DKNY business in China that we did not

already own, and in fiscal 2024, (iii) asset impairments, (iv)

incentive compensation expenses related to the Karl Lagerfeld

transaction, (v) one-time expenses, primarily related to our DKNY

business in China and (vi) the gain recorded from the reduction of

the earnout liability related to our acquisition of Sonia Rykiel in

fiscal 2022. Adjusted EBITDA is being presented as a supplemental

disclosure because management believes that it is a common measure

of operating performance in the apparel industry. Adjusted EBITDA

should not be construed as an alternative to net income, as an

indicator of the Company’s operating performance, or as an

alternative to cash flows from operating activities as a measure of

the Company’s liquidity, as determined in accordance with GAAP.

|

G-III APPAREL GROUP, LTD. AND

SUBSIDIARIESRECONCILIATION OF FORECASTED AND

ACTUAL GAAP NET INCOME TO FORECASTED AND ACTUAL NON-GAAP NET

INCOME(In thousands) |

|

|

|

|

|

|

|

|

|

|

|

Forecasted Twelve |

|

Actual Twelve |

|

|

|

Months Ending |

|

Months Ended |

|

|

|

January 31, 2025 |

|

January 31, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

income attributable to G-III Apparel Group, Ltd. |

|

$ |

185,000 - 190,000 |

|

$ |

176,168 |

|

|

|

|

|

|

|

|

|

|

Excluded from non-GAAP: |

|

|

|

|

|

|

|

Write-off of deferred financing costs |

|

|

1,598 |

|

|

|

— |

|

|

One-time warehouse related severance expenses |

|

|

559 |

|

|

|

— |

|

|

Gain on forgiveness of liabilities |

|

|

(600 |

) |

|

|

— |

|

|

Asset impairments |

|

|

— |

|

|

|

6,758 |

|

|

Expenses related to Karl Lagerfeld acquisition |

|

|

— |

|

|

|

6,115 |

|

|

Non-cash imputed interest |

|

|

— |

|

|

|

3,798 |

|

|

One-time expenses primarily related to our DKNY business in

China |

|

|

— |

|

|

|

3,138 |

|

|

Change in fair value of earnout liability |

|

|

— |

|

|

|

(1,041 |

) |

|

Income tax impact of non-GAAP adjustments |

|

|

(557 |

) |

|

|

(5,137 |

) |

|

Non-GAAP net income attributable to G-III Apparel Group, Ltd., as

defined |

|

$ |

186,000 - 191,000 |

|

$ |

189,799 |

|

Non-GAAP net income is a “non-GAAP financial

measure” that excludes in fiscal 2025, (i) the write-off of

deferred financing costs related to the redemption of the Notes,

(ii) one-time severance expenses related to a closed warehouse,

(iii) the gain on the forgiveness of certain liabilities related to

the acquisition of the minority interest of our DKNY business in

China that we did not already own, and in fiscal 2024, (iii) asset

impairments, (iv) incentive compensation expenses related to the

Karl Lagerfeld transaction, (v) non-cash imputed interest expense,

(vi) one-time expenses, primarily related to our DKNY business in

China and (vii) the gain recorded from the reduction of the earnout

liability related to our acquisition of Sonia Rykiel in fiscal

2022. The income tax impact of non-GAAP adjustments is calculated

using an effective tax for the period. Management believes that

these non-GAAP financial measures provide meaningful supplemental

information regarding our performance by excluding items that are

not indicative of our core business operating results. Management

uses these non-GAAP financial measures to assess our performance on

a comparative basis and believes that they are also useful to

investors to enable them to assess our performance on a comparative

basis across historical periods and facilitate comparisons of our

operating results to those of our competitors. The presentation of

this financial information is not intended to be considered in

isolation or as a substitute for, or superior to, the financial

information prepared and presented in accordance with GAAP.

|

G-III APPAREL GROUP, LTD. AND

SUBSIDIARIESRECONCILIATION OF FORECASTED AND

ACTUAL GAAP NET INCOME PER SHARE TO FORECASTED AND ACTUAL NON-GAAP

NET INCOME PER SHARE |

|

|

|

|

|

|

|

|

|

|

|

Forecasted Twelve |

|

Actual Twelve |

|

|

|

Months Ending |

|

Months Ended |

|

|

|

January 31, 2025 |

|

January 31, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP diluted net income attributable to G-III Apparel Group, Ltd.

per common share |

|

$ |

4.08 - 4.18 |

|

$ |

3.75 |

|

|

|

|

|

|

|

|

|

|

Excluded from non-GAAP: |

|

|

|

|

|

|

|

Write-off of deferred financing costs |

|

|

0.04 |

|

|

|

— |

|

|

One-time warehouse related severance expenses |

|

|

0.01 |

|

|

|

— |

|

|

Gain on forgiveness of liabilities |

|

|

(0.01 |

) |

|

|

— |

|

|

Asset impairments |

|

|

— |

|

|

|

0.14 |

|

|

Expenses related to Karl Lagerfeld acquisition |

|

|

— |

|

|

|

0.13 |

|

|

Non-cash imputed interest |

|

|

— |

|

|

|

0.08 |

|

|

One-time expenses primarily related to our DKNY business in

China |

|

|

— |

|

|

|

0.07 |

|

|

Change in fair value of earnout liability |

|

|

— |

|

|

|

(0.02 |

) |

|

Income tax impact of non-GAAP adjustments |

|

|

(0.02 |

) |

|

|

(0.11 |

) |

|

Non-GAAP diluted net income attributable to G-III Apparel Group,

Ltd. per common share, as defined |

|

$ |

4.10 - 4.20 |

|

$ |

4.04 |

|

Non-GAAP diluted net income per common

share is a “non-GAAP financial measure” that excludes in fiscal

2025, (i) the write-off of deferred financing costs related to the

redemption of the Notes, (ii) one-time severance expenses related

to a closed warehouse, (iii) the gain on the forgiveness of certain

liabilities related to the acquisition of the minority interest of

our DKNY business in China that we did not already own, and in

fiscal 2024, (iii) asset impairments, (iv) incentive compensation

expenses related to the Karl Lagerfeld transaction, (v) non-cash

imputed interest expense, (vi) one-time expenses, primarily related

to our DKNY business in China and (vii) the gain recorded from the

reduction of the earnout liability related to our acquisition of

Sonia Rykiel in fiscal 2022. The income tax impact of non-GAAP

adjustments is calculated using an effective tax for the period.

Management believes that these non-GAAP financial measures provide

meaningful supplemental information regarding our performance by

excluding items that are not indicative of our core business

operating results. Management uses these non-GAAP financial

measures to assess our performance on a comparative basis and

believes that they are also useful to investors to enable them to

assess our performance on a comparative basis across historical

periods and facilitate comparisons of our operating results to

those of our competitors. The presentation of this financial

information is not intended to be considered in isolation or as a

substitute for, or superior to, the financial information prepared

and presented in accordance with GAAP.

G-III Apparel Group, Ltd.

Company Contact:Priya

TrivediSVP of Investor Relations and Treasurer(646) 473-5228

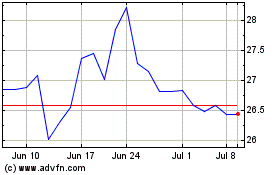

G III Apparel (NASDAQ:GIII)

Historical Stock Chart

From Dec 2024 to Jan 2025

G III Apparel (NASDAQ:GIII)

Historical Stock Chart

From Jan 2024 to Jan 2025