Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

April 08 2021 - 11:18AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of April 2021

Commission File Number: 000-29442

FORMULA SYSTEMS (1985) LTD.

(Translation of registrant’s name into English)

1 Yahadut Canada Street, Or Yehuda 6037501, Israel

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

CONTENTS

Israeli Private Placement of Additional Secured, Non-Convertible Debentures

On April 8, 2021, Formula Systems (1985) Ltd. (“Formula” or the “Company”) reported to the Israeli Securities Authority (the “ISA”) and the Tel Aviv Stock Exchange (the “TASE”) that it has entered into agreements with qualified investors in Israel for the private placement (the “Private Placement”) to those investors of an additional, aggregate 160 million New Israeli Shekels (“NIS”) principal amount of the Company’s non-convertible, secured Series C Debentures (the “Series C Debentures”), at a price of NIS 1,037 for each NIS 1,000 principal amount. The total aggregate gross proceeds to be received by the Company from the investors will be NIS 165.92 million.

The additional debentures will be sold by means of an increase in the outstanding principal amount of Series C Debentures, which series was initially offered publicly on March 28, 2019, under a shelf offering report pursuant to Formula’s Israeli shelf prospectus, dated March 25, 2019 (the “Shelf Offering Report”). As a result of the Private Placement, the total outstanding principal amount of the Series C Debentures will increase to approximately NIS 427 million. The Series C Debentures to be sold in the Private Placement will be subject to the terms of the Deed of Trust, entered into on March 28, 2019, by and between Formula, as the issuer of the debentures, and Reznick Paz Nevo Trusts Ltd., as trustee on behalf of the debenture holders.

The terms of the Series C Debentures to be sold in the Private Placement will be identical in all respects to those of the Series C Debentures sold in Formula’s March 2019 public offering under the Shelf Offering Report. The terms of Formula’s Series C Debentures were previously described in the Company’s Report of Foreign Private Issuer on Form 6-K (a “Form 6-K”) furnished to the Securities and Exchange Commission on April 1, 2019. The content of that Form 6-K is incorporated by reference herein:

https://www.sec.gov/Archives/edgar/data/1045986/000104598619000006/f6kreportingresultsofmarch20.htm

The consummation of the Private Placement is subject to the approval by the TASE of the listing, on the TASE, of the Series C Debentures to be sold, and final approval from Formula’s board of directors.

The Private Placement of additional Series C Debentures was not made to U.S. persons and has been made in an “overseas directed offering” in Israel pursuant to the exemption from registration under Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”).

Rating of Debentures

On April 8, 2021, Formula publicized rating reports published by Standard & Poor’s, Maalot Ltd. (“S&P”), with respect to Formula and its two-outstanding series of debentures. In those reports, S&P, which had previously rated the Company and its two series of debentures, assigned a rating of ilAA- for both series of debentures and a rating of ilA+/stable for the Company.

Important Note re: Debenture Offering and Related Disclosures

This Form 6-K is not an offer of securities for sale in the United States. Securities may not be offered or sold in the United States absent registration under the Securities Act or an exemption from the registration requirements thereunder. Any offering of Series A Debentures pursuant to the Private Placement will be made only in Israel to residents of Israel, will not be registered under the Securities Act and will not be offered or sold in the United States or to U.S. persons (as defined in Rule 902(k) under the Securities Act), except pursuant to an applicable exemption from registration under the Securities Act.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

FORMULA SYSTEMS (1985) LTD.

|

|

|

|

|

|

|

|

Date: April 8, 2021

|

By:

|

/s/ Asaf Berenstin

|

|

|

|

|

Asaf Berenstin

|

|

|

|

|

Chief Financial Officer

|

|

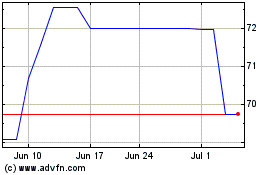

Formula Systems 1985 (NASDAQ:FORTY)

Historical Stock Chart

From Dec 2024 to Jan 2025

Formula Systems 1985 (NASDAQ:FORTY)

Historical Stock Chart

From Jan 2024 to Jan 2025