Formula Systems (1985) Ltd. (NASDAQ: FORTY), a global information

technology holding company engaged, through its subsidiaries and

affiliates, in providing software consulting services and

computer-based business solutions and developing proprietary

software products, today announced its results for the fourth

quarter and full year ended December 31, 2020.

Financial Highlights for the Fourth Quarter Ended

December 31, 2020

- Consolidated revenues for the fourth quarter increased by 21.2%

to a record breaking $543.2 million. Revenues for the fourth

quarter ended December 31, 2019 amounted to $448.2 million.

- Consolidated operating income for the fourth quarter increased

by 23.4% to a record breaking $45.8 million, with growth recorded

across Formula’s entire investment portfolio. Consolidated

operating income for the fourth quarter ended December 31, 2019

amounted to $37.1 million.

- Consolidated net income attributable to Formula’s shareholders

for the fourth quarter increased by 19.1% to $11.9 million, or

$0.76 per fully diluted share, compared to $10.0 million, or $0.64

per fully diluted share, for the fourth quarter ended December 31,

2019.

Financial Highlights for the Year Ended December 31,

2020

- Consolidated revenues for the year increased by 13.7% to a

record breaking $1,933.9 million, with growth recorded across

Formula’s entire investment portfolio. Revenues for the year ended

December 31, 2019 amounted to $1,701.1 million.

- Consolidated operating income for the year increased by 23.2%

to a record breaking $170.6 million, with growth recorded across

Formula’s entire investment portfolio. Consolidated operating

income for the year ended December 31, 2019 amounted to $138.5

million.

- Consolidated net income attributable to Formula’s shareholders

for the year was $46.8 million, or $3.01 per fully diluted share,

compared to $38.8 million, or $2.44 per fully diluted share in the

year ended December 31, 2019, reflecting an increase of 20.5% year

over year.

- As of December 31, 2020, Formula held 49.3%, 44.0%, 45.5%,

100%, 50%, 90.09% and 80% of the outstanding ordinary shares of

Matrix IT Ltd., Sapiens International Corporation N.V, Magic

Software Enterprises Ltd., Michpal Micro Computers (1983) Ltd., TSG

IT Advanced Systems Ltd., Insync Staffing Solutions, Inc., and Ofek

Aerial Photography Ltd., respectively.

- Consolidated cash and cash equivalents, bank deposits and

investments in marketable securities totaled approximately $533.2

million as of December 31, 2020, compared to $405.2 million as of

December 31, 2019.

- Total equity as of December 31, 2020 was $ 1,107.5 million

(representing 43.9% of the total consolidated balance sheet),

compared to $896.3 million (representing 42.9% of the total

consolidated balance sheet) as of December 31, 2019.

Debentures Covenants

As of December 31, 2020, Formula was in compliance with all of

its financial covenants under the debenture series issued by

Formula, based on the following achievements:

Covenant 1

- Target equity attributable to Formula’s shareholders (excluding

non-controlling interests): above $215 million.

- Actual equity attributable to Formula’s shareholders is equal

to $502.7 million.

Covenant 2

- Target ratio of net financial indebtedness to net

capitalization (in each case, as defined under the indenture for

Formula’s Series A and C Secured Debentures): below 65%.

- Actual ratio of net financial indebtedness to net

capitalization is equal to 1.1%.

Covenant 3

- Target ratio of net financial indebtedness to EBITDA (based on

the accumulated calculation for the four recent quarters): below

5.

- Actual ratio of net financial indebtedness to EBITDA (based on

the accumulated calculation for the four recent quarters) is equal

to 0.046.

Comments of Management

Commenting on the results, Guy Bernstein, CEO of

Formula Systems, said: “We are very pleased to conclude 2020 on a

high note across our entire investment portfolio reaching an

all-time record across all of our key indices (revenues, operating

income, EBITDA and net income), overcoming multiple challenges

introduced by COVID-19 pandemic and quickly and productively

adjusting to the new work environment. We enter into 2021 with a

strong momentum and plan to continue our efforts across our entire

portfolio to adhere our core values of innovation, professionalism,

agility and transparency which allow us to continue our growth and

preserve our leading position.”

“Matrix managed to quickly overcome the

challenges and adjust to the “New Normal” introduced by the

COVID-19 global pandemic and managed to finish 2020 as a

record-breaking year across all financial indices. Among the

adjustments were the transition to a hybrid work model and

significantly increase the company’s scope of operations in all

high-demand technology sectors. We are pleased with Matrix

continued recognition as a market leader in the implementation of

fastest-growing technologies, such as: cloud, cyber, digital, data,

AI and machine learning, which enables the company to create

significant value for its customers in managing, streamlining,

accelerating, and making their businesses thrive. Matrix is

positioned as the preferred technology partner in the Israeli

market for 15 years in a row. Looking forward and witnessing the

increasing demand for digital services, cloud services,

infrastructure, computing, and data analytics, Matrix intends to

expand and recruit more quality personnel to fill the many

positions required in these areas in order to continue to lead the

innovation in Israel’s IT industry and maintain the position of a

market leader.”

“Sapiens finished 2020 on a strong note, despite

the multiple challenges introduced by the COVID-19 pandemic, with

record fourth quarter Non-GAAP revenues crossing the $100

million-dollar-mark, coming in at $103 million, 19% higher than

last year and strong Non-GAAP operating margin of 18.1%, improving

by 164 basis points, compared to the same period last year. For the

full year of 2020 Non-GAAP revenue increased by 18% to $384 million

and Non-GAAP operating margin of 17.7%. The results demonstrate how

well Sapiens is executing its proven “Land and Expand” strategy,

which enables it to grow in the highly regulated and regionally

diverse global insurance markets and validate its operating

leverage. In addition, Sapiens continues to preserve its position

as a one-stop-shop in P&C and Life with its hundreds of

customers, along with offering complimentary and digital solutions.

Sapiens enters into 2021 with a strong momentum, a solid balance

sheet and plans to leverage its recent acquisitions.”

“Magic also finished 2020 on a strong note with

record breaking revenues of $104.6 million for the fourth quarter,

reflecting 15% increase from the same period last year and

exceeding the 100 million-dollar-mark for the first time. For the

full year of 2020, Magic’s revenues increased 14% year over year to

$371 million and non-GAAP operating income increased 20% year over

year to $53 million. The company’s results of operations for the

year demonstrate its ability to manage the business and execute on

its strategy during uncertain times introduced by the COVID-19

global pandemic while keeping its employees safe and

productive.”

“Michpal group continues to realize synergies

and monetize on its business model with its revenues also fueled by

the acquisition of Unique Software Enterprises Ltd. concluded in

November 2019 and Liram Financial Software Ltd., concluded in May

2020. Michpal Group is well positioned to continue helping its

customers to adjust to the ever-changing governmental labor

guidelines which are introduced in light of the COVID-19

pandemic.”

“TSG (held jointly by Formula and Israel

Aerospace Industries) also finished the year on a high note,

signing a new multi-million-dollar G2G agreement with a law

enforcement agency in South East Asia. TSG will deliver a

multi-sensory and multidisciplinary system which would include and

integrate a Command & Control system, for the use of the entire

organization. In addition, during 2020 TSG had the opportunity to

put to good use its proven AI development capabilities developed

for the defense sector in order to predict Hospital respiratory

deterioration of Covid-19 infected patients. The system was

integrated in the Beilinson Hospital in Israel and generated

impressive results. This is another perfect example of TSG’s

capability to monetize on long term capabilities dedicated to the

defense sector in the private sector.”

Stand-Alone Financial

Measures

This press release presents, further below,

certain stand-alone financial measures to reflect Formula’s

stand-alone financial position in reference to its assets and

liabilities as the parent company of the group. These financial

measures are prepared consistent with the accounting principles

applied in the consolidated financial statements of the group. Such

measures include investments in subsidiaries and a jointly

controlled entity measured at cost adjusted by Formula’s share in

the investees’ accumulated undistributed earnings and other

comprehensive income or loss.

Formula believes that these financial measures

provide useful information to management and investors regarding

Formula’s stand-alone financial position. Formula’s management uses

these measures to compare the Company’s performance to that of

prior periods for trend analyses. These measures are also used in

financial reports prepared for management and in quarterly

financial reports presented to the Company’s board of directors.

The Company believes that the use of these stand-alone financial

measures provides an additional tool for investors to use in

evaluating Formula’s financial position.

Management of the Company does not consider

these stand-alone measures in isolation or as an alternative to

financial measures determined in accordance with GAAP. Formula

urges investors to review the consolidated financial statements

which it includes in press releases announcing quarterly financial

results, including this press release, and not to rely on any

single financial measure to evaluate the Company’s business or

financial position.

About Formula

Formula Systems, whose ordinary shares are

traded on the Tel-Aviv Stock Exchange and ADSs are traded on the

NASDAQ Global Select Market, is a global information technology

holding company engaged, through its subsidiaries and affiliates,

in providing software consulting services and computer-based

business solutions and developing proprietary software

products.

For more information, visit

www.formulasystems.com.

Press Contact:

Formula Systems (1985)

Ltd.+972-3-5389487ir@formula.co.il

Except for any historical information contained

herein, matters discussed in this press release might include

forward-looking statements that involve a number of risks and

uncertainties. Regarding any financial statements, actual results

might vary significantly based upon a number of factors including,

but not limited to, risks in product and technology development,

market acceptance of new products and continuing product

conditions, both locally and abroad, release and sales of new

products by strategic resellers and customers, and other risk

factors detailed in Formula’s most recent annual report and other

filings with the Securities and Exchange Commission. These

forward-looking statements are made only as of the date hereof, and

the Company undertakes no obligation to update or revise the

forward-looking statements, whether as a result of new information,

future events or otherwise. In addition, there is uncertainty about

the spread of the COVID19 pandemic virus and the impact

it will have on the Company’s operations, the demand for Company’s

products, global supply chains and economic activity in general.

These and other risks and uncertainties are detailed in the

Company’s Securities and Exchange Commission

filings.

FORMULA SYSTEMS (1985) LTD.CONSOLIDATED

CONDENSED STATEMENTS OF PROFIT OR LOSSU.S. dollars

in thousands (except per share data)

|

|

|

Three months ended |

|

|

Year ended |

|

|

|

|

December 31, |

|

|

December 31, |

|

|

|

|

2020 |

|

|

2019 |

|

|

2020 |

|

|

2019 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Unaudited |

|

|

Unaudited |

|

|

|

|

|

Revenues |

|

|

543,240 |

|

|

|

448,205 |

|

|

|

1,933,918 |

|

|

|

1,701,115 |

|

| Cost of revenues |

|

|

418,264 |

|

|

|

344,224 |

|

|

|

1,486,485 |

|

|

|

1,315,066 |

|

| Gross

profit |

|

|

124,976 |

|

|

|

103,981 |

|

|

|

447,433 |

|

|

|

386,049 |

|

| Research and development

costs, net |

|

|

14,220 |

|

|

|

12,439 |

|

|

|

52,604 |

|

|

|

46,690 |

|

| Selling, marketing and general

and administrative expenses |

|

|

64,989 |

|

|

|

54,468 |

|

|

|

224,188 |

|

|

|

200,870 |

|

| Operating

income |

|

|

45,767 |

|

|

|

37,074 |

|

|

|

170,641 |

|

|

|

138,489 |

|

| Financial expenses, net |

|

|

10,723 |

|

|

|

6,147 |

|

|

|

26,885 |

|

|

|

18,652 |

|

| Income before taxes on

income |

|

|

35,044 |

|

|

|

30,927 |

|

|

|

143,756 |

|

|

|

119,837 |

|

| Taxes on income |

|

|

6,754 |

|

|

|

6,726 |

|

|

|

31,268 |

|

|

|

27,201 |

|

| Income after

taxes |

|

|

28,290 |

|

|

|

24,201 |

|

|

|

112,488 |

|

|

|

92,636 |

|

| Share of profit of companies

accounted for at equity, net |

|

|

1,200 |

|

|

|

272 |

|

|

|

1,535 |

|

|

|

1,787 |

|

| Net

income |

|

|

29,490 |

|

|

|

24,473 |

|

|

|

114,023 |

|

|

|

94,423 |

|

| Net income attributable to

non-controlling interests |

|

|

17,597 |

|

|

|

14,489 |

|

|

|

67,247 |

|

|

|

55,603 |

|

| Net income

attributable to Formula Systems’ shareholders |

|

|

11,893 |

|

|

|

9,984 |

|

|

|

46,776 |

|

|

|

38,820 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share

(basic) |

|

|

0.77 |

|

|

|

0.65 |

|

|

|

3.05 |

|

|

|

2.56 |

|

| Earnings per share

(diluted) |

|

|

0.76 |

|

|

|

0.64 |

|

|

|

3.01 |

|

|

|

2.44 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of shares used in computing earnings per share (basic) |

|

|

15,288,017 |

|

|

|

15,282,600 |

|

|

|

15,286,142 |

|

|

|

15,189,758 |

|

|

Number of shares used in computing earnings per share

(diluted) |

|

|

15,293,138 |

|

|

|

15,291,360 |

|

|

|

15,292,450 |

|

|

|

15,340,867 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORMULA SYSTEMS (1985) LTD.CONSOLIDATED

STATEMENTS OF FINANCIAL POSITIONU.S. dollars in

thousands

|

|

|

December 31, |

|

|

December 31, |

|

|

|

|

2020 |

|

|

2019 |

|

|

|

|

(Unaudited) |

|

|

|

|

| ASSETS |

|

|

|

|

|

|

| CURRENT

ASSETS: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

501,626 |

|

|

|

368,666 |

|

|

Short-term deposits |

|

|

30,289 |

|

|

|

29,886 |

|

|

Marketable securities |

|

|

1,238 |

|

|

|

6,600 |

|

|

Trade receivables |

|

|

520,144 |

|

|

|

486,007 |

|

|

Other accounts receivable and prepaid expenses |

|

|

83,610 |

|

|

|

65,709 |

|

|

Inventories |

|

|

23,988 |

|

|

|

8,636 |

|

| Total current

assets |

|

|

1,160,895 |

|

|

|

965,504 |

|

| |

|

|

|

|

|

|

|

|

| LONG-TERM

ASSETS: |

|

|

|

|

|

|

|

|

|

Deferred taxes |

|

|

39,890 |

|

|

|

38,865 |

|

|

Other long-term accounts receivable and prepaid expenses |

|

|

22,703 |

|

|

|

22,205 |

|

| Total long-term

assets |

|

|

62,593 |

|

|

|

61,070 |

|

| |

|

|

|

|

|

|

|

|

|

INVESTMENTS IN COMPANIES ACCOUNTED FOR AT EQUITY

METHOD |

|

|

28,478 |

|

|

|

26,021 |

|

| |

|

|

|

|

|

|

|

|

| PROPERTY, PLANTS AND

EQUIPMENT, NET |

|

|

59,559 |

|

|

|

43,059 |

|

| |

|

|

|

|

|

|

|

|

| OPERATING LEASE

RIGHT-OF-USE ASSETS |

|

|

114,414 |

|

|

|

104,130 |

|

| |

|

|

|

|

|

|

|

|

| NET INTANGIBLE ASSETS

AND GOODWILL |

|

|

1,094,073 |

|

|

|

889,473 |

|

| |

|

|

|

|

|

|

|

|

| TOTAL

ASSETS |

|

|

2,520,012 |

|

|

|

2,089,257 |

|

| |

|

|

|

|

|

|

|

|

| CURRENT

LIABILITIES: |

|

|

|

|

|

|

|

|

|

Loans and credit from banks and others |

|

|

120,444 |

|

|

|

125,297 |

|

|

Debentures |

|

|

41,454 |

|

|

|

31,362 |

|

|

Current maturities of operating lease liabilities |

|

|

32,065 |

|

|

|

35,673 |

|

|

Trade payables |

|

|

153,259 |

|

|

|

125,163 |

|

|

Deferred revenues |

|

|

128,898 |

|

|

|

93,512 |

|

|

Other accounts payable |

|

|

258,717 |

|

|

|

205,205 |

|

|

Dividend payable |

|

|

- |

|

|

|

7,081 |

|

|

Liabilities in respect of business combinations |

|

|

9,121 |

|

|

|

8,431 |

|

|

Put options of non-controlling interests |

|

|

35,843 |

|

|

|

39,668 |

|

| Total current

liabilities |

|

|

779,801 |

|

|

|

671,392 |

|

| |

|

|

|

|

|

|

|

|

| LONG-TERM

LIABILITIES: |

|

|

|

|

|

|

|

|

|

Loans and credit from banks and others |

|

|

180,316 |

|

|

|

162,062 |

|

|

Debentures |

|

|

203,070 |

|

|

|

175,411 |

|

|

Long term operating lease liabilities |

|

|

91,188 |

|

|

|

73,686 |

|

|

Other long-term liabilities |

|

|

12,191 |

|

|

|

8,311 |

|

|

Deferred taxes |

|

|

68,368 |

|

|

|

53,854 |

|

|

Deferred revenues |

|

|

16,626 |

|

|

|

6,491 |

|

|

Liabilities in respect of business combinations |

|

|

16,582 |

|

|

|

14,895 |

|

|

Put options of non-controlling interests |

|

|

29,257 |

|

|

|

15,182 |

|

|

Employees benefit liabilities |

|

|

15,119 |

|

|

|

11,639 |

|

| Total long-term

liabilities |

|

|

632,717 |

|

|

|

521,531 |

|

| |

|

|

|

|

|

|

|

|

| EQUITY |

|

|

|

|

|

|

|

|

|

Equity attributable to Formula Systems’ shareholders |

|

|

502,728 |

|

|

|

421,640 |

|

|

Non-controlling interests |

|

|

604,766 |

|

|

|

474,694 |

|

| Total

equity |

|

|

1,107,494 |

|

|

|

896,334 |

|

| |

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES AND

EQUITY |

|

|

2,520,012 |

|

|

|

2,089,257 |

|

| |

|

|

|

|

|

|

|

|

FORMULA SYSTEMS (1985) LTD.STAND-ALONE

STATEMENTS OF FINANCIAL POSITIONU.S. dollars in

thousands

|

|

|

December 31, |

|

|

December 31, |

|

|

|

|

2020 |

|

|

2019 |

|

| |

|

|

|

|

|

|

(Unaudited) |

|

| ASSETS |

|

|

|

|

|

|

| CURRENT

ASSETS: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

47,852 |

|

|

|

82,725 |

|

|

Other accounts receivable and prepaid expenses |

|

|

4,977 |

|

|

|

6,803 |

|

| Total current

assets |

|

|

52,829 |

|

|

|

89,528 |

|

| |

|

|

|

|

|

|

|

|

| INVESTMENTS IN

SUBSIDIARIES AND A JOINTLY |

|

|

|

|

|

|

|

|

| CONTROLLED ENTITY

(*) |

|

|

|

|

|

|

|

|

|

Matrix IT Ltd. |

|

|

142,194 |

|

|

|

125,809 |

|

|

Sapiens International Corporation N.V. |

|

|

227,771 |

|

|

|

176,832 |

|

|

Magic Software Enterprises Ltd. |

|

|

117,624 |

|

|

|

114,019 |

|

|

Other |

|

|

90,395 |

|

|

|

72,322 |

|

| Total Investments in

subsidiaries and a jointly controlled entity |

|

|

577,984 |

|

|

|

488,982 |

|

| |

|

|

|

|

|

|

|

|

| OTHER LONG TERM

RECEIVABLES |

|

|

1,707 |

|

|

|

1,539 |

|

| |

|

|

|

|

|

|

|

|

| PROPERTY, PLANTS AND

EQUIPMENT, NET |

|

|

2 |

|

|

|

2 |

|

| |

|

|

|

|

|

|

|

|

| TOTAL

ASSETS |

|

|

632,522 |

|

|

|

580,051 |

|

| |

|

|

|

|

|

|

|

|

| CURRENT

LIABILITIES: |

|

|

|

|

|

|

|

|

|

Loans from banks and others |

|

|

- |

|

|

|

13,130 |

|

|

Debentures |

|

|

21,652 |

|

|

|

20,296 |

|

|

Trade payables |

|

|

349 |

|

|

|

69 |

|

|

Other accounts payable |

|

|

2,328 |

|

|

|

1,274 |

|

|

Dividends payable |

|

|

- |

|

|

|

7,081 |

|

| Total current

liabilities |

|

|

24,329 |

|

|

|

41,850 |

|

| |

|

|

|

|

|

|

|

|

| LONG-TERM

LIABILITIES: |

|

|

|

|

|

|

|

|

|

Debentures |

|

|

104,394 |

|

|

|

116,561 |

|

|

Put options of non-controlling interests |

|

|

1,071 |

|

|

|

- |

|

| Total long-term

liabilities |

|

|

105,465 |

|

|

|

116,561 |

|

| |

|

|

|

|

|

|

|

|

| EQUITY |

|

|

502,728 |

|

|

|

421,640 |

|

| |

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES AND

EQUITY |

|

|

632,522 |

|

|

|

580,051 |

|

| |

|

|

|

|

|

|

|

|

(*)The investments’ carrying amounts are measured consistent

with the accounting principles applied in the consolidated

financial statements of the group and representing the investments’

cost adjusted by Formula’s share in the investees’ accumulated

undistributed earnings and other comprehensive income or loss.

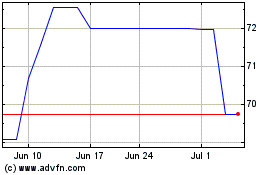

Formula Systems 1985 (NASDAQ:FORTY)

Historical Stock Chart

From Dec 2024 to Jan 2025

Formula Systems 1985 (NASDAQ:FORTY)

Historical Stock Chart

From Jan 2024 to Jan 2025