Five Below, Inc. (NASDAQ: FIVE) today announced financial results

for the third quarter and year to date period ended

November 2, 2024.

For the third

quarter ended November 2,

2024:

- Net

sales increased by 14.6% to $843.7 million from $736.4 million in

the third quarter of fiscal 2023; comparable sales increased by

0.6%.

- The

Company opened 82 new stores and ended the quarter with 1,749

stores in 44 states. This represents an increase in stores of 18.1%

from the end of the third quarter of fiscal 2023.

-

Operating loss was $0.6 million compared to operating income of

$16.1 million in the third quarter of fiscal 2023. Adjusted

operating income(1) was $27.6 million.

- The

effective tax rate was 23.4% compared to 25.4% in the third quarter

of fiscal 2023.

- Net

income was $1.7 million compared to $14.6 million in the third

quarter of fiscal 2023. Adjusted net income(1) was $23.3

million.

-

Diluted income per common share was $0.03 compared to $0.26 in the

third quarter of fiscal 2023. Adjusted diluted income per common

share(1) was $0.42.

(1) A reconciliation of

adjusted operating income, adjusted net income, and adjusted

diluted income per common share to the most directly comparable

financial measure presented in accordance with accounting

principles generally accepted in the United States ("GAAP") is set

forth in the schedule accompanying this release. See also “Non-GAAP

Information.”

Ken Bull, Interim CEO and COO of Five Below said,

“We are pleased to report third quarter results that exceeded our

outlook. We delivered stronger performance across a broader group

of our merchandise worlds compared to the second quarter and

improved our operational execution. We were encouraged to see the

positive results from the initiatives we undertook to add newness

and deliver value in key categories. We opened a record 82 new

stores during this period with new store performance also

surpassing our expectations. Our merchant and operational teams

across the organization are focused on our key priorities of

product, value and store experience, and I want to thank them for

their efforts in delivering these results."

Mr. Bull continued, "We will build on this progress

and are focused on delivering for our customers in the

all-important fourth quarter. Our solid Black Friday weekend

results were an encouraging start to the holiday season, though the

highest volume selling days lie ahead. In addition, this year we

have five fewer shopping days between Thanksgiving and Christmas,

which is reflected in our outlook."

For the year to date period ended

November 2, 2024:

- Net

sales increased by 11.9% to $2.49 billion from $2.22 billion in the

year to date period of fiscal 2023; comparable sales decreased by

2.6%.

- The

Company opened 205 new stores compared to 141 new stores in the

year to date period of fiscal 2023.

-

Operating income was $77.1 million compared to $117.1 million in

the year to date period of fiscal 2023. Adjusted operating

income(2) was $102.8 million.

- The

effective tax rate was 24.7% compared to 23.1% in the year to date

period of fiscal 2023.

- Net

income was $66.2 million compared to $98.9 million in the year to

date period of fiscal 2023. Adjusted net income(2) was $85.5

million.

-

Diluted income per common share was $1.20 compared to $1.78 in the

year to date period of fiscal 2023. The benefit from share-based

accounting was approximately $0.01 in the year to date period of

fiscal 2024 compared to approximately $0.07 in the year to date

period of fiscal 2023. Adjusted diluted income per common share(2)

was $1.55.

- The

Company repurchased approximately 267,000 shares in the year to

date period of fiscal 2024 at a cost of approximately $40.0

million

(2) A reconciliation of

adjusted operating income, adjusted net income, and adjusted

diluted income per common share to the most directly comparable

financial measure presented in accordance with accounting

principles generally accepted in the United States ("GAAP") is set

forth in the schedule accompanying this release. See also “Non-GAAP

Information."

Appointment of Chief Executive

Officer

Five Below also announced today the appointment of

Winnie Park to the role of Chief Executive Officer, effective

December 16, 2024. Ken Bull, Chief Operating Officer, who was

serving as Interim CEO, will continue in his role as COO, and Tom

Vellios will remain Executive Chairman. This announcement was made

concurrently this afternoon and can be found

at investor.fivebelow.com/investors.

Fourth Quarter and Fiscal

2024 Outlook:The Company expects

the following results for the fourth quarter and full year fiscal

2024:

For the fourth quarter of Fiscal

2024:

- Net sales are expected

to be in the range of $1.35 billion to $1.38 billion based on

opening approximately 22 net new stores and assumes an approximate

3% to 5% decrease in comparable sales.

- Net income is expected

to be in the range of $174 million to $184 million. Adjusted net

income(3) is expected to be in the range of $179 million to $189

million.

- Diluted income per

common share is expected to be in the range of $3.15 to $3.33 on

approximately 55.3 million diluted weighted average shares

outstanding. Adjusted diluted income per common share(3) is

expected to be in the range of $3.23 to $3.41.

(3) Adjusted net income

and adjusted diluted income per common share exclude the impact of

nonrecurring or non-cash items which includes retention awards,

costs associated with cost-optimization initiatives and stock

compensation benefits, net of income tax impacts.

For the full year of Fiscal

2024:

- Net sales are expected

to be in the range of $3.84 billion to $3.87 billion based on

opening approximately 227 net new stores and assumes an approximate

3% decrease in comparable sales.

- Net income is expected

to be in the range of $240 million to $250 million. Adjusted net

income(4) is expected to be in the range of $265 million to $275

million.

- Diluted income per

common share is expected to be in the range of $4.34 to $4.52 on

approximately 55.3 million diluted weighted average shares

outstanding. Adjusted diluted income per common share(4) is

expected to be in the range of $4.78 to $4.96.

- Gross capital

expenditures are expected to be approximately $340 million in

fiscal 2024.

(4) Adjusted net income

and adjusted diluted income per common share exclude the impact of

nonrecurring or non-cash items which includes inventory write-off,

retention awards, stock compensation benefits, costs associated

with cost-optimization initiatives, settlement of

employment-related litigation, and asset disposal, net of income

tax impacts.

Conference Call Information:A

conference call to discuss the financial results for the third

quarter of fiscal 2024 is scheduled for today, December 4, 2024, at

4:30 p.m. Eastern Time. A live audio webcast of the conference call

will be available online at investor.fivebelow.com, where a replay

will be available shortly after the conclusion of the call.

Investors and analysts interested in participating in the call are

invited to dial 412-902-6753 approximately 10 minutes prior to the

start of the call.

Non-GAAP Information:This press

release includes adjusted operating income, adjusted net income,

and adjusted diluted income per common share, each is a non-GAAP

financial measure. The Company has reconciled these non-GAAP

financial measures with the most directly comparable GAAP financial

measures within this filing. The Company believes that these

non-GAAP financial measures not only provide its management with

comparable financial data for internal financial analysis but also

provide meaningful supplemental information to investors.

Specifically, these non-GAAP financial measures allow investors to

better understand the performance of the Company's business and

facilitate a meaningful evaluation of its quarterly and fiscal year

2024 diluted income per common share and actual results on a

comparable basis with its quarterly and fiscal year 2023 results.

In evaluating these non-GAAP financial measures, investors should

be aware that in the future the Company may incur expenses that are

the same as or similar to some of the adjustments in this filing.

The Company's presentation of non-GAAP financial measures should

not be construed to imply that its future results will be

unaffected by any such adjustments. The Company has provided this

information as a means to evaluate the results of its ongoing

operations. Other companies in the Company's industry may calculate

these items differently than it does. Each of these measures is not

a measure of performance under GAAP and should not be considered as

a substitute for the most directly comparable financial measures

prepared in accordance with GAAP. Non-GAAP financial measures have

limitations as analytical tools, and investors should not consider

them in isolation or as a substitute for analysis of the Company's

results as reported under GAAP.

Forward-Looking Statements:This

news release includes forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995 as

contained in Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934, which reflect

management's current views and estimates regarding the Company's

industry, business strategy, goals and expectations concerning its

market position, future operations, margins, profitability, capital

expenditures, liquidity and capital resources, store count

potential and other financial and operating information. Investors

can identify these statements by the fact that they use words such

as "anticipate," "assume," "believe," "continue," "could,"

"estimate," "expect," "intend," "may," "plan," "potential,"

"predict," "project," "future" and similar terms and phrases. The

Company cannot assure investors that future developments affecting

the Company will be those that it has anticipated. Actual results

may differ materially from these expectations due to risks related

to disruption to the global supply chain, risks related to the

Company's strategy and expansion plans, risks related to our

ability to attract, retain, and integrate qualified executive

talent, risks related to disruptions in our information technology

systems and our ability to maintain and upgrade those systems,

risks related to the inability to successfully implement our online

retail operations, risks related to cyberattacks or other cyber

incidents, risks related to increased usage of machine learning and

other types of artificial intelligence in our business, and

challenges with properly managing its use; risks related to our

ability to select, obtain, distribute and market merchandise

profitably, risks related to our reliance on merchandise

manufactured outside of the United States, the availability of

suitable new store locations and the dependence on the volume of

traffic to our stores, risks related to changes in consumer

preferences and economic conditions, risks related to increased

operating costs, including wage rates, risks related to inflation

and increasing commodity prices, risks related to potential

systematic failure of the banking system in the United States or

globally, risks related to extreme weather, pandemic outbreaks,

global political events, war, terrorism or civil unrest (including

any resulting store closures, damage, or loss of inventory), risks

related to leasing, owning or building distribution centers, risks

related to our ability to successfully manage inventory balance and

inventory shrinkage, quality or safety concerns about the Company's

merchandise, increased competition from other retailers including

online retailers, risks related to the seasonality of our business,

risks related to our ability to protect our brand name and other

intellectual property, risks related to customers' payment methods,

risks related to domestic and foreign trade restrictions including

duties and tariffs affecting our domestic and foreign suppliers and

increasing our costs, including, among others, the direct and

indirect impact of current and potential tariffs imposed and

proposed by the United States on foreign imports, risks associated

with the restrictions imposed by our indebtedness on our current

and future operations, the impact of changes in tax legislation and

accounting standards and risks associated with leasing substantial

amounts of space. For further details and a discussion of these

risks and uncertainties, see the Company's periodic reports,

including the annual report on Form 10-K, quarterly reports on Form

10-Q and current reports on Form 8-K, filed with or furnished to

the Securities and Exchange Commission and available at

www.sec.gov. If one or more of these risks or uncertainties

materialize, or if any of the Company's assumptions prove

incorrect, the Company's actual results may vary in material

respects from those projected in these forward-looking statements.

Any forward-looking statement made by the Company in this news

release speaks only as of the date on which the Company makes it.

Factors or events that could cause the Company's actual results to

differ may emerge from time to time, and it is not possible for the

Company to predict all of them. The Company undertakes no

obligation to publicly update any forward-looking statement,

whether as a result of new information, future developments or

otherwise, except as may be required by any applicable securities

laws.

About Five Below:Five Below is a

leading high-growth value retailer offering trend-right,

high-quality products loved by teens and pre-teens. We believe life

is better when customers are free to "let go & have fun" in an

amazing experience filled with unlimited possibilities. With most

items priced between $1 and $5, and some extreme value items priced

beyond $5 in our incredible Five Beyond shop, Five Below makes it

easy to say YES! to the newest, coolest stuff across eight awesome

Five Below worlds: Style, Room, Sports, Tech, Create, Party, Candy

and New & Now. Founded in 2002 and headquartered in

Philadelphia, Pennsylvania, Five Below today has over 1,750 stores

in 44 states. For more information, please visit

www.fivebelow.com or find Five Below on Instagram, TikTok, and

Facebook @FiveBelow.

Investor Contact:Five Below,

Inc.Christiane PelzVice President, Investor

Relations215-207-2658InvestorRelations@fivebelow.com

| |

| |

|

FIVE BELOW, INC.Consolidated Balance

Sheets(Unaudited)(in thousands) |

| |

| |

November 2, 2024 |

|

February 3, 2024 |

|

October 28, 2023 |

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

169,702 |

|

|

$ |

179,749 |

|

|

$ |

162,928 |

|

|

Short-term investment securities |

|

46,941 |

|

|

|

280,339 |

|

|

|

— |

|

|

Inventories |

|

817,832 |

|

|

|

584,627 |

|

|

|

763,349 |

|

|

Prepaid income taxes and tax receivable |

|

20,348 |

|

|

|

4,834 |

|

|

|

23,906 |

|

|

Prepaid expenses and other current assets |

|

157,396 |

|

|

|

153,993 |

|

|

|

140,816 |

|

|

Total current assets |

|

1,212,219 |

|

|

|

1,203,542 |

|

|

|

1,090,999 |

|

|

Property and equipment, net |

|

1,259,768 |

|

|

|

1,134,312 |

|

|

|

1,075,275 |

|

|

Operating lease assets |

|

1,692,978 |

|

|

|

1,509,416 |

|

|

|

1,475,095 |

|

|

Long-term investment securities |

|

— |

|

|

|

7,791 |

|

|

|

— |

|

|

Other assets |

|

20,354 |

|

|

|

16,976 |

|

|

|

16,069 |

|

| |

$ |

4,185,319 |

|

|

$ |

3,872,037 |

|

|

$ |

3,657,438 |

|

| |

|

|

|

|

|

|

Liabilities and Shareholders’ Equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Line of credit |

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

Accounts payable |

|

352,180 |

|

|

|

256,275 |

|

|

|

349,340 |

|

|

Income taxes payable |

|

— |

|

|

|

41,772 |

|

|

|

— |

|

|

Accrued salaries and wages |

|

28,758 |

|

|

|

30,028 |

|

|

|

19,357 |

|

|

Other accrued expenses |

|

143,388 |

|

|

|

146,887 |

|

|

|

158,272 |

|

|

Operating lease liabilities |

|

351,062 |

|

|

|

240,964 |

|

|

|

231,197 |

|

|

Total current liabilities |

|

875,388 |

|

|

|

715,926 |

|

|

|

758,166 |

|

|

Other long-term liabilities |

|

8,962 |

|

|

|

6,826 |

|

|

|

4,625 |

|

|

Long-term operating lease liabilities |

|

1,616,964 |

|

|

|

1,497,586 |

|

|

|

1,455,358 |

|

|

Deferred income taxes |

|

68,153 |

|

|

|

66,743 |

|

|

|

61,364 |

|

|

Total liabilities |

|

2,569,467 |

|

|

|

2,287,081 |

|

|

|

2,279,513 |

|

|

Shareholders’ equity: |

|

|

|

|

|

|

Common stock |

|

549 |

|

|

|

551 |

|

|

|

551 |

|

|

Additional paid-in capital |

|

147,453 |

|

|

|

182,709 |

|

|

|

177,877 |

|

|

Retained earnings |

|

1,467,850 |

|

|

|

1,401,696 |

|

|

|

1,199,497 |

|

|

Total shareholders’ equity |

|

1,615,852 |

|

|

|

1,584,956 |

|

|

|

1,377,925 |

|

| |

$ |

4,185,319 |

|

|

$ |

3,872,037 |

|

|

$ |

3,657,438 |

|

|

|

|

FIVE BELOW, INC.Consolidated Statements of

Operations(Unaudited)(in thousands, except share and per share

data) |

|

|

|

|

Thirteen Weeks Ended |

|

Thirty-Nine Weeks Ended |

|

|

November 2, 2024 |

|

October 28, 2023 |

|

November 2, 2024 |

|

October 28, 2023 |

|

Net sales |

$ |

843,710 |

|

|

$ |

736,405 |

|

|

$ |

2,485,642 |

|

|

$ |

2,221,633 |

|

|

Cost of goods sold (exclusive of items shown separately below) |

|

585,668 |

|

|

|

513,577 |

|

|

|

1,692,294 |

|

|

|

1,499,422 |

|

|

Selling, general and administrative expenses |

|

215,367 |

|

|

|

173,121 |

|

|

|

594,362 |

|

|

|

511,430 |

|

|

Depreciation and amortization |

|

43,281 |

|

|

|

33,584 |

|

|

|

121,933 |

|

|

|

93,652 |

|

|

Operating (loss) income |

|

(606 |

) |

|

|

16,123 |

|

|

|

77,053 |

|

|

|

117,129 |

|

|

Interest income and other income |

|

2,808 |

|

|

|

3,434 |

|

|

|

10,852 |

|

|

|

11,423 |

|

|

Income before income taxes |

|

2,202 |

|

|

|

19,557 |

|

|

|

87,905 |

|

|

|

128,552 |

|

|

Income tax expense |

|

515 |

|

|

|

4,963 |

|

|

|

21,751 |

|

|

|

29,645 |

|

|

Net income |

$ |

1,687 |

|

|

$ |

14,594 |

|

|

$ |

66,154 |

|

|

$ |

98,907 |

|

|

Basic income per common share |

$ |

0.03 |

|

|

$ |

0.26 |

|

|

$ |

1.20 |

|

|

$ |

1.78 |

|

|

Diluted income per common share |

$ |

0.03 |

|

|

$ |

0.26 |

|

|

$ |

1.20 |

|

|

$ |

1.78 |

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

Basic shares |

|

55,007,054 |

|

|

|

55,452,533 |

|

|

|

55,067,467 |

|

|

|

55,592,536 |

|

|

Diluted shares |

|

55,110,433 |

|

|

|

55,576,140 |

|

|

|

55,152,976 |

|

|

|

55,717,987 |

|

|

|

|

FIVE BELOW, INC.Consolidated Statements of Cash

Flows(Unaudited)(in thousands) |

|

|

|

|

Thirty-Nine Weeks Ended |

|

|

November 2, 2024 |

|

October 28, 2023 |

|

Operating activities: |

|

|

|

|

Net income |

$ |

66,154 |

|

|

$ |

98,907 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

Depreciation and amortization |

|

121,933 |

|

|

|

93,652 |

|

|

Share-based compensation expense |

|

11,303 |

|

|

|

13,366 |

|

|

Deferred income tax expense |

|

1,410 |

|

|

|

2,213 |

|

|

Other non-cash expenses |

|

861 |

|

|

|

172 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

Inventories |

|

(233,205 |

) |

|

|

(235,629 |

) |

|

Prepaid income taxes and tax receivable |

|

(15,514 |

) |

|

|

(15,008 |

) |

|

Prepaid expenses and other assets |

|

(6,889 |

) |

|

|

(12,530 |

) |

|

Accounts payable |

|

96,900 |

|

|

|

123,374 |

|

|

Income taxes payable |

|

(41,772 |

) |

|

|

(19,928 |

) |

|

Accrued salaries and wages |

|

(1,270 |

) |

|

|

(6,063 |

) |

|

Operating leases |

|

45,914 |

|

|

|

33,841 |

|

|

Other accrued expenses |

|

21,288 |

|

|

|

15,521 |

|

|

Net cash provided by operating activities |

|

67,113 |

|

|

|

91,888 |

|

|

Investing activities: |

|

|

|

|

Purchases of investment securities and other investments |

|

(4,508 |

) |

|

|

(128,950 |

) |

|

Sales, maturities, and redemptions of investment securities |

|

245,696 |

|

|

|

195,795 |

|

|

Capital expenditures |

|

(271,855 |

) |

|

|

(231,921 |

) |

|

Net cash used in investing activities |

|

(30,667 |

) |

|

|

(165,076 |

) |

|

Financing activities: |

|

|

|

|

Net proceeds from issuance of common stock |

|

600 |

|

|

|

440 |

|

|

Repurchase and retirement of common stock |

|

(40,226 |

) |

|

|

(80,541 |

) |

|

Proceeds from exercise of options to purchase common stock and

vesting of restricted and performance-based restricted stock

units |

|

1 |

|

|

|

288 |

|

|

Common shares withheld for taxes |

|

(6,868 |

) |

|

|

(16,395 |

) |

|

Net cash used in financing activities |

|

(46,493 |

) |

|

|

(96,208 |

) |

|

Net decrease in cash and cash equivalents |

|

(10,047 |

) |

|

|

(169,396 |

) |

|

Cash and cash equivalents at beginning of period |

|

179,749 |

|

|

|

332,324 |

|

|

Cash and cash equivalents at end of period |

$ |

169,702 |

|

|

$ |

162,928 |

|

|

|

|

FIVE BELOW, INC.GAAP to Non-GAAP Reconciliation of

Consolidated Statements of Operations(Unaudited)(in thousands,

except share and per share data) |

|

|

|

Reconciliation of gross profit as reported, to adjusted

gross profit |

|

|

|

|

Thirteen Weeks Ended |

|

Thirty-Nine Weeks Ended |

|

|

November 2, 2024 |

|

October 28, 2023 |

|

November 2, 2024 |

|

October 28, 2023 |

|

Gross profit, as reported(5) |

$ |

258,042 |

|

|

$ |

222,828 |

|

|

$ |

793,348 |

|

|

$ |

722,211 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

Retention awards(6) |

|

444 |

|

|

|

— |

|

|

|

597 |

|

|

|

— |

|

|

Non-recurring inventory write-off |

|

21,208 |

|

|

|

— |

|

|

|

21,208 |

|

|

|

— |

|

|

Cost-optimization initiatives(7) |

|

378 |

|

|

|

— |

|

|

|

378 |

|

|

|

— |

|

|

Adjusted gross profit(8) |

$ |

280,072 |

|

|

$ |

222,828 |

|

|

$ |

815,531 |

|

|

$ |

722,211 |

|

|

Reconciliation of operating (loss) income, as reported, to

adjusted operating income |

|

|

|

|

Thirteen Weeks Ended |

|

Thirty-Nine Weeks Ended |

|

|

November 2, 2024 |

|

October 28, 2023 |

|

November 2, 2024 |

|

October 28, 2023 |

|

Operating (loss) income, as reported |

$ |

(606 |

) |

|

$ |

16,123 |

|

|

$ |

77,053 |

|

|

$ |

117,129 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

Non-recurring employment-related litigation |

|

— |

|

|

|

— |

|

|

|

1,976 |

|

|

|

— |

|

|

Retention awards(6) |

|

4,931 |

|

|

|

— |

|

|

|

6,578 |

|

|

|

— |

|

|

Non-recurring stock compensation benefit |

|

— |

|

|

|

— |

|

|

|

(6,116 |

) |

|

|

— |

|

|

Non-recurring inventory write-off |

|

21,208 |

|

|

|

— |

|

|

|

21,208 |

|

|

|

— |

|

|

Cost-optimization initiatives(7) |

|

1,544 |

|

|

|

— |

|

|

|

1,544 |

|

|

|

— |

|

|

Non-recurring asset disposal |

|

513 |

|

|

|

— |

|

|

|

513 |

|

|

|

— |

|

|

Adjusted operating income(8) |

$ |

27,590 |

|

|

$ |

16,123 |

|

|

$ |

102,756 |

|

|

$ |

117,129 |

|

|

Reconciliation of net income, as reported, to adjusted net

income |

|

|

|

|

Thirteen Weeks Ended |

|

Thirty-Nine Weeks Ended |

|

|

November 2, 2024 |

|

October 28, 2023 |

|

November 2, 2024 |

|

October 28, 2023 |

|

Net income, as reported |

$ |

1,687 |

|

|

$ |

14,594 |

|

|

$ |

66,154 |

|

|

$ |

98,907 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

Non-recurring employment-related litigation, net of tax |

|

— |

|

|

|

— |

|

|

|

1,487 |

|

|

|

— |

|

|

Retention awards, net of tax(6) |

|

3,778 |

|

|

|

— |

|

|

|

4,950 |

|

|

|

— |

|

|

Non-recurring stock compensation benefit, net of tax |

|

— |

|

|

|

— |

|

|

|

(4,603 |

) |

|

|

— |

|

|

Non-recurring inventory write-off, net of tax |

|

16,248 |

|

|

|

— |

|

|

|

15,961 |

|

|

|

— |

|

|

Cost-optimization initiatives, net of tax(7) |

|

1,183 |

|

|

|

— |

|

|

|

1,162 |

|

|

|

— |

|

|

Non-recurring asset disposal, net of tax |

|

393 |

|

|

|

— |

|

|

|

386 |

|

|

|

— |

|

|

Adjusted net income(8) |

$ |

23,289 |

|

|

$ |

14,594 |

|

|

$ |

85,497 |

|

|

$ |

98,907 |

|

|

Reconciliation of diluted income per common share, as

reported, to adjusted diluted income per common share |

|

|

|

|

Thirteen Weeks Ended |

|

Thirty-Nine Weeks Ended |

|

|

November 2, 2024 |

|

October 28, 2023 |

|

November 2, 2024 |

|

October 28, 2023 |

|

Diluted income per common share, as reported |

$ |

0.03 |

|

|

$ |

0.26 |

|

|

$ |

1.20 |

|

|

$ |

1.78 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

Non-recurring employment-related litigation per share |

|

— |

|

|

|

— |

|

|

|

0.03 |

|

|

|

— |

|

|

Retention awards per share(6) |

|

0.07 |

|

|

|

— |

|

|

|

0.09 |

|

|

|

— |

|

|

Non-recurring stock compensation benefit per share |

|

— |

|

|

|

— |

|

|

|

(0.08 |

) |

|

|

— |

|

|

Non-recurring inventory write-off per share |

|

0.29 |

|

|

|

— |

|

|

|

0.29 |

|

|

|

— |

|

|

Cost-optimization initiatives per share(7) |

|

0.02 |

|

|

|

— |

|

|

|

0.02 |

|

|

|

— |

|

|

Non-recurring asset disposal per share |

|

0.01 |

|

|

|

— |

|

|

|

0.01 |

|

|

|

— |

|

|

Adjusted diluted income per common share(8) |

$ |

0.42 |

|

|

$ |

0.26 |

|

|

$ |

1.55 |

|

|

$ |

1.78 |

|

(5) Gross profit is equal to our net sales less our

cost of goods sold.(6) Retention awards relate to the on-going

expense recognition of cash and equity granted to certain

individuals in fiscal 2024 during the CEO transition that will be

earned and have vestings through fiscal 2026.(7) Represents charges

related to the cost-optimization of certain functions. (8)

Components may not add to total due to rounding.

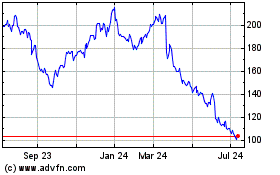

Five Below (NASDAQ:FIVE)

Historical Stock Chart

From Nov 2024 to Dec 2024

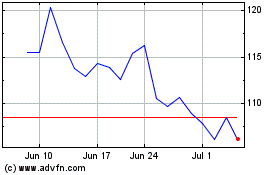

Five Below (NASDAQ:FIVE)

Historical Stock Chart

From Dec 2023 to Dec 2024