false

0000919864

0000919864

2023-12-22

2023-12-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): December 22, 2023

|

| |

|

Finward Bancorp

|

|

(Exact name of registrant as specified in its charter)

|

| |

|

Indiana

|

001-40999

|

35-1927981

|

|

(State or other jurisdiction of

incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

| |

|

|

|

9204 Columbia Avenue

Munster, Indiana

|

46321

|

|

(Address of principal executive offices)

|

(Zip Code)

|

| |

|

(219) 836-4400

|

|

(Registrant’s telephone number, including area code)

|

| |

|

|

N/A

|

|

(Former name or former address, if changed since last report.)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, no par value

|

FNWD

|

The NASDAQ Stock Market, LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

On December 22, 2023, the Board of Directors for Finward Bancorp (“Finward”), the holding company for Peoples Bank (the “Bank”), declared a quarterly dividend of $0.12 per share on Finward’s common stock payable on February 5, 2024 to shareholders of record on January 23, 2024. On December 26, 2023, Finward issued a press release reporting the dividend. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Forward Looking Statements

This Current Report on Form 8-K may contain forward-looking statements regarding the financial performance, business prospects, growth, and operating strategies of Finward. For these statements, Finward claims the protections of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Statements in this communication should be considered in conjunction with the other information available about Finward, including the information in the filings Finward makes with the Securities and Exchange Commission (“SEC”). Forward-looking statements provide current expectations or forecasts of future events and are not guarantees of future performance. The forward-looking statements are based on management’s expectations and are subject to a number of risks and uncertainties. Forward-looking statements are typically identified by using words such as “anticipate,” “estimate,” “project,” “intend,” “plan,” “believe,” “will” and similar expressions in connection with any discussion of future operating or financial performance.

Although management believes that the expectations reflected in such forward-looking statements are reasonable, actual results may differ materially from those expressed or implied in such statements. Risks and uncertainties that could cause actual results to differ materially include: the Bank’s ability to demonstrate compliance with the terms of the previously disclosed consent order and memorandum of understanding entered into between the Bank and the Federal Deposit Insurance Corporation (“FDIC”) and Indiana Department of Financial Institutions (“DFI”), or to demonstrate compliance to the satisfaction of the FDIC and/or DFI within prescribed time frames; the Bank’s agreement under the memorandum of understanding to refrain from paying cash dividends without prior regulatory approval; changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer acceptance of Finward’s products and services; customer borrowing, repayment, investment, and deposit practices; customer disintermediation; the introduction, withdrawal, success, and timing of business initiatives; competitive conditions; the inability to realize cost savings or revenues or to implement integration plans and other consequences associated with mergers, acquisitions, and divestitures; economic conditions; and the impact, extent, and timing of technological changes, capital management activities, and other actions of the Federal Reserve Board and legislative and regulatory actions and reforms. Additional factors that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in Finward’s reports (such as the Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K) filed with the SEC and available at the SEC’s Internet website (www.sec.gov). All subsequent written and oral forward-looking statements concerning Finward or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. Except as required by law, Finward does not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statement is made.

In addition to the above factors, we also caution that the actual amounts and timing of any future common stock dividends or share repurchases will be subject to various factors, including our capital position, financial performance, capital impacts of strategic initiatives, market conditions, and regulatory and accounting considerations, as well as any other factors that our Board of Directors deems relevant in making such a determination. Therefore, there can be no assurance that we will repurchase shares or pay any dividends to holders of our common stock, or as to the amount of any such repurchases or dividends.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits are being furnished with this Current Report on Form 8-K.

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Finward Bancorp

|

|

Date: December 26, 2023

|

|

|

| |

|

|

| |

By:

|

/s/ Robert T. Lowry

|

| |

|

Printed Name: Robert T. Lowry

|

| |

|

Title: Executive Vice President, Chief Operating Officer

|

Exhibit 99.1

|

FOR IMMEDIATE RELEASE

DECEMBER 26, 2023

|

FOR FURTHER INFORMATION

CONTACT SHAREHOLDER SERVICES

(219) 853-7575

|

FINWARD BANCORP ANNOUNCES FOURTH QUARTER DIVIDEND

Munster, Indiana – Finward Bancorp (Nasdaq: FNWD) (the “Bancorp” or “Finward”), the holding company for Peoples Bank (the “Bank”), today announced that on December 22, 2023 the Board of Directors of Finward declared a dividend of $0.12 per share on Finward’s common stock payable on February 5, 2024 to shareholders of record at the close of business on January 23, 2024.

“Finward’s Board of Directors has announced a dividend of $0.12 per share for the fourth quarter of 2023,” said Benjamin Bochnowski, chairman and chief executive officer. “While this is lower than the dividend for the third quarter, we understand the importance of the dividend to our shareholders. Based on careful evaluation, the Board determined it is appropriate and prudent to lower the dividend at this time to accelerate the build-up of capital, strengthen our company, and expand optionality to further improve our balance sheet.”

The Board’s decision on the dividend level for the current quarter came following a thorough review of the Bank’s capital position. Bochnowski continued that, “Peoples Bank continues to be a well-capitalized bank and places a high value on maintaining a strong capital base. The Board of Directors is committed to building shareholder value and believes the action taken to reduce the dividend is consistent with this commitment. The Board will continue to review the Bancorp’s dividend policy from time to time in a careful and holistic manner and consider future adjustments to the policy as conditions warrant.”

Dividends to the Bancorp’s shareholders are determined by the Bancorp’s Board of Directors based on a disciplined evaluation of the Bancorp’s and the Bank’s current and anticipated operating results, capital position, financial condition, regulatory and legal requirements, and other factors it deems relevant. The Board continually evaluates the factors that go into dividend decisions, consistent with the long-term best interests of the Bancorp and its shareholders. The Bancorp has no current plans to raise equity capital.

About Finward Bancorp

Finward Bancorp is a locally managed and independent financial holding company headquartered in Munster, Indiana, whose activities are primarily limited to holding the stock of Peoples Bank. Peoples Bank provides a wide range of personal, business, electronic and wealth management financial services from its 26 locations in Lake and Porter Counties in Northwest Indiana and the Chicagoland area. Finward Bancorp’s common stock is quoted on the The NASDAQ Stock Market, LLC under the symbol FNWD. The website ibankpeoples.com provides information on Peoples Bank’s products and services, and Finward Bancorp’s investor relations.

Forward Looking Statements

This press release may contain forward-looking statements regarding the financial performance, business prospects, growth, and operating strategies of the Bancorp. For these statements, the Bancorp claims the protections of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Statements in this communication should be considered in conjunction with the other information available about the Bancorp, including the information in the filings the Bancorp makes with the Securities and Exchange Commission (“SEC”). Forward-looking statements provide current expectations or forecasts of future events and are not guarantees of future performance. The forward-looking statements are based on management’s expectations and are subject to a number of risks and uncertainties. Forward-looking statements are typically identified by using words such as “anticipate,” “estimate,” “project,” “intend,” “plan,” “believe,” “will” and similar expressions in connection with any discussion of future operating or financial performance.

Although management believes that the expectations reflected in such forward-looking statements are reasonable, actual results may differ materially from those expressed or implied in such statements. Risks and uncertainties that could cause actual results to differ materially include: the Bank’s ability to demonstrate compliance with the terms of the previously disclosed consent order and memorandum of understanding entered into between the Bank and the Federal Deposit Insurance Corporation (“FDIC”) and Indiana Department of Financial Institutions (“DFI”), or to demonstrate compliance to the satisfaction of the FDIC and/or DFI within prescribed time frames; the Bank’s agreement under the memorandum of understanding to refrain from paying cash dividends without prior regulatory approval; changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer acceptance of the Bancorp’s products and services; customer borrowing, repayment, investment, and deposit practices; customer disintermediation; the introduction, withdrawal, success, and timing of business initiatives; competitive conditions; the inability to realize cost savings or revenues or to implement integration plans and other consequences associated with mergers, acquisitions, and divestitures; economic conditions; and the impact, extent, and timing of technological changes, capital management activities, and other actions of the Federal Reserve Board and legislative and regulatory actions and reforms. Additional factors that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in the Bancorp’s reports (such as the Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K) filed with the SEC and available at the SEC’s Internet website (www.sec.gov). All subsequent written and oral forward-looking statements concerning the Bancorp or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. Except as required by law, the Bancorp does not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statement is made.

###

v3.23.4

Document And Entity Information

|

Dec. 22, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Finward Bancorp

|

| Document, Type |

8-K

|

| Document, Period End Date |

Dec. 22, 2023

|

| Entity, Incorporation, State or Country Code |

IN

|

| Entity, File Number |

001-40999

|

| Entity, Tax Identification Number |

35-1927981

|

| Entity, Address, Address Line One |

9204 Columbia Avenue

|

| Entity, Address, City or Town |

Munster

|

| Entity, Address, State or Province |

IN

|

| Entity, Address, Postal Zip Code |

46321

|

| City Area Code |

219

|

| Local Phone Number |

836-4400

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

FNWD

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000919864

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

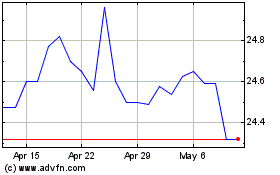

Finward Bancorp (NASDAQ:FNWD)

Historical Stock Chart

From Apr 2024 to May 2024

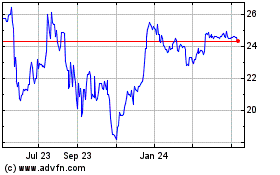

Finward Bancorp (NASDAQ:FNWD)

Historical Stock Chart

From May 2023 to May 2024