false

2024

FY

0001602409

0001602409

2023-03-01

2024-02-29

0001602409

2023-08-31

0001602409

2024-05-23

0001602409

2024-02-29

0001602409

2023-02-28

0001602409

2022-03-01

2023-02-28

0001602409

us-gaap:CommonStockMember

2023-02-28

0001602409

us-gaap:AdditionalPaidInCapitalMember

2023-02-28

0001602409

fngr:AdditionalPaidinCapitalStockMember

2023-02-28

0001602409

us-gaap:RetainedEarningsMember

2023-02-28

0001602409

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-02-28

0001602409

fngr:StockholdersEquityMember

2023-02-28

0001602409

us-gaap:NoncontrollingInterestMember

2023-02-28

0001602409

us-gaap:CommonStockMember

2022-02-28

0001602409

us-gaap:AdditionalPaidInCapitalMember

2022-02-28

0001602409

fngr:AdditionalPaidinCapitalStockMember

2022-02-28

0001602409

us-gaap:RetainedEarningsMember

2022-02-28

0001602409

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-02-28

0001602409

fngr:StockholdersEquityMember

2022-02-28

0001602409

us-gaap:NoncontrollingInterestMember

2022-02-28

0001602409

2022-02-28

0001602409

us-gaap:CommonStockMember

2023-03-01

2024-02-29

0001602409

us-gaap:AdditionalPaidInCapitalMember

2023-03-01

2024-02-29

0001602409

fngr:AdditionalPaidinCapitalStockMember

2023-03-01

2024-02-29

0001602409

us-gaap:RetainedEarningsMember

2023-03-01

2024-02-29

0001602409

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-03-01

2024-02-29

0001602409

fngr:StockholdersEquityMember

2023-03-01

2024-02-29

0001602409

us-gaap:NoncontrollingInterestMember

2023-03-01

2024-02-29

0001602409

us-gaap:CommonStockMember

2022-03-01

2023-02-28

0001602409

us-gaap:AdditionalPaidInCapitalMember

2022-03-01

2023-02-28

0001602409

fngr:AdditionalPaidinCapitalStockMember

2022-03-01

2023-02-28

0001602409

us-gaap:RetainedEarningsMember

2022-03-01

2023-02-28

0001602409

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-03-01

2023-02-28

0001602409

fngr:StockholdersEquityMember

2022-03-01

2023-02-28

0001602409

us-gaap:NoncontrollingInterestMember

2022-03-01

2023-02-28

0001602409

us-gaap:CommonStockMember

2024-02-29

0001602409

us-gaap:AdditionalPaidInCapitalMember

2024-02-29

0001602409

fngr:AdditionalPaidinCapitalStockMember

2024-02-29

0001602409

us-gaap:RetainedEarningsMember

2024-02-29

0001602409

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-02-29

0001602409

fngr:StockholdersEquityMember

2024-02-29

0001602409

us-gaap:NoncontrollingInterestMember

2024-02-29

0001602409

fngr:FingerMotionCompanyLimitedMember

2017-07-12

2017-07-13

0001602409

us-gaap:ShareDistributionMember

2017-07-12

2017-07-13

0001602409

us-gaap:VariableInterestEntityPrimaryBeneficiaryMember

2024-02-29

0001602409

us-gaap:VariableInterestEntityPrimaryBeneficiaryMember

2023-02-28

0001602409

us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember

2024-02-29

0001602409

us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember

2023-02-28

0001602409

us-gaap:VariableInterestEntityPrimaryBeneficiaryMember

2023-03-01

2024-02-29

0001602409

us-gaap:VariableInterestEntityPrimaryBeneficiaryMember

2022-03-01

2023-02-28

0001602409

us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember

2023-03-01

2024-02-29

0001602409

us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember

2022-03-01

2023-02-28

0001602409

srt:MinimumMember

2024-02-29

0001602409

srt:MaximumMember

2024-02-29

0001602409

fngr:TelecommunicationProductsAndServicesMember

2023-03-01

2024-02-29

0001602409

fngr:TelecommunicationProductsAndServicesMember

2022-03-01

2023-02-28

0001602409

fngr:SMSAndMMSBusinessMember

2023-03-01

2024-02-29

0001602409

fngr:SMSAndMMSBusinessMember

2022-03-01

2023-02-28

0001602409

fngr:BigDataMember

2023-03-01

2024-02-29

0001602409

fngr:BigDataMember

2022-03-01

2023-02-28

0001602409

us-gaap:LicenseMember

2024-02-29

0001602409

us-gaap:LicenseMember

2023-02-28

0001602409

fngr:MobileApplicationMember

2024-02-29

0001602409

fngr:MobileApplicationMember

2023-02-28

0001602409

fngr:TelecommunicationProductsAndServicesMember

2024-02-29

0001602409

fngr:TelecommunicationProductsAndServicesMember

2023-02-28

0001602409

fngr:SMSAndMMSBusinessMember

2024-02-29

0001602409

fngr:SMSAndMMSBusinessMember

2023-02-28

0001602409

2022-05-02

0001602409

2023-04-28

0001602409

fngr:PrimaryLenderMember

2023-03-01

2023-03-17

0001602409

fngr:PrimaryLenderMember

2023-03-17

0001602409

2023-04-01

2023-04-18

0001602409

2023-04-18

0001602409

fngr:ConsultingAgreementMember

2023-04-01

2023-04-24

0001602409

fngr:ConsultingAgreementMember

2023-04-24

0001602409

fngr:BenchmarkCompanyLLCMember

2023-07-01

2023-07-17

0001602409

fngr:BenchmarkCompanyLLCMember

2023-07-17

0001602409

2023-08-01

2023-08-03

0001602409

2023-08-03

0001602409

fngr:ConsultingAgreementMember

2023-08-01

2023-08-03

0001602409

fngr:ConsultingAgreementMember

2023-08-03

0001602409

fngr:ConsultingAgreementMember

2023-09-01

2023-09-05

0001602409

fngr:ConsultingAgreementMember

2023-09-05

0001602409

fngr:ConsultingAgreement1Member

2023-09-01

2023-09-05

0001602409

fngr:ConsultingAgreement1Member

2023-09-05

0001602409

fngr:TwoOfficersMember

2023-09-01

2023-09-14

0001602409

fngr:TwoOfficersMember

2023-09-14

0001602409

fngr:OneIndividualMember

2023-04-01

2023-04-18

0001602409

fngr:OneIndividualMember

2023-04-18

0001602409

2023-04-01

2023-04-19

0001602409

2023-04-19

0001602409

fngr:ThreeIndividualMember

2023-07-01

2023-07-13

0001602409

fngr:ThreeIndividualMember

2023-07-13

0001602409

2023-07-01

2023-07-13

0001602409

2023-07-13

0001602409

2023-07-01

2023-07-17

0001602409

us-gaap:StockOptionMember

2021-12-01

2021-12-28

0001602409

fngr:StockIncentivePlan2023Member

2023-07-01

2023-07-28

0001602409

fngr:Individuals40Member

2023-03-01

2024-02-29

0001602409

fngr:Individuals22Member

2023-03-01

2024-02-29

0001602409

us-gaap:WarrantMember

2023-02-28

0001602409

us-gaap:WarrantMember

2023-03-01

2024-02-29

0001602409

us-gaap:WarrantMember

2024-02-29

0001602409

fngr:StockOption1Member

2024-02-29

0001602409

fngr:StockOption1Member

2023-03-01

2024-02-29

0001602409

fngr:StockOption2Member

2024-02-29

0001602409

fngr:StockOption2Member

2023-03-01

2024-02-29

0001602409

fngr:StockOption3Member

2024-02-29

0001602409

fngr:StockOption3Member

2023-03-01

2024-02-29

0001602409

fngr:StockOption4Member

2024-02-29

0001602409

fngr:StockOption4Member

2023-03-01

2024-02-29

0001602409

fngr:Individuals40Member

2022-03-01

2023-02-28

0001602409

fngr:Individuals22Member

2022-03-01

2023-02-28

0001602409

us-gaap:StockOptionMember

2022-02-28

0001602409

us-gaap:StockOptionMember

2022-03-01

2023-02-28

0001602409

us-gaap:StockOptionMember

2023-02-28

0001602409

us-gaap:StockOptionMember

2023-03-01

2024-02-29

0001602409

us-gaap:StockOptionMember

2024-02-29

0001602409

srt:MinimumMember

us-gaap:StockOptionMember

fngr:Range1Member

2023-03-01

2024-02-29

0001602409

srt:MaximumMember

us-gaap:StockOptionMember

fngr:Range1Member

2023-03-01

2024-02-29

0001602409

us-gaap:StockOptionMember

fngr:Range1Member

2024-02-29

0001602409

us-gaap:StockOptionMember

fngr:Range1Member

2023-03-01

2024-02-29

0001602409

srt:MinimumMember

us-gaap:StockOptionMember

fngr:Range2Member

2023-03-01

2024-02-29

0001602409

srt:MaximumMember

us-gaap:StockOptionMember

fngr:Range2Member

2023-03-01

2024-02-29

0001602409

us-gaap:StockOptionMember

fngr:Range2Member

2024-02-29

0001602409

us-gaap:StockOptionMember

fngr:Range2Member

2023-03-01

2024-02-29

0001602409

us-gaap:DomesticCountryMember

2023-03-01

2024-02-29

0001602409

us-gaap:DomesticCountryMember

2022-03-01

2023-02-28

0001602409

us-gaap:ForeignCountryMember

us-gaap:InlandRevenueHongKongMember

2023-03-01

2024-02-29

0001602409

us-gaap:ForeignCountryMember

us-gaap:InlandRevenueHongKongMember

2022-03-01

2023-02-28

0001602409

us-gaap:ForeignCountryMember

us-gaap:StateAdministrationOfTaxationChinaMember

2023-03-01

2024-02-29

0001602409

us-gaap:ForeignCountryMember

us-gaap:StateAdministrationOfTaxationChinaMember

2022-03-01

2023-02-28

0001602409

2024-02-01

2024-02-29

0001602409

us-gaap:PrivatePlacementMember

2024-02-29

0001602409

2023-12-01

2024-02-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark One) |

| ☒ |

Annual Report Under Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| |

|

| For the fiscal year ended: February 29, 2024 |

| |

February 28 |

| ☐ |

Transition report under Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| |

|

| For the transition period from ______ to _______. |

Commission file number: 001-41187

| FINGERMOTION, INC. |

| (Exact name of registrant as specified in its charter) |

| Delaware |

|

46-4600326 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(IRS Employer

Identification Number) |

111 Somerset Road, Level 3

Singapore 238164

(Address of principal executive offices)

Registrant’s telephone number, including

area code (347) 349-5339

Securities registered under Section 12(b) of the

Exchange Act:

| Title of each class |

Trading Symbol (s) |

Name of each exchange on which registered |

| Common Stock, $0.0001 par value |

FNGR |

The Nasdaq Stock Market LLC |

Securities registered under Section 12(g) of the

Exchange Act:

None.

(Title of class)

Indicate by check mark if the registrant is a

well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not

required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes

☒ No ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated Filer |

☒ |

Smaller reporting company |

☒ |

| |

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report. ☐

If securities are registered pursuant to Section

12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction

or an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error

corrections are restatements that required a recover analysis of incentive-based compensation received by any of the registrant’s

executive officers during the relevant recovery period pursuant to 240.10D-1(b). ☐

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act.) Yes ☐ No ☒

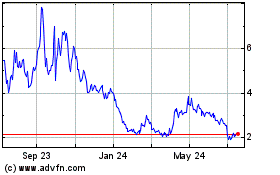

The aggregate market value of the voting and non-voting

common equity held by non-affiliates computed by reference to the price at which the common equity was last sold as of the last business

day of the registrant’s most recently completed second fiscal quarter ($5.11 on August 31, 2023) was approximately $209,481,650.

The registrant had 52,712,850 common shares outstanding

as of May 23, 2024.

table of contents

REFERENCES

As used in this Annual Report on Form 10-K (the

“Annual Report”): (i) the terms the “Registrant”, “we”, “us”, “our”,

“FingerMotion” and the “Company” mean FingerMotion, Inc. or as the context requires, collectively with its consolidated

subsidiaries; (ii) “SEC” refers to the Securities and Exchange Commission; (iii) “Securities Act” refers to the

United States Securities Act of 1933, as amended; (iv) “Exchange Act” refers to the United States Securities Exchange Act

of 1934, as amended; and (v) all dollar amounts refer to United States dollars unless otherwise indicated.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking

statements that involve risks and uncertainties. Forward-looking statements give our current expectations of forecasts of future events.

All statements other than statements of current or historical fact contained in this Annual Report, including statements regarding our

future financial position, business strategy, new products, budgets, liquidity, cash flows, projected costs, regulatory approvals or the

impact of any laws or regulations applicable to us, and plans and objectives of management for future operations, are forward-looking

statements. The words “anticipate,” “believe,” “continue,” “should,” “estimate,”

“expect,” “intend,” “may,” “plan,” “project,” “will,” and similar

expressions, as they relate to us, are intended to identify forward-looking statements.

We have based these forward-looking statements

on our current expectations about future events. While we believe these expectations are reasonable, such forward-looking statements are

inherently subject to risks and uncertainties, many of which are beyond our control. Our actual future results may differ materially from

those discussed or implied in our forward-looking statements for various reasons. Factors that could contribute to such differences include,

but are not limited to:

| |

● |

international, national and local general economic and market conditions including impacts from the ongoing war between Russia and Ukraine and the related sanctions and other measures, changes in the rates of investments or economic growth in key markets we serve, or an escalation of sanctions, tariffs or other trade tensions between the U.S. and China or other countries, and related impacts on our businesses.; |

| |

|

|

| |

● |

demographic changes; |

| |

|

|

| |

● |

natural phenomena |

| |

|

|

| |

● |

the ability of the Company to sustain, manage or forecast its growth; |

| |

|

|

| |

● |

the ability of the Company to manage its VIE contracts; |

| |

|

|

| |

● |

the ability of the Company to maintain its relationships and licenses in China; |

| |

|

|

| |

● |

adverse publicity; |

| |

|

|

| |

● |

competition and changes in the Chinese telecommunications market; |

| |

|

|

| |

● |

fluctuations and difficulty in forecasting operating results; |

| |

|

|

| |

● |

business disruptions, such as technological failures and/or cybersecurity breaches; |

| |

|

|

| |

● |

future decision by management in response to changing conditions; |

| |

|

|

| |

● |

our ability to execute prospective business plans; |

| |

|

|

| |

● |

misjudgments in the course of preparing forward-looking statements; |

| |

|

|

| |

● |

our ability to raise sufficient funds to carry out our proposed business plan; |

| |

|

|

| |

● |

actions by government authorities, including changes in government regulation; |

| |

|

|

| |

● |

dependency on certain key personnel and any inability to retain and attract qualified personnel; |

| |

● |

inability to reduce and adequately control operating costs; |

| |

|

|

| |

● |

failure to manage future growth effectively; and |

| |

|

|

| |

● |

and the other factors discussed below in Item 1A. “Risk Factors,” in Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and in other filings we make with the SEC. |

| |

|

|

Although management has attempted to identify

important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be

other factors that cause results not to be as anticipated, estimated or intended. Forward-looking statements might not prove to be accurate,

as actual results and future events could differ materially from those anticipated in such forward-looking statements. Accordingly, readers

should not place undue reliance on forward-looking statements. We wish to advise you that these cautionary remarks expressly qualify,

in their entirety, all forward-looking statements attributable to our company or persons acting on our company’s behalf. We do not

undertake to update any forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting

such statements, except as, and to the extent required by, applicable securities laws. You should carefully review the cautionary statements

and risk factors contained in this Annual Report and other documents that we may file from time to time with the SEC.

INTRODUCTORY COMMENTS

We are a holding company

incorporated in Delaware and not a Chinese operating company. As a holding company, we conduct a significant part of our operations through

our subsidiaries and through contractual arrangements with a variable interest entity (“VIE”) based in the People’s

Republic of China (“PRC” or “China”). To address challenges resulting from laws, policies and practices

that may disfavor foreign-owned entities that operate within industries deemed sensitive by the Chinese government, we use the VIE structure

to provide contractual exposure to foreign investment in Chinese-based companies. We own 100% of the equity of a wholly foreign owned

enterprise (“WFOE”), which has entered into contractual arrangements with the VIE (the “VIE Agreements”),

which is owned by Ms. Li Li the legal representative and general manager, and also the shareholder of the VIE. The VIE Agreements have

not been tested in court. For a description of the VIE structure and our contractual arrangements with the VIE, see “Business –

Corporate Information – VIE Agreements”. As a result of our use of the VIE structure, you may never directly hold equity interests

in the VIE.

Because we do not directly

hold an equity interest in the VIE, which has never been challenged or recognized in court for the time being, we are subject to risks

and uncertainties of the interpretations and applications of Chinese laws and regulations, including but not limited to, the validity

and enforcement of the contractual arrangements among the WFOE, the VIE and the shareholder of the VIE. We are also subject to the risks

and uncertainties about any future actions of the Chinese government in this regard that could disallow the VIE structure, which would

likely result in a material change in our operations, and the value of our common stock may depreciate significantly or become worthless.

See “Risk Factors—Risks Related to the VIE Agreements” and “Risk Factors—Risks Related to Doing Business

in China”.

We are subject to certain

legal and operational risks associated with having a significant portion of our operations in China. Chinese laws and regulations governing

our current business operations are sometimes vague and uncertain, and as a result, these risks could result in a material change in our

operations, significant depreciation of the value of our common stock, or a complete hindrance of our ability to offer our securities

to investors. Recently, the Chinese government adopted a series of regulatory actions and issued statements to regulate business operations

in China, including those related to the use of VIEs, data security and anti-monopoly concerns. As of the date of this Annual Report on

Form 10-K, our Company and subsidiaries and the VIE have not been involved in any investigations on cybersecurity review initiated by

any Chinese regulatory authority, nor has any of them received any inquiry, notice or sanction.

On February 17, 2023,

the China Securities Regulatory Commission (the “CSRC”) promulgated Trial Administrative Measures of Overseas Securities

Offering and Listing by Domestic Companies (the “Overseas Listing Trial Measures”) and five relevant guidelines, which

became effective on March 31, 2023. The Overseas Listing Trial Measures regulate both direct and indirect overseas offering and listing

of PRC domestic companies’ securities by adopting a filing-based regulatory regime. According to the Overseas Listing Trial Measures,

if the issuer meets both the following conditions, the overseas securities offering and listing conducted by such issuer will be determined

as indirect overseas offering, which shall subject to the filing procedure set forth under the Overseas Listing Trial Measures: (i) 50%

or more of the issuer’s operating revenue, total profit, total assets or net assets as documented in its audited consolidated financial

statements for the most recent accounting year is accounted for by domestic companies; and (ii) the main parts of the issuer’s business

activities are conducted in mainland China, or its main places of business are located in mainland China, or the senior managers in charge

of its business operations and management are mostly Chinese citizens or domiciled in mainland China. Where an abovementioned issuer submits

an application for an initial public offering to competent overseas regulators, such issuer shall file with the CSRC within three business

days after such application is submitted. Where a domestic company fails to fulfill filing procedure or in violation of the provisions

as stipulated above, in respect of its overseas offering and listing, the CSRC shall order rectification, issue warnings to such domestic

company, and impose a fine ranging from RMB1,000,000 to RMB10,000,000. Also the directly liable persons and actual controllers of the

domestic company that organize or instruct the aforementioned violations shall be warned and/or imposed fines.

Also on February 17,

2023, the CSRC also held a press conference for the release of the Overseas Listing Trial Measures and issued the Notice on Administration

for the Filing of Overseas Offering and Listing by Domestic Companies, which, among others, clarifies that the domestic companies that

have already been listed overseas on or before the effective date of the Overseas Listing Trial Measures (March 31, 2023) shall be deemed

as “stock enterprises”. Stock enterprises are not required to complete the filling procedures immediately, and they shall

be required to file with the CSRC when subsequent matters such as refinancing are involved.

As of the date of this

Annual Report on Form 10-K, our Company and subsidiaries and the VIE have not received any inquiry, notice, warning or sanctions from

the CSRC or any other Chinese governmental authorities relating to securities listings, although it seems we will be required to file

with the CSRC with respect to a new offering of our securities. However, since these statements and regulatory actions, including the

Overseas Listing Trial Measures, are newly published it is uncertain what potential impact such modified or new laws and regulations will

have on our ability to conduct our business, accept investments or list or maintain a listing on a U.S. or foreign exchange. See “Risk

Factors— Risks Related to Doing Business in China”.

As of the date of this Annual Report on Form 10-K,

none of our subsidiaries or any of the consolidated VIE have made any dividends or distributions to our Company. Under Delaware law, a

Delaware corporation’s ability to pay cash dividends on its capital stock requires the corporation to have either net profits or

positive net assets (total assets less total liabilities) over its capital. If we determine to pay dividends on any of our common stock

in the future, as a holding company, we will rely, in part, on payments made from the VIE to our WFOE in accordance with the VIE Agreements

and dividends and other distributions on equity from our WFOE to the Company. Our ability to settle amounts owed under the VIE Agreements

is subject to certain restrictions and limitations. Under the VIE Agreements, the VIE is obligated to make payments to our WFOE, in cash

or in kind, at the WFOE’s request. However, such payments are subject to Chinese taxes, including a 6% VAT and 25% enterprise income

tax. In addition, current Chinese regulations permit our WFOE to pay dividends to its shareholders only out of registered capital amount,

if any, as determined in accordance with Chinese accounting standards and regulations. If our WFOE incurs debt in the future, the instruments

governing the debt may restrict its ability to pay dividends or make other payments to us. Any limitation on the ability of our WFOE to

distribute dividends or other payments to us could materially and adversely limit our ability to grow, make investments or acquisitions

that could be beneficial to our businesses, pay dividends or otherwise fund and conduct our business. In addition, any cash dividends

or distributions of assets by our WFOE to its stockholder are subject to a Chinese withholding tax of as much as 10%. The Chinese government

also imposes controls on the conversion of Renminbi (“RMB”) into foreign currencies and the remittance of currencies

out of China. Therefore, we may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign

currency for the payment of dividends from our profits, if any. If we are unable to receive all of the revenues from our operations through

the current VIE Agreements, we may be unable to pay dividends on our common stock.

Transfer of Cash or Assets

Dividend Distributions

We have never declared or paid dividends or distributions

on our common stock. We currently intend to grant a dividend in kind of warrants to purchase shares of our common stock to holders of

our common stock as previously disclosed, however, we intend to retain all available funds and any future consolidated earnings to fund

our operations and continue the development and growth of our business; therefore, we do not anticipate paying any cash dividends.

Under Delaware law, a Delaware corporation’s

ability to pay cash dividends on its capital stock requires the corporation to have either net profits or positive net assets (total assets

less total liabilities) over its capital. If we determine to pay dividends on any of our common stock in the future, as a holding company,

we may rely on dividends and other distributions on equity from our WFOE for cash requirements, including the funds necessary to pay dividends

and other cash contributions to our shareholders.

Our WFOE’s ability to distribute dividends

is based upon its distributable earnings. PRC legal restrictions permit payments of dividends by our WFOE only out of its accumulated

after-tax profits, if any, determined in accordance with PRC accounting standards and regulations. A PRC company is not permitted to distribute

any profits until any losses from prior fiscal years have been offset. Profits retained from prior fiscal years may be distributed together

with distributable profits from the current fiscal year. Our WFOE is also required under PRC laws and regulations to allocate at least

10% of our annual after-tax profits determined in accordance with PRC GAAP to a statutory general reserve fund until the amounts in said

fund reach 50% of our register capital. Current Chinese regulations permit our WFOE to pay dividends to its shareholder only out of its

registered capital amount, if any, as determined in accordance with PRC accounting standards and regulations. If our WFOE incurs debt

in the future, the instruments governing the debt may restrict its ability to pay dividends or make other payments to us. Any limitation

on the ability of our WFOE to distribute dividends or other payments to us could materially and adversely limit our ability to grow, make

investments or acquisitions that could be beneficial to our businesses, pay dividends or otherwise fund and conduct our business. In addition,

any cash dividends or distributions of assets by our WFOE to its shareholder are subject to a Chinese withholding tax of as much as 10%.

Remittance of dividends by our WFOE out of China is also subject to examination by the banks designated by the State Administration of

Foreign Exchange, or the SAFE. For risks relating to the fund flows of our operations in China, see “Risk Factors – Risks

Related to Doing Business in China.”

The Chinese government also imposes controls on

the conversion of RMB into foreign currencies and the remittance of currencies out of China. Therefore, we may experience difficulties

in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of dividends from our profits,

if any. If we are unable to receive all of the revenues from our operations through the current VIE Agreements, we may be unable to pay

dividends on our common stock.

For us to pay dividends to our shareholders, we

will rely on payments made from the VIE to our WFOE in accordance with the VIE Agreements, and the distribution of payments from the WFOE

to the Delaware holding company as dividends. Certain payments from the VIE to the WFOE pursuant to the VIE Agreements are subject to

Chinese taxes, including a 6% VAT and 25% enterprise income tax.

Our Company’s Ability to Settle Amounts Owed under the

VIE Agreements

We transfer cash to our wholly-owned Hong Kong

subsidiary, by making capital contributions or providing loans, and our Hong Kong Subsidiary transfers cash to the WFOE in China by making

capital contributions. Because we control the VIE through contractual arrangements, we are unable to make direct capital contributions

to the VIE and its subsidiaries.

Under the VIE Agreements, the VIE is obligated

to make payments to our WFOE, in cash or in kind, at the WFOE’s request. We will be able to settle amounts owed under the VIE Agreements

through dividends paid by our WFOE to our Company. Such ability may be restricted or limited as follows:

| |

● |

First, any payments from the VIE to our WFOE is subject to Chinese taxes, including a 6% VAT and 25% enterprise income tax. |

| |

● |

Second, current Chinese regulations permit our WFOE to pay dividends to their shareholders only out of its registered capital amount, if any, as determined in accordance with Chinese accounting standards and regulations. In addition, if our WFOE incurs debt in the future, the instruments governing the debt may restrict its ability to pay dividends or make other payments to the Delaware holding company. |

| |

● |

Third, the Chinese government also imposes controls on the conversion of RMB into foreign currencies and the remittance of currencies out of China. Therefore, we may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of dividends from profits, if any. |

The VIE may transfer cash to our WFOE by paying service fees according

to the consulting services agreement.

Effect of Holding Foreign Companies Accountable

Act and Related SEC Rules.

On December 16, 2021, Public Company Accounting

Oversight Board (“PCAOB”) issued a report on its determinations that PCAOB is unable to inspect or investigate completely

PCAOB-registered public accounting firms headquartered in mainland China and in Hong Kong, a Special Administrative Region of the PRC,

because of positions taken by PRC authorities in those jurisdictions. The PCAOB made these determinations pursuant to PCAOB Rule 6100,

which provides a framework for how the PCAOB fulfills its responsibilities under the Holding Foreign Companies Accountable Act (“HFCAA”).

The report further listed in its Appendix A and Appendix B, Registered Public Accounting Firms Subject to the Mainland China Determination

and Registered Public Accounting Firms Subject to the Hong Kong Determination, respectively. The audit report included in our Annual Report

on Form 10-K for the years ended February 28, 2023 and 2022 was issued by Centurion ZD CPA & Co. (“CZD CPA”), an

audit firm headquartered in Hong Kong, a jurisdiction that the PCAOB previously determined that the PCAOB is unable to conduct inspections

or investigate auditors. However, on December 15, 2022, the PCAOB determined that the PCAOB was able to secure complete access to inspect

and investigate registered public accounting firms headquartered in mainland China and Hong Kong and voted to vacate its previous determinations.

Should the PRC authorities obstruct or otherwise fail to facilitate the PCAOB’s access in the future, the PCAOB will consider the

need to issue a new determination.

Under the HFCAA (as amended by the Consolidated

Appropriations Act, 2023), our securities may be prohibited from trading on the U.S. stock exchanges or in the over the counter trading

market in the U.S. if our auditor is not inspected by the PCAOB for two consecutive years, and this ultimately could result in our common

stock being delisted. On June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act (“AHFCAA”),

which was enacted under the Consolidated Appropriations Act, 2023, as further described below.

On August 26, 2022, the PCAOB signed a Statement

of Protocol with the China Securities Regulatory Commission and the Ministry of Finance of the PRC, taking the first step toward opening

access for the PCAOB to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong. The

Statement of Protocol gives the PCAOB sole discretion to select the firms, audit engagements and potential violations it inspects and

investigates and put in place procedures for PCAOB inspectors and investigators to view complete audit work papers with all information

included and for the PCAOB to retain information as needed. In addition, the Statement of Protocol grants the PCAOB direct access to interview

and take testimony from all personnel associated with the audits the PCAOB inspects or investigates. While significant, the Statement

of Protocol is only a first step. Uncertainties still exists as to whether and how this new Statement of Protocol will be implemented.

Notwithstanding the signing of the Statement of Protocol, if the PCAOB cannot make a determination that it is able to inspect and investigate

completely registered public accounting firms headquartered in mainland China and Hong Kong, trading of our securities will still be prohibited

under the HFCAA and Nasdaq will determine to delist our securities. Therefore, there is no assurance that the Statement of Protocol will

relieve us from the delisting risks under the HFCAA.

On December 29, 2022, the Consolidated Appropriations

Act, 2023, was signed into law, which amended the HFCAA (i) to reduce the number of consecutive years that would trigger delisting from

three years to two years, and (ii) so that any foreign jurisdiction could be the reason why the PCAOB does not to have complete access

to inspect or investigate a company’s auditors. As it was originally enacted, the HFCAA applied only if the PCAOB’s inability

to inspect or investigate because of a position taken by an authority in the foreign jurisdiction where the relevant public accounting

firm is located. As a result of the Consolidated Appropriations Act, 2023, the HFCAA now also applies if the PCAOB’s inability to

inspect or investigate the relevant accounting firm is due to a position taken by an authority in any foreign jurisdiction. The denying

jurisdiction does not need to be where the accounting firm is located.

In the future, if we do not engage an auditor

that is subject to regular inspection by the PCAOB, our common stocks may be delisted. The delisting of our shares of common stock (“Common

Shares”), or the threat of the Common Shares being delisted, may materially and adversely affect the value of your investment.

In June 2022, we were identified on the SEC’s

“Conclusive list of issuers identified under the HFCAA” (available at https://www.sec.gov.hfcaa) and, as a results

we are required to comply with the submission or disclosure requirements in this Annual Report on Form 10-K for our fiscal year ending

February 29, 2024. If we are so identified for two consecutive years, the SEC would prohibit our securities from trading on a securities

exchange or in the over-the-counter trading market in the United States.

PART I

ITEM 1. BUSINESS

Company Overview

The Company is a mobile data specialist company

incorporated in Delaware, USA, with its head office located at 111 Somerset Road, Level 3, Singapore 238164. The Company operates the

following lines of business: (i) Telecommunications Products and Services; (ii) Value Added Products and Services (iii) Short Message

Services (“SMS”) and Multimedia Messaging Services (“MMS”); (iv) a Rich Communication Services (“RCS”)

platform; (v) Big Data Insights; and (vi) a Video Games Division (inactive).

Telecommunications Products and Services

The Company’s current product mix consisting

of payment and recharge services, data plans, subscription plans, mobile phones, loyalty points redemption and other products bundles

(i.e. mobile protection plans). Chinese mobile phone consumers often utilize third-party e-marketing websites to pay their phone bills.

If the consumer connected directly to the telecommunications provider to pay his or her bill, the consumer would miss out on any benefits

or marketing discounts that e-marketers provide. Thus, consumers log on to these e-marketer’s websites, click into their respective

phone provider’s store, and “top up,” or pay, their telecommunications provider for additional mobile data and talk

time.

To connect to the respective mobile telecommunications

providers, these e-marketers must utilize a portal licensed by the applicable telecommunication company that processes the payment. We

have been granted one of these licenses by China United Network Communications Group Co., Ltd. (“China Unicom”) and

China Mobile Communications Corporation (“China Mobile”), each of which is a major telecommunications provider in China.

We principally earn revenue by providing mobile payment and recharge services to customers of China Unicom and China Mobile.

We conduct our mobile payment business through

JiuGe Technology, our contractually controlled affiliate through the entry into the VIE Agreements in October 2018. In the first half

of 2018, JiuGe Technology secured contracts with China Unicom and China Mobile to distribute mobile data for businesses and corporations

in nine provinces/municipalities, namely Chengdu, Jiangxi, Jiangsu, Chongqing, Shanghai, Zhuhai, Zhejiang, Shaanxi, Inner Mongolia, Henan

and Fujian. In September 2018, JiuGe Technology launched and commercialized mobile payment and recharge services to businesses for China

Unicom. In May 2021, JiuGe Technology signed a volume-based agreement with China Mobile Fujian to offer recharge services to the Fujian

province which we have launched and commercialized in November 2021.

The JiuGe Technology mobile payment and recharge

platform enables the seamless delivery of real-time payment and recharge services to third-party channels and businesses. We earn a rebate

from each telecommunications company on the funds paid by consumers to the telecommunications companies we process. To encourage consumers

to utilize our portal instead of using our competitors’ platforms or paying China Unicom or China Mobile directly, we offer mobile

data and talk time at a rate discounted from these companies’ stated rates, which are also the rates we must pay to them to purchase

the mobile data and talk time provided to consumers through the use of our platform. Accordingly, we earn income on the rebates we receive

from China Unicom and China Mobile, reduced by the amounts by which we discount the mobile data and talk time sold through our platform.

FingerMotion started and commercialized its “Business

to Business” (“B2B”) model by integrating with various e-commerce platforms to provide its mobile payment and

recharge services to subscribers or end consumers. In the first quarter of 2019 FingerMotion expanded its business by commercializing

its first “Business to Consumer” (“B2C”) model, offering the telecommunication providers’ products

and services, including data plans, subscription plans, mobile phones, and loyalty points redemption, directly to subscribers or customers

of the e-commerce companies, such as PinDuoDuo (“PDD”), TMall (“TMALL”) and JD.Com. The Company

is planning to further expand its universal exchange platform by setting up B2C stores on several other major e-commerce platforms in

China. In addition to that, we have been assigned as one of China’s Mobile’s loyalty redemption partner where we will be providing

the services for their customers via our platform.

Additionally, as previously disclosed, on July

7, 2019, JiuGe Technology, our contractually controlled affiliate, entered into that certain Cooperation Agreement with China Unicom Yunnan,

whereby JiuGe Technology is responsible for constructing and operating China Unicom’s electronic sales platform through which consumers

can purchase various goods and services from China Unicom, including mobile telephones, mobile telephone service, broadband data services,

terminals, “smart” devices and related financial insurance. The Cooperation Agreement provides that JiuGe Technology is required

to construct and operate the platform’s webpage in accordance with China Unicom’s specifications and policies, and applicable

law, and bear all expenses in connection therewith. As consideration for the service JiuGe Technology provides under the Cooperation Agreement,

it receives a percentage of the revenue received from all sales it processes for China Unicom on the platform. The Cooperation Agreement

expires three years from the date of its signature with a yearly auto-renewal clause, which is currently in an auto-renewal period, but

it may be terminated by (i) JiuGe Technology upon three months’ written notice or (ii) by China Unicom unilaterally.

During the recent fiscal year, the Company expanded

its offering under their telecommunication product and services by increasing their product line revenue streams. In March 2020, FingerMotion

secured a contract with both China Mobile and China Unicom to acquire new users to take up the respective subscription plans.

In February 2021, we increased the mobile phones

sales to end users using all of our platforms. This business will continue to contribute to the overall revenue for the group as part

of our offering to our customers.

Value Added Product and Services

These are new product and services that the Company

expects to secure and work with the telecommunication provider and all our e-commerce platform partners to market. In February 2022, our

contractually controlled subsidiary, JiuGe Technology, through its 99% own subsidiary TengLian signed an agreement with both China Unicom

and China Mobile to co-operate to roll out the Mobile Device Protection product which is incorporated into the Telecommunication subscription

plans in line with their roll out of new mobile phones and new 5G phones. In mid-July 2022, we launched the roll out of the Mobile Device

protection product with the roll out of the new mobile phones and 5G phones. Complementing our hardware protection services, we have introduced

cloud services designed to offer corporate customers robust data storage, processing capabilities, and databases accessible via the internet.

SMS and MMS Services

On March 7, 2019, the Company through JiuGe Technology

acquired Beijing Technology Co, a company in the business of providing mass SMS text services to businesses looking to communicate with

large numbers of their customers and prospective customers. With this acquisition, the Company expanded into a second partnership with

the telecom companies by acquiring bulk SMS and MMS bundles at reduced prices and offering bulk SMS services to end consumers with competitive

pricing. Beijing Technology retains a license from MIIT to operate the SMS and MMS business in the PRC. Similar to the mobile payment

and recharge business, Beijing Technology is required to make a deposit or bulk purchase in advance and has secured business customers,

including premium car manufacturers, hotel chains, airlines and e-commerce companies, that utilize Beijing Technology’s SMS integrated

platform to send bulk SMS text messages monthly. Beijing Technology has the capability to manage and track the entire process, including

guiding the Company’s customer to meet MIIT’s guidelines on messages composed, until the SMS messages have been delivered

successfully.

Rich Communication Services

In March 2020, the Company began the development

of an RCS platform, also known as Messaging as a Platform (“MaaP”). This RCS platform will be a proprietary business

messaging platform that enables businesses and brands to communicate and service their customers on the 5G infrastructure, delivering

a better and more efficient user experience at a lower cost. For example, with the new 5G RCS message service, consumers will have the

ability to list available flights by sending a message regarding a holiday and will also be able to book and buy flights by sending messages.

This will allow telecommunication providers like China Unicom and China Mobile to retain users on their systems without having to utilize

third-party apps or log onto the Internet, which will increase their user retention. We expect this to open up a new marketing channel

for the Company’s current and prospective business partners. Currently, the deployment of this RCS platform is under review, with

discussion ongoing among government bodies, major service providers, and telecommunication companies. These deliberations aim to assess

the potential market impacts and establish the necessary consents before the launch, considering the significant changes the platform

may introduce to user interactions with existing services. These discussions seek to ensure that all stakeholders’ concerns are

addressed comprehensively. Once these issues are resolved and the necessary approval is obtained, we anticipate a substantial enhancement

in our service offerings and an expansion of our market reach.

Big Data Insights

In July 2020, the Company launched its proprietary

technology platform “Sapientus” as its big data insights arm to deliver data-driven solutions and insights for businesses

within the insurance, healthcare, and financial services industries. The Company applies its vast experience in the insurance and financial

services industry and capabilities in technology and data analytics to develop revolutionary solutions targeted towards insurance and

financial consumers. Integrating diverse publicly available information, insurance and financial based data with technology and finally

registering them into the FingerMotion telecommunications and insurance ecosystem, the Company would be able to provide functional insights

and facilitate the transformation of key components of the insurance value chain, including driving more effective and efficient underwriting,

enabling fraud evaluation and management, empowering channel expansion and market penetration through novel product innovation, and more.

The ultimate objective is to promote, enhance and deliver better value to our partners and customers.

The Company’s proprietary risk assessment

engine offers standard and customized scoring and appraisal services based on multi-dimensional factors. The Company has the ability to

provide potential customers and partners with insights-driven and technology-enabled solutions and applications including preferred risk

selection, precision marketing, product customization, and claims management (e.g., fraud detection). The Company’s mission is to

deliver the next generation of data-driven solutions in the financial services, healthcare, and insurance industries that result in more

accurate risk assessments, more efficient processes, and a more delightful user experience.

On or around January 25, 2021, the Company’s

wholly owned subsidiary, Finger Motion Financial Company Limited’s, big data analytic arm branded “Sapientus,” entered

into a services agreement with Pacific Life Re, a global life reinsurer serving the insurance industry with a comprehensive suite of products

and services.

In December 2021, the Company through JiuGe Technology

formed a collaborative research alliance with Munich Re in extending behavioral analytics to enhance understanding of morbidity and behavioral

patterns in China market, with the goal of creating value for both insurers and the end insurance consumers through better technology,

product offerings and customer experience.

Our Video Game Division

The video game industry covers multiple sectors

and is currently experiencing a move away from physical games towards digital software. Advances in technology and streaming now allow

users to download games rather than visiting retailers. Video game publishers are expanding their direct-to-consumer channels with mobile

gaming, the current growth leader, and eSports and virtual reality gaining momentum as the next big sectors. In June 2018, we temporarily

paused its publishing and operating plans for existing games, and the Company’s Board of Directors decided to re-focus the Company’s

resources into new business opportunities in China, particularly the mobile phone payment and data business.

Corporate Information

The Company was initially incorporated as Property

Management Corporation of America on January 23, 2014 in the State of Delaware.

On June 21, 2017, the Company amended its certificate

of incorporation to effect a 1-for-4 reverse stock split of the Company’s outstanding common stock, to increase the authorized shares

of common stock to 200,000,000 shares and to change the name of the Company from “Property Management Corporation of America”

to “FingerMotion, Inc.” (the “Corporate Actions”). The Corporate Actions and the amended certificate of

incorporation became effective on June 21, 2017.

Our principal executive offices are located at

111 Somerset Road, Level 3, Singapore 238164, and our telephone number is (347) 349-5339.

We are a holding company incorporated in Delaware

and not an operating company incorporated in the People’s Republic of China (the “PRC” or “China”).

As a holding company, we conduct a significant part of our operations through our subsidiaries and through the VIE Agreements with the

VIE based in China.

The following diagram depicts our corporate structure:

Our holding company structure presents unique

risks as our investors may never directly hold equity interests in our subsidiaries or the VIE, and will be dependent upon contributions

from our subsidiaries and the VIE to finance our cash flow needs. Our subsidiaries and the VIE are currently not required to obtain permission

from the Chinese authorities including the China Securities Regulatory Commission (the “CSRC”), or Cybersecurity Administration

Committee (the “CAC”), to operate or to issue securities to foreign investors. However, as of March 31, 2023, pursuant

to the Overseas Listing Trial Measures promulgated by the CSRC, we may have to file with the CSRC with respect to a new offering of our

securities. The business of our subsidiaries and the VIE until now are not subject to cybersecurity review with the CAC, given that: (i)

data processed in our business does not have a bearing on national security and thus may not be classified as core or important data by

the authorities; (ii) we do not possess a large amount of personal information in our business operations. In addition, we are not subject

to merger control review by China’s anti-monopoly enforcement agency due to the level of our revenues which provided from us and

audited by our auditor and the fact that we currently do not expect to propose or implement any acquisition of control of, or decisive

influence over, any company with revenues within China of more than RMB400 million. Currently, these statements and regulatory actions

have had no impact on our daily business operations, the ability to accept foreign investments and list our securities on an U.S. or other

foreign exchange. However, since these statements and regulatory actions, including the Overseas Listing Trial Measures, are new, it is

uncertain what potential impact such modified or new laws and regulations will have on our daily business operation, the ability to accept

foreign investments and list our securities on an U.S. or other foreign exchange.

To operate, the VIE and Beijing XunLian TianXia

Technology Co., Ltd. are required to obtain, and have obtained, a value-added telecommunications business licence from PRC authorities.

In connection with our previous issuance of securities to foreign investors, under current PRC laws, regulations and regulatory rules,

as of the date of this periodic report on Form 10-Q, we, our PRC subsidiaries and the VIE, (i) are not required to obtain permissions

from the CSRC except that as of March 31, 2023 we may have to file with the CSRC with respect to a new offering of our securities, (ii)

are not required to go through cybersecurity review by the CAC, and (iii) have received or were not denied such requisite permissions

by any PRC authority. If we, our subsidiaries or the VIE (i) do not receive or maintain such permissions or approvals, (ii) inadvertently

conclude that such permissions or approvals are not required or (iii) applicable laws, regulations, or interpretations change and we are

required to obtain such permissions or approvals in the future, we may be subject to government enforcement actions, investigations, penalties,

sanctions and fines imposed by the CSRC, the CAC and relevant departments of the State Council. In severe circumstances, the business

of our PRC subsidiary may be ordered to suspend and its business qualifications and licenses may be revoked.

To address challenges resulting from laws,

policies and practices that may disfavors foreign-owned entities that operate within industries deemed sensitive by the Chinese

government, we use the VIE structure to provide contractual exposure to foreign investment in the PRC-based companies. We own 100%

of the equity of a WFOE, Shanghai JiuGe Business Management Co., Ltd. (“JiuGe Management”), which has entered

into the VIE Agreements with the VIE, which is owned by Ms. Li Li the legal representative and general manager, and also the

shareholder of the VIE. The VIE Agreements have not been tested in court. As a result of our use of the VIE structure, you may never

directly hold equity interests in the VIE. Any securities that we offer will be securities of the Company, the Delaware holding

company, not of the VIE.

We fund

the registered capital and operating expenses of the VIE by extending loans to the shareholders of the VIE. The VIE Agreements governing

the relationship between the VIE and our WFOE enable us to (i) direct the activities of the VIE that most significantly impact the VIE’s

economic performance, (ii) receive substantially all of the economic benefits of the VIE, and (iii) have an exclusive call option to purchase,

at any time, all or part of the equity interests in and/or assets of the VIE to the extent permitted by Chinese laws. As a result of the

VIE Agreements, the Company is considered the primary beneficiary of the VIE for accounting purposes and is able to consolidate the financial

results of the VIE in its consolidated financial statements in accordance with U.S. GAAP. As a result, investors in our Common

Shares are not purchasing an equity interest in the VIE but instead are purchasing equity interest in FingerMotion, Inc., a Delaware holding

company.

Share Exchange Agreement

Effective July 13, 2017, the Company entered into

that certain Share Exchange Agreement (the “Share Exchange Agreement”) by and among the Company, Finger Motion Company

Limited, a Hong Kong corporation (“FMCL”) and certain shareholders of FMCL (the “FMCL Shareholders”).

FMCL, a Hong Kong corporation, was formed on April 6, 2016 and is an information technology company that specializes in operating and

publishing mobile games. Pursuant to the Share Exchange Agreement, the Company agreed to exchange the outstanding equity stock of FMCL

held by the FMCL Shareholders for shares of common stock of the Company. On the closing date of the Share Exchange Agreement, the Company

issued 12,000,000 shares of common stock to the FMCL shareholders. In addition, the Company issued 600,000 shares to consultants in connection

with the transactions contemplated by the Share Exchange Agreement, and 2,562,500 additional shares to accredited investors, which was

a concurrent financing but not a condition of closing the Share Exchange Agreement.

As a result of the Share Exchange Agreement and

the other transactions contemplated thereunder, FMCL became a wholly owned subsidiary of the Company. The Company operates its video game

division through FMCL. However, in June 2018, the Company decided to pause the operation of the game division as it saw the opportunity

in the telecommunication business and have since refocused into this business.

This description of the Share Exchange Agreement

does not purport to be complete and is qualified in its entirety by reference to the terms of the Share Exchange Agreement, which was

filed as an exhibit to our Current Report on Form 8-K filed with the SEC on July 20, 2017 and incorporated by reference herein.

VIE Agreements

On October 16, 2018, the Company, through its

indirect wholly owned subsidiary, Shanghai JiuGe Business Management Co., Ltd. (“JiuGe Management”), entered into a

series of agreements known as variable interest agreements (the “VIE Agreements”) pursuant to which Shanghai JiuGe

Information Technology Co., Ltd. (“JiuGe Technology”) became our contractually controlled affiliate. The use of VIE

agreements is a common structure used to acquire PRC corporations, particularly in certain industries in which foreign investment is restricted

or forbidden by the PRC government. The VIE Agreements include a Consulting Services Agreement, a Loan Agreement, a Power of Attorney

Agreement, a Call Option Agreement, and a Share Pledge Agreement in order to secure the connection and commitments of JiuGe Technology.

We operate our mobile payment platform business through JiuGe Technology.

The VIE Agreements included:

| |

● |

a consulting services agreement through which JiuGe Management is mainly engaged in data marketing, technical services, technical consulting and business consultancy to JiuGe Technology (the “JiuGe Technology Consulting Services Agreement”). This agreement was duly signed among the WFOE and the VIE. Under this agreement, the WFOE will provide the following services to the VIE on an exclusive basis: (i) providing a comprehensive solution for all technical issues required for the VIE’s business; (ii) providing training to the professional technicians of the VIE; (iii) assisting the VIE in collecting technical and commercial information and conducting market surveys; (iv) assisting the VIE in procuring business opportunities to obtain contracts awarded by the telecom carries in China and maintaining the commercial relationship with the telecom carries; (v) introducing clients to the VIE and assisting the VIE in developing commercial and cooperative relationship with the clients; (vi) providing suggestions and opinions on establishment and improvement of the VIE’s corporate structure, management system and departmental organization; (vii) assisting the VIE in formulating annual business plans, the draft of which shall be made available to WFOE by the VIE prior to the end of November each year; (viii) granting license to the VIE to use WFOE’s intellectual property necessary for the services; and (ix) providing other consulting and technical services at the request of the VIE. The VIE will pay to the WFOE service fees equivalent to the after-tax net profits distributable by the VIE to its shareholder each year, as set forth in the audited financial statements in accordance with the PRC accounting standards, ensuring all the distributable profits of the VIE will be dispatched to the WFOE. The VIE may not assign any of its rights and obligations under the JiuGe Technology Consulting Services Agreement without prior written consent of the WFOE. This agreement ensures that the WFOE and investors will be able to legally obtain the profits of the VIE, and transfer them to the WFOE more conveniently in the form of “service fee”; |

| |

|

|

| |

● |

a loan agreement through which JiuGe Management grants a loan to the Legal Representative of JiuGe Technology for the purpose of capital contribution (the “JiuGe Technology Loan Agreement”). This agreement was duly signed between the WFOE and Ms. Li Li. Under this agreement, the WFOE loaned RMB 10,000,000 to Ms. Li Li, as the sole shareholder of the VIE, solely for the purpose of the capital contribution of the subscribed capital of the VIE. The loan amount has now been increased to RMB50,000,000. The WFOE has the right to convert the whole or any part of the outstanding principal amount into the equity interests in the VIE and may demand repayment of any or all of the principal amount/ As security for performance and discharge of Ms. Li Li’s obligations under the JiuGe Technology Loan Agreement, Ms. Li Li pledged 100% equity interests in the VIE, representing the entire registered capital of the VIE, by way of first-ranking security to the WFOE. This agreement could constrain Ms. Li Li to cooperate with WFOE’s instructions and avoid damaging the rights and interests of the WFOE and investors; |

| |

● |

a power of attorney agreement under which the owner of JiuGe Technology has vested their collective voting control over JiuGe Technology to JiuGe Management and will only transfer their equity interests in JiuGe Technology to JiuGe Management or its designee(s) (the “JiuGe Technology Power of Attorney Agreement”). The Power of Attorney Agreement was duly issued by Ms. Li Li to the WFOE. Under the JiuGe Technology Power of Attorney Agreement, the WFOE is the exclusive agent who may exercise, at WFOE’s sole discretion, all the rights and powers in respect of all the 100% equity interests held by Ms. Li Li in the VIE on Ms. Li Li’s behalf, including without limitation to propose to convene, attend and vote at the shareholder’s meeting of the VIE. Ms. Li Li cannot assign her rights and obligations under the JiuGe Technology Power of Attorney Agreement without prior written consent of the WFOE and the WFOE will bear its own costs, expenses and fees in connection with performance of the JiuGe Technology Power of Attorney Agreement. This agreement ensures that the WFOE can replace Ms. LI Li in the operation and management of the VIE, and controlling its assets; |

| |

|

|

| |

● |

a call option agreement under which the owner of JiuGe Technology has granted to JiuGe Management the irrevocable and unconditional right and option to acquire all of their equity interests in JiuGe Technology or transfer these rights to a third party (the “JiuGe Technology Call Option Agreement”). This agreement was duly signed by and among Ms. Li Li, the WFOE and the VIE. Under this agreement, the WFOE has an exclusive, irrevocable and unconditional option to purchase or to designate a third party to purchase 100% equity interests of the VIE at RMB one (1) yuan or the lowest amount of consideration permitted under the laws of PRC at any time, giving the WFOE a sole discretion to exercise such option at any time and in any manner as permitted by the laws of PRC. Pursuant to the JiuGe Technology Call Option Agreement, Ms. Li Li may not, without prior written consent of the WFOE: (i) transfer or dispose of the equity interests in the VIE or the assets of the VIE in any manner; (ii) create any encumbrance of any kind over the equity interests in the VIE, other than the VIE Agreements; and (iii) resolve to or procure the VIE to: (a) change its registered capital; (b) amend its articles of association; (c) change any of its shareholders; (d) appoint, remove or replace its senior management; (e) make or receive investment of any kind or merge or consolidate with any entity; (f) change information filed at the competent authorities in the PRC; (g) make any lending or borrowing or provide security of any kind; (h) pay, make or declare any dividend, charge, fee or other distribution of any kind; (i) incure, create or permit to subsist or have any outstanding financial indebtedness; (j) enter into any agreements that conflict with the JiuGe Technology Call Option Agreement; or (k) do any acts that would adversely impair the VIE’s ability to perform the obligations under the VIE Agreements. Neither Ms. Li Li nor the VIE may assign any of its rights and obligations under the agreement without the prior written consent of WFOE or unilaterally terminate the agreement. This agreement is one of the guarantees for WFOE and investors to ensure that the VIE will not have any potential equity changes that endanger the rights and interests of WFOE and investors; and |

| |

|

|

| |

● |

a share pledge agreement under which the owner of JiuGe Technology has pledged all of their rights, titles and interests in JiuGe Technology to JiuGe Management to guarantee JiuGe Technology’s performance of its obligations under the JiuGe Technology Consulting Services Agreement (the “JiuGe Technology Share Pledge Agreement”). This agreement was duly signed among Ms. Li Li, the WFOE and the VIE. Under this agreement, all the equity interests of the VIE held by Ms. Li Li were pledged to the WFOE, giving the WFOE a right to exercise the share pledge where Ms. Li Li or the VIE violates the VIE Agreements. This measure under this agreement will result in the equity of the VIE being locked, making it impossible for any third party to legally obtain the equity of the VIE without the prior consent of the WFOE. |

| |

|

|

Our PRC counsel has reviewed these agreements

and believes that all the VIE Agreements were duly signed and are not in violation of applicable laws of PRC. We are of the opinion that

the VIE Agreements are valid and giving the WFOE a full control over the VIE in respect of the current and effective PRC laws and regulations.

However, the VIE Agreements have never been challenged or recognized in court for the time being, and the PRC government may determine

that the VIE Agreements are not in compliance with applicable PRC laws, rules and regulations compared with direct ownership, there may

be less effective in controlling through the VIE structure.

In the first half of 2018, JiuGe Technology established

contracts with China Unicom and China Mobile, initiating the provision of mobile data services to businesses and corporations in key provinces/municipalities

including Chengdu, Jiangxi, Jiangsu, Chongqing, Shanghai, Zhuhai, Zhejiang, Shaanxi and Inner Mongolia. As with all dynamic markets, the

specifics of our operational contracts have naturally evolved over time but our dedication to these provinces is unwavering, and we consistently

enhance our service and product offerings to ensure optimal service. Additionally, as we continue to grow, there is the potential for

our reach to expand into additional provinces in the PRC.

In September 2018, JiuGe Technology launched and

commercialized mobile payment and recharge services to businesses for China Unicom. The JiuGe Technology mobile payment and recharge platform

enables the seamless delivery of real-time payment and recharge services to third-party channels and businesses. We earn a negotiated

rebate amount from each of China Unicom and China Mobile for all monies paid by consumers to China Unicom and China Mobile that we process.

To encourage consumers to utilize our portal instead of using our competitors’ platforms or paying China Unicom or China Mobile

directly, we offer mobile data and talk time at a rate discounted from these companies’ stated rates, which are also the rates we

must pay to them to purchase the mobile data and talk time provided to consumers through the use of our platform. Accordingly, we earn

income on the rebates we receive from the telecommunications companies, reduced by the amounts by which we discount the mobile data and

talk time sold through our platform.

In October 2018, China Unicom and China Mobile

awarded JiuGe Technology with contracts that established partnerships for data analysis, that could unlock potential value-added services.

This description of the VIE Agreements discussed

above do not purport to be complete and are qualified in their entirety by reference to the terms of the VIE Agreements, which were filed

as exhibits to our Current Report on Form 8-K filed with the SEC on December 27, 2018 and are incorporated by reference herein. The English

translation version of the JiuGe Technology Share Pledge Agreement was filed as Exhibit 10.6 to our Form S-1/A (Amendment No. 1) filed

with the SEC on January 5, 2023, and is incorporated by reference herein.

Acquisition of Beijing Technology

On March 7, 2019, the Company through JiuGe Technology

acquired Beijing Technology, a company in the business of providing mass SMS text services to businesses looking to communicate with large

numbers of their customers and prospective customers. Through Beijing Technology, the Company entered into the business of mass SMS text

message service as a compliment to its mobile payment and recharge business. The mass SMS text message service offers bulk SMS services

to end consumers with competitive pricing. Currently, the Company’s SMS integrated platform is processing more than 150 million

SMS text messages per month. Beijing Technology retains a license from the Ministry of Industry and Information Technology (“MIIT”)

to operate SMS and MMS business in the PRC. Similar to the mobile recharge business, Beijing Technology is required to make a deposit

or bulk purchase in advance and has secured business customers that will utilize Beijing Technology’s SMS integrated platform to

send bulk SMS text messages monthly. Beijing Technology has the capability to manage and track the entire process, including to assist

the Company’s clients to fulfil the government guidelines, until the SMS messages have been delivered successfully.

China Unicom Cooperation Agreement

On July 7, 2019, JiuGe Technology entered into

that certain Yunnan Unicom Electronic Sales Platform Construction and Operation Cooperation Agreement (the “Cooperation Agreement”)

with China United Network Communications Limited Yunnan Branch (“China Unicom Yunnan”). Under the Cooperation Agreement,

JiuGe Technology is responsible for constructing and operating China Unicom Yunnan’s electronic sales platform through which consumers

can purchase various goods and services from China Unicom Yunnan, including mobile telephones, mobile telephone service, broadband data

services, terminals, “smart” devices and related financial insurance. The Cooperation Agreement provides that JiuGe Technology

is required to construct and operate the platform’s webpage in accordance with China Unicom Yunnan’s specifications and policies,

and applicable law, and bear all expenses in connection therewith. As consideration for the services it provides under the Cooperation

Agreement, JiuGe Technology receives a percentage of the revenue received from all sales it processes for China Unicom Yunnan on the platform.

The Cooperation Agreement expires three years

from the date of its signature, subject to a yearly auto-renewal clause, which is currently in an auto-renewal period, but it may be terminated

by (i) JiuGe Technology upon three months’ written notice or (ii) by China Unicom Yunnan unilaterally. The Cooperation Agreement

contains customary representations from each party regarding such party’s authority to enter into and perform under the Cooperation

Agreement, and provides customary events of default, including for various types of failure to perform. Any disputes arising between the

parties under the Cooperation Agreement will be adjudicated in Chinese courts.