false

0001211583

0001211583

2024-12-18

2024-12-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 18, 2024

FENNEC

PHARMACEUTICALS INC.

(Exact name of registrant as specified in its charter)

001-32295

(Commission File Number)

| British Columbia, Canada |

|

20-0442384 |

|

(State or other jurisdiction of

incorporation) |

|

(I.R.S. Employer Identification No.) |

|

PO Box 13628, 68 TW Alexander Drive,

Research Triangle Park, NC |

|

27709 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (919) 636-4530

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12 of the Act:

| Title of each class |

Trading symbol(s) |

Name of each exchange on which

registered |

| Common shares, no par value |

FENC |

Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

| Item 1.01. |

Entry into a Material Definitive Agreement. |

As previously disclosed, on August 1, 2022, Fennec

Pharmaceuticals Inc. (the “Company”) entered into a Securities Purchase Agreement with Petrichor Opportunities Fund I LP (the

“Petrichor”) in connection with the issuance of up to $45 million of senior secured floating rate convertible notes (the “Notes”),

issuable in multiple tranches, pursuant to which the Company issued $5 million in Notes on August 1, 2022 (the “First Closing

Notes”), $20 million in Notes on September 23, 2022 (the “Second Closing Notes”), and $5 million in Notes on December 4,

2023 (the “Third Closing Notes”).

On December 18, 2024, the Company entered into a Waiver and Redemption Agreement (the “Redemption Agreement”) with Petrichor,

pursuant to which the Company repurchased and redeemed Notes in an aggregate principal amount of $13,000,000 (consisting of approximately

$11.8 million of original principal balance and approximately $1.2 million in PIK interest) (collectively, the “Note Redemptions”).

As a result of the Note Redemptions, the First

and Third Closing Notes were repurchased and redeemed in full, and, as of December 19, 2024, there remains outstanding Second Closing

Notes in the aggregate principal amount (inclusive of PIK interest) of approximately $19.2 million.

The foregoing description of the Redemption Agreement

is not complete and is qualified in its entirety by reference to the full text of the Redemption Agreement, which is filed as Exhibit

10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

On December 19, 2024, the Company issued a news

release announcing the Note repayments resulting from the Note Redemptions described under Item 1.01 of this Current Report on Form 8-K.

A copy of the news release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

The

information contained in this Item 8.01, as well as Exhibit 99.1 attached hereto, shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be deemed incorporated

by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by

specific reference in such a filing.

| Item 9.01 |

Financial Statements and Exhibits. |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

FENNEC PHARMACEUTICALS INC. |

| |

|

|

| Date: December 20, 2024 |

By: |

/s/ Robert Andrade |

| |

|

Robert Andrade

Chief Financial Officer |

Exhibit 10.1

WAIVER AND REDEMPTION AGREEMENT

This Waiver and Redemption Agreement, dated as

of December 18, 2024 (this “Agreement”), is entered into by and among Fennec Pharmaceuticals, Inc., a British

Columbia corporation (the “Company”), the investors party hereto (the “Investors”),

and Petrichor Opportunities Fund I LP, as collateral agent (in such capacity, the “Collateral Agent”; and together

with the Company and the Investors, collectively, the “Parties”). Capitalized terms used but not otherwise defined

herein shall have the respective meanings ascribed thereto in the Securities Purchase Agreement.

R E C I T A L S

WHEREAS, the Parties have heretofore entered into

that certain Securities Purchase Agreement, dated as of August 1, 2022 (the “Securities Purchase Agreement”),

pursuant to which, among other things, the Company has issued and sold certain Notes to the Investors;

WHEREAS, the Company has informed the Investors

and the Collateral Agent that the Company desires to repurchase and redeem from the Investors Notes in an aggregate outstanding principal

amount of $13,000,000;

WHEREAS, pursuant to the terms of the Securities

Purchase Agreement and the Notes, the Company is not permitted to optionally redeem any of the Notes until August 19, 2025; and

WHEREAS, the Company has requested that the Investors

and the Collateral Agent agree to waive the restriction on the optional redemption of the Notes prior to August 19, 2025 in order to permit

the repurchase and redemption of the Notes contemplated by this Agreement and, subject to the terms and conditions of this Agreement,

the Investors and the Collateral Agent have agreed to waive such restriction with respect to the repurchase and redemption of the Notes

contemplated by this Agreement.

NOW THEREFORE, in consideration

of the foregoing and the mutual agreements and covenants contained herein, and other good and valuable consideration, the receipt and

sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

1. Waiver

of Restriction on Redemption. Subject to the terms and conditions of this Agreement, the Investors and the Collateral Agent hereby

waive the restriction on the optional redemption of the Notes prior to August 19, 2025 as set forth in Section 8.1(a) of the Notes solely

for the purposes of permitting the repurchase and redemption of the Notes contemplated by this Agreement and for no other purpose. The

waiver contained in this Section 1 is a limited waiver and (a) shall only be relied upon and used for the specific purpose set

forth herein, and (b) shall not constitute nor be deemed to constitute a waiver of (i) any Event of Default under the Securities Purchase

Agreement or any Note or (ii) any term or condition of the Securities Purchase Agreement or any Note other than as specifically set forth

herein.

2. Waiver

Fee. In consideration of each Investor’s agreement to waive the restriction on the optional redemption of the Notes prior to

August 19, 2025 as set forth in Section 8.1(a) of the Notes with respect to the repurchase and redemption of the Notes contemplated by

this Agreement, the Company hereby agrees to pay each Investor a waiver fee, payable in cash to each Investor on the date hereof, in the

amount set forth opposite such Investor’s name under the heading “Waiver Fee” on Schedule I hereto (with respect

to each such Investor, such Investor’s “Waiver Fee”).

3. Repurchase

of Notes. The Company hereby agrees to repurchase and redeem from each Investor and each Investor hereby agrees to sell to the Company,

in each case on the terms and conditions set forth herein:

(a)

First Closing Notes in an aggregate principal amount set

forth opposite such Investor’s name under the heading “First Closing Notes (Principal and Interest)” on Schedule

I hereto (with respect to each such Investor, such Investor’s “Repurchased First Closing Notes”) for

an aggregate cash purchase price equal to the sum of (x) the amount set forth opposite such Investor’s name under the heading “First

Closing Notes (Closing Purchase Price)” on Schedule I hereto (with respect to each such Investor, such Investor’s “Repurchased

First Closing Notes Closing Purchase Price”), which represents the aggregate outstanding principal amount of such Investor’s

Repurchased First Closing Notes as of the date hereof, plus (y) the amount set forth opposite such Investor’s name under

the heading “First Closing Notes (Deferred Purchase Price)” on Schedule I hereto (with respect to each such Investor,

such Investor’s “Repurchased First Closing Notes Deferred Purchase Price”), which represents the aggregate

amount of accrued and unpaid interest in respect of such Investor’s Repurchased First Closing Notes as of the date hereof;

(b) Second

Closing Notes in an aggregate principal amount set forth opposite such Investor’s name under the heading “Second Closing Notes

(Principal and Interest)” on Schedule I hereto (with respect to each such Investor, such Investor’s “Repurchased

Second Closing Notes”) for an aggregate cash purchase price equal to the sum of (x) the amount set forth opposite such Investor’s

name under the heading “Second Closing Notes (Closing Purchase Price)” on Schedule I hereto (with respect to each such

Investor, such Investor’s “Repurchased Second Closing Notes Closing Purchase Price”), which represents

the aggregate outstanding principal amount of such Investor’s Repurchased Second Closing Notes as of the date hereof, plus

(y) the amount set forth opposite such Investor’s name under the heading “Second Closing Notes (Deferred Purchase Price)”

on Schedule I hereto (with respect to each such Investor, such Investor’s “Repurchased Second Closing Notes Deferred

Purchase Price”), which represents the aggregate amount of accrued and unpaid interest in respect of such Investor’s

Repurchased Second Closing Notes as of the date hereof; and

(c)

Third Closing Notes in an aggregate principal amount set

forth opposite such Investor’s name under the heading “Third Closing Notes (Principal and Interest)” on Schedule

I hereto (with respect to each such Investor, such Investor’s “Repurchased Third Closing Notes”; and

together with such Investor’s Repurchased First Closing Notes and Repurchased Second Closing Notes, collectively, such Investor’s

“Repurchased Notes”) for an aggregate cash purchase price equal to the sum of (x) the amount set forth opposite

such Investor’s name under the heading “Third Closing Notes (Closing Purchase Price)” on Schedule I hereto (with

respect to each such Investor, such Investor’s “Repurchased Third Closing Notes Closing Purchase Price”;

and together with such Investor’s Repurchased First Closing Notes Closing Purchase Price and Repurchased Second Closing Notes Closing

Purchase Price, collectively, such Investor’s “Aggregate Repurchased Notes Closing Purchase Price”), which

represents the aggregate outstanding principal amount of such Investor’s Repurchased Third Closing Notes as of the date hereof,

plus (y) the amount set forth opposite such Investor’s name under the heading “Third Closing Notes (Deferred Purchase

Price)” on Schedule I hereto (with respect to each such Investor, such Investor’s “Repurchased Third Closing

Notes Deferred Purchase Price”; and together with such Investor’s Repurchased First Closing Notes Deferred Purchase

Price and Repurchased Second Closing Notes Deferred Purchase Price, collectively, such Investor’s “Aggregate Repurchased

Notes Deferred Purchase Price”), which represents the aggregate amount of accrued and unpaid interest in respect of such

Investor’s Repurchased Third Closing Notes as of the date hereof.

4. Closing

of Repurchase of Repurchased Notes; Payment of Waiver Fee and Purchase Price.

(a) The

closing of the repurchase and redemption of the Repurchased Notes hereunder shall occur on the date hereof (the “Closing”).

(b) At

the Closing, the Company shall deliver to each Investor, by wire transfer of immediately available funds to an account specified by each

such Investor, cash in an aggregate amount equal to the sum of (a) such Investor’s Aggregate Repurchased Notes Closing Purchase

Price, plus (b) such Investor’s Waiver Fee.

(c) On

January 2, 2025, the Company shall deliver to each Investor, by wire transfer of immediately available funds to an account specified by

each such Investor, cash in an aggregate amount equal to such Investor’s Aggregate Repurchased Notes Deferred Purchase Price.

(d) The

provisions of Section 11.1(e) of the Notes, as applicable, shall apply to the repurchase and redemption of the Repurchased Notes hereunder.

5. Miscellaneous.

Except as specifically waived herein, the Securities Purchase Agreement, the Notes and all other Transaction Documents are and shall continue

to be in full force and effect and are hereby in all respects ratified and confirmed. Except as specifically set forth in Section 1,

the execution, delivery and effectiveness of this Agreement shall not operate as a waiver of any right, power or remedy of the Investors

or the Collateral Agent under the Securities Purchase Agreement, the Notes or any other Transaction Documents, nor constitute a waiver

of any provision of the Securities Purchase Agreement, the Notes or any other Transaction Documents. This Agreement may be amended or

modified only pursuant to a written instrument executed by all of the Parties. This Agreement and the rights and obligations of the parties

under this Agreement shall be governed by, and construed and interpreted in accordance with, the law of the State of New York (without

reference to its choice of law rules). Section 8.9 of the Securities Purchase Agreement is incorporated herein, mutatis mutandis, as if

a part hereof. This Agreement may be executed in any number of counterparts and by different parties hereto in separate counterparts,

each of which when so executed and delivered shall be deemed to be an original and all of which taken together shall constitute but one

and the same agreement. Delivery of an executed counterpart of a signature page to this Agreement electronically shall be effective as

delivery of a manually executed counterpart of this Agreement.

[Signatures Follow]

IN WITNESS WHEREOF,

the parties hereto have executed, acknowledged and delivered this Agreement effective as of the day and year first above written.

| |

COMPANY: |

| |

|

| |

FENNEC PHARMACEUTICALS INC. |

| |

INVESTORS: |

| |

|

| |

PETRICHOR OPPORTUNITIES FUND I LP |

| |

|

| |

By: Petrichor Opportunities Fund I GP, LLC |

| |

PETRICHOR OPPORTUNITIES FUND I INTERMEDIATE LP |

| |

|

| |

By: Petrichor Opportunities Fund I GP, LLC |

| |

COLLATERAL AGENT: |

| |

|

| |

PETRICHOR OPPORTUNITIES FUND I LP |

| |

|

| |

By: Petrichor Opportunities Fund I GP, LLC |

SCHEDULE I

Repurchased Notes

SCHEDULE I

Repurchased Notes

| Investor | |

Waiver

Fee | | |

First

Closing

Notes (Principal

and Interest) | | |

First

Closing

Notes (Closing

Purchase

Price) |

| |

First

Closing

Notes (Deferred

Purchase

Price) | | |

Second

Closing Notes (Principal

and Interest) | | |

Second

Closing Notes (Closing

Purchase

Price) | | |

Second

Closing

Notes (Deferred

Purchase

Price) | | |

Third

Closing Notes (Principal

and Interest) | | |

Third

Closing

Notes (Closing

Purchase Price) | | |

Third

Closing

Notes (Deferred

Purchase

Price) | | |

Aggregate

Repurchased

Notes Closing

Purchase Price | | |

Aggregate

Repurchased

Notes Deferred

Purchase Price | |

| Petrichor

Opportunities Fund I LP | |

$ | 1.00 | | |

$ | 3,833,583.27 | | |

$ | 3,730,754.35 | 1 | |

$ | 102,828.92 | | |

$ | 1,375,546.54 | | |

$ | 1,334,225.88 | 2 | |

$ | 41,320.66 | | |

$ | 3,971,319.77 | | |

$ | 3,971,319.77 | 3 | |

$ | 0.00 | | |

$ | 9,036,301.00 | | |

$ | 144,149.58 | |

| Petrichor

Opportunities Fund I Intermediate LP | |

$ | 1.00 | | |

$ | 1,681,570.33 | | |

$ | 1,636,465.26 | 4 | |

$ | 45,105.07 | | |

$ | 603,372.38 | | |

$ | 585,247.41 | 5 | |

$ | 18,124.97 | | |

$ | 1,741,987.33 | | |

$ | 1,741,987.33 | 6 | |

$ | 0.00 | | |

$ | 3,963,701.00 | | |

$ | 63,230.04 | |

| 1 | Represents an aggregate initial principal amount of $3,475,500.00

plus an aggregate of $ in PIK Interest that has been added to the outstanding principal amount of the First Closing Notes prior to the

date hereof |

| 2 | Represents an aggregate initial principal amount of $ plus an

aggregate of $ in PIK Interest that has been added to the outstanding principal amount of the Second Closing Notes prior to the date

hereof |

| 3 | Represents an aggregate initial principal amount of $ plus an

aggregate of $ in PIK Interest that has been added to the outstanding principal amount of the Third Closing Notes prior to the date hereof |

| 4 | Represents an aggregate initial principal amount of $ plus an

aggregate of $ in PIK Interest that has been added to the outstanding principal amount of the First Closing Notes prior to the date hereof |

| 5 | Represents an aggregate initial principal amount of $ plus an

aggregate of $ in PIK Interest that has been added to the outstanding principal amount of the Second Closing Notes prior to the date

hereof |

| 6 | Represents an aggregate initial principal amount of $ plus an

aggregate of $ in PIK Interest that has been added to the outstanding principal amount of the Third Closing Notes prior to the date hereof |

Exhibit 99.1

FENNEC PHARMACEUTICALS

ANNOUNCES EARLY PARTIAL REPAYMENT OF ITS OUTSTANDING CONVERTIBLE DEBT FACILITY WITH PETRICHOR HEALTHCARE CAPITAL MANAGEMENT

~ $13 Million Convertible Debt Repayment from

Available Cash ~

~ Elimination of Approximately $1.5 Million

in Annual Interest Expense and Potential Equity Overhang of Approximately 1.6 Million Shares ~

Research

Triangle Park, NC, December 19, 2024 – Fennec

Pharmaceuticals Inc. (NASDAQ:FENC; TSX: FRX), a specialty pharmaceutical company, today announced the early repayment of $13 million of

the Company’s approximately $32 million outstanding convertible

debt facility with Petrichor Healthcare Capital Management (“Petrichor”).

Pro forma for today’s announced repayment, the convertible debt

facility with Petrichor will be approximately $19 million and maintain a maturity of September 2027. This early partial repayment was

financed entirely with available cash.

“We

are pleased to announce the early partial repayment of a significant portion of our debt to Petrichor in a financial and strategic action

that optimizes the Company’s balance sheet and overall capital structure, while effectively saving approximately $1.5 million in

future annual interest payments and eliminating potential dilutive shares,” said Jeff Hackman, chief executive officer of Fennec

Pharmaceuticals. “This financial milestone underscores the confidence we continue to have in our business and reflects our commitment

to maintaining a strong and sustainable operating model that enables us to accelerate our commercialization plans for PEDMARKÒ.

We thank Petrichor for their continued support of Fennec and believe that we are well positioned for near-term and sustainable growth.”

As previously

reported in Fennec’s third quarter 2024 earnings and inclusive of this announcement, the Company anticipates that its cash, cash

equivalents and investment securities will be sufficient to fund planned operations into 2026.

Further

information will be set forth in the Current Report on Form 8-K to be filed by the Company with the U.S. Securities and Exchange

Commission (the “SEC”) on or about December 20, 2024.

About Fennec

Pharmaceuticals

Fennec Pharmaceuticals Inc. is a specialty pharmaceutical

company focused on the development and commercialization of PEDMARK® to reduce the risk of platinum-induced ototoxicity

in pediatric patients. Further, PEDMARK received FDA approval in September 2022 and European Commission approval in June 2023 and U.K.

approval in October 2023 under the brand name PEDMARQSIÒ. PEDMARK has

received Orphan Drug Exclusivity in the U.S. and PEDMARQSI has received Pediatric Use Marketing Authorization in Europe which includes

eight years plus two years of data and market protection. For more information, please visit www.fennecpharma.com.

About Petrichor

Petrichor partners

with world-class healthcare managers and businesses to provide customized investment structures and support. Petrichor has completed

over 125 investments representing more than $6 billion in invested capital and has held over 50 board seats. Petrichor maintains

a deep in-house understanding of healthcare products and services, including scientific, technical, and commercial expertise. This healthcare

expertise, together with a breadth of experience investing across sectors, geographies, and capital structures, provides a unique combination

to help build successful companies. For more information on Petrichor, please visit www.petrichorcap.com.

PEDMARK® (sodium thiosulfate

injection)

PEDMARK® is the first and only

U.S. Food and Drug Administration (FDA) approved therapy indicated to reduce the risk of ototoxicity associated with cisplatin treatment

in pediatric patients with localized, non-metastatic, solid tumors. It is a unique formulation of sodium thiosulfate in single-dose, ready-to-use

vials for intravenous use in pediatric patients.7 PEDMARK is also the first and only therapeutic agent with proven efficacy

and safety data with an established dosing regimen, across two open-label, randomized Phase 3 clinical studies, the Children’s Oncology

Group (COG) Protocol ACCL0431 and SIOPEL 6.

In the U.S.

and Europe, it is estimated that, annually, more than 10,000 children may receive platinum-based chemotherapy. The incidence of ototoxicity

depends upon the dose and duration of chemotherapy, and many of these children require lifelong hearing aids. There is currently no established

preventive agent for this hearing loss and only expensive, technically difficult, and sub-optimal cochlear (inner ear) implants have been

shown to provide some benefit. Infants and young children that suffer ototoxicity at critical stages of development lack speech language

development and literacy, and older children and adolescents lack social-emotional development and educational achievement.

PEDMARK

has been studied by co-operative groups in two Phase 3 clinical studies of survival and reduction of ototoxicity, COG ACCL0431 and SIOPEL

6. Both studies have been completed. The COG ACCL0431 protocol enrolled childhood cancers typically treated with intensive cisplatin therapy

for localized and disseminated disease, including newly diagnosed hepatoblastoma, germ cell tumor, osteosarcoma, neuroblastoma, medulloblastoma,

and other solid tumors. SIOPEL 6 enrolled only hepatoblastoma patients with localized tumors.

Indications

and Usage

PEDMARK®

(sodium thiosulfate injection) is indicated to reduce the risk of ototoxicity associated with cisplatin in pediatric patients 1 month

of age and older with localized, non-metastatic solid tumors.

Limitations of Use

The safety and efficacy of PEDMARK have not been

established when administered following cisplatin infusions longer than 6 hours. PEDMARK may not reduce the risk of ototoxicity when administered

following longer cisplatin infusions, because irreversible ototoxicity may have already occurred.

Important Safety Information

PEDMARK is contraindicated in patients with history

of a severe hypersensitivity to sodium thiosulfate or any of its components.

Hypersensitivity reactions occurred in 8% to

13% of patients in clinical trials. Monitor patients for hypersensitivity reactions. Immediately discontinue PEDMARK and institute

appropriate care if a hypersensitivity reaction occurs. Administer antihistamines or glucocorticoids (if appropriate) before each

subsequent administration of PEDMARK. PEDMARK may contain sodium sulfite; patients with sulfite sensitivity may have

hypersensitivity reactions, including anaphylactic symptoms and life-threatening or severe asthma episodes. Sulfite sensitivity is

seen more frequently in people with asthma.

PEDMARK is not indicated for use in pediatric

patients less than 1 month of age due to the increased risk of hypernatremia or in pediatric patients with metastatic cancers.

Hypernatremia occurred in 12% to 26% of patients

in clinical trials, including a single Grade 3 case. Hypokalemia occurred in 15% to 27% of patients in clinical trials, with Grade 3 or

4 occurring in 9% to 27% of patients. Monitor serum sodium and potassium levels at baseline and as clinically indicated. Withhold PEDMARK

in patients with baseline serum sodium greater than 145 mmol/L.

Monitor for signs and symptoms of hypernatremia

and hypokalemia more closely if the glomerular filtration rate (GFR) falls below 60 mL/min/1.73m2.

Administer antiemetics prior to each PEDMARK administration.

Provide additional antiemetics and supportive care as appropriate.

The most common adverse reactions (≥25%

with difference between arms of >5% compared to cisplatin alone) in SIOPEL 6 were vomiting, nausea, decreased hemoglobin, and hypernatremia.

The most common adverse reaction (≥25% with difference between arms of >5% compared to cisplatin alone) in COG ACCL0431 was hypokalemia.

Please see full Prescribing Information for PEDMARK®

at: www.PEDMARK.com.

Forward Looking Statements

Except for historical information described

in this press release, all other statements are forward-looking. Words such as “believe,” “anticipate,” “plan,”

“expect,” “estimate,” “intend,” “may,” “will,” or the negative of those terms,

and similar expressions, are intended to identify forward-looking statements. These forward-looking statements include statements about

our business strategy, timeline and other goals, plans and prospects, including our commercialization plans respecting PEDMARK®,

the market opportunity for and market impact of PEDMARK®, its potential impact on patients and anticipated benefits associated

with its use, and potential access to further funding after the date of this release. Forward-looking statements are subject to certain

risks and uncertainties inherent in the Company’s business that could cause actual results to vary, including the risks and uncertainties

that regulatory and guideline developments may change, scientific data and/or manufacturing capabilities may not be sufficient to meet

regulatory standards or receipt of required regulatory clearances or approvals, clinical results may not be replicated in actual patient

settings, unforeseen global instability, including political instability, or instability from an outbreak of pandemic or contagious disease,

such as the novel coronavirus (COVID-19), or surrounding the duration and severity of an outbreak, protection offered by the Company’s

patents and patent applications may be challenged, invalidated or circumvented by its competitors, the available market for the Company’s

products will not be as large as expected, the Company’s products will not be able to penetrate one or more targeted markets, revenues

will not be sufficient to fund further development and clinical studies, our ability to obtain necessary capital when needed on acceptable

terms or at all, the Company may not meet its future capital requirements in different countries and municipalities, and other risks detailed

from time to time in the Company’s filings with the Securities and Exchange Commission including its Annual Report on Form 10-K

for the year ended December 31, 2023. Fennec disclaims any obligation to update these forward-looking statements except as required by

law.

For

a more detailed discussion of related risk factors, please refer to our public filings available at www.sec.gov and www.sedar.com.

PEDMARK®

and Fennec® are registered trademarks of Fennec Pharmaceuticals Inc.

©2024

Fennec Pharmaceuticals Inc. All rights reserved. FEN-1604-v1

For further

information, please contact:

Investors:

Robert Andrade

Chief Financial Officer

Fennec Pharmaceuticals, Inc.

+1 919-246-5299

Corporate & Media:

Lindsay Rocco

Elixir Health Public Relations

+1 862-596-1304

lrocco@elixirhealthpr.com

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

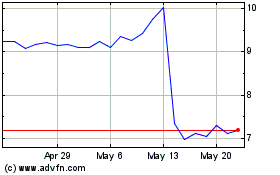

Fennec Pharmaceuticals (NASDAQ:FENC)

Historical Stock Chart

From Dec 2024 to Jan 2025

Fennec Pharmaceuticals (NASDAQ:FENC)

Historical Stock Chart

From Jan 2024 to Jan 2025