As filed with the Securities and Exchange Commission

on March 7, 2024

Registration

No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

FANHUA

INC.

(Exact name of Registrant as specified in its

charter)

Not Applicable

(Translation of Registrant’s name into

English)

| Cayman Islands |

|

Not Applicable |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification Number) |

60/F, Pearl River Tower

No. 15 West Zhujiang Road

Guangzhou, Guangdong 510623

People’s Republic of China

Tel: +86 20 8388-6888 |

| (Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices) |

| |

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

+1 800 221-0102 |

|

| (Name, address, including zip code, and telephone number, including area code, of agent for service) |

| Copies to: |

| |

|

Peng Ge

Chief Financial Officer

60/F, Pearl River Tower

No. 15 West Zhujiang Road

Guangzhou, Guangdong 510623

People’s Republic of China

+86 20 8388-3033 |

|

Steve Lin, Esq.

Kirkland & Ellis International LLP

58th Floor, China World Tower A

No. 1 Jian Guo Men Wai Avenue

Chaoyang District, Beijing 100004

People’s Republic of China

+86 10 5737-9315 |

Approximate date of commencement

of proposed sale to the public: from time to time after the effective date of this registration statement

If the only securities being registered on this Form are being offered

pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered

on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering

pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number

of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c)

under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration

statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction

I.C. or a post-effective amendment thereto that shall become effective upon filing with the Securities and Exchange Commission pursuant

to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement

filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities pursuant to Rule

413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☐

If an emerging growth company that prepares its financial statements

in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

| † | The term “new or revised financial accounting standard”

refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The Registrant hereby amends this Registration

Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which

specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission,

acting pursuant to such Section 8(a), may determine.

PROSPECTUS

Fanhua

Inc.

Ordinary Shares

Warrants

Debt Securities

Units

We may from time to time in one or more offerings

offer and sell up to 1,500,000,000 of our ordinary shares, including ordinary shares represented by American depositary shares, or ADSs,

warrants, debt securities, units, or a combination of such securities. We refer to our ADS, ordinary shares, warrants, debt securities

and units collectively as “securities” in this prospectus. This prospectus provides a general description of offerings of

these securities that we may undertake.

We will provide specific terms of any offering

in a supplement to this prospectus. Any prospectus supplement may also add, update, or change information contained in this prospectus.

You should carefully read this prospectus and the applicable prospectus supplement as well as the documents incorporated or deemed to

be incorporated by reference in this prospectus before you purchase any of the securities offered hereby.

These securities may be offered and sold in the

same offering or in separate offerings; to or through underwriters, dealers, and agents; or directly to purchasers. The names of any underwriters,

dealers, or agents involved in the sale of our securities, their compensation and any options to purchase additional securities held by

them will be described in the applicable prospectus supplement. For a more complete description of the plan of distribution of these securities,

see the section entitled “Plan of Distribution” beginning on page 37 of this prospectus.

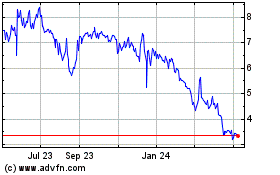

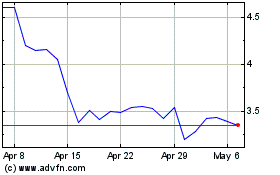

The ADSs are listed on the Nasdaq Global Select

Market under the symbol “FANH.” On March 4, 2024, the last reported sale price of the ADSs on the Nasdaq Global Select Market

was US$4.32 per ADS.

Fanhua Inc. is not an operating company in China

but a Cayman Islands holding company with no direct controlling equity ownership in its consolidated variable interest entities (“VIEs”),

namely Shenzhen Xinbao Investment Management Co., Ltd. and Fanhua RONS (Beijing) Technologies Co., Ltd. We conduct operations in China

through (i) our PRC subsidiaries, (ii) the consolidated VIEs with which we have contractual arrangements, and (iii) the subsidiaries of

the consolidated VIEs. PRC laws and regulations restrict and impose conditions on foreign ownership and investment in certain internet-based

businesses. Accordingly, we operate these businesses in China through the consolidated VIEs and their subsidiaries, and rely on contractual

arrangements among our PRC subsidiaries, the consolidated VIEs and their respective shareholders to control the business operations of

the consolidated VIEs and their subsidiaries. This structure provides investors with exposure to foreign investment in China-based companies

where PRC laws and regulations prohibit or restrict direct foreign investment in operating companies in certain sectors. The contractual

arrangements are not equivalent to equity ownership in the business of the consolidated VIEs and their subsidiaries in China. Investors

in our ADSs are not purchasing equity interest in our subsidiaries or the consolidated VIEs in China but instead are purchasing equity

interest in a holding company incorporated in the Cayman Islands, Fanhua Inc. Investors may never directly hold all equity interests in

the consolidated VIEs.

Our corporate structure is subject to risks associated

with our contractual arrangements with the consolidated VIEs. The contractual arrangements may not be as effective as equity ownership

over the consolidated VIEs, and we may incur substantial costs to enforce the terms of the arrangements. In addition, as of the date of

this prospectus, the legality and enforceability of these contractual arrangements, as a whole, have not been tested in any PRC court.

There is no guarantee that these contractual arrangements, as a whole, would be enforceable if they were tested in a PRC court, and we

may incur substantial costs to enforce the terms of the arrangements. Uncertainties in the PRC legal system may limit our ability, as

a Cayman Islands holding company, to enforce these contractual arrangements. Meanwhile, there are very few precedents as to whether contractual

arrangements would be judged to be effective over the relevant consolidated VIE through the contractual arrangements, or how contractual

arrangements in the context of a consolidated VIE should be interpreted or enforced by the PRC courts. Should legal actions become necessary,

we cannot guarantee that the PRC courts will rule in favor of the enforceability of the contractual arrangements with consolidated VIEs.

In the event we are unable to enforce these contractual arrangements, or if we suffer significant delay or other obstacles in the process

of enforcing these contractual arrangements, our ability to conduct our business may be materially adversely affected. There are also

substantial uncertainties regarding the interpretation and application of current and future PRC laws, regulations and rules regarding

the status of the rights of our Cayman Islands holding company with respect to its contractual arrangements with the consolidated VIEs

and their registered shareholders. It is uncertain whether any new PRC laws or regulations relating to VIE structures will be adopted

or if adopted, what they would provide. If we or the consolidated VIEs are found to be in violation of any existing or future PRC laws

or regulations, or fail to obtain or maintain any of the required permits or approvals, the relevant PRC regulatory authorities would

have broad discretion to take action in dealing with such violations or failures. If the PRC government deems that our contractual arrangements

with the consolidated VIEs do not comply with PRC regulatory restrictions on foreign investment in the relevant industries, or if these

regulations or the interpretation of existing regulations change or are interpreted differently in the future, we could be subject to

severe penalties or be forced to relinquish our interests in those operations. Our Cayman Islands holding company, our PRC subsidiaries

and the consolidated VIEs, and investors of our company face uncertainty about potential future actions by the PRC government that could

affect the enforceability of the contractual arrangements with the consolidated VIEs, which may significantly affect the financial performance

of the consolidated VIEs and our company as a whole. As such, this structure involves unique risks to investors of our holding company.

For a detailed description of the risks associated with our corporate structure, please refer to risks disclosed under “Item 3.

Key Information—D. Risk Factors—Risks Relating to Our Corporate Structure” in our annual report on Form 20-F for the

fiscal year ended December 31, 2022, which is incorporated herein by reference.

We face various legal and operational risks and

uncertainties related to doing business in China. Our business operations are primarily conducted in China, and we are subject to complex

and evolving PRC laws and regulations. The PRC government has issued statements and regulatory actions relating to areas such as approvals

on offshore offerings, anti-monopoly regulatory actions, and oversight on cybersecurity and data privacy. For example, we are required

to make filings with the China Securities Regulatory Commission (the “CSRC”) for applicable securities offerings, including

an offering made pursuant to this prospectus. These statements and regulatory actions may impact our ability to conduct certain businesses,

accept foreign investments, maintain our listing status on a United States stock exchange or list on a foreign exchange outside of mainland

China. These risks could result in a material change in our operations and the value of our ADSs, significantly limit or completely hinder

our ability to continue to offer securities to investors, or cause the value of such securities to significantly decline or become worthless.

For a detailed description of risks related to doing business in China, please refer to risks disclosed under “Item 3. Key Information — D.

Risk Factors — Risks Related to Doing Business in China” in our annual report on Form 20-F for the fiscal year

ended December 31, 2022, which is incorporated by reference in this prospectus.

Pursuant to the Holding Foreign Companies Accountable

Act, which was enacted on December 18, 2020 and further amended by the Consolidated Appropriations Act, 2023 signed into law on December

29, 2022, or the HFCA Act, if the SEC determines that we have filed audit reports issued by a registered public accounting firm that has

not been subject to inspections by the Public Company Accounting Oversight Board, or the PCAOB, for two consecutive years, the SEC shall

prohibit our shares or ADSs from being traded on a national securities exchange or in the over-the-counter trading market in the United

States. Trading in our securities on U.S. markets, including the Nasdaq Global Select Market, will be prohibited under the HFCA Act if

the PCAOB determines that it is unable to inspect or investigate completely our auditor for two consecutive years. On December 16, 2021,

the PCAOB issued the HFCA Act Determination Report to notify the SEC of its determinations that the PCAOB was unable to inspect or investigate

completely registered public accounting firms headquartered in mainland China and Hong Kong, or the 2021 Determinations, including our

auditor. On May 26, 2022, we have been conclusively identified by the Commission as a Commission-Identified Issuer under the HFCA Act.

On December 15, 2022, the PCAOB issued a report that vacated its December 16, 2021 determination and removed mainland China and Hong Kong

from the list of jurisdictions where it is unable to inspect or investigate completely registered public accounting firms. For this reason,

we have not been identified as a Commission-Identified Issuer under the HFCA Act after the filing of our annual report on Form 20-F for

the fiscal year ended December 31, 2022. Each year, the PCAOB will determine whether it can inspect and investigate completely audit firms

in mainland China and Hong Kong, among other jurisdictions. If the PCAOB determines in the future that it no longer has full access to

inspect and investigate completely accounting firms in mainland China and Hong Kong and we use an accounting firm headquartered in one

of these jurisdictions to issue an audit report on our financial statements filed with the SEC, we would be identified as a Commission-Identified

Issuer following the filing of the annual report on Form 20-F for the relevant fiscal year. There can be no assurance that we would not

be identified as a Commission-Identified Issuer for any future fiscal year, and if we were so identified for two consecutive years, we

would become subject to the prohibition on trading under the HFCA Act. For more details, see “Item 3. Key Information — D.

Risk Factors — Risks Related to Our ADS—If the PCAOB determines in the future that it no longer has full access

to inspect and investigate completely accounting firms in mainland China and Hong Kong, we and our investors may be deprived with the

benefits of such inspections, which could cause investors and potential investors in the ADSs to lose confidence in the audit procedures

and reported financial information and the quality of our financial statements.” and “— Our ADSs may be prohibited from

trading in the United States under the HFCA Act in the future if the PCAOB is unable to inspect or investigate completely auditors located

in China. The delisting of the ADSs, or the threat of their being delisted, may materially and adversely affect the value of your investment”

in our annual report on Form 20-F for the fiscal year ended December 31, 2022, which is incorporated by reference in this prospectus.

Although other means are available for us to obtain

financing at the holding company level, Fanhua Inc.’s ability to pay dividends to its shareholders and investors of the ADSs and

to service any debt it may incur may depend upon dividends paid by our PRC subsidiaries and service fees paid by the consolidated VIEs

in China. If any of our PRC subsidiaries or the consolidated VIEs incurs debt on its own behalf in the future, the instruments governing

such debt may restrict our PRC subsidiaries’ ability to pay dividends to Fanhua Inc. or the consolidated VIEs’ ability to

pay service fees. In addition, our PRC subsidiaries are permitted to pay dividends to Fanhua Inc. only out of their retained earnings,

if any, as determined in accordance with PRC accounting standards and regulations. Further, our PRC subsidiaries and the consolidated

VIEs are required to make appropriations to certain statutory reserve funds or may make appropriations to certain discretionary funds,

which are not distributable as cash dividends except in the event of a solvent liquidation of the companies. Under PRC laws, Fanhua Inc.

may provide funding to our PRC subsidiaries only through capital contributions or loans, and to the consolidated VIEs only through loans,

subject to satisfaction of government registration and approval requirements. In 2021, 2022 and the nine months ended September 30, 2023,

dividends or distributions were made to Fanhua Inc., the parent company, by our subsidiaries of RMB157.9 million, nil, nil, respectively.

In 2021, 2022, and the nine months ended September 30, 2023, Fanhua Inc. provided no capital contributions to its subsidiaries and received

no capital return from its subsidiaries. During the same periods, Fanhua Inc. did not provide any loans to its subsidiaries, and the subsidiaries

made no loan repayments to Fanhua Inc. The consolidated VIEs may transfer cash to the relevant PRC subsidiaries by paying service fees

according to the contractual arrangements. In 2021, 2022, and the nine months ended September 30, 2023, no service fees had been paid

by the consolidated VIEs to the PRC subsidiaries pursuant to the contractual arrangements. If there is any amount payable to relevant

PRC subsidiaries under the contractual arrangements, the consolidated VIEs will settle the amount accordingly. See “Item 3. Key

Information — Fund Flows between Fanhua Inc., its Subsidiaries and the Consolidated VIEs” in our annual report

on Form 20-F for the fiscal year ended December 31, 2022, which is incorporated by reference in this prospectus.

Investing in our securities involves a

high degree of risk. You should carefully consider the risks described under “Risk Factors” starting on page 4 of this

prospectus, included in any prospectus supplement or in the documents incorporated by reference into this prospectus before you

invest in our securities.

This prospectus may not be used to offer or sell

any securities unless accompanied by a prospectus supplement.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

The date of this

prospectus is March 7, 2024

table

of contents

About this Prospectus

This prospectus is part of a registration statement

that we filed with the U.S. Securities and Exchange Commission, or the SEC, using a “shelf” registration process. By using

this shelf registration statement, we may, at any time and from time to time, offer the securities described in this prospectus in one

or more offerings. This prospectus provides you with a general description of the securities offered. We may also add, update or change

information contained in this prospectus by means of a prospectus supplement or by incorporating by reference information that we file

or furnish to the SEC. If there is any inconsistency between the information in this prospectus and any related prospectus supplement,

you should rely on the information in the applicable prospectus supplement. As allowed by the SEC rules, this prospectus and any accompanying

prospectus supplement do not contain all of the information included in the registration statement. For further information, we refer

you to the registration statement, including its exhibits. Statements contained in this prospectus or any prospectus supplement about

the provisions or contents of any agreement or other document are not necessarily complete. If the SEC’s rules and regulations require

that an agreement or document be filed as an exhibit to the registration statement, please see that agreement or document for a complete

description of these matters.

You should carefully read this document and any

applicable prospectus supplement. You should also read the documents we have referred you to under “Where You Can Find More Information

About Us” and “Incorporation of Documents by Reference” below for information on our company, the risks we face and

our financial statements. The registration statement and exhibits can be read on the SEC’s website as described under “Where

You Can Find More Information About Us.”

In this prospectus, unless otherwise indicated

or unless the context otherwise requires:

| ● | “ADSs”

refers to our American depositary shares, each of which represents 20 of our ordinary shares; |

| ● | “China”

or “PRC” refers to the People’s Republic of China, for the purpose of this

prospectus only, excluding Taiwan, Hong Kong and Macau, unless the context otherwise indicates; |

| ● | “provinces”

of China refer to the 23 provinces, the four municipalities directly administered by the

central government (Beijing, Shanghai, Tianjin and Chongqing) and the five autonomous regions

(Xinjiang, Tibet, Inner Mongolia, Ningxia and Guangxi); |

| ● | “RMB”

and “Renminbi” are the legal currency of China and “U.S. dollars,”

“US$,” “dollars” and “$” are the legal currency of the

United States; |

| ● | “shares”

or “ordinary shares” refers to our ordinary shares, par value US$0.001 per share; |

| ● | “VIEs”

refer to Shenzhen Xinbao Investment Management Co., Ltd. and Fanhua RONS (Beijing) Technologies

Co., Ltd.; and |

| ● | “we,”

“us,” “our company,” “our” or “Fanhua” refers

to Fanhua Inc., a Cayman Islands company, its predecessor entities and its subsidiaries.

|

Forward-Looking

Statements

This prospectus and the documents incorporated

by reference in this prospectus may contain forward-looking statements that reflect our current or then-current expectations and views

of future events. All statements other than statements of historical facts are forward-looking statements. These forward-looking statements

are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements

involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be

materially different from those expressed or implied by the forward-looking statements.

In some cases, you can identify these forward-looking

statements by terminology such as “may,” “will,” “expect,” “anticipate,” “aim,”

“forecast,” “intend,” “plan,” “predict,” “propose,” “potential,”

“continue,” “believe,” “estimate,” “is/are likely to,” or the negative of these terms,

and other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about

future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial

needs. These forward-looking statements include, but are not limited to, statements about:

| ● | our

anticipated growth strategies; |

| ● | the

anticipated growth of our life insurance business; |

| ● | the

anticipated growth of our e-commerce business; |

| ● | our

future business development, results of operations and financial condition; |

| ● | factors

that affect our future revenues and expenses; |

| ● | the

future growth of the Chinese insurance industry as a whole and the professional insurance

intermediary sector in particular; |

| ● | trends

and competition in the Chinese insurance industry; and |

| ● | economic

and demographic trends in the PRC. |

The forward-looking statements included in this

prospectus and the documents incorporated by reference are subject to risks, uncertainties and assumptions about our company. Our actual

results of operations may differ materially from the forward-looking statements as a result of the risk factors disclosed in the documents

incorporated by reference in this prospectus or in any accompanying prospectus supplement.

We would like to caution you not to place undue

reliance on these forward-looking statements and you should read these statements in conjunction with the risk factors disclosed in the

documents incorporated by reference in this prospectus or in any accompanying prospectus supplement for a more complete discussion of

the risks of an investment in our securities. The forward-looking statements included in this prospectus or incorporated by reference

into this prospectus are made only as of the date of this prospectus or the date of the incorporated document, and we do not undertake

any obligation to update the forward-looking statements except as required under applicable law.

Corporate Information

Our principal executive offices are located at

60/F, Pearl River Tower, No. 15 West Zhujiang Road, Guangzhou, Guangdong 510623, People’s Republic of China. Our telephone number

at this address is +86-20-8388-6888. Our registered office in the Cayman Islands is located at P.O. Box 309, Ugland House, Grand Cayman,

KY1-1104, Cayman Islands. Our agent for service of process in the United States is Cogency Global Inc., located at 122 East 42nd Street,

18th Floor, New York, NY 10168.

We are subject to the periodic reporting and other

informational requirements of the Exchange Act as applicable to foreign private issuers. Under the Exchange Act, we are required to file

reports and other information with the SEC. Specifically, we are required to file annually a Form 20-F within four months after the end

of each fiscal year. The SEC also maintains a website at www.sec.gov that contains reports, proxy and information statements, and other

information regarding registrants that make electronic filings with the SEC using its EDGAR system. Such information can also be found

on our investor relations website at https://www.fanhuaholdings.com/. The information contained on our website is not a part of this prospectus.

Risk Factors

Investment in any securities offered pursuant

to this prospectus involves risks. You should carefully consider the risks and uncertainties described in this section, the risk factors

incorporated by reference from our most recent Annual Report on Form 20-F and any subsequent Annual Reports on Form 20-F we file after

the date of this prospectus, and all other information contained or incorporated by reference into this prospectus or the registration

statement of which this prospectus forms a part, as updated by our subsequent filings under the Exchange Act, and the risk factors and

other information contained in any applicable prospectus supplement before acquiring any of such securities. The occurrence of any of

these risks might cause you to lose all or part of your investment in the offered securities.

Please see the risk factors set forth under “Item

3. Key Information—D. Risk Factors” in our annual report on Form 20-F for the year ended December 31, 2022, which is incorporated

by reference in this prospectus and any accompanying prospectus supplement before investing in any securities that may be offered pursuant

to this prospectus.

The following disclosure is intended to highlight,

update or supplement previously disclosed risk factors facing the Company set forth in the Company’s public filings. These risk

factors should be carefully considered along with any other risk factors identified in the Company’s other filings with the SEC.

Risks Related to Our Business and Industry

There can be no assurance that any definitive

agreement with respect to the Strategic Framework Agreement with White Group will be executed or that this or any other transaction will

be approved or consummated. Potential uncertainty involving the proposed transaction may adversely affect our business and the market

price of our ordinary shares and warrants.

On February 1, 2024, Fanhua entered into a framework

agreement with Singapore White Group Pte. Ltd. (“White Group”), pursuant to which White Group and its partners intend to invest

up to US$500 million in Fanhua. Subsequently, Fanhua and White Group entered into a supplementary agreement, according to which, in addition

to the up to US$500 million investment, both parties will explore investments in certain high-quality assets including an Asia-based telehealth

solution provider and an AI Humanoid hardware manufacturer. There can be no assurance that any definitive agreement will be executed or

that any proposed transaction will be approved or consummated. These uncertainties may increase the volatility of the market price of

our ordinary shares and have a material adverse effect on the market price of our ordinary shares.

Our business is subject to the risks associated

with international operations.

We started to expand into international market

in 2023 by establishing two joint venture companies in Hong Kong including an insurance broker company and an insurance technology company,

extending our strategy of building quality independent financial distribution and technology-driven open platform to markets outside of

mainland China. Expanding our business overseas exposes us to a number of risks, including but not limited to:

| ● | difficulty in understanding local markets and culture and complying with unfamiliar laws and regulations; |

| ● | ability to adapt to unexpected legal or regulatory changes in local markets; |

| ● | fluctuations in currency exchange rates; |

| ● | difficulty in identifying suitable partners and establishing and maintaining good cooperative relationships with them; |

| ● | difficulty in recruiting and retaining qualified personnel; |

| ● | potentially adverse tax consequences; and |

| ● | increased costs associated with doing business in foreign jurisdictions. |

Risks Related to Doing Business in China

Our business could be negatively impacted

if we are unable to adapt our services to regulatory changes in China.

China’s insurance regulatory regime is undergoing

significant changes. Some of these changes and the further development of regulations applicable to us may result in additional restrictions

on our activities or more intensive competition in this industry, which may adversely affect our business operations.

For example, on September 29, 2023, the National

Financial Regulatory Administration, or the NFRA, promulgated Measures for the Supervision of Insurance Sales Behavior, effective on March

1, 2024, which provides for a comprehensive management on the pre-sale, mid-sale and after-sale behaviors of insurance distribution of

insurance companies, insurance intermediaries and insurance salespeople, with requirements focusing on, among others, (i) establishment

of a tiered management mechanism for insurance sales practitioners based on their qualifications, sales abilities, integrity and ethics

level; (ii) classification of life insurance products by product types, complexity, risk level and affordability ; (iii) pre-sales product

suitability assessment on the policyholders; (iv) restrictions on the pre-sales promotion of insurance, including the requirement for

insurance institutions to conduct pre-approval and authorization for the dissemination of insurance sales promotional information by insurance

sales practitioners; (v) restriction on compulsory bundled-sales of insurance products with healthcare and elderly-care services; and

(vi) retrospective management of insurance sales process which requires that retrospective management must be conducted for insurance

product sales activities through methods such as audio recording, video recording, sales page management, and recording operational traces,

depending on the sales method according to the specific requirements of relevant rules. Backup archiving should be conducted for the audio-visual

and electronic data generated during the retrospective management process. The implementation of such requirements may significantly increase

our compliance cost and failure to comply with the requirements may result in penalties and damage our reputations which may adversely

affect our financial results.

On August 22, 2023, the NFRA issued the Notice

of Regulating the Insurance Products Sold Through Bancassurance Channel to life insurance companies in China, which required that, among

others, actual expenses such as commissions paid to bancassurance channel’ agents should be consistent with cost structure and commission

ceiling reported in the filed documents. On October 9, 2023, the NFRA issued the Notice on Matters Related to the Management of Bancassurance

Products, stating the discrepancy in the predetermined additional fee rate for some companies’ registered bancassurance products and the

total fee of the bancassurance channels as subsequently separately reported and that it will determine the total fee for the bancassurance

channels based on the principle of the lower of the two. If insurance companies exceed this lower threshold in their actual implementation,

they will be subject to strict legal and regulatory actions. On January 14, 2024, the NFRA issued the Notice on Regulating the Bancassurance

Channel Business of Life Insurance Companies, further regulating the bancassurance channel business of life insurance companies, and urging

insurance companies to strictly comply with the registered insurance terms and insurance fee rates, and that the commissions paid by insurance

companies to bancassurance channels shall not exceed the upper limit of the commission rate as filed. The strict implementation of these

rules has since resulted in significant drop in commission rates in the bancassurance channel. On October 18, 2023, the NFAR issued the

Notice of Strengthening Management to Promote the Stable and Healthy Development of Life Insurance Business, emphasizing the requirement

of consistency in filed and actually-paid expenses. If NFRA were to issue implementation rules and strictly enforce such requirement in

the independent agency and broker channel nationwide, there would be significant drop in our commission income and revenues and adversely

affect our overall financial results.

CAPITALIZATION

AND INDEBTEDNESS

Our capitalization and indebtedness will be set

forth in a prospectus supplement to this prospectus or in a report subsequently furnished to the SEC and specifically incorporated herein

by reference.

Use of Proceeds

We intend to use the net proceeds from the sale

of the securities we offer as set forth in the applicable prospectus supplement(s). The specific allocations of the proceeds we receive

from the sale of our securities will be described in the applicable prospectus supplement(s).

Description of

Share Capital

We are an exempted company incorporated in the

Cayman Islands and our affairs are governed by our memorandum and articles of association, as amended and restated from time to time,

and Companies Act (As Revised) of the Cayman Islands, which we refer to as the “Companies Act” below, and the common law of

the Cayman Islands.

As of September 30, 2023, our authorized share

capital consists of 10,000,000,000 ordinary shares, with a par value US$0.001 each. As of September 30, 2023, 1,149,004,044 ordinary shares

were issued and outstanding, excluding 9,909,180 ordinary shares repurchased by the Company and held as treasury shares.

The following is a summary of the material provisions

of our amended and restated memorandum and articles of association and the Companies Act insofar as they relate to the material terms

of our ordinary shares. The following discussion primarily concerns ordinary shares and the rights of holders of ordinary shares. Holders

of our ADSs will not be treated as our shareholders and their rights are subject to the deposit agreement. See “Description of American

Depositary Shares.”.

Ordinary Shares

General. Our authorized

share capital consists of 10,000,000,000 ordinary shares, with a par value of US$0.001 each. All of our outstanding ordinary shares are

fully paid and non-assessable. Certificates representing the ordinary shares are issued in registered form. Our shareholders who are nonresidents

of the Cayman Islands may freely hold and vote their shares.

Dividend Rights. The

holders of our ordinary shares are entitled to such dividends as may be declared by our board of directors subject to the Companies Act.

In addition, our shareholders may by ordinary resolution declare a dividend, but no dividend shall exceed the amount recommended by our

directors. Under the laws of the Cayman Islands, our company may declare and pay a dividend only out of funds legally available, namely

out of either our profit or share premium account, provided that in no circumstances may a dividend be paid if, immediately after this

payment, this would result in our company being unable to pay its debts as they fall due in the ordinary course of business.

Voting Rights. On

a show of hands, each shareholder present in person or by proxy (or, for a corporation or other non-natural person, present by its duly

authorized representative or proxy) at general meeting shall have one vote and on a poll, shall have one vote for each share registered

in his name in the register of members of our company. Voting at any meeting of shareholders is by show of hands unless a poll is demanded.

A poll may be demanded by the chairman of the meeting or by any one or more shareholders together holding at least ten percent of our

paid up voting share capital, present in person or by proxy.

A quorum required for a meeting of shareholders

consists of shareholders holding in aggregate not less than one-third of our issued voting share capital present in person or by proxy

or, if a corporation or other non-natural person, by its duly authorized representative. We may, but are not obliged, to hold an annual

general meeting of shareholders. General meetings may be convened by our board of directors on its own initiative or upon a request to

the directors by shareholders holding in aggregate not less than one-third of the share capital of our company as at that date carries

the right of voting at general meetings of our company. Advance notice of at least 14 days is required for the convening of our annual

general meeting and other shareholders meetings.

An ordinary resolution to be passed by the shareholders

requires the affirmative vote of a simple majority of the votes attaching to the ordinary shares cast in a general meeting, while a special

resolution requires the affirmative vote of no less than two-thirds of the votes attaching to the ordinary shares cast in a general meeting.

A special resolution is required for important matters such as a change of name or making changes to our memorandum and articles of association.

Holders of the ordinary shares may effect certain changes by ordinary resolution, including consolidating and dividing all or any of our

share capital into shares of larger amount than our existing shares, and canceling any shares which have not been taken or agreed to be

taken.

Transfer of Shares. Subject

to the restrictions of our articles of association, as applicable, any of our shareholders may transfer all or any of his or her ordinary

shares by an instrument of transfer in the usual or common form or any other form approved by our board.

Liquidation. On

a return of capital on winding up or otherwise (other than on conversion, redemption or purchase of shares), assets available for distribution

among the holders of ordinary shares may be distributed among the holders of the ordinary shares as determined by the liquidator, subject

to sanction of an ordinary resolution of our company.

Calls on Shares and Forfeiture of Shares. Our

board of directors may from time to time make calls upon shareholders for any amounts unpaid on their shares in a notice served to such

shareholders at least 14 days prior to the specified time of payment. The shares that have been called upon and remain unpaid on the specified

time are subject to forfeiture.

Redemption, Repurchase and Surrender of

Shares. Subject to the provisions of the Companies Act and our articles of association, we may issue shares on

terms that they are subject to redemption, at our option or at the option of the holders, on such terms and in such manner as our board

of directors may determine before the issue of such shares. We also may purchase our own shares, provided that our shareholders have approved

the manner of purchase by ordinary resolution or the manner of purchase is in accordance with that specified in our articles of association.

The manner of purchase specified in our articles of association, which cover purchases of shares listed on an internationally recognized

stock exchange and shares not so listed, is in accordance with Section 37(2) of the Companies Act or any modification or reenactment thereof

for the time being in force. In addition, our company may accept the surrender of any fully paid share for no consideration. Pursuant

to the Companies Act as amended, upon the repurchase, redemption or surrender of shares, instead of cancelling them the board of directors

can determine whether or not to cancel those shares or hold them as treasury shares pending cancellation, transfer or sale. The company

must obtain authorization to hold such shares as treasury shares either in accordance with the procedures set out in our articles of association

or (if there are none) by a board resolution before being repurchased, redeemed or surrendered in accordance with the usual rules and

articles.

Variations of Rights of Shares. All

or any of the special rights attached to any class of shares may, subject to the provisions of the Companies Act, be varied or abrogated

either with the written consent of the holders of a majority of the issued shares of that class or with the sanction of a special resolution

passed at a general meeting of the holders of the shares of that class. The rights conferred upon the holders of the shares of any class

shall not, unless otherwise expressly provided by the terms of issue of the shares of that class, be deemed to be varied by the creation

or issue of further shares ranking in priority to or pari passu therewith.

Inspection of Books and Records. Holders

of our ordinary shares have no general right under Cayman Islands law to inspect or obtain copies of our list of shareholders or our corporate

records (other than our memorandum and articles of association, special resolutions passed by our shareholders, and our register of mortgages

and charges). However, we make our annual reports, which contain our audited financial statements, available to our shareholders.

Exempted Company

We are an exempted company with limited liability

under the Companies Act. The Companies Act distinguishes between ordinary resident companies and exempted companies. Any company that

is registered in the Cayman Islands but conducts business mainly outside of the Cayman Islands may apply to be registered as an exempted

company. The requirements for an exempted company are essentially the same as for an ordinary company except that an exempted company:

| ● | does not have to file an annual return of its shareholders with the Registrar of Companies; |

| ● | is not required to open its register of members for inspection; |

| ● | does not have to hold an annual general meeting; |

| ● | may issue shares or shares with no par value; |

| ● | may obtain an undertaking against the imposition of any future taxation (such undertakings are usually given for 20 years in

the first instance); |

| ● | may register by way of continuation in another jurisdiction and be deregistered in the Cayman Islands; |

| ● | may register as a limited duration company; and |

| ● | may register as a segregated portfolio company. |

“Limited liability” means that the

liability of each shareholder is limited to the amount unpaid by the shareholder on that shareholder’s shares of the company (except

in exceptional circumstances, such as involving fraud, the establishment of an agency relationship or an illegal or improper purpose or

other circumstances in which a court may be prepared to pierce or lift the corporate veil).

Register of Members

Under the Companies Act, we must keep a register

of members and there should be entered therein:

| ● | the names and addresses of our members, together with a statement of the shares held by each member, and such statement shall confirm

(i) the amount paid or agreed to be considered as paid, on the shares of each member, (ii) the number and category of shares

held by each member, and (iii) whether each relevant category of shares held by a member carries voting rights under the articles

of association of our company, and if so, whether such voting rights are conditional; |

| ● | the date on which the name of any person was entered on the register as a member; and |

| ● | the date on which any person ceased to be a member. |

Under the Companies Act, the register of members

of our company is prima facie evidence of the matters set out therein (that is, the register of members will raise a presumption of fact

on the matters referred to above unless rebutted) and a member registered in the register of members is deemed as a matter of the Companies

Act to have legal title to the shares as set against its name in the register of members.

If the name of any person is incorrectly entered

in or omitted from our register of members, or if there is any default or unnecessary delay in entering on the register the fact of any

person having ceased to be a member of our company, the person or member aggrieved (or any member of our company or our company itself)

may apply to the Grand Court of the Cayman Islands for an order that the register be rectified, and the Court may either refuse such application

or it may, if satisfied of the justice of the case, make an order for the rectification of the register.

Differences in Corporate Law

The Companies Act is derived, to a large extent,

from the older Companies Acts of England, but does not follow many recent English law statutory enactments. In addition, the Companies

Act differs from laws applicable to United States corporations and their shareholders. Set forth below is a summary of the significant

differences between the provisions of the Companies Act applicable to us and the laws applicable to companies incorporated in the State

of Delaware.

Mergers and Similar Arrangements. The

Companies Act permits mergers and consolidations between Cayman Islands companies and between Cayman Islands companies and non-Cayman

Islands companies. For these purposes, (a) “merger” means the merging of two or more constituent companies and the vesting

of their undertaking, property and liabilities in one of such companies as the surviving company, and (b) a “consolidation”

means the combination of two or more constituent companies into a consolidated company and the vesting of the undertaking, property and

liabilities of such companies to the consolidated company. In order to effect such a merger or consolidation, the directors of each constituent

company must approve a written plan of merger or consolidation, which must then be authorized by (a) a special resolution of the

shareholders of each constituent company, and (b) such other authorization, if any, as may be specified in such constituent company’s

articles of association. The written plan of merger or consolidation must be filed with the Registrar of Companies of the Cayman Islands

together with a declaration as to the solvency of the consolidated or surviving company, a declaration as to the assets and liabilities

of each constituent company and an undertaking that a copy of the certificate of merger or consolidation will be given to the members

and creditors of each constituent company and that notification of the merger or consolidation will be published in the Cayman Islands

Gazette. Court approval is not required for a merger or consolidation which is effected in compliance with these statutory procedures.

A

merger between a Cayman parent company and its Cayman subsidiary or subsidiaries does not require authorization by a resolution of shareholders

of that Cayman subsidiary if a copy of the plan of merger is given to every member of that Cayman subsidiary to be merged unless that

member agrees otherwise. For this purpose a company is a “parent” of a subsidiary if it holds issued shares that together

represent at least ninety percent (90%) of the votes at a general meeting of the subsidiary.

The

consent of each holder of a fixed or floating security interest over a constituent company is required unless this requirement is waived

by a court in the Cayman Islands.

Save

in certain limited circumstances, a shareholder of a Cayman constituent company who dissents from the merger or consolidation is entitled

to payment of the fair value of his shares (which, if not agreed between the parties, will be determined by the Cayman Islands court)

upon dissenting to the merger or consolidation, provide that the dissenting shareholder complies strictly with the procedures set out

in the Companies Act. The exercise of dissenter rights will preclude the exercise by the dissenting shareholder of any other rights to

which he or she might otherwise be entitled by virtue of holding shares, save for the right to seek relief on the grounds that the merger

or consolidation is void or unlawful.

Separate

from the statutory provisions relating to mergers and consolidations, the Companies Act also contains statutory provisions that facilitate

the reconstruction and amalgamation of companies by way of schemes of arrangement, provided that the arrangement is

approved by (a) 75% in value of the shareholders or class of shareholders, as the case may be, or (b) a majority in number

representing 75% in value of the creditors or each class of creditors, as the case may be, with whom the arrangement is to be made, that

are, in each case, present and voting either in person or by proxy at a meeting, or meetings, convened for that purpose. The convening

of the meetings and subsequently the arrangement must be sanctioned by the Grand Court of the Cayman Islands. While a dissenting shareholder

has the right to express to the court the view that the transaction ought not to be approved, the court can be expected to approve the

arrangement if it determines that:

| ● | the

statutory provisions as to the required majority vote have been met; |

| ● | the

shareholders have been fairly represented at the meeting in question and the statutory majority

are acting bona fide without coercion of the minority to promote interests adverse to those

of the class; |

| ● | the

arrangement is such that may be reasonably approved by an intelligent and honest man of that

class acting in respect of his interest; and |

| ● | the

arrangement is not one that would more properly be sanctioned under some other provision

of the Companies Act. |

The

Companies Act also contains a statutory power of compulsory acquisition which may facilitate the “squeeze out” of a dissenting

minority shareholder upon a tender offer. When a tender offer is made and accepted by holders of 90.0% of the shares affected within

four months, the offeror may, within a two-month period commencing on the expiration of such four-month period, require the holders

of the remaining shares to transfer such shares to the offeror on the terms of the offer. An objection can be made to the Grand Court

of the Cayman Islands but this is unlikely to succeed in the case of an offer which has been so approved unless there is evidence of

fraud, bad faith or collusion.

If

an arrangement and reconstruction is thus approved, or if a tender offer is made and accepted, a dissenting shareholder would have no

rights comparable to appraisal rights, which would otherwise ordinarily be available to dissenting shareholders of Delaware corporations,

providing rights to receive payment in cash for the judicially determined value of the shares.

Shareholders’

Suits. In principle, we will normally be the proper plaintiff to sue for a wrong done to us as a company, and as a general rule

a derivative action may not be brought by a minority shareholder. However, based on English authorities, which would in all likelihood

be of persuasive authority in the Cayman Islands, the Cayman Islands court can be expected to follow and apply the common law principles

(namely the rule in Foss v. Harbottle and the exceptions thereto) which permit a minority shareholder to commence a

class action against or derivative actions in the name of the company to challenge actions where:

| ● | a

company acts or proposes to act illegally or ultra vires; |

| ● | the

act complained of, although not ultra vires, could only be effected duly if authorized by

more than a simple majority vote that has not been obtained; and |

| ● | those

who control the company are perpetrating a “fraud on the minority.” |

Indemnification

of Directors and Executive Officers and Limitation of Liability. Cayman Islands law does not limit the extent

to which a company’s memorandum and articles of association may provide for indemnification of officers and directors, except to

the extent any such provision may be held by the Cayman Islands courts to be contrary to public policy, such as to provide indemnification

against civil fraud or the consequences of committing a crime. Under our memorandum and articles of association, to the fullest extent

permissible under Cayman Islands law every director and officer of our company shall be indemnified against all actions, proceedings,

costs, charges, losses, damages or liabilities incurred or sustained by him in connection with the execution or discharge of his duties,

powers, authorities or discretions as a director or officer of our company, including without prejudice to the generality of the foregoing,

any costs, expenses, losses or liabilities incurred by him in defending (whether successful or otherwise) any civil proceedings concerning

our company or its affairs in any court whether in the Cayman Islands or elsewhere. This standard of conduct is generally the same as

permitted under the Delaware General Corporation Law for a Delaware corporation.

In

addition, we have entered into indemnification agreements with our directors and executive officers that provide such persons with additional

indemnification beyond that provided in our amended and restated memorandum and articles of association.

Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers or persons controlling

us under the foregoing provisions, we have been informed that in the opinion of the SEC, such indemnification is against public policy

as expressed in the Securities Act and is therefore unenforceable.

Directors’

Fiduciary Duties. Under Delaware corporate law, a director of a Delaware corporation has a fiduciary duty to

the corporation and its shareholders. This duty has two components: the duty of care and the duty of loyalty. The duty of care requires

that a director act in good faith, with the care that an ordinarily prudent person would exercise under similar circumstances. Under

this duty, a director must inform himself of, and disclose to shareholders, all material information reasonably available regarding a

significant transaction. The duty of loyalty requires that a director acts in a manner he reasonably believes to be in the best interests

of the corporation. He must not use his corporate position for personal gain or advantage. This duty prohibits self-dealing by a director

and mandates that the best interest of the corporation and its shareholders take precedence over any interest possessed by a director,

officer or controlling shareholder and not shared by the shareholders generally. In general, actions of a director are presumed to have

been made on an informed basis, in good faith and in the honest belief that the action taken was in the best interests of the corporation.

However, this presumption may be rebutted by evidence of a breach of one of the fiduciary duties. Should such evidence be presented concerning

a transaction by a director, the director must prove the procedural fairness of the transaction, and that the transaction was of fair

value to the corporation.

As

a matter of Cayman Islands law, a director of a Cayman Islands company is in the position of a fiduciary with respect to the company

and therefore it is considered that he owes the following duties to the company — a duty to act bona fide in the

best interests of the company, a duty not to make a profit based on his position as director (unless the company permits him to do so),

a duty not to put himself in a position where the interests of the company conflict with his personal interest or his duty to a third

party, and a duty to exercise powers for the purpose for which such powers were intended. A director of a Cayman Islands company owes

to the company a duty to act with skill and care. It was previously considered that a director need not exhibit in the performance of

his duties a greater degree of skill than may reasonably be expected from a person of his knowledge and experience. However, English

and Commonwealth courts have moved towards an objective standard with regard to the required skill and care and these authorities are

likely to be followed in the Cayman Islands.

Shareholder

Action by Written Consent. Under the Delaware General Corporation Law, a corporation may eliminate the

right of shareholders to act by written consent by amendment to its certificate of incorporation. The Companies Act and our amended and

restated articles of association provide that our shareholders may approve corporate matters by way of a unanimous written resolution

signed by or on behalf of each shareholder who would have been entitled to vote on such matter at a general meeting without a meeting

being held.

Shareholder

Proposals. Under the Delaware General Corporation Law, a shareholder has the right to put any proposal before

the annual meeting of shareholders, provided it complies with the notice provisions in the governing documents. A special meeting may

be called by the board of directors or any other person authorized to do so in the governing documents, but shareholders may be precluded

from calling special meetings.

The

Companies Act provides shareholders with only limited rights to requisition a general meeting, and does not provide shareholders with

any right to put any proposal before a general meeting. However, these rights may be provided in a company’s articles of association.

Our amended and restated articles of association allow our shareholders holding in aggregate not less than one-third of the share capital

of our company as at that date carries the right of voting at general meetings of our company to requisition an extraordinary general

meeting of our shareholders, in which case our board is obliged to convene an extraordinary general meeting and to put the resolutions

so requisitioned to a vote at such meeting. Other than this right to requisition a shareholders’ meeting, our amended and restated

articles of association do not provide our shareholders with any other right to put proposals before annual general meetings or extraordinary

general meetings not called by such shareholders. As an exempted Cayman Islands company, we are not obliged by law to call shareholders’

annual general meetings.

Cumulative

Voting. Under the Delaware General Corporation Law, cumulative voting for elections of directors is not permitted

unless the corporation’s certificate of incorporation specifically provides for it.

Cumulative

voting potentially facilitates the representation of minority shareholders on a board of directors since it permits the minority shareholder

to cast all the votes to which the shareholder is entitled on a single director, which increases the shareholder’s voting power

with respect to electing such director. There are no prohibitions in relation to cumulative voting under the laws of the Cayman Islands

but our amended and restated articles of association do not provide for cumulative voting. As a result, our shareholders are not afforded

any less protections or rights on this issue than shareholders of a Delaware corporation.

Removal

of Directors. Under the Delaware General Corporation Law, a director of a corporation with a classified board

may be removed only for cause with the approval of a majority of the outstanding shares entitled to vote, unless the certificate of incorporation

provides otherwise. Under our amended and restated articles of association, directors may be removed with or without cause, by an ordinary

resolution of our shareholders or the affirmative vote of a simple majority of the other directors present and voting at a board meeting.

A director shall hold office until the expiration of his or her term or his or her successor shall have been elected and qualified, or

until his or her office is otherwise vacated. In addition, a director’s office shall be vacated if the director (i) becomes

bankrupt or makes any arrangement or composition with his creditors; (ii) is found to be or becomes of unsound mind; (iii) resigns

his office by notice in writing to the company; (iv) without special leave of absence from our board of directors, is absent from

meetings of our board of directors for six consecutive months and our board of directors resolves that his office be vacated; or (v) is

removed from office pursuant to any other provisions of our amended and restated memorandum and articles of association.

Transactions

with Interested Shareholders. The Delaware General Corporation Law contains a business combination statute applicable

to Delaware corporations whereby, unless the corporation has specifically elected not to be governed by such statute by amendment to

its certificate of incorporation, it is prohibited from engaging in certain business combinations with an “interested shareholder”

for three years following the date that such person becomes an interested shareholder. An interested shareholder generally is a

person or a group who or which owns or owned 15% or more of the target’s outstanding voting share within the past three years.

This has the effect of limiting the ability of a potential acquirer to make a two-tiered bid for the target in which all shareholders

would not be treated equally. The statute does not apply if, among other things, prior to the date on which such shareholder becomes

an interested shareholder, the board of directors approves either the business combination or the transaction which resulted in the person

becoming an interested shareholder. This encourages any potential acquirer of a Delaware corporation to negotiate the terms of any acquisition

transaction with the target’s board of directors.

Cayman

Islands law has no comparable statute. As a result, we cannot avail ourselves of the types of protections afforded by the Delaware business

combination statute. However, although Cayman Islands law does not regulate transactions between a company and its significant shareholders,

the directors of the Company are required to comply with fiduciary duties which they owe to the Company under Cayman Islands laws, including

the duty to ensure that, in their opinion, any such transactions must be entered into bona fide in the best interests of the company,

and are entered into for a proper corporate purpose and not with the effect of constituting a fraud on the minority shareholders.

Restructuring.

A company may present a petition to the Grand Court of the Cayman Islands for the appointment of a restructuring officer on the

grounds that the company:

(a)

is or is likely to become unable to pay its debts; and

(b)

intends to present a compromise or arrangement to its creditors (or classes thereof) either pursuant to the Companies Act, the law of

a foreign country or by way of a consensual restructuring.

The

Grand Court may, among other things, make an order appointing a restructuring officer upon hearing of such petition, with such powers

and to carry out such functions as the court may order. At any time (i) after the presentation of a petition for the appointment

of a restructuring officer but before an order for the appointment of a restructuring officer has been made, and (ii) when an order

for the appointment of a restructuring officer is made, until such order has been discharged, no suit, action or other proceedings (other

than criminal proceedings) shall be proceeded with or commenced against the company, no resolution to wind up the company shall be passed,

and no winding up petition may be presented against the company, except with the leave of the court. However, notwithstanding the presentation

of a petition for the appointment of a restructuring officer or the appointment of a restructuring officer, a creditor who has security

over the whole or part of the assets of the company is entitled to enforce the security without the leave of the court and without reference

to the restructuring officer appointed.

Dissolution;

Winding up. Under the Delaware General Corporation Law, unless the board of directors approves the proposal

to dissolve, dissolution must be approved by shareholders holding 100% of the total voting power of the corporation. Only if the dissolution

is initiated by the board of directors may it be approved by a simple majority of the corporation’s outstanding shares. Delaware

law allows a Delaware corporation to include in its certificate of incorporation a supermajority voting requirement in connection with

dissolutions initiated by the board.

Under

Cayman Islands law, a company may be wound up by either an order of the courts of the Cayman Islands or by a special resolution of its

members or, if the company is unable to pay its debts as they fall due, by an ordinary resolution of its members. The court has authority

to order winding up in a number of specified circumstances including where it is, in the opinion of the court, just and equitable to

do so. Under the Companies Act and our amended and restated articles of association, our company may be dissolved, liquidated or wound

up by a special resolution of our shareholders.

Variation

of Rights of Shares. Under the Delaware General Corporation Law, a corporation may vary the rights of a class

of shares with the approval of a majority of the outstanding shares of such class, unless the certificate of incorporation provides otherwise.

Under Cayman Islands law and our amended and restated articles of association, if our share capital is divided into more than one class

of shares, we may vary or abrogate the rights attached to any class with the written consent of the holders of a majority of the issued

shares of that class or with the sanction of a special resolution passed at a general meeting of the holders of the shares of that class.

Amendment

of Governing Documents. Under the Delaware General Corporation Law, a corporation’s governing documents

may be amended with the approval of a majority of the outstanding shares entitled to vote, unless the certificate of incorporation provides

otherwise. Under the Companies Act and our amended and restated memorandum and articles of association, our memorandum and articles of

association may only be amended by a special resolution of our shareholders.

Rights

of Nonresident or Foreign Shareholders. There are no limitations imposed by our amended and restated memorandum

and articles of association on the rights of nonresident or foreign shareholders to hold or exercise voting rights on our shares. In

addition, there are no provisions in our amended and restated memorandum and articles of association that require our company to disclose

shareholder ownership above any particular ownership threshold.

History

of Securities Issuances

The

following is a summary of our securities issuances in the past three years.

Issuance

of Ordinary Shares

On

January 3, 2023, Fanhua entered into definitive agreements (“Share Purchase Agreement”) with the existing shareholders of Zhongrong

Smart Finance Information Technology Co., Ltd. (“Zhongrong”), to acquire 57.73% of the equity interests of Zhongrong. In

connection with the acquisition, 61,853,580 ordinary shares of the Company have been issued to these shareholders as of March 31, 2023.

The consideration, adjustable based on the achievement of certain performance targets in the next three years by Zhongrong, is subject

to a lock-up period of three years and will be released from lock-up in two batches after 2025. On August 31, 2023, one former shareholder

of Zhongrong (“Such Shareholder”) that previously transferred its owned 1.56% equity interests in Zhongrong in exchange for

its equity interests of 0.3% in Fanhua, entered into a supplemental agreement with Fanhua to modify the payment terms as stated in the

Share Purchase Agreement from issuing ordinary shares by Fanhua to transferring cash as consideration. As a result, 3,591,780 ordinary

shares previously issued to Such Shareholder were subsequently returned to Fanhua in December 2023.

On

February 6, 2023, Fanhua entered into a definitive agreement with the existing shareholders of Jilin Zhongji Shi’An Insurance Agency

Co., Ltd (“Zhongji”), to acquire 51% of the equity interests of Zhongji. In connection with the acquisition, 13,660,720 ordinary

shares of the Company have been issued to these shareholders as of March 31, 2023. The consideration, adjustable based on the achievement

of certain performance targets in the next three years by Zhongji, is subject to a lock-up period of three years and will be released

from lock-up in two batches after 2025.

On

February 8, 2023, Fanhua entered into a definitive agreement with the existing shareholder of Wuhan Taiping Online Insurance Agency Co.,

Ltd. (“Taiping”), to acquire 51% of the equity interests of Taiping. In connection with the acquisition, 9,107,140 ordinary

shares of the Company have been issued to the shareholder of Taiping as of March 31, 2023. As Taiping failed to meet certain performance

targets, 9,107,140 previously issued ordinary shares were returned to Fanhua and Fanhua surrendered the acquired 51% equity interests

of Taiping, pursuant to a supplementary agreement entered on November 30, 2023.

Share

Option Grants

We

have granted share options to purchase our ordinary shares to certain of our directors, executive officers and employees. See “Item

6. Directors, Senior Management and Employees — B. Compensation — Share Incentives” in our annual report

on Form 20-F for the year ended December 31, 2022, which is incorporated in this prospectus by reference.

Description

of American Depositary Shares

American

Depositary Receipts

JPMorgan

Chase Bank, N.A. (“JPMorgan”), as depositary, will issue the ADSs that you will be entitled to receive in this offering. Each

ADS will represent an ownership interest in a designated number or percentage of shares that we will deposit with the custodian, as agent

of the depositary, under the second amended and restated deposit agreement (the “deposit agreement”) among ourselves, the

depositary, and all holders and beneficial owners from time to time of American depositary receipts issued thereunder.

The

depositary’s office is located at 383 Madison Avenue, Floor 11, New York, NY 10179.

The

ADS-to-share ratio is subject to amendment as provided in the form of ADR (which may give rise to fees contemplated by the form of ADR).

In the future, each ADS will also represent any securities, cash or other property deposited with the depositary but which they have

not distributed directly to you.

A

beneficial owner is any person or entity having a beneficial ownership interest ADSs. A beneficial owner need not be the holder of the

ADR evidencing such ADS. If a beneficial owner of ADSs is not an ADR holder, it must rely on the holder of the ADR(s) evidencing such

ADSs in order to assert any rights or receive any benefits under the deposit agreement. A beneficial owner shall only be able to exercise

any right or receive any benefit under the deposit agreement solely through the holder of the ADR(s) evidencing the ADSs owned by such

beneficial owner. The arrangements between a beneficial owner of ADSs and the holder of the corresponding ADRs may affect the beneficial

owner’s ability to exercise any rights it may have.

An

ADR holder shall be deemed to have all requisite authority to act on behalf of any and all beneficial owners of the ADSs evidenced by

the ADRs registered in such ADR holder’s name for all purposes under the deposit agreement and ADRs. The depositary’s only notification

obligations under the deposit agreement and the ADRs is to registered ADR holders. Notice to an ADR holder shall be deemed, for all purposes

of the deposit agreement and the ADRs, to constitute notice to any and all beneficial owners of the ADSs evidenced by such ADR holder’s

ADRs.

Unless

certificated ADRs are specifically requested, all ADSs will be issued on the books of our depositary in book-entry form and periodic

statements will be mailed to you which reflect your ownership interest in such ADSs. In our description, references to American depositary

receipts or ADRs shall include the statements you will receive that reflect your ownership of ADSs.

You

may hold ADSs either directly or indirectly through your broker or other financial institution. If you hold ADSs directly, by having

an ADS registered in your name on the books of the depositary, you are an ADR holder. This description assumes you hold your ADSs directly.

If you hold the ADSs through your broker or financial institution nominee, you must rely on the procedures of such broker or financial

institution to assert the rights of an ADR holder described in this section. You should consult with your broker or financial institution

to find out what those procedures are.

As

an ADR holder or beneficial owner, we will not treat you as a shareholder of ours and you will not have any shareholder rights. Because

the depositary or its nominee will be the shareholder of record for the shares represented by all outstanding ADSs, shareholder rights