Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

February 02 2024 - 10:44AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2024

Commission File Number: 001-33768

FANHUA INC.

60/F, Pearl River Tower

No.15 West Zhujiang Road

Tianhe District, Guangzhou 510623

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Fanhua Inc. |

| |

|

|

| |

By: |

/s/ Yinan Hu |

| |

Name: |

Yinan Hu |

| |

Title: |

Chief Executive Officer |

Date: February 2, 2024

Exhibit Index

2

Exhibit 99.1

|

IR-386 |

FANHUA Announces Significant Investment from

White Group

GUANGZHOU, China, February 2, 2024 (GLOBE NEWSWIRE)

-- FANHUA Inc. (“FANHUA” or the “Company”) (Nasdaq: FANH), a leading independent financial services provider in

China, today announced that Fanhua and Puyi Inc. (“Puyi”) entered into a framework agreement with Singapore White Group Pte.

Ltd. (“White Group”). Pursuant to the framework agreement, White Group and its partners intend to invest up to US$500 million

in Fanhua and up to US$500 million in Puyi. Both parties will proceed with finalising the details of the agreement soon.

About White Group

White Group was established in 2005. It is

a privately-owned boutique investment and development firm based in Singapore. It is focused on acquiring, investing in, and managing

businesses that develop solutions in real estate, technology, and healthcare, among others. Its primary interest is in China and

Southeast Asia. Its investments seek to create long-term economic value for its partners.

About FANHUA

Established in 1998, FANHUA is a leading comprehensive

financial services provider in China, driven by digital technology and professional expertise, with a focus on delivering family asset

allocation services throughout the entire lifecycle for individual clients, while also providing a one-stop support platform for individual

agents and sales organizations.

As of September 30, 2023, the Company’s

offline sales service network spans 31 provinces in China, comprising 673 sales service outlets, 91,098 agents, and more than 2,215 claims

adjustors. Through proprietary technological tools such as “Lan Zhanggui”, “Fanhua Policy Custody System”, and

“RONS DOP”, the Company is dedicated to supporting agents in providing convenient services to clients through technological

means.

With an integrated online and offline approach,

the Company has provided services to more than 12 million individual clients. For the nine months ended September 30, 2023, FANHUA facilitated

RMB12.4 billion gross written premiums, with its net revenues reaching RMB2.6 billion, net income attributable to shareholders of RMB307.7

million and total assets of RMB4.0 billion.

|

IR-386 |

Forward-looking Statements

This press release contains statements of a forward-looking

nature. These statements, including the statements relating to the Company’s future financial and operating results, are made under

the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. You can identify these forward-looking

statements by terminology such as “will”, “expects”, “believes”, “anticipates”, “intends”,

“estimates” and similar statements. Among other things, management’s quotations contain forward-looking statements.

These forward-looking statements involve known and unknown risks and uncertainties and are based on current expectations, assumptions,

estimates and projections about FANHUA and the industry. Potential risks and uncertainties include, but are not limited to, those relating

to its ability to attract and retain productive agents, especially entrepreneurial agents, its ability to maintain existing and develop

new business relationships with insurance companies, its ability to execute its growth strategy, its ability to adapt to the evolving

regulatory environment in the Chinese insurance industry, its ability to compete effectively against its competitors, quarterly variations

in its operating results caused by factors beyond its control and macroeconomic conditions in China and their potential impact on the

sales of insurance products. Except as otherwise indicated, all information provided in this press release speaks as of the date hereof,

and FANHUA undertakes no obligation to update any forward-looking statements to reflect subsequent occurring events or circumstances,

or changes in its expectations, except as may be required by law. Although FANHUA believes that the expectations expressed in these forward-looking

statements are reasonable, it cannot assure you that its expectations will turn out to be correct, and investors are cautioned that actual

results may differ materially from the anticipated results. Further information regarding risks and uncertainties faced by FANHUA is included

in FANHUA’s filings with the U.S. Securities and Exchange Commission, including its annual report on Form 20-F.

For more information, please contact:

FANHUA Inc.

Investor Relations

Tel: +86 (20) 8388-3191

Email: ir@fanhgroup.com

Source: FANHUA Inc.

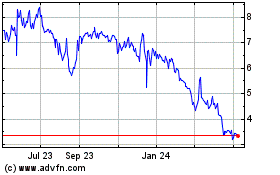

Fanhua (NASDAQ:FANH)

Historical Stock Chart

From Oct 2024 to Nov 2024

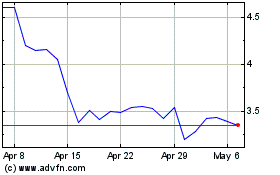

Fanhua (NASDAQ:FANH)

Historical Stock Chart

From Nov 2023 to Nov 2024