Q3

2023

--12-31

false

0000033488

1.25

1.10

2.75

3.00

4.25

3.00

3.25

3.00

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

00000334882023-01-012023-09-30

iso4217:USD

0000033488us-gaap:RevolvingCreditFacilityMemberesca:RestatedCreditAgreementMember2023-09-30

0000033488us-gaap:RevolvingCreditFacilityMemberesca:RestatedCreditAgreementMember2023-09-01

0000033488us-gaap:RevolvingCreditFacilityMemberesca:RestatedCreditAgreementMember2023-05-08

0000033488us-gaap:RevolvingCreditFacilityMemberesca:RestatedCreditAgreementMember2022-10-26

0000033488us-gaap:RevolvingCreditFacilityMemberesca:RestatedCreditAgreementMember2023-07-012023-09-30

xbrli:pure

0000033488us-gaap:RevolvingCreditFacilityMemberesca:RestatedCreditAgreementMember2024-01-01

0000033488us-gaap:RevolvingCreditFacilityMemberesca:RestatedCreditAgreementMember2023-12-31

0000033488us-gaap:RevolvingCreditFacilityMemberesca:RestatedCreditAgreementMember2023-10-012023-12-31

0000033488us-gaap:RevolvingCreditFacilityMemberesca:RestatedCreditAgreementMember2023-04-012023-06-30

0000033488us-gaap:RevolvingCreditFacilityMemberesca:RestatedCreditAgreementMember2023-01-012023-03-31

0000033488us-gaap:RevolvingCreditFacilityMemberesca:RestatedCreditAgreementMember2022-07-102022-12-31

0000033488us-gaap:RevolvingCreditFacilityMemberesca:RestatedCreditAgreementMember2022-07-18

0000033488us-gaap:RevolvingCreditFacilityMemberesca:RestatedCreditAgreementMember2022-07-182022-07-18

0000033488us-gaap:RevolvingCreditFacilityMemberesca:RestatedCreditAgreementMember2022-01-21

0000033488us-gaap:RevolvingCreditFacilityMemberesca:RestatedCreditAgreementMember2021-12-25

00000334882023-09-30

00000334882022-10-01

utr:Y

00000334882021-12-262022-10-01

00000334882022-07-102022-10-01

00000334882023-07-012023-09-30

0000033488srt:MaximumMember2023-09-30

0000033488srt:MinimumMember2023-09-30

0000033488esca:OtherChannelsMember2021-12-262022-10-01

0000033488esca:OtherChannelsMember2023-01-012023-09-30

0000033488esca:OtherChannelsMember2022-07-102022-10-01

0000033488esca:OtherChannelsMember2023-07-012023-09-30

0000033488esca:InternationalMember2021-12-262022-10-01

0000033488esca:InternationalMember2023-01-012023-09-30

0000033488esca:InternationalMember2022-07-102022-10-01

0000033488esca:InternationalMember2023-07-012023-09-30

0000033488esca:EcommerceMember2021-12-262022-10-01

0000033488esca:EcommerceMember2023-01-012023-09-30

0000033488esca:EcommerceMember2022-07-102022-10-01

0000033488esca:EcommerceMember2023-07-012023-09-30

0000033488esca:SpecialtyDealersMember2021-12-262022-10-01

0000033488esca:SpecialtyDealersMember2023-01-012023-09-30

0000033488esca:SpecialtyDealersMember2022-07-102022-10-01

0000033488esca:SpecialtyDealersMember2023-07-012023-09-30

0000033488esca:MassMerchantsMember2021-12-262022-10-01

0000033488esca:MassMerchantsMember2023-01-012023-09-30

0000033488esca:MassMerchantsMember2022-07-102022-10-01

0000033488esca:MassMerchantsMember2023-07-012023-09-30

xbrli:shares

00000334882023-03-202023-03-20

iso4217:USDxbrli:shares

00000334882023-06-192023-06-19

00000334882023-09-052023-09-05

0000033488us-gaap:CorporateMember2022-10-01

0000033488esca:SportingGoodsMember2022-10-01

0000033488us-gaap:CorporateMember2021-12-262022-10-01

0000033488esca:SportingGoodsMember2021-12-262022-10-01

0000033488us-gaap:CorporateMember2022-07-102022-10-01

0000033488esca:SportingGoodsMember2022-07-102022-10-01

0000033488us-gaap:CorporateMember2023-09-30

0000033488esca:SportingGoodsMember2023-09-30

0000033488us-gaap:CorporateMember2023-01-012023-09-30

0000033488esca:SportingGoodsMember2023-01-012023-09-30

0000033488us-gaap:CorporateMember2023-07-012023-09-30

0000033488esca:SportingGoodsMember2023-07-012023-09-30

0000033488us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedPaymentArrangementEmployeeMember2023-01-012023-09-30

0000033488us-gaap:RestrictedStockUnitsRSUMembersrt:DirectorMember2023-01-012023-09-30

0000033488esca:IncentivePlan2017Membersrt:DirectorMember2023-01-012023-09-30

0000033488esca:IncentivePlan2017Member2023-01-012023-09-30

0000033488us-gaap:FairValueInputsLevel2Member2022-10-01

0000033488us-gaap:FairValueInputsLevel1Member2022-10-01

0000033488us-gaap:FairValueInputsLevel2Member2022-12-31

00000334882022-12-31

0000033488us-gaap:FairValueInputsLevel1Member2022-12-31

0000033488us-gaap:FairValueInputsLevel2Member2023-09-30

0000033488us-gaap:FairValueInputsLevel1Member2023-09-30

00000334882021-12-25

0000033488srt:DirectorMember2021-12-262022-10-01

0000033488srt:DirectorMember2023-01-012023-09-30

0000033488srt:OfficerMember2021-12-262022-10-01

0000033488srt:OfficerMember2023-01-012023-09-30

0000033488us-gaap:RetainedEarningsMember2023-09-30

0000033488us-gaap:CommonStockMember2023-09-30

0000033488us-gaap:RetainedEarningsMember2023-01-012023-09-30

0000033488us-gaap:CommonStockMember2023-01-012023-09-30

0000033488us-gaap:RetainedEarningsMember2022-12-31

0000033488us-gaap:CommonStockMember2022-12-31

0000033488us-gaap:RetainedEarningsMember2023-07-012023-09-30

00000334882023-06-30

0000033488us-gaap:RetainedEarningsMember2023-06-30

0000033488us-gaap:CommonStockMember2023-06-30

0000033488us-gaap:RetainedEarningsMember2022-10-01

0000033488us-gaap:CommonStockMember2022-10-01

0000033488us-gaap:RetainedEarningsMember2021-12-262022-10-01

0000033488us-gaap:CommonStockMember2021-12-262022-10-01

0000033488us-gaap:RetainedEarningsMember2021-12-25

0000033488us-gaap:CommonStockMember2021-12-25

0000033488us-gaap:RetainedEarningsMember2022-07-102022-10-01

00000334882022-07-09

0000033488us-gaap:RetainedEarningsMember2022-07-09

0000033488us-gaap:CommonStockMember2022-07-09

00000334882023-10-23

thunderdome:item

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

☒ Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the quarterly period ended September 30, 2023 or

☐ Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from _____ to _____

Commission File Number 0-6966

ESCALADE, INCORPORATED

(Exact name of registrant as specified in its charter)

|

Indiana

(State of incorporation)

|

13-2739290

(I.R.S. EIN)

|

|

817 Maxwell Ave, Evansville, Indiana

(Address of principal executive office)

|

47711

(Zip Code)

|

812-467-1358

(Registrant's Telephone Number)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol |

Name of Exchange on which registered |

|

Common Stock, No Par Value

|

ESCA

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐

|

|

Accelerated filer ☒

|

|

Non-accelerated filer ☐

|

|

Smaller reporting company ☒

Emerging growth company ☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

| |

Class

|

Outstanding at October 23, 2023

|

|

| |

Common, no par value

|

13,736,800

|

|

INDEX

| |

|

Page

No.

|

|

Part I.

|

Financial Information:

|

|

| |

|

|

|

Item 1 -

|

Financial Statements:

|

|

| |

|

|

| |

Consolidated Condensed Balance Sheets as of September 30, 2023, December 31, 2022, and October 1, 2022

|

3

|

| |

|

|

| |

Consolidated Condensed Statements of Operations for the Third Quarter and Three Quarters Ended September 30, 2023 and October 1, 2022

|

4

|

| |

|

|

| |

Consolidated Condensed Statements of Stockholders’ Equity for the Third Quarter and Three Quarters Ended September 30, 2023 and October 1, 2022

|

5

|

| |

|

|

| |

Consolidated Condensed Statements of Cash Flows for the Three Quarters Ended September 30, 2023 and October 1, 2022

|

6

|

| |

|

|

| |

Notes to Consolidated Condensed Financial Statements

|

7

|

| |

|

|

|

Item 2 -

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

14

|

| |

|

|

|

Item 3 -

|

Quantitative and Qualitative Disclosures About Market Risk

|

17

|

| |

|

|

|

Item 4 -

|

Controls and Procedures

|

17

|

| |

|

|

|

Part II.

|

Other Information

|

|

| |

|

|

|

Item 1A -

|

Risk Factors

|

18

|

| |

|

|

|

Item 2 -

|

Unregistered Sales of Equity Securities and Use of Proceeds

|

18

|

| |

|

|

|

Item 6 -

|

Exhibits

|

19

|

| |

|

|

| |

Signature

|

19

|

PART I - FINANCIAL INFORMATION

Item 1. FINANCIAL STATEMENTS

ESCALADE, INCORPORATED AND SUBSIDIARIES

CONSOLIDATED CONDENSED BALANCE SHEETS

|

All Amounts in Thousands Except Share Information

|

|

September 30,

2023

|

|

|

December 31,

2022

|

|

|

October 1,

2022

|

|

| |

|

(Unaudited)

|

|

|

(Audited)

|

|

|

(Unaudited)

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

919 |

|

|

$ |

3,967 |

|

|

$ |

4,000 |

|

|

Receivables, less allowance of $367; $492; and $729; respectively

|

|

|

63,378 |

|

|

|

57,419 |

|

|

|

65,258 |

|

|

Inventories

|

|

|

105,267 |

|

|

|

121,870 |

|

|

|

134,957 |

|

|

Prepaid expenses

|

|

|

4,303 |

|

|

|

4,942 |

|

|

|

4,143 |

|

|

Prepaid income tax

|

|

|

2,080 |

|

|

|

-- |

|

|

|

1,075 |

|

|

TOTAL CURRENT ASSETS

|

|

|

175,947 |

|

|

|

188,198 |

|

|

|

209,433 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net

|

|

|

23,949 |

|

|

|

24,751 |

|

|

|

27,618 |

|

|

Assets held for sale

|

|

|

2,823 |

|

|

|

2,823 |

|

|

|

-- |

|

|

Operating lease right-of-use assets

|

|

|

8,645 |

|

|

|

9,100 |

|

|

|

9,074 |

|

|

Intangible assets, net

|

|

|

29,260 |

|

|

|

31,120 |

|

|

|

34,712 |

|

|

Goodwill

|

|

|

42,326 |

|

|

|

42,326 |

|

|

|

39,226 |

|

|

Other assets

|

|

|

423 |

|

|

|

400 |

|

|

|

261 |

|

|

TOTAL ASSETS

|

|

$ |

283,373 |

|

|

$ |

298,718 |

|

|

$ |

320,324 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current portion of long-term debt

|

|

$ |

7,143 |

|

|

$ |

7,143 |

|

|

$ |

7,143 |

|

|

Trade accounts payable

|

|

|

24,050 |

|

|

|

9,414 |

|

|

|

22,684 |

|

|

Accrued liabilities

|

|

|

11,991 |

|

|

|

21,320 |

|

|

|

19,060 |

|

|

Income tax payable

|

|

|

-- |

|

|

|

71 |

|

|

|

-- |

|

|

Current operating lease liabilities

|

|

|

1,037 |

|

|

|

993 |

|

|

|

816 |

|

|

TOTAL CURRENT LIABILITIES

|

|

|

44,221 |

|

|

|

38,941 |

|

|

|

49,703 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Long‑term debt

|

|

|

64,896 |

|

|

|

87,738 |

|

|

|

99,568 |

|

|

Deferred income tax liability

|

|

|

4,516 |

|

|

|

4,516 |

|

|

|

4,759 |

|

|

Operating lease liabilities

|

|

|

8,163 |

|

|

|

8,641 |

|

|

|

8,557 |

|

|

Other liabilities

|

|

|

407 |

|

|

|

407 |

|

|

|

448 |

|

|

TOTAL LIABILITIES

|

|

|

122,203 |

|

|

|

140,243 |

|

|

|

163,035 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' Equity:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred stock:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Authorized 1,000,000 shares; no par value, none issued

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Authorized 30,000,000 shares; no par value, issued and outstanding – 13,736,800; 13,594,407; and 13,590,407; shares respectively

|

|

|

13,737 |

|

|

|

13,594 |

|

|

|

13,590 |

|

|

Retained earnings

|

|

|

147,433 |

|

|

|

144,881 |

|

|

|

143,699 |

|

|

TOTAL STOCKHOLDERS' EQUITY

|

|

|

161,170 |

|

|

|

158,475 |

|

|

|

157,289 |

|

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

$ |

283,373 |

|

|

$ |

298,718 |

|

|

$ |

320,324 |

|

See notes to Consolidated Condensed Financial Statements.

ESCALADE, INCORPORATED AND SUBSIDIARIES

CONSOLIDATED CONDENSED STATEMENTS OF OPERATIONS (UNAUDITED)

| |

|

Third Quarter Ended |

|

|

Three Quarters Ended

|

|

|

All Amounts in Thousands Except Per Share Data

|

|

September

30, 2023

|

|

|

October

1, 2022

|

|

|

September

30, 2023

|

|

|

October

1, 2022

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales

|

|

$ |

73,358 |

|

|

$ |

74,904 |

|

|

|

198,060 |

|

|

$ |

241,621 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of products sold

|

|

|

55,222 |

|

|

|

61,273 |

|

|

|

152,225 |

|

|

|

184,147 |

|

|

Selling, administrative and general expenses

|

|

|

11,071 |

|

|

|

8,769 |

|

|

|

31,123 |

|

|

|

33,975 |

|

|

Amortization

|

|

|

620 |

|

|

|

642 |

|

|

|

1,860 |

|

|

|

2,067 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Income

|

|

|

6,445 |

|

|

|

4,220 |

|

|

|

12,852 |

|

|

|

21,432 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Income (Expense)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

(1,325 |

) |

|

|

(954 |

) |

|

|

(4,280 |

) |

|

|

(2,462 |

) |

|

Other income (expense)

|

|

|

5 |

|

|

|

(22 |

) |

|

|

30 |

|

|

|

50 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Before Income Taxes

|

|

|

5,125 |

|

|

|

3,244 |

|

|

|

8,602 |

|

|

|

19,020 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for Income Taxes

|

|

|

850 |

|

|

|

286 |

|

|

|

1,637 |

|

|

|

3,735 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income

|

|

$ |

4,275 |

|

|

$ |

2,958 |

|

|

$ |

6,965 |

|

|

$ |

15,285 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings Per Share Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share

|

|

$ |

0.31 |

|

|

$ |

0.22 |

|

|

$ |

0.51 |

|

|

$ |

1.13 |

|

|

Diluted earnings per share

|

|

$ |

0.31 |

|

|

$ |

0.22 |

|

|

$ |

0.50 |

|

|

$ |

1.12 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends declared

|

|

$ |

0.15 |

|

|

$ |

0.15 |

|

|

$ |

0.45 |

|

|

$ |

0.45 |

|

See notes to Consolidated Condensed Financial Statements.

ESCALADE, INCORPORATED AND SUBSIDIARIES

CONSOLIDATED CONDENSED STATEMENT OF STOCKHOLDERS’ EQUITY (UNAUDITED)

| |

|

Common Stock

|

|

|

Retained

|

|

|

|

|

|

|

All Amounts in Thousands

|

|

Shares

|

|

|

Amount

|

|

|

Earnings

|

|

|

Total

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balances at July 9, 2022

|

|

|

13,590 |

|

|

$ |

13,590 |

|

|

$ |

142,403 |

|

|

$ |

155,993 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

|

|

|

|

|

|

|

|

|

2,958 |

|

|

|

2,958 |

|

|

Expense of restricted stock units

|

|

|

|

|

|

|

|

|

|

|

377 |

|

|

|

377 |

|

|

Dividends declared

|

|

|

|

|

|

|

|

|

|

|

(2,039 |

) |

|

|

(2,039 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balances at October 1, 2022

|

|

|

13,590 |

|

|

$ |

13,590 |

|

|

$ |

143,699 |

|

|

$ |

157,289 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balances at December 25, 2021

|

|

|

13,493 |

|

|

$ |

13,493 |

|

|

$ |

133,122 |

|

|

$ |

146,615 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

|

|

|

|

|

|

|

|

|

15,285 |

|

|

|

15,285 |

|

|

Expense of restricted stock units

|

|

|

|

|

|

|

|

|

|

|

1,453 |

|

|

|

1,453 |

|

|

Settlement of restricted stock units

|

|

|

93 |

|

|

|

93 |

|

|

|

(93 |

) |

|

|

-- |

|

|

Dividends declared

|

|

|

|

|

|

|

|

|

|

|

(6,115 |

) |

|

|

(6,115 |

) |

|

Stock issued to directors as compensation

|

|

|

4 |

|

|

|

4 |

|

|

|

47 |

|

|

|

51 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balances at October 1, 2022

|

|

|

13,590 |

|

|

$ |

13,590 |

|

|

$ |

143,699 |

|

|

$ |

157,289 |

|

| |

|

Common Stock

|

|

|

Retained

|

|

|

|

|

|

|

All Amounts in Thousands

|

|

Shares

|

|

|

Amount

|

|

|

Earnings

|

|

|

Total

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balances at June 30, 2023

|

|

|

13,737 |

|

|

$ |

13,737 |

|

|

$ |

144,672 |

|

|

$ |

158,409 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

|

|

|

|

|

|

|

|

|

4,275 |

|

|

|

4,275 |

|

|

Expense of restricted stock units

|

|

|

|

|

|

|

|

|

|

|

546 |

|

|

|

546 |

|

|

Dividends declared

|

|

|

|

|

|

|

|

|

|

|

(2,060 |

) |

|

|

(2,060 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balances at September 30, 2023

|

|

|

13,737 |

|

|

$ |

13,737 |

|

|

$ |

147,433 |

|

|

$ |

161,170 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balances at December 31, 2022

|

|

|

13,594 |

|

|

$ |

13,594 |

|

|

$ |

144,881 |

|

|

$ |

158,475 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

|

|

|

|

|

|

|

|

|

6,965 |

|

|

|

6,965 |

|

|

Expense of restricted stock units

|

|

|

|

|

|

|

|

|

|

|

1,463 |

|

|

|

1,463 |

|

|

Settlement of restricted stock units

|

|

|

108 |

|

|

|

108 |

|

|

|

(108 |

) |

|

|

-- |

|

|

Dividends declared

|

|

|

|

|

|

|

|

|

|

|

(6,180 |

) |

|

|

(6,180 |

) |

|

Stock issued to directors as compensation

|

|

|

4 |

|

|

|

4 |

|

|

|

48 |

|

|

|

52 |

|

|

Issuance of common stock for service

|

|

|

31 |

|

|

|

31 |

|

|

|

364 |

|

|

|

395 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balances at September 30, 2023

|

|

|

13,737 |

|

|

$ |

13,737 |

|

|

$ |

147,433 |

|

|

$ |

161,170 |

|

See notes to Consolidated Condensed Financial Statements.

ESCALADE, INCORPORATED AND SUBSIDIARIES

CONSOLIDATED CONDENSED STATEMENTS OF CASH FLOWS (UNAUDITED)

| |

|

Three Quarters Ended

|

|

|

All Amounts in Thousands

|

|

September 30,

2023

|

|

|

October 1,

2022

|

|

| |

|

|

|

|

|

|

|

|

|

Operating Activities:

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$ |

6,965 |

|

|

$ |

15,285 |

|

|

Depreciation and amortization

|

|

|

4,221 |

|

|

|

5,207 |

|

|

Provision for doubtful accounts

|

|

|

171 |

|

|

|

258 |

|

|

Stock-based compensation

|

|

|

1,463 |

|

|

|

1,453 |

|

|

(Gain) loss on disposal of property and equipment

|

|

|

4 |

|

|

|

(22 |

) |

|

Common stock issued in lieu of bonus to officers

|

|

|

395 |

|

|

|

-- |

|

|

Director stock compensation

|

|

|

52 |

|

|

|

51 |

|

|

Adjustments necessary to reconcile net income to net cash provided by operating activities

|

|

|

14,435 |

|

|

|

(27,974 |

) |

| Net cash provided (used) by operating activities |

|

|

27,706 |

|

|

|

(5,742 |

) |

| |

|

|

|

|

|

|

|

|

|

Investing Activities:

|

|

|

|

|

|

|

|

|

|

Purchase of property and equipment

|

|

|

(1,568 |

) |

|

|

(1,792 |

) |

|

Proceeds from sale of property and equipment

|

|

|

5 |

|

|

|

40 |

|

|

Acquisitions

|

|

|

-- |

|

|

|

(35,757 |

) |

|

Net cash used by investing activities

|

|

|

(1,563 |

) |

|

|

(37,509 |

) |

| |

|

|

|

|

|

|

|

|

|

Financing Activities:

|

|

|

|

|

|

|

|

|

| Proceeds from issuance of long-term debt |

|

|

76,062 |

|

|

|

180,355 |

|

|

Payments on long-term debt

|

|

|

(98,904 |

) |

|

|

(131,183 |

) |

|

Deferred financing fees

|

|

|

(169 |

) |

|

|

(180 |

) |

|

Cash dividends paid

|

|

|

(6,180 |

) |

|

|

(6,115 |

) |

|

Net cash provided (used) by financing activities

|

|

|

(29,191 |

) |

|

|

42,877 |

|

|

Net decrease in cash and cash equivalents

|

|

|

(3,048 |

) |

|

|

(374 |

) |

| Cash and cash equivalents, beginning of period |

|

|

3,967 |

|

|

|

4,374 |

|

|

Cash and cash equivalents, end of period

|

|

$ |

919 |

|

|

$ |

4,000 |

|

See notes to Consolidated Condensed Financial Statements.

ESCALADE, INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS (UNAUDITED)

Note A – Summary of Significant Accounting Policies

Presentation of Consolidated Condensed Financial Statements – The significant accounting policies followed by the Company and its wholly owned subsidiaries for interim financial reporting are consistent with the accounting policies followed for its annual financial reporting. All adjustments that are of a normal recurring nature and are in the opinion of management necessary for a fair statement of the results for the periods reported have been included in the accompanying consolidated condensed financial statements. The consolidated condensed balance sheet of the Company as of December 31, 2022 has been derived from the audited consolidated balance sheet of the Company as of that date. Certain information and note disclosures normally included in the Company’s annual financial statements prepared in accordance with accounting principles generally accepted in the United States of America (GAAP) have been condensed or omitted. These consolidated condensed financial statements should be read in conjunction with the consolidated financial statements and notes thereto included in the Company’s Form 10-K annual report for 2022 filed with the Securities and Exchange Commission.

On August 10, 2022, Escalade’s Board of Directors approved a change in its fiscal year end from the last Saturday in December of each year to December 31 of each year. Escalade’s fiscal quarters will end on March 31, June 30, and September 30. The fiscal year change is effective beginning with Escalade’s 2023 fiscal calendar, which began on January 1, 2023. Consistent with SEC guidance, no transition report is required in connection with the change in Escalade’s fiscal year end.

Reclassifications – Certain reclassifications have been made to prior year financial statements to conform to the current year financial statement presentation. These reclassifications had no effect on net earnings.

Note B ‑ Seasonal Aspects

The results of operations for the third quarter and three quarter periods ended September 30, 2023 and October 1, 2022 are not necessarily indicative of the results to be expected for the full year.

Note C ‑ Inventories

|

In thousands

|

|

September 30,

2023

|

|

|

December 31,

2022

|

|

|

October 1,

2022

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Raw materials

|

|

$ |

5,048 |

|

|

$ |

7,789 |

|

|

$ |

9,988 |

|

|

Work in progress

|

|

|

2,874 |

|

|

|

3,478 |

|

|

|

4,537 |

|

|

Finished goods

|

|

|

97,345 |

|

|

|

110,603 |

|

|

|

120,432 |

|

| |

|

$ |

105,267 |

|

|

$ |

121,870 |

|

|

$ |

134,957 |

|

Note D – Fair Values of Financial Instruments

The following methods were used to estimate the fair value of all financial instruments recognized in the accompanying balance sheets at amounts other than fair values.

Cash and Cash Equivalents

Fair values of cash and cash equivalents approximate cost due to the short period of time to maturity.

Long-term Debt

Fair values of long-term debt is estimated based on borrowing rates currently available to the Company for bank loans with similar terms and maturities and determined through the use of a discounted cash flow model.

The following table presents estimated fair values of the Company’s financial instruments and the level within the fair value hierarchy in which the fair value measurements fall in accordance with FASB ASC 825 at September 30, 2023, December 31, 2022 and October 1, 2022.

| |

|

|

|

|

|

Fair Value Measurements Using

|

|

|

September 30, 2023

In thousands

|

|

Carrying

Amount

|

|

|

Quoted Prices in

Active Markets

for Identical

Assets (Level 1)

|

|

|

Significant Other

Observable Inputs

(Level 2)

|

|

|

Significant

Unobservable

Inputs

(Level 3)

|

|

|

Financial assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

919 |

|

|

$ |

919 |

|

|

$ |

-- |

|

|

$ |

-- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current portion of long-term debt

|

|

$ |

7,143 |

|

|

$ |

-- |

|

|

$ |

7,143 |

|

|

$ |

-- |

|

|

Long-term debt

|

|

$ |

64,896 |

|

|

$ |

-- |

|

|

$ |

64,896 |

|

|

$ |

-- |

|

| |

|

|

|

|

|

Fair Value Measurements Using

|

|

|

December 31, 2022

In thousands

|

|

Carrying

Amount

|

|

|

Quoted Prices in

Active Markets

for Identical

Assets (Level 1)

|

|

|

Significant Other

Observable Inputs

(Level 2)

|

|

|

Significant

Unobservable

Inputs

(Level 3)

|

|

|

Financial assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

3,967 |

|

|

$ |

3,967 |

|

|

$ |

-- |

|

|

$ |

-- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current portion of long-term debt

|

|

$ |

7,143 |

|

|

$ |

-- |

|

|

$ |

7,143 |

|

|

$ |

-- |

|

|

Long-term debt

|

|

$ |

87,738 |

|

|

$ |

-- |

|

|

$ |

87,738 |

|

|

$ |

-- |

|

| |

|

|

|

|

|

Fair Value Measurements Using

|

|

|

October 1, 2022

In thousands

|

|

Carrying

Amount

|

|

|

Quoted Prices in

Active Markets

for Identical

Assets (Level 1)

|

|

|

Significant Other

Observable Inputs

(Level 2)

|

|

|

Significant

Unobservable

Inputs

(Level 3)

|

|

|

Financial assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

4,000 |

|

|

$ |

4,000 |

|

|

$ |

-- |

|

|

$ |

-- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current portion of long-term debt

|

|

$ |

7,143 |

|

|

$ |

-- |

|

|

$ |

7,143 |

|

|

$ |

-- |

|

|

Long-term debt

|

|

$ |

99,568 |

|

|

$ |

-- |

|

|

$ |

99,568 |

|

|

$ |

-- |

|

Note E – Stock Compensation

The fair value of stock-based compensation is recognized in accordance with the provisions of FASB ASC 718, Stock Compensation.

During the three quarters ended September 30, 2023, and pursuant to the 2017 Incentive Plan, the Company issued 30,921 shares of common stock with a fair market value of $395 thousand in lieu of accrued and unpaid annual cash incentives for fiscal year 2022 to certain officers. During the three quarters ended September 30, 2023 and pursuant to the 2017 Incentive Plan, in lieu of cash payments of director fees, the Company awarded to certain directors 4,441 shares of common stock.

During the three quarters ended September 30, 2023, the Company awarded 21,200 restricted stock units to directors and 145,563 restricted stock units to employees. The restricted stock units awarded to directors time vest over two years (one-half one year from grant date and one-half two years from grant date) provided that the director is still a director of the Company at the vest date. Director restricted stock units are subject to forfeiture, except for termination of services as a result of retirement, death or disability, if on the vesting date the director no longer holds a position with the Company. The 2023 restricted stock units awarded to employees time vest over three years (one-third one year from grant, one-third two years from grant and one-third three years from grant) provided that the employee is still employed by the Company on the vesting date.

For the third quarter and three quarters ended September 30, 2023, the Company recognized stock based compensation expense of $546 thousand and $1,463 thousand, respectively compared to stock based compensation expense of $377 thousand and $1,453 thousand for the same periods in the prior year. At September 30, 2023 and October 1, 2022, respectively, there was $1,979 thousand and $1,937 thousand in unrecognized stock-based compensation expense related to non-vested stock awards.

Note F ‑ Segment Information

| |

|

For the Third Quarter

Ended September 30, 2023

|

|

|

In thousands

|

|

Sporting

Goods

|

|

|

Corp.

|

|

|

Total

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues from external customers

|

|

$ |

73,358 |

|

|

$ |

-- |

|

|

$ |

73,358 |

|

|

Operating income (loss)

|

|

|

6,958 |

|

|

|

(513 |

) |

|

|

6,445 |

|

|

Net income

|

|

|

4,089 |

|

|

|

186 |

|

|

|

4,275 |

|

| |

|

As of and for the Three Quarters

Ended September 30, 2023

|

|

|

In thousands

|

|

Sporting

Goods

|

|

|

Corp.

|

|

|

Total

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues from external customers

|

|

$ |

198,060 |

|

|

$ |

-- |

|

|

$ |

198,060 |

|

|

Operating income (loss)

|

|

|

14,485 |

|

|

|

(1,633 |

) |

|

|

12,852 |

|

|

Net income (loss)

|

|

|

7,422 |

|

|

|

(457 |

) |

|

|

6,965 |

|

|

Total assets

|

|

$ |

279,805 |

|

|

$ |

3,568 |

|

|

$ |

283,373 |

|

| |

|

For the Third Quarter

Ended October 1, 2022

|

|

|

In thousands

|

|

Sporting

Goods

|

|

|

Corp.

|

|

|

Total

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues from external customers

|

|

$ |

74,904 |

|

|

$ |

-- |

|

|

$ |

74,904 |

|

|

Operating income (loss)

|

|

|

4,661 |

|

|

|

(441 |

) |

|

|

4,220 |

|

|

Net income

|

|

|

2,387 |

|

|

|

571 |

|

|

|

2,958 |

|

| |

|

As of and for the Three Quarters

Ended October 1, 2022

|

|

|

In thousands

|

|

Sporting

Goods

|

|

|

Corp.

|

|

|

Total

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues from external customers

|

|

$ |

241,621 |

|

|

$ |

-- |

|

|

$ |

241,621 |

|

|

Operating income (loss)

|

|

|

23,026 |

|

|

|

(1,594 |

) |

|

|

21,432 |

|

|

Net income

|

|

|

14,665 |

|

|

|

620 |

|

|

|

15,285 |

|

|

Total assets

|

|

$ |

312,418 |

|

|

$ |

7,906 |

|

|

$ |

320,324 |

|

Note G – Dividend Payment

On September 5, 2023, the Company paid a quarterly dividend of $0.15 per common share to all shareholders of record on August 29, 2023. The total amount of the dividend was approximately $2.1 million and was charged against retained earnings.

On June 19, 2023, the Company paid a quarterly dividend of $0.15 per common share to all shareholders of record on June 12, 2023. The total amount of the dividend was approximately $2.1 million and was charged against retained earnings.

On March 20, 2023, the Company paid a quarterly dividend of $0.15 per common share to all shareholders of record on March 13, 2023. The total amount of the dividend was approximately $2.1 million and was charged against retained earnings.

Note H ‑ Earnings Per Share

The shares used in computation of the Company’s basic and diluted earnings per common share are as follows:

| |

|

Third Quarter Ended

|

|

|

Three Quarters Ended

|

|

|

In thousands

|

|

September

30, 2023

|

|

|

October

1, 2022

|

|

|

September

30, 2023

|

|

|

October

1, 2022

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding

|

|

|

13,737 |

|

|

|

13,590 |

|

|

|

13,706 |

|

|

|

13,565 |

|

|

Dilutive effect of stock options and restricted stock units

|

|

|

150 |

|

|

|

62 |

|

|

|

140 |

|

|

|

82 |

|

|

Weighted average common shares outstanding, assuming dilution

|

|

|

13,887 |

|

|

|

13,652 |

|

|

|

13,846 |

|

|

|

13,647 |

|

Note I – New Accounting Standards and Changes in Accounting Principles

With the exception of that discussed below, there have been no recent accounting pronouncements or changes in accounting pronouncements during the third quarter and three quarters ended September 30, 2023, as compared to the recent accounting pronouncements described in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, that are of significance, or potential significance to the Company.

In June 2016, the FASB issued ASU 2016-13, Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments. This amendment requires the measurement and recognition of expected credit losses for financial assets held at amortized cost. ASU 2016-13 replaces the existing incurred loss impairment model with an expected loss model which requires the use of forward-looking information to calculate credit loss estimates. It also eliminates the concept of other-than-temporary impairment and requires credit losses related to available-for-sale debt securities to be recorded through an allowance for credit losses rather than as a reduction in the amortized cost basis of the securities. These changes will result in earlier recognition of credit losses.

The Company adopted this standard on January 1, 2023. The adoption of this standard did not have a material impact on the financial statements of the Company.

Note J – Revenue from Contracts with Customers

Revenue Recognition – Revenue is recognized when obligations under the terms of a contract with our customer are satisfied; generally this occurs with the transfer of control of our goods at a point in time based on shipping terms and transfer of title. Revenue is measured as the amount of consideration we expect to receive in exchange for transferring goods. Sales, value add, and other taxes we collect concurrent with revenue-producing activities are excluded from revenue. Shipping and handling fees charged to customers are reported within revenue.

Gross-to-net sales adjustments – We recognize revenue net of various sales adjustments to arrive at net sales as reported on the statement of operations. These adjustments are referred to as gross-to-net sales adjustments and primarily fall into one of three categories: returns, warranties and customer allowances.

Returns – The Company records an accrued liability and reduction in sales for estimated product returns based upon historical experience. An accrued liability and reduction in sales is also recorded for approved return authorizations that have been communicated by the customer.

Warranties – Limited warranties are provided on certain products for varying periods. We record an accrued liability and reduction in sales for estimated future warranty claims based upon historical experience and management’s estimate of the level of future claims. Changes in the estimated amounts recognized in prior years are recorded as an adjustment to the accrued liability and sales in the current year.

Customer Allowances – Customer allowances are common practice in the industries in which the Company operates. These agreements are typically in the form of advertising subsidies, volume rebates and catalog allowances and are accounted for as a reduction to gross sales. The Company reviews such allowances on an ongoing basis and accruals are adjusted, if necessary, as additional information becomes available.

Disaggregation of Revenue – We generate revenue from the sale of widely recognized sporting goods brands in basketball goals, archery, indoor and outdoor game recreation and fitness products. These products are sold through multiple sales channels that include: mass merchants, specialty dealers, key on-line retailers (“E-commerce”) and international. The following table depicts the disaggregation of revenue according to sales channel:

| |

|

Third Quarter Ended

|

|

|

Three Quarters Ended

|

|

|

All Amounts in Thousands

|

|

September

30, 2023

|

|

|

October

1, 2022

|

|

|

September

30, 2023

|

|

|

October

1, 2022

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Sales by Channel:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mass Merchants

|

|

$ |

35,931 |

|

|

$ |

29,849 |

|

|

$ |

72,101 |

|

|

$ |

85,804 |

|

|

Specialty Dealers

|

|

|

19,669 |

|

|

|

20,298 |

|

|

|

65,134 |

|

|

|

74,631 |

|

|

E-commerce

|

|

|

21,785 |

|

|

|

26,090 |

|

|

|

69,512 |

|

|

|

87,441 |

|

|

International

|

|

|

2,961 |

|

|

|

4,032 |

|

|

|

9,189 |

|

|

|

12,643 |

|

|

Other

|

|

|

892 |

|

|

|

1,188 |

|

|

|

3,206 |

|

|

|

3,454 |

|

|

Total Gross Sales

|

|

|

81,238 |

|

|

|

81,457 |

|

|

|

219,142 |

|

|

|

263,973 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less: Gross-to-Net Sales Adjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Returns

|

|

|

2,493 |

|

|

|

892 |

|

|

|

6,039 |

|

|

|

3,740 |

|

|

Warranties

|

|

|

358 |

|

|

|

663 |

|

|

|

988 |

|

|

|

1,985 |

|

|

Customer Allowances

|

|

|

5,029 |

|

|

|

4,998 |

|

|

|

14,055 |

|

|

|

16,627 |

|

|

Total Gross-to-Net Sales Adjustments

|

|

|

7,880 |

|

|

|

6,553 |

|

|

|

21,082 |

|

|

|

22,352 |

|

|

Total Net Sales

|

|

$ |

73,358 |

|

|

$ |

74,904 |

|

|

$ |

198,060 |

|

|

$ |

241,621 |

|

Note K – Leases

We have operating leases for office, manufacturing and distribution facilities as well as for certain equipment. Our leases have remaining lease terms of 1 year to 9 years. As of September 30, 2023, the Company has not entered into any lease arrangements classified as a finance lease.

We determine if an arrangement is a lease at inception. Operating leases are included in operating lease right-of-use (“ROU”) assets, current operating lease liabilities and operating lease liabilities on our consolidated balance sheet. The Company has elected an accounting policy to not recognize short-term leases (one year or less) on the balance sheet. The Company also elected the package of practical expedients which applies to leases that commenced before the adoption date.

ROU assets and operating lease liabilities are recognized based on the present value of future minimum lease payments over the lease term at commencement date. When the implicit rate of the lease is not provided or cannot be determined, we use our incremental borrowing rate based on the information available at the commencement date to determine the present value of future payments. Lease terms may include options to extend or terminate the lease when it is reasonably certain that we will exercise those options. Lease expense for minimum lease payments is recognized on a straight-line basis over the lease term. Components of lease expense and other information is as follows:

| |

|

Third Quarter Ended

|

|

|

Three Quarters Ended

|

|

|

All Amounts in Thousands

|

|

September

30, 2023

|

|

|

October

1, 2022

|

|

|

September

30, 2023

|

|

|

October

1, 2022

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease Expense

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Lease Cost

|

|

$ |

388 |

|

|

$ |

393 |

|

|

$ |

1,137 |

|

|

$ |

1,073 |

|

|

Short-term Lease Cost

|

|

|

388 |

|

|

|

658 |

|

|

|

1,611 |

|

|

|

1,882 |

|

|

Variable Lease Cost

|

|

|

117 |

|

|

|

81 |

|

|

|

415 |

|

|

|

393 |

|

|

Total Operating Lease Cost

|

|

$ |

893 |

|

|

$ |

1,132 |

|

|

$ |

3,163 |

|

|

$ |

3,348 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Lease – Operating Cash Flows

|

|

$ |

266 |

|

|

$ |

100 |

|

|

$ |

759 |

|

|

$ |

712 |

|

|

New ROU Assets – Operating Leases

|

|

$ |

242 |

|

|

$ |

30 |

|

|

$ |

325 |

|

|

$ |

7,773 |

|

Other information about lease amounts recognized in our consolidated financial statements is summarized as follows:

| |

|

Three Quarters Ended

|

|

|

All Amounts in Thousands

|

|

September 30,

2023

|

|

|

October 1,

2022

|

|

| |

|

|

|

|

|

|

|

|

|

Weighted Average Remaining Lease Term – Operating Leases (in years)

|

|

|

8.29 |

|

|

|

9.29 |

|

|

Weighted Average Discount Rate – Operating Leases

|

|

|

5.21 |

% |

|

|

5.00 |

% |

Future minimum lease payments under non-cancellable leases as of September 30, 2023 were as follows:

|

All Amounts in Thousands

|

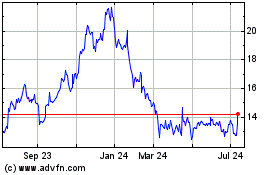

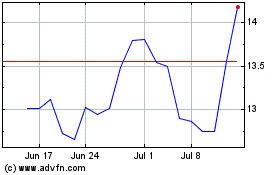

|

|

|

|

| |

|

|

|

|

|

Year 1

|

|

$ |

381 |

|

|

Year 2

|

|

|

1,480 |

|

|

Year 3

|

|

|

1,445 |

|

|

Year 4

|

|

|

1,401 |

|

|

Year 5

|

|

|

1,314 |

|

|

Thereafter

|

|

|

5,331 |

|

|

Total future minimum lease payments

|

|

|

11,352 |

|

|

Less imputed interest

|

|

|

(2,152 |

) |

|

Total

|

|

$ |

9,200 |

|

| |

|

|

|

|

| Reported as of September 30, 2023 |

|

|

|

|

|

Current operating lease liabilities

|

|

|

1,037 |

|

|

Long-term operating lease liabilities

|

|

|

8,163 |

|

|

Total

|

|

$ |

9,200 |

|

Note L – Commitments and Contingencies

The Company is involved in litigation arising in the normal course of business. The Company does not believe that the disposition or ultimate resolution of existing claims or lawsuits will have a material adverse effect on the business or financial condition of the Company.

Note M – Debt

On January 21, 2022, the Company entered into an Amended and Restated Credit Agreement (“Restated Credit Agreement”) with its issuing bank, JP Morgan Chase Bank, N.A. (“Chase”), and the other lenders identified in the Restated Credit Agreement (collectively, the “Lender”). Under the terms of the Restated Credit Agreement, Old National Bank has been added as a Lender. The Lenders made available to the Company a senior revolving credit facility with increased maximum availability of $65.0 million (the “Revolving Facility”), up from $50.0 million, plus an accordion feature that would allow borrowings up to $90.0 million under the Revolving Facility subject to certain terms and conditions. The maturity date of the revolving credit facility was extended to January 21, 2027. The Company may prepay the Revolving Facility, in whole or in part, and reborrow prior to the revolving loan maturity date. The Restated Credit Agreement further extended the maturity date for the term loan facility to January 21, 2027.

On July 18, 2022, the Company entered into the First Amendment to the Restated Credit Agreement. Under the terms of the First Amendment, the Lender increased the maximum availability under the senior revolving credit facility from $65.0 million to $75.0 million pursuant to the accordion feature in the Restated Credit Agreement. The First Amendment also adjusted the funded debt to EBITDA ratio financial covenant to 3:00 to 1:00 as of the end of the Company’s third and fourth fiscal quarters of 2022.

On October 26, 2022, the Company entered into the Second Amendment ("Second Amendment”) to the Restated Credit Agreement. Under the terms of the Second Amendment, the Lender increased the maximum availability under the senior revolving credit facility from $75.0 million to $90.0 million pursuant to the accordion feature in the Restated Credit Agreement. The Second Amendment adjusted the funded debt to EBITDA ratio financial covenant to 3:25 to 1:00 as of the end of the Company’s third and fourth fiscal quarters of 2022 and 3:00 to 1:00 as of the end of the Company’s first fiscal quarter of 2023. The Second Amendment also modified the EBITDA definition to permit add-backs of a) up to $2.0 million for disposition related expenses; and b) up to $2.0 million for unusual or non-recurring expenses which are incurred prior to the end of fiscal year 2023 and which are subject to the approval of the Administrative Agent.

On May 8, 2023, the Company entered into the Third Amendment (the “Third Amendment”) to the Restated Credit Agreement. The Third Amendment adjusted the funded debt to EBITDA ratio financial covenant to 4:25 to 1:00 as of the end of the Company’s second fiscal quarter of 2023, 3:00 to 1:00 as of the end of the Company’s third fiscal quarter of 2023, and 2:75 to 1:00 as of the end of the Company’s fourth fiscal quarter of 2023 and thereafter. The Third Amendment adjusted the fixed charge coverage ratio covenant to 1:10 to 1:00 commencing as of the Company’s fourth fiscal quarter of 2023 and 1:25 to 1:00 as of the end of the Company’s first fiscal quarter of 2024 and thereafter. For the Company’s second and third fiscal quarters in 2023, the Third Amendment suspended the fixed charge coverage ratio covenant and added a minimum EBITDA covenant of $22.5 million as of the end of each such fiscal quarter. Under the terms of the Third Amendment, the Company and the Lender also agreed to decrease the maximum availability under the senior revolving credit facility from $90.0 million to $75.0 million, upon the consummation of the sale of the Company’s Mexican subsidiary and the dissolution of Escalade Insurance, Inc. The proceeds from such sale and dissolution, respectively, will be used to partially prepay the amounts outstanding under the revolving credit facility. As reflected in the Fourth Amendment to the Restated Credit Agreement effective September 1, 2023, the maximum availability of the senior revolving credit facility was reduced to $85.0 million following the dissolution of Escalade Insurance, Inc.

As of September 30, 2023, the outstanding principal amount of the term loan was $34.5 million and total amount drawn under the Revolving Facility was $37.5 million.

Item 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Forward-Looking Statements

This report contains forward-looking statements relating to present or future trends or factors that are subject to risks and uncertainties. These risks include, but are not limited to: specific and overall impacts and residual effects of the COVID-19 global pandemic on Escalade’s financial condition and results of operations; the impact of competitive products and pricing; product demand and market acceptance; new product development; Escalade’s ability to achieve its business objectives; Escalade’s ability to successfully achieve the anticipated results of strategic transactions, including the integration of the operations of acquired assets and businesses and of divestitures or discontinuances of certain operations, assets, brands, and products; the continuation and development of key customer, supplier, licensing and other business relationships; Escalade’s ability to develop and implement our own direct to consumer e-commerce distribution channel; Escalade’s ability to successfully negotiate the shifting retail environment and changes in consumer buying habits; the financial health of our customers; disruptions or delays in our business operations, including without limitation disruptions or delays in our supply chain, arising from political unrest, war, labor strikes, natural disasters, public health crises such as the coronavirus pandemic, and other events and circumstances beyond our control; Escalade’s ability to control costs; Escalade’s ability to successfully implement actions to lessen the potential impacts of tariffs and other trade restrictions applicable to our products and raw materials, including impacts on the costs of producing our goods, importing products and materials into our markets for sale, and on the pricing of our products; general economic conditions, including inflationary pressures; fluctuation in operating results; changes in foreign currency exchange rates; changes in the securities markets; continued listing of the Company’s common stock on the NASDAQ Global Market; the Company’s inclusion or exclusion from certain market indices; Escalade’s ability to obtain financing and to maintain compliance with the terms of such financing; the availability, integration and effective operation of information systems and other technology, and the potential interruption of such systems or technology; the potential impact of actual or perceived defects in, or safety of, our products, including any impact of product recalls or legal or regulatory claims, proceedings or investigations involving our products; risks related to data security of privacy breaches; the potential impact of regulatory claims, proceedings or investigations involving our products; and other risks detailed from time to time in Escalade’s filings with the Securities and Exchange Commission. Escalade’s future financial performance could differ materially from the expectations of management contained herein. Escalade undertakes no obligation to release revisions to these forward-looking statements after the date of this report.

Overview

Escalade, Incorporated (Escalade, the Company, we, us or our) is focused on growing its Sporting Goods business through organic growth of existing categories, strategic acquisitions, and new product development. The Sporting Goods business competes in a variety of categories including basketball goals, archery, billiards, indoor and outdoor game recreation and fitness products. Strong brands and on-going investment in product development provide a solid foundation for building customer loyalty and continued growth.

Within the sporting goods industry, the Company has successfully built a robust market presence in several niche markets. This strategy is heavily dependent on expanding our customer base, barriers to entry, strong brands, excellent customer service and a commitment to innovation. A key strategic advantage is the Company’s established relationships with major customers that allow the Company to bring new products to market in a cost effective manner while maintaining a diversified portfolio of products to meet the demands of consumers. In addition to strategic customer relations, the Company has substantial manufacturing and import experience that enable it to be a low cost supplier.

To enhance growth opportunities, the Company has focused on promoting new product innovation and development and brand marketing. In addition, the Company has embarked on a strategy of acquiring companies or product lines that complement or expand the Company's existing product lines or provide expansion into new or emerging categories in sporting goods. A key objective is the acquisition of product lines with barriers to entry that the Company can take to market through its established distribution channels or through new market channels. Significant synergies are achieved through assimilation of acquired product lines into the existing Company structure.

In January 2022, the Company acquired the assets of the Brunswick Billiards® business, complementing its existing portfolio of billiards brands and other offerings in the Company’s indoor recreation market. These and other acquisitions strengthen the Company’s leadership in various product categories, while providing exciting new opportunities within the growing water sports market. The Company also sometimes divests or discontinues certain operations, assets, and products that do not perform to the Company's expectations or no longer fit with the Company's strategic objectives.

Management believes that key indicators in measuring the success of these strategies are revenue growth, earnings growth, new product introductions, and the expansion of channels of distribution.

Notwithstanding that the World Health Organization has declared that COVID-19 no longer constitutes a public health emergency, the impact of the COVID-19 pandemic continues to evolve and the Company continues to respond to the challenges and opportunities arising from the residual effects of the pandemic. Even though the pandemic may not have had a material adverse direct effect on the Company, the pandemic’s effects on the global supply chain, higher freight and materials costs, supplier product delays, workforce availability and labor costs have caused operational challenges for the Company. The ultimate extent of the effects of the COVID-19 pandemic on the Company is highly uncertain and will depend on future developments, and such effects could exist for an extended period of time. Consumer demand for the Company’s products may be slowing due to additional factors such as general economic conditions, inflation, recessionary fears, rising interest rates, changes in the housing market and declining consumer confidence. Management cannot predict the full impact of these factors on the Company. Due to the above circumstances and as described generally in this Form 10-Q, the Company’s results of operations for the period ended September 30, 2023 are not necessarily indicative of the results to be expected for fiscal year 2023.

Results of Operations

The following schedule sets forth certain consolidated statement of operations data as a percentage of net revenue:

| |

|

Third Quarter Ended

|

|

|

Three Quarters Ended

|

|

| |

|

September 30,

2023

|

|

|

October 1,

2022

|

|

|

September 30,

2023

|

|

|

October 1,

2022

|

|

|

Net revenue

|

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

100.0 |