UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of: September 2023

Commission file number: 001-36578

ENLIVEX THERAPEUTICS LTD.

(Translation of registrant’s name into English)

14 Einstein Street, Nes Ziona, Israel 7403618

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

Annual General Meeting of

Shareholders

On

September 13, 2023, Enlivex Therapeutics Ltd., a company organized under the laws of the State of Israel (the

“Company”), announced that it will hold its 2023 Annual General Meeting of

Shareholders of the Company (the “Annual Meeting”) on Thursday, October 26, 2023,

beginning at 7:00 p.m. Israel time, at the offices of the Company located at 14

Einstein Street, Nes Ziona, Israel 7403618. Copies of the proxy statement and the related proxy

card are attached to this Report on Form 6-K as Exhibit 99.1 and Exhibit 99.2, respectively, and

incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Enlivex Therapeutics Ltd. |

| |

(Registrant) |

| |

|

| |

By: |

/s/ Oren Hershkovitz |

| |

Name: |

Oren Hershkovitz |

| |

Title: |

Chief Executive Officer |

Date: September 13, 2023

2

Exhibit

99.1

ENLIVEX THERAPEUTICS LTD.

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

To be held on October 26, 2023

Dear Shareholder:

We cordially invite you to attend

the Annual General Meeting of Shareholders (the “Meeting”) of Enlivex Therapeutics Ltd. (the “Company”),

to be held on Thursday, October 26, 2023, at 7:00 p.m. (Israel time), at the offices of the Company at 14 Einstein Street, Ness Ziona,

Israel 7403618, for the following purposes:

| 1. | To elect the following persons to the Company’s Board

of Directors, each to serve until the Company’s next annual general meeting of shareholders and until their respective successors

are duly elected and qualified: Shai Novik, Dr. Roger Pomerantz, Dr. Abraham Havron, Dr. Gili Hart, Dr. Brian Schwartz and

Andrew Singer; |

| 2. | To approve the grant of an equity award to each of the Company’s

non-executive directors standing for election at the Meeting, subject to their election by the Company’s shareholders at the Meeting; |

| 3. | To approve the award of a one-time bonus for 2022, associated

with certain accomplished milestones, including obtaining regulatory approval to commence clinical trials with the frozen formulation

of Allocetra™ from agencies in multiple jurisdictions, to each of Mr. Shai Novik, the Company’s Executive Chairman, and Dr.

Oren Hershkovitz, the Company’s Chief Executive Officer, and the payment of such one-time bonuses as follows: (A) to Mr. Novik,

10% of the one-time bonus in cash and the remainder in restricted stock units (vesting over a period of four years); and (B) to Dr. Hershkovitz,

all of the one-time bonus, as well as a portion of his 2022 performance bonus, in restricted stock units (vesting over a period of four

years); |

| 4. | To approve an amendment to the Company’s Articles of

Association relating to the quorum required for a general meeting of shareholders of the Company; and |

| 5. | To approve the re-appointment of Yarel & Partners, Certified

Public Accountants, a member of BKR International, as the Company’s independent registered public accounting firm for the year

ending December 31, 2023 and until the next annual general meeting of shareholders, and to authorize the Company’s Board of Directors

(with power of delegation to its audit committee) to set the fees to be paid to such auditors in accordance with the volume and nature

of their services. |

In addition, the Company’s

shareholders will have the opportunity to hear from representatives of the Company’s management, who will be available at the Meeting

to review and discuss with shareholders the consolidated financial statements of the Company for the year ended December 31, 2022.

Our Board of Directors recommends

that you vote “FOR” each of the foregoing proposals, which are described in the attached proxy statement.

Shareholders of record at the

close of business on September 18, 2023 (the “Record Date”) are entitled to notice of and to vote at the Meeting and

any adjournments or postponements thereof. All shareholders are cordially invited to attend the Meeting in person, but only shareholders

as of the Record Date are entitled to vote at the Meeting. The proxy statement and the enclosed

proxy card will first be mailed to our shareholders of record on or about September 20, 2023.

On or about September 20, 2023, the Company will begin mailing to our beneficial owners who do not hold shares through a member

of the Tel Aviv Stock Exchange (“TASE”) a Notice of Internet Availability of Proxy Materials (the “Notice”)

and will post our proxy materials on the website referenced in the Notice.

Whether or not you plan to attend

the Meeting, you are urged to vote your shares: (1) by telephone, (2) through the Internet or (3), if you received printed copies of the

proxy materials, by promptly completing, dating and signing the enclosed proxy card and mailing it in the enclosed envelope, which requires

no postage if mailed in the United States, but if you are a beneficial owner holding shares through a member of the TASE you must vote

in accordance with the procedures of the TASE described below. For specific instructions on how

to vote your shares, please refer to the instructions on the Notice, in the section titled “How You Can Vote”

of the proxy statement, on the proxy card or those provided by your broker, bank, trustee or nominee, as applicable.

A mailed proxy must be received

by our transfer agent or at our registered office in Israel no later than 7:00 p.m. (Israel time) on October 23, 2023 to be validly included

in the tally of ordinary shares voted at the Meeting. Return of your proxy does not deprive you of your right to attend the Meeting, to

revoke your proxy or to vote your shares in person at the Meeting.

Beneficial owners who hold their

shares through members of the TASE may vote their shares (i) in person at the Meeting, by presenting a certificate signed by a member

of the TASE that complies with the Israel Companies Regulations (Proof of Ownership of Shares for Voting at General Meetings), 5760-2000

(an “Ownership Certificate”), confirming ownership of the shares on the Record Date. An Ownership Certificate may be

obtained at the TASE member’s offices or may be sent to the shareholder by mail (subject to payment of the cost of mailing), at

the election of the shareholder, provided that the shareholder’s request is submitted with respect to a specific securities account,

(ii) by proxy, by delivering a duly executed proxy card together with a valid Ownership Certificate as of the Record Date, to the Company

office’s at 14 Einstein Street, Ness Ziona, Israel 7403618, Attention: Chief Financial Officer, no

later than 7:00 p.m. (Israel time) on October 23, 2023, or (iii) electronically via the electronic voting system of the Israel

Securities Authority (the “ISA”), after receiving a personal identifying number, an access code and additional information

regarding the Meeting from the member of the TASE and after carrying out a secured identification process, up to six hours before the

time set for the Meeting (i.e., by no later than 1:00 p.m. Israel time, on October 26, 2023). You should receive instructions about electronic

voting from the TASE member through which you hold your shares.

Shareholders

may send the Company position statements no later than October 16, 2023, and the last

date for submitting a request to include a proposal in accordance with Section 66(b) of the Israeli Companies Law, 5759-1999 (the “Companies

Law”), is September 20, 2023.

The presence (in person, by proxy

or via the ISA’s electronic voting system) of any two or more shareholders holding, in the aggregate, at least one third of the

voting power of the Company’s ordinary shares constitutes a quorum for purposes of the Meeting. If such quorum is not present within

an hour from the time scheduled for the Meeting, the Meeting will be adjourned to the following week, to the same day, time, and place,

without it being necessary to notify our shareholders. At such an adjourned meeting, the presence of any two shareholders (in person or

by proxy or via the ISA’s electronic voting system) (regardless of the voting power represented by their ordinary shares) will constitute

a quorum.

The approval of each of the proposals

requires the affirmative vote of a majority of the ordinary shares present, in person, by proxy or via the ISA’s electronic voting

system, and voting on such proposal (excluding abstentions). In addition, the approval of Proposal 3B is also subject to the fulfillment

of one of the following additional voting requirements: (i) a majority of the shares held by shareholders who are not controlling shareholders

(within the meaning of the Companies Law) and shareholders who do not have a personal interest (within the meaning of the Companies Law)

in the proposal, present in person, by proxy or via the ISA’s electronic voting system and voting on the matter at the Meeting (excluding

abstentions), vote in favor of the proposal, or (ii) the total number of shares voted against the proposal by shareholders who are not

controlling shareholders and shareholders who do not have a personal interest in the proposal does not exceed two-percent (2%) of our

outstanding voting rights.

Shareholders may review the full

version of the proposed resolutions in the accompanying proxy statement as well as the accompanying proxy card, at www.Proxyvote.com

as described in the Notice, via the website of the U.S. Securities and Exchange Commission at www.sec.gov or via the ISA’s

electronic filing system at http://www.magna.isa.gov.il or the website of the TASE at http://maya.tase.co.il and at the

“Investor Relations” portion of our website, which can be found at www.enlivex.com,

and also at the Company’s offices, upon prior notice and during regular working hours (14 Einstein Street, Ness Ziona, Israel 7403618;

Tel: +972-8-6380301 (phone)), until the date of the Meeting.

| |

By Order of the Board of Directors, |

| |

|

| |

|

| |

Shai Novik

Executive Chairman of the Board of Directors |

September 13, 2023

ENLIVEX THERAPEUTICS LTD.

14 Einstein Street,

Ness Ziona 7403618

Israel

PROXY STATEMENT

ANNUAL GENERAL MEETING OF SHAREHOLDERS

To be held on October 26, 2023

This

proxy statement is being furnished in connection with the solicitation of proxies on behalf of the Board of Directors of Enlivex

Therapeutics Ltd. (“we,” “us,” “our” or the “Company”) to

be voted at an Annual General Meeting of Shareholders (the “Meeting”), or at any adjournment or postponement thereof,

pursuant to the accompanying Notice of Annual General Meeting of Shareholders. The Meeting will

be held on Thursday, October 26, 2023, at 7:00 p.m. (Israel time) at the offices of the Company at 14 Einstein Street, Ness Ziona,

Israel 7403618.

You are entitled to receive notice

of, and vote at, the Meeting if you were a shareholder of record at the close of business on September 18, 2023 (the “Record

Date”). Subject to the terms described herein, you are also entitled to vote at the Meeting if you held ordinary shares through

a bank, broker or other nominee that was a shareholder of record at the close of business on the Record Date or which appeared in the

participant listing of a securities depository on that date. See below “How You Can Vote.”

Purpose of the Annual General Meeting

At the Meeting, shareholders of

the Company will be asked to consider and vote upon the following: (1) the election of the following persons to the Company’s Board

of Directors, each to serve until the Company’s next annual general meeting of shareholders and until their respective successors

are duly elected and qualified: Shai Novik, Dr. Roger Pomerantz, Dr. Abraham Havron, Dr. Gili Hart, Dr. Brian Schwartz and Andrew Singer;

(2) the approval of the grant of an equity award to each of our non-executive directors standing for election at the Meeting, subject

to their election the Company’s shareholders at the Meeting; (3) the approval of the award of a one-time bonus for 2022, associated

with certain accomplished milestones, including obtaining regulatory approval to commence clinical trials with the frozen formulation

of Allocetra™ from agencies in multiple jurisdictions, to each of Mr. Shai Novik, the Company’s Executive Chairman, and Dr.

Oren Hershkovitz, the Company’s Chief Executive Officer, and the payment of such one-time bonuses as follows: (A) to Mr. Novik,

10% of the one-time bonus in cash and the remainder in restricted stock units (vesting over a period of four years); and (B) to Dr. Hershkovitz,

all of the one-time bonus, as well as a portion of his 2022 performance bonus, in restricted stock units (vesting over a period of four

years); (4) the amendment to the Company’s Articles of Association relating to the quorum required for a general meeting of shareholders

of the Company; and (5) the approval of the re-appointment of Yarel & Partners, Certified Public Accountants, a member of BKR International,

as the Company’s independent registered public accounting firm for the year ending December 31, 2023 and until the next annual general

meeting of shareholders, and to authorize the Company’s Board of Directors (with power of delegation to its audit committee) to

set the fees to be paid to such auditors in accordance with the volume and nature of their services. In addition, the Company’s

shareholders will have the opportunity to hear from representatives of the Company’s management, who will be available at the Meeting

to review and discuss with shareholders the consolidated financial statements of the Company for the year ended December 31, 2022.

Board Recommendation

Our Board of

Directors unanimously recommends that you vote “FOR” each of the above proposals.

We are not aware of any other

matters that will come before the Meeting. If any other matters properly come before the Meeting, the persons designated as proxies intend

to vote on such matters in accordance with their judgment and recommendation of the Board of Directors.

Quorum and Adjournment

The presence (in person, by proxy

or via the electronic voting system of the Israel Securities Authority (“ISA”)) of any two or more shareholders holding,

in the aggregate, at least one third of the voting power of the Company’s ordinary shares constitutes a quorum for purposes of the

Meeting. If such quorum is not present within an hour from the time scheduled for the Meeting, the Meeting will be adjourned to the following

week, to the same day, time and place, without it being necessary to notify our shareholders. At such an adjourned meeting, the presence

of any two shareholders (in person, by proxy or via the ISA’s electronic voting system) (regardless of the voting power represented

by their ordinary shares) will constitute a quorum.

Abstentions and broker non-votes

will be counted towards the quorum, but they will not have an effect on the outcome of any proposal. Broker non-votes occur for a particular

proposal when brokers that hold their customers’ shares in street name sign and submit proxies for such shares (in which case they

are considered present for purposes of determining the presence of a quorum at the Meeting) but do not have the discretionary authority

to vote on such particular proposal. Brokers that have not received voting instructions from their customers may vote such shares, as

the holders of record, on “routine” matters but not on “non-routine” matters. Other than Proposal 5, all proposals

described in this Proxy Statement are non-routine matters; therefore, it is important that you vote your shares, either by proxy or in

person at the Meeting.

Unsigned or unreturned proxies,

including those not returned by banks, brokers, or other record holders, will not be counted for quorum or voting purposes.

How You Can Vote

| ● | Shareholders

of Record and Beneficial Owners of Shares Traded on Nasdaq |

| o | Voting in person. If your shares are registered directly

in your name with our transfer agent (i.e., you are a “registered shareholder”), you may attend and vote in person at the

Meeting. If you are a beneficial owner of shares registered in the name of your broker, bank, trustee or nominee (i.e., your shares are

held in “street name”), you are also invited to attend the Meeting; however, to vote in person at the Meeting as a beneficial

owner, you must first obtain a “legal proxy” from your broker, bank, trustee or nominee, as the case may be, authorizing you

to do so. If you vote by telephone or Internet, there is no need to vote again at the Meeting unless you wish to revoke and change your

vote. |

| o | Voting by mailing your proxy. If you have received

printed copies of the proxy materials, you may submit your proxy by mail by completing, signing

and mailing the enclosed proxy card in the enclosed, postage-paid envelope, or, for shares held in street name, by following the voting

instructions provided by your broker, bank, trustee or nominee. The proxy must be received by our transfer agent or at our registered

office in Israel by no later than 7:00 p.m. Israel time, on October 23, 2023,

to be validly included in the tally of ordinary shares voted at the Meeting. Upon the receipt of a properly signed and dated proxy in

the form enclosed, the persons named as proxies therein will vote the ordinary shares represented thereby in accordance with the instructions

of the shareholder indicated thereon, or, if no direction is indicated, in accordance with the recommendations of our Board of Directors. |

| o | Voting by telephone or Internet. If your shares are

held in an account at a brokerage firm or bank or registered directly in your name with our transfer agent, you may vote those shares

by accessing the Internet website address specified in the Notice of Internet Availability of Proxy Materials,

the instructions provided by your broker, bank, trustee or nominee or on your proxy, instead

of completing and signing the proxy itself. If your shares are held in an account at a brokerage firm or bank, you may also call the telephone

number specified in the instructions provided by your broker, bank, trustee or nominee. Submitting a telephonic or Internet proxy will

not affect your right to vote at the Meeting should you decide to attend the Meeting. The telephone and Internet voting procedures are

designed to authenticate shareholders’ identities, to allow shareholders to give their voting instructions, and to confirm that

shareholders’ instructions have been recorded properly. The accompanying proxy card provides instructions on how to vote via telephone

and the Internet. |

| ● | Beneficial Owners

of Shares Traded on TASE. Shareholders who hold shares through members of the Tel Aviv Stock Exchange (the “TASE”)

may vote in person or vote through the enclosed form of proxy by completing, signing, dating and mailing the proxy with a copy of their

identity card, passport or certificate of incorporation, as the case may be, to the Company’s offices. Shareholders who hold shares

through members of the TASE and intend to vote their shares either in person or by proxy must deliver to the Company an ownership certificate

confirming their ownership of the Company’s shares on the Record Date (“Ownership Certificate”), which must

be certified by a recognized financial institution, as required by the Israeli Companies Regulations (Proof of Ownership of Shares for

Voting at General Meeting) of 2000, as amended. An Ownership Certificate may be obtained at the TASE member’s offices or

may be sent to the shareholder by mail (subject to payment of the cost of mailing), at the election of the shareholder, provided that

the shareholder’s request is submitted with respect to a specific securities account. Alternatively,

shareholders who hold shares through members of the TASE may vote electronically via the electronic voting system of the Israel Securities

Authority up to six hours before the time fixed for the Meeting (i.e., by no later than 1:00 p.m. Israel

time, on October 26, 2023). You should receive instructions about electronic voting from

the TASE member through which you hold your shares. |

A shareholder whose shares are registered

with a TASE member is entitled to receive from the TASE member that holds the shares on the shareholder’s behalf by e-mail (for

no charge) a link to the text of the voting slip and any position statements posted on the website of the ISA, unless the shareholder

notified such TASE member that he or she or it is not interested in receiving such link and position statements, provided that such notification

was provided by the shareholder with respect to a particular securities account prior to the Record Date.

Vote Required for Approval of the Proposals

Each outstanding ordinary share

held by a shareholder is entitled to one vote.

The approval of each of the proposals

requires the affirmative vote of a majority of the ordinary shares present, in person, by proxy or via the ISA’s electronic voting

system, and voting on such proposal (excluding abstentions).

In addition, the approval of Proposal

3B is also subject to the fulfillment of one of the following additional voting requirements (the “Special Majority”):

(i) a majority of the shares held by shareholders who are not controlling shareholders (within the meaning of the Israeli Companies Law,

1999 (the “Companies Law”)) and shareholders who do not have a personal interest (within the meaning of the Companies

Law) in the proposal, present in person, by proxy or via the ISA’s electronic voting system and voting on the matter at the Meeting

(excluding abstentions), voted in favor of the proposal, or (ii) the total number of shares voted against the proposal by shareholders

who are not controlling shareholders and shareholders who do not have a personal interest in the proposal does not exceed two-percent

(2%) of our outstanding voting rights.

We are unaware of any shareholder

that would be deemed to be a controlling shareholder of the Company as of the date of this proxy statement for purposes of Proposal 3B.

A shareholder who signs and returns a proxy card will be deemed to be confirming that such shareholder, and any related party of such

shareholder, is not a controlling shareholder for purposes of Proposal 3B. If you believe that you, or a related party of yours, may be

deemed to be a controlling shareholder and you wish to participate in the vote on Proposal 3B, you should contact our Chief Financial

Officer, Shachar Shlosberger, at shachar@enlivexpharm.com or +972-8-6380301.

The Companies Law requires

that each shareholder voting on Proposal 3B indicate on the proxy card, or, if voting in person at the Meeting, inform us prior to voting

on the matter at the Meeting, whether or not the shareholder has a personal interest in such proposal. Otherwise, the shareholder is not

eligible to vote on the proposal and such shareholder’s vote will not be counted for the purposes of the proposal. Under the

Companies Law, a “personal interest” of a shareholder in an act or transaction of a company (i) includes a personal interest

of (a) any spouse, sibling, parent, grandparent or descendant of the shareholder, any descendant, sibling or parent of a spouse of the

shareholder and the spouse of any of the foregoing; and (b) a company with respect to which the shareholder (or any of the foregoing relatives

of the shareholder) owns at least 5% of the outstanding shares or voting rights, serves as a director or chief executive officer or has

the right to appoint one or more directors or the chief executive officer; and (ii) excludes a personal interest arising solely from the

ownership of shares. Under the Companies Law, in the case of a person voting by proxy, “personal interest” includes the personal

interest of either the proxy holder or the shareholder granting the proxy, whether or not the proxy holder has discretion how to vote.

In tabulating the voting results

for any particular proposal, shares that constitute broker non-votes and abstentions are not considered votes cast on that proposal and

will have no effect on the vote. Unsigned or unreturned proxies, including those not returned by banks, brokers, or other record holders,

will not be counted for voting purposes. Therefore, it is important for a shareholder that holds ordinary shares through a bank or broker

to instruct its bank or broker how to vote its shares if the shareholder wants its shares to count towards the vote tally for a given

proposal.

Change or Revocation of Proxy

If you are a shareholder of record,

you may change your vote at any time prior to the exercise of authority granted in the proxy by delivering to us a written notice of revocation,

by granting a new proxy bearing a later date, or by attending the Meeting and voting in person. Attendance at the Meeting will not cause

your previously granted proxy to be revoked unless you specifically so request. You may also revoke

your proxy and change your vote at any time before the final vote at the Meeting by voting again via the Internet or by telephone, as

applicable.

If your shares are held in “street

name” through a broker, bank, trustee or other nominee, you may change your vote by submitting new voting instructions to your broker,

bank, trustee or nominee or, if you have obtained a legal proxy from your broker, bank, trustee or nominee giving you the right to vote

your shares, by attending the Meeting and voting in person.

If your shares are held via a

member of the TASE, you may change your vote (i) by attending the Meeting and voting in person,

by presenting a valid Ownership Certificate as of the Record Date; (ii) by delivering a later-dated duly executed proxy card, together

with a valid Ownership Certificate as of the Record Date, to the Company’s registered office not later than 7:00 p.m. Israel

time, on October 23, 2023, or (iii) by following the relevant instructions for changing your

vote via the ISA’s electronic voting system by no later than six hours before the time set for the Meeting.

Solicitation of Proxies

All expenses of this solicitation

will be borne by the Company. In addition to the solicitation of proxies by mail, directors, officers and employees of the Company, without

receiving additional compensation therefor, may solicit proxies by telephone, facsimile, in person or by other means. Brokerage firms,

nominees, fiduciaries and other custodians have been requested to forward proxy solicitation materials to the beneficial owners of shares

of the Company held of record by such persons, and the Company will reimburse such brokerage firms, nominees, fiduciaries and other custodians

for reasonable out-of-pocket expenses incurred by them in connection therewith.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

The following table sets forth

certain information as of August 30, 2023 (unless otherwise indicated below) regarding the beneficial ownership by: (i) each person known

to us to beneficially own more than 5% of our outstanding ordinary shares based on public filings

or information available to us; (ii) each of our current directors and director nominees; and (iii) all of our current directors

and executive officers as a group. The percentage of ordinary shares beneficially owned is based on 18,598,555 ordinary shares issued

and outstanding as of August 30, 2023.

Beneficial

ownership is determined in accordance with the rules of the U.S. Securities and Exchange Commission (“SEC”) and is

generally based on whether a person has voting or investment power with respect to the securities. Ordinary shares of the Company that

may be acquired by an individual or group within 60 days of August 30, 2023, pursuant to the exercise of the Company’s outstanding

options, warrants or other rights held by such individual or group that are exercisable or will

become exercisable within 60 days of August 30, 2023, are deemed outstanding for the purposes of computing the percentage of ordinary

shares beneficially owned by such individual or group, but are not deemed outstanding for purposes of computing the percentage of ordinary

shares beneficially owned by any other individual or group shown in the table.

| Beneficial Owner | |

Number of

Ordinary

Shares

Beneficially

Owned | | |

Percentage of

Ordinary

Shares

Beneficially

Owned | |

| The Company’s 5% or Greater Shareholders (other than Directors and Executive Officers) | |

| | |

| |

| KIP Global Pharma-Ecosystem Private Equity Fund | |

| 1,417,950 | | |

| 7.62 | % |

| | |

| | | |

| | |

| Directors and Director Nominees | |

| | | |

| | |

| Shai Novik (1) | |

| 1,566,703 | | |

| 8.07 | % |

| Roger Pomerantz, M.D. | |

| - | | |

| - | |

| Avri Havron, Ph.D. (2) | |

| 232,732 | | |

| 1.25 | % |

| Gili Hart, Ph.D. (3) | |

| 69,866 | | |

| * | |

| Sangwoo Lee (4) | |

| 56,568 | | |

| * | |

| Brian Schwartz, M.D. (5) | |

| 22,078 | | |

| * | |

| Andrew Singer | |

| - | | |

| - | |

| All directors and executive officers as a group (10 persons) | |

| 2,673,293 | | |

| 13.32 | % |

| * |

Less than 1% of our outstanding ordinary shares. |

| (1) |

Includes 812,939 shares underlying options currently exercisable or exercisable within 60 days from August 30, 2023, of which 132,979 options expire in January 2025 and have an exercise price of US$2.69, 145,238 options expire in December 2027 and have an exercise price of US$6.22, 250,000 options expire in May 2030 and have an exercise price of US$3.66, 222,222 options expire in May 2031 and have an exercise price of US$12.23 and 62,500 options expire in November 2032 and have an exercise price of US$5.34. |

| |

|

| (2) |

Includes 53,192 shares underlying options currently exercisable or exercisable within 60 days from August 30, 2023, which expire in January 2025 and have an exercise price of US$2.69. |

| |

|

| (3) |

Includes 66,490 shares underlying options currently exercisable or exercisable within 60 days from August 30, 2023, which expire in January 2025 and have an exercise price of US$2.69. |

| |

|

| (4) |

Includes 53,192 shares underlying options currently exercisable or exercisable within 60 days from August 30, 2023, which expire in December 2027 and have an exercise price of US$6.22. |

| |

|

| (5) |

Includes 20,250 shares underlying options currently exercisable or exercisable within 60 days from August 30, 2023, which expire in November 2030 and have an exercise price of US$9.02. |

Board Diversity Matrix

The table below provides certain

information with respect to the diversity of our Board of Directors as of the date hereof.

|

Country of Principal Executive Offices |

Israel |

| Foreign Private Issuer: |

Yes |

| Disclosure Prohibited Under Home Country Law |

No |

| Total Number of Directors |

7 |

| |

Female |

Male |

Non-Binary |

Did Not Disclose Gender |

| Part I: Gender Identity |

|

|

|

|

| Directors |

1 |

5 |

|

1 |

| Part II: Demographic Background |

| Underrepresented Individual in Home Country Jurisdiction |

0 |

| LGBTQ+ |

0 |

| Did Not Disclose Demographic Background |

2 |

Board Practices, Corporate Governance and Compensation

of Executive Officers and Directors

Item 6.B (“Compensation”)

of our Annual Report on Form 20-F for the year ended December 31, 2022, filed with the SEC on April 10, 2023 (which we refer to as our

“2022 Form 20-F”), contains information regarding compensation paid to our directors and officers with respect to 2022,

including information concerning the annual compensation earned by our five most highly compensated executive directors and officers during

2022. Item 6.C of our 2022 Form 20-F (“Board Practices”) contains additional information regarding our Board of Directors,

its committees and our corporate governance practices. We encourage you to review those portions of our 2022 Form 20-F.

PROPOSAL 1

ELECTION OF DIRECTORS

Background

Under our Articles of Association,

the number of directors on our Board of Directors shall be at least five but not more than 11. Our Board of Directors is currently composed

of seven directors and includes Mr. Shai Novik (Executive Chairman), Dr. Roger Pomerantz (Vice Chairman),

Dr. Abraham (Avri) Havron, Dr. Gili Hart, Mr. Sangwoo Lee, Dr. Brian Schwartz and Andrew Singer. All of our currently serving directors

were elected to serve in such capacity at our 2022 annual general meeting of shareholders, other than Andrew Singer who was appointed

to serve as a director by our Board of Directors in April 2023. Each of our directors generally holds office until the first annual general

meeting of shareholders following his or her appointment or election (unless the tenure of such director expires earlier, or a director

resigns or is removed from office pursuant to the Companies Law).

We rely on the exemption available

to foreign private issuers under the Nasdaq Listing Rules and follow Israeli law and practice with regard to the directors’ nomination

process, in accordance with which our Board of Directors (or a committee thereof) is authorized to recommend to our shareholders director

nominees for election by our shareholders.

At the Meeting, shareholders will

be asked to elect the following directors: Shai Novik (Executive Chairman), Dr. Roger Pomerantz

(Vice Chairman), Dr. Abraham (Avri) Havron, Dr. Gili Hart, Dr. Brian Schwartz and Andrew Singer. Mr. Sangwoo

Lee has elected not to stand for re-election to the Board of Directors at the Meeting. If elected at the Meeting, each of the director

nominees will serve until the next annual general meeting of our shareholders, and until his or

her successor has been duly elected and qualified, or until his or her office is vacated in accordance with our Articles of Association

or the Companies Law. Subject to shareholder approval of the election of the director nominees, our Board of Directors will consist

of six members, five of whom satisfy the independence requirements of the Nasdaq Listing Rules.

We believe that our Board of Directors

contains highly qualified and talented directors, including directors with global pharmaceutical and clinical, and financial experience.

In accordance with the Companies Law, each of the director nominees has certified to us that he or she meets all the requirements of the

Companies Law for election as a director of a public company and that he or she possesses the necessary qualifications and is able to

dedicate sufficient time to fulfill his or her duties as a director of our Company, taking into consideration our Company’s size

and special needs.

The following biographical information

is provided with respect to each director nominee based upon our records and information provided to us by each nominee.

|

Director |

|

Age |

|

Principal Occupation |

| Shai Novik |

|

57 |

|

Shai Novik has served as the Company’s Executive Chairman of the Board of Directors since 2014. Mr. Novik previously founded PROLOR Biotech in 2005 and served as its President until 2013. PROLOR Biotech was listed on the NYSE in 2010 and was sold in 2013, in a $560 million transaction. Mr. Novik executed a strategic partnership with Pfizer for PROLOR’s lead drug product, Ngenla®, and Pfizer continued with the clinical development of two-Phase III trials. Ngenla® recently obtained marketing approvals in 18 countries, including Australia, Canada, Japan, Europe & USA. Mr. Novik is the co-founder and a board member of Cortex Therapeutics, which is focused on developing and commercializing prescription digital therapies for patients with age-related diseases including macular degeneration (AMD) and dementia. Mr. Novik received his M.B.A. degree, with distinction, from Cornell University. |

| |

|

|

|

|

| Roger Pomerantz, M.D. |

|

66 |

|

Roger Pomerantz, M.D. has served as a director and Vice Chairman of the Board of Directors since May 2022.Dr. Pomerantz has served as Chairman of the board of directors and Chief Executive Officer of ContraFect Corporation (Nasdaq: CFRX), a clinical-stage biotechnology company, since April 2019. Prior to that, Dr. Pomerantz served as Vice Chairman of the board of directors of ContraFect Corporation since May 2014. From November 2013 to December 2019, Dr. Pomerantz served as Chairman of the board of directors of Seres Therapeutics, Inc., a biotechnology company, and as its President and Chief Executive Officer from June 2014 to January 2019.From 2011 to 2013, Dr. Pomerantz was formerly Worldwide Head of Licensing & Acquisitions, Senior Vice President at Merck & Co., Inc. where he oversaw all licensing and acquisitions at Merck Research Laboratories. Previously, Dr. Pomerantz served as Senior Vice President and Global Franchise Head of Infectious Diseases at Merck.Prior to joining Merck, Dr. Pomerantz was Global Head of Infectious Diseases for Johnson & Johnson Pharmaceuticals. Dr. Pomerantz joined Johnson & Johnson in 2005 as President of Tibotec Pharmaceuticals, Inc.Dr. Pomerantz serves as Chairman of the board of directors of the public companies Collplant Biotechnologies, Inc. since 2021, Indaptus Therapeutics since 2021 and Viracta Therapeutics since 2020. Dr. Pomerantz also serves as Chairman of the board of directors of the private company Silicon Therapeutics Inc. since 2019, and a member of the board of the private companies X-VAX Technology, Inc. since 2019 and VerImmune since 2020. Previously, Dr. Pomerantz served on the board of directors of public companies Rubius Therapeutics from 2014 to 2019 and Evelo Therapeutics from 2015 to 2016.Dr. Pomerantz received his B.A. in Biochemistry at the Johns Hopkins University and his M.D. at the Johns Hopkins School of Medicine. Dr. Pomerantz received post-graduate training at the Massachusetts General Hospital, Harvard Medical School and M.I.T.Dr. Pomerantz is Board Certified in both Internal Medicine and Infectious Diseases. Dr. Pomerantz was Professor of Medicine, Biochemistry and Molecular Pharmacology, Chief of Infectious Diseases, and the Founding Director and Chair of the Institute for Human Virology and Biodefense at Thomas Jefferson University and Medical School.Dr. Pomerantz has developed nine drugs approved world-wide in important diseases, including HIV, HCV, and tuberculosis. |

|

Director |

|

Age |

|

Principal Occupation |

| Abraham (Avri) Havron, Ph.D. |

|

75 |

|

Abraham (Avri) Havron, Ph.D., has served as a director since 2014. Dr. Havron served as the Chief Executive Officer of PROLOR Biotech, Inc. from 2005 through 2013. Dr. Havron is a 43-year veteran of the biotechnology industry and was a member of the founding team and Director of Research and Development of Interpharm Laboratories (then, a subsidiary of Serono, later acquired by Merck) from 1980 to 1987, and headed the development of the multiple sclerosis drug REBIF, with current sales of more than Euro 1.0 billion annually. Dr. Havron served as Vice-President Manufacturing and Process-Development of BioTechnology General Ltd., from 1987 to 1999; and Vice President and Chief Technology Officer of Clal Biotechnology Industries Ltd. from 1999 to 2003. Dr. Havron’s managerial responsibilities included the co-development of eight biopharmaceuticals currently in the market, including recombinant human growth hormone (BioTropin), recombinant Hepatitis B Vaccine (Bio-Hep-B), recombinant Beta Interferon (REBIF), recombinant human insulin, recombinant long-acting human growth hormone (Ngenla), a botanical burn debridement agent (Nexxobrid) and hyaluronic acid for ophthalmic and orthopedic applications. Dr. Havron earned his Ph.D. in Bio-Organic Chemistry from the Weizmann Institute of Science and served as a Research Fellow at Harvard Medical School, Department of Radiology. Dr. Havron served as a director of Kamada Ltd. (KMDA) from 2010 to 2018, and PamBio Ltd., a private biotech company, from 2016 to 2019. Dr. Havron also currently serves on the board of directors of CollPlant Biotechnologies Ltd. (CLGN), which position he has held since 2016. |

| |

|

|

|

|

| Gili Hart Ph.D. |

|

48 |

|

Gili Hart, Ph.D., has served as a director since 2014. Dr. Hart is a biotech executive and has served as the chief executive officer of SpilSense since 2020. Dr. Hart has extensive experience in preclinical, clinical and global regulatory strategic planning, partnering with large-pharma, and financing. In addition, Dr. Hart brings broad experience in managing critical global programs ranging from discovery phase through Phase 3 clinical trials.Previously, Dr. Hart served as the chief executive officer of Mitoconix Bio (2017-2019), the General Manager of OPKO Biologics (2014 - 2017) and as VP of Pre-clinical and Clinical Pharmacology at PROLOR Biotech (2007 -2013).During 2005-2007, Dr. Hart was a Research Fellow at Yale University’s School of Medicine.Dr. Hart holds Ph.D. and M.Sc. degrees, cum laude, from the Weizmann Institute of Science and a M.Sc. degree in Biotechnology Engineering, summa cum laude, from the Technion – Israel Institute of Technology. Dr. Hart has published numerous papers and patents; her scientific work is focused on autoimmunity diseases as well as on B and T cell maturation and migration that can directly affect inflammation and immune conditions. |

| |

|

|

|

|

| Brian Schwartz, M.D. |

|

61 |

|

Brian Schwartz, M.D., has served as a director since

December 2020. Dr. Schwartz has wide-ranging experience as a drug development expert in pharmaceutical and biotechnology industries, spanning

several therapeutic areas including oncology, hematology, dermatology, neurology and rare diseases. During the past decade Dr. Schwartz

has served as Senior Vice President, Head of Research & Development and Chief Medical Officer of ArQule Inc., which was acquired for

US$2.7 billion by Merck & Co. in 2020. Prior to ArQule, Dr. Schwartz was CMO at ZIOPHARM Oncology

Inc. (Nasdaq: ZIO), and previously held several senior leadership roles at Bayer AG and LEO Pharma. The majority of Dr. Schwartz’s

achievements have been in oncology, encompassing the development of targeted, cytotoxic agents and immunotherapy. Dr. Schwartz has been

involved with a number of drug approvals, including sorafenib at Bayer, which has been used as a foundation for a number of initiatives

in U.S. based cancer/rare disease focused biotechnology companies. At ArQule and Ziopharm, Dr. Schwartz was a key member of the management

team and managed diverse interdisciplinary teams to prepare multiple successful New Drug Applications (NDA), numerous Investigational

New Drug (IND) applications, preclinical and clinical drug development programs. Dr. Schwartz has acquired knowledge and experience of

medical affairs, cooperative oncology group, investors relations, partnering and capital raising. Dr. Schwartz is currently a Board Member

of Mereo Biopharma Group plc (Nasdaq: MREO), Cyclacel Pharmaceutical Inc (Nasdaq: CYCC) and Infinity Pharmaceuticals Inc. (Nasdaq: INFI).

In addition, Dr. Schwartz serves as an advisor, SAB member and independent consultant for numerous private biotech and investment companies.

Dr. Schwartz received his medical degree from the University of Pretoria, South Africa.

|

| |

|

|

|

|

| Andrew Singer |

|

52 |

|

Andrew Singer has served as a director since April 2023. Mr. Singer is currently a corporate strategy consultant to biotech companies through his firm, Fika Bio Consulting LLC. Prior to that, Mr. Singer was a Managing Director at Credit Suisse from 2019 to 2023, ultimately named Head of West Coast Biotechnology Investment Banking. Before joining Credit Suisse, Mr. Singer was a Managing Director in Biotechnology Investment Banking at Wells Fargo from 2017 to 2019. Prior to joining Wells Fargo, Mr. Singer was Executive Vice President and Chief Financial Officer of Epizyme Inc., an oncology drug discovery and development company, from 2015 to 2017.At Epizyme, Mr. Singer’s responsibilities included finance, business development, alliance management and corporate communications.From 2004 to 2015, Mr. Singer progressed from Vice President to Managing Director in the life sciences investment banking group of RBC Capital Markets.Mr. Singer is also a member of the Board of Directors of the J.F. Kapnek Trust. Mr. Singer holds a B.A. degree in East Asian studies from Yale University and M.B.A. degree from the Harvard Business School. |

We are not aware of any reason

why the nominees, if elected, would be unable or unwilling to serve as directors. Should any nominee(s) be unavailable for election, the

proxies will be voted for substitute nominee(s) designated by our Board of Directors.

As approved by our shareholders

at the 2021 annual general meeting of shareholders, if elected at the Meeting, the non-executive directors (namely, all directors other

than Mr. Novik) will be paid an annual fee of NIS 67,580 (approximately US$17,794) and per-meeting fee of NIS 2,490 (approximately US$656)

until June 30, 2024, which amounts will increase annually by 25% thereafter up to the maximum fixed amount payable from time to time by

us under the Companies Regulations (Rules Regarding Compensation and Expense Reimbursement of External Directors), 2000. For details regarding

Mr. Novik’s compensation, see our 2022 Form 20-F. In addition, if elected at the Meeting, the director nominees shall continue to

benefit from the indemnification and exculpation agreement previously entered into with each of them, as well as from directors’

and officers’ liability insurance as we shall procure from time to time. In addition, at the Meeting, shareholders are being asked

to approve the grant of equity awards to each of our non-executive directors standing for election at the Meeting, subject to their election

at the Meeting (see Proposal 2).

Proposal

Our shareholders are being asked

to elect each of the director nominees named above to serve until our next annual general meeting of our shareholders and until his or

her respective successor has been duly elected and qualified, or until his or her office is vacated in accordance with our Articles of

Association or the Companies Law. Each director nominee shall be voted on separately.

Approval Required

See “Vote Required for Approval

of the Proposals” above.

Board Recommendation

Our Board of Directors recommends

a vote “FOR” the election of each of the director nominees named above.

PROPOSAL 2

APPROVAL OF EQUITY AWARD TO NON-EXECUTIVE DIRECTORS

Background

Under the Companies Law, the

payment of compensation, including equity-based compensation, to a director that is consistent with a company’s compensation policy

must be approved by the compensation committee, board of directors and shareholders, in that order.

Our Compensation Committee and

Board of Directors approved, subject to shareholder approval, the award to each of our non-executive directors (other than Andrew Singer

who was appointed to serve as a director by our Board of Directors in April 2023) of an equity bonus for 2022, in the form of 2,480 RSUs

to Dr. Pomerantz, the Vice Chairman of the Board of Directors, and 922 RSUs to all other non-executive directors.

In addition, in connection with

the appointment of Andrew Singer as a director by our Board of Directors in April 2023, our Compensation Committee and Board of Directors

approved, subject to shareholder approval, the award to Mr. Singer of options to purchase 53,192 ordinary shares at an exercise price

of US$3.53 per share (which is equal to the higher of (i) the closing price of the Company’s ordinary shares on the Nasdaq Stock

Market on the trading day prior to the date of the approval of the option grant by our Board of Directors and (ii) the average closing

price for the 30 trading days prior to the date of the approval of the option grant by our Board of Directors). Any outstanding unexercised

options shall expire 10 years following the date of grant.

The proposed RSUs and option

awards (together, the “Equity Awards”) will vest over a period of four years, such that 25% of the applicable Equity

Award shall vest on each of the four anniversaries of the date of grant, subject to the respective director’s continued service

in such capacity on each applicable vesting date. The vesting of any outstanding Equity Award shall fully accelerate upon a Transaction,

as defined in the Company’s Global Share Incentive Plan (2019) (the “2019 Plan”). If approved at the Meeting,

the Equity Awards will be granted under and shall be subject to the 2019 Plan and the applicable award agreements to be entered into with

each of them. The Equity Awards to Israeli resident directors (namely, Dr. Abraham (Avri) Havron

and Dr. Gili Hart), are intended to be granted pursuant to the capital gains track of Section 102 of the Israeli Income Tax Ordinance

[New Version] 5721-1961.

Each of our Compensation Committee

and Board of Directors noted that the proposed grant of the Equity Awards to our non-executive directors and their terms is consistent

with our Company’s Amended and Restated Compensation Policy for Company Officer Holders, as currently in effect (the “Compensation

Policy”).

In considering the grant of

the Equity Awards, the Compensation Committee and Board of Directors considered our compensation philosophies and the provisions of our

Compensation Policy, as well as internal consistency and market trends. Our compensation philosophy encourages the grant of equity-based

compensation to our officers and directors in order to further align their compensation with the long-term interests of our shareholders.

Proposed Resolution

It is proposed that the following

resolution be adopted at the Meeting:

“RESOLVED, to approve the grant

of an equity-based award to each of the non-executive directors of the Company standing for election at the Meeting, subject to their

election by the Company’s shareholders at the Meeting, in such form and amounts and with such terms and conditions as described

in Proposal 2 of the Company’s Proxy Statement for the Meeting.”

Approvals Required

See “Vote Required for

Approval of the Proposals” above.

Board Recommendation

Our Board of Directors recommends

that you vote “FOR” the approval of the grant of equity-based awards to each of our non-executive directors standing for election

at the Meeting, subject to their election by the Company’s shareholders at the Meeting.

PROPOSAL 3

APPROVAL OF AWARD OF ONE-TIME BONUSES FOR 2022

AND PAYMENT OF BONUSES IN THE FORM OF CASH AND RSUS (INSTEAD OF CASH) TO OUR EXECUTIVE CHAIRMAN AND RSUS (INSTEAD OF CASH) TO OUR CHIEF

EXECUTIVE OFFICER

Background

In connection with the annual

assessment of the 2022 executive performance bonuses by our Compensation Committee and Board of Directors, our Compensation Committee

and Board of Directors determined that it would be appropriate to award one-time bonuses to certain of our executives, including Mr. Shai

Novik, our Executive Chairman, and Dr. Oren Hershkovitz, our Chief Executive Officer, in consideration of their significant efforts and

achievements in 2022, including, among other things, obtaining the U.S. Food & Drug Administration’s clearance of the Company’s

Investigational New Drug (IND) application to study the frozen-formulation of Allocetra™ in patients with advanced solid malignancies

in the United States, which represented a significant milestone for the Company, as well as obtaining regulatory approval to commence

clinical trials with the frozen formulation of Allocetra™ from agencies in other jurisdictions, including France, Belgium, Israel,

Spain and Greece. Accordingly, our Compensation Committee and Board of Directors approved, subject to shareholder approval, the award

of a one-time bonus for 2022 in the amount of US$245,000 to Mr. Novik and NIS 503,911 (US$132,678) to Dr. Hershkovitz. Each of our Compensation

Committee and Board of Directors noted that the award of the one-time bonuses to the executives is consistent with the Compensation Policy.

In addition, our Compensation

Committee and Board of Directors determined that: (i) 40% of the aggregate executive performance and (if applicable) one-time bonuses

for 2022 (together, the “2022 Executive Bonuses”) will be immediately paid to the executives in cash (the “2022

Cash Executive Bonus”) and 60% of the 2022 Executive Bonuses will be paid in cash or RSUs, to be determined by the Board of

Directors within 75 days prior to the Meeting, based on the Company’s cash balance and the market conditions at such time (except

that in the case of the Executive Chairman, due to Israeli law requirements relating to shareholder approval of director compensation,

the initial amount to be paid in cash to the Executive Chairman was limited to the amount of his 2022 performance bonus (which accounted

for approximately one-third of his total 2022 Executive Bonus), and the payment of the balance of his 2022 Cash Executive Bonus being

subject to shareholder approval at the Meeting); and (ii) if the Board of Directors shall resolve to pay 60% of the 2022 Executive Bonuses

in RSUs (the “2022 Non-Cash Executive Bonus”), such executives shall be awarded a number of RSUs at a value of 300%

of their respective 2022 Non-Cash Executive Bonus based on the then current share price, in which case the RSUs will be subject to the

Company’s standard vesting schedule. Each of our Compensation Committee and Board of Directors noted that the grant to the Company’s

executives of the 2022 Non-Cash Executive Bonus in the form of RSUs, in the amount proposed, and their terms are consistent with the Compensation

Policy. Accordingly, the eligible executives, including Mr. Novik and Dr. Hershkovitz, were immediately paid their respective 2022 Cash

Executive Bonus, except that Mr. Novik’s initial 2022 Cash Executive Bonus payment was limited to the amount of his 2022 performance

bonus, with the unpaid portion of his 2022 Cash Executive Bonus to be paid subject to shareholder approval at the Meeting.

Accordingly, on August 30, 2023,

our Board of Directors determined, based on the Company’s then current cash balance and the then current market conditions, that

it is in the Company’s best interest to pay the remaining 60% of the 2022 Executive Bonuses in RSUs (instead of cash) (or in the

case of the Executive Chairman, as his initial cash payment was limited to the amount of his 2022 performance bonus, which accounted for

approximately one-third of his 2022 Executive Bonus, subject to shareholder approval at the Meeting, the remaining two-thirds of his 2022

Executive Bonus, which accounts for his one-time bonus, to be allocated between cash and RSUs, such that in total 40% of his 2022 Executive

Bonus shall be paid in cash and the remainder in RSUs), such that the respective executives shall be awarded a number of RSUs at a value

of 300% of their respective 2022 Non-Cash Executive Bonuses based on a price of $2.565 per share, which is equal to the average of the

Company’s closing share price on the Nasdaq Capital Market during the 30 trading days prior to the date of the approval by the Board

of Directors. According to the Company’s standard vesting schedule, the RSUs will vest over a period of four years, such that 25%

of the RSUs shall vest on each of the four anniversaries of the date of grant, subject to each such executive’s continued service

in such capacity on each applicable vesting date. The vesting of any outstanding RSUs shall fully accelerate upon a Transaction, as defined

in the 2019 Plan.

Under the Companies Law, the

payment of compensation, including equity-based compensation, to a director or a chief executive officer that is consistent with a company’s

compensation policy must be approved by the compensation committee, board of directors and shareholders, by an ordinary majority in the

case of a director and by the Special Majority in the case of the chief executive officer (see above “Vote Required for Approval

of the Proposals”), in that order.

Accordingly, shareholders are

being asked to approve the award of one-time bonuses to each of Mr. Shai Novik, our Executive Chairman, and Dr. Oren Hershkovitz, our

Chief Executive Officer, in the amounts detailed above, and the payment of 60% of their 2022 Executive Bonuses in RSUs (instead of cash)

calculated as described above, resulting in the following payments: (A) in the case of Mr. Novik, US$24,500 in cash and 257,895 RSUs;

and (B) in the case of Dr. Hershkovitz, 40,858 RSUs. If approved at the Meeting, the RSUs will be granted to Mr. Novik and Dr. Hershkovitz

under and shall be subject to the 2019 Plan and the applicable award agreements to be entered into with each of them, and shall be granted

pursuant to the capital gains track of Section 102 of the Israeli Income Tax Ordinance [New Version] 5721-1961.

Proposed Resolutions

It is proposed that the following

resolutions be adopted at the Meeting:

3A: “RESOLVED, to approve the award

to Mr. Shai Novik, the Company’s Executive Chairman, of a one-time bonus for 2022 and the payment to Mr. Novik of the one-time bonus

part in cash and part in the form of RSUs, in each case in such amounts and as described in Proposal 3 of the Company’s Proxy Statement

for the Meeting.”

3B: “RESOLVED, to approve the award

to Dr. Oren Hershkovitz, the Company’s Chief Executive Officer, of a one-time bonus for 2022 and the payment to Dr. Hershkovitz

of the one-time bonus and a portion of his 2022 performance bonus in the form of RSUs, in each case in such amounts and as described in

Proposal 3 of the Company’s Proxy Statement for the Meeting.”

Approvals Required

See “Vote Required for

Approval of the Proposals” above.

Board Recommendation

Our Board of Directors recommends

that you vote “FOR” the approval of the award to Mr. Novik and Dr. Hershkovitz of the one-time bonuses for 2022 and the payment

(i) to Mr. Novik, of the one-time bonus part in cash and part in RSUs and (ii) to Dr. Hershkovitz, of the one-time bonus as well as a

portion of his 2022 performance bonus in the form of RSUs.

PROPOSAL 4

AMENDMENT TO THE COMPANY’S ARTICLES OF ASSOCIATION

Background

Nasdaq Listing Rules require that

the quorum for purposes of any meeting of the holders of a listed company’s common voting stock, as specified in the company’s

bylaws, be no less than one third of the company’s outstanding common voting stock. However, under

those rules, as a “foreign private issuer” (as such term is defined in Rule 3b-4 under the U.S. Securities Exchange

Act of 1934, as amended (the “Exchange Act”)), we may elect to follow certain

corporate governance practices permitted under the Companies Law in lieu of compliance with corresponding corporate governance requirements

otherwise imposed by the Nasdaq Stock Market rules for U.S. domestic issuers.

Under

the Companies Law, the quorum for purposes of a general meeting of shareholders is the presence of at least two shareholders holding,

in the aggregate, at least 25% of the voting rights of the company. If a legal quorum is not present within half an hour from the time

scheduled for a general meeting of shareholders, the meeting shall be adjourned by one week, to the same day, the same hour, and the same

venue, or to a later date, if specified in the invitation or notice for the meeting. If a legal quorum is not present within half an hour

of the time scheduled for the adjourned meeting, the presence of any number of shareholders shall constitute a quorum.

In

line with the Nasdaq Listing Rules, Article 3.3 of our Articles of Association currently provides that the quorum required for

a general meeting of shareholders is the presence (including by proxy or through a voting deed) of at least two shareholders holding,

in the aggregate, at least one third of the voting rights of the Company. If a quorum is not present within an hour from the time scheduled

for the opening of a general meeting of shareholders, the meeting shall be adjourned by one week, to the same day, the same hour, and

the same venue, or to a later date, if specified in the invitation to the meeting or in the notification of the meeting. However, unlike

the Nasdaq Listing Rules, the quorum required at such an adjourned meeting is the presence of any two shareholders (including by proxy

or through a voting deed), regardless of the voting power represented by their ordinary shares.

Our Board of Directors determined

that it would be advisable and in the best interest of the Company and its shareholders to fully follow Israeli law and practice with

respect to quorum requirements, as described above, in lieu of the requirements under Nasdaq Listing Rules. Accordingly, our Board of

Directors approved, and recommended that the shareholders approve, an amendment to Article 3.3 of the Company’s Articles of Association

such that it will read as follows:

“3.3 Discussion at General

Meetings

3.3.1 The

discussion at the General Meeting shall be opened only if a legal quorum is present at the time the discussion begins. A legal quorum

is the presence of at least two shareholders holding at least twenty-five percent (25%) of the voting rights of the Company (including

presence by means of proxy or through a voting deed) within half an hour from the time specified for the opening of the meeting.

3.3.2 If,

at the end of half an hour from the time specified for the opening of the meeting, no legal quorum is present, the meeting shall be postponed

by one week, to the same day, the same hour, and the same venue, or to a later date, if specified in the invitation to the meeting or

in the notification of the meeting (the “Postponed Meeting”). Notification of a Postponed Meeting shall be made as stated

in Article 3.2.6, mutatis mutandis, provided that notification and invitation regarding a Postponed Meeting postponed for a period

of not more than 21 days shall be made not later than seventy-two hours prior to the Postponed Meeting.

3.3.3 The

legal quorum for commencing a Postponed Meeting shall be the presence of any two shareholders (including presence by means of proxy or

through a voting deed).”

Proposed Resolution

It is proposed that the following

resolution be adopted at the Meeting:

“RESOLVED, to approve an amendment

to the Company’s Articles of Association relating to the quorum required for a general meeting of shareholders of the Company, as

set forth in Proposal 4 of the Company’s Proxy Statement for the Meeting.”

Vote Required

See “Vote Required for Approval

of the Proposals” above.

Board Recommendation

Our Board of Directors recommends

that you vote “FOR” the approval of the amendment of the Articles of Association of the Company.

PROPOSAL 5

RE-APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTANTS

Background

Yarel & Partners, Certified

Public Accountants, a member of BKR International, has served as the Company’s auditors since 2013. Except for serving as the Company’s

auditor, there is no other affiliation between such firm and the Company.

At the Meeting, shareholders will

be asked to approve the re-appointment of Yarel & Partners as the Company’s independent registered public accountants for the

fiscal year ending December 31, 2023 and for such additional period until our next annual general meeting of shareholders, pursuant to

the recommendation of our Audit Committee and Board of Directors.

In accordance with the rules of

the SEC, Israeli law and our Articles of Association, our Audit Committee pre-approves and recommends to the Board of Directors, and our

Board of Directors approves the compensation of Yarel & Partners for audit and other services, in accordance with the volume and nature

of their services. For the year ended December 31, 2022, we paid Yarel & Partners $129,000 (plus VAT) for audit services and $21,000

(plus VAT) for tax services.

Proposed Resolution

It is proposed that the following

resolution be adopted at the Meeting:

“RESOLVED, to approve the re-appointment

of Yarel & Partners, Certified Public Accountants, a member of BKR International, as the Company’s independent registered public

accounting firm for the year ending December 31, 2023 and until the next annual general meeting of shareholders, and to authorize the

Company’s Board of Directors (with power of delegation to its audit committee) to set the fees to be paid to such auditors in accordance

with the volume and nature of their services.”

Vote Required

See “Vote Required for Approval

of the Proposals” above.

Board Recommendation

Our Board of Directors recommends

that you vote “FOR” the approval of the re-appointment of Yarel & Partners, Certified Public Accountants, a member of

BKR International, as our independent registered public accounting firm for the year ending December 31, 2023.

REVIEW OF THE COMPANY’S AUDITED

CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED DECEMBER 31, 2022

In addition to considering the

foregoing agenda items at the Meeting, we will also present our audited consolidated financial statements for the fiscal year ended December

31, 2022. The audited consolidated financial statements of the Company for the fiscal year ended December 31, 2022 were filed together

with our 2022 Form 20-F with the SEC and is available at the SEC’s website, www.sec.gov, the ISA’s website at www.magna.isa.gov.il

and the TASE’s website at http://maya.tase.co.il, as well as under the “Investor Relations” portion of our website

at www.enlivex.com. This item will not involve a vote by the shareholders. None of the audited financial statements, the 2022 Form

20-F nor the contents of our website form part of the proxy solicitation material.

OTHER BUSINESS

The Board of Directors is not

aware of any other business to be transacted at the Meeting other than those described in this proxy statement. If any other matters are

properly come before the Meeting, it is intended that the persons named as proxies in the enclosed form of proxy will vote upon such matters,

pursuant to their discretionary authority, in accordance with their best judgment in the interest of the Company.

ADDITIONAL

INFORMATION

We are subject to the information

reporting requirements of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), applicable to

foreign private issuers and we fulfill the obligations with respect to those requirements by filing reports with the SEC. Our SEC filings

are available to the public on the SEC’s website at www.sec.gov, the ISA’s website at www.magna.isa.gov.il,

the TASE’s website at http://maya.tase.co.il and under the “Investor Relations”

portion of our website at www.enlivex.com. The contents of our website do not form part of the proxy solicitation material.

As a foreign private issuer, we

are exempt from the rules under the Exchange Act related to the furnishing and content of proxy statements. The circulation of this proxy

statement and related notice should not be taken as an admission that we are subject to those proxy rules.

| |

By Order of the Board of Directors |

| |

|

| |

|

| |

Shai Novik

Executive Chairman of the Board of Directors |

| |

|

September 13, 2023

17

Exhibit

99.2

THIS

PROXY WHEN PROPERLY EXECUTED WILL BE VOTED AS DIRECTED HEREIN.

EXCEPT

AS MENTIONED OTHERWISE IN THE PROXY STATEMENT AND BELOW ON THIS PROXY, IF NO DIRECTION IS INDICATED, THIS PROXY WILL BE VOTED “FOR”

THE PROPOSALS HEREIN. |

| Please mark your vote as in this example ☒ |

|

PROPOSAL

NO. 1: To elect the following persons to the Board of Directors, each to serve until the next annual general meeting of shareholders

and until their respective successors are duly elected and qualified: Shai Novik, Roger Pomerantz, Abraham Havron, Gil Hart, Brian

Schwartz and Andrew Singer.

|

|

| NO.

1(a): Shai Novik |

FOR |

AGAINST |

ABSTAIN |

| ☐ |

☐ |

☐ |

| NO.

1(b): Roger Pomerantz |

FOR |

AGAINST |

ABSTAIN |

| ☐ |

☐ |

☐ |

| NO.

1(c): Abraham Havron |

FOR |

AGAINST |

ABSTAIN |

| ☐ |

☐ |

☐ |

| NO.

1(d): Gili Hart |

FOR |

AGAINST |

ABSTAIN |

| ☐ |

☐ |

☐ |

| NO.

1(e): Brian Schwartz |

FOR |

AGAINST |

ABSTAIN |

| ☐ |

☐ |

☐ |

| NO.

1(f): Andrew Singer |

FOR |

AGAINST |

ABSTAIN |

| ☐ |

☐ |

☐ |

| PROPOSAL

NO. 2: To approve the grant of an equity-based award to each of the Company’s non-executive directors standing

for election at the meeting, subject to their election at the meeting, in such form and amounts and with such terms and conditions

as described in Proposal 2 of the Company’s proxy statement for the meeting. |

FOR |

AGAINST |

ABSTAIN |

☐ |

☐ |

☐

|

| PROPOSAL

NO. 3A: To approve the award to Mr. Shai Novik, the Company’s Executive Chairman, of a one-time bonus for 2022

and the payment to Mr. Novik of the one-time bonus part in cash and part in the form of restricted share units, in each case in such

amounts and as described in Proposal 3 of the Company’s proxy statement for the meeting. |

FOR |

AGAINST |

ABSTAIN |

| ☐ |

☐ |

☐ |

| PROPOSAL

NO. 3B: To approve the award to Dr. Oren Hershkovitz, the Company’s Chief Executive Officer, of a one-time bonus

for 2022 and the payment to Dr. Hershkovitz of the one-time bonus and a portion of his 2022 performance bonus in the form of restricted

share units, in each case in such amounts and as described in Proposal 3 of the Company’s proxy statement for the meeting. |

FOR |

AGAINST |

ABSTAIN |

| ☐ |

☐ |

☐ |

Do

you have a “Personal Interest” (as defined IN THE PROXY STATEMENT AND below) with respect to the subject matter of Proposal

3B? (Please note: if you do not mark either “YES” or “NO” you will be deemed as having a Personal Interest with

respect to proposal 3B and your vote will not be counted for Purposes of proposal 3B). |

YES |

NO |

|

| ☐ |

☐ |

☐ |

| PROPOSAL

NO. 4: To approve an amendment to the Company’s Articles of Association relating to the quorum required for

a general meeting of shareholders of the Company, as set forth in Proposal 4 of the Company’s proxy statement for the meeting.

|

FOR

|

AGAINST

|

ABSTAIN

|

| ☐ |

☐ |

☐ |

| PROPOSAL

NO. 5: To approve the re-appointment of Yarel & Partners, Certified Public Accountants, a member of BKR International,

as the Company’s independent registered public accounting firm for the year ending December 31, 2023 and until the next annual

general meeting of shareholders, and to authorize the Company’s Board of Directors (with power of delegation to its audit committee)

to set the fees to be paid to such auditors in accordance with the volume and nature of their services. |

FOR

|

AGAINST

|

ABSTAIN

|

☐

|

☐

|

☐

|

The

undersigned hereby acknowledges receipt of the Notice of the Annual General Meeting, revokes any proxy or proxies heretofore given

to vote upon or act with respect to the undersigned’s shares and hereby ratifies and confirms all that the proxies, their substitutes,

or any of them, may lawfully do by virtue hereof.

|

| ____________________________ |

|

______________________________________ |

|

_______________________ |

| (NAME

OF SHAREHOLDER) |

|

(SIGNATURE

OF SHAREHOLDER) |

|

(DATE) |

Each

shareholder voting at the meeting or prior thereto by means of this accompanying proxy card is requested to notify us whether he, she

or it has a “Personal Interest” in Proposal No. 3B, as a condition for his, her or its vote to be counted with respect to

such proposal. Votes cast on Proposal No. 3B will not be counted unless “YES” or NO” has been specified as to whether

the shareholder has a “Personal Interest” with respect to such proposal.

Under the Israeli Companies Law, 1999, a “Personal Interest”

of a shareholder in an act or transaction of a company (i) includes a personal interest of (a) any spouse, sibling, parent, grandparent

or descendant of the shareholder, any descendant, sibling or parent of a spouse of the shareholder and the spouse of any of the foregoing;

and (b) a company with respect to which the shareholder (or any of the foregoing relatives of the shareholder) owns at least 5% of the

outstanding shares or voting rights, serves as a director or chief executive officer or has the right to appoint one or more directors

or the chief executive officer; and (ii) excludes a personal interest arising solely from the ownership of shares. In the case of a person

voting by proxy, “Personal Interest” includes the personal interest of either the proxy holder or the shareholder granting

the proxy, whether or not the proxy holder has discretion how to vote.

ENLIVEX THERAPEUTICS

LTD.

Annual General

Meeting of Shareholders to be held on October 26, 2023

THIS PROXY IS SOLICITED

ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned

shareholder of Enlivex Therapeutics Ltd. (the “Company”) hereby appoints Ms. Shachar Shlosberger, the true and lawful

attorney, agent and proxy of the undersigned, to vote, as designated below, all of the ordinary shares of the Company which the undersigned

is entitled in any capacity to vote at the Annual General Meeting of Shareholders of the Company, to be held at the corporate offices

of the Company at 14 Einstein Street, Ness Ziona 7403618, Israel on Thursday, October 26, 2023, at 7:00 p.m. (Israel time), and all adjournments

and postponements thereof.

(CONTINUED AND TO BE SIGNED ON REVERSE SIDE)

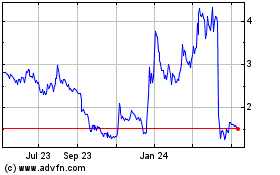

Enlivex Therapeutics (NASDAQ:ENLV)

Historical Stock Chart

From Dec 2024 to Jan 2025

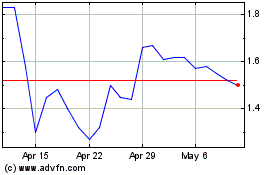

Enlivex Therapeutics (NASDAQ:ENLV)

Historical Stock Chart

From Jan 2024 to Jan 2025