Current Report Filing (8-k)

May 30 2019 - 5:05PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): May 21, 2019

ENERGY FOCUS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-36583

|

|

94-3021850

|

|

(State or Other Jurisdiction of Incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification Number)

|

|

|

|

|

|

|

|

32000 Aurora Road, Suite B

|

|

|

|

Solon, Ohio

|

|

44139

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(440) 715-1300

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240-13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

On May 29, 2019, Energy Focus, Inc. (the “Company”), amended and restated the subordinated convertible promissory notes (the “Notes,” and as amended and restated, the “A&R Notes”) that were issued on March 29, 2019, pursuant to the Note Purchase Agreement entered into by the Company, Fusion Park LLC, F&S Electronic Technology (HK) Co., Ltd., Brilliant Start Enterprises Inc., Vittorio Viarengo and Amaury Furmin (the “Investors”) on March 29, 2019, a copy of which was attached to the Company’s Form 8-K filed on April 1, 2019.

The A&R Notes delete in its entirety the provision granting the holders of the Notes most favored nations preferential treatment with respect to other indebtedness convertible into equity securities of the Company so long as the Notes are outstanding, and eliminate provisions relating to the conversion price and conversion timing that are no longer applicable as the conversion price has been set at $0.67 based on the formula originally set forth in the Notes. The A&R Notes will only convert into Series A Convertible Preferred Stock (the “Series A Preferred Stock”) if stockholder approval is received in accordance with applicable rules of the NASDAQ Stock Market. A copy of the form of A&R Note is attached hereto as Exhibit 10.1.

Item 3.01. Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On May 21, 2019, the Company received a notification from the Nasdaq Stock Market (“Nasdaq”) informing the Company that since it has not yet filed its Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2019 (the “Quarterly Report”), the Company is not in compliance with Nasdaq Listing Rule 5250(c)(1) (the “Listing Rule”). The Listing Rule requires listed companies to timely file all required periodic financial reports with the Securities and Exchange Commission (“SEC”). The Nasdaq notification letter specifies that the Company has 60 calendar days, or until July 22, 2019, to submit a plan to regain compliance with the Listing Rule. If Nasdaq accepts a plan from the Company, Nasdaq can grant an exception of up to 180 calendar days from the Quarterly Report’s due date, or until November 13, 2019, to regain compliance. The Company’s common stock will continue to trade on the Nasdaq Capital Market pending Nasdaq’s review of the Company’s plan to regain compliance.

Item 4.01. Changes in Registrant’s Certifying Accountant.

On May 24, 2019 (the “Engagement Date”), Energy Focus, Inc. (the “Company”) engaged GBQ Partners LLC, an independent member of the BDO Alliance USA, (the “New Auditor”) as its independent registered public accounting firm. The New Auditor’s main office is located at 230 West Street, Suite 700, Columbus, Ohio 43215. The decision to appoint the New Auditor was approved by the Company’s Audit Committee & Finance Committee of the Board of Directors.

During the two most recent fiscal years and through the Engagement Date, the Company has not consulted with the New Auditor regarding either:

|

|

|

|

•

|

application of accounting principles to any specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s financial statements, and neither a written report was provided to the Company nor oral advice was provided that the New Auditor concluded was an important factor considered by the Company in reaching a decision as to the accounting, auditing or financial reporting issue; or

|

|

|

|

|

•

|

any matter that was either the subject of a disagreement (as defined in Regulation S-K, Item 304(a)(1)(iv) and the related instructions) or reportable event (as defined in Regulation S-K, Item 304(a)(1)(v)).

|

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On May 30, 2019, the Company filed an Amendment (the “Amendment”) to the Certificate of Designation of the Series A Preferred Stock (the “Certificate of Designation”) filed with the Secretary of State of the state of Delaware on March 29, 2019. The Amendment limits the voting power of the holders of Series A Preferred Stock to the number of votes equal to 55.37% of the number of shares of common stock of the Company into which each share of Series A Preferred Stock is convertible into pursuant to the Certificate of Designation. A copy of the Amendment is attached hereto as Exhibit 3.1. The information set forth under Item 1.01 above is incorporated herein by reference.

|

|

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d)

Exhibits.

|

|

|

|

|

|

|

|

Exhibit

|

|

|

|

|

Number

|

Description

|

|

|

|

|

|

|

|

|

3.1

|

|

|

|

|

|

|

|

10.1

|

|

|

|

|

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Dated: May 30, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

ENERGY FOCUS, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ James Tu

|

|

|

Name:

|

James Tu

|

|

|

Title:

|

Chairman, Chief Executive Officer and President and interim Chief Financial Officer

|

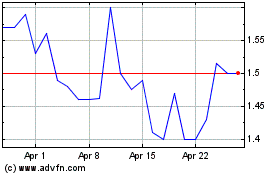

Energy Focus (NASDAQ:EFOI)

Historical Stock Chart

From Aug 2024 to Sep 2024

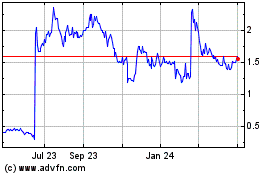

Energy Focus (NASDAQ:EFOI)

Historical Stock Chart

From Sep 2023 to Sep 2024