Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

May 29 2024 - 8:02AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed

by the Registrant x

Filed by a Party other than the Registrant ¨

Check

the appropriate box:

| ¨ |

Preliminary Proxy Statement |

| |

|

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ¨ |

Definitive Proxy Statement |

| |

|

| x |

Definitive Additional Materials |

| |

|

| ¨ |

Soliciting Material Pursuant to §240.14a-12 |

ENCORE

WIRE CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

| x |

No fee required. |

| |

|

| ¨ |

Fee paid previously with preliminary materials. |

| |

|

| ¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

As previously reported, on April 14, 2024, Encore Wire Corporation,

a Delaware corporation (“Encore” or the “Company”), entered into an Agreement and Plan of Merger

(the “Merger Agreement”) by and among the Company, Prysmian S.p.A., a company organized under the laws of the Republic

of Italy (“Parent”), Applause Merger Sub Inc., a Delaware corporation and a wholly owned subsidiary of Parent (“Merger

Sub”), and solely as provided in Section 9.12 therein, Prysmian Cables and Systems USA, LLC, a Delaware limited liability

company, pursuant to which Merger Sub will merge with and into the Company (the “Merger”), with the Company surviving

the Merger as a wholly owned subsidiary of Parent.

The respective obligations of each party to consummate the Merger are

subject to the fulfillment or waiver of certain customary mutual closing conditions, including the expiration or termination of the applicable

waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”). As previously

disclosed, each of Parent and Encore filed its respective notification and report form required to be filed pursuant to the HSR Act on

April 26, 2024. Effective as of 11:59 p.m. Eastern Time on May 28, 2024, the applicable waiting period under the HSR Act

expired.

Additional Information About the Merger and Where to Find It

This communication relates to the proposed merger (the “Merger”)

of Encore Wire Corporation (the “Company”), with a subsidiary of Prysmian S.p.A., a company organized under the laws

of the Republic of Italy (“Parent”). In connection with the Merger, the Company filed a definitive proxy statement

on Schedule 14A (the “Definitive Proxy Statement”) on May 22, 2024 with the U.S. Securities and Exchange Commission

(the “SEC”). On or about May 22, 2024, the Company commenced mailing the Definitive Proxy Statement and a proxy

card to each stockholder entitled to vote at the special meeting of stockholders relating to the Merger. The Definitive Proxy Statement

contains important information about the Merger and related matters. BEFORE MAKING A VOTING DECISION, STOCKHOLDERS OF THE COMPANY ARE

URGED TO READ THE DEFINITIVE PROXY STATEMENT AND ALL OTHER RELEVANT MATERIALS FILED OR TO BE FILED WITH THE SEC CAREFULLY AND IN THEIR

ENTIRETY WHEN THEY BECOME AVAILABLE, BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY AND THE MERGER. Stockholders

are able to obtain copies of the Definitive Proxy Statement and any other documents filed by the Company with the SEC (when they become

available) for no charge at the SEC’s website at www.sec.gov. In addition, stockholders are able to obtain free copies of the Definitive

Proxy Statement from the Company by going to the Company’s Investor Relations page on its corporate website at https://www.encorewire.com/investors/index.html.

Participants in the Solicitation

The

Company, its directors—Daniel L. Jones, Gina A Norris, William R. Thomas, W. Kelvin Walker, Scott D. Weaver, and John H. Wilson—and

Bret J. Eckert, the Company’s Executive Vice President and CFO, may be deemed to be participants in the solicitation of proxies

from the Company’s stockholders in respect of the Merger. As disclosed under “Security

Ownership of Certain Beneficial Owners and Management” in the Definitive Proxy Statement, filed with the SEC on May 22,

2024 (available on the SEC’s EDGAR website at: https://www.sec.gov/Archives/edgar/data/850460/000110465924064083/tm2412615-3_defm14a.htm),

as of May 17, 2024, Mr. Jones beneficially owned 5.36% of the Company’s common stock and Mr. Eckert beneficially

owned 1.55% of the Company’s common stock. None of the other participants in the solicitation owns in excess of one percent of

the Company’s common stock. More detailed information about the ownership interests of each director and Mr. Eckert can be

found in their respective SEC filings on Forms 3, 4, and 5, all of which are available on the SEC’s website at www.sec.gov for

no charge, and in the section of the Definitive Proxy Statement titled “Interests of the Directors and Executive Officers of Encore in the Merger.” Additional information regarding the participants in the solicitation, including their direct or indirect interests,

by security holdings or otherwise, may be included in other relevant materials to be filed with the SEC in respect of the Merger when

they become available.

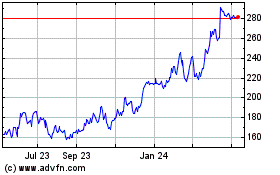

Encore Wire (NASDAQ:WIRE)

Historical Stock Chart

From Nov 2024 to Dec 2024

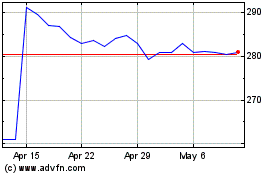

Encore Wire (NASDAQ:WIRE)

Historical Stock Chart

From Dec 2023 to Dec 2024