Current Report Filing (8-k)

November 03 2022 - 4:52PM

Edgar (US Regulatory)

0000808326FALSE00008083262022-11-012022-11-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

November 1, 2022

Date of Report (Date of earliest event reported)

EMCORE CORPORATION

Exact Name of Registrant as Specified in its Charter

| | | | | | | | |

| New Jersey | 001-36632 | 22-2746503 |

| State of Incorporation | Commission File Number | IRS Employer Identification Number |

2015 W. Chestnut Street, Alhambra, California, 91803

Address of principal executive offices, including zip code

(626) 293-3400

Registrant’s telephone number, including area code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | |

Title of Each Class | Trading symbol(s) | Name of Each Exchange on Which Registered |

Common stock, no par value | EMKR | The Nasdaq Stock Market LLC | (Nasdaq Global Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On November 1, 2022, EMCORE Chicago Inertial Corporation (“EMCORE Chicago”), a wholly owned subsidiary of EMCORE Corporation (“EMCORE”), entered into a Purchase and Sale Agreement (the “Purchase Agreement”) dated as of November 1, 2022 with HSRE Fund VII Holding Company, LLC (“Buyer”), pursuant to which the parties agreed to consummate a sale and leaseback transaction (the “Sale and Leaseback Transaction”). Under the terms of the Purchase Agreement, EMCORE Chicago agreed to sell its property located at 8412 West 185th St., Tinley Park, Illinois (the “Real Property”) to Buyer, for a total purchase price of $10.9 million. The net proceeds to be received by EMCORE Chicago will be reduced by transaction commissions and expenses incurred in connection with the sale.

At the consummation of the Sale and Leaseback Transaction, EMCORE Chicago will enter into a Single-Tenant Triple Net Lease (the “Lease Agreement”) with Buyer pursuant to which EMCORE Chicago will lease back from Buyer the Real Property for a term commencing on the consummation of the Sale and Leaseback Transaction and ending twelve (12) years after the consummation of the Sale and Leaseback Transaction, unless earlier terminated or extended in accordance with the terms of the Lease Agreement. Under the Lease Agreement, EMCORE Chicago’s financial obligations will include base monthly rent of $0.58 per square feet, or approximately $58,557 per month, which rent will increase on an annual basis at three percent (3%) over the life of the lease. EMCORE Chicago will also be responsible for all monthly expenses related to the leased facilities, including insurance premiums, taxes and other expenses, such as utilities. In connection with the execution of the Lease Agreement, EMCORE will execute a Lease Guaranty (the “Guaranty”) with Buyer under which EMCORE will guarantee the payment when due of the monthly rent, and all other additional rent, interest and charges to be paid by EMCORE Chicago under the Lease Agreement, and the performance by EMCORE Chicago of all of the material terms, conditions, covenants and agreements of the Lease Agreement.

EMCORE anticipates that the close of the Sale and Leaseback Transaction will occur in the quarter ending December 31, 2022, subject to satisfaction of certain customary closing conditions for transactions of this type.

The foregoing summaries of the Purchase Agreement, the Lease Agreement and the Guaranty are qualified in their entirety by reference to the full text of the Purchase Agreement, the form of Lease Agreement and the form of Guaranty, which are attached to this Current Report on Form 8-K as Exhibits 10.1, 10.2 and 10.3, respectively, and which are incorporated by reference into this Item 1.01.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

Exhibit

Number | | Exhibit Description |

| 10.1 | | |

| 10.2 | | |

| 10.3 | | |

* Schedules and attachments to the Purchase Agreement have been omitted pursuant to Item 601(b)(2) of Regulation S-K. The registrant hereby undertakes to furnish supplemental copies of any of the omitted schedules and attachments upon request by the Securities and Exchange Commission.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| EMCORE CORPORATION |

| | |

| By: | /s/ Tom Minichiello |

| Name: | Tom Minichiello |

| Dated: November 3, 2022 | Title: | Chief Financial Officer |

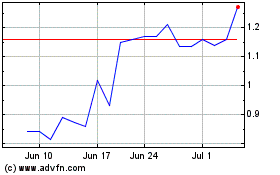

EMCORE (NASDAQ:EMKR)

Historical Stock Chart

From Jun 2024 to Jul 2024

EMCORE (NASDAQ:EMKR)

Historical Stock Chart

From Jul 2023 to Jul 2024