As filed with the Securities and Exchange Commission

on July 21, 2023

Registration No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

S-8

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

E-HOME

HOUSEHOLD SERVICE HOLDINGS LIMITED

(Exact name of registrant as specified in its

charter)

| Cayman Islands |

|

N/A |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

E-Home, 18/F, East Tower, Building B,

Dongbai Center, Yangqiao Road,

Gulou District, Fuzhou City 350001,

People’s Republic of China

(Address of Principal Executive Offices) (Zip

Code)

2023 Share Incentive Plan

(Full title of the plans)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

(Name and address of agent for service)

800-221-0102

(Telephone number, including area code, of agent

for service)

It is requested that copies of notices and communications

from the Securities and Exchange Commission be sent to:

Huan Lou, Esq.

David Manno, Esq.

Sichenzia Ross Ference

LLP

1185 Avenue of the

Americas, 31st Floor

New York, NY 10036

(212) 930-9700

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

Accelerated filer ☐ |

| Non-accelerated filer ☒ |

Smaller reporting company ☐ |

| |

Emerging growth company ☒ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY NOTE

This Registration Statement

on Form S-8 (this “Registration Statement”) is being filed by E-Home Household Service Holdings Limited, an exempt

company incorporated in the Cayman Islands (the “Company”) relating to 6,000,000 ordinary shares of $0.02 par value

per share (the “Shares”), issuable under the 2023 Share Incentive Plan.

This Registration Statement

also includes a prospectus (the “Reoffer Prospectus”) prepared in accordance with General Instruction C of Form S-8

and in accordance with the requirements of Part I of Form F-3. This Reoffer Prospectus may be used for the reoffer and resale of Shares

on a continuous or delayed basis that may be deemed to be “restricted securities” and/or “control securities”

within the meaning of the Securities Act of 1933, as amended (the “Securities Act”), and the rules and regulations

promulgated thereunder, that are issuable to certain of our executive officers, employees, consultants and directors identified in the

Reoffer Prospectus. The number of Shares included in the Reoffer Prospectus represents Shares issuable to the selling shareholders pursuant

to equity awards granted to the selling shareholders and does not necessarily represent a present intention to sell any or all such Shares.

As specified in General Instruction

C of Form S-8, until such time as we meet the registrant requirements for use of Form F-3, the number of Shares to be offered by means

of this reoffer prospectus, by each of the selling security holders, and any other person with whom he or she is acting in concert for

the purpose of selling our Shares, may not exceed, during any three month period, the amount specified in Rule 144(e) of the Securities

Act.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

Item

1. Plan Information.

The Company will provide

each recipient of a grant under the 2023 Share Incentive Plan (the “Recipients”) with documents that contain information

related to the 2023 Share Incentive Plan, and other information including, but not limited to, the disclosure required by Item 1 of Form

S-8, which information is not required to be and is not being filed as a part of this Registration Statement on Form S-8 (the “Registration

Statement”) or as prospectuses or prospectus supplements pursuant to Rule 424 under the Securities Act. The foregoing information

and the documents incorporated by reference in response to Item 3 of Part II of this Registration Statement, taken together, constitute

a prospectus that meets the requirements of Section 10(a) of the Securities Act. A Section 10(a) prospectus will be given to each Recipient

who receives Shares covered by this Registration Statement, in accordance with Rule 428(b)(1) under the Securities Act.

Item

2. Registrant Information and Employee Plan Annual Information.

Upon written or oral request,

any of the documents incorporated by reference in Item 3 of Part II of this Registration Statement (which documents are incorporated

by reference in this Section 10(a) Prospectus) and other documents required to be delivered to eligible employers, non-employee directors

and consultants pursuant to Rule 428(b) are available without charge by contacting:

Mr. Wenshan Xie

Chairman and Chief Executive Officer

E-Home Household Service Holdings Limited

E-Home, 18/F, East Tower, Building B,

Dongbai Center, Yangqiao Road,

Gulou District, Fuzhou City 350001,

People’s Republic of China

+86-591-87590668

REOFFER PROSPECTUS

E-HOME

HOUSEHOLD SERVICE HOLDINGS LIMITED

Up to 2,600,000 Shares

Issuable under certain awards granted under

the

2023 Share Incentive Plan

This reoffer prospectus relates

to the public resale, from time to time, of an aggregate of 2,600,000 of our Shares by certain security holders identified herein

in the section titled “Selling Securityholders”. Such shares may be issued under the 2023 Share Incentive Plan. You should

read this reoffer prospectus carefully before you invest in our Shares.

Such resales shall take place

on NASDAQ, or such other stock market or exchange on which our Shares may be listed or quoted, in negotiated transactions or otherwise,

at market prices prevailing at the time of the sale or at prices otherwise negotiated (see “Plan of Distribution” starting

on page 33 of this reoffer prospectus). We will receive no part of the proceeds from sales made under this reoffer prospectus.

The Selling Securityholders will bear all sales commissions and similar expenses. Any other expenses incurred by us in connection with

the registration and offering and not borne by the Selling Securityholders will be borne by us.

This reoffer prospectus has

been prepared for the purposes of registering our Shares under the Securities Act to allow for future sales by Selling Securityholders

on a continuous or delayed basis to the public without restriction, provided that, until such time as we meet the registrant requirements

for use of Form F-3, the amount of Shares to be offered or resold under this Reoffer Prospectus by each Selling Securityholder or other

person with whom he or she is acting in concert for the purpose of selling Shares, may not exceed, during any three-month period, the

amount specified in Rule 144(e) under the Securities Act. We have not entered into any underwriting arrangements in connection with the

sale of the Shares covered by this reoffer prospectus. The Selling Securityholders identified in this reoffer prospectus, or their pledgees,

donees, transferees or other successors-in-interest, may offer the Shares covered by this reoffer prospectus from time to time through

public or private transactions at prevailing market prices, at prices related to prevailing market prices or at privately negotiated

prices.

The securities offered by

this reoffer prospectus involve a high degree of risks. E-Home Household Service Holdings Limited (“E-Home”) is not an operating

company but rather a holding company incorporated in the Cayman Islands. Because E-Home has no operations of its own, we conduct substantially

all of our business in Hong Kong and mainland China (which is also referred to as “PRC,” and for the purpose of this prospectus,

excluding Taiwan and the special administrative regions of Hong Kong and Macau) through E-Home’s subsidiaries, particularly, E-Home

(Pingtan) Home Service Co., Ltd. and Fuzhou Bangchang Technology Co. Ltd., and their respective Chinese subsidiaries.

As used in this reoffer prospectus,

throughout this document, unless the context indicates otherwise, references to “E-Home” refer to E-Home Household Service

Holdings Limited, a holding company and references to “we,” “us,” “our,” the “Company”

or “our company” are to E-Home and its consolidated subsidiaries, including E-Home Household Service Holdings Limited (Hong

Kong), Zhongrun (Fujian) Pharmaceutical Co. Ltd., E-Home Household Service Technology Co., Ltd., E-Home (Pingtan) Home Service Co., Ltd.,

Fuzhou Bangchang Technology Co. Ltd., Fuzhou Yongheng Xin Electric Co., Ltd., Fujian Happiness Yijia Family Service Co., Ltd., and Danyang

Fumao Health Development Co., Ltd, as a whole.

This structure involves unique

risks to investors, and you may never directly hold equity interests in E-Home’s Chinese operating entities. You are specifically

cautioned that there are significant legal and operational risks associated with having substantially all of our business operations

in China, including that changes in the legal, political and economic policies of the Chinese government, the relations between China

and the United States, or Chinese or United States regulations may materially and adversely affect our business, financial condition,

results of operations and the market price of E-Home securities. Moreover, the Chinese government may exercise significant oversight

and discretion over the conduct of our business and may intervene in or influence the PRC subsidiaries’ operations in China at

any time. Recent statements by the Chinese government indicate an intent to exert more oversight and more control over offerings conducted

overseas and/or foreign investment in China-based issuers. Any such actions by the Chinese government could significantly limit or completely

hinder E-Home’s ability to offer or continue to offer its securities to investors and cause the value of the securities being registered

hereby to significantly decline or become worthless. Although we believe our operating structure is legal and permissible under the Chinese

law and regulations currently in effect, Chinese regulatory authorities could take a different position on the interpretation and enforcement

of laws and regulations and disallow our holding company structure, which would likely result in a material adverse change in our operations

and/or the value of E-Home’s securities being offered, including that it could cause the value of such securities to significantly

decline or become worthless. See “Risk Factors—Risks Related to Doing Business in China —The Chinese government

exerts significant oversight and discretion over the conduct of our business. The Chinese government may intervene or influence our PRC

subsidiaries’ operations at any time, which could result in a material adverse change in our PRC subsidiaries’ operations

and in the value of the securities being offered hereby”, “Risk Factors—Risks Related to Doing Business in China —Recent

statements by the Chinese government indicate an intent to exert more oversight and more control over offerings conducted overseas and/or

foreign investment in China-based issuers. Any such actions by the Chinese government could significantly limit or completely hinder

E-Home’s ability to offer or continue to offer its securities to investors and cause the value of the securities being registered

hereby to significantly decline or become worthless” and “Risk Factors — Risks Related to Doing Business in

China — There are uncertainties regarding the interpretation and enforcement of PRC laws, rules and regulations”.

For a description of the

corporate structure, see “Corporate Structure” on Page 2. For a description of the risks involved in investing in

E-Home’s securities, see “Risk Factors” beginning on page 6.

We are subject to legal and

operational risks associated with having a significant portion of our operations in mainland China, including risks related to the legal,

political and economic policies of the Chinese government, the relations between China and the United States, and changes in Chinese

laws and regulations. Recently, the PRC government initiated a series of regulatory actions and made a number of public statements on

the regulation of business operations in China with little advance notice, including cracking down on illegal activities in the securities

market, enhancing supervision over China-based companies listed overseas, adopting new measures to extend the scope of cybersecurity

reviews, and expanding efforts in anti-monopoly enforcement. On December 28, 2021, thirteen governmental departments of the PRC,

including the Cyberspace Administration of China (the “CAC”), issued the Cybersecurity Review Measures, which became effective

on February 15, 2022. The Cybersecurity Review Measures provide that an online platform operator, which possesses personal information

of at least one million users, must apply for a cybersecurity review by the CAC if it intends to be listed in foreign countries. We do

not believe that we are subject to the cybersecurity review by the CAC. In addition, as of the date hereof, we have not been involved

in any investigations on cybersecurity review initiated by any PRC regulatory authority, nor have we received any inquiry, notice, or

sanction related to cybersecurity review under the Cybersecurity Review Measures. As of the date hereof, no relevant laws or regulations

in the PRC explicitly require us to seek approval from the China Securities Regulatory Commission (the “CSRC”) or any other

PRC governmental authorities for our overseas listing or securities offering plan, nor have we (including any of our subsidiaries) received

any inquiry, notice, warning or sanctions regarding our planned offering of securities from the CSRC or any other PRC governmental authorities.

Also, as of the date hereof, we do not believe we are in a monopolistic position in the industry in which we operate. However,

since these statements and regulatory actions by the PRC government are newly published and official guidance and related implementation

rules have not been issued, it remains uncertain what the potential impact such modified or new laws and regulations will have on

our daily business operations. The Standing Committee of the National People’s Congress (the “SCNPC”) or other PRC

regulatory authorities may in the future promulgate laws, regulations or implementing rules that would require our Chinese subsidiaries

to obtain regulatory approval from Chinese authorities before future offerings of securities in the U.S. These risks could result in

a material change in our operations in China and potentially the value of our securities being registered herein for sale. The CSRC regulatory

risks could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the

value of such securities to significantly decline or be worthless.

On February 17, 2023, the

CSRC issued the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies, or the Trial Measures,

which became effective on March 31, 2023. Pursuant to the Trial Measures, domestic companies that seek to offer or list securities overseas,

both directly and indirectly, should fulfill the filing procedure and report relevant information to the CSRC. As the Trial Measures

were newly published and there is uncertainty with respect to the filing requirements and the implementation, if we are required to submit

to the CSRC and complete the filing procedures, we cannot be sure that we will be able to complete such filings in a timely manner. Any

failure or perceived failure by us to comply with such filing requirements under the Trial Measures may result in forced corrections,

warnings and fines against us and could materially hinder our ability to offer or continue to offer our securities.

Our Shares may be prohibited

from trading on a national exchange or “over-the-counter” markets under the Holding Foreign Companies Accountable Act (the

“HFCA Act”) if the Public Company Accounting Oversight Board (United States) (the “PCAOB”) is unable to inspect

our auditors for three consecutive years. In addition, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies

Accountable Act (the “AHFCAA”), which was signed into law on December 29, 2022, reducing the period of time for foreign companies

to comply with the PCAOB audits to two consecutive years instead of three, thus reducing the time period for triggering the prohibition

on trading. Pursuant to the HFCA Act, the PCAOB issued a Determination Report on December 16, 2021 which found that the PCAOB is unable

to inspect or investigate completely registered public accounting firms headquartered in: (i) Mainland China of the PRC, and (ii) Hong

Kong; and such report identified the specific registered public accounting firms which are subject to these determinations. On August

26, 2022, the PCAOB signed a Statement of Protocol with the CSRC and China’s Ministry of Finance (the “PRC MOF”) in

respect of cooperation on the oversight of PCAOB-registered public accounting firms based in Mainland China and Hong Kong. Pursuant to

the Statement of Protocol, the PCAOB conducted inspections on select registered public accounting firms subject to the Determination

Report in Hong Kong between September 2022 and November 2022. On December 15, 2022, the PCAOB issued a report that vacated its December

16, 2021 determination and removed mainland China and Hong Kong from the list of jurisdictions where it is unable to inspect or investigate

completely registered public accounting firms. Each year, the PCAOB will determine whether it can inspect and investigate completely

audit firms in mainland China and Hong Kong, among other jurisdictions. If the PCAOB determines in the future that it no longer has full

access to inspect and investigate completely accounting firms in mainland China and Hong Kong and we use an accounting firm headquartered

in one of these jurisdictions to issue an audit report on our financial statements filed with the SEC, we would be identified as a Commission-Identified

Issuer following the filing of the annual report on Form 20-F for the relevant fiscal year. There can be no assurance that we would not

be identified as a Commission-Identified Issuer for any future fiscal year, and if we were so identified for two consecutive years, we

would become subject to the prohibition on trading under the HFCAA. Our auditor, Enrome LLP, is headquartered in Singapore, and is subject

to inspection by the PCAOB on a regular basis. Our auditor is not headquartered in Mainland China or Hong Kong and was not identified

in the Determination Report as a firm subject to the PCAOB’s determinations.

Under our current corporate

structure, to fund any liquidity requirements an entity in our corporate group may have, a subsidiary may rely on loans or payments from

E-Home and E-Home may receive distributions or cash transfers from our subsidiaries. Additionally, the transfer of funds and assets between

E-Home and its subsidiaries is not subject to any Chinese currency exchange restrictions. As of the date hereof, during the past two

completed fiscal years, none of our subsidiaries has made any dividends or distributions to E-Home and neither has E-Home made any dividends

or distributions to its shareholders or subsidiaries. We intend to keep any future earnings to finance the expansion of our business,

and we do not anticipate any cash dividends will be paid in the foreseeable future. If E-Home determines to pay dividends on any of its

ordinary shares in the future, as a holding company, it may derive funds for such distribution from its own cash position or contributions

from its subsidiaries. As of the date hereof, during the past two completed fiscal years, no transfer of non-cash assets has occurred

between E-Home and any of its subsidiaries. As of the date hereof, neither E-Home nor its subsidiaries have a cash management policy. See

“Cash Distribution” on page 4.

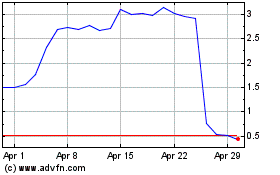

Our Shares are quoted on NASDAQ under the symbol “EJH” and the closing price of our Shares on July 18, 2023 was $0.1240 per

Share.

NEITHER THE SECURITIES

AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS REOFFER

PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this reoffer prospectus is July 21,

2023

E-HOME HOUSEHOLD SERVICE HOLDINGS LIMITED

TABLE OF CONTENTS

Except where the

context otherwise requires, the terms, “we,” “us,” “our” or “the Company,” refer to the

business of E-Home Household Service Holdings Limited, a holding company incorporated in the Cayman Islands and its subsidiaries.

CAUTIONARY STATEMENT

REGARDING FORWARD-LOOKING STATEMENTS

This reoffer prospectus and

the documents and information incorporated by reference in this reoffer prospectus include forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934,

as amended, or the Exchange Act. These statements are based on our management’s beliefs and assumptions and on information currently

available to our management. Such forward-looking statements include those that express plans, anticipation, intent, contingency, goals,

targets or future development and/or otherwise are not statements of historical fact.

All statements in this reoffer

prospectus and the documents and information incorporated by reference in this reoffer prospectus that are not historical facts are forward-looking

statements. We may, in some cases, use terms such as “anticipates,” “believes,” “could,” “estimates,”

“expects,” “intends,” “may,” “plans,” “potential,” “predicts,”

“projects,” “should,” “will,” “would” or similar expressions or the negative of such

items that convey uncertainty of future events or outcomes to identify forward-looking statements.

Forward-looking statements

are made based on management’s beliefs, estimates and opinions on the date the statements are made and we undertake no obligation

to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as may be

required by applicable law. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we

cannot guarantee future results, levels of activity, performance or achievements.

We caution you therefore

that you should not rely on any of these forward-looking statements as statements of historical fact or as guarantees or assurances of

future performance.

Information regarding market

and industry statistics contained in this reoffer prospectus, including the documents that we incorporate by reference, is included based

on information available to us that we believe is accurate. It is generally based on academic and other publications that are not produced

for purposes of securities offerings or economic analysis. Forecasts and other forward-looking information obtained from these sources

are subject to the same qualifications and the additional uncertainties accompanying any estimates of future market size, revenue and

market acceptance of products and services. Except as required by U.S. federal securities laws, we have no obligation to update forward-looking

information to reflect actual results or changes in assumptions or other factors that could affect those statements.

PROSPECTUS SUMMARY

The Securities and Exchange

Commission (the “Commission”) allows us to ‘‘incorporate by reference’’ certain information that

we file with the Commission, which means that we can disclose important information to you by referring you to those documents. The information

incorporated by reference is considered to be part of this reoffer prospectus, and information that we file later with the Commission

will update automatically, supplement and/or supersede the information disclosed in this reoffer prospectus. Any statement contained

in a document incorporated or deemed to be incorporated by reference in this reoffer prospectus shall be deemed to be modified or superseded

for purposes of this reoffer prospectus to the extent that a statement contained in this reoffer prospectus or in any other document

that also is or is deemed to be incorporated by reference in this reoffer prospectus modifies or supersedes such statement. Any such

statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this reoffer prospectus.

You should read the following summary together with the more detailed information regarding our company, our Shares and our financial

statements and notes to those statements appearing elsewhere in this reoffer prospectus or incorporated herein by reference.

Our Company

Overview

We are a household service

company based in Fuzhou, China. We provide integrated household services through our website and WeChat platform, “e家快服”

(“E-Home”), across 21 provinces in China. Currently, these services primarily include home appliance services and housekeeping

services. For our home appliance services, we partner with individuals and service stores which provide the technicians to deliver the

on-site services. We have partnerships with more than 2,300 individuals and service stores providing these services in China. For our

housekeeping services, we primarily partner with individual service providers who serve as independent contractors. We currently have

more than 3,000 cleaners providing our housekeeping or care services. Our online platform integrates these offline service providers,

which helps them to gain a larger customer base, and provides professional and reliable one-stop household services to our customers.

In July 2015, we successfully

transitioned from an outsourcing after-market service provider of home appliances and building materials to an operator of home appliance

services. In January 2018, we officially became an integrated household service provider after expanding our service portfolio from distribution,

installation, repair and maintenance of home appliances to delivery, installation, repair and maintenance of home appliances, home-moving

and house cleaning. In addition, we have recently launched and are actively promoting our senior care services. We had generated a limited

amount of revenue from our senior care services as of June 30, 2022. We plan to further expand our business to include smart community

services, as well as sales of smart home supplementary merchandise. We currently have approximately 526 employees to support our operations.

The focus of our integrated

household services will be adjusted based on different seasons and different locations. Most of our home appliance services are conducted

in Shandong, Henan and Hunan provinces, while our housekeeping and care services are mainly conducted in Fujian, Shandong and Guangxi

provinces. We received over 1,393,660 and 1,273,111 service orders in the fiscal years ended June 30, 2021 and 2022, respectively. We

believe that all services ordered were successfully delivered.

We operate our business mainly

by receiving the orders online and providing the services offline. Our online platform includes our website and WeChat platform. Customers

order services and complete payments online. After our system automatically matches an order to the corresponding service provider, the

service provider receives the order and arranges for a technician/cleaner to deliver the on-site service. We are committed to raising

our service quality and improving the efficiency of our platform operation, which would ultimately improve the customer experience. After

the services are delivered, customers can upload their evaluations on the platform and our customer service team will follow up with

customers and get their feedback.

We market our brand and services

through multiple channels, both online and offline. Online marketing is mainly done through WeChat events. Offline services are mainly

promoted by clients from communities, institutions, training agencies and firms through peer-to-peer marketing. We also aim to deliver

premium services to garner strong word-of-mouth referrals and enhance our brand recognition. The number of our registered members increased

to more than 3,600,000 for the year ended June 30, 2022 and 2,800,000 for the year ended June 30, 2021 from about 2,629,000 for the year

ended June 30, 2020. Registered members are those customers who followed our WeChat official account and provided their profiles, including

their phone numbers or WeChat User IDs. Most of the orders for our services are placed from our registered members; therefore, we believe

that the number of registered members is a key metric for our operations.

We have invested heavily in

expanding and upgrading our business. In 2017, we acquired 67% of Fujian Happiness Yijia Family Service Co., Ltd. and 100% of Fuzhou Yongheng

Xin Electric Co., Ltd. to support the expansion of our integrated household services and the training of our service providers. In 2021,

we entered into equity transfer agreements to acquire all or a majority of equity interests of certain companies, including 51% of Fuzhou

Sijie Cleaning Service Co., Ltd., 33% of Fujian Happiness Yijia Family Service Co., Ltd. (67% of which was previously owned by us), 100%

of Fujian Jin Ri Dao Jia Technology Co., Ltd., 55% of Fujian Zhi Xie Education Technology Development Co., Ltd., and 55% of Fuzhou Ju

Shang Enterprise Management Consulting Co., Ltd. We also contracted to purchase all the assets of Danyang Situ Fengyi Farm with its owner.

As of the date hereof, except for the acquisition of 33% of Fujian Happiness Yijia Family Service Co., Ltd. and the termination of the

acquisition 51% of Fuzhou Sijie Cleaning Service Co., Ltd., none of the foregoing acquisitions in 2021 have been closed . On June

23, 2021, Fuzhou Fumao, a 20% owned PRC subsidiary of ours, entered into an equity transfer agreement with Fuzhou Gulou Jiajiale Family

Service Co. Ltd. (“Jiajiale”), pursuant to which Fuzhou Fumao acquired 100% of equity interests of Jiajiale in cash.

Our business was adversely

impacted by the continued outbreak or resurgence of COVID-19 in recent years as demonstrated by our decline in revenue from fiscal year

2021 to fiscal year 2022. Due to the impact of COVID-19 our overall revenue decreased by approximately 14.46% to approximately $63.75

million for the year ended June 30, 2022, and our revenue from installation and maintenance services decreased by 22.36% to approximately

$4.02 million for the year ended June 30, 2022. We also generated approximately $7.39 million of revenues from our senior care services

for the fiscal year ended June 30, 2022. Our net income for the year ended June 30, 2022, decreased by 184.85% as compared with the year

ended June 30, 2021. The results of operations for the fiscal year ending June 30, 2023, and beyond are still uncertain and may continue

to be adversely impacted by any further outbreak or resurgence of the COVID-19 pandemic. See “Risks Related to Our Business and

Industry — We face risks related to natural disasters, health epidemics and other outbreaks, including the outbreak of COVID-19

since December 2019 which may have a continued material adverse effect on our business, results of operation and financial condition.”

Corporate Structure

E-Home is not an operating

company in China but a Cayman Islands holding company. We conduct our operations in China primarily through our PRC and Hong Kong subsidiaries.

Investors in securities being offered in this prospectus are not purchasing equity interests in our operating subsidiaries in China,

but instead are purchasing equity interests in a holding company incorporated in the Cayman Islands.

The chart below presents

our current corporate structure:

This structure involves unique

risks to investors, and you may never directly hold equity interests in E-Home’s Chinese operating entities. You are specifically

cautioned that there are significant legal and operational risks associated with having substantially all of our business operations

in China, including changes in the legal, political and economic policies of the Chinese government, the relations between China and

the United States, or Chinese or United States regulations may materially and adversely affect our business, financial condition, results

of operations and the market price of E-Home securities. Moreover, the Chinese government may exercise significant oversight and discretion

over the conduct of our business and may intervene in or influence the PRC subsidiaries’ operations in China at any time. Recent

statements by the Chinese government indicate an intent to exert more oversight and more control over offerings conducted overseas and/or

foreign investment in China-based issuers. Any such actions by the Chinese government could cause uncertainties regarding the status

of the rights of the Cayman Islands holding company and may significantly limit or completely hinder E-Home’s ability to offer

or continue to offer its securities to investors and cause the value of the securities being registered hereby to significantly decline

or become worthless. Although we believe our current operating structure is legal and permissible under the Chinese law and regulations

currently in effect, Chinese regulatory authorities could take a different position on the interpretation and enforcement of laws and

regulations and disallow our holding company structure, which would likely result in a material adverse change in our operations and/or

the value of E-Home’s securities being offered, including that it could cause the value of such securities to significantly decline

or become worthless. For a detailed discussion of risks facing us and the offering as a result of this structure, see “Risk Factors—Risks

Related to Doing Business in China —The Chinese government exerts significant oversight and discretion over the conduct of our

business. The Chinese government may intervene or influence our PRC subsidiaries’ operations at any time, which could result in

a material adverse change in our PRC subsidiaries’ operations and in the value of the securities being offered hereby” on

page 14 of the accompanying prospectus, “Risk Factors—Risks Related to Doing Business in China —Recent statements

by the Chinese government indicate an intent to exert more oversight and more control over offerings conducted overseas and/or foreign

investment in China-based issuers. Any such actions by the Chinese government could significantly limit or completely hinder E-Home’s

ability to offer or continue to offer its securities to investors and cause the value of the securities being registered hereby to significantly

decline or become worthless” on page 14 and “Risk Factors — Risks Related to Doing Business in China

— There are uncertainties regarding the interpretation and enforcement of PRC laws, rules and regulations” on page

15.

The PRC government recently

initiated a series of regulatory actions and made a number of public statements on the regulation of business operations in China, including

cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using

a VIE structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding efforts in anti-monopoly enforcement.

We do not believe that our PRC subsidiaries are directly subject to these regulatory actions or statements, as our PRC subsidiaries have

not carried out any monopolistic behavior and the business of our PRC subsidiaries does not involve the collection of user data or implicate

cybersecurity.

We

also have dissolved the VIE structure in October 2021 as the business of our PRC subsidiaries does not involve any type of restricted

industry. As advised by our PRC legal counsel, Tian Yuan Law Office, the risk that we may face penalties associated with our prior VIE

structure if such structures are invalidated in the PRC in the future is minimal. Currently there are no existing rules or regulations

in China that may impose penalties on PRC entities that adopted a VIE structure, which was dissolved later. On December 24, 2021, the

CSRC published the Administrative Provisions of the State Council on Overseas Issuance and Listing of Securities by Domestic Enterprises

(Draft for Comment) and the Administrative Measures for the Filings of Overseas Issuance and Listing of Securities by Domestic Enterprises

(Draft for Comment), which provide principles and guidelines for direct and indirect issuance of securities overseas by a Chinese domestic

enterprise. The Administrative Provisions and Measures aim to establish a unified supervision system and promote cross-border regulatory

cooperation. According to the Q&A held by CSRC officials for journalists, the CSRC will adhere to the principle of non-retroactive

application of law and first focus on issuers conducting initial public offerings and follow-on offerings by requiring them to complete

the registration procedures.

As further advised by our

PRC counsel, Tian Yuan Law Office, as of the date hereof, no relevant laws or regulations in the PRC explicitly require E-Home or our

PRC subsidiaries to seek approval from the CSRC, or any other PRC governmental authorities for the offering, nor has E-Home, the Cayman

Islands holding company or any of our subsidiaries received any inquiry, notice, warning or sanctions regarding the offering from the

CSRC or any other PRC governmental authorities. However, since these statements and regulatory actions by the PRC government are newly

published and detailed official guidance and related implementation rules have not been issued or taken effect, it is uncertain how soon

the regulatory bodies in China will finalize implementation measures, and the impact the modified or new laws and regulations will have

on the daily business operations of our PRC subsidiaries, our ability to accept foreign investments and list on an U.S. or other foreign

exchange. For more information on various risks related to doing business in China, see “Risk Factors—Risks Related to Doing

Business in China” beginning on page 14.

Corporate Information

Our principal executive offices

are located at E-Home, 18/F, East Tower, Building B, Dongbai Center, Yangqiao Road, Gulou District, Fuzhou City 350001, People’s

Republic of China. The telephone number at our executive offices is +86-591-87590668.

E-Home’s registered

office is at Harneys Fiduciary (Cayman) Limited, 4th Floor, Harbour Place, 103 South Church Street, P.O. Box 10240, Grand Cayman KY1-1002,

Cayman Islands . E-Home’s agent for service of process in the United States is Cogency Global Inc., located at 122 East 42nd

Street, 18th Floor, New York, NY 10168.

Our website can be found

at www.ej111.com. Information on our website is not incorporated by reference into this reoffer prospectus or into any information incorporated

herein by reference. You should not consider information on our website to be part of this reoffer prospectus or any information incorporated

by reference herein.

Cash Distribution

Under our current corporate

structure, to fund any liquidity requirements an entity in our corporate group may have, a subsidiary may rely on loans or payments from

E-Home and E-Home may receive distributions or cash transfers from our subsidiaries. Additionally, the transfer of funds and assets between

E-Home and its subsidiaries is not subject to any Chinese currency exchange restrictions, except that the transfers are subject to money

laundering and anti-corruption rules and regulations. However, there is no guarantee that the applicable government will not promulgate

new laws or regulations that may impose such restrictions on currency exchanges in the future.

As of the date hereof, during

the past two completed fiscal years, no non-cash assets transfer occurred between E-Home and its subsidiaries.

The

following table illustrates the breakdown of cash transfers within our organization for the year ended June 30, 2022:

| Lender | |

Borrower | |

Amount Due | |

| E-Home Household Service Holdings Limited (Cayman Islands) | |

E-Home Household Service Holdings Limited (Hong Kong) | |

$ | 6,100,000 | |

| E-Home Household Service Holdings Limited (Cayman Islands) | |

E-Home Household Service Technology Co., Ltd. | |

$ | 200,000 | |

| E-Home Household Service Holdings Limited (Cayman Islands) | |

E-Home (Pingtan) Home Service Co., Ltd. | |

$ | 5,410,000 | |

| E-Home Household Service Holdings Limited (Hong Kong) | |

E-Home Household Service Technology Co., Ltd. | |

$ | 5,400,000 | |

| E-Home Household Service Holdings Limited (Hong Kong) | |

E-Home (Pingtan) Home Service Co., Ltd. | |

$ | 1,700,000 | |

| E-Home Household Service Technology Co., Ltd. | |

E-Home (Pingtan) Home Service Co., Ltd. | |

$ | 6,476,023 | |

The

following table illustrates the breakdown of our outstanding loans within our group as of June 30, 2022 (including non-cash transfers

of claims and obligations):

| Lender | |

Borrower | |

Amount Due | |

| E-Home Household Service Holdings Limited (Cayman Islands) | |

E-Home Household Service Holdings Limited (Hong Kong) | |

$ | 6,100,000 | |

| E-Home Household Service Holdings Limited (Cayman Islands) | |

E-Home Household Service Technology Co., Ltd. | |

$ | 200,000 | |

| E-Home Household Service Holdings Limited (Cayman Islands) | |

E-Home (Pingtan) Home Service Co., Ltd. | |

$ | 5,410,000 | |

| E-Home Household Service Holdings Limited (Hong Kong) | |

E-Home Household Service Technology Co., Ltd. | |

$ | 5,400,000 | |

| E-Home Household Service Holdings Limited (Hong Kong) | |

E-Home (Pingtan) Home Service Co., Ltd. | |

$ | 1,700,000 | |

| E-Home Household Service Technology Co., Ltd. | |

E-Home (Pingtan) Home Service Co., Ltd. | |

$ | 6,476,023 | |

As of the date hereof, neither

E-Home nor its subsidiaries has a cash management policy. During the past two completed fiscal years, none of E-Home’s subsidiaries

has paid dividends, made distributions, transferred cash or other assets by kind to E-Home or its shareholders directly or indirectly.

The current laws and regulations of the PRC on currency exchange requires registration with or approval from the SAFE for conversion

of RMB into foreign currency and remission out of mainland China to pay capital expenses, such as the repayment of loans denominated

in foreign currencies. The PRC government may also at its discretion restrict access in the future to foreign currencies for current

account transactions. However, there is no assurance that the Chinese government will not, in the future, intervene or impose restrictions

or limitations on our Company’s ability to generate income out of mainland China and Hong Kong.

As of the date hereof, during

the past two completed fiscal years, none of our subsidiaries has made any dividends or distributions to E-Home, nor has E-Home made any

dividends or distributions to its shareholders. We intend to keep any future earnings to re-invest in and finance the expansion of our

business. If E-Home determines to pay dividends on any of its ordinary shares in the future, as a holding company, it may derive funds

for such distribution from its own cash position or contributions from its subsidiaries.

| The Offering |

| |

| Outstanding Shares: |

|

27,248,959 of our Shares are outstanding as of July 14, 2023. |

| |

|

|

| Shares Offered: |

|

Up to 2,600,000 Shares for sale by the selling securityholders (which

include our executive officers and directors) for their own account pursuant to the 2023 Share Incentive Plan. |

| |

|

|

| Selling Securityholders: |

|

The selling securityholders are set forth in the section titled “Selling

Securityholders” of this reoffer prospectus on page 32. Until such time as we meet the registrant requirements for use

of Form F-3, the amount of securities to be offered or resold by means of the reoffer prospectus by the designated selling securityholders

may not exceed, during any three month period, the amount specified in Rule 144(e). |

| |

|

|

| Use of proceeds: |

|

We will not receive any proceeds from the sale of our Shares by the selling

securityholders. |

| |

|

|

| Risk Factors: |

|

The securities offered hereby involve a high degree of risk. See “Risk

Factors.” |

| |

|

|

| Nasdaq trading symbol: |

|

EJH |

RISK FACTORS

An investment in E-Home’s

securities involves a high degree of risk. We operate in a highly competitive environment in which there are numerous factors which can

influence our business, financial position, or results of operations and which can also cause the value of the securities being offered

to decline. Many of these factors are beyond our control and therefore, are difficult to predict. Prior to making a decision about investing

in E-Home’s securities, you should carefully consider the risk factors discussed in the sections entitled “Risk Factors”

contained in our most recent Annual Report on Form 20-F filed with the SEC and our other filings with the SEC and incorporated by reference

in this reoffer prospectus. If any of the risks or uncertainties described in our SEC filings or any additional risks and uncertainties

actually occur, our business, financial condition and results of operations could be materially and adversely affected. In that case,

the trading price of E-Home’s securities could decline, and you might lose all or part of your investment.

The following disclosure is intended to highlight,

update or supplement previously disclosed risk factors facing the Company set forth in the Company’s public filings. These risk

factors should be carefully considered along with any other risk factors identified in the Company’s other filings with the SEC.

Risks Related to our Business and Industry

Performance issues or an inability to provide

good customer service could adversely affect our business and harm our reputation.

The success of our business

hinges on our ability to provide quality performance and good customer service, which in turn depends on a variety of factors. These

factors include our ability to continue to offer our services at competitive prices, offer services that respond to evolving customer

tastes and demands, maintain the quality of our services, provide timely and reliable delivery of our services, flexible payment options

and good customer service following the provision of our services. If our services are not delivered on time, customers may refuse to

accept delivery. Any failure for our service providers to provide good customer service may negatively impact the experience of our customers,

damage our reputation and cause us to lose customers. If our customer service representatives, sales representatives or service providers

fail to provide satisfactory service, our brand and customer loyalty may be adversely affected. In addition, any negative publicity or

poor feedback regarding our customer service may harm our brand and reputation and in turn cause us to lose customers and market share.

We aim to provide customers

with a good customer service experience, including by providing our customers with access to a full suite of services conveniently through

our online platform. In addition, we seek to engage with our customers on an ongoing basis using online and offline channels. We cannot

assure you that our services or our efforts to engage with our customers using both our online and offline channels will be successful,

which could impact our revenue as well as our customer satisfaction and marketing. If we are unable to provide quality performance or

good customer service, our business and reputation may be materially and adversely impacted.

If we fail to retain existing or attract

new customers or service providers, our business, financial condition and prospects may be materially and adversely affected.

If we fail to retain existing or

attract new customers, or if we fail to retain quality existing or attract new service providers, our business, financial condition and prospects

may be materially and adversely affected. The success of our business depends on our ability to attract and retain new customers

to use our online platform and pay for our services, and to offer attractive services to our customers. If we are unable to grow and

maintain a healthy ecosystem of customers or service providers, our customers may find our online platform less useful than expected

and may not continue to use our services. This in turn may affect our ability to attract new customers and convince existing customers

to request future services or increase their level of spending on our services.

Our business could be adversely affected

if our customers are not satisfied with the services provided by our service providers.

Our business depends on our

ability to satisfy our customers, use and functionality of our online platform, and the services that are performed by our customer service

representatives and service providers. Services may be performed by our own staff, by a third party, or by a combination of the two.

Our strategy is to work with third parties to increase the breadth of capability of services through extensive training programs for

delivery of these services to our customers, and third parties provide almost all of our on-site services. If customers are not

satisfied with the quality of services performed by us or a third party or with the type of professional services delivered, then we

could incur additional costs to address the situation and the dissatisfaction with our services could damage our ability to expand our

service offerings. We must also align our service offerings and service provider operations in order to ensure that customers’

evolving needs are met. Negative publicity related to our customer relationships, regardless of its accuracy, may further damage our

business by affecting our ability to compete for new business with current and prospective customers.

Interruptions or delays in service from

our outside service providers could impair the delivery of our services and harm our business and reputation.

We depend upon outside service

providers to provide almost all of the on-site services to our customers. The occurrence of unanticipated problems with these third-party

service providers could result in unanticipated interruptions in the delivery of our services. Any significant loss in our

ability to communicate or any impediments to third-party service providers’ ability to provide services to our customers could

result in a disruption to our business. This, in turn, could lead to substantial liability to our customers, customer dissatisfaction,

loss of revenue and a material adverse effect on our business, our operating results and financial condition.

We face intense competition, and if we

do not compete successfully against existing and new competitors, we may lose market share and suffer losses.

The PRC home appliance and

housekeeping services industries are highly competitive, and we compete with a number of other companies that provide similar services.

Our ability to compete successfully and to manage our planned growth will depend primarily upon our ability to:

| |

● |

maintain the continuity in our management and key personnel; |

| |

● |

maintain our professional sales force; |

| |

● |

react to competitive services, pricing pressures and pricing promotions; |

| |

● |

improve the strength of our brand, brand awareness and reputation; |

| |

● |

maintain customer satisfaction; |

| |

● |

maintain the quality and speed of our service; |

| |

● |

increase the productivity of our customer service personnel and service providers; |

| |

● |

effectively market and sell our services; |

| |

● |

expand our service provider network and referrals; |

| |

● |

acquire and maintain new customers and services; |

| |

● |

respond to service requests in a timely fashion; |

| |

● |

expand our geographic segments and service provider network; |

| |

● |

pursue selective acquisitions; |

| |

● |

develop and improve our operational, financial and management controls; and |

| |

● |

develop and improve our information reporting systems and procedures. |

We compete in residential

and commercial services industries, focusing on home appliance installation and maintenance, home-moving, home cleaning, senior care

and smart community services, as well as sales of smart home supplementary merchandise. We compete with many other companies in the sale

of our services. Many of our competitors have greater financial, technical, product development, marketing and other resources than we

do. These organizations may be better known than we are and may have more customers or users than we do. We cannot provide assurance

that we will be able to compete successfully against these organizations, which may lead to lower customer satisfaction, decreased demand

for our services, loss of market share or reduction of operating profits.

We may not be able to effectively manage

our growth and expansion or implement our business strategies, in which case our business and results of operations may be materially

and adversely affected.

Our growth depends significantly

on the growth of the Chinese economy which has recently slowed and industry demand and our ability to:

| |

● |

expand our service offerings and diversify our customer base; |

| |

|

|

| |

● |

source sufficient levels of service providers to meet additional or existing customer needs; |

| |

|

|

| |

● |

successfully address competition challenges; |

| |

|

|

| |

● |

hire, train and retain a sufficient number of qualified personnel to manage growth and operations; |

| |

|

|

| |

● |

successfully maintain and develop relationships with strategic partners; |

| |

|

|

| |

● |

improve and expand our website and WeChat platform in an increasingly competitive environment; |

| |

|

|

| |

● |

drive traffic to our online platform through our planned expenditures and convert such traffic to

sales efficiently and effectively; |

| |

|

|

| |

● |

respond to changes in government policies that may impose restrictions on our business, including

privacy or other consumer protection laws; |

| |

|

|

| |

● |

keep up with changes in technology; and |

| |

|

|

| |

● |

successfully integrate our strategic acquisitions and investments. |

Such growth and expansion,

when they occur, will place increased demands on our management, operational and administrative resources. These increased demands and

operating complexities could cause us to operate our business less effectively, which, in turn, could cause a deterioration in our financial

performance and negatively impact our growth. Any planned growth will also require that we continually monitor and upgrade our management

information and other systems, as well as our infrastructure.

There can be no assurance

that we will be able to grow our business and achieve our goals. Even if we succeed in establishing new strategic partnerships, and further

expand our geographic footprint, we cannot assure that we will achieve planned revenue or profitability levels in the time periods estimated

by us, or at all. If any of these initiatives fails to achieve or is unable to sustain acceptable revenue and profitability levels, we

may incur significant costs.

Future strategic alliances or acquisitions

may have a material and adverse effect on our business, reputation and results of operations.

We may in the future enter

into strategic alliances with various third parties to further our business purposes from time to time. Strategic alliances with third

parties could subject us to a number of risks, including risks associated with sharing proprietary information, non-performance by the

counter-party, and an increase in expenses incurred in establishing new strategic alliances, any of which may materially and adversely

affect our business. In addition, to the extent the strategic partner suffers negative publicity or harm to their reputation from events

relating to their business, we may also suffer negative publicity or harm to our reputation by virtue of our association with such third

parties, and we may have little ability to control or monitor their actions. In addition, although we have no current acquisition plans,

if we are presented with appropriate opportunities, we may acquire additional assets, products, technologies or businesses that are complementary

to our existing business, including businesses that are owned or controlled by directors, officers, shareholders or their affiliates.

Future acquisitions and the

subsequent integration of new assets and businesses into our own would require significant attention from our management and could result

in a diversion of resources from our existing business, which in turn could have an adverse effect on our business operations. Acquired

assets or businesses may not generate the financial results we expect. Furthermore, acquisitions could result in the use of substantial

amounts of cash, potentially dilutive issuances of equity securities, the occurrence of significant goodwill impairment charges, amortization

expenses for other intangible assets and exposure to potential unknown liabilities of the acquired business. Moreover, the costs of identifying

and consummating acquisitions may be significant. We may also have to obtain approvals and licenses from the relevant government

authorities in the PRC for the acquisitions and to comply with any applicable PRC laws and regulations, which could result in increased

costs and delay.

Our expansion into new services, technologies

and geographic regions may expose us to new challenges and more competitive risks.

We may have limited or no

experience in our newer market segments, such as senior care services, and our customers may not adopt our new service offerings. These

service offerings may present new and difficult technology challenges, and we may be subject to claims if customers of these service

offerings experience quality issues or other issues. In addition, profitability, if any, in our newer activities may be lower than in

our older activities, and we may not be successful enough in these newer activities to recoup our investments in them. If any of this

were to occur, it could damage our reputation, limit our growth, and negatively affect our operating results.

If we are unable to conduct marketing activities

cost-effectively, or if our customer acquisition costs increase or costs associated with serving our customers increase, our results

of operations and financial condition may be materially and adversely affected.

We have incurred significant

expenses on a variety of advertising and brand promotion initiatives designed to enhance our brand recognition, acquire new customers

and increase sales of our services. We incurred $11,989,918, $10,279,274 and $7,514,211 of sales and marketing expenses in

fiscal years ended June 30, 2022, 2021 and 2020, respectively. We expect to continue to spend significant amounts to acquire additional

customers and retain existing customers, primarily through advertising and brand promotion initiatives. We market our brand and services

through multiple channels, both online and offline. Online marketing is mainly done through WeChat events. Offline services are mainly

promoted by clients from communities, institutions, training agencies and firms through peer-to-peer marketing. We also aim to deliver

premium services to garner strong word-of-mouth referrals and enhance our brand recognition.

Our decisions regarding investments

in customer acquisition are based upon our analysis of the revenue we have historically generated per customer over the expected lifetime

value of the customer. Our analysis of the revenue that we expect a customer to generate over his or her lifetime depends upon several

estimates and assumptions, including the demographic groups of the customers, whether a customer will make a second service order, whether

a customer will make multiple service orders in a month, average sales per order and the predictability of a customer’s purchase

pattern. Our experience in markets or customer demographic groups in which we presently have low penetration rates may differ from our

more established markets.

Our brand promotion and marketing

activities may not be as effective as we anticipate. If our estimates and assumptions regarding the revenue we can generate from customers

prove incorrect, or if the revenue generated from new customers differs significantly from that of existing customers, we may be unable

to recover our customer acquisition costs or generate profits from our investment in acquiring new customers. Moreover, if our customer

acquisition costs or other operating costs increase, the return on our investment may be lower than we anticipate irrespective of the

revenue generated from new customers. If we cannot generate profits from this investment, we may need to alter our growth strategy, and

our growth rate and results of operations may be harmed. In addition, marketing approaches and tools in the household services market

in China are evolving, which require us to keep pace with industry developments and changing preferences. Failure to refine our existing

marketing approaches or to introduce new marketing approaches in a cost-effective manner could reduce our market share, cause our net

revenue to decline and negatively impact our profitability, if any.

If our senior management is unable to work

together effectively or efficiently or if we lose their services, our business may be severely disrupted.

Our success heavily depends

upon the continued services of our senior management. In particular, we rely on the expertise and experience of Wenshan Xie, our

Chairman and Chief Executive Officer, Chunsheng Zhu, our Chief Financial Officer and Director, as well as other senior officers. If our

senior management cannot work together effectively or efficiently, our business may be severely disrupted. If one or more of

our senior management were unable or unwilling to continue in their present positions, we might not be able to replace

them easily or at all, and our business, financial condition and results of operations may be materially and adversely affected. If any

of our senior management joins a competitor or forms a competing business, we may lose customers, service providers, know-how

and key professionals and staff members. Our senior management has entered into employment agreements and confidentiality and

non-competition agreements with us. However, if any dispute arises between our officers and us, we may have to incur substantial costs

and expenses in order to enforce such agreements in China or we may be unable to enforce them at all.

In addition, while we formulate

the overall business strategy at our headquarters, we also give latitude to our subsidiaries to manage the daily operations. We cannot

assure you that communications between the senior management team and the local management teams will always be effective,

or the executions at the local levels will always have the results that the senior management team expects.

Non-payment by our end customers or service

providers could adversely affect our revenues and profitability if we experience difficulties in collecting our receivables.

As a provider of home appliance

services and housekeeping services, we depend upon the services provided by service providers to end customers and the collection of

receivables from these customers. When our end customers place orders online for services, they pay either a required visit fee

or the estimated full amount of service fee through third-party payment platforms, such as WeChat Pay and Alipay. After the service

is rendered, our service provider will facilitate the collection of any unpaid balance of service fee from the end customer. Our

customers are normally asked to pay such balance through WeChat Pay or Alipay to our accounts so that we receive the payments immediately.

If the customer does not have WeChat or Alipay accounts, our service providers will accept cash payments from them. The service providers

will then have thirty days to wire the payments to the bank accounts designated by us according to the agreement that we entered into

with them. If the end customer refuses to pay, we will communicate directly with the end customer. Depending on the reasons for

non-payment, we may either request the service provider to fix the service problems or request the ender customer to pay. If the

end user continues to fail to pay after a satisfactory service is provided and the service provider is unable to collect payment from

the end customer, the service provider has no obligation to pay us, nor are we obligated to pay the service provider. We are also

at risk in the event that the service provider collects cash from the end customers and does not remit it to us. We will treat the failure

of payment by the end customer as a bad debt. While we have not experienced collection problems from end customers or service

providers in the past, we may incur significant write-offs if a significant number of our end customers fail to pay their outstanding

balances or our service providers fail to remit the cash to us, which could adversely affect our revenues and profitability.

Any change, disruption, discontinuity in

the features and functions of our online platform, including our failure to enhance and upgrade when needed, can be disruptive and may

negatively impact our revenue.

Defects or disruptions in

our hosted software, including our website or WeChat platform, could result in service disruptions for our customers. Our network performance

and service levels could be disrupted by numerous events, including natural disasters and power losses. We might inadvertently operate

or misuse the system in ways that could cause a service disruption for some or all of our customers. We might have insufficient

redundancy or server capacity to address any such disruption, which could result in interruptions in our services or

degradation of our service levels. Our customers might use our hosted software in ways that cause a service disruption for

other customers. These defects or disruptions could undermine confidence in our services and cause us to lose

customers or make it more difficult to attract new ones, either of which could have a material adverse effect on our results

of operations and cash flow.

In addition, as we continue

to increase the number of customers and users on our platform, we will need to increase the capacity of our infrastructure. If we do

not increase our capacity in a timely manner, customers could experience interruptions or delays in access to our online platform,

and we may not be able to retain or attract customers. Any damage to, or failure of, our online platform could result in interruptions in

service. Interruptions in our service may reduce our revenue, cause us to issue refunds, subject us to claims and litigation, cause

our customers to terminate their services, and adversely affect our ability to attract new customers. Our business will also be harmed

if our customers and potential customers believe our platform is unreliable.

Our operations depend on the performance

of the internet infrastructure and fixed telecommunications networks in China.

Almost all access to the

internet in China is maintained through state-owned telecommunication operators under the administrative control and regulatory supervision

of the Ministry of Industry and Information Technology. We primarily rely on a limited number of telecommunication service providers

to provide us with data communications capacity through local telecommunications lines and internet data centers to host our servers.

We may have limited access to alternative networks or services in the event of disruptions, failures or other problems with China’s

internet infrastructure or the fixed telecommunications networks provided by telecommunication service providers. With the expansion

of our business, we may be required to upgrade our technology and infrastructure to keep up with increasing traffic. We cannot assure

you that our cloud computing service provider and the underlying internet infrastructure and the fixed telecommunications networks in

China will be able to support the demand associated with the continued growth in internet usage. In addition, we have no control over

the costs of the services provided by telecommunication service providers which in turn, may affect our costs of using customized cloud

computing services. If the prices we pay for customized cloud computing services rise significantly, our results of operations may be

adversely affected. Furthermore, if internet access fees or other charges to internet users increase, our user traffic may decline and

our business may be harmed.

Any failure to protect our intellectual

property rights could impair our ability to protect our proprietary technology and our brand.

We regard our trademarks,

domain names, copyrights, know-how, proprietary technologies and similar intellectual property as critical to our success, and we rely

on trademark and trade secret laws and confidentiality, invention assignment and non-compete agreements with our employees and others

to protect our proprietary rights. Any unauthorized use of our trademarks and other intellectual property rights could harm our competitive

advantages and business. Historically, China has not protected intellectual property rights to the same extent as the United States and

infringement of intellectual property rights continues to pose a serious risk of doing business in China. Monitoring and preventing

unauthorized use is difficult. The measures we take to protect our intellectual property rights may not be adequate. Furthermore, the

application of laws governing intellectual property rights in China and abroad is uncertain and evolving, and could involve substantial

risks to us. If we are unable to adequately protect our brand, trademarks and other intellectual property rights, we may lose these rights

and our business may suffer materially. As internet domain name rights are not rigorously regulated or enforced in China, other companies

may incorporate in their domain names elements similar in writing or pronunciation to our company name or its Chinese equivalents. This

may result in confusion between those companies and our company and may lead to the dilution of our brand value,

which could adversely affect our business.

Any disruption in our information systems

could disrupt our future operations and could adversely impact our business and results of operations.

We depend on various information

systems to support our customers’ service orders and to successfully manage our business, including managing orders, accounting

controls, payroll, among other things. Any inability to successfully manage the procurement, development, implementation or execution

of our information systems and back-up systems, including matters related to system security, reliability, performance and access, as

well as any inability of these systems to fulfill their intended purpose within our business, could have an adverse effect on our business

and results of operations.

The wide variety of payment methods that

we accept subjects us to third-party payment processing-related risks.

We accept payments using

a variety of methods, including online payments with credit cards and debit cards issued by major banks in China, and payment through

third-party online payment platforms such as WeChat Pay. For certain payment methods, including credit and debit cards, we pay interchange

and other fees, which may increase over time and raise our operating costs and lower our profit margins. We may also be susceptible to

fraud and other illegal activities in connection with the various payment methods we offer. We are also subject to various rules, regulations

and requirements, regulatory or otherwise, governing electronic funds transfers which could change or be reinterpreted to make it difficult

or impossible for us to comply. If we fail to comply with these rules or requirements, we may be subject to fines and higher transaction

fees and become unable to accept credit and debit card payments from our customers, or facilitate other types of online payments, and

our business, financial condition and results of operations could be materially and adversely affected.

We may need additional capital, and the

sale of other equity securities could result in additional dilution to our shareholders, and the incurrence of additional indebtedness could increase

our debt service obligations.

We believe that our current

cash and cash equivalents and anticipated cash flow from operations should be sufficient to meet our anticipated cash needs for the foreseeable

future. We may, however, require additional cash resources due to changed business conditions or other future developments,

including any investments or acquisitions that we may decide to pursue. If these resources are insufficient to satisfy our cash requirements,

we may seek to issue additional shares or debt securities or to obtain a credit facility. The sale of additional equity and equity-linked securities

could result in additional dilution to our shareholders. The incurrence of indebtedness would result in increased

debt service obligations and could result in operating and financing covenants that would restrict our operations. Our ability

to obtain additional financing will be subject to a number of factors, including general market conditions, government approvals,

investor acceptance of our plan of operations and results from our business operations. We cannot assure you that financing

will be available in amounts or on terms acceptable to us, if at all.

We face risks related to natural disasters,