Dyadic International, Inc. (“Dyadic”, “we”, “us”, “our”, or the

“Company”) (NASDAQ: DYAI), a global biotechnology company focused

on building innovative microbial platforms to address the growing

demand for global protein bioproduction and unmet clinical needs

for effective, affordable, and accessible biopharmaceutical

products and alternative proteins for human and animal health,

today announced its financial results for the third quarter of

2023, and highlighted recent company developments.

“Dyadic’s business strategy to focus on near

term applications for our proprietary and patented C1 and Dapibus™

protein production platforms and pipeline product opportunities is

showing significant increased interest and inbound new projects”,

said Mr. Mark Emalfarb, President and CEO of Dyadic. “Launching our

Dapibus™ platform for non-pharmaceutical applications less than 10

months ago, we have already signed a number of agreements,

including with Fermbox Bio in the second quarter and with an enzyme

development company in the third quarter where in October we

received $600,000 for the development and commercialization of

select animal-free recombinant products. The progress we have made

with our recombinant serum albumin product pipeline demonstrates

our continued focus on products with near-term commercial

potential, shorter development timelines and lower production

costs. We have developed stable cell lines for the production of

recombinant serum albumin at high productivity levels that in

initial testing has shown analytical comparability to reference

standard samples of currently marketed products. These products,

and other projects in development align with our strategy to

improve our revenue outlook while we continue to increase the

adoption of C1 for the higher margin applications of human

preventative and therapeutic biological vaccines and drugs to

combat infectious and other diseases.”

Mr. Emalfarb continued, “We are continuing to

engage with large pharmaceutical and biotech companies, academic

institutions, and governmental agencies, and other commercial

organizations. We are very pleased to see increased interest in our

proprietary and patented C1-cell protein production platform to

develop vaccines and drugs, such as monoclonal antibodies for

commercialization. Examples of this include the funded research and

development project with a top 5 pharmaceutical company to express

a vaccine antigen from C1 for human health in a large infectious

disease segment, as well as our collaboration with the Vaccine and

Immunotherapy Center at Massachusetts General Hospital as part of

US $5.88 Million Department of Defense grant.”

“We are continuing our pursuit of additional

vaccine and drug development opportunities. We believe the safety

data being generated in our DYAI-100 phase 1 clinical trial,

coupled with our non-human primate study, are pivotal points in the

Company’s evolution from a commercial success in industrial biotech

to realizing our capability as a life-science biotechnology

company,” concluded Mr. Emalfarb.

Recent Company

Progress

DYAI-100 SARS-CoV-2

RBD (Receptor

Binding Domain)

Booster Vaccine

Candidate

- Phase 1 clinical trial, last patient

last visit occurred in September, data lock achieved on November 1,

2023 and top-line results are expected in December 2023 with full

study report to follow.

- No major vaccine-related safety

concerns for both low and high dose groups reviewed by the Data

Safety Monitoring Board (DSMB).

- To date, no serious adverse events or

adverse events of special interest have been observed.

- Interim phase 1 clinical trial

safety results are helping to accelerate the adoption of our C1

protein production platform in use for manufacturing human

vaccines.

VIC at

Massachusetts General

Hospital – On October 25, 2023, the Company

announced that it has entered into a new research collaboration

with Vaccine and Immunotherapy Center (“VIC”) at Massachusetts

General Hospital to express vaccine antigens for influenza A and

other infectious diseases, as part of US $5.88 million awards from

the Department of Defense (“DoD”).

bYoRNA SAS

(“bYoRNA”) – On

September 26, 2023, the Company entered into a development and

commercialization agreement with bYoRNA combining bYoRNA’s novel

eukaryotic “bio” RNA platform with Dyadic’s industrially proven C1

protein production platform to provide the pharmaceutical industry

with a potentially more cost-efficient platform for manufacturing

large quantities of lower cost mRNA, enabling access to mRNA

vaccines and drugs to a broader global population.

Animal-free

Dairy Enzymes – On September 18,

2023, the Company signed a development and license agreement to

develop and commercialize certain non-animal dairy enzymes used in

the production of food products using Dapibus™. In October 2023,

the Company received an upfront payment of $0.6 million for product

development. Dyadic is also eligible to receive certain potential

success fees, milestones, and royalties.

New Fully

Funded Collaborations - In the

third quarter, the Company entered into a number of new fully

funded research collaborations in the follow areas:

- Development of an enzyme for

dispersion and absorption of injected drugs to reduce tissue

damage;

- Development and commercialization

agreement with a multinational pharmaceutical company to develop

multiple C1 cell lines to produce monoclonal antibodies targeting

infectious diseases;

- Development of a C1 cell line for a

monoclonal antibody against Filoviruses such as Ebola and

Marburg.

Multiple Preclinical

Animal Studies

- C1 expressed adjuvanted ferritin

nanoparticle H5N1 antigen targeting pandemic influenza (H5N1/Bird

Flu) showed high neutralizing antibody and hemagglutinin inhibition

(HI) levels.

- C1 expressed adjuvanted MHCII H1N1

antigen targeting seasonal influenza showed high neutralizing

antibody levels.

- C1 expressed adjuvanted Full Spike

SARS-CoV-2 antigen showed high neutralizing antibody levels after

single dose.

On-going Research

and Development

Collaborations

- The Company signed MoUs with

Essential Drugs Company Limited (EDCL) in Bangladesh and Fondazione

Biotecnopolo di Siena (“FBS”) in Italy and are currently

negotiating for formal contracts.

- The Company continues to develop C1

expressed vaccine antigens for human health in a large infectious

disease segment with a Top 5 pharmaceutical company, and other

research collaborations with Uvax Bio and Virovax Bio.

- The Company has on-going

collaborations with Phibro animal health/Abic Biological

Laboratories, Rubic One Health and entered a fully funded research

and development project with a new animal health company for

livestock animals.

- The Company is continuing its

development of innovative animal free alternative proteins,

including cellulosic enzymes for renewable biofuels with Fermbox

Bio and pulp and paper processing.

Advancement of

Pharmaceutical and

Non-pharmaceutical Product

Pipeline

- The Company is making progress in

developing animal-free recombinant serum albumin with initial

positive analytical results towards commercialization and

prospective licensing opportunities.

- The Company is continuing its

development cell culture media and other proteins and enzymes for

multiple applications.

Corporate Development

The Company expanded its leadership team and appointed Doug Pace

as its Executive Vice President for Business Development to support

its increased business development activities and accelerated

timeline.

Financial

Highlights

Cash Position:

As of September 30, 2023, cash, cash equivalents, and the carrying

value of investment grade securities, including accrued interest,

were approximately $8.2 million compared to $12.7 million as of

December 31, 2022.

Revenue: Research and

development revenue and license revenue for the three months ended

September 30, 2023, decreased to approximately $397,000 compared to

$880,000 for the same period a year ago. The decrease in research

and development revenue was due to several research projects

winding down or on hold as a result of a laboratory relocation at a

major contract research organization. Research and development

revenue and license revenue for the nine months ended September 30,

2023, slightly increased to approximately $2,212,000 compared to

$2,187,000 for the same period a year ago.

Cost of

Revenue: Cost of research and development revenue

for the three months ended September 30, 2023, decreased to

approximately $106,000 compared to $603,000 for the same period a

year ago. The decrease in cost of research and development revenue

was due to several research projects winding down or on hold as a

result of a laboratory relocation at a major contract research

organization. Cost of research and development revenue for the nine

months ended September 30, 2023, increased to approximately

$1,626,000 compared to $1,419,000 for the same period a year

ago.

R&D

Expenses: Research and development expenses for

the three months ended September 30, 2023, decreased to

approximately $716,000 compared to $744,000 for the same period a

year ago. Research and development expenses for the nine months

ended September 30, 2023, decreased to approximately $2,444,000

compared to $3,917,000 for the same period a year ago. The decrease

primarily reflected the winding down of activities related to the

Company’s Phase 1 clinical trial of DYAI-100 COVID-19 vaccine

candidate as patient dosing was completed in February 2023.

G&A

Expenses: General and administrative expenses for

the three months ended September 30, 2023, decreased by 7.3% to

approximately $1,282,000 compared to $1,383,000 for the same period

a year ago. The decrease principally reflected decreases in

business development and investor relations expenses of

approximately $55,000, insurance expenses of $41,000, and legal

expenses of $27,000, offset by other increases of $22,000.

General and administrative expenses for the nine

months ended September 30, 2023, decreased by 12.4% to

approximately $4,165,000 compared to $4,753,000 for the same period

a year ago. The decrease principally reflected decreases in

business development and investor relations expenses of

approximately $192,000, accrued expenses related to management

incentives of $172,000, insurance expenses of $113,000, legal

expenses of $75,000 and other decreases of $36,000.

Net Loss: Net

loss for the three months ended September 30, 2023, was

approximately $1,614,000 or $(0.06) per share compared to

$1,809,000 or $(0.06) per share for the same period a year ago. Net

loss for the nine months ended September 30, 2023, was

approximately $4,724,000 or $(0.16) per share compared to

$7,589,000 or $(0.27) per share for the same period a year ago.

Conference Call

Information

Date: Wednesday, November 8, 2023 at 5:00 p.m.

Eastern Time Dial-in numbers: Toll Free

844-826-3033, International +1-412-317-5185Conference

ID: 10183803 Webcast Link:

https://viavid.webcasts.com/starthere.jsp?ei=1593556&tp_key=ec162fd8d6

An archive of the webcast will be available

within 24 hours after completion of the live event and will be

accessible on the Investor Relations section of the Company’s

website at www.dyadic.com. To access the replay of the webcast,

please follow the webcast link above.

About Dyadic

International, Inc.

Dyadic International, Inc. is a global

biotechnology company focused on building innovative microbial

platforms to address the growing demand for global protein

bioproduction and unmet clinical needs for effective, affordable,

and accessible biopharmaceutical products and alternative proteins

for human and animal health.

Dyadic’s gene expression and protein production

platforms are based on the highly productive and scalable fungus

Thermothelomyces heterothallica (formerly Myceliophthora

thermophila). Our lead technology, C1-cell protein production

platform, is based on an industrially proven microorganism (named

C1), which is currently used to speed development, lower production

costs, and improve performance of biologic vaccines and drugs at

flexible commercial scales for the human and animal health markets.

Dyadic has also developed the Dapibus™ filamentous fungal based

microbial protein production platform to enable the rapid

development and large-scale manufacture of low-cost proteins,

metabolites, and other biologic products for use in

non-pharmaceutical applications, such as food, nutrition, and

wellness.

With a passion to enable our partners and

collaborators to develop effective preventative and therapeutic

treatments in both developed and emerging countries, Dyadic is

building an active pipeline by advancing its proprietary microbial

platform technologies, including our lead asset DYAI-100 COVID-19

vaccine candidate, as well as other biologic vaccines, antibodies,

and other biological products.

To learn more about Dyadic and our commitment to

helping bring vaccines and other biologic products to market

faster, in greater volumes and at lower cost, please visit

www.dyadic.com.

Safe Harbor

Regarding Forward-Looking

Statements

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934,

including those regarding Dyadic International’s expectations,

intentions, strategies, and beliefs pertaining to future events or

future financial performance, such as the success of our clinical

trial and interest in our protein production platforms, our

research projects and third-party collaborations, as well as the

availability of necessary funding. Actual events or results may

differ materially from those in the forward-looking statements

because of various important factors, including those described in

the Company’s most recent filings with the SEC. Dyadic assumes no

obligation to update publicly any such forward-looking statements,

whether because of new information, future events or otherwise. For

a more complete description of the risks that could cause our

actual results to differ from our current expectations, please see

the section entitled “Risk Factors” in Dyadic’s annual reports on

Form 10-K and quarterly reports on Form 10-Q filed with the SEC, as

such factors may be updated from time to time in Dyadic’s periodic

filings with the SEC, which are accessible on the SEC’s website and

at www.dyadic.com.

Contact:

Dyadic International, Inc.Ping Rawson, Chief

Financial OfficerPhone: 561-743-8333Email: ir@dyadic.com

|

DYADIC INTERNATIONAL,

INC. AND

SUBSIDIARIES |

|

CONSOLIDATED STATEMENTS

OF OPERATIONS |

| |

|

|

|

Three Months Ended September 30, |

|

|

|

Nine Months Ended September 30, |

|

|

|

|

2023 |

|

|

2022 |

|

|

|

2023 |

|

|

2022 |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development revenue |

$ |

352,942 |

|

$ |

835,480 |

|

|

$ |

2,079,918 |

|

$ |

1,983,636 |

|

|

License revenue |

|

44,118 |

|

|

44,117 |

|

|

|

132,353 |

|

|

202,941 |

|

| Total

revenue |

|

397,060 |

|

|

879,597 |

|

|

|

2,212,271 |

|

|

2,186,577 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Costs

and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs of research and development revenue |

|

105,869 |

|

|

602,847 |

|

|

|

1,625,731 |

|

|

1,418,702 |

|

|

Research and development |

|

716,351 |

|

|

743,585 |

|

|

|

2,444,469 |

|

|

3,917,245 |

|

|

General and administrative |

|

1,282,361 |

|

|

1,383,433 |

|

|

|

4,164,970 |

|

|

4,753,162 |

|

|

Foreign currency exchange loss |

|

12,600 |

|

|

13,205 |

|

|

|

38,143 |

|

|

23,578 |

|

| Total

costs and

expenses |

|

2,117,181 |

|

|

2,743,070 |

|

|

|

8,273,313 |

|

|

10,112,687 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from

operations |

|

(1,720,121 |

) |

|

(1,863,473 |

) |

|

|

(6,061,042 |

) |

|

(7,926,110 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other

income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

105,862 |

|

|

54,300 |

|

|

|

319,787 |

|

|

87,277 |

|

|

Other income |

|

— |

|

|

— |

|

|

|

1,017,592 |

|

|

250,000 |

|

| Total other

income |

|

105,862 |

|

|

54,300 |

|

|

|

1,337,379 |

|

|

337,277 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

loss |

$ |

(1,614,259 |

) |

$ |

(1,809,173 |

) |

|

$ |

(4,723,663 |

) |

$ |

(7,588,833 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted net loss per

common share |

$ |

(0.06 |

) |

$ |

(0.06 |

) |

|

$ |

(0.16) |

|

$ |

(0.27 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted

weighted-average common shares outstanding |

|

28,811,061 |

|

|

28,391,894 |

|

|

|

28,794,712 |

|

|

28,302,332 |

|

See Notes to Consolidated Financial Statements in

Item 1 of Dyadic’s Quarterly Report on Form 10-Q filed with the

Securities and Exchange Commission on November 8, 2023.

|

DYADIC INTERNATIONAL, INC. AND SUBSIDIARIES |

|

CONSOLIDATED BALANCE SHEETS |

|

|

|

|

|

|

|

|

September 30,

2023 |

|

|

|

December 31,

2022 |

|

| |

|

|

(Unaudited) |

|

|

|

(Audited) |

|

| Assets |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

7,403,176 |

|

|

$ |

5,794,272 |

|

| Short-term investment

securities |

|

|

772,804 |

|

|

|

6,847,270 |

|

| Interest receivable |

|

|

9,822 |

|

|

|

58,285 |

|

| Accounts receivable |

|

|

417,878 |

|

|

|

330,001 |

|

| Prepaid expenses and other

current assets |

|

|

484,188 |

|

|

|

392,236 |

|

| Total current assets |

|

|

9,087,868 |

|

|

|

13,422,064 |

|

| |

|

|

|

|

|

|

|

|

| Non-current assets: |

|

|

|

|

|

|

|

|

| Operating lease right-of-use

asset, net |

|

|

153,112 |

|

|

|

— |

|

| Investment in Alphazyme |

|

|

— |

|

|

|

284,709 |

|

| Other assets |

|

|

14,586 |

|

|

|

6,045 |

|

| Total

assets |

|

$ |

9,255,566 |

|

|

$ |

13,712,818 |

|

| |

|

|

|

|

|

|

|

|

| Liabilities

and stockholders’

equity |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

600,148 |

|

|

$ |

1,276,313 |

|

| Accrued expenses |

|

|

620,242 |

|

|

|

955,081 |

|

| Deferred research and

development obligations |

|

|

13,897 |

|

|

|

40,743 |

|

| Deferred license revenue,

current portion |

|

|

176,471 |

|

|

|

176,471 |

|

| Operating lease liability,

current portion |

|

|

46,599 |

|

|

|

— |

|

| Total current liabilities |

|

|

1,457,357 |

|

|

|

2,448,608 |

|

| |

|

|

|

|

|

|

|

|

| Deferred license revenue, net

of current portion |

|

|

44,118 |

|

|

|

176,471 |

|

| Operating lease liability, net

of current portion |

|

|

101,567 |

|

|

|

— |

|

| Total liabilities |

|

|

1,603,042 |

|

|

|

2,625,079 |

|

| |

|

|

|

|

|

|

|

| Commitments and contingencies

(Note 4) |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

Preferred stock, $.0001 par value: |

|

|

|

|

|

|

|

Authorized shares - 5,000,000; none issued and outstanding |

|

— |

|

|

|

— |

|

|

Common stock, $.001 par value: |

|

|

|

|

|

|

|

Authorized shares - 100,000,000; issued shares - 41,064,563 and

40,816,602, outstanding shares - 28,811,061 and28,563,100 as of

September 30, 2023, and December 31, 2022, respectively |

|

41,065 |

|

|

|

40,817 |

|

|

Additional paid-in capital |

|

104,746,897 |

|

|

|

103,458,697 |

|

|

Treasury stock, shares held at cost - 12,253,502 |

|

(18,929,915 |

) |

|

|

(18,929,915 |

) |

|

Accumulated deficit |

|

(78,205,523 |

) |

|

|

(73,481,860 |

) |

| Total

stockholders’ equity |

|

7,652,524 |

|

|

|

11,087,739 |

|

|

Total liabilities

and stockholders’

equity |

$ |

9,255,566 |

|

|

$ |

13,712,818 |

|

See Notes to Consolidated Financial Statements in

Item 1 of Dyadic’s Quarterly Report on Form 10-Q filed with the

Securities and Exchange Commission on November 8, 2023.

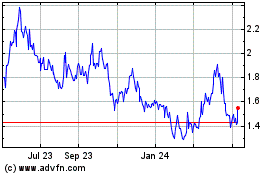

Dyadic (NASDAQ:DYAI)

Historical Stock Chart

From Apr 2024 to May 2024

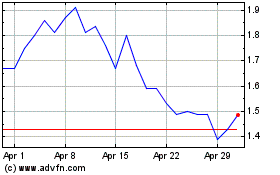

Dyadic (NASDAQ:DYAI)

Historical Stock Chart

From May 2023 to May 2024