UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

N-CSR

CERTIFIED

SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT

COMPANIES

INVESTMENT

COMPANY ACT FILE NUMBER 811-22684

DAXOR

CORPORATION

(Exact

name of registrant as specified in charter)

109

Meco Lane

Oak

Ridge, TN 37830

(Address

of principal executive offices) (Zip code)

Michael

Feldschuh

109

Meco Lane

Oak

Ridge, TN 37830

(Name

and address of agent for service)

REGISTRANT’S

TELEPHONE NUMBER, INCLUDING AREA CODE: 212-330-8500

DATE

OF FISCAL YEAR END: DECEMBER 31

DATE

OF REPORTING PERIOD: JANUARY 1, 2023 to JUNE 30, 2023

Daxor

Corporation

Financial

Statements (Unaudited)

For

the Six Months Ended

June

30, 2023

Table

of Contents

Exhibits

Daxor

Corporation

August

28, 2023

Dear

Fellow Shareholders:

There

are rare times in a business when multiple efforts converge leading to opportunity that is greater than the sum of its parts. For Daxor,

now is just such a time. The company is focused on profoundly improving outcomes for tens of millions of patients as well as the hospital

systems and the payers which support the system by solving a central problem of medicine – providing highly accurate, convenient,

and rapid knowledge of patient blood volume. Managing blood volume is the cornerstone of care for some of the largest areas of patient

care – heart failure, sepsis, post-surgical blood loss and syncope to cite a few, but this urgent medical need has been hampered

using surrogate markers, not direct measurement, of the blood volume. Many of these markers are costly, some are invasive, and none are

accurate – in contrast to Daxor’s 98% accurate system. Care teams cannot effectively treat what they do not correctly diagnose,

so a rapid accurate diagnostic is a game-changer. Every metric that matters is impacted from this first principle of accurate diagnosis

– patients receiving optimal care are treated more quickly with better outcomes, have shorter lengths of stay in the hospital,

suffer fewer costly readmissions, and have lower mortality and fewer complications in the long run. This leads to better results for

patients, hospitals, and insurers on both a health and economic level.

So,

what is the convergence of efforts that has Daxor Management so excited? A new portable point-of-care analyzer capable of giving blood

volume results in as little as 15 minutes at the patient bedside to replace the lab-based BVA-100® (Blood Volume Analyzer) in current

use, compelling new clinical and health economic outcomes, additional funding from the U.S. Department of Defense (DoD) and National

Institutes of Health (NIH) for further technology development and clinical trials, and partnerships with medical societies and key opinion

leaders to shape the discourse and guidelines on the need for direct blood volume analysis to become the standard of care. These efforts

are happening as Daxor continues to expand its commercial adoption among leading academic medical centers with innovations such as our

new reference lab service and growth of our intellectual property (IP) portfolio with more than half a dozen patents pending. It is the

convergence of these efforts leading to the growing awareness that one of the thorniest problems in medicine has a new solution which

is a paradigm shift benefiting all parts of the healthcare system.

It

is my pleasure to report on Daxor’s results for the mid-year ended June 30, 2023. For the fourth year in a row our operating business

is experiencing continued growth and development — increasing revenues from commercialization, great progress in research and development

for our next-generation systems set for potential approval at the end of this year, and a growing body of clinical evidence from leading

research centers of the unique value of our diagnostic to save lives and vastly improve patient health and hospital economic outcomes.

The opportunity for our business is to scale into the total serviceable market of more than ten million tests per year in the United

States alone through organic growth, partnership, and joint ventures.

I

have written in the past that to realize that promise and the enormous market potential for our products requires the company to execute

on three key areas of performance: strong commercialization, next-generation product development, and continued clinical outcomes. I

am pleased to report that in 2023 we continue building on our focus in each of these key areas.

As

of June 30, 2023, Daxor’s net assets were $30,359,013 or $6.33 per share as compared to $28,969,469, or $6.75 per share on December

31, 2022. This increase in net assets is primarily due to the public offering during the six-month period ended June 30, 2023, whereby

Daxor raised $4.1 million, net to Daxor by selling 464,599 shares at $9.75. The net asset value per share was adjusted to account for

the addition of 464,599 shares to the float of the stock. For the six-month period ended June 30, 2023, Daxor had net dividend income

of $77,990, and net realized gains on investment activity of $603,661. There was a net decrease in the unrealized appreciation on investments,

of $760,280 as we sold positions during 2023 and prior period’s significant unrealized gains unwound into the gains for the period.

Included in the Net Decrease in Net Assets Resulting from Operations of $3,037,182 is non-cash stock-based compensation expense of $324,273

in an effort to provide incentive to employees, officers, agents, and consultants through proprietary interest in the company. There

was a net realized loss of $2,445,170 from the operating division relating to spending on research, development, sales and overhead as

the Company continues to invest judiciously in research and development for our 2023 product launch, ramping the commercial sales teams,

as well as production facilities for our next generation blood volume analyzers.

Focusing

further on the operating division financial performance, the Company is pleased to report a 20.64 percent increase in the unaudited revenues

of our single-use test kits for the six-month period ended June 30, 2023, as compared to the six-month period ended June 30, 2022. Revenue

growth was driven by a combination of the sale and leasing of our capital equipment to hospitals and orders for our single-use blood

volume diagnostics kits for heart failure management, critical care use, among other indications. Daxor added eight new accounts during

the six-month period ended June 30, 2023. Many of these new accounts are just beginning to ramp up as they integrate our diagnostic into

their treatment protocols and the need for our product has never been greater – heart failure patients are set to rise from the

current 6 million to more than 8 million in the next six years as the baby boom generation ages and hospitals are under increasing pressure

to improve outcomes and contain costs.

In

June of this year Daxor launched its new ezBVA Lab service for clinical sites that wish to perform BVA testing using Daxor’s lab

services without the need for an on-site analyzer. This new service, priced at $965 per test, represents a significant value for customers

and is a premium to the sale of a test kit which sells for $385. The company is paid for performing the lab analysis and the customer

requires little overhead and reduced labor to administer the test. This new service has a building pipeline of customers in the on-boarding

process, and management anticipates signing new customers at a rate of approximately one a month going forward given the initial demand

for the product. This effort is a faster sales cycle and has attractive margins for the company and is complementary to the launch of

our next generation analyzer which management anticipates being priced at a similar level. Increasing the value of our offerings and

the associated revenue is a priority for the company to drive growth in both absolute terms and on a profit per unit sold metric.

Daxor

anticipates submission and review by the FDA of its next generation analyzer under a 510-K/CLIA dual submission pathway by the end of

this year. Validation has been underway at several sites since Q1, and the study has been proceeding according to plan although enrollment

at some centers has been slower than Management initially anticipated. This point-of-care blood volume analysis system, developed under

multiple contracts with the U.S. DoD, as well as grants from the NIH, is a significant leap forward in our market-leading technology.

Daxor developed the new analyzer under contract with the U.S. DoD in 2022, and successfully demonstrated a manufacture-ready prototype

that was specified to be equivalent to the current 510(k) cleared BVA-100 unit in terms of accuracy and capabilities. This new system

has been measured to be three times faster, simpler, battery powered and capable of being a full point-of-care CLIA-waived device. Our

development for a model utilizing a novel fluorescent marker is also ongoing under U.S. DoD contract for use in new care settings beyond

our current systems. Daxor met with the FDA in the fall of 2022 to discuss its pre-submission data for a 510(k)/CLIA dual pathway. Management

was able to ask questions and receive guidance from the agency on a validation plan and application pathway to satisfy regulatory requirements.

Daxor is currently executing the validation of the prototype system with clinical partners to satisfy FDA standards and intends to submit

its application with a goal of receiving approval by the end of 2023. Driving this important project is our Vice President of Development

and Operations, Linda Cooper - a seasoned professional with a background in bioengineering as well as extensive regulatory experience

with the FDA. For us, it is no exaggeration that this next generation analyzer is our most important product launch in twenty years and

has the potential to deliver a level of speed, access, and accuracy to fluid and blood volume management that can broadly change medicine.

Management

anticipates that upon approval there will be significant interest and uptake of the new system based upon preliminary discussions with

clinicians advising Daxor in the development of the technology as well as an increase in disposable kit sales driven by the speed and

convenience of the new system. Daxor’s next generation devices will also be eligible for Phase III funding awards and acquisition

by branches of the military for their deployment to aid in combat casualty care as well as further development contracts.

Daxor

recently received and is executing a new $1.1 million contract from the U.S. DoD for additional capabilities to its next-generation analyzer

this year. This two-year contract is just one of several pending applications for contract work with the U.S. DoD which are under consideration,

in addition to grant proposals for substantial research studies under review with agencies at the NIH. These contracts provide important

sources of non-dilutive funding, further technology development, and additional clinical validation which drives broader adoption of

our diagnostic. Management anticipates announcing the results of several of these efforts in Q3 and will continue to build upon successful

Phase I funded efforts toward the larger Phase II awards which commonly follow.

Equally

important is the progress that Daxor has made in the area of clinical outcomes utilizing our blood volume analyzer. In Q2 the results

of a pilot Randomized Control Trial (RCT) in heart failure patients with BVA guided treatment was published in the prestigious Journal

of the American College of Cardiology-Heart Failure by researchers from the Duke Clinical Research Institute. This RCT documented

that an astonishing 68% of heart failure patients were misdiagnosed regarding their volume status and that care teams were ineffective

at adjusting these derangements prior to discharge. The researchers citing the outcomes called for funding of a large-scale trial centered

around BVA technology based upon their findings. This trial is in addition to Phase I RCT work at two Veterans Administration hospitals

under NIH funding which completed enrollment in Q2 and will report its findings shortly as a prelude to making an anticipated Phase II

application. In the first half of 2023, over half a dozen new research studies on BVA were published in peer-reviewed journals or at

society conferences. Importantly, these studies highlighted that BVA can reduce hospital length of stay by 2.5 days on average for heart

failure patients, a significant savings, while also improving clinical outcomes. Data on the value of BVA for use in Left Ventricular

Assist Device (LVAD) patients and its superiority to pressure-based cardiac implantable devices are also highlights of data that researchers

from a variety of institutions published. About recognition and awareness of these developments, a landmark session at the Heart Failure

Society of America in 2023 marks the second year in a row that the Annual Meeting will focus on blood volume measurement to improve heart

failure care. Last year’s meeting was attended by hundreds of physicians which posited that Daxor’s BVA provided uniquely

valuable data for congestion management, superior utility to existing standards of care of pressure-based measures, and that further

study and adoption of it was supported by the growing body of evidence. Sessions of this nature led by key opinion leaders - comparing

volume versus pressure measures - represents the growing awareness and substantial need for BVA as an innovative diagnostic to improve

heart failure care. Management is incredibly pleased at the strong and growing reception that our technology is receiving at these events

at special sessions that are not sponsored by Daxor in any way.

The

Company also announced in August 2021 that a promising research letter on the use of Daxor’s BVA-100 analyzer on six COVID-19 patients

at NYU Medical Center had been published in the prestigious Journal of Critical Care. Daxor launched a prospective multi-center

trial on the back of that data which has been expanded to incorporate not only COVID patients but sepsis patients as well. The COVID

arm has completed enrollment and the sepsis comparator arm also completed enrollment at the end of Q2. We anticipate publication to follow

shortly, and Management looks forward to sharing the results of the multi-center trial when they become available. Sepsis is a leading

cause of death in hospitals and an intense area of focus for health system improvements. All data shows that individualized fluid management

holds the key to improving outcomes, something that BVA can uniquely do compared to the existing surrogate markers. A substantial expansion

of the Company’s revenue in critical care medicine could be driven by a combination of the new data, new funding opportunities

the data will open, as well as our next-generation analyzer which promises a speedy workflow which is critical to the needs of this specialty.

The

strong trend of healthcare is toward individualized care and cost-effectiveness. Our BVA diagnostic is a non-invasive, inexpensive, and

rapid blood test which allows care teams to solve the significant challenge of accurately managing the fluid levels of patients, whether

it is in the heart failure clinic (outpatient) or the hospitalized heart failure patient or in the ICU, and studies published and presented

are proving just how exciting the potential for this approach is. Reducing mortality, lowering complications, reducing hospital resource

use and length of stay with a non-invasive and 98% accurate test is achievable with our patented technology. In the competitive area

of healthcare, having achieved reimbursement for our technology for both inpatient and outpatient use is a strong competitive advantage

that will drive BVA adoption in step with our increasing clinical evidence and commercial teams. Just as exciting is the next generation

of products that are in our development pipeline slated for completion this year which should further enhance the accessibility of our

test and open it up to both government as well as civilian hospital systems on an international scale.

Daxor

has been reporting as an investment company under the Investment Company Act of 1940 since January 1, 2012. See the Notes to the Financial

Statements of Form N-CSR for further information on Daxor’s strategies and goals regarding its investments in publicly traded securities

to help fund its diagnostic operations. Because of its significant holding of publicly traded securities, the SEC currently classifies

Daxor as a closed-end investment management company with a fully owned medical operating division; however, the primary focus of management

is on our operational objectives. Daxor anticipates that as the value of the operating company continues to increase as a percentage

of assets owned, it will be eligible to file under its previous designation as an operating company and report as an operating company

and will take steps to accomplish this result.

Any

shareholder who is interested in learning more about our medical instrumentation and biotechnology operations should visit our website

at www.daxor.com or contact our investor relations representative Bret Shapiro of CORE IR at 516-222-2560 for more detailed information.

We periodically issue press releases regarding research reports and placements of the BVA-100 Blood Volume Analyzer in hospitals.

To

sign up for electronic delivery of shareholder reports and prospectuses, please send an email to info@daxor.com. If you do not

hold your account directly with Daxor, please contact the firm that holds your account about electronic delivery.

Cordially

Yours,

Michael

Feldschuh

CEO

and President

Item

1. Schedule of Investments

Daxor

Corporation

Schedule

of Investments

June

30, 2023 (Unaudited)

| | |

Shares | | |

Fair Value | |

| Common Stock - (United States) – 8.62% | |

| | | |

| | |

| Industrials – 0.01% | |

| | | |

| | |

| Wabtec | |

| 13 | | |

$ | 1,426 | |

| | |

| | | |

| | |

| Materials – 0.36% | |

| | | |

| | |

| Enbridge Inc. | |

| 2,952 | | |

| 109,667 | |

| | |

| | | |

| | |

| Utilities – 8.25% | |

| | | |

| | |

| Electric Utilities – 8.25% | |

| | | |

| | |

| Avangrid, Inc. | |

| 7,000 | | |

| 263,760 | |

| Avista Corporation | |

| 6,000 | | |

| 235,620 | |

| CenterPoint Energy, Inc. | |

| 1,000 | | |

| 29,150 | |

| Centrus Energy Corp. | |

| 1 | | |

| 33 | |

| CMS Energy Corporation | |

| 3,500 | | |

| 205,625 | |

| DTE Energy Company | |

| 2,000 | | |

| 220,040 | |

| Edison International | |

| 4,000 | | |

| 277,800 | |

| Entergy Corporation | |

| 3,500 | | |

| 340,795 | |

| Evergy Inc. | |

| 4,297 | | |

| 251,031 | |

| Eversource Energy | |

| 2,000 | | |

| 141,840 | |

| Exelon Corporation | |

| 2,100 | | |

| 85,554 | |

| FirstEnergy Corp. | |

| 3,800 | | |

| 147,743 | |

| Pinnacle West Capital Corporation | |

| 3,000 | | |

| 244,380 | |

| Xcel Energy, Inc. | |

| 1,000 | | |

| 62,170 | |

| Total Utilities | |

| | | |

| 2,505,541 | |

| | |

| | | |

| | |

| Total Common Stock (Cost $816,920) – 8.62% | |

| | | |

$ | 2,616,634 | |

| | |

Shares | | |

Fair Value | |

| Preferred Stock - (United States) – 1.16% | |

| | | |

| | |

| | |

| | | |

| | |

| Banking – 1.16% | |

| | | |

| | |

| Bank of America Corp 7.250% Series L | |

| 300 | | |

$ | 351,546 | |

| | |

| | | |

| | |

| Total Preferred Stock (Cost $193,985) – 1.16% | |

| | | |

$ | 351,546 | |

| | |

| | | |

| | |

| Money Market – UBS Select Prime Institutional Fund – (Cost $1,360,081) – 4.48% | |

| | | |

$ | 1,360,081 | |

| | |

| | | |

| | |

| Total Investments in Securities (Cost $2,370,956) – 14.26% | |

| | | |

$ | 4,328,261 | |

| | |

| | | |

| | |

| Investment in Operating Division (Cost $3,118,857) - (United States) – 85.64% (1) | |

| | | |

$ | 26,000,000 | |

| | |

| | | |

| | |

| Dividends receivable – 0.04% | |

| | | |

$ | 10,943 | |

| | |

| | | |

| | |

| Other Assets – 0.06% | |

| | | |

$ | 19,809 | |

| | |

| | | |

| | |

| Total Assets – 100.00% | |

| | | |

$ | 30,359,013 | |

| Total Liabilities - (0%) | |

| | | |

$ | - | |

| Net Assets - 100% | |

| | | |

$ | 30,359,013 | |

(1)

The Fair Value of the Operating Division was determined by using significant unobservable inputs.

The

accompanying notes are an integral part of these financial statements.

Daxor

Corporation

Schedule

of Investments – (Unaudited) (Continued)

June

30, 2023

At

June 30, 2023, the net unrealized appreciation on investment in securities, options and securities borrowed of $1,957,274 was composed

of the following:

| Aggregate gross unrealized appreciation for which there was an excess of value over cost | |

$ | 1,962,453 | |

| Aggregate gross unrealized depreciation for which there was an excess of cost over value | |

| (5,179 | ) |

| Net unrealized appreciation | |

$ | 1,957,274 | |

At

June 30, 2023, the net unrealized appreciation on investment in operating division was composed of the following:

| Net unrealized appreciation on investment in operating division | |

$ | 22,881,143 | |

Portfolio

Analysis

June

30, 2023

| | |

Percentage of Net Assets | |

| Common Stock (United States) | |

| |

| Industrials | |

| 0.01 | % |

| Materials | |

| 0.36 | % |

| Electric Utilities | |

| 8.25 | % |

| | |

| | |

| Total Common Stock | |

| 8.62 | % |

| | |

| | |

| Preferred Stock (United States) | |

| | |

| Banking | |

| 1.16 | % |

| | |

| | |

| Money Market | |

| 4.48 | % |

| | |

| | |

| Total Investments in Securities | |

| 14.26 | % |

The

accompanying notes are an integral part of these financial statements.

Daxor

Corporation

Summary

of Liabilities

(Unaudited)

June

30, 2023

| Total Liabilities - None | |

| - | | |

| - | |

| | |

| - | | |

$ | - | |

The

accompanying notes are an integral part of these financial statements.

Daxor

Corporation

Statement

of Assets and Liabilities (Unaudited)

June

30, 2023

| Assets: | |

| |

| Investments in securities, at fair value (cost of $2,370,986) | |

$ | 4,328,261 | |

| Investment in operating division, at fair value (cost of $3,118,857) | |

| 26,000,000 | |

| Dividends receivable | |

| 10,943 | |

| Prepaid taxes and other assets | |

| 19,809 | |

| Total Assets | |

| 30,359,013 | |

| | |

| | |

| Liabilities: | |

| | |

| Margin loans payable | |

| - | |

| Accounts payable and accrued expenses | |

| - | |

| | |

| | |

| Total Liabilities | |

| - | |

| Commitments (Note 14) | |

| | |

| Net Assets | |

$ | 30,359,013 | |

| | |

| | |

| Net Asset Value, (10,000,000 shares authorized, 5,316,530

issued and 4,792,319 shares outstanding of $0.01 par value capital stock outstanding) | |

$ | 6.33 | |

| Net Assets consist of: | |

| | |

| Capital paid in | |

$ | 13,278,406 | |

| Total distributable earnings | |

| 21,749,179 | |

| Treasury Stock | |

| (4,668,572 | ) |

| Net Assets | |

$ | 30,359,013 | |

The

accompanying notes are an integral part of these financial statements.

Daxor

Corporation

Statement

of Operations (Unaudited)

For

the Six Months Ended June 30, 2023

| Investment Income: | |

| | |

| Dividend income (net of foreign withholding taxes of $1,019) | |

$ | 77,990 | |

| Other income | |

| 2,983 | |

| Total Investment Income | |

| 80,973 | |

| | |

| | |

| Expenses: | |

| | |

| Investment administrative charges | |

| 414,847 | |

| Professional fees | |

| 21,200 | |

| Transfer agent fees | |

| 24,469 | |

| Interest expense | |

| 44,466 | |

| Other taxes | |

| 11,384 | |

| Total Expenses | |

| 516,366 | |

| | |

| | |

| Net Investment(Loss) | |

| (435,393 | ) |

| | |

| | |

| Realized and Unrealized Gain (Loss) on Investments and Other items: | |

| | |

| Net realized gain from investments in securities sold | |

| 603,661 | |

| | |

| | |

| Net change in unrealized (depreciation) on investments | |

| (760,280 | ) |

| | |

| | |

| Realized (loss) on investment in operating division | |

| (2,445,170 | ) |

| Net Realized and Unrealized Gain on Investments and Investment in Operating Division | |

| (2,601,789 | ) |

| | |

| | |

| Income tax (benefit) | |

| 0 | |

| | |

| | |

| Net Increase in Net Assets Resulting From Operations | |

$ | (3,037,182 | ) |

The

accompanying notes are an integral part of these financial statements.

Daxor

Corporation

Statement

of Changes in Net Assets

| | |

Six Months Ended | | |

| |

| | |

June 30, 2023 | | |

Year Ended | |

| | |

(Unaudited) | | |

December 31, 2022 | |

| Increase/(Decrease) in Net Assets Resulting from Operations | |

| | | |

| | |

| | |

| | | |

| | |

| Net investment (loss) | |

$ | (435,393 | ) | |

$ | (972,974 | ) |

| Net realized income (loss) from investments in securities and securities sold short | |

| 603,661 | | |

| 2,736,375 | |

| Net realized (loss) from options | |

| - | | |

| (56,954 | ) |

| Net change in unrealized (depreciation) on investments, options and securities borrowed | |

| (760,280 | ) | |

| (2,763,895 | ) |

| Net change in unrealized appreciation in operating division | |

| - | | |

| 9,500,000 | |

| Realized (loss) on investment in operating division | |

| (2,445,170 | ) | |

| (3,264,419 | ) |

| Net Increase in Net Assets Resulting From Operations | |

| (3,037,182 | ) | |

| 5,178,133 | |

| | |

| | | |

| | |

| Capital Share Transactions: | |

| | | |

| | |

| Increase in net assets resulting from stock-based compensation | |

| 324,273 | | |

| 786,642 | |

| Proceeds from sale of treasury stock | |

| 4,102,453 | | |

| 1,851,975 | |

| Net Increase in Net Assets Resulting From Capital Share Transactions | |

| 4,426,726 | | |

| 2,638,617 | |

| | |

| | | |

| | |

| Total Net Increase in Net Assets | |

| 1,389,544 | | |

| 7,816,750 | |

| | |

| | | |

| | |

| Net Assets: | |

| | | |

| | |

| | |

| | | |

| | |

| Beginning of Period | |

| 28,969,469 | | |

| 21,152,719 | |

| |

| | | |

| | |

| End of Period (including undistributed net investment income of $4,326,911 in

2023 and $4,223,230 in 2022 included in net assets) | |

$ | 30,359,013 | | |

$ | 28,969,469 | |

The

accompanying notes are an integral part of these financial statements.

Daxor

Corporation

Statement

of Cash Flows

For

the Six Months Ended June 30, 2023 (Unaudited)

| Cash flows from operating activities: | |

| |

| Net (decrease) in net assets resulting from operations | |

$ | (3,037,182 | ) |

| Adjustment to reconcile net increase in net assets resulting from operations to net cash used in operating activities: | |

| | |

| Net realized gain from investments in securities sold | |

| (603,661 | ) |

| Net realized (loss) from options | |

| | |

| Net change in unrealized depreciation on investments, options and securities borrowed | |

| 760,280 | |

| Net change in unrealized appreciation in operating division | |

| | |

| Investment in/advances to operating division | |

| (2,445,170 | ) |

| Realized loss on operating division | |

| 2,445,170 | |

| Proceeds from sales of securities | |

| 1,337,409 | |

| Purchase of securities | |

| (1,637,710 | ) |

| Payments to cover securities borrowed at fair value | |

| | |

| Stock based compensation expense | |

| 324,273 | |

| Changes in operating assets and liabilities: | |

| | |

| Decrease in dividends receivable | |

| 7,087 | |

| Decrease in accrued expenses and other assets | |

| (62,436 | ) |

| Net cash used in operating activities | |

| (2,871,940 | ) |

| | |

| | |

| Cash flows from financing activities: | |

| | |

| Proceeds from margin loan payable | |

| 3,337,615 | |

| Repayment of margin loan payable | |

| (4,568,128 | ) |

| Proceeds from the sale of treasury stock | |

| 4,102,453 | |

| | |

| | |

| Net cash provided by financing activities | |

| 2,871,940 | |

| | |

| | |

| Net change in cash and restricted cash | |

$ | - | |

| Cash and restricted cash at beginning of the year | |

| | |

| Cash and restricted cash at end of the year | |

$ | - | |

| | |

| | |

| Supplemental Disclosures of Cash Flow Information: | |

| | |

| | |

| | |

| Cash paid during the year for: | |

| | |

| | |

| | |

| Income Taxes (State income taxes) | |

$ | 12,209 | |

| | |

| | |

| Interest on margin loan payable | |

$ | 44,466 | |

The

accompanying notes are an integral part of these financial statements.

Daxor

Corporation

Financial

Highlights

The

table below sets forth financial data for weighted average shares of stock outstanding for each year and for one share of capital stock

outstanding throughout the years presented. The total investment return does not reflect sales load.

| | |

Six Months Ended | | |

| |

| | |

June 30, 2023 | | |

Year Ended | |

| | |

(Unaudited) | | |

December 31, 2022 | |

| Net Asset Value Per Share, Beginning of Year | |

$ | 6.75 | | |

$ | 5.24 | |

| | |

| | | |

| | |

| Income (loss) from operations: | |

| | | |

| | |

| Net investment (loss) income | |

| (0.10 | ) | |

| (0.24 | ) |

| Net realized and unrealized gain (loss) from investments, options and securities | |

| | | |

| | |

| Borrowed | |

| (0.04 | ) | |

| (0.02 | ) |

| Net realized and unrealized gain from operating division | |

| (0.55 | ) | |

| 1.53 | |

| Other | |

| (0.72 | ) | |

| (0.40 | ) |

| Total (loss) from Operations | |

| (1.41 | ) | |

| 0.87 | |

| | |

| | | |

| | |

| Capital share transactions: | |

| | | |

| | |

| Increase in net assets from stock based compensation | |

| 0.07 | | |

| 0.19 | |

| Increase from sale of treasury stock | |

| 0.92 | | |

| 0.45 | |

| | |

| | | |

| | |

| (Decrease) /increase in Net Asset Value Per Share | |

| (0.42 | ) | |

| 1.51 | |

| | |

| | | |

| | |

| Net Asset Value Per Share, End of Period | |

$ | 6.33 | | |

$ | 6.75 | |

| | |

| | | |

| | |

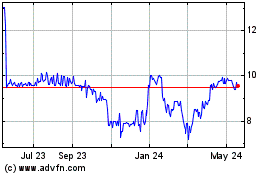

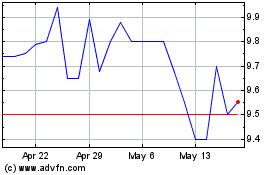

| Market Price Per Share of Common Stock, Beginning of Year | |

$ | 9.16 | | |

$ | 11.29 | |

| Market Price Per Share of Common Stock, End of Period | |

$ | 9.60 | | |

$ | 9.16 | |

| Change in Price Per Share of Common Stock | |

$ | 0.44 | | |

$ | (2.13 | ) |

| | |

| | | |

| | |

| Total Investment Return | |

| 4.80 | % | |

| (18.87 | )% |

| | |

| | | |

| | |

| Weighted Average Shares Outstanding | |

| 4,463,280 | | |

| 4,083,847 | |

| | |

| | | |

| | |

| Ratios/Supplemental Data | |

| | | |

| | |

| | |

| | | |

| | |

| Net assets, End of Period (in 000’s) | |

$ | 30,359 | | |

$ | 28,969 | |

| | |

| | | |

| | |

| Ratio of total expenses to average net assets | |

| 1.80 | % | |

| 5.86 | % |

| | |

| | | |

| | |

| Ratio of net investment (loss) income after income taxes to average net assets | |

| (1.52 | )% | |

| (4.73 | )% |

| | |

| | | |

| | |

| Portfolio turnover rate | |

| 44.69 | % | |

| 0 | % |

The

accompanying notes are an integral part of these financial statements.

Daxor

Corporation

Financial

Highlights (continued)

| | |

Year Ended

December 31, 2021 | | |

Year Ended

December 31, 2020 | | |

Year Ended

December 31, 2019 | |

| | |

| | |

| | |

| |

| Net Asset Value Per Share, Beginning of Year | |

$ | 3.89 | | |

$ | 3.41 | | |

$ | 3.49 | |

| | |

| | | |

| | | |

| | |

| Income (loss) from operations: | |

| | | |

| | | |

| | |

| Net investment (loss) income | |

| (0.20 | ) | |

| (0.08 | ) | |

| (0.03 | ) |

| Net realized and unrealized gain from investments, options and securities Borrowed | |

| 0.21 | | |

| (0.32 | ) | |

| 0.59 | |

| Net realized and unrealized loss from operating division | |

| 1.16 | | |

| 0.11 | | |

| (0.69 | ) |

| Income tax (expense) benefit | |

| 0.00 | | |

| 0.00 | | |

| 0.00 | |

| Other | |

| 0.00 | | |

| 0.01 | | |

| 0.01 | |

| Total income (loss) from Investment Operations | |

| 1.17 | | |

| (0.28 | ) | |

| (0.13 | ) |

| Capital share transactions: | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Increase in net assets from stock based compensation | |

| 0.18 | | |

| 0.06 | | |

| (0.05 | ) |

| Proceeds from sale of treasury stock and exercise of stock options | |

| - | | |

| 0.70 | | |

| 0.00 | |

| | |

| | | |

| | | |

| | |

| Increase/(Decrease) in Net Asset Value Per Share | |

| 1.35 | | |

| 0.48 | | |

| (0.08 | ) |

| | |

| | | |

| | | |

| | |

| Net Asset Value Per Share, End of Year | |

$ | 5.24 | | |

$ | 3.89 | | |

$ | 3.41 | |

| | |

| | | |

| | | |

| | |

| Market Price Per Share of Common Stock, Beginning of Year | |

$ | 12.50 | | |

$ | 9.40 | | |

$ | 8.20 | |

| Market Price Per Share of Common Stock, End of Year | |

| 11.29 | | |

| 12.50 | | |

| 9.40 | |

| Change in Price Per Share of Common Stock | |

$ | (1.21 | ) | |

$ | 3.10 | | |

$ | 1.20 | |

| | |

| | | |

| | | |

| | |

| Total Investment Return | |

| (9.68 | )% | |

| 32.98 | % | |

| 14.63 | % |

| | |

| | | |

| | | |

| | |

| Weighted Average Shares Outstanding | |

| 4,036,660 | | |

| 3,935,902 | | |

| 3,746,858 | |

| | |

| | | |

| | | |

| | |

| Ratios/Supplemental Data | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Net assets, End of Year (in 000’s) | |

$ | 21,153 | | |

$ | 15,675 | | |

$ | 12,766 | |

| Ratio of total expenses to average net assets | |

| 7.29 | % | |

| 5.79 | % | |

| 4.26 | % |

| Ratio of net investment (loss) income after income taxes to average net assets | |

| (5.44 | )% | |

| (3.53 | )% | |

| (1.12 | )% |

| Portfolio turnover rate | |

| 0.00 | % | |

| 12.54 | % | |

| 0.00 | % |

The

accompanying notes are an integral part of these financial statements.

Daxor

Corporation

Notes

to Financial Statements

June

30, 2023 (Unaudited)

1.

Organization and Investment Objective

Daxor

Corporation (the “Company”) is registered under the Investment Company Act of 1940, as amended, as a diversified, closed-end

management investment company.

The

Company qualifies as a “controlled company” under the listing requirements of the Nasdaq, as the estate of Joseph

Feldschuh, M.D. controls more than 50% of the Company’s voting power, as evidenced by the Company’s ownership records. The

estate owns 53.8% of the outstanding shares. As a result, the estate has the ability to control the outcome on any matter requiring

the approval of shareholders of the Company.

The

Company’s investment goals, objectives and principal strategies are as follows:

| A. | The

Company’s investment goals and objectives are capital preservation, maintaining returns

on capital with a high degree of safety and generating income from dividends and option sales

to help offset operating losses from the Company’s Operating Division. |

| | |

| B. | In

order to achieve these goals, the Company maintains a diversified securities portfolio comprised

primarily of electric utility company common and preferred stocks. The Company also sells

covered calls on portions of its portfolio and also sells puts on stocks it is willing to

own. It also sells uncovered calls and may have net short positions in common stock up to

15% of the value of the portfolio. The net short position is the total fair market value

of the Company’s short positions reduced by the amount due to the Company from the

Broker. If the amount due from the Broker is more than the fair market value of the short

positions, the Company will have a net receivable from the Broker. The Company’s investment

policy is to maintain a minimum of 80% of its portfolio in equity securities of utility companies.

The Board of Directors has authorized this minimum to be temporarily lowered to 70% when

Company management deems it to be necessary. Investments in utilities are primarily in electric

companies. Investments in non-utility stocks will generally not exceed 20% of the value of

the portfolio. |

2.

Significant Accounting Policies

Basis

of Presentation and Use of Estimates

The

Company is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting

Standards Codification Topic 946 (ASC 946). The accompanying financial statements were prepared in accordance with accounting principles

generally accepted in the United States of America (“GAAP”), including, but not limited to, ASC 946. GAAP requires the use

of estimates made by management. Management believes that estimates and valuations are appropriate; however, actual results may differ

from those estimates, and the valuations reflected in the accompanying financial statements may differ from the value ultimately realized

upon sale or maturity.

The

following is a summary of significant accounting policies consistently followed by the Company in the preparation of its financial statements.

Valuation

of Investments

The

Company carries its investments in securities at fair value and utilizes various methods to measure the fair value of its investments

on a recurring basis. Fair value is an estimate of the exit price, representing the amount that would be received to sell an asset or

paid to transfer a liability in an orderly transaction between market participants (i.e., the exit price at the measurement date). Fair

value measurements are not adjusted for transaction costs. GAAP establishes a hierarchy that prioritizes inputs to valuation methods.

The three levels of inputs are:

Level

1- Unadjusted quoted prices in active markets for identical assets and liabilities that the Company has the ability to access.

Level

2 - Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly

or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments,

interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level

3 - Unobservable inputs for an asset or liability, to the extent relevant observable inputs are not available; representing the Company’s

own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best

information available.

Daxor

Corporation

Notes

to Financial Statements

June

30, 2023 (Unaudited)

2.

Significant Accounting Policies - (continued)

Valuations

of Investments (continued)

The

availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example,

the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics

particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the

market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value

is greatest for instruments categorized in Level 3.

The

inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, the level in the fair value

hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant

to the fair value measurement in its entirety. The inputs or methodology used for valuing securities are not necessarily an indication

of the risk associated with investing in those securities.

Investments

in securities, securities borrowed and put and call options that are freely traded and are listed on a national securities exchange are

valued at the last reported sales price on the last business day of the year; securities traded on the over-the-counter market and listed

securities for which no sale was reported on that date are valued at the mean between the last reported bid and asked prices.

The

Company establishes valuation processes and procedures to ensure that the valuation techniques for investments that are categorized within

Level 3 of the fair value hierarchy are fair, consistent, and verifiable. At June 30, 2023, Level 3 investments consist solely of the

Company’s investment in its wholly owned Operating Division at fair value. The Company’s Audit Committee oversees the valuation

process of the Company’s Level 3 investments. The Audit Committee is comprised of members of the Company’s Board of Directors

and is responsible for the valuation processes and procedures and evaluating the overall fairness and consistent application of the valuation

policies. For this valuation process the Audit Committee meets semi-annually or as needed, and in conjunction with reports from an independent

valuation company determines the valuations of the Company’s Level 3 investments. Valuations determined by the Audit Committee

are required to be supported by the independent valuation company whose reports may include information such as market data, third-party

pricing sources; industry accepted pricing models, counterparty prices, or other appropriate methods. On an annual basis, the Company

engages the services of an independent valuation company to perform an independent review of the valuation of the Company’s investment

in its wholly owned Operating Division, and may adjust its valuations based on the recommendations from the valuation firm.

Daxor

Corporation

Notes

to Financial Statements

June

30, 2023 (Unaudited)

2.

Significant Accounting Policies - (continued)

Valuation

of Derivative Instruments

The

Company accounts for derivative instruments under FASB ASC 815, “Derivatives and Hedging,” which establishes accounting and

reporting standards requiring that derivative instruments be recorded in the statement of assets and liabilities at fair value. The changes

in the fair values of derivatives are included in the statements of operations as a component of net realized and unrealized loss from

investments.

Investment

Transactions and Income and Expenses

Investment

transactions are accounted for on the trade date. Realized gains and losses on sales of investments are calculated on the basis of identifying

the specific securities delivered. Dividend income and expense are recorded on the ex-dividend date, and interest income is recognized

on the accrual basis. Expenses are recorded on an accrual basis.

Distributions

Net

investment income and net realized gains are accumulated within the Company and used to pay expenses, to make additional investments

or held in cash as a reserve and at the discretion of the Company, to pay dividends to shareholders.

Revenue

Recognition

ACS

Topic 606, Revenue from Contracts with Customers, requires that an entity recognize revenue to depict the transfer of promised goods

or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those

goods or services. The guidance requires an entity to follow a five step model to (a) identify the contract(s) with a customer, (b) identify

the performance obligations in the contract, (c) determine the transaction price, (d) allocate the transaction price to the performance

obligations in the contract, and (e) recognize revenue when the entity satisfies a performance obligation.

The

Company recognizes revenues in the Operating Division from product sales when a product is shipped and recognizes revenue from service

contracts as the revenues are earned over the life of service contract and performance obligations are met.

Income

Taxes

The

Company accounts for income taxes under the provisions of FASB ASC 740, “Income Taxes.” This pronouncement requires recognition

of deferred tax assets and liabilities for the estimated future tax consequences of events attributable to differences between the financial

statement carrying amounts of existing assets and liabilities and their respective tax bases and operating loss and tax credit carry

forwards. Deferred tax assets and liabilities are measured using enacted tax rates in effect for the year in which the differences are

expected to be recovered or settled. The effect on deferred tax assets and liabilities of changes in tax rates is recognized in the statement

of operations in the period in which the enactment rate changes. Deferred tax assets and liabilities are reduced through the establishment

of a valuation allowance at such time as, based on available evidence, it is more likely than not that the deferred tax assets will not

be realized.

The

Company accounts for uncertainties in income taxes under the provisions of FASB ASC 740-10-05, “Accounting for Uncertainties in

Income Taxes”. The ASC clarifies the accounting for uncertainty in income taxes recognized in an enterprise’s financial statements.

The ASC prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax

position taken or expected to be taken in a tax return. The ASC provides guidance on de-recognition, classification, interest and penalties,

accounting in interim periods, disclosure and transition.

Daxor

Corporation

Notes

to Financial Statements

June

30, 2023 (Unaudited)

2.

Significant Accounting Policies - (continued)

Treasury

Stock

Treasury

stock is recorded under the cost method and shown as a reduction of net assets.

3.

Fair Value Measurements of Investments, Financial Instruments and Related Risks

The

following tables summarize the inputs used as of June 30, 2023 for the Company’s assets and liabilities measured at fair value

on a recurring basis at June 30, 2023, categorized by the above mentioned fair value hierarchy and also by denomination:

| Assets | |

Level 1 | | |

Level 2 | | |

Level 3 | | |

Total | |

| Common Stocks | |

$ | 2,616,634 | | |

$ | - | | |

$ | - | | |

$ | 2,616,634 | |

| Preferred Stocks | |

| 351,546 | | |

| - | | |

| - | | |

| 351,546 | |

| Money Market | |

| 1,360,081 | | |

| | | |

| | | |

| 1,360,081 | |

| Investment in Operating Division | |

| - | | |

| - | | |

| 26,000,000 | | |

| 26,000,000 | |

| Total | |

$ | 4,328,261 | | |

$ | - | | |

$ | 26,000,000 | | |

$ | 30,328,261 | |

The

Company purchases equity securities in the form of common and preferred stocks, primarily in the utility sector which historically have

a high degree of safety and pays dividends. The common and preferred stocks are recorded at fair value at the unadjusted closing quoted

price on active securities markets.

Purchased

call and put options: When the Company purchases an option; an amount equal to the premium paid by the Company is recorded as an investment

on the Statement of Assets and Liabilities, the value of which is marked-to-market to reflect the current market value of the option

purchased. If the purchased option expires, the Company realizes a loss equal to the amount of premium paid. When an instrument is purchased

or sold through the exercise of an option, the related premium paid is added to the basis of the instrument acquired or deducted from

the proceeds of the instrument sold. The risk associated with purchasing put and call options is limited to the premium paid.

Written

call and put options: When the Company writes (sells) an option, an amount equal to the premium received by the Company is recorded as

an obligation on the Statement of Assets and Liabilities, the value of which is marked-to-market to reflect the current market value

of the written option. If the written option expires, the Company realizes a gain equal to the amount of premium received. When an instrument

is purchased or sold through the exercise of an option, the related premium received is adjusted to the basis of the instrument acquired

or the instrument sold. The risk associated with writing options is based on the difference between the strike price of the option and

current market price of the underlying security less premium received. See Note 7 for further discussion of Investment and Market Risk

Factors and risks of written call and put options.

Securities

sold short: The Company may sell securities that it does not own, and it will therefore be obligated to purchase such securities at a

future date. The value of the open short position is recorded as a liability, and the Company records an unrealized gain or loss to the

extent of the difference between the proceeds received and the value of the open short position. The Company records a realized gain

or loss when a short position is closed out. By entering into short sales, the Company bears the market risk of increases in the value

of the security sold short in excess of the proceeds received. Possible losses from short sales differ from losses that could be incurred

from purchases of securities because losses from short sales may be unlimited whereas losses from purchases cannot exceed the total amount

invested. See Note 1 regarding the Company’s investment goals and its use of covered positions and Note 7 for further discussion

of Investment and Market Risk Factors.

During

the year ended June 30, 2023, the Company realized proceeds of $1,377,409 from the sale of investment securities.

All

transfers are recognized by the Company at the end of each reporting period. Transfers between Levels 2 and 3 (if any) generally relate

to whether significant unobservable inputs are used for the fair value measurements. See Note 2 – Significant Accounting Policies

for additional information related to the fair value hierarchy and valuation techniques and inputs. During the year ended June 30, 2023

there were no transfers between Levels.

Daxor

Corporation

Notes

to Financial Statements

June

30, 2023 (Unaudited)

3.

Fair Value Measurements of Investments, Financial Instruments and Related Risks (continued)

The

following table is a reconciliation of the beginning and ending balances for the Company’s assets measured at fair value on a recurring

basis using significant unobservable inputs (level 3) during the year ended June 30, 2023:

| | |

Balance at

June 30, 2023 | |

| | |

| |

| Balance, December 31, 2022 | |

$ | 26,000,000 | |

| | |

| | |

| Investment in/advances to operating division | |

| 2,445,170 | |

| Realized loss on investment in operating division | |

| (2,445,170 | ) |

| Balance, June 30, 2023 | |

$ | 26,000,000 | |

The

Company’s Level 3 asset consists of its investment in its wholly owned Operating Division at fair value and requires significant

judgment due to the absence of quoted market prices, inherent lack of liquidity, heavy reliance on Level 3 inputs, and the long-term

nature of such investments. Since its inception, the Operating Division has not generated significant revenue and has incurred substantial

operating losses. Due to these substantial losses, the Operating Division has been completely dependent on funding from the Company to

sustain its operations. Investment in Operating Division is primarily located in Oak Ridge, Tennessee and was initially valued at transaction

value for identified assets (property and equipment, land, buildings and laboratory equipment), less accumulated depreciation adjusted

for investment in/advances to operating division, business operations and activity and realized losses. Based on Company initiatives

started in 2016 and through 2022, related to potential partnerships, joint ventures, product development, marketing and other operations

of the Operating Division, the Company hired an independent valuation company to perform a valuation of the Operating Division. The Company

updated the initial 2016 valuation and subsequent valuations at December 31, 2017 through December 31, 2022, using the Income Approach

and Market Approaches as defined in SFAS 157 (ASC Topic 820). Based on the valuation approaches, the valuation ranges were $25,700,000

to $26,300,000 for the blended Income Approach and Market Approach at December 31, 2022. In determining the Income Approach value range,

the Gordon Growth Model valuation technique was used with a discount rate of 20.0% and long-term growth rate of 3.0%. Significant increases

(decreases) in these unobservable inputs in isolation could result in significant changes in fair value measurements. The Income Approach

was weighted 40% given the current financial performance and expectations as to longer-term revenue growth and profitability and a 60%

weight to a recent arm’s length Daxor share sales transactions which raised $2.0 million, resulting in a midpoint of value range

of $26,000,000. Management has reviewed and assessed this valuation and concluded the valuation remains reasonable at June 30,2023.

4.

Derivative Instruments

The

Company may write call and put options in order to generate additional investment income as part of its investment strategy. In the opinion

of management, the use of financial derivative instruments in its investment program is appropriate and customary for the investment

strategies employed reducing certain investment risks. There were no investments in derivative instruments as of June 30, 2023.

Daxor

Corporation

Notes

to Financial Statements

June

30, 2023 (Unaudited)

5.

Income Taxes (Benefit)

The

net income tax expense (benefit) for the period ended June 30, 2023 is comprised of the following:

| Current Income Tax Expense (Benefit): | |

| | |

| Federal | |

$ | - | |

| State and local | |

| - | |

| Total current income tax expense (benefit) | |

| - | |

| Deferred Tax Expense: | |

| | |

| Federal | |

$ | - | |

| State and local | |

| - | |

| Total deferred tax expense | |

| - | |

| Net income tax (benefit) | |

$ | - | |

The

Company has a net operating loss carry forward of approximately $31,965,810 at June 30, 2023. Approximately $16,744,764 of these losses

relate to years prior to 2018 and will begin to expire in 2033. Approximately $15,221,046 of these losses relates to the years 2018 through

2022, and will not expire, but are subject to limitations on usage.

The

following table sets forth the net operating loss carry forwards by state and local jurisdiction at June 30, 2023:

| New York State | |

$ | 4,728,155 | |

| New York City | |

$ | 6,741,134 | |

| California | |

$ | 2,371,705 | |

| Tennessee | |

$ | 7,704,435 | |

| South Carolina | |

$ | 9,635,570 | |

At

June 30, 2023, the Company had no material unrecognized tax benefits and no adjustments to liabilities or operations were required. The

Company does not expect that its unrecognized tax benefits will materially increase within the next twelve months. The Company recognizes

interest and penalties related to uncertain tax positions in investment administrative expenses. As of June 30, 2023, the Company has

not recorded any provisions for accrued interest and penalties related to uncertain tax positions.

Daxor

Corporation

Notes

to Financial Statements

June

30, 2023 (Unaudited)

5.

Income Taxes (Benefit) - (continued)

In

certain cases, the Company’s uncertain tax positions are related to tax years that remain subject to examination by the relevant

tax authorities. The Company files federal, state and local income tax returns in jurisdictions with varying statutes of limitations.

The 2016 through 2022 tax years generally remain subject to examination by federal, state and local tax authorities.

Under

Internal revenue code section 542, a company is defined as a Personal Holding Company (“PHC”) if it meets both an ownership

test and an income test. The ownership test is met if a company has five or fewer shareholders that own more than 50% of the company,

which is applicable to Daxor. The income test is met if PHC income items such as dividends, interest and rents exceed 60% of adjusted

ordinary gross income. Adjusted ordinary income is defined as all items of income except capital gains. For the year ended June 30, 2023,

more than 60% of Daxor’s adjusted gross income came from items defined as PHC income.

Determining

the PHC tax liability requires computing Daxor’s “undistributed PHC income” and taxing such PHC income at the statutory

rate of 20%. Undistributed PHC income is current year taxable income of the Company, exclusive of the net operating loss carry forward

deduction that is allowed for regular tax purposes. The Company incurred no liability for PHC for the period ended June 30, 2023 due

to the net operating losses applied to realized gains incurred during the year.

| Computed expected provision at statutory rates | |

| (21.0 | )% |

| Valuation allowance | |

| (13.4 | )% |

| State taxes | |

| (0.5 | )% |

| Non-deductible/non-taxable and other items | |

| 36.3 | % |

| Dividend received deduction and other items | |

| (1.4 | )% |

| | |

| | |

| Effective income tax (benefit) rate | |

| 0.0 | % |

6.

Deferred Income Taxes

Deferred

income taxes result from differences in the recognition of gains and losses on marketable securities; stock options, as well as from

carry forwards of the Company’s net operating losses of approximately $31,965,810 at June 30, 2023, and tax credits of approximately

$1,528,433 for tax purposes. At June 30, 2023 the aggregate cost of investments for federal income tax purposes was $5,489,843.

Daxor

Corporation

Notes

to Financial Statements

June

30, 2023 (Unaudited)

6.

Deferred Income Taxes - (continued)

The

significant components of deferred tax assets and liabilities are reflected in the following table:

| Unrealized gains on investments in securities | |

$ | (462,484 | ) |

| Unrealized gain on investment in operating division | |

| (5,537,458 | ) |

| Net operating loss-carry forward | |

| 7,477,080 | |

| Net capital loss carry forward | |

| (289,300 | ) |

| Business tax credits carried forward | |

| 1,528,433 | |

| Others | |

| 51,511 | |

| Deferred Income Tax Available for use | |

| 2,767,782 | |

| Valuation allowance | |

| (2,767,782 | ) |

| Net Deferred Tax Asset | |

$ | - | |

Realization

of deferred tax assets is dependent on future earnings. Due to the uncertainty of the realization of its net deferred tax assets, the

Company has provided a valuation allowance. In assessing the potential to realize the deferred tax asset, management considers whether

it is more likely than not that some or perhaps all of the deferred tax assets will be realized. The ultimate realization of deferred

tax assets is dependent upon the generation of future taxable income during the periods in which these temporary differences become deductible.

Management considers the scheduled reversal of deferred tax liabilities, projected future taxable income and tax planning strategies

in making their assessment. The Company recorded a valuation allowance of $2,767,782 at June 31, 2023. The valuation allowance increased

$179,646 from December 31, 2022. If the Company becomes profitable before the expiration of the loss carry forwards, it would have the

ability to utilize them in order to offset any taxable income.

7.

Investment and Market Risk Factors

The

Company enters into investments in securities, call and put options and securities borrowed and/or financial instruments that may have

off balance sheet risks, where the potential loss due to changes in the market (market risk), failure of counterparty to perform on the

transaction risk (credit risk) and other risk elements, such as interest rate risk, exceeds the value and/or obligations of such financial

instruments. It is the Company’s general policy to mitigate such risks by transacting with established counterparties. The Company

transacts with and custodies investment assets at UBS Financial Services, Inc. (“Broker”).

The

Company’s investments in securities arise from investments in long common and preferred stocks, selling common stocks short and

transacting in put and call (naked and covered) options. These investments are subject to equity risks of increases and decreases in

market exchange prices such as on the Nasdaq.

Daxor

Corporation

Notes

to Financial Statements

June

30, 2023 (Unaudited)

7.

Investment and Market Risk Factors - (continued)

The

Company is subject to certain inherent risks arising from its investing activities of selling securities short and writing put and call

options. Selling securities short creates an obligation to purchase the securities at an unknown future date, subject to the Company’s

discretion, at the then prevailing future market prices. Securities borrowed create the risk that the ultimate obligation may exceed

the liability reflected in these financial statements.

The

Company collects premiums and the opportunity to create option premium income when writing put and call options if the options expire

out-of-the-money. Writing put and call options gives the option buyer the right to exercise the option against the option writer. Writing

put options obligates the writer to purchase the stock at the strike price if the stocks’ current market price is below the strike

price prior to expiration of the put option. The potential loss in writing a put option is the strike price less the premium collected

if the stock price falls to zero. Writing call options obligates the writer to sell the stock at the strike price if the stock’s

current market price is greater than the strike price prior to expiration of the call option. The potential loss in writing a naked call

option is unlimited as the rise of a stock price is unlimited. The potential loss in writing a covered call is limited to the strike

price less the cost of the underlying security the Company holds in the portfolio. The Company endeavors to write covered calls but may

also write naked calls.

Cash

receivable from broker and margin loans payable reflect accounts with the Company’s Broker. Due from broker represents amounts

receivable from brokers that are available for investing but have not been invested. Margin loan payable represents obligations to the

Broker for leveraging investments in securities. Investments in securities are collateral for the margin loan payable. The Company does

not have the right of setoff nor netting agreements between brokers.

The

Company’s investments may be subject to changes in interest rates as they may affect equity and option markets. Interest rate risk

refers to the fluctuations in value of fixed-income securities resulting from the inverse relationship between price and yield. For example,

an increase in general interest rates will tend to reduce the market value of already issued fixed-income investments, and a decline

in general interest rates will tend to increase their value. In addition, debt securities with longer maturities, which tend to have

higher yields, are subject to potentially greater fluctuations in value from changes in interest rates than obligations with shorter

maturities.

The

Company is subject to volatility risk which refers to the magnitude of the movement, but not the direction of the movement, in a financial

instrument’s price over a defined time period. Large increases or decreases in a financial instrument’s price over a relative

time period typically indicate greater volatility risk, while small increases or decreases in its price typically indicate lower volatility

risk.

Legal,

tax and regulatory changes continue to occur in the United States and globally, additionally, regulatory environments, as a whole, continue

to evolve and change. The effect of any future legal, tax and/or regulatory changes are unknown and could be substantial and adverse.

8.

Related Party Transactions

The

Company reported $64,333 of portfolio administrative expenses which is included in investment administrative charges on the Statement

of Operations for the six-month period ended June 30, 2023. These charges represent a portion of the payroll and related expenses of

two (2) employees of the Operating Division for services performed for the Company.

Daxor

Corporation

Notes

to Financial Statements

June

30, 2023 (Unaudited)

9.

Margin Loan

As

of June 30, 2023 the Company was not utilizing the margin loan facility available. The Company has available a facility that is secured

by the Company’s investments in marketable securities. The Company utilized the facility during the six month period ended June

30, 2023 and the interest expense on the margin loan for the six month period ended June 30, 2023 was $44,466. The ability of the Company

to incur margin debt at any given time is based on the current amount outstanding and the market value of the portfolio of marketable

securities. There are no set repayment terms for the Company’s margin loan.

The

following table summarizes the margin loan activity for the year ended June 30, 2023:

| Balance at 6/30/23 | | |

Interest

rate at

6/30/23 | |

Maximum

amount

outstanding during

the six months ended

June 30, 2023 | | |

Average

amount

outstanding

during the

six-months ended

June 30, 2023 | | |

Weighted average interest

rate during the six months

ended June 30, 2023 | |

| $ | -0- | | |

|

N/A |

| |

$ | 2,438,635 | | |

$ | 1,011,753 | | |

| 5.720 | % |

10.

Capital Stock

At

June 30, 2023, there were 10,000,000 shares of $0.01 par value capital stock authorized. The paid in capital of $13,278,406 at June 30,

2023 consists of the following amounts:

| Additional Paid in Capital in excess of par value of common Stock | |

$ | 13,225,240 | |

| Common Stock | |

| 53,166 | |

| Total Paid in Capital | |

$ | 13,278,406 | |

11.

Treasury Stock

The

Company’s Board of Directors from time to time has authorized the repurchase of shares of the Company’s common stock in the

open market usually as funds are available and if the stock is trading at a price which management feels is undervalued. The Company

did not repurchase any shares of the Company during the six months ended June 30, 2023. The Company sold 464,599 shares of treasury stock

in May and June 2023 for net proceeds to the Company of $4,102,453.

Treasury stock at Jun 30, 2023:

| Treasury Stock at repurchase price | |

$ | 4,668,572 | |

| Treasury Stock shares | |

| 524,211 | |

12.

Dividends

In

2008, management instituted a policy of paying dividends when funds are available. The Company did not declare a dividend for six-months

ended June 30, 2023.

Daxor

Corporation

Notes

to Financial Statements

June

30, 2023 (Unaudited)

13.

Stock Options

In

June 2019, the Board of Directors of the Company approved the Daxor Corporation 2020 Incentive Compensation Plan (the “2020 Plan”).

In April 2020 the Company received exemptive relief from the Securities & Exchange Commission (“SEC”) and The 2020 Plan

was given approval to become operational effective in April, 2020. The 2020 Plan was approved by shareholders of the Company on June

25, 2020. In addition to Stock Options, awards under the 2020 Plan can consist of Stock Appreciation Rights, Restricted Stock, Restricted

Stock Units, Deferred Stock Units, Cash Awards and Bonus Stock (collectively, “Stock Awards”). The 2020 Plan is an effort

to provide incentive to employees, officers, agents, consultants, and independent contractors through proprietary interest. The Board

of Directors acts as the Plan Administrator, and may issue these Stock Awards at its discretion.

The

2020 Plan replaced the 2004 Stock Option Plan.

The

maximum number of shares that may be issued under the 2020 Plan is 250,000 or 5% of the Company’s outstanding shares, whichever

is greater. The Company has obtained approval from shareholders to increase the number of shares available for issuance from 250,000

shares to 400,000 shares (or such lesser amount as may be determined by the Company), subject to the SEC granting an exemptive order

to permit the operation of the 2020 Plan as amended, and the SEC may not elect to grant such order. Under the provisions of the 2020

Plan, the exercise price of any stock options issued is a minimum of 100% of the closing market price of the Company’s stock on

the grant date of the option. Previously, the Company issued options to various employees under the previous 2004 Stock Option Plan and

the Stock Option Plan that was also administered by the Board of Directors. All issuances have varying vesting and expiration timelines.

As of June 30, 2023 the 2020 Plan had 206,220 options outstanding and 149,228 were exercisable. The 2004 Stock Option Plan had 37,216

options outstanding and 37,216 were exercisable. The Company has not granted options under the 2004 Stock Option Plan since August 2018.

The 2004 Stock Option Plan ceased operation upon approval of the 2020 Plan, although stock options that were awarded under the 2004 Plan

that have not expired are still eligible to be exercised.

At

June 30, 2023, there was $1,745,712 of unvested stock-based compensation expense to recognize. The Company recognized $324,273 of stock-based

compensation expense, which is included in investment administrative charges in the Statement of Operations for six month period ended

June 30, 2023. There was no aggregate intrinsic value at June 30, 2023 as the closing price of the Company’s stock was lower than

the average exercise price of the underlying options. The intrinsic value is calculated based on the difference between the closing market

price of the Company’s common stock and the exercise price of the underlying options.

To

calculate the option-based compensation, the Company used the Black-Scholes option-pricing model. The Company’s determination of

fair value of option-based awards on the date of grant using the Black-Scholes model is affected by the Company’s stock price as

well as assumptions regarding a number of subjective variables. These variables include, but are not limited to, the Company’s

expected stock price volatility over the term of the awards, risk-free interest rate, and the expected life of the options. The risk-free

interest rate is based on a treasury instrument whose term is consistent with the expected life of the stock options. The expected volatility,

holding period, and forfeitures of options are based on historical experience.

For

the six month period ended June 30, 2023, 20,072 stock options were granted to employees, Directors and outside consultants from the

2020 Plan with a weighted average exercise price of $9.48. The stock options granted during the six month period ended June 30, 2023

from the 2020 Plan are still outstanding and 149,228 stock options have vested as of June 30, 2023.

The

fair values of stock options granted in the six month period ended June 30, 2023 were estimated using the Black-Scholes option-pricing

model with the following assumptions for the six month period ended June 30, 2023.

| | |

Six

Months

June 2023 | |

| Risk free rate | |

| 4.74 | % |

| Expected life (in years) | |

| 4.79 | |

| Expected volatility | |

| 53.43 | % |

| Dividend yield | |

| 0.00 | % |

| | |

| | |

| Weighted Average grant date fair value per share | |

$ | 9.48 | |

Daxor