Cytek Biosciences, Inc. (“Cytek Biosciences” or “Cytek”) (Nasdaq:

CTKB), a leading cell analysis solutions company, today reported

financial results for the third quarter ended September 30, 2024.

Recent Highlights

- Total revenue for the third quarter of 2024 was

$51.5 million, representing a 7% increase over the third

quarter of 2023 and a 10% increase over the second quarter of 2024.

Year-to-date revenue of $143.0 million at September 30, 2024 was 6%

above the same 9 month period in 2023

- Launched SpectroPanel™ tool, a proprietary new intelligent

algorithm which suggests optimized panels in minutes, expanding the

capabilities of the Panel Builder tool within the Cytek® Cloud

digital ecosystem

- Expanded to a total installed base of 2,821 Cytek instruments,

including the Amnis® and Guava® instruments shipped since the

acquisition of the flow cytometry and imaging business from Luminex

Corporation in February 2023, adding 164 units in the third quarter

of 2024

- Repurchased $12.1 million of Cytek common stock in open market

purchases during the third quarter of 2024 and a total of 2.2

million shares of Cytek common stock since the stock repurchase

program was announced in June 2024

“We delivered solid year-over-year revenue growth in the third

quarter of 2024 despite persistent industry headwinds,

demonstrating how we are leading with the strength of our

portfolio, loyal customer base and reputation in serving growing

markets that need better technology for cell analysis,” said Dr.

Wenbin Jiang, CEO of Cytek Biosciences. “As we look ahead, we

remain focused on strong execution of our growth pillars and

building on the positive momentum we are seeing with the demand for

our products. With the combination of our industry-leading

end-to-end technology portfolio, global diversification and clear

long-term growth drivers, we believe we are fundamentally well

positioned to deliver sustainable growth and profitability.”

Third Quarter 2024 Financial Results

Total revenue for the third quarter of 2024 was $51.5 million, a

7% increase compared to the third quarter of 2023. The increase in

revenue was driven by strong revenue growth across the EMEA and

APAC regions and our service revenue globally.

Gross profit was $29.0 million for the third quarter of 2024, a

7% increase compared to the third quarter of 2023. GAAP gross

profit margin was 56% in the third quarter of 2024 compared to 57%

in the third quarter of 2023. Adjusted gross profit margin, after

adjusting for stock-based compensation expense and amortization of

acquisition-related intangibles, was 60% in the third quarter of

2024 compared to 59% in the third quarter of 2023.

Operating expenses were $33.3 million for the third quarter of

2024, a 1% decrease from $33.6 million in the third quarter of

2023.

Research and development expenses were $9.9 million for the

third quarter of 2024 compared to $11.2 million for the third

quarter of 2023.

Sales and marketing expenses were $12.4 million for the third

quarter of 2024 compared to $12.1 million for the third quarter of

2023.

General and administrative expenses were $10.9 million for the

third quarter of 2024 compared to $10.4 million for the third

quarter of 2023.

Loss from operations in the third quarter of 2024 was $4.2

million compared to loss from operations of $6.4 million in the

third quarter of 2023. Net income in the third quarter of 2024 was

$0.9 million compared to a net loss of $6.5 million in the third

quarter of 2023.

Adjusted EBITDA in the third quarter of 2024 was $7.6 million

compared to $3.7 million in the third quarter of 2023, after

adjusting for stock-based compensation expense, foreign currency

exchange impacts and acquisition-related expenses.

Cash and marketable securities were $277.8 million as of

September 30, 2024, compared to $277.2 million as of June 30, 2024.

This represents an increase of $0.6 million, despite a cash

expenditure of $12.1 million for the repurchase of Cytek shares

during the third quarter.

2024 Outlook

Cytek Biosciences reaffirms its 2024 revenue guidance of full

year 2024 revenue to be in the range of $203 million to $210

million, representing growth of 5% to 9% over full year 2023,

assuming no change in currency exchange rates. In addition, Cytek

continues to expect to report a net loss in the single digit

millions for the full year 2024 and positive cash flow from

operations in 2024.

Webcast Information

Cytek will host a conference call to discuss its third quarter

2024 financial results on Tuesday, November 5, 2024, at 1:30 p.m.

Pacific Time / 4:30 p.m. Eastern Time. A webcast of the conference

call can be accessed at investors.cytekbio.com.

About Cytek Biosciences, Inc. Cytek Biosciences

(Nasdaq: CTKB) is a leading cell analysis solutions company

advancing the next generation of cell analysis tools by delivering

high-resolution, high-content and high-sensitivity cell analysis

utilizing its patented Full Spectrum Profiling™ (FSP™) technology.

Cytek’s novel approach harnesses the power of information within

the entire spectrum of a fluorescent signal to achieve a higher

level of multiplexing with precision and sensitivity. Cytek’s FSP

platform includes its core instruments, the Cytek Aurora™ and

Northern Lights™ systems; its cell sorter, the Cytek Aurora CS; the

Cytek Orion™ reagent cocktail preparation system; the Enhanced

Small Particle™ (ESP™) detection technology; the flow cytometer and

imaging products under the Amnis® and Guava® brands; and reagents,

software and service to provide a comprehensive and integrated

suite of solutions for its customers. Cytek is headquartered in

Fremont, California with offices and distribution channels across

the globe. More information about the company and its products is

available at www.cytekbio.com.

Cytek’s products are for research use only and not for use in

diagnostic procedures (other than Cytek’s Northern Lights-CLC

system and certain reagents, which are available for clinical use

in China and the European Union).

Cytek, SpectroPanel, Full Spectrum Profiling, FSP, Cytek Aurora,

Northern Lights, Cytek Orion, Enhanced Small Particle, ESP, Amnis

and Guava are trademarks of Cytek Biosciences, Inc.

In addition to filings with the Securities and Exchange

Commission (SEC), press releases, public conference calls and

webcasts, Cytek uses its website (www.cytekbio.com), LinkedIn page

and X (formerly Twitter) account as channels of distribution of

information about its company, products, planned financial and

other announcements, attendance at upcoming investor and industry

conferences and other matters. Such information may be deemed

material information and Cytek may use these channels to comply

with its disclosure obligations under Regulation FD. Therefore,

investors should monitor Cytek’s website, LinkedIn page, and X

account in addition to following its SEC filings, news releases,

public conference calls and webcasts.

Statement Regarding Use of Non-GAAP Financial

Information

Cytek has presented certain financial information in accordance

with U.S. GAAP and also on a non-GAAP basis for the three-month

periods ended September 30, 2024 and September 30, 2023. Management

believes that non-GAAP financial measures, including “Adjusted

gross profit margin” and “Adjusted EBITDA” referenced above, taken

in conjunction with GAAP financial measures, provide useful

information for both management and investors by excluding certain

non-cash and other expenses that are not indicative of the

company’s core operating results. Management uses non-GAAP measures

to compare the company’s performance relative to forecasts and

strategic plans and to benchmark the company’s performance

externally against competitors. Non-GAAP information is not

prepared under a comprehensive set of accounting rules and should

only be used to supplement an understanding of the company’s

operating results as reported under U.S. GAAP. Cytek encourages

investors to carefully consider its results under GAAP, as well as

its supplemental non-GAAP information and the reconciliation

between these presentations, to more fully understand its business.

Reconciliations between GAAP and non-GAAP operating results are

presented in the accompanying tables of this release.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995

as contained in Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, which are subject to the “safe harbor” created by those

sections. All statements, other than statements of historical

facts, may be forward-looking statements. Forward-looking

statements generally can be identified by the use of

forward-looking terminology such as “may,” “might," "will,”

“should,” “expect,” “plan,” “anticipate,” “could,” “intend,”

“target,” “project,” “contemplate,” “believe,” “estimate,”

“predict,” “potential” or “continue” or the negatives of these

terms or variations of them or similar terminology, but the absence

of these words does not mean that a statement is not

forward-looking. These forward-looking statements include

statements regarding the execution of Cytek’s growth pillars; the

potential to build on positive momentum with the demand for Cytek’s

products; long-term growth drivers; the potential to deliver

sustainable growth and profitability; and Cytek’s future financial

performance, including its outlook for fiscal year 2024. These

statements are based on management’s current expectations,

forecasts, beliefs, assumptions and information currently available

to management. These statements also deal with future events and

involve known and unknown risks, uncertainties and other factors

that may cause actual results, performance or achievements to be

materially different from the information expressed or implied by

these forward-looking statements. Factors that could cause actual

results to differ materially include global geopolitical, economic

and market conditions; Cytek's ability to evaluate its prospects

for future viability and predict future performance; Cytek’s

ability to accurately forecast customer demand and adoption of its

products; Cytek’s ability to recognize the anticipated benefits of

collaborations; Cytek’s dependence on certain sole and single

source suppliers; competition; market acceptance of Cytek’s current

and potential products; Cytek’s ability to manage the growth and

complexity of its organization, maintain relationships with

customers and suppliers and retain key employees; Cytek’s ability

to maintain, protect and enhance its intellectual property; and

Cytek’s ability to continue to stay in compliance with its material

contractual obligations, applicable laws and regulations. You

should refer to the section entitled “Risk Factors” set forth in

Cytek’s most recent Annual Report on Form 10-K filed with the SEC

on March 13, 2024, Cytek’s Quarterly Report on Form 10-Q to be

filed with the SEC on or about the date hereof and other filings

Cytek makes with the SEC from time to time for a discussion of

important factors that may cause actual results to differ

materially from those expressed or implied by Cytek’s

forward-looking statements. Although Cytek believes that the

expectations reflected in the forward-looking statements are

reasonable, it cannot provide any assurance that these expectations

will prove to be correct nor can it guarantee that the future

results, levels of activity, performance and events and

circumstances reflected in the forward-looking statements will be

achieved or occur. The forward-looking statements in this press

release are based on information available to Cytek as of the date

hereof, and Cytek disclaims any obligation to update any

forward-looking statements provided to reflect any change in its

expectations or any change in events, conditions, or circumstances

on which any such statement is based, except as required by law.

These forward-looking statements should not be relied upon as

representing Cytek’s views as of any date subsequent to the date of

this press release.

Media Contact:Stephanie OlsenLages &

Associates(949) 453-8080stephanie@lages.com

Investor Relations Contact:Paul D. GoodsonHead

of Investor Relationspgoodson@cytekbio.com

|

Cytek Biosciences,

Inc.Consolidated Balance

Sheets |

|

(In thousands,

except share and

per share

data) |

September

30,2024 |

December

31,2023 |

|

|

(unaudited) |

(audited) |

|

Assets |

|

|

|

Current assets: |

|

|

|

Cash and cash equivalents |

$ |

162,272 |

|

$ |

167,299 |

|

|

Restricted cash |

|

31 |

|

|

331 |

|

|

Marketable securities |

|

115,505 |

|

|

95,111 |

|

|

Trade accounts receivable, net |

|

52,634 |

|

|

55,928 |

|

|

Inventories |

|

46,800 |

|

|

60,877 |

|

|

Prepaid expenses and other current assets |

|

12,949 |

|

|

12,514 |

|

|

Total current assets |

|

390,191 |

|

|

392,060 |

|

|

Deferred income tax assets, noncurrent |

|

30,778 |

|

|

30,487 |

|

|

Property and equipment, net |

|

18,508 |

|

|

18,405 |

|

|

Operating lease right-of-use assets |

|

10,124 |

|

|

10,853 |

|

|

Goodwill |

|

16,183 |

|

|

16,183 |

|

|

Intangible assets, net |

|

20,492 |

|

|

23,084 |

|

|

Other noncurrent assets |

|

4,950 |

|

|

3,385 |

|

|

Total assets |

$ |

491,226 |

|

$ |

494,457 |

|

|

Liabilities and

stockholders’ equity |

|

|

|

Current liabilities: |

|

|

|

Trade accounts payable |

$ |

5,389 |

|

$ |

3,032 |

|

|

Legal settlement liability, current |

|

2,496 |

|

|

2,561 |

|

|

Accrued expenses |

|

20,733 |

|

|

20,035 |

|

|

Other current liabilities |

|

8,814 |

|

|

7,903 |

|

|

Deferred revenue, current |

|

25,365 |

|

|

22,695 |

|

|

Total current liabilities |

|

62,797 |

|

|

56,226 |

|

|

Legal settlement liability, noncurrent |

|

17,066 |

|

|

16,477 |

|

|

Deferred revenue, noncurrent |

|

14,787 |

|

|

15,132 |

|

|

Operating lease liability, noncurrent |

|

7,756 |

|

|

9,479 |

|

|

Long term debt |

|

1,236 |

|

|

1,648 |

|

|

Other noncurrent liabilities |

|

2,121 |

|

|

2,431 |

|

|

Total liabilities |

$ |

105,763 |

|

$ |

101,393 |

|

|

Stockholders’ equity: |

|

|

|

Common stock, $0.001 par value; 1,000,000,000 authorized shares as

of September 30, 2024 and December 31, 2023; 129,766,011 and

130,714,906issued and outstanding shares as of September 30, 2024

and December 31, 2023, respectively. |

|

130 |

|

|

131 |

|

|

Additional paid-in capital |

|

430,072 |

|

|

423,386 |

|

|

Accumulated deficit |

|

(44,840 |

) |

|

(29,178 |

) |

|

Accumulated other comprehensive gain (loss) |

|

101 |

|

|

(1,275 |

) |

|

Total stockholders’ equity |

|

385,463 |

|

|

393,064 |

|

|

Total liabilities and stockholders’ equity |

$ |

491,226 |

|

$ |

494,457 |

|

|

Cytek Biosciences,

Inc.Consolidated

Statements of

Operations and

Comprehensive Income

(Loss)(unaudited) |

|

|

Three months ended September 30, |

Nine months ended September 30, |

|

(In thousands,

except share and

per share

data) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Revenue, net: |

|

|

|

|

|

Product |

$ |

39,544 |

|

$ |

38,441 |

|

$ |

108,242 |

|

$ |

110,065 |

|

|

Service |

|

11,956 |

|

|

9,559 |

|

|

34,735 |

|

|

24,717 |

|

|

Total revenue, net |

|

51,500 |

|

|

48,000 |

|

|

142,977 |

|

|

134,782 |

|

|

Cost of sales: |

|

|

|

|

|

Product |

|

17,490 |

|

|

16,205 |

|

|

50,044 |

|

|

45,557 |

|

|

Service |

|

5,005 |

|

|

4,617 |

|

|

15,479 |

|

|

12,847 |

|

|

Total cost of sales |

|

22,495 |

|

|

20,822 |

|

|

65,523 |

|

|

58,404 |

|

|

Gross profit |

|

29,005 |

|

|

27,178 |

|

|

77,454 |

|

|

76,378 |

|

|

Operating expenses: |

|

|

|

|

|

Research and development |

|

9,882 |

|

|

11,171 |

|

|

29,679 |

|

|

33,282 |

|

|

Sales and marketing |

|

12,429 |

|

|

12,076 |

|

|

37,240 |

|

|

37,587 |

|

|

General and administrative |

|

10,942 |

|

|

10,351 |

|

|

34,044 |

|

|

33,217 |

|

|

Total operating expenses |

|

33,253 |

|

|

33,598 |

|

|

100,963 |

|

|

104,086 |

|

|

Loss from operations |

|

(4,248 |

) |

|

(6,420 |

) |

|

(23,509 |

) |

|

(27,708 |

) |

|

Other income (expense): |

|

|

|

|

|

Interest expense |

|

(119 |

) |

|

(595 |

) |

|

(694 |

) |

|

(1,677 |

) |

|

Interest income |

|

1,433 |

|

|

1,622 |

|

|

4,208 |

|

|

4,965 |

|

|

Other income, net |

|

3,091 |

|

|

1,208 |

|

|

3,972 |

|

|

4,600 |

|

|

Total other income, net |

|

4,405 |

|

|

2,235 |

|

|

7,486 |

|

|

7,888 |

|

|

Income (loss) before income taxes |

|

157 |

|

|

(4,185 |

) |

|

(16,023 |

) |

|

(19,820 |

) |

|

(Benefit from) provision for income taxes |

|

(784 |

) |

|

2,271 |

|

|

(360 |

) |

|

(2,169 |

) |

|

Net income (loss) |

|

941 |

|

|

(6,456 |

) |

|

(15,663 |

) |

|

(17,651 |

) |

| Net

income (loss), basic and diluted |

$ |

941 |

|

$ |

(6,456 |

) |

$ |

(15,663 |

) |

$ |

(17,651 |

) |

|

Net income (loss) per share, basic |

$ |

0.01 |

$ |

(0.05) |

|

$ |

(0.12 |

) |

$ |

(0.13 |

) |

| Net

income (loss) per share, diluted |

$ |

0.01 |

$ |

(0.05) |

|

$ |

(0.12 |

) |

$ |

(0.13 |

) |

|

Weighted-average shares used incalculating net income (loss) per

share, basic |

|

131,003,744 |

|

136,173,278 |

|

|

131,121,301 |

|

|

135,862,905 |

|

|

Weighted-average shares used incalculating net income (loss) per

share, |

|

|

|

|

|

|

|

|

|

|

|

|

diluted |

|

132,785,552 |

|

136,173,278 |

|

|

131,121,301 |

|

|

135,862,905 |

|

|

Comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

| Net

income (loss) |

$ |

941 |

$ |

(6,456 |

) |

$ |

(15,663 |

) |

$ |

(17,651 |

) |

|

Foreign currency translation adjustment, net of tax |

|

101 |

|

165 |

|

|

1,232 |

|

|

(856 |

) |

|

Unrealized gain (loss) on marketable securities |

|

195 |

|

15 |

|

|

144 |

|

|

(26 |

) |

|

Net comprehensive income (loss) |

$ |

1,237 |

$ |

(6,276 |

) |

$ |

(14,287 |

) |

$ |

(18,533 |

) |

|

Cytek Biosciences, Inc.Reconciliation of

GAAP to Non-GAAP Measures (Unaudited) |

|

|

|

Three months ended |

|

(In thousands) |

|

September 30,

2024 |

September 30,

2023 |

|

|

|

(Unaudited) |

(Unaudited) |

|

GAAP Gross

profit |

|

$ |

29,005 |

|

$ |

27,178 |

|

|

Stock based compensation |

|

$ |

1,154 |

|

$ |

829 |

|

|

Amortization of acquisition-related intangible assets |

|

$ |

492 |

|

$ |

458 |

|

|

Non-GAAP Adjusted

gross profit |

|

$ |

30,651 |

|

$ |

28,465 |

|

|

Non-GAAP Adjusted

gross profit

margin % |

|

|

60 |

% |

|

59 |

% |

|

GAAP Net income

(loss) |

|

$ |

941 |

|

$ |

(6,456 |

) |

|

Depreciation and amortization |

|

$ |

2,807 |

|

$ |

2,561 |

|

|

(Benefit from) provision for income taxes |

|

$ |

(784 |

) |

$ |

2,271 |

|

|

Interest income |

|

$ |

(1,433 |

) |

$ |

(1,622 |

) |

|

Interest expense |

|

$ |

119 |

|

$ |

595 |

|

|

Foreign currency exchange (gain) loss |

|

$ |

(1,076 |

) |

$ |

613 |

|

|

Stock based compensation |

|

$ |

7,053 |

|

$ |

5,758 |

|

|

Non-GAAP Adjusted

EBITDA |

|

$ |

7,627 |

|

$ |

3,720 |

|

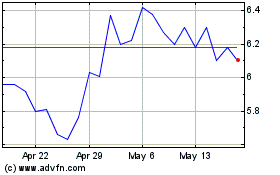

Cytek Biosciences (NASDAQ:CTKB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Cytek Biosciences (NASDAQ:CTKB)

Historical Stock Chart

From Dec 2023 to Dec 2024