0001005757Q2false--12-313 YearsP1DP4D30-09-202830-09-2026September 30, 20260001005757csgs:AcquisitionOneMember2024-04-010001005757us-gaap:LicenseAndServiceMember2023-04-012023-06-3000010057572024-01-012024-03-310001005757us-gaap:TreasuryStockCommonMember2024-03-310001005757srt:AsiaPacificMember2024-01-012024-06-300001005757csgs:BroadbandCableSatelliteMember2024-04-012024-06-3000010057572023-04-012023-06-300001005757srt:MaximumMember2024-01-012024-06-300001005757srt:AmericasMember2023-01-012023-06-300001005757us-gaap:LicenseAndServiceMember2023-01-012023-06-300001005757csgs:TimeBasedAwardsMember2024-01-012024-06-300001005757us-gaap:OneTimeTerminationBenefitsMember2023-12-310001005757us-gaap:CommonStockMember2024-06-300001005757csgs:BroadbandCableSatelliteMember2024-01-012024-06-300001005757us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001005757us-gaap:MaintenanceMember2023-01-012023-06-300001005757us-gaap:LicenseAndServiceMember2024-01-012024-06-300001005757us-gaap:CommonStockMember2023-04-012023-06-300001005757us-gaap:RetainedEarningsMember2023-06-300001005757csgs:SECRule10b51PlanMember2024-04-012024-06-300001005757us-gaap:OtherCurrentAssetsMember2024-06-300001005757us-gaap:TreasuryStockCommonMember2024-01-012024-03-310001005757csgs:TwoThousandTwentyOneCreditAgreementMembersrt:MinimumMember2024-01-012024-06-300001005757us-gaap:RetainedEarningsMember2023-04-012023-06-300001005757csgs:StockRepurchaseProgramMember2024-08-010001005757us-gaap:MaintenanceMember2023-04-012023-06-300001005757csgs:OtherMember2023-04-012023-06-300001005757srt:MinimumMember2024-01-012024-06-300001005757csgs:CustomerContractCostsMember2023-04-012023-06-300001005757csgs:AcquiredCustomerContractsMember2023-12-310001005757us-gaap:RetainedEarningsMember2023-12-310001005757us-gaap:AdditionalPaidInCapitalMember2023-06-300001005757csgs:TelecommunicationsMember2023-01-012023-06-300001005757us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-3000010057572024-07-012024-06-300001005757csgs:SoftwareAsAServiceAndRelatedSolutionsMember2024-01-012024-06-300001005757csgs:ComcastCorporationMember2024-06-300001005757us-gaap:EMEAMember2023-01-012023-06-300001005757srt:AsiaPacificMember2023-04-012023-06-300001005757csgs:NewFinancingAgreementMemberus-gaap:OtherCurrentLiabilitiesMember2024-06-300001005757us-gaap:EMEAMember2024-01-012024-06-300001005757us-gaap:AdditionalPaidInCapitalMember2023-03-310001005757us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001005757us-gaap:ComputerSoftwareIntangibleAssetMember2023-12-310001005757csgs:MarketBasedAwardsMember2024-01-012024-06-300001005757csgs:SoftwareAsAServiceAndRelatedSolutionsMember2023-04-012023-06-300001005757csgs:NewFinancingAgreementMemberus-gaap:OtherNoncurrentLiabilitiesMember2024-06-300001005757srt:AsiaPacificMember2024-04-012024-06-300001005757csgs:AcquiredCustomerContractsMember2024-06-300001005757us-gaap:OneTimeTerminationBenefitsMember2024-01-012024-06-300001005757us-gaap:EMEAMember2023-04-012023-06-300001005757us-gaap:RevolvingCreditFacilityMembercsgs:TwoThousandTwentyOneCreditAgreementMember2023-12-3100010057572024-03-310001005757us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001005757csgs:TwoThousandTwentyOneCreditAgreementMembersrt:MaximumMember2024-01-012024-06-300001005757csgs:TwoThousandTwentyThreeSeniorConvertibleNotesMember2024-01-012024-06-3000010057572023-12-310001005757csgs:StockRepurchaseProgramMember2024-01-012024-06-300001005757us-gaap:TreasuryStockCommonMember2024-04-012024-06-300001005757us-gaap:LicenseAndServiceMember2024-04-012024-06-300001005757csgs:IcheckGatewayComLLCMember2024-06-032024-06-030001005757us-gaap:MaintenanceMember2024-04-012024-06-300001005757us-gaap:CommonStockMember2023-01-012023-03-310001005757us-gaap:MaintenanceMember2024-01-012024-06-300001005757csgs:SoftwareAsAServiceAndRelatedSolutionsMember2023-01-012023-06-300001005757us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001005757us-gaap:TreasuryStockCommonMember2023-12-310001005757csgs:TwoThousandTwentyThreeSeniorUnsecuredConvertibleNotesMember2024-01-012024-06-300001005757csgs:NewFinancingAgreementMember2024-06-300001005757csgs:SoftwareAsAServiceAndRelatedSolutionsRevenueMembersrt:MinimumMember2024-01-012024-06-300001005757csgs:CustomerContractCostsMember2024-04-012024-06-3000010057572023-01-012023-03-310001005757csgs:TwoThousandTwentyThreeSeniorConvertibleNotesMember2024-06-3000010057572024-06-3000010057572023-03-310001005757csgs:IcheckGatewayComLLCMember2024-06-300001005757csgs:AcquisitionOneMembercsgs:AcquiredCustomerContractsMember2024-04-010001005757us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001005757csgs:AcquisitionOneMember2024-01-012024-06-300001005757us-gaap:CommonStockMember2024-03-310001005757csgs:OtherMember2024-04-012024-06-300001005757us-gaap:AdditionalPaidInCapitalMember2022-12-310001005757us-gaap:CommonStockMember2023-06-300001005757csgs:ComcastCorporationMember2014-07-310001005757csgs:TwoThousandTwentyOneCreditAgreementMember2024-06-300001005757csgs:BroadbandCableSatelliteMember2023-01-012023-06-300001005757us-gaap:CommonStockMember2022-12-310001005757us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001005757csgs:TwoThousandTwentyThreeSeniorConvertibleNotesMembersrt:MinimumMember2024-01-012024-06-300001005757csgs:CurrentLiabilitiesMember2024-06-300001005757csgs:BidBondMember2024-06-3000010057572024-08-060001005757csgs:DgitSystemsPtyLtdMember2024-01-012024-06-300001005757us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001005757srt:AsiaPacificMember2023-01-012023-06-300001005757us-gaap:BaseRateMembercsgs:TwoThousandTwentyOneCreditAgreementMembersrt:MinimumMember2024-01-012024-06-300001005757us-gaap:RevolvingCreditFacilityMembercsgs:TwoThousandTwentyOneCreditAgreementMember2024-01-012024-06-300001005757srt:AmericasMember2024-04-012024-06-300001005757us-gaap:RetainedEarningsMember2024-03-310001005757csgs:OtherMember2023-01-012023-06-300001005757us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300001005757csgs:TwoThousandTwentyThreeSeniorUnsecuredConvertibleNotesMember2024-06-300001005757csgs:TerminationBenefitsRelatedToOrganizationalChangesMember2024-01-012024-06-300001005757us-gaap:AdditionalPaidInCapitalMember2023-12-310001005757us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembercsgs:TwoThousandTwentyOneCreditAgreementMembercsgs:TwoThousandTwentyOneTermLoanMember2024-06-300001005757csgs:TwoThousandTwentyThreeSeniorConvertibleNotesMember2023-12-3100010057572014-07-012014-07-310001005757us-gaap:RetainedEarningsMember2024-04-012024-06-300001005757us-gaap:RetainedEarningsMember2023-03-310001005757csgs:IcheckGatewayComLLCMember2024-06-030001005757csgs:TwoThousandTwentyOneCreditAgreementMembercsgs:TwoThousandTwentyOneTermLoanMember2024-06-300001005757us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001005757us-gaap:OtherRestructuringMember2024-01-012024-06-300001005757csgs:BroadbandCableSatelliteMember2023-04-012023-06-3000010057572014-07-310001005757us-gaap:TreasuryStockCommonMember2023-01-012023-03-310001005757csgs:SoftwareAsAServiceAndRelatedSolutionsMember2024-04-012024-06-300001005757us-gaap:OtherRestructuringMember2024-06-3000010057572024-01-012024-06-300001005757us-gaap:EMEAMember2024-04-012024-06-300001005757csgs:TwoThousandTwentyOneCreditAgreementMember2023-12-310001005757srt:AmericasMember2024-01-012024-06-300001005757us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001005757us-gaap:CommonStockMember2023-12-310001005757us-gaap:ComputerSoftwareIntangibleAssetMember2024-06-300001005757csgs:CustomerContractCostsMember2024-01-012024-06-300001005757us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300001005757csgs:TelecommunicationsMember2024-04-012024-06-300001005757csgs:TwoThousandTwentyThreeSeniorUnsecuredConvertibleNotesMember2023-12-310001005757us-gaap:TreasuryStockCommonMember2023-06-300001005757us-gaap:RetainedEarningsMember2024-06-300001005757us-gaap:CommonStockMember2023-03-310001005757us-gaap:RetainedEarningsMember2024-01-012024-03-310001005757us-gaap:CommonStockMembercsgs:TwoThousandTwentyThreeSeniorConvertibleNotesMember2024-01-012024-06-300001005757us-gaap:RevolvingCreditFacilityMembercsgs:TwoThousandTwentyOneCreditAgreementMember2024-06-300001005757us-gaap:RetainedEarningsMember2022-12-310001005757csgs:SoftwareAsAServiceAndRelatedSolutionsRevenueMembersrt:MaximumMember2024-01-012024-06-300001005757us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001005757csgs:SuretyAndMoneyTransmitterBondsMember2024-06-300001005757us-gaap:TreasuryStockCommonMember2024-06-300001005757us-gaap:AdditionalPaidInCapitalMember2024-06-300001005757us-gaap:BaseRateMembercsgs:TwoThousandTwentyOneCreditAgreementMembersrt:MaximumMember2024-01-012024-06-300001005757us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembercsgs:TwoThousandTwentyOneCreditAgreementMembersrt:MinimumMember2024-01-012024-06-300001005757csgs:OtherMember2024-01-012024-06-300001005757csgs:SECRule10b51PlanMember2024-01-012024-06-3000010057572023-01-012023-06-300001005757csgs:TelecommunicationsMember2024-01-012024-06-300001005757us-gaap:RetainedEarningsMember2023-01-012023-03-310001005757us-gaap:CommonStockMember2024-01-012024-03-310001005757us-gaap:TreasuryStockCommonMember2022-12-310001005757us-gaap:OneTimeTerminationBenefitsMember2024-06-300001005757csgs:TwoThousandTwentyThreeSeniorConvertibleNotesMembersrt:MinimumMember2024-06-300001005757csgs:IcheckGatewayComLLCMembercsgs:AcquiredCustomerContractsMember2024-06-0300010057572024-04-012024-06-300001005757csgs:TwoThousandTwentyOneCreditAgreementMembercsgs:TwoThousandTwentyOneTermLoanMember2023-12-3100010057572023-06-3000010057572022-12-310001005757us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001005757csgs:CustomerContractCostsMember2023-01-012023-06-300001005757csgs:TelecommunicationsMember2023-04-012023-06-300001005757us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:RevolvingCreditFacilityMembercsgs:TwoThousandTwentyOneCreditAgreementMember2024-06-300001005757us-gaap:CommonStockMember2024-04-012024-06-300001005757srt:AmericasMember2023-04-012023-06-300001005757us-gaap:AdditionalPaidInCapitalMember2024-03-310001005757csgs:DgitSystemsPtyLtdMember2024-06-300001005757us-gaap:OtherRestructuringMember2023-12-310001005757csgs:TwoThousandTwentyOneCreditAgreementMembercsgs:TwoThousandTwentyOneTermLoanMember2024-01-012024-06-300001005757csgs:IcheckGatewayComLLCMember2024-01-012024-06-300001005757csgs:StockRepurchaseProgramMember2024-06-300001005757us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembercsgs:TwoThousandTwentyOneCreditAgreementMembersrt:MaximumMember2024-01-012024-06-300001005757us-gaap:TreasuryStockCommonMember2023-03-310001005757us-gaap:OtherNoncurrentAssetsMember2024-06-30xbrli:purecsgs:Employeesxbrli:sharescsgs:Tradingdayiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

|

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2024

OR

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 0-27512

CSG SYSTEMS INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

|

|

Delaware |

47-0783182 |

(State or other jurisdiction

of incorporation or organization) |

(I.R.S. Employer

Identification No.) |

169 Inverness Dr W, Suite 300

Englewood, Colorado 80112

(Address of principal executive offices, including zip code)

(303) 200-2000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, Par Value $0.01 Per Share |

|

CSGS |

|

NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

Large accelerated filer |

|

☒ |

|

Accelerated filer |

|

☐ |

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

☐ |

Emerging growth company |

|

☐ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of August 6, 2024, there were 29,503,059 shares of the registrant’s common stock outstanding.

CSG SYSTEMS INTERNATIONAL, INC.

FORM 10-Q for the Quarter Ended June 30, 2024

INDEX

CSG SYSTEMS INTERNATIONAL, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS - UNAUDITED

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

June 30,

2024 |

|

|

December 31,

2023 |

|

ASSETS |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

110,435 |

|

|

$ |

186,264 |

|

Settlement and merchant reserve assets |

|

|

232,054 |

|

|

|

274,699 |

|

Trade accounts receivable: |

|

|

|

|

|

|

Billed, net of allowance of $4,720 and $5,432 |

|

|

266,214 |

|

|

|

267,680 |

|

Unbilled |

|

|

84,570 |

|

|

|

82,163 |

|

Income taxes receivable |

|

|

10,028 |

|

|

|

1,345 |

|

Other current assets |

|

|

55,740 |

|

|

|

50,075 |

|

Total current assets |

|

|

759,041 |

|

|

|

862,226 |

|

Non-current assets: |

|

|

|

|

|

|

Property and equipment, net of depreciation of $131,573 and $121,816 |

|

|

59,111 |

|

|

|

65,545 |

|

Operating lease right-of-use assets |

|

|

28,656 |

|

|

|

34,283 |

|

Software, net of amortization of $164,369 and $157,601 |

|

|

21,408 |

|

|

|

14,224 |

|

Goodwill |

|

|

317,129 |

|

|

|

308,596 |

|

Acquired customer contracts, net of amortization of $128,867 and $126,469 |

|

|

46,818 |

|

|

|

35,879 |

|

Customer contract costs, net of amortization of $44,140 and $42,094 |

|

|

57,128 |

|

|

|

54,421 |

|

Deferred income taxes |

|

|

54,934 |

|

|

|

57,855 |

|

Other assets |

|

|

9,063 |

|

|

|

10,017 |

|

Total non-current assets |

|

|

594,247 |

|

|

|

580,820 |

|

Total assets |

|

$ |

1,353,288 |

|

|

$ |

1,443,046 |

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Current portion of long-term debt |

|

$ |

7,500 |

|

|

$ |

7,500 |

|

Operating lease liabilities |

|

|

14,841 |

|

|

|

15,946 |

|

Customer deposits |

|

|

35,993 |

|

|

|

41,035 |

|

Trade accounts payable |

|

|

52,862 |

|

|

|

46,406 |

|

Accrued employee compensation |

|

|

49,765 |

|

|

|

84,380 |

|

Settlement and merchant reserve liabilities |

|

|

229,636 |

|

|

|

273,817 |

|

Deferred revenue |

|

|

56,145 |

|

|

|

54,199 |

|

Income taxes payable |

|

|

645 |

|

|

|

4,104 |

|

Other current liabilities |

|

|

29,057 |

|

|

|

33,449 |

|

Total current liabilities |

|

|

476,444 |

|

|

|

560,836 |

|

Non-current liabilities: |

|

|

|

|

|

|

Long-term debt, net of unamortized discounts of $13,893 and $15,628 |

|

|

532,982 |

|

|

|

534,997 |

|

Operating lease liabilities |

|

|

27,722 |

|

|

|

34,360 |

|

Deferred revenue |

|

|

22,375 |

|

|

|

23,447 |

|

Income taxes payable |

|

|

3,241 |

|

|

|

3,041 |

|

Deferred income taxes |

|

|

122 |

|

|

|

123 |

|

Other non-current liabilities |

|

|

17,073 |

|

|

|

12,916 |

|

Total non-current liabilities |

|

|

603,515 |

|

|

|

608,884 |

|

Total liabilities |

|

|

1,079,959 |

|

|

|

1,169,720 |

|

Stockholders' equity: |

|

|

|

|

|

|

Preferred stock, par value $.01 per share; 10,000 shares authorized; zero shares issued and

outstanding |

|

|

- |

|

|

|

- |

|

Common stock, par value $.01 per share; 100,000 shares authorized; 29,591 and 29,541 shares

outstanding |

|

|

717 |

|

|

|

713 |

|

Additional paid-in capital |

|

|

499,995 |

|

|

|

490,947 |

|

Treasury stock, at cost; 40,802 and 40,398 shares |

|

|

(1,155,542 |

) |

|

|

(1,136,055 |

) |

Accumulated other comprehensive income (loss): |

|

|

|

|

|

|

Unrealized gain on short-term investments, net of tax |

|

|

- |

|

|

|

1 |

|

Cumulative foreign currency translation adjustments |

|

|

(55,629 |

) |

|

|

(50,414 |

) |

Accumulated earnings |

|

|

983,788 |

|

|

|

968,134 |

|

Total stockholders' equity |

|

|

273,329 |

|

|

|

273,326 |

|

Total liabilities and stockholders' equity |

|

$ |

1,353,288 |

|

|

$ |

1,443,046 |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

CSG SYSTEMS INTERNATIONAL, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME - UNAUDITED

(in thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended |

|

|

Six Months Ended |

|

|

|

June 30, 2024 |

|

|

June 30, 2023 |

|

|

June 30, 2024 |

|

|

June 30, 2023 |

|

|

Revenue |

$ |

290,318 |

|

|

$ |

286,327 |

|

|

$ |

585,453 |

|

|

$ |

585,066 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue (exclusive of depreciation, shown separately below) |

|

152,892 |

|

|

|

151,142 |

|

|

|

310,779 |

|

|

|

306,163 |

|

|

Other operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

38,411 |

|

|

|

36,645 |

|

|

|

74,506 |

|

|

|

72,109 |

|

|

Selling, general and administrative |

|

61,159 |

|

|

|

62,686 |

|

|

|

122,881 |

|

|

|

121,833 |

|

|

Depreciation |

|

5,337 |

|

|

|

5,573 |

|

|

|

10,973 |

|

|

|

11,293 |

|

|

Restructuring and reorganization charges |

|

7,099 |

|

|

|

2,075 |

|

|

|

9,097 |

|

|

|

7,269 |

|

|

Total operating expenses |

|

264,898 |

|

|

|

258,121 |

|

|

|

528,236 |

|

|

|

518,667 |

|

|

Operating income |

|

25,420 |

|

|

|

28,206 |

|

|

|

57,217 |

|

|

|

66,399 |

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

(7,698 |

) |

|

|

(7,837 |

) |

|

|

(15,204 |

) |

|

|

(15,056 |

) |

|

Interest income |

|

2,103 |

|

|

|

772 |

|

|

|

4,719 |

|

|

|

1,341 |

|

|

Other, net |

|

174 |

|

|

|

(1,428 |

) |

|

|

732 |

|

|

|

(3,860 |

) |

|

Total other |

|

(5,421 |

) |

|

|

(8,493 |

) |

|

|

(9,753 |

) |

|

|

(17,575 |

) |

|

Income before income taxes |

|

19,999 |

|

|

|

19,713 |

|

|

|

47,464 |

|

|

|

48,824 |

|

|

Income tax provision |

|

(6,170 |

) |

|

|

(5,759 |

) |

|

|

(14,168 |

) |

|

|

(13,942 |

) |

|

Net income |

$ |

13,829 |

|

|

$ |

13,954 |

|

|

$ |

33,296 |

|

|

$ |

34,882 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

28,546 |

|

|

|

30,629 |

|

|

|

28,531 |

|

|

|

30,524 |

|

|

Diluted |

|

28,600 |

|

|

|

30,726 |

|

|

|

28,698 |

|

|

|

30,668 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.48 |

|

|

$ |

0.46 |

|

|

$ |

1.17 |

|

|

$ |

1.14 |

|

|

Diluted |

|

0.48 |

|

|

|

0.45 |

|

|

|

1.16 |

|

|

|

1.14 |

|

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

CSG SYSTEMS INTERNATIONAL, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME - UNAUDITED

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended |

|

|

Six Months Ended |

|

|

|

|

June 30, 2024 |

|

|

June 30, 2023 |

|

|

June 30, 2024 |

|

|

June 30, 2023 |

|

|

Net income |

|

$ |

13,829 |

|

|

$ |

13,954 |

|

|

$ |

33,296 |

|

|

$ |

34,882 |

|

|

Other comprehensive income (loss), net of tax: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments |

|

|

(241 |

) |

|

|

1,709 |

|

|

|

(5,216 |

) |

|

|

4,552 |

|

|

Other comprehensive income (loss), net of tax |

|

|

(241 |

) |

|

|

1,709 |

|

|

|

(5,216 |

) |

|

|

4,552 |

|

|

Total comprehensive income, net of tax |

|

$ |

13,588 |

|

|

$ |

15,663 |

|

|

$ |

28,080 |

|

|

$ |

39,434 |

|

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

CSG SYSTEMS INTERNATIONAL, INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY - UNAUDITED

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares of Common Stock Outstanding |

|

Common Stock |

|

Additional Paid-in Capital |

|

Treasury Stock |

|

Accumulated Other Comprehensive Income (Loss) |

|

Accumulated Earnings |

|

Total Stockholders' Equity |

|

For the Six Months Ended June 30, 2024: |

|

BALANCE, January 1, 2024 |

|

29,541 |

|

$ |

713 |

|

$ |

490,947 |

|

$ |

(1,136,055 |

) |

$ |

(50,413 |

) |

$ |

968,134 |

|

$ |

273,326 |

|

Comprehensive income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

19,467 |

|

|

|

Foreign currency translation adjustments |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

(4,975 |

) |

|

- |

|

|

|

Total comprehensive income |

|

|

|

|

|

|

|

|

|

|

|

|

|

14,492 |

|

Repurchase of common stock |

|

(344 |

) |

|

(2 |

) |

|

(8,538 |

) |

|

(9,683 |

) |

|

- |

|

|

- |

|

|

(18,223 |

) |

Issuance of common stock pursuant to employee stock

purchase plan |

|

20 |

|

|

- |

|

|

866 |

|

|

- |

|

|

- |

|

|

- |

|

|

866 |

|

Issuance of restricted common stock pursuant to

stock-based compensation plans |

|

573 |

|

|

6 |

|

|

(6 |

) |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

Cancellation of restricted common stock issued

pursuant to stock-based compensation plans |

|

(11 |

) |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

Stock-based compensation expense |

|

- |

|

|

- |

|

|

7,736 |

|

|

- |

|

|

- |

|

|

- |

|

|

7,736 |

|

Dividends |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

(8,857 |

) |

|

(8,857 |

) |

BALANCE, March 31, 2024 |

|

29,779 |

|

|

717 |

|

|

491,005 |

|

|

(1,145,738 |

) |

|

(55,388 |

) |

|

978,744 |

|

|

269,340 |

|

Comprehensive income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

13,829 |

|

|

|

Foreign currency translation adjustments |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

(241 |

) |

|

- |

|

|

|

Total comprehensive income |

|

|

|

|

|

|

|

|

|

|

|

|

|

13,588 |

|

Repurchase of common stock |

|

(228 |

) |

|

- |

|

|

(397 |

) |

|

(9,804 |

) |

|

- |

|

|

- |

|

|

(10,201 |

) |

Issuance of common stock pursuant to employee stock

purchase plan |

|

20 |

|

|

- |

|

|

752 |

|

|

- |

|

|

- |

|

|

- |

|

|

752 |

|

Issuance of restricted common stock pursuant to

stock-based compensation plans |

|

90 |

|

|

1 |

|

|

(1 |

) |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

Cancellation of restricted common stock issued

pursuant to stock-based compensation plans |

|

(70 |

) |

|

(1 |

) |

|

1 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

Stock-based compensation expense |

|

- |

|

|

- |

|

|

8,635 |

|

|

- |

|

|

- |

|

|

- |

|

|

8,635 |

|

Dividends |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

(8,785 |

) |

|

(8,785 |

) |

BALANCE, June 30, 2024 |

|

29,591 |

|

$ |

717 |

|

$ |

499,995 |

|

$ |

(1,155,542 |

) |

$ |

(55,629 |

) |

$ |

983,788 |

|

$ |

273,329 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares of Common Stock Outstanding |

|

Common Stock |

|

Additional Paid-in Capital |

|

Treasury Stock |

|

Accumulated Other Comprehensive Income (Loss) |

|

Accumulated Earnings |

|

Total Stockholders' Equity |

|

For the Six Months Ended June 30, 2023: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BALANCE, January 1, 2023 |

|

31,269 |

|

$ |

708 |

|

$ |

495,189 |

|

$ |

(1,018,034 |

) |

$ |

(58,829 |

) |

$ |

936,215 |

|

$ |

355,249 |

|

Comprehensive income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

20,928 |

|

|

|

Foreign currency translation adjustments |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

2,843 |

|

|

- |

|

|

|

Total comprehensive income |

|

|

|

|

|

|

|

|

|

|

|

|

|

23,771 |

|

Repurchase of common stock |

|

(166 |

) |

|

(2 |

) |

|

(9,304 |

) |

|

- |

|

|

- |

|

|

- |

|

|

(9,306 |

) |

Issuance of common stock pursuant to employee stock

purchase plan |

|

19 |

|

|

- |

|

|

893 |

|

|

- |

|

|

- |

|

|

- |

|

|

893 |

|

Issuance of restricted common stock pursuant to

stock-based compensation plans |

|

574 |

|

|

6 |

|

|

(6 |

) |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

Cancellation of restricted common stock issued

pursuant to stock-based compensation plans |

|

(18 |

) |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

Stock-based compensation expense |

|

- |

|

|

- |

|

|

6,412 |

|

|

- |

|

|

- |

|

|

- |

|

|

6,412 |

|

Dividends |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

(8,796 |

) |

|

(8,796 |

) |

BALANCE, March 31, 2023 |

|

31,678 |

|

|

712 |

|

|

493,184 |

|

|

(1,018,034 |

) |

|

(55,986 |

) |

|

948,347 |

|

|

368,223 |

|

Comprehensive income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

13,954 |

|

|

|

Foreign currency translation adjustments |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

1,709 |

|

|

- |

|

|

|

Total comprehensive income |

|

|

|

|

|

|

|

|

|

|

|

|

|

15,663 |

|

Repurchase of common stock |

|

(2 |

) |

|

- |

|

|

(112 |

) |

|

- |

|

|

- |

|

|

- |

|

|

(112 |

) |

Issuance of common stock pursuant to employee stock

purchase plan |

|

18 |

|

|

- |

|

|

771 |

|

|

- |

|

|

- |

|

|

- |

|

|

771 |

|

Issuance of restricted common stock pursuant to

stock-based compensation plans |

|

64 |

|

|

1 |

|

|

(1 |

) |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

Cancellation of restricted common stock issued

pursuant to stock-based compensation plans |

|

(7 |

) |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

Stock-based compensation expense |

|

- |

|

|

- |

|

|

7,644 |

|

|

- |

|

|

- |

|

|

- |

|

|

7,644 |

|

Dividends |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

(8,878 |

) |

|

(8,878 |

) |

BALANCE, June 30, 2023 |

|

31,751 |

|

$ |

713 |

|

$ |

501,486 |

|

$ |

(1,018,034 |

) |

$ |

(54,277 |

) |

$ |

953,423 |

|

$ |

383,311 |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

CSG SYSTEMS INTERNATIONAL, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS - UNAUDITED

(in thousands)

|

|

|

|

|

|

|

|

|

|

Six Months Ended |

|

|

|

June 30, 2024 |

|

|

June 30, 2023 |

|

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net income |

$ |

33,296 |

|

|

$ |

34,882 |

|

|

Adjustments to reconcile net income to net cash provided by operating activities- |

|

|

|

|

|

|

Depreciation |

|

11,409 |

|

|

|

11,506 |

|

|

Amortization |

|

24,147 |

|

|

|

22,808 |

|

|

Asset impairment |

|

- |

|

|

|

1,689 |

|

|

Gain on lease modifications |

|

- |

|

|

|

(3,812 |

) |

|

Unrealized foreign currency transaction (gain) loss, net |

|

(254 |

) |

|

|

241 |

|

|

Deferred income taxes |

|

2,311 |

|

|

|

(4,673 |

) |

|

Stock-based compensation |

|

16,371 |

|

|

|

14,056 |

|

|

Changes in operating assets and liabilities, net of acquired amounts: |

|

|

|

|

|

|

Trade accounts receivable, net |

|

892 |

|

|

|

(7,789 |

) |

|

Other current and non-current assets and liabilities |

|

(11,154 |

) |

|

|

(16,083 |

) |

|

Income taxes payable/receivable |

|

(11,937 |

) |

|

|

(7,235 |

) |

|

Trade accounts payable and accrued liabilities |

|

(52,596 |

) |

|

|

(26,853 |

) |

|

Deferred revenue |

|

1,269 |

|

|

|

9,046 |

|

|

Net cash provided by operating activities |

|

13,754 |

|

|

|

27,783 |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

Purchases of software, property, and equipment |

|

(9,073 |

) |

|

|

(16,428 |

) |

|

Proceeds from sale/maturity of short-term investments |

|

- |

|

|

|

71 |

|

|

Business combinations, net of cash and settlement assets acquired of $46,432 and zero |

|

17,293 |

|

|

|

- |

|

|

Net cash provided by (used in) investing activities |

|

8,220 |

|

|

|

(16,357 |

) |

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

Proceeds from issuance of common stock |

|

1,618 |

|

|

|

1,664 |

|

|

Payment of cash dividends |

|

(18,088 |

) |

|

|

(17,712 |

) |

|

Repurchase of common stock |

|

(27,943 |

) |

|

|

(9,418 |

) |

|

Deferred acquisition payments |

|

(488 |

) |

|

|

(1,220 |

) |

|

Proceeds from long-term debt |

|

15,000 |

|

|

|

30,000 |

|

|

Payments on long-term debt |

|

(18,750 |

) |

|

|

(18,750 |

) |

|

Payments on financing obligations |

|

(469 |

) |

|

|

- |

|

|

Settlement and merchant reserve activity |

|

(88,703 |

) |

|

|

(63,107 |

) |

|

Net cash used in financing activities |

|

(137,823 |

) |

|

|

(78,543 |

) |

|

Effect of exchange rate fluctuations on cash, cash equivalents, and restricted cash |

|

(2,438 |

) |

|

|

708 |

|

|

|

|

|

|

|

|

|

Net decrease in cash, cash equivalents, and restricted cash |

|

(118,287 |

) |

|

|

(66,409 |

) |

|

|

|

|

|

|

|

|

Cash, cash equivalents, and restricted cash, beginning of period |

|

463,876 |

|

|

|

389,018 |

|

|

Cash, cash equivalents, and restricted cash, end of period |

$ |

345,589 |

|

|

$ |

322,609 |

|

|

|

|

|

|

|

|

|

Supplemental disclosures of cash flow information: |

|

|

|

|

|

|

Cash paid during the period for- |

|

|

|

|

|

|

Interest |

$ |

13,566 |

|

|

$ |

14,672 |

|

|

Income taxes |

|

23,822 |

|

|

|

23,720 |

|

|

|

|

|

|

|

|

|

Non-cash investing and financing activities: |

|

|

|

|

|

|

Software, property, and equipment included in current and noncurrent liabilities |

|

9,017 |

|

|

|

- |

|

|

|

|

|

|

|

|

|

Reconciliation of cash, cash equivalents, and restricted cash: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

110,435 |

|

|

$ |

146,212 |

|

|

Settlement and merchant reserve assets |

|

232,054 |

|

|

|

176,397 |

|

|

Restricted cash included in current and non-current assets |

|

3,100 |

|

|

|

- |

|

|

Total cash, cash equivalents, and restricted cash |

$ |

345,589 |

|

|

$ |

322,609 |

|

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

CSG SYSTEMS INTERNATIONAL, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

1. GENERAL

We have prepared the accompanying unaudited condensed consolidated financial statements as of June 30, 2024 and December 31, 2023, and for the quarters and six months ended June 30, 2024 and 2023, in accordance with accounting principles generally accepted in the United States of America (“U.S.”) (“GAAP”) for interim financial information, and pursuant to the instructions to Form 10-Q and the rules and regulations of the Securities and Exchange Commission (the “SEC”). Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements. In the opinion of our management, all adjustments (consisting only of normal recurring adjustments) considered necessary for a fair presentation of our financial position and operating results have been included. The unaudited Condensed Consolidated Financial Statements (the “Financial Statements”) should be read in conjunction with the Consolidated Financial Statements and notes thereto, together with Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”), contained in our Annual Report on Form 10-K for the year ended December 31, 2023 (our “2023 10-K”), filed with the SEC. The results of operations for the quarter and six months ended June 30, 2024 are not necessarily indicative of the expected results for the entire year ending December 31, 2024.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Use of Estimates in Preparation of Financial Statements. The preparation of our Financial Statements requires management to make estimates and assumptions that may affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of our Financial Statements and the reported amounts of revenue and expenses during the reporting periods. Actual results could differ from those estimates.

Revenue. The majority of our future revenue is related to our customer contracts for our SaaS and related solutions that include variable consideration dependent upon a series of monthly volumes and/or daily usage of services and have contractual terms ending from 2024 through 2036. Our customer contracts may include guaranteed minimums and fixed monthly or annual fees. As of June 30, 2024, our aggregate amount of the transaction price allocated to the remaining performance obligations was approximately $1.4 billion, which is made up of fixed fee consideration and guaranteed minimums expected to be recognized in the future related to performance obligations that are unsatisfied (or partially unsatisfied). We expect to recognize approximately 75% of this amount by the end of 2026, with the remaining amount recognized by the end of 2036. We have excluded from this amount variable consideration expected to be recognized in the future related to performance obligations that are unsatisfied.

The nature, amount, timing, and uncertainty of our revenue and how revenue and cash flows are affected by economic factors is most appropriately depicted by revenue type, geographic region, and customer vertical.

Revenue by type for the quarters and six months ended June 30, 2024 and 2023 was as follows (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended |

|

|

Six Months Ended |

|

|

|

June 30, 2024 |

|

|

June 30, 2023 |

|

|

June 30, 2024 |

|

|

June 30, 2023 |

|

SaaS and related solutions |

|

$ |

262,658 |

|

|

$ |

255,600 |

|

|

$ |

524,353 |

|

|

$ |

513,476 |

|

Software and services |

|

|

14,681 |

|

|

|

18,766 |

|

|

|

37,075 |

|

|

|

49,657 |

|

Maintenance |

|

|

12,979 |

|

|

|

11,961 |

|

|

|

24,025 |

|

|

|

21,933 |

|

Total revenue |

|

$ |

290,318 |

|

|

$ |

286,327 |

|

|

$ |

585,453 |

|

|

$ |

585,066 |

|

We use the location of the customer as the basis of attributing revenue to geographic regions. Revenue by geographic region for the quarters and six months ended June 30, 2024 and 2023, as a percentage of our total revenue, was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended |

|

|

Six Months Ended |

|

|

|

June 30, 2024 |

|

|

June 30, 2023 |

|

|

June 30, 2024 |

|

|

June 30, 2023 |

|

Americas (principally the U.S.) |

|

|

89 |

% |

|

|

87 |

% |

|

|

87 |

% |

|

|

85 |

% |

Europe, Middle East, and Africa |

|

|

6 |

% |

|

|

9 |

% |

|

|

8 |

% |

|

|

11 |

% |

Asia Pacific |

|

|

5 |

% |

|

|

4 |

% |

|

|

5 |

% |

|

|

4 |

% |

Total revenue |

|

|

100 |

% |

|

|

100 |

% |

|

|

100 |

% |

|

|

100 |

% |

We generate our revenue primarily from the global communications markets; however, we serve an expanding group of customers in other markets including retail, financial services, healthcare, insurance, and government entities. Revenue by customer vertical for the quarters and six months ended June 30, 2024 and 2023, as a percentage of our total revenue, was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended |

|

|

Six Months Ended |

|

|

|

June 30, 2024 |

|

|

June 30, 2023 |

|

|

June 30, 2024 |

|

|

June 30, 2023 |

|

Broadband/Cable/Satellite |

|

|

53 |

% |

|

|

54 |

% |

|

|

52 |

% |

|

|

53 |

% |

Telecommunications |

|

|

16 |

% |

|

|

18 |

% |

|

|

17 |

% |

|

|

19 |

% |

Other |

|

|

31 |

% |

|

|

28 |

% |

|

|

31 |

% |

|

|

28 |

% |

Total revenue |

|

|

100 |

% |

|

|

100 |

% |

|

|

100 |

% |

|

|

100 |

% |

Deferred revenue recognized during the quarters ended June 30, 2024 and 2023 was $10.7 million and $11.3 million, respectively. Deferred revenue recognized during the six months ended June 30, 2024 and 2023 was $29.8 million and $31.5 million, respectively.

Cash and Cash Equivalents. We consider all highly liquid investments with original maturities of three months or less as of the date of purchase to be cash equivalents. As of June 30, 2024 and December 31, 2023, our cash equivalents consist primarily of institutional money market funds and time deposits held at major banks. For the cash and cash equivalents denominated in foreign currencies and/or located outside the U.S., we do not anticipate any material amounts being unavailable for use in running our business, but may face limitations on moving cash out of certain foreign jurisdictions due to currency controls and potential negative economic consequences.

Restricted Cash. Restricted cash includes cash that is legally or contractually restricted, as well as our settlement and merchant reserve assets (discussed below). The nature of the restrictions on our settlement and merchant reserve assets consists of contractual restrictions with the merchants and restrictions arising from our policy and intention. It has historically been our policy to segregate settlement and merchant reserve assets from our operating cash balances and our intention is to continue to do so. As of June 30, 2024 and December 31, 2023, we had $3.1 million and $2.9 million, respectively, of restricted cash that mainly serves to collateralize bank and performance guarantees included in other current and non-current assets in our unaudited Condensed Consolidated Balance Sheets (“Balance Sheets” or “Balance Sheet”).

Settlement and Merchant Reserve Assets and Liabilities. Settlement assets and settlement liabilities represent cash collected on behalf of merchants via payments processing services which is held for an established holding period until settlement with the customer. The holding period is generally one to four business days depending on the payment model and contractual terms with the customer. During the holding period, cash is subject to restriction and segregation based on the nature of our custodial relationship with the merchants. Should we fail to remit these funds to our merchants, the merchant's sole recourse for payment would be against us. These rights and obligations are set forth in the contracts between us and the merchants. Settlement assets are held with various major financial institutions and a corresponding liability is recorded for the amounts owed to the customer. At any given time, there may be differences between the cash held and the corresponding liability due to the timing of operating-related cash transfers.

Merchant reserve assets/liabilities represent deposits collected from merchants to mitigate our risk of loss due to nonperformance of settlement obligations initiated by those merchants using our payments processing services, or non-payment by customers for services rendered by us. We perform a credit risk evaluation on each customer based on multiple criteria, which provides the basis for the deposit amount required for each merchant. For the duration of our relationship with each merchant, we hold their reserve deposits with major financial institutions. We hold these funds in separate accounts, which are offset by corresponding liabilities.

The following table summarizes our settlement and merchant reserve assets and liabilities as of the indicated periods (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2024 |

|

|

December 31, 2023 |

|

|

|

Assets |

|

|

Liabilities |

|

|

Assets |

|

|

Liabilities |

|

Settlement assets/liabilities |

|

$ |

216,485 |

|

|

$ |

214,067 |

|

|

$ |

260,712 |

|

|

$ |

259,825 |

|

Merchant reserve assets/liabilities |

|

|

15,569 |

|

|

|

15,569 |

|

|

|

13,987 |

|

|

|

13,992 |

|

Total |

|

$ |

232,054 |

|

|

$ |

229,636 |

|

|

$ |

274,699 |

|

|

$ |

273,817 |

|

Financial Instruments. Our financial instruments as of June 30, 2024 and December 31, 2023 include cash and cash equivalents, settlement and merchant reserve assets and liabilities, accounts receivable, accounts payable, and debt. Due to their short maturities, the carrying amounts of cash equivalents, settlement and merchant reserve assets and liabilities, accounts receivable, and accounts payable approximate their fair value.

We have chosen not to record our debt at fair value, with changes recognized in earnings each reporting period. The following table indicates the carrying value and estimated fair value of our debt as of the indicated periods (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2024 |

|

|

December 31, 2023 |

|

|

|

Carrying Value |

|

|

Fair Value |

|

|

Carrying Value |

|

|

Fair Value |

|

2023 Convertible Notes (par value) |

|

$ |

425,000 |

|

|

$ |

396,483 |

|

|

$ |

425,000 |

|

|

$ |

428,506 |

|

2021 Credit Agreement (carrying value including

current maturities) |

|

|

129,375 |

|

|

|

129,375 |

|

|

|

133,125 |

|

|

|

133,125 |

|

The fair value of our convertible notes was estimated based upon quoted market prices or recent sales activity, while the fair value of our credit agreement was estimated using a discounted cash flow methodology, both of which are considered Level 2 inputs. See Note 4 for a discussion regarding our debt.

Pillar Two. Numerous foreign jurisdictions have enacted, or are in the process of enacting, legislation to adopt a minimum effective tax rate. Pillar Two, which was established by the Organization for Economic Co-operation and Development (OECD), generally provides for a 15% minimum effective tax rate for multinational enterprises in every jurisdiction in which they operate. The U.S. has not yet adopted Pillar Two, however, various other governments around the world have. These rules did not have a material impact on our taxes for the quarter and six months ended June 30, 2024. We continue to monitor evolving tax legislation in the jurisdictions in which we operate.

Accounting Pronouncements Issued but Not Yet Effective. In November 2023, the FASB issued ASU No. 2023-07, Segment Reporting (Topic 280), (“ASU 2023-07”), which enhances reportable segment disclosure requirements in part by requiring entities to disclose significant expenses related to their reportable segments. ASU 2023-07 also requires disclosure of the title and position of the company’s Chief Operating Decision Maker (“CODM”) and how the CODM uses financial reporting to assess segment performance and allocate resources. ASU 2023-07 is effective for fiscal years beginning after December 15, 2023 and interim periods within fiscal years beginning after December 15, 2024. We are in the process of evaluating what impact this ASU will have on our Financial Statements and disclosures.

In December 2023, the FASB issued ASU No. 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures (“ASU 2023-09”), which requires entities to disclose more detailed information about their effective tax rate reconciliation as well as information on income taxes paid. ASU 2023-09 is effective for fiscal years beginning after December 15, 2024. We are in the process of evaluating what impact this ASU will have on our Financial Statements and disclosures.

3. GOODWILL AND INTANGIBLE ASSETS

Goodwill. The changes in the carrying amount of goodwill for the six months ended June 30, 2024 were as follows (in thousands):

|

|

|

|

|

January 1, 2024, balance |

|

$ |

308,596 |

|

Effects of changes in foreign currency exchange rates |

|

|

(1,705 |

) |

Goodwill acquired during the period |

|

|

10,238 |

|

June 30, 2024, balance |

|

$ |

317,129 |

|

Goodwill acquired during the period relates to the acquisitions discussed in Note 5.

Other Intangible Assets. Our other intangible assets subject to ongoing amortization consist of acquired customer contracts and software. As of June 30, 2024 and December 31, 2023, the carrying values of these assets were as follows (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2024 |

|

|

December 31, 2023 |

|

|

|

Gross Carrying Amount |

|

|

Accumulated Amortization |

|

|

Net Amount |

|

|

Gross Carrying Amount |

|

|

Accumulated Amortization |

|

|

Net Amount |

|

Acquired customer contracts |

|

$ |

175,685 |

|

|

$ |

(128,867 |

) |

|

$ |

46,818 |

|

|

$ |

162,348 |

|

|

$ |

(126,469 |

) |

|

$ |

35,879 |

|

Software |

|

|

185,777 |

|

|

|

(164,369 |

) |

|

|

21,408 |

|

|

|

171,825 |

|

|

|

(157,601 |

) |

|

|

14,224 |

|

Total other intangible assets |

|

$ |

361,462 |

|

|

$ |

(293,236 |

) |

|

$ |

68,226 |

|

|

$ |

334,173 |

|

|

$ |

(284,070 |

) |

|

$ |

50,103 |

|

Acquired customer contracts as of June 30, 2024 include the assets acquired as part of the acquisitions discussed in Note 5.

The total amortization expense related to other intangible assets for the second quarters of 2024 and 2023 were $6.3 million and $6.4 million, respectively, and for the six months ended June 30, 2024 and 2023 were $11.7 million and $13.0 million, respectively. Based on the June 30, 2024 net carrying value of our intangible assets, the estimated total amortization expense for each of the five succeeding fiscal years ending December 31 are: 2024 - $24.5 million; 2025 - $19.8 million; 2026 - $14.2 million; 2027 - $6.5 million; and 2028 - $4.3 million.

Customer Contract Costs. As of June 30, 2024 and December 31, 2023, the carrying values of our customer contract cost assets, related to those contracts with a contractual term greater than one year, were as follows (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2024 |

|

|

December 31, 2023 |

|

|

|

Gross Carrying Amount |

|

|

Accumulated Amortization |

|

|

Net Amount |

|

|

Gross Carrying Amount |

|

|

Accumulated Amortization |

|

|

Net Amount |

|

Customer contract costs |

|

$ |

101,268 |

|

|

$ |

(44,140 |

) |

|

$ |

57,128 |

|

|

$ |

96,515 |

|

|

$ |

(42,094 |

) |

|

$ |

54,421 |

|

The total amortization expense related to customer contract costs for the second quarters of 2024 and 2023 were $5.7 million and $4.8 million, respectively, and for the six months ended June 30, 2024 and 2023 were $10.7 million and $9.4 million, respectively.

4. DEBT

As of June 30, 2024 and December 31, 2023, our long-term debt was as follows (in thousands):

|

|

|

|

|

|

|

|

|

|

|

June 30,

2024 |

|

|

December 31,

2023 |

|

2023 Convertible Notes: |

|

|

|

|

|

|

2023 Convertible Notes – senior unsecured convertible notes, due

September 2028, cash interest at 3.875% |

|

$ |

425,000 |

|

|

$ |

425,000 |

|

Less – deferred financing costs |

|

|

(11,932 |

) |

|

|

(13,216 |

) |

2023 Convertible Notes, net of unamortized discounts |

|

|

413,068 |

|

|

|

411,784 |

|

2021 Credit Agreement: |

|

|

|

|

|

|

2021 Term Loan, due September 2026, interest at adjusted SOFR plus

applicable margin (combined rate of 6.810% at June 30, 2024) |

|

|

129,375 |

|

|

|

133,125 |

|

Less – deferred financing costs |

|

|

(1,961 |

) |

|

|

(2,412 |

) |

2021 Term Loan, net of unamortized discounts |

|

|

127,414 |

|

|

|

130,713 |

|

$450 million revolving loan facility, due September 2026, interest at adjusted

SOFR plus applicable margin |

|

|

- |

|

|

|

- |

|

Total debt, net of unamortized discounts |

|

|

540,482 |

|

|

|

542,497 |

|

Current portion of long-term debt, net of unamortized discounts |

|

|

(7,500 |

) |

|

|

(7,500 |

) |

Long-term debt, net of unamortized discounts |

|

$ |

532,982 |

|

|

$ |

534,997 |

|

2023 Convertible Notes. The 2023 Convertible Notes will be convertible at the option of the noteholders before June 15, 2028, upon the occurrence of certain events. On or after June 15, 2028, and until the close of business on the second scheduled trading day immediately preceding September 15, 2028, the maturity date, noteholders may convert all or any portion of their notes at any time regardless of these conditions.

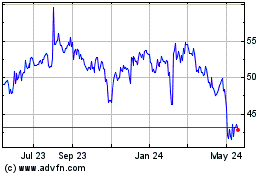

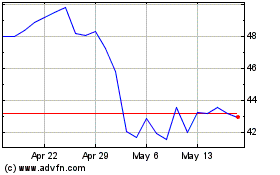

The 2023 Convertible Notes will be convertible at an initial conversion rate of 14.0753 shares of our common stock per $1,000 principal amount of the 2023 Convertible Notes, which is equivalent to an initial conversion price of $71.05 per share of our common stock, plus carryforward adjustments not yet effected pursuant to the terms of the indenture governing the 2023 Convertible Notes. Under the terms of the 2023 Convertible Notes, we will adjust the conversion rate for any quarterly dividends exceeding $0.28 per share.

We are required to satisfy our conversion obligation as follows: (i) paying cash up to the aggregate principal amount of notes to be converted; and (ii) to the extent the value of our conversion obligation exceeds the par value, we will satisfy the remaining conversion obligation in our common stock, cash, or a combination thereof, at our election. As of June 30, 2024, none of the conditions to early convert have been met.

We may not redeem the 2023 Convertible Notes prior to September 21, 2026. On or after September 21, 2026, we may redeem for cash all or part of the 2023 Convertible Notes, subject to a partial redemption limitation that requires at least $100.0 million of the principal amount of the 2023 Convertible Notes to remain outstanding if the last reported sales price of our common stock has been at least 130% of the conversion price then in effect for at least 20 trading days (whether or not consecutive) during any 30 consecutive trading day period (including the last trading day of such period) ending on, and including, the trading day immediately preceding the date on which we provide notice of redemption. The redemption price will equal the principal amount of the 2023 Convertible Notes to be redeemed, plus accrued and unpaid interest to, but excluding, the redemption date. No sinking fund has been established for the 2023 Convertible Notes.

In connection with the pricing of the 2023 Convertible Notes, we entered into privately negotiated capped call transactions (the “Capped Call Transactions”) with certain of the initial purchasers of the 2023 Convertible Notes and other financial institutions (collectively, the “Option Counterparties”). As of June 30, 2024, all the Capped Call Transactions were outstanding and cover, subject to anti-dilution adjustments substantially similar to those applicable to the 2023 Convertible Notes, 5.98 million shares of our common stock, the same number of shares of common stock underlying the 2023 Convertible Notes. The Capped Call Transactions will expire upon the maturity of the 2023 Convertible Notes.

2021 Credit Agreement. During the six months ended June 30, 2024, we made $3.8 million of principal repayments on our $150.0 million aggregate principal five-year term loan (the “2021 Term Loan”). As of June 30, 2024, we had no borrowings outstanding on our $450.0 million aggregate principal five-year revolving loan facility (the "2021 Revolver"), and had issued standby letters of credit of $1.5 million that count against our available 2021 Revolver balance, leaving $448.5 million available to us.

As of June 30, 2024, our interest rate on the 2021 Term Loan was 6.810% (adjusted Secured Overnight Financing Rate ("SOFR"), credit spread adjustment of 0.10%, plus 1.375% per annum), effective through September 2024, and our commitment fee on the 2021 Revolver was 0.15%.

The interest rates under the 2021 Credit Agreement are based upon our choice of an adjusted SOFR rate plus an applicable margin of 1.375% - 2.125%, or an alternate base rate (“ABR”) plus an applicable margin of 0.375% - 1.125%, with the applicable margin determined in accordance with our then-net secured total leverage ratio. We pay a commitment fee of 0.150% - 0.325% of the average daily unused amount of the 2021 Revolver, with the commitment fee rate also determined in accordance with our then-net secured total leverage ratio.

Other. We finance certain of our internal use software. During the second quarter of 2024, we entered into an additional financing agreement at a total cost of $8.4 million with payments through 2027. As a result, as of June 30, 2024, we had $9.0 million outstanding under these agreements, of which $3.2 million was included in other current liabilities and $5.8 million was included in other noncurrent liabilities in our Balance Sheet. These arrangements are treated as a non-cash investing and financing activity for purposes of our Condensed Consolidated Statements of Cash Flows ("Statements of Cash Flows").

5. ACQUISITIONS

Prior Years Acquisition. On October 4, 2021, we acquired DGIT Systems Pty Ltd (“DGIT”), a provider of configure, price and quote (CPQ), and order management solutions for the telecommunications industry. We acquired 100% of the equity of DGIT for a purchase price of approximately $16 million, approximately $14 million paid upon close and the remaining consideration of approximately $2 million to be paid through 2025, subject to certain reductions, as applicable. During the six months ended June 30, 2024, we made deferred purchase price payments of $0.5 million.

The DGIT acquisition includes provisions for up to approximately $13 million of potential future earn-out payments. The earn-out payments are tied to performance-based goals and a defined service period and are accounted for as post-acquisition compensation, as applicable. The earn-out period is through September 30, 2025.

Current Year Acquisitions. On April 1, 2024, we acquired a customer communication services business that operates in multiple industry verticals. The acquisition date fair value of the consideration transferred was $15.0 million, which consisted of $11.5 million in cash paid upfront and a non-cash settlement of working capital items of $3.5 million. The results of this acquisition are included in our results of operations for the period subsequent to the acquisition date.

The preliminary estimated fair values of assets acquired primarily include goodwill of $6.4 million, acquired customer contracts of $4.3 million, trade accounts receivable of $2.1 million, and liabilities assumed of $2.7 million. The estimated fair values are considered provisional and are based on the information that was available as of the acquisition date. The provisional measurements of fair value are subject to change, however, such changes are not expected to be significant. We expect to finalize the valuation and complete the purchase price allocation as soon as practicable but no later than one year from the acquisition date. The amount allocated to goodwill is deductible for income tax purposes.

On June 3, 2024, we acquired 100% of the equity of iCheckGateway.com, LLC (“iCG Pay”), an ACH and credit card payment processing company. We acquired iCG Pay to further expand the industry verticals we serve and to provide opportunities for the continued growth of our business. The acquisition date fair value of the consideration transferred was $17.6 million in cash paid, subject to customary working capital adjustments.

The iCG Pay acquisition includes provisions for up to $15.0 million of potential future earn-out payments. The earn-out payments are tied to performance-based goals and a defined service period and are accounted for as post-acquisition compensation, as applicable. The earn-out period is through June 3, 2027. As of June 30, 2024, we accrued $0.9 million related to the potential earn-out payments. The results of iCG Pay are included in our results of operations for the period subsequent to the acquisition date.

The preliminary estimated fair values of assets acquired primarily include settlement assets of $45.9 million, acquired customer contracts of $11.8 million, goodwill of $3.8 million, and settlement liabilities assumed of $44.7 million. The estimated fair values are considered provisional and are based on the information that was available as of the acquisition date. The provisional measurements of fair value are subject to change, however, such changes are not expected to be significant. We expect to finalize the valuation and complete the purchase price allocation as soon as practicable but no later than one year from the acquisition date. The amount allocated to goodwill is deductible for income tax purposes.

The cash paid for the acquisitions discussed above, less cash and settlement assets acquired, resulted in net cash provided by business combinations for the six months ended June 30, 2024 of $17.3 million on our Statement of Cash Flows.

6. RESTRUCTURING AND REORGANIZATION CHARGES

During the second quarters of 2024 and 2023, we recorded restructuring and reorganization charges of $7.1 million and $2.1 million, respectively, and for the six months ended June 30, 2024 and 2023, we recorded restructuring and reorganization charges of $9.1 million and $7.3 million, respectively.