Form SC 13D/A - General statement of acquisition of beneficial ownership: [Amend]

June 18 2024 - 4:31PM

Edgar (US Regulatory)

| SECURITIES AND EXCHANGE COMMISSION |

|

| Washington, D.C. 20549 |

|

| |

|

| SCHEDULE 13D/A |

| |

| Under the Securities Exchange Act of 1934 |

| (Amendment No. 1)* |

| |

|

Comtech Telecommunications

Corp. |

| (Name of Issuer) |

| |

|

Common stock, par

value $0.10 per share |

| (Title of Class of Securities) |

| |

|

205826209 |

| (CUSIP Number) |

| |

| Mark R. Quinlan |

| c/o White Hat Capital Partners LP |

| 520 Madison Avenue, 33rd Floor |

| New York, New York 10022 |

| (212) 257-5940 |

| |

| With a copy to: |

| |

|

Eleazer Klein, Esq.

Clara Zylberg, Esq. |

| Schulte Roth & Zabel LLP |

| 919 Third Avenue |

| New York, NY 10022 |

|

(212) 756-2000 |

| (Name, Address and Telephone Number of Person |

| Authorized to Receive Notices and Communications) |

| |

|

June 17, 2024 |

| (Date of Event Which Requires Filing of This Statement) |

| |

If the filing person has previously filed a statement on Schedule 13G to

report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), Rule 13d-1(f) or

Rule 13d-1(g), check the following box. [ ]

(Page 1 of 13 Pages)

______________________________

* The remainder of this cover page shall be filled out for a reporting

person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing

information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not

be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or

otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

| CUSIP No. 205826209 | SCHEDULE 13D/A | Page 2 of 13 Pages |

| 1 |

NAME OF REPORTING PERSON

White Hat Strategic Partners LP |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

OO (see Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

State of Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

3,370,488 shares of Common Stock (including 3,122,849 shares

of Common Stock issuable upon conversion of shares of Series B-1 Convertible Preferred Stock (as defined in Item 4 below))* |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

3,370,488 shares of Common Stock (including 3,122,849 shares

of Common Stock issuable upon conversion of shares of Series B-1 Convertible Preferred Stock)* |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

3,370,488 shares of Common Stock (including 3,122,849 shares

of Common Stock issuable upon conversion of shares of Series B-1 Convertible Preferred Stock)* |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

9.99%* |

| 14 |

TYPE OF REPORTING PERSON

PN |

| |

|

|

|

|

*The conversion of shares of Series B-1 Convertible Preferred Stock reported

herein is subject to the Blocker (as defined in Item 4 below) and the percentage set forth in row (13) gives effect to the Blocker. However,

rows (8), (10) and (11) show the number of shares of Common Stock that would be issuable upon the conversion of the shares of Series B-1

Convertible Preferred Stock in full and does not give effect to the Blocker. Therefore, the actual number of shares of Common Stock beneficially

owned by such Reporting Person, after giving effect to the Blocker, is less than the number of securities reported in rows (8), (10) and

(11). In addition, the voting power of the shares of Common Stock issuable upon conversion of the Series B-1 Preferred Stock is subject

to restrictions set forth in the Voting Agreement (as defined and as described in Item 4).

| CUSIP No. 205826209 | SCHEDULE 13D/A | Page 3 of 13 Pages |

| 1 |

NAME OF REPORTING PERSON

White Hat SP GP LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

AF, OO (see Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

State of Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

3,370,488 shares of Common Stock (including 3,122,849 shares

of Common Stock issuable upon conversion of shares of Series B-1 Convertible Preferred Stock)* |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

3,370,488 shares of Common Stock (including 3,122,849 shares

of Common Stock issuable upon conversion of shares of Series B-1 Convertible Preferred Stock)* |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

3,370,488 shares of Common Stock (including 3,122,849 shares

of Common Stock issuable upon conversion of shares of Series B-1 Convertible Preferred Stock)* |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

9.99%* |

| 14 |

TYPE OF REPORTING PERSON

OO |

| |

|

|

|

|

*The conversion of shares of Series B-1 Convertible Preferred Stock reported

herein is subject to the Blocker and the percentage set forth in row (13) gives effect to the Blocker. However, rows (8), (10) and (11)

show the number of shares of Common Stock that would be issuable upon the conversion of the shares of Series B-1 Convertible Preferred

Stock in full and does not give effect to the Blocker. Therefore, the actual number of shares of Common Stock beneficially owned by such

Reporting Person, after giving effect to the Blocker, is less than the number of securities reported in rows (8), (10) and (11). In addition,

the voting power of the shares of Common Stock issuable upon conversion of the Series B-1 Preferred Stock is subject to restrictions set

forth in the Voting Agreement.

| CUSIP No. 205826209 | SCHEDULE 13D/A | Page 4 of 13 Pages |

| 1 |

NAME OF REPORTING PERSON

White Hat Strategic Partners II LP |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

WC, OO (see Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

State of Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

909,579 shares of Common Stock (including 809,579 shares of

Common Stock issuable upon conversion of shares of Series B-1 Convertible Preferred Stock)* |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

909,579 shares of Common Stock (including 809,579 shares of

Common Stock issuable upon conversion of shares of Series B-1 Convertible Preferred Stock)* |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

909,579 shares of Common Stock (including 809,579 shares of

Common Stock issuable upon conversion of shares of Series B-1 Convertible Preferred Stock)* |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

3.1%* |

| 14 |

TYPE OF REPORTING PERSON

PN |

| |

|

|

|

|

* The conversion of the shares of Series B-1 Convertible Preferred Stock reported

herein is subject to the Blocker. The number of shares of Common Stock in rows (8), (10) and (11) and the percentage set forth in row

(13) reflect the conversion in full of the Series B-1 Convertible Preferred Stock reported on this cover page, however, the ability to

convert such Series B-1 Convertible Preferred Stock at any given time is subject to the Blocker which applies to the beneficial ownership

of the Reporting Persons in the aggregate. In addition, the voting power of the shares of Common Stock issuable upon conversion of the

Series B-1 Preferred Stock is subject to restrictions set forth in the Voting Agreement.

| CUSIP No. 205826209 | SCHEDULE 13D/A | Page 5 of 13 Pages |

| 1 |

NAME OF REPORTING PERSON

White Hat SP GP II LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

AF, OO (see Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

State of Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

909,579 shares of Common Stock (including 809,579 shares of

Common Stock issuable upon conversion of shares of Series B-1 Convertible Preferred Stock)* |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

909,579 shares of Common Stock (including 809,579 shares of

Common Stock issuable upon conversion of shares of Series B-1 Convertible Preferred Stock)* |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

909,579 shares of Common Stock (including 809,579 shares of

Common Stock issuable upon conversion of shares of Series B-1 Convertible Preferred Stock)* |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

3.1%* |

| 14 |

TYPE OF REPORTING PERSON

OO |

| |

|

|

|

|

* The conversion of the shares of Series B-1 Convertible Preferred Stock reported

herein is subject to the Blocker. The number of shares of Common Stock in rows (8), (10) and (11) and the percentage set forth in row

(13) reflect the conversion in full of the Series B-1 Convertible Preferred Stock reported on this cover page, however, the ability to

convert such Series B-1 Convertible Preferred Stock at any given time is subject to the Blocker which applies to the beneficial ownership

of the Reporting Persons in the aggregate. In addition, the voting power of the shares of Common Stock issuable upon conversion of the

Series B-1 Preferred Stock is subject to restrictions set forth in the Voting Agreement.

| CUSIP No. 205826209 | SCHEDULE 13D/A | Page 6 of 13 Pages |

| 1 |

NAME OF REPORTING PERSON

White Hat Capital Partners LP |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

AF, OO (see Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

State of Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

4,280,067 shares of Common Stock (including 3,932,428 shares

of Common Stock issuable upon conversion of shares of Series B-1 Convertible Preferred Stock)* |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

4,280,067 shares of Common Stock (including 3,932,428 shares

of Common Stock issuable upon conversion of shares of Series B-1 Convertible Preferred Stock)* |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

4,280,067 shares of Common Stock (including 3,932,428 shares

of Common Stock issuable upon conversion of shares of Series B-1 Convertible Preferred Stock)* |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

9.99%* |

| 14 |

TYPE OF REPORTING PERSON

PN |

| |

|

|

|

|

*The conversion of shares of Series B-1 Convertible Preferred Stock reported

herein is subject to the Blocker and the percentage set forth in row (13) gives effect to the Blocker. However, rows (8), (10) and (11)

show the number of shares of Common Stock that would be issuable upon the conversion of the shares of Series B-1 Convertible Preferred

Stock in full and does not give effect to the Blocker. Therefore, the actual number of shares of Common Stock beneficially owned by such

Reporting Person, after giving effect to the Blocker, is less than the number of securities reported in rows (8), (10) and (11). In addition,

the voting power of the shares of Common Stock issuable upon conversion of the Series B-1 Preferred Stock is subject to restrictions set

forth in the Voting Agreement.

| CUSIP No. 205826209 | SCHEDULE 13D/A | Page 7 of 13 Pages |

| 1 |

NAME OF REPORTING PERSON

David J. Chanley |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

AF, OO (see Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

4,280,067 shares of Common Stock (including 3,932,428 shares

of Common Stock issuable upon conversion of shares of Series B-1 Convertible Preferred Stock)* |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

4,280,067 shares of Common Stock (including 3,932,428 shares

of Common Stock issuable upon conversion of shares of Series B-1 Convertible Preferred Stock)* |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

4,280,067 shares of Common Stock (including 3,932,428 shares

of Common Stock issuable upon conversion of shares of Series B-1 Convertible Preferred Stock)* |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

9.99%* |

| 14 |

TYPE OF REPORTING PERSON

IN |

| |

|

|

|

|

*The conversion of shares of Series B-1 Convertible Preferred Stock reported

herein is subject to the Blocker and the percentage set forth in row (13) gives effect to the Blocker. However, rows (8), (10) and (11)

show the number of shares of Common Stock that would be issuable upon the conversion of the shares of Series B-1 Convertible Preferred

Stock in full and does not give effect to the Blocker. Therefore, the actual number of shares of Common Stock beneficially owned by such

Reporting Person, after giving effect to the Blocker, is less than the number of securities reported in rows (8), (10) and (11). In addition,

the voting power of the shares of Common Stock issuable upon conversion of the Series B-1 Preferred Stock is subject to restrictions set

forth in the Voting Agreement.

| CUSIP No. 205826209 | SCHEDULE 13D/A | Page 8 of 13 Pages |

| 1 |

NAME OF REPORTING PERSON

Mark R. Quinlan |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

AF, OO (see Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

27,627 shares of Common Stock (See Item 6 of the Schedule

13D) |

| 8 |

SHARED VOTING POWER

4,280,067 shares of Common Stock (including 3,932,428 shares

of Common Stock issuable upon conversion of shares of Series B-1 Convertible Preferred Stock)* |

| 9 |

SOLE DISPOSITIVE POWER

27,627 shares of Common Stock (See Item 6 of the Schedule

13D) |

| 10 |

SHARED DISPOSITIVE POWER

4,280,067 shares of Common Stock (including 3,932,428 shares

of Common Stock issuable upon conversion of shares of Series B-1 Convertible Preferred Stock)* |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

4,307,694 shares of Common Stock (including 3,932,428

shares of Common Stock issuable upon conversion of shares of Series B-1 Convertible Preferred Stock)* (See Item 6 of the Schedule 13D) |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

9.99%* |

| 14 |

TYPE OF REPORTING PERSON

IN |

| |

|

|

|

|

*The conversion of shares of Series B-1 Convertible Preferred Stock reported

herein is subject to the Blocker and the percentage set forth in row (13) gives effect to the Blocker. However, rows (8), (10) and (11)

show the number of shares of Common Stock that would be issuable upon the conversion of the shares of Series B-1 Convertible Preferred

Stock in full and does not give effect to the Blocker. Therefore, the actual number of shares of Common Stock beneficially owned by such

Reporting Person, after giving effect to the Blocker, is less than the number of securities reported in rows (8), (10) and (11). In addition,

the voting power of the shares of Common Stock issuable upon conversion of the Series B-1 Preferred Stock is subject to restrictions set

forth in the Voting Agreement.

| CUSIP No. 205826209 | SCHEDULE 13D/A | Page 9 of 13 Pages |

The following constitutes Amendment No. 1 (“Amendment

No. 1”) to the Schedule 13D filed by the undersigned with the Securities and Exchange Commission on January 24, 2024 (the “Original

Schedule 13D” and the Original Schedule 13D as amended by this Amendment No. 1, the “Schedule 13D”). This

Amendment No. 1 amends the Schedule 13D as specifically set forth herein. Unless specified otherwise, capitalized terms used but not defined

herein shall have the meanings ascribed to them in the Schedule 13D.

| Item 1. |

SECURITY AND ISSUER |

| |

|

| Item 1 of the Schedule 13D is hereby amended and restated in its entirety: |

| |

This statement on Schedule 13D (the “Schedule 13D”) relates to the common stock, par value $0.10 per share (the “Common Stock”) of Comtech Telecommunications Corp., a Delaware corporation (the “Issuer”). The Issuer’s principal executive offices are located at 305 N 54th Street, Chandler, Arizona 85226. |

| Item 3. |

SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION |

| Item 3 of the Schedule 13D is hereby amended and supplemented to include the following: |

| |

WHSP

acquired (i) 23,271.73 shares of Series B-1 Convertible Preferred Stock (as defined in Item 4) reported herein by surrendering to

the Issuer 23,271.73 shares of Series B Convertible Preferred Stock for cancellation and (ii) 799.32 shares of Series B-1

Convertible Preferred Stock as June Additional Shares (as defined and described in the Subscription and Exchange Agreement). WHSP II

acquired (i) 6,033.05 shares of Series B-1 Convertible Preferred Stock reported herein by surrendering to the Issuer 6,033.05 shares

of Series B-1 Convertible Preferred Stock and (ii) 207.22 shares of Series B-1 Convertible Preferred Stock as June Additional

Shares. |

| Item 4. |

PURPOSE OF TRANSACTION |

| Item 4 of the Schedule 13D is hereby amended and supplemented to include the following: |

| |

On June 17, 2024, the White Hat Funds

entered into an Subscription and Exchange Agreement (the “Subscription and Exchange Agreement”) with the Issuer and

the other investors listed on the signature pages attached thereto (each of the White Hat Funds and such other parties, an “Investor”

and collectively, the “Investors”) pursuant to which the parties agreed to change certain terms of the Series B Convertible

Preferred Stock. The changes altered the preferred holders’ existing consent rights and existing put rights alongside payments

upon a change of control following specified asset sales, in each case consistent with the Existing Credit Agreement (as defined in the

Certificate of Designations of the Series B-1 Convertible Preferred Stock (the “Series B-1 Certificate of Designations”)).

To effect the changes described above, (i) WHSP exchanged 23,271.73 shares of Series B Convertible Preferred Stock for 23,271.73 shares

of the Issuer’s newly issued Series B-1 Convertible Preferred Stock, par value $0.10 per share, with an initial liquidation preference

of $1,036.58 per share (the per share liquidation preference of the Series B Convertible Preferred Stock as of June 16, 2024) (the “Series

B-1 Convertible Preferred Stock”), (ii) WHSP II exchanged 6,033.05 Series B Convertible Preferred Stock for 6,033.05 shares

of Series B-1 Convertible Preferred Stock, (iii) WHSP acquired 799.32 shares of Series B-1 Convertible Preferred Stock as June Additional

Shares and (iv) WHSP II acquired 207.22 shares of Series B-1 Convertible Preferred Stock as June Additional Shares. The transactions

contemplated by the Subscription and Exchange Agreement closed on June 17, 2024 (the “Closing Date”).

|

| CUSIP No. 205826209 | SCHEDULE 13D/A | Page 10 of 13 Pages |

| |

|

| |

In connection with the closing of the transactions contemplated by the Subscription

and Exchange Agreement, the White Hat Funds also entered into a Voting Agreement with the Issuer (the “Voting Agreement”),

substantially consistent with the existing voting agreement between the parties, pursuant to which the White Hat Funds agreed, subject

to the qualifications and exceptions set forth in the Voting Agreement, to vote their shares of Series B-1 Convertible Preferred Stock

or shares issued upon conversion of the Series B-1 Convertible Preferred Stock that exceed 3.4999% of the Issuer’s outstanding voting

power as of January 22, 2024 in the same proportion as the vote of all holders (excluding the Investors) of the Series B-1 Convertible

Preferred Stock or Common Stock, as applicable. The prior voting agreement dated as of January 22, 2024 by and among the White Hat Funds

and the Issuer was terminated and is of no further force or effect in its entirety. |

| |

|

| |

Also, in connection with the closing of

the transaction contemplated by the Subscription and Exchange Agreement, the White Hat Funds entered into a Registration Rights

Agreement (the “Registration Rights Agreement”), substantially consistent with the existing registration rights

agreement between the parties, with the Issuer and the other Investors, pursuant to which the Issuer granted the Investors certain

customary registration rights with respect to the shares of Common Stock issued and issuable upon conversion of the Series B-1

Convertible Preferred Stock and upon exercise of the Warrants issued in substitution for the Series B-1 Convertible Preferred Stock

in certain circumstances (described below). |

| |

Except for the changes described above, the powers, preferences and rights of the Series B-1 Convertible Preferred Stock are substantially the same as those of the Series B Convertible Preferred Stock, including, without limitation, that the shares of Series B-1 Convertible Preferred Stock are convertible, subject to the Blocker, into shares of Common Stock at a conversion price of $7.99 per share of Common Stock (the same as the current conversion price of the Series B Convertible Preferred Stock, and subject to the same adjustments). |

|

| |

Like the Series B Convertible Preferred Stock, the Series B-1 Convertible Preferred

Stock will provide for repurchase of the Series B-1 Convertible Preferred Stock at the Issuer’s option or the holders’ options

upon the occurrence of specified asset sales. Upon the occurrence of such repurchases by an Investor or the Issuer, the Issuer will issue

to each Investor whose shares of Series B-1 Convertible Preferred Stock were repurchased a warrant to purchase Common Stock (a “Warrant”).

A Warrant will represent the right to acquire Common Stock, as further described in the Subscription and Exchange Agreement, for a term

of five years and six months from the issuance of such Warrant, in the amount of (x) the aggregate Liquidation Preference of shares of

Series B-1 Convertible Preferred Stock purchased by the Issuer divided by (y) the Conversion Price as of such Optional Repurchase Date

(as defined in the Series B-1 Certificate of Designations) or the Optional Call Date (as defined in the Subscription and Exchange Agreement),

subject to adjustments set forth in the Warrant, and with an initial exercise price equal to the Conversion Price as of such Optional

Repurchase Date or the Optional Call Date, as applicable, in each case, subject to adjustments substantially similar to the Series B-1

Convertible Preferred Stock.

|

| |

Mark R. Quinlan, a Reporting Person, who currently

serves as a director on the Board and has been serving as a director on the Board since January 3, 2022, has been elected as Chairman

of the Board on March 12, 2024. |

|

| CUSIP No. 205826209 | SCHEDULE 13D/A | Page 11 of 13 Pages |

| |

The

foregoing descriptions of the Subscription and Exchange Agreement Agreement, Series B-1 Certificate of Designations, Warrant, Voting

Agreement and Registration Rights Agreement do not purport to be complete and are qualified in their entireties by reference to the

full texts of the Subscription and Exchange Agreement, Certificate of Designations, Form of

Warrant, Voting Agreement and Registration Rights Agreement. For further information regarding the Subscription and Exchange

Agreement, Certificate of Designations, Warrant, Voting Agreement and Registration Rights Agreement reference is made to the

texts of the Subscription and Exchange Agreement, Certificate of Designations, Form of Warrant, Form of Voting Agreement and

Registration Rights Agreement, which have been filed as Exhibit 99.5 hereto, Exhibit 3.1 to the Issuer’s Current Report

on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on June 18, 2024, Exhibit F to the

Subscription and Exchange Agreement, which has been filed as Exhibit 99.5 hereto, and Exhibit 99.6 and Exhibit

99.7 hereto, respectively, and incorporated by reference herein. |

| Item 5. |

INTEREST IN SECURITIES OF THE ISSUER |

| Items 5(a)-(c) of the Schedule 13D are hereby amended and restated in their entirety: |

| (a) |

See

rows (11) and (13) of the cover pages to this Schedule 13D for the aggregate number of shares of Common Stock and percentages of

shares of Common Stock beneficially owned by each of the Reporting Persons, which includes accumulated dividends through June 16,

2024. The percentages used in this Schedule 13D are calculated based upon an aggregate of 28,493,147 shares of Common

Stock outstanding as of June 17, 2024, as reported in Exhibit 10.2 to the Issuer’s Current Report on Form 8-K filed with the

SEC on June 18, 2024, and assumes the conversion of the shares of Series B-1

Convertible Preferred Stock held by the White Hat Funds, subject to the Blocker. |

| |

|

| (b) |

See rows

(7) through (10) of the cover pages to this Schedule 13D for the number of shares of Common Stock as to which each Reporting Person

has the sole or shared power to vote or direct the vote and sole or shared power to dispose or to direct the disposition, which

includes accumulated dividends through June 16, 2024. |

| |

|

| (c) |

Other than as described in Item 4 of this Amendment No. 1, no transactions in the shares of Common Stock were effected by the Reporting Persons during the past sixty (60) days. |

| Item 6. |

CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER |

| Item 6 of the Schedule 13D is hereby amended and supplemented to include the following: |

| |

The Reporting Persons’ response to Item 4 of this Amendment No. 1 is incorporated by reference into this Item 6. |

| CUSIP No. 205826209 | SCHEDULE 13D/A | Page 12 of 13 Pages |

| Item 7. |

MATERIAL TO BE FILED AS EXHIBITS |

| Item 7 is hereby amended and supplemented to include the following: |

| Exhibit 99.5 |

Subscription

and Exchange Agreement, dated as of June 17, 2024 (incorporated by reference to Exhibit 10.2 to the Issuer’s Current Report on

Form 8-K filed with the SEC on June 18, 2024). |

| |

|

| Exhibit 99.6 |

Form of Voting

Agreement (incorporated by reference to Exhibit 10.3 of the Issuer’s Current Report on Form 8-K filed with the SEC on June 18, 2024). |

| |

|

| Exhibit 99.7 |

Registration

Rights Agreement, dated as of June 17, 2024 (incorporated by reference to Exhibit 10.4 of the Issuer’s Current Report on Form 8-K

filed with the SEC on June 18, 2024). |

| CUSIP No. 205826209 | SCHEDULE 13D/A | Page 13 of 13 Pages |

SIGNATURES

After reasonable inquiry and to the best of his

or its knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true, complete and

correct.

| DATE: June 18, 2024 |

/s/ Mark R. Quinlan |

| |

MARK R. Quinlan, (i) individually, (ii) as Managing Member of: (a) White Hat SP GP LLC, (x) for itself and (y) as General Partner of White Hat Strategic Partners LP, (b) White Hat SP GP II LLC, (x) for itself and (y) as General Partner of White Hat Strategic Partners II LP and (c) White Hat Capital Partners GP LLC, as General Partner of White Hat Capital Partners LP. |

| |

|

| |

/s/ David J. Chanley |

| |

DAVID J. CHANLEY, individually |

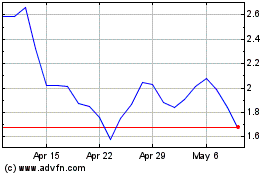

Comtech Telecommunications (NASDAQ:CMTL)

Historical Stock Chart

From May 2024 to Jun 2024

Comtech Telecommunications (NASDAQ:CMTL)

Historical Stock Chart

From Jun 2023 to Jun 2024