false000152493100015249312023-10-262023-10-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): October 26, 2023

CHUY’S HOLDINGS, INC.

(Exact Name Of Registrant As Specified In Its Charter)

| | | | | | | | |

| Delaware | 001-35603 | 20-5717694 |

(State or Other Jurisdiction

of Incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

1623 Toomey Rd.

Austin, Texas 78704

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (512) 473-2783

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | |

| | ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| | ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| | ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| | ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | CHUY | Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Clawback Policy

On October 26, 2023, the Board of Directors (the “Board”) of Chuy’s Holdings, Inc. (the “Company”) adopted a Clawback Policy (the “Clawback Policy”) in order to comply with Section 10D of the Securities Exchange Act of 1934 (the “Exchange Act”), Rule 10D-1 of the Exchange Act and the listing standards adopted by the Nasdaq Stock Market.

The Clawback Policy provides for the mandatory recovery of erroneously awarded incentive-based compensation from current and former executive officers (as defined in the Clawback Policy) of the Company in the event that the Company is required to prepare an accounting restatement.

The foregoing description of the Clawback Policy is a summary only and is qualified in its entirety by reference to the full text of the Clawback Policy, a copy of which is attached to this Current Report on Form 8-K as Exhibit 10.1 and is incorporated herein by reference.

Appointment of Chief Operating Officer

On October 26, 2023, the Board appointed John Korman as the Company’s Chief Operating Officer. Mr. Korman, age 46, had previously served as the Company’s Senior Vice President of Operations since June 2023 and as Vice President of Operations from July 2018 to June 2023. He joined the Company in May 2000 and served as a Manager from May 2000 to June 2005, as a Kitchen Manager from July 2005 to December 2007, as a General Manager from January 2008 to December 2010, as an Area Supervisor from January 2011 to December 2014 and as Director of Operations from January 2015 to June 2018.

In connection with his appointment as Chief Operating Officer, the Company entered into an employment agreement with Mr. Korman on October 26, 2023 (the “Korman Employment Agreement”). The Korman Employment Agreement does not have a fixed term. The Korman Employment Agreement provides that Mr. Korman will receive an annual base salary of at least $245,426 and will be eligible to receive a target short-term incentive program payout of 30% of his annual base salary, based upon the achievement of performance objectives determined by the compensation committee with a minimum and maximum payout of 0% and 60% of his annual base salary, respectively. Beginning on February 15, 2024, Mr. Korman will be eligible to receive a target short-term incentive program payout of 50% of his annual base salary, based upon the achievement of performance objectives determined by the compensation committee with a minimum and maximum payout of 0% and 100% of his annual base salary, respectively; provided that Mr. Korman’s short-term incentive program payout for the 2024 fiscal year will be prorated to reflect such changes in percentages and annual base salary, if applicable, as of February 15, 2024.

Additionally, pursuant to the Korman Employment Agreement, Mr. Korman is eligible to receive a targeted annual equity award equal to 50% of his base salary, as determined and authorized from time to time by the compensation committee and subject to the terms and conditions of the Chuy’s Holdings, Inc. 2020 Omnibus Incentive Plan or any successor plan (the “Equity Plan”) and any award agreements governing the grant of equity awards. The Korman Employment Agreement also provides that Mr. Korman will be eligible to participate in the Company’s employee plans, including any health, disability or group life insurance plans or any retirement or non-qualified deferred compensation plans that are generally made available to the Company’s other senior executives and will be entitled to four weeks paid vacation per calendar year to be taken in accordance with the Company’s vacation policy.

The Korman Employment Agreement provides for severance benefits if Mr. Korman’s employment is terminated without cause (as defined in the Korman Employment Agreement) or by Mr. Korman for good reason (as defined in the Korman Employment Agreement), subject to Mr. Korman’s compliance with certain assignment of invention, confidentiality, non-compete, non-solicitation and non-disparagement obligations and the execution of a general release of claims. In the event the employment of Mr. Korman is terminated without cause or by Mr. Korman for good reason, he is entitled to continue to receive one year’s base salary following his termination and an amount equal to his target short-term incentive program payout for the year his employment was terminated. Additionally, in the event Mr. Korman’s employment is terminated without cause or by him for good reason, Mr. Korman is

entitled to continue to receive the amount that the Company was subsidizing for his and his dependents’ medical and dental insurance coverage during the same period he is entitled to continue to receive his base salary after his termination.

The Korman Employment Agreement also provides that if (1) Mr. Korman’s employment is terminated on account of Mr. Korman’s death or disability (as defined in the Korman Employment Agreement) or (2) Mr. Korman’s employment is terminated without cause or by him for good reason, in each case, on or during the 24 month period after a change in control (as defined in the Equity Plan), subject to his compliance with certain assignment of invention, confidentiality, non-compete, non-solicitation and non-disparagement obligations and the execution of a general release of claims, then any unvested or unexercisable portion of any award granted to Mr. Korman under the Equity Plan shall become fully vested or exercisable.

The foregoing description of the Korman Employment Agreement is a summary only and is qualified in its entirety by reference to the full text of the Korman Employment Agreement, a copy of which is attached to this Current Report on Form 8-K as Exhibit 10.2 and is incorporated herein by reference.

In connection with his appointment as Chief Operating Officer, Mr. Korman also entered into the Company’s standard form of indemnification agreement. Additionally, there are no relationships between Mr. Korman and the Company that would require disclosure under Item 404(a) of Regulation S-K.

Appointment of Chief Culinary and Procurement Officer

On October 26, 2023, the Board appointed John Mountford as the Company’s Chief Culinary and Procurement Officer. Mr. Mountford had previously served as the Company’s Chief Operating Officer since September 2018.

In connection with his appointment as Chief Culinary and Procurement Officer, the Company entered into an Amendment to Employment Agreement with Mr. Mountford on October 26, 2023 (the “Amendment”). The Amendment provides that (1) Mr. Mountford will serve as Chief Culinary and Procurement Officer, (2) effective February 15, 2024, Mr. Mountford will receive an annual base salary of at least $250,000 and (3) effective February 15, 2024, Mr. Mountford will be eligible to receive a target short-term incentive program payout of 30% of his annual base salary, based upon the achievement of performance objectives determined by the compensation committee with a minimum and maximum bonus of 0% and 60% of his annual base salary, respectively; provided that Mr. Mountford’s short-term incentive program payout for the 2024 fiscal year will be prorated to reflect such changes in percentages and annual base salary as of February 15, 2024.

The foregoing description of the Amendment is a summary only and is qualified in its entirety by reference to the full text of the Amendment, a copy of which is attached to this Current Report on Form 8-K as Exhibit 10.4 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

Exhibit

Number | Description |

| Clawback Policy |

| Employment Agreement, dated October 26, 2023, between Chuy’s Holdings, Inc., Chuy’s Opco, Inc. and John Korman |

| Form of Director and Officer Indemnification Agreement (incorporated by reference to Exhibit 10.8 of Amendment No. 7 to the Registration Statement on Form S-1 (File No. 333-176097), filed on July 11, 2012) |

| Amendment to Employment Agreement, dated October 26, 2023, between Chuy’s Holdings, Inc., Chuy’s Opco, Inc. and John Mountford |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL) |

| |

| |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| | CHUY’S HOLDINGS, INC. |

| | |

| By: | /s/ Jon W. Howie |

| | Name: Jon W. Howie

Title: Vice President and Chief Financial Officer |

Date: October 30, 2023

CHUY’S HOLDINGS, INC.

CLAWBACK POLICY

Chuy’s Holdings, Inc. (the “Company”) will recover reasonably promptly the amount of erroneously awarded incentive-based compensation in the event that the Company is required to prepare an accounting restatement due to the material noncompliance of the Company with any financial reporting requirement under the securities laws, including any required accounting restatement to correct an error in previously issued financial statements that is material to the previously issued financial statements, or that would result in a material misstatement if the error were corrected in the current period or left uncorrected in the current period (an “accounting restatement”).

This policy applies to all incentive-based compensation received by a person:

(1)after beginning service as an executive officer;

(2)who served as an executive officer at any time during the performance period for that incentive-based compensation;

(3)while the Company has a class of securities listed on a national securities exchange or a national securities association; and

(4)during the three completed fiscal years immediately preceding the date that the Company is required to prepare an accounting restatement; provided that this policy also applies to any transition period that results from a change in the Company’s fiscal year within or immediately following the three completed fiscal year period; provided further that a transition period between the last day of the Company’s previous fiscal year end and the first day of its new fiscal year that comprises a period of nine to 12 months would be deemed a completed fiscal year; provided further that this policy will only apply to incentive-based compensation received on or after October 2, 2023.

Incentive-based compensation is deemed received in the Company’s fiscal year during which the financial reporting measure specified in the incentive-based compensation award is attained, even if the payment or grant of the incentive-based compensation occurs after the end of that period.

For purposes of determining the relevant recovery period, the date that the Company is required to prepare an accounting restatement is the earlier to occur of:

(1)the date the Company’s board of directors, a committee of the board of directors, or the officer or officers of the Company authorized to take such action if board action is not required, concludes, or reasonably should have concluded, that the Company is required to prepare an accounting restatement; or

(2)the date a court, regulator, or other legally authorized body directs the Company to prepare an accounting restatement.

The amount of incentive-based compensation that is subject to recovery under this policy (“erroneously awarded compensation”) is the amount of incentive-based compensation received that exceeds the amount of incentive-based compensation that otherwise would have been received had it been determined based on the restated amounts. The amount of incentive-based compensation that is subject to recovery will be computed without regard to any taxes paid. For

incentive-based compensation based on stock price or total shareholder return, where the amount of erroneously awarded compensation is not subject to mathematical recalculation directly from the information in an accounting restatement:

(1)the amount will be based on a reasonable estimate of the effect of the accounting restatement on the stock price or total shareholder return upon which the incentive-based compensation was received; and

(2)the Company will maintain documentation of the determination of that reasonable estimate and provide such documentation to the Nasdaq Stock Market.

The Company will recover erroneously awarded compensation in accordance with this policy, except to the extent that any of the following conditions are met and the Company’s Compensation Committee has made a determination that recovery would be impracticable:

(1)the direct expense paid to a third party to assist in enforcing this policy would exceed the amount to be recovered; provided that before concluding that it would be impracticable to recover any amount of erroneously awarded compensation based on expense of enforcement, the Company will make a reasonable attempt to recover such erroneously awarded compensation, document such reasonable attempt(s) to recover and provide such documentation to the Nasdaq Stock Market;

(2)recovery would violate home country law where that law was adopted prior to November 28, 2022; provided that before concluding that it would be impracticable to recover any amount of erroneously awarded compensation based on violation of home country law, the Company will obtain an opinion of home country counsel, acceptable to the Nasdaq Stock Market, that recovery would result in such a violation and provide such opinion to the Nasdaq Stock Market; or

(3)recovery would likely cause an otherwise tax-qualified retirement plan, under which benefits are broadly available to employees of the Company, to fail to meet the requirements of 26 U.S.C. 401(a)(13) or 26 U.S.C. 411(a) and regulations thereunder.

The Company will not indemnify any executive officer or former executive officer against the loss of erroneously awarded compensation.

The Company will file all disclosures with respect to this policy in accordance with the requirements of the federal securities laws, including the disclosures required by applicable Securities and Exchange Commission filings.

For purposes of this policy, the following terms have the definitions set forth below:

“Executive officer” means the Company’s president, principal financial officer, principal accounting officer (or if there is no such accounting officer, the controller), any vice-president of the Company in charge of a principal business unit, division or function (such as sales, administration, or finance), any other officer who performs a policy-making function, or any other person who performs similar policy-making functions for the Company. Executive officers of the Company’s parent(s) or subsidiaries are deemed executive officers of the Company if they perform such policy making functions for the Company.

“Financial reporting measures” means measures that are determined and presented in accordance with the accounting principles used in preparing the Company’s financial statements

and any measures that are derived wholly or in part from such measures. Stock price and total shareholder return are also financial reporting measures. A financial reporting measure need not be presented within the financial statements or included in a filing with the Securities and Exchange Commission.

“Incentive-based compensation” means compensation that is granted, earned or vested based wholly or in part upon the attainment of a financial reporting measure.

This policy is not intended to limit the Company’s ability to pursue other means to recover damages resulting from wrongdoing. The Company retains all rights it may have under applicable law.

This policy may be amended from time to time in the Company’s sole discretion.

Notwithstanding the foregoing, this policy will be interpreted to comply with applicable securities laws, including the requirements of (1) Section 10D of the Securities Exchange Act of 1934 (the “Exchange Act”), (2) Rule 10D-1 under the Exchange Act, and (3) the listing standards adopted by the Nasdaq Stock Market pursuant to Rule 10D-1, and, to the extent this policy is in any manner deemed inconsistent with such requirements, this policy shall be treated as retroactively amended to be compliant with such requirements.

Approved and Adopted: October 26, 2023

EMPLOYMENT AGREEMENT

This Employment Agreement (this “Agreement”), dated as of October 26, 2023 (the “Effective Date”), is made by and among Chuy’s Opco, Inc., a Delaware corporation (the “Company”), Chuy’s Holdings, Inc., a Delaware corporation (“Parent”) and John Korman (“Executive”).

R E C I T A L S

A. The Company and Parent (collectively, hereinafter referred to as, the “Employer”) desire to continue to retain the services of the Executive and Executive desires to continue to provide such services to the Employer pursuant to this Agreement.

B. The parties hereto wish to enter into a formal agreement that will govern the terms and conditions applicable to Executive’s employment and service to the Employer.

Now, therefore, in consideration of the premises and mutual covenants contained herein, the parties hereto hereby agree as follows:

I. TERMS AND CONDITIONS OF EMPLOYMENT

1.1 Employment Period; Duties and Responsibilities.

(a) This Agreement shall be effective as of the Effective Date and shall continue, unless terminated earlier pursuant to Article II of this Agreement. The period during which Executive is employed by the Company and will act as an officer of Parent hereunder is hereinafter referred to as the “Employment Period.” During the Employment Period, Executive will (i) serve as Chief Operating Officer of the Employer, and (ii) report directly to the President and Chief Executive Officer of the Employer (the “President and CEO”). Executive acknowledges that Executive’s employment is “at will”; and that his employment may be terminated during the Employment Period for any reason or for no reason, subject to the provisions of this Agreement.

(b) Executive will perform and undertake in good faith and to the best of his ability the customary duties and responsibilities associated with his position and such other duties as may be assigned to him from time to time by the President and CEO or the Board of Directors of Parent (the “Board”). All operations and support departments will report, directly or indirectly, to Executive.

(c) During the Employment Period, Executive will devote his full working time and attention to the business and affairs of the Employer and its subsidiaries; provided, however, that the foregoing will not preclude Executive from being involved in civic or charitable activities or investment activities and related matters, as long as such activities do not interfere with his ability to perform his duties and obligations hereunder.

(d) Each of the parties acknowledges that this Agreement imposes certain obligations on each of them to be performed and observed after the Termination Date (as defined below) with respect to the Employment Period.

1.2 Compensation.

(a) Base Salary: During the Employment Period, Executive will be paid a base salary (such amount, as may be so increased, is hereinafter referred to as “Base Salary”) of not less than $245,426 per annum, less payroll taxes and other deductions required by applicable

law and other deductions authorized in writing by Executive. Base Salary will be paid in substantially equal installments at periodic intervals in accordance with the Employer’s payroll practices for salaried employees, but not less frequently than twice each month. Executive’s Base Salary shall be reviewed annually by the Compensation Committee of the Board (or the Board, at such times the Board does not have a Compensation Committee, hereinafter collectively referred to as the “Compensation Committee”) and may be increased from time to time above the Base Salary set forth in this Section 1.2(a). Any such increased Base Salary shall constitute the “Base Salary” for purposes of this Agreement.

(b) Bonus: In addition to any Base Salary, Executive will be eligible to earn an annual bonus (the “Bonus”) with respect to each completed fiscal year of the Employer based upon the achievement of certain performance objectives as determined by the Compensation Committee. As of the Effective Date, Executive’s target annual bonus shall be equal to 30% of Executive’s Base Salary stated above, with a minimum and maximum bonus of 0% and 60%, respectively, of Executive’s Base Salary stated above. As of February 15, 2024, and thereafter, Executive’s target annual bonus shall be increased to equal 50% of Executive’s Base Salary at the time performance objectives are established, with a minimum and maximum bonus of 0% and 100%, respectively, of Executive’s Base Salary at the time performance objectives are established, it being understood that the Bonus for the 2024 fiscal year will be prorated to reflect such changes in Bonus percentages and Base Salary, if applicable, as of February 15, 2024. The Bonus shall be paid as soon as commercially practicable in the calendar year after such Bonus is earned and, in any event, no later than March 15th of such calendar year; provided, however, that Executive must (i) be employed by Employer on the last day of the calendar year in which the Bonus was earned and (ii) not terminate his employment with the Employer under Section 2.5 hereof prior to the Bonus being paid. The performance objectives applicable to the Bonus shall be established by the Compensation Committee. Determinations regarding the achievement of performance objectives and the payout of the Bonus shall be subject to the approval of the Compensation Committee. Executive’s target annual bonus, minimum and maximum annual bonus and resulting potential bonus shall be reviewed annually by the Compensation Committee and may be increased from time to time above the target annual bonus, minimum and maximum annual bonus and resulting potential bonus set forth in this Section 1.2(b).

(c) Equity Compensation: In addition to the Base Salary and Bonus payable under this Agreement, as may be determined and authorized from time to time in the sole discretion of the Compensation Committee, and subject to the terms and conditions of the Chuy’s Holdings, Inc. 2020 Omnibus Equity Incentive Plan or any successor plan (collectively, the “Equity Plan”) and award agreement governing the grant of equity awards, Executive shall be eligible to participate annually in the Equity Plan, with a targeted equity award equal to 50% of Executive’s Base Salary at the time the grant is made. The grant of such award shall be made on or around March 15th of each calendar year; provided, however, that Executive must (i) be employed by the Employer on the date of the grant and (ii) execute the applicable award agreement in connection with the grant. Executive’s annual equity award grant shall be reviewed annually by the Compensation Committee and may be increased from time to time above the targeted equity award grant set forth in this Section 1.2(c).

1.3 Participation in Employee Benefits Plans.

(a) Executive shall be entitled to participate in the employee benefit plans of the Employer generally available to other senior executives, including any health, disability or group life insurance plans or any retirement or non-qualified deferred compensation plans of the Employer, subject to the eligibility requirements of such plans.

(b) Executive will be entitled to four weeks paid vacation per calendar year to be taken in accordance with the applicable vacation policy of the Employer. Any unused portion

of available vacation days per annum will not carry over to the following year and Executive will not receive any compensation for such unused vacation prior to and/or upon the Termination Date (as defined below).

1.4 Expense Reimbursement. Executive will be entitled to reimbursement from the Employer for reasonable business expenses incurred by Executive in the performance of his duties, subject to, and in accordance with the applicable expense reimbursement policy of the Employer; provided, that Executive furnishes the Employer with substantiating documentation in accordance with the Employer’s policies.

II. TERMINATION OF EMPLOYMENT

2.1 Termination of Employment. The Employment Period and Executive’s employment hereunder may be terminated by either the Employer or Executive at any time and for any reason. Upon termination of Executive’s employment during the Employment Period, Executive shall be entitled to the compensation and benefits described in this Article II and shall have no further rights to any compensation or any other benefits from the Company, Parent, their subsidiaries, or any of their respective Affiliates (as defined below) (all such entities, together, the “Company Group”). Any termination of Executive’s employment hereunder by the Employer or by Executive during the Employment Period (other than termination pursuant to Section 2.6 on account of Executive’s death) shall be communicated by written notice of termination (“Notice of Termination”) to the other parties hereto in accordance with Section 4.2. The Notice of Termination shall specify:

(a) The termination provision of this Agreement relied upon;

(b) To the extent applicable, the facts and circumstances claimed to provide a basis for termination of Executive’s employment under the provision so indicated; and

(c) The applicable Termination Date.

2.2 Termination Date. Executive’s “Termination Date” shall be:

(a) If Executive’s employment hereunder terminates on account of Executive’s death, the date of Executive’s death;

(b) If Executive’s employment hereunder is terminated on account of Executive’s Disability (as defined below), the date that it is determined that Executive has a Disability;

(c) If the Company terminates Executive’s employment hereunder for Cause (as defined below), the date the Notice of Termination is delivered to Executive;

(d) If the Company terminates Executive’s employment hereunder without Cause, the date specified in the Notice of Termination, which shall be no less than 30 days following the date on which the Notice of Termination is delivered provided, however, such date in the Notice of Termination may be earlier than 30 days following the date on which the Notice of Termination is delivered if a lump sum payment equal to 30 days’ Base Salary accompanies such Notice of Termination;

(e) If Executive terminates Executive’s employment hereunder for Good Reason, the date specified in Executive’s Notice of Termination, which shall be within 30 days after the expiration of the Employer’s Cure Period (as defined below); and

(f) If Executive terminates Executive’s employment hereunder other than for Good Reason, the date specified in Executive’s Notice of Termination, which shall be no less than 30 days following the date on which the Notice of Termination is delivered; provided that the Company may waive all or any part of the 30-day notice period for no consideration by giving written notice to Executive (and for all purposes of this Agreement, Executive’s Termination Date in accordance with this Section 2.2(f) shall be the date determined by the Company).

(g) Notwithstanding anything contained herein, the Termination Date shall not occur until the date on which Executive incurs a “separation from service” within the meaning of Section 409A (as defined below).

2.3 Termination by the Company for Cause.

(a) The Company may terminate Executive’s employment hereunder for Cause (as defined below). If Executive’s Employment Period is terminated by the Employer for Cause, Executive will be entitled to receive only the following:

(i) any accrued but unpaid Base Salary, which shall be paid on the payroll date immediately following the Termination Date in accordance with the Employer’s customary payroll procedures;

(ii) reimbursement for unreimbursed business expenses properly incurred by Executive, which shall be subject to and paid in accordance with the Employer’s expense reimbursement policy; and

(iii) such employee benefits, if any, as to which Executive may be entitled under the Employer’s employee benefit plans as of the Termination Date; provided that, in no event shall Executive be entitled to any payments in the nature of severance or termination payments except as specifically provided herein.

Items in Section 2.3(a)(i) through Section 2.3(a)(iii) are referred to herein collectively as the “Accrued Amounts”.

(b) “Cause” means: (i) Executive’s commission of any act of fraud, embezzlement or material dishonesty; (ii) any intentional misconduct by Executive that has a materially adverse effect upon the Employer’s business or reputation; (iii) the admission or conviction of Executive of, or entering of a plea of nolo contendere by Executive to, any felony or any lesser crime involving moral turpitude, fraud, embezzlement or theft; (iv) any intentional violation of a written policy of the Company Group that remains uncured 15 days after notice from the Employer to Executive describing such violation; (v) the use of alcohol or illegal drugs (or prescription drugs in a manner other than as prescribed by a physician), interfering with the performance of Executive’s obligations hereunder; or (vi) breach by Executive of any provision of Article III. Any determination of Cause will be made by the Board.

2.4 Termination by the Employer Without Cause or by the Executive for Good Reason.

(a) In the event the Employer terminates Executive’s employment under this Agreement without Cause or the Executive terminates Executive’s employment for Good Reason:

(i) Executive shall be entitled to receive the Accrued Amounts; and

(ii) subject to Executive’s compliance with Article III of this Agreement and Executive’s execution of a release of claims in favor of the Company Group and each of their respective officers and directors in a form provided by the Employer (the “Release”) and such Release becoming effective within 60 days following the Termination Date (such 60 day period, the “Release Execution Period”), the Executive shall be entitled to receive for 12 months following the Termination Date (the applicable period, the “Severance Period”) (A) (1) the continuation of Executive’s Base Salary, as in effect on the Termination Date and (2) an amount equal to the Executive’s target annual bonus as set by the Compensation Committee for the year in which the Termination Date occurs, and (B) an amount, if any, by which the Employer was subsidizing medical and dental insurance coverage for Executive and his eligible dependents immediately prior to Executive’s Termination Date, and in each case, amounts owed to the Executive will be payable in equal installments during the Severance Period in accordance with the Employer’s normal payroll practices, but no less frequently than monthly, commencing with the first ordinary Employer payroll date following the Release Execution Period; provided that the first installment payment shall include all amounts that would otherwise have been paid to Executive during the period beginning on the Termination Date and ending on the first payment date if no delay associated with the Release Execution Period had been imposed.

The Employer shall provide Executive with the Release within five business days after the Termination Date. The parties agree that time is of the essence and each party agrees to work to complete the Release so that the prescribed time periods for execution and revocation of the Release under the Age Discrimination in Employment Act will lapse before the last day of the Release Execution Period.

(b) “Good Reason” means, without the Executive’s consent: (i) a reduction in Executive’s Base Salary, other than pursuant to a reduction applicable to all executives or employees of the Employer generally, (ii) a move of Executive’s primary place of work more than 50 miles from its current location, (iii) a material diminution in Executive’s normal duties and responsibilities, including, but not limited to, the assignment without Executive’s consent of any diminished duties and responsibilities which are inconsistent with Executive’s positions, duties and responsibilities with the Employer on the Effective Date, or a materially adverse change in Executive’s reporting responsibilities or titles as in effect on the Effective Date, or any removal of Executive from or any failure to re-elect Executive to any of such positions, or (iv) following a Change in Control (as defined in the Equity Plan), a reduction in Executive’s target annual Bonus or target annual equity award or, in either case, an adverse change in the vesting or performance conditions of such Bonus or equity awards, except in the case of any of (i) through (iv) in connection with the termination of Executive’s employment for Cause or upon Executive’s death or disability, or the resignation by Executive other than for Good Reason; provided that, in the case of any of (i) through (iv), Executive must provide written notice to the Employer within 30 days after the initial occurrence of the event that Executive claims constitutes Good Reason, and the Employer shall have 30 days from receipt of such notice to cure such circumstances (the “Cure Period”). For the avoidance of doubt, Good Reason shall not exist hereunder unless and until the Cure Period expires and the Employer shall not have cured such circumstances.

2.5 Resignation by Executive Other than for Good Reason.

Executive may terminate Executive’s employment hereunder at any time by delivering Notice of Termination no less than 30 days prior to Executive’s Termination Date as defined in Section 2.2(f). If Executive’s Employment Period is terminated under this Section 2.5, Executive will be entitled to receive only the Accrued Amounts.

2.6 Death or Disability.

(a) Executive’s employment hereunder shall terminate automatically upon Executive’s death during the Employment Period, and the Employer may terminate Executive’s employment on account of Executive’s Disability by providing Notice of Termination. If Executive’s employment is terminated during the Employment Period on account of Executive’s death or Disability, Executive (or Executive’s estate and/or beneficiaries, as the case may be) shall be entitled to receive only the Accrued Amounts.

(b) “Disability” means Executive’s inability to perform the normal and usual duties of Executive’s position with the Employer, with or without accommodation, by reason of any physical or mental impairment for more than 90 consecutive days, or 120 or more non-consecutive days, in any consecutive 12-month period as determined by a physician mutually acceptable to Executive and the Employer. Any determination of Disability will be made by the Board and shall be based on the determination of such physician.

(c) During any period that Executive fails to perform Executive’s duties as a result of Disability (“Disability Period”), Executive will continue to receive his full Base Salary at the rate then in effect for such period until Executive’s employment is terminated pursuant to Section 2.6(a); provided, that payment so made to Executive during a Disability Period will be reduced by the sum of the amounts, if any, payable to Executive at or prior to the time of any such payment under the disability benefit plans of the Company Group.

2.7 Accelerated Vesting of Equity Awards.

Notwithstanding any provision of this Agreement or any applicable award agreement under the Equity Plan, if (i) Executive’s employment is terminated on account of Executive’s death or Disability or (ii) Executive is terminated by the Employer without Cause or by the Executive for Good Reason, in each case, on or during the 24 month period after a Change in Control, subject to Executive’s compliance with Article III of this Agreement and Executive’s execution of a Release during the Release Execution Period, then (x) any unvested or unexercisable portion of any award granted under the Equity Plan to Executive carrying a right to exercise shall become fully vested and all of Executive’s awards that carry a right to exercise shall be exercisable until the earlier of (A) two years from the Termination Date and (B) the last day of the original term of such award and (y) the restrictions, deferral limitations, payment conditions and forfeiture conditions applicable to any award granted under the Equity Plan shall lapse and such awards shall be deemed fully vested and any performance conditions imposed with respect to such awards shall be deemed to be fully achieved at the target level. This Section 2.7 shall be deemed to amend Executive’s outstanding award agreements under the Equity Plan.

2.8 Termination of Benefits.

Notwithstanding anything to the contrary in this Agreement, all payments and benefits under this Article II will immediately terminate, except for Accrued Amounts, in the event Executive breaches any provision of Article III.

2.9 Assistance After Termination.

From and after any termination of the Employment Period (whether by the Employer, by Executive or otherwise), Executive agrees to do or cause to be done all other things and acts, to execute, deliver, file and perform or cause to be executed, delivered, filed and performed all other instruments, documents and certificates as may be reasonably requested by the Employer or are necessary, proper or advisable in order to effect the removal, transition, substitution or modification of Executive as an officer, agent, affiliate, director, manager or

authorized representative of the Employer or any other positions that Executive holds with the Company Group.

2.10 Excise Tax.

Notwithstanding any other provision of this Agreement or any other plan, arrangement or agreement to the contrary, if any of the payments or benefits received or to be received by Executive (including, without limitation, any payment or benefits received in connection with a change in control of the Employer or the termination of Executive's employment, whether pursuant to the terms of this Agreement or any other plan, arrangement, or agreement, or otherwise) (all such payments collectively referred to herein as the “280G Payments”) constitute “parachute payments” within the meaning of Section 280G of the Internal Revenue Code of 1986, as amended (the “Code”), and will be subject to the excise tax imposed under Section 4999 of the Code (the “Excise Tax”), the Employer shall either (i) reduce (but not below zero) such payments or benefits received or to be received by Executive so that the aggregate present value of the payments and benefits received by the Executive is $1.00 less than the amount which would otherwise cause Executive to incur an Excise Tax, or (ii) be paid in full, whichever results in the greatest net after-tax payment to Executive. To the extent reduction is required, the Employer will reduce Executive’s cash payments and/or benefits under this Agreement followed by any acceleration of Executive’s outstanding equity awards. All calculations and determinations under this Section 2.10 shall be made by an independent accounting firm or independent tax counsel appointed by the Employer (the “Tax Counsel”) whose determinations shall be conclusive and binding on the Employer and Executive for all purposes. For purposes of making the calculations and determinations required by this Section 2.10, the Tax Counsel may rely on reasonable, good faith assumptions and approximations concerning the application of Section 280G and Section 4999 of the Code. The Employer and Executive shall furnish the Tax Counsel with such information and documents as the Tax Counsel may reasonably request in order to make its determinations under this Section 2.10. The Employer shall bear all costs the Tax Counsel may reasonably incur in connection with its services.

III. NON-COMPETITION, NON-SOLICITATION,

NON-DISPARAGEMENT, ETC.

3.1 Assignment of Inventions. Executive, and Executive on behalf of Executive’s heirs and assigns, irrevocably assigns to the Employer all of Executive’s rights, titles and interest, including, but not limited to, all patent, copyright and trade secret rights, in and to all inventions, ideas, disclosures and improvements (whether patented or unpatented), any copyrightable works or any other works of authorship which are or may be developed, made or conceived by Executive, either alone or jointly with others, in whole or in part, during the Employment Period (an “Invention”). Executive will promptly disclose such Inventions to the Employer and perform all actions reasonably requested by the Employer (whether during or after the Employment Period) to establish and confirm the Employer’s ownership of such Inventions (including, without limitation, the execution and delivery of assignments, consents, powers of attorney and other instruments) and to provide reasonable assistance to the Employer (whether during or after the Employment Period) in connection with the prosecution of any applications for patents, trademarks, trade names, service marks or reissues thereof or in the prosecution or defense of interferences relating to any Invention. Executive recognizes and agrees that the Inventions, to the extent copyrightable, constitute works for hire under the copyright laws of the United States.

3.2 Proprietary Information. Executive understands and agrees that Executive’s employment with the Company creates a relationship of confidence and trust with respect to any information of a confidential or secret nature that may be disclosed to Executive by or on behalf

of the Company Group that (a) relates to the business of the Company Group, its customers and suppliers, as well as other entities or individuals on whose behalf Executive or the Company Group has agreed or may, during the Employment Period, agree to hold information in confidence or (b) is otherwise produced or acquired by or on behalf of the Company Group, including, in addition to the information itself, all files, letters, memoranda, reports, records, data or other written, reproduced or other tangible manifestations pertaining to the information (“Proprietary Information”).

3.3 Confidentiality. (a) During the Employment Period and after any termination of Executive’s employment hereunder, Executive agrees to keep and hold all Proprietary Information in strict confidence and trust, and agrees that Executive will not directly or indirectly use or disclose any of such Proprietary Information, except as may be necessary: (i) to perform Executive’s duties as an employee of the Employer for the benefit of the Employer, or (ii) to comply with a court order to disclose such Proprietary Information. Executive agrees to return all Proprietary Information to the Employer upon the termination of Executive’s employment with the Employer, or any request by the Employer subsequent to such termination, without retaining any copies, notes or excerpts thereof.

(b) The Employer will have the right to communicate with any future or prospective employer of Executive concerning Executive’s continuing obligations under this Section 3.3.

3.4 Non-Competition. During the Employment Period and for a period of 12 months following the Termination Date (the “Restricted Period”), Executive will not engage in any Competing Business, either directly or indirectly, as a principal or for his own account or solely or jointly with others, or as a stockholder or equity owner in or officer, director, employee or consultant of, any corporation or other entity, in any geographic area in which the Company Group operates restaurants or is actively considering new restaurant locations at any time during the Employment Period. For the purposes of this Agreement, a “Competing Business” is any business engaged in the operation of one or more Tex-Mex or Mexican fast casual or casual dining restaurants, including, but not limited to, Pappasito’s, Torchy’s, Uncle Julio’s, Abuelo’s and On the Border Mexican Grill & Cantina. For the avoidance of doubt, nothing herein shall prohibit the acquisition by Executive of an interest representing 5% or less of the outstanding shares of a publicly traded Competing Business.

3.5 Non-Solicitation. During the Employment Period and during the Restricted Period, Executive will not, directly or indirectly, solicit, induce or in any manner encourage (a) any employee or consultant of the Company Group to leave the employ of the Company Group or otherwise terminate his or her relationship with the Company Group or to enter into an independent contractor, agency, or business partner relationship with any business that competes with the business of the Employer or withdraw in any way from any existing relationship with the Company Group, as the case may be, or (b) any manufacturer, vendor, supplier or customer of the Company Group to terminate its relationship or reduce its level of business with the Company Group, as the case may be. In addition, during the Restricted Period, Executive will not, directly or indirectly, hire any individual who was an employee of or independent contractor to the Company Group at any time within 12 months immediately preceding the Termination Date.

3.6 Non-Disparagement. During the Restricted Period, neither party will, directly or indirectly, make any oral or written statement or publication with respect to the other party or any Affiliate of such party or any of their respective shareholders, directors, officers, employees or lenders which disparages or denigrates, or could reasonably be interpreted as, disparaging or denigrating, such other party or its Affiliates or any of their respective shareholders, directors, officers, employees or lenders.

3.7 Relief.

Executive acknowledges and agrees that the remedy at law available to the Company Group for breach of any of Executive’s obligations under this Article III would be inadequate. Notwithstanding the provisions of Section 4.6 hereof, Executive agrees that, in addition to any other rights or remedies that the Company Group might have at law or in equity, temporary and permanent injunctive relief may be granted in any proceeding brought to enforce the provisions of this Article III, without the necessity of proof of actual damage.

3.8 Reasonableness.

Executive acknowledges that Executive’s obligations under this Article III are reasonable in the context of the nature of the Company Group’s business and the competitive injuries likely to be sustained by the Company Group if Executive were to violate such obligations.

3.9 Consideration.

Each of the parties acknowledges that this Agreement is made in consideration of, and is adequately supported by the agreement of the other parties to perform their respective obligations under this Agreement and by other consideration, which each acknowledges constitutes good, valuable and sufficient consideration.

IV. MISCELLANEOUS

4.1 Successors and Assigns.

The provisions of this Agreement will inure to the benefit of, and will be binding upon, Parent, the Company, their respective successors and assigns, and Executive, the personal representative of his estate and his heirs and legatees. This Agreement and any rights and obligations of Executive hereunder may not be assigned or delegated by Executive without the prior written consent of Parent and the Company, and any such purported assignment without such consent will be null and void; provided, however, that Parent and/or the Company may assign its or their rights and obligations hereunder to one of their respective Affiliates without Executive’s prior written consent.

No right, benefit or interest of Executive hereunder will be subject to anticipation, alienation, sale, assignment, encumbrance, charge, pledge, hypothecation, or set-off in respect of any claim, debt or obligation, or to execution, attachment, levy or similar process, or assignment by operation of law. Any attempt, voluntary or involuntary, to effect any action specified in the immediately preceding sentence will, to the full extent permitted by law, be null, void and of no effect. For purposes of this Agreement, “Affiliate” means, with respect to a person or entity, another person or entity that directly, or indirectly through one or more intermediaries, controls, or is controlled by, or is under common control with, such person or entity.

4.2 Notices.

All notices and other communications required or permitted hereunder will be in writing and, unless otherwise provided in this Agreement, will be deemed to have been duly given when delivered in person or when sent by e-mail or one business day after having been dispatched by a nationally recognized overnight courier service to the appropriate party. The addresses for such notices, demands or other communications will be those set forth below for the respective party (or to such other address as a party may have furnished to the other in

writing in accordance herewith, except that notices of change of address shall be effective only upon receipt):

If to Parent or the Company:

Steve Hislop

President and Chief Executive Officer

1623 Toomey, Road

Austin, Texas 78704

or if by e-mail, at the e-mail address given to the President and Chief Executive Officer by the Employer.

If to Executive:

At Executive’s last known address, as set forth in the personnel records of the Employer or if by e-mail, at the e-mail address given to Executive by the Employer.

4.3 Governing Document.

This Agreement constitutes the entire agreement and understanding of the parties with respect to the terms and conditions of Executive’s employment with the Employer and the payment of severance benefits and supersedes all prior and contemporaneous written or verbal agreements and understandings between the parties relating to employment, compensation, benefits, severance or any other subject matter hereof.

4.4 Amendments.

Except for any increases in Base Salary, Bonus or other compensation, no provision of this Agreement may be amended, modified, waived or discharged unless such amendment, waiver, modification or discharge is agreed to in writing signed by Executive and a duly authorized officer of the Company and Parent other than Executive. No waiver by any party hereto at any time of any breach by any other party hereto of, or compliance with, any condition or provision of this Agreement to be performed by such other party will be deemed a waiver of similar or dissimilar provisions or conditions at the same or at any prior or subsequent time.

4.5 Governing Law.

The provisions of this Agreement will be construed and enforced under the laws of Texas, without giving effect to the principles of conflicts of laws thereof.

4.6 Dispute Escalation; Jurisdiction.

(a) In the event of any dispute, controversy or claim of any kind or nature arising under or in connection with this Agreement (including disputes as to the creation, validity, interpretation, breach or termination of this Agreement) (a “Dispute”), the Employer will appoint a designated senior business executive whose task it will be to meet with Executive for the purpose of endeavoring to resolve the Dispute. The designated executive and Executive will meet as often as the parties reasonably deem necessary in order to gather and furnish to the other all information with respect to the matter in issue which the parties believe to be appropriate and germane in connection with its resolution. Such designated executive and Executive will discuss the Dispute and will negotiate in good faith in an effort to resolve the Dispute without the necessity of any formal proceeding relating thereto. The specific format for

such discussions will be left to the discretion of the designated executive and Executive, but may include the preparation of agreed upon statements of fact or written statements of position furnished to the other party. No formal proceedings for the resolution of the Dispute may be commenced until the earlier to occur of (i) a good faith mutual conclusion by the designated executive and Executive that amicable resolution through continued negotiation of the matter in issue does not appear likely or (ii) the 30th day after the initial request to negotiate the Dispute; provided, however, that nothing in this Section 4.6 will prohibit Executive from filing administrative charges with the Equal Employment Opportunity Commission, the National Labor Relations Board or any other federal or state governmental agencies.

(b) Any Dispute, if not resolved informally through negotiation between the parties as contemplated by Section 4.6(a), will be resolved by trial in any state or federal court in Travis County, Texas having jurisdiction.

4.7 Remedies.

All rights and remedies provided pursuant to this Agreement or by law will be cumulative, and no such right or remedy will be exclusive of any other. A party may pursue any one or more rights or remedies hereunder or may seek damages or specific performance in the event of another party’s breach hereunder or may pursue any other remedy by law or equity, whether or not stated in this Agreement.

4.8 Withholding.

Employer will deduct and withhold from all amounts payable to Executive under this Agreement any and all applicable federal, state and local income and employment withholding taxes and any other amounts required to be deducted or withheld by Employer under applicable statutes, regulations, ordinances or orders governing or requiring the withholding or deduction of amounts otherwise payable as compensation or wages to employees.

4.9 Waiver.

Any party by written notice to the other parties may (a) extend the time for performance of any of the obligations or other actions of the other under this Agreement, (b) waive compliance with any of the conditions or covenants of the other contained in this Agreement, or (c) waive or modify performance of any of the obligations of the other under this Agreement. Except as provided in the immediately preceding sentence, no action taken pursuant to this Agreement will be deemed to constitute a waiver of compliance with any covenants contained in this Agreement. Any waiver of any term or condition will not be construed as a subsequent waiver of the same term or condition, or a waiver of any other term or condition of this Agreement. No failure or delay of any party in asserting any of its rights hereunder will constitute a waiver of any such rights.

4.10 Survival.

The respective rights and obligations of the parties hereunder shall survive any termination of this Agreement to the extent necessary to effect the intended preservation of such rights and obligations and to the extent that any performance is required following termination of this Agreement. Without limiting the foregoing, Articles II, III and IV will expressly survive the termination of this Agreement.

4.11 Titles and Headings.

Titles and headings to Sections herein are inserted for convenience of reference only, and are not intended to be a part of or to affect the meaning or interpretation of this Agreement.

4.12 Severability.

Any provision of this Agreement held by a court of competent jurisdiction to be invalid or unenforceable shall not impair or invalidate the remainder of this Agreement, and the effect thereof shall be confined to the provision so held to be invalid or unenforceable.

4.13 Section 409A.

(a) All payments to which Executive may be entitled under this Agreement are intended to either be exempt from, or comply with, the requirements of Section 409A of the Code (“Section 409A”) including the final treasury regulations and other legally binding guidance promulgated thereunder, and shall be interpreted in accordance therewith. Unless otherwise expressly provided, any payment of compensation by Parent or the Company to Executive, whether pursuant to this Agreement or otherwise, shall be made by the 15th day of the third month after the end of the calendar year in which Executive’s right to such payment is no longer subject to a substantial risk of forfeiture (for purposes of Section 409A). No party, individually or jointly, may accelerate or defer any deferred payment, except in compliance with Section 409A, and no amount shall be paid prior to the earliest date on which it is permitted to be paid under Section 409A. Notwithstanding the foregoing, nothing in this Section 4.13 shall create any obligation by any member of the Company Group to Executive should any payment under this Section 4.13 fail to satisfy Section 409A.

(b) No payment of deferred compensation within the meaning of Section 409A that would otherwise be paid, and no benefit that constitutes deferred compensation that would otherwise be provided, upon a termination of employment will be made or provided, as the case may be, unless and until such termination of employment also constitutes a separation from service within the meaning of Section 409A.

(c) Notwithstanding any provisions of this Agreement to the contrary, if Executive is a “specified employee” (within the meaning of Section 409A and determined pursuant to policies adopted by the Company Group) on his Termination Date and if any portion of the payments or benefits to be received by Executive upon separation from service would be considered deferred compensation under Section 409A, amounts of deferred compensation that would otherwise be payable pursuant to this Agreement during the six-month period immediately following the Termination Date and benefits that constitute deferred compensation that would otherwise be provided pursuant to this Agreement during the six-month period immediately following Executive’s Termination Date will instead be paid or made available on the earlier of (i) the first day of the seventh month following Executive’s Termination Date and (ii) Executive’s death.

(d) The reimbursement of expenses and the provision of in-kind benefits under any provisions of this Agreement will be subject to the following:

(i) the amounts eligible for reimbursement, or the in-kind benefits provided, during any calendar year may not affect the expenses eligible for reimbursement, or the in-kind benefits provided, in any other calendar year;

(ii) any reimbursement of an eligible expense shall be made on or before the last day of the calendar year following the calendar year in which the expense was incurred; and

(iii) Executive’s right to an in-kind benefit or reimbursement is not subject to liquidation or exchange for cash or another benefit.

(e) Each payment made under this Agreement will be considered a separate payment and not one of a series of payments for purpose of Section 409A.

4.14 Certain Interpretive Matters.

Unless the context otherwise requires, (a) all references to Sections, Articles or Schedules are to be Sections, Articles and Schedules of or to this Agreement, (b) each term defined in this Agreement has the meaning assigned to it, (c) words in the singular include the plural and vice versa, (d) the term “including,” “include,” “includes,” and other similar constructions mean such terms without limitation, (e) all reference to $ or dollar amounts will be to lawful currency of the United States and (f) unless otherwise specified, to the extent the term “day” or “days” is used, it will mean calendar days. No provision of this Agreement will be interpreted in favor of, or against, any of the parties hereto by reason of the extent to which any such party or its counsel participated in the drafting thereof or by reason of the extent to which any such provision is inconsistent with any prior draft hereof or thereof.

4.15 Clawback Provisions.

Notwithstanding any other provisions in this Agreement to the contrary, any incentive-based compensation, or any other compensation, paid to Executive pursuant to this Agreement or any other agreement or arrangement with the Company Group which is subject to recovery under any law, government regulation or stock exchange listing requirement, will be subject to such deductions and clawback as may be required to be made pursuant to such law, government regulation or stock exchange listing requirement (or any policy adopted by the Company Group pursuant to any such law, government regulation or stock exchange listing requirement).

4.16 COUNTERPARTS.

THIS AGREEMENT MAY BE EXECUTED IN MORE THAN ONE COUNTERPART, EACH OF WHICH WILL BE DEEMED AN ORIGINAL, BUT ALL OF WHICH TOGETHER WILL CONSTITUTE BUT ONE AND THE SAME INSTRUMENT.

[Signature page follows]

IN WITNESS WHEREOF, the parties have executed this Agreement as of the day and year first written above.

Chuy’s Opco, Inc.

By: /s/ Steve Hislop

Name: Steve Hislop

Title: President and Chief Executive Officer

Chuy’s Holdings, Inc.

By: /s/ Steve Hislop

Name: Steve Hislop

Title: President and Chief Executive Officer

/s/ John Korman

John Korman

AMENDMENT TO EMPLOYMENT AGREEMENT

This Amendment to Employment Agreement (this “Amendment”), is entered into as of the date indicated below (the “Effective Date”) by and between Chuy’s Opco, Inc., a Delaware corporation (the “Company”), Chuy’s Holdings, Inc., a Delaware corporation (“Parent”) and John Mountford (“Executive”) (each, a “Party” and collectively, the “Parties”).

Executive is employed as the Company’s Chief Operating Officer pursuant to that certain Employment Agreement, dated March 11, 2019 (the “Employment Agreement”). Executive, Parent and the Company have agreed to amend and restate Executive’s employment terms and the Employment Agreement as set forth herein.

1. Amendments to Employment Agreement. The Parties have agreed that henceforth:

(a) As of the Effective Date, Sections 1.1(a) and 1.1(b) are revised so that Executive’s job title shall be changed from “Chief Operating Officer” to “Chief Culinary and Procurement Officer”, and the people reporting directly or indirectly to Executive shall be changed from “all operations and support departments” to “all culinary and purchasing personnel”. Subject to these revisions, all other provisions in Sections 1.1(a) and 1.1(b) shall continue to apply.

(b) Effective February 15, 2024, Section 1.2(a) is revised so that Executive’s Base Salary shall be revised to be not less than $250,000 per annum, less payroll taxes and other deductions required by applicable law and other deductions authorized in writing by Executive. Subject to these revisions, all other terms and provisions in Section 1.2(a) shall continue to apply.

(c) Effective February 15, 2024, Section 1.2(b) is revised so that Executive’s target annual bonus shall be equal to 30% of Executive’s Base Salary at the time performance objectives are established, with a minimum and maximum bonus of 0% and 60%, respectively, of Executive’s Base Salary at the time performance objectives are established (although it’s understood that the Bonus for 2024 will be prorated, so that the prorated portion attributable to January 1, 2024 to February 15, 2024 will be based on Executive’s Base Salary and minimum/maximum Bonus percentages in effect under the Employment Agreement immediately prior to this Amendment). Subject to these revisions, all other terms and provisions in Section 1.2(b) shall continue to apply.

2. The Employment Agreement shall be amended as provided above mutatis mutandis. In undertaking this Amendment, the Parties agree and acknowledge that they intend only to change (i) the Executive’s job title and corresponding duties, responsibilities, and authorities, and (ii) the Executive’s Base Salary and Bonus. All other terms and provisions of the Employment Agreement shall remain in full force and effect. The Executive acknowledges and agrees that this Amendment, the change to the Executive’s job title, duties, Base Salary, and Bonus, and any corresponding changes to the Employment Agreement do not constitute or otherwise give rise to “Good Reason” or a termination without “Cause” pursuant to the Employment Agreement or under any other agreement, plan, or policy.

IN WITNESS HEREOF, the Parties have executed this Amendment as of October 26, 2023 (the “Effective Date”).

Chuy’s Opco, Inc.

By: /s/ Steve Hislop

Name: Steve Hislop

Title: President and Chief Executive Officer

Chuy’s Holdings, Inc.

By: /s/ Steve Hislop

Name: Steve Hislop

Title: President and Chief Executive Officer

/s/ John Mountford

John Mountford

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

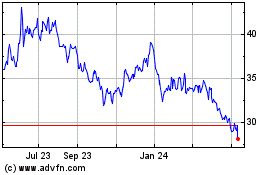

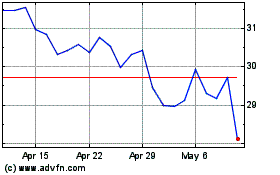

Chuy s (NASDAQ:CHUY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Chuy s (NASDAQ:CHUY)

Historical Stock Chart

From Apr 2023 to Apr 2024