ChampionX Corporation (NASDAQ: CHX) (“ChampionX” or the

“Company”) today announced third quarter of 2023 results.

Revenue was $939.8 million, net income attributable to ChampionX

was $77.7 million, and adjusted EBITDA was $189.5 million. Income

before income taxes margin was 11.7% and adjusted EBITDA margin was

20.2%. Cash from operating activities was $163.0 million and free

cash flow was $114.6 million.

CEO Commentary

“We delivered adjusted EBITDA growth and robust free cash flow

generation during the third quarter and once again demonstrated our

commitment to return excess cash to our shareholders through our

regular cash dividend and share repurchases. Our ongoing focus on

price realization and productivity contributed to strong

year-over-year profitability improvement. We remain focused on

shareholder value creation and our disciplined framework of capital

allocation. I am grateful to our employees around the world for

their tireless dedication to serving our customers and communities

well,” ChampionX’s President and Chief Executive Officer

Sivasankaran “Soma” Somasundaram said.

“During the third quarter of 2023, we generated revenue of $940

million, which decreased 8% year-over-year, and increased 1%

sequentially. Both North America and international revenue

increased sequentially, led by our Production Chemical Technologies

business. Strong sequential growth in international and offshore

markets was largely offset by lower than expected drilling and

completions activity in U.S. land, which impacted Production &

Automation Technologies and Drilling Technologies revenues during

the period. We generated net income attributable to ChampionX of

$78 million, which increased 237% year-over-year and decreased 19%

sequentially, and adjusted EBITDA of $190 million, which increased

14% year-over-year and 2% sequentially and included approximately

$7 million of foreign exchange loss related to the devaluation of

our peso exposure in Argentina during the period. Our income before

income taxes margin improved by approximately 802 basis points

year-over-year and was flat sequentially, and our adjusted EBITDA

margin expanded by approximately 391 basis points year-over-year

and 7 basis points sequentially in the third quarter.

“Cash flow from operating activities was $163 million during the

third quarter, which represented 210% of net income attributable to

ChampionX, and we generated strong free cash flow of $115 million

during the period, which represented 60% of our adjusted EBITDA for

the period. Through our regular cash dividend of $17 million and

$68 million of ChampionX share repurchases, we returned 52% of cash

from operating activities and 74% of our free cash flow in the

third quarter to our shareholders. Our balance sheet and financial

position remain strong, ending the third quarter with $954 million

of liquidity, including $285 million of cash and $669 million of

available capacity on our revolving credit facility.

“As we look to the fourth quarter, we expect continued positive

momentum in our international and offshore businesses, offset by

seasonal declines in our North American businesses into the

year-end holidays. We expect our Drilling Technologies business to

experience a sequential revenue decline similar to the fourth

quarter of 2022 as some of our customers act to manage their

working capital into year end. On a consolidated basis, in the

fourth quarter, we expect revenue to be between $930 million and

$970 million. We expect adjusted EBITDA of $187 million to $197

million. Our cash generation remains strong, and for the full year,

we still expect to convert at least 50% of our adjusted EBITDA to

free cash flow, and we remain committed to returning at least 60%

of our free cash flow to our shareholders for the year.

“As we look into 2024 and beyond, we remain excited about the

constructive market fundamentals as the oil and gas industry is

benefiting from a multi-year growth cycle. As the leading provider

of production optimization solutions for the industry, we are well

positioned to benefit from this trend as the growth cycle unfolds.

We expect continued revenue and adjusted EBITDA growth, margin

expansion, and strong capital returns consistent with our capital

allocation framework.”

Production Chemical Technologies

Production Chemical Technologies revenue in the third quarter of

2023 was $604.3 million, an increase of $30.0 million, or 5%,

sequentially, due to higher demand both in North America and

internationally.

Segment operating profit was $94.6 million and adjusted segment

EBITDA was $125.1 million. Segment operating profit margin was

15.6%, an increase of 47 basis points, sequentially, and adjusted

segment EBITDA margin was 20.7%, an increase of 37 basis points,

sequentially. The increase in segment operating profit margin and

adjusted segment EBITDA margin reflects higher sales volumes,

offset by $7.2 million of foreign exchange loss related to the

devaluation of our peso exposure in Argentina during the

period.

Production & Automation Technologies

Production & Automation Technologies revenue in the third

quarter of 2023 was $256.1 million, an increase of $2.0 million, or

1%, sequentially, due to higher demand in our businesses

internationally.

Revenue from digital products was $58.0 million in the third

quarter of 2023, down 4% sequentially, and up 17%

year-over-year.

Segment operating profit was $28.3 million and adjusted segment

EBITDA was $59.3 million. Segment operating profit margin was

11.0%, a decrease of 202 basis points, sequentially, and adjusted

segment EBITDA margin was 23.2%, a decrease of 73 basis points,

sequentially. The decrease in segment operating profit margin and

adjusted segment EBITDA margin was driven by product mix.

Drilling Technologies

Drilling Technologies revenue in the third quarter of 2023 was

$54.9 million, a decrease of $2.5 million, or 4%, sequentially,

driven by lower U.S. rig count and customer activity.

Segment operating profit was $12.3 million and adjusted segment

EBITDA was $13.8 million. Segment operating profit margin was

22.3%, an increase of 25 basis points, sequentially, and adjusted

segment EBITDA margin was 25.1%, an increase of 5 basis points,

sequentially, in each case due to improved processing costs.

Reservoir Chemical Technologies

Reservoir Chemical Technologies revenue in the third quarter

2023 was $25.1 million, an increase of $1.2 million, or 5%,

sequentially, driven by higher sales volumes.

Segment operating profit was $2.5 million and adjusted segment

EBITDA was $4.2 million. Segment operating profit margin was 9.8%,

an increase of 64 bps basis points, sequentially, and adjusted

segment EBITDA margin was 16.6%, a decrease of 110 basis points,

sequentially. The decrease in adjusted segment EBITDA margin was

driven by product mix.

Q3 2023 Other Business Highlights

Chemical Technologies

- Secured a multi-year performance-based contract extension with

an Oil Major in U.S. land.

- Won a two-year contract extension with an independent E&P

operator in Colombia.

- Secured a multi-year contract extension with a global energy

company in Australia, which affords opportunities for additional

business growth in the next several years.

- Received safety performance and supplier quality recognition

from multiple customers in the Middle East and North Africa

region.

- Deployed its first nano-particle technology squeeze in

Europe.

- Converted production enhancement chemical treatment to

continual application for a customer in the UK North Sea.

- Gained a substantial win of a competitively held midstream

account in the Permian Basin, due to deep knowledge of the

customer’s operations and excellent technical capability and

service.

- Awarded the chemicals supply contract for a large independent

E&P operator’s second frac water reuse facility in the Permian

Basin as the customer expands its footprint and investment in the

area.

- Experienced a successful competitive gain of a scale squeeze in

the U.S. Gulf of Mexico, utilizing its XR portfolio of

products.

Production & Automation Technologies

- Achieved a net promoter score of 51% (versus industry average

of 41%) and garnered top-tier marks in every category in the most

recent Artificial Lift Market Survey by Kimberlite International

Oilfield Research.

- Won a large PurePower Pro™ order for harmonic filters with

a large independent producer in the Permian Basin. This technology

significantly reduces distortion, significantly reducing

power-generation costs and fees.

- Awarded a contract by an Integrated Oil Company in Latin

America to monitor 400 wells with our XSPOC™ production

optimization software, with the potential for an additional 600

wells.

- Awarded a project for an Oil Major in the Permian Basin to

install 150 full chemical injection skid solutions (including pumps

and automation technology) on newly drilled unconventional

wells.

- Secured a customer commitment in Australia for our newly

commercialized ultra-quiet progressing cavity pumping (PCP) system

drivehead, which addresses noise pollution concerns of land

holders.

- Received the Shell Quality Recognition Award from Shell’s QGC

business, one of the top natural gas producers in Australia.

Drilling Technologies

- 43% of third quarter revenue was generated from products that

were less than three years old.

Other

- ChampionX is honored to be nominated eight times across four

categories for the ALLY Energy GRIT Awards for making a positive

impact on energy, sustainability, and the climate.

- ChampionX published its second annual Sustainability Report

highlighting our initiatives that align with our purpose of

Improving Lives and the work we are doing to further our customers’

carbon-reduction efforts.

- ChampionX opened our newest technology center in Chennai,

India. The new ChampionX Global Technology Center - India

represents a further extension of our focus on developing and

delivering a wide range of cross-industry technology solutions and

expertise.

Conference Call Details

ChampionX Corporation will host a conference call on Wednesday,

October 25, 2023, to discuss its third quarter 2023 financial

results and outlook. The call will begin at 9:00 a.m. Eastern Time.

Presentation materials that supplement the conference call will be

available on ChampionX’s website at investors.championx.com.

To listen to the call via a live webcast, please visit

ChampionX’s website at investor.championx.com. The call will also

be available by dialing 1-888-259-6580 in the United States or

1-416-764-8624 for international calls. Please call approximately

15 minutes prior to the scheduled start time and reference

ChampionX conference call number 11375578.

A replay of the conference call will be available for 30 days on

ChampionX’s website.

About Non-GAAP Measures

In addition to financial results determined in accordance with

generally accepted accounting principles in the United States

(“GAAP”), this news release presents non-GAAP financial measures.

Management believes that adjusted EBITDA, adjusted EBITDA margin,

adjusted segment EBITDA, adjusted segment EBITDA margin, adjusted

net income attributable to ChampionX and adjusted diluted earnings

per share attributable to ChampionX, provide useful information to

investors regarding the Company’s financial condition and results

of operations because they reflect the core operating results of

our businesses and help facilitate comparisons of operating

performance across periods. In addition, free cash flow, free cash

flow to adjusted EBITDA ratio, and free cash flow to revenue ratio

provide useful information to investors because they reflect the

core operating results of our businesses and help facilitate

comparisons of operating performance across periods. In addition,

these measures are used by management to measure our ability to

generate positive cash flow for debt reduction and to support our

strategic objectives. Although management believes the

aforementioned non-GAAP financial measures are good tools for

internal use and the investment community in evaluating ChampionX’s

overall financial performance, the foregoing non-GAAP financial

measures should be considered in addition to, not as a substitute

for or superior to, other measures of financial performance

prepared in accordance with GAAP. A reconciliation of these

non-GAAP measures to the most directly comparable GAAP measures is

included in the accompanying financial tables.

This press release contains certain forward-looking non-GAAP

financial measures, including adjusted EBITDA. The Company has not

provided projected net income attributable to ChampionX or a

reconciliation of projected adjusted EBITDA. Management cannot

predict with a reasonable degree of accuracy certain of the

necessary components of net income attributable to ChampionX, such

as depreciation and amortization expense. As such, a reconciliation

of projected adjusted EBITDA to projected net income attributable

to ChampionX is not available without unreasonable effort. The

actual amount of depreciation and amortization, in particular, and

other amounts excluded from adjusted EBITDA will have a significant

impact on net income attributable to ChampionX.

About ChampionX

ChampionX is a global leader in chemistry solutions, artificial

lift systems, and highly engineered equipment and technologies that

help companies drill for and produce oil and gas safely,

efficiently, and sustainably around the world. ChampionX’s

expertise, innovative products, and digital technologies provide

enhanced oil and gas production, transportation, and real-time

emissions monitoring throughout the lifecycle of a well. To learn

more about ChampionX, visit our website at www.championX.com.

Forward-Looking Statements

This news release contains statements relating to future actions

and results, which are "forward-looking statements" within the

meaning of the Securities Exchange Act of 1934, as amended, and the

Private Securities Litigation Reform Act of 1995. Such statements

relate to, among other things, ChampionX's market position and

growth opportunities. Forward-looking statements include

statements related to ChampionX’s expectations regarding the

performance of the business, financial results, liquidity and

capital resources of ChampionX. Forward-looking statements are

subject to inherent risks and uncertainties that could cause actual

results to differ materially from current expectations, including,

but not limited to, changes in economic, competitive, strategic,

technological, tax, regulatory or other factors that affect the

operations of ChampionX’s businesses. You are encouraged to refer

to the documents that ChampionX files from time to time with the

Securities and Exchange Commission (“SEC”), including the “Risk

Factors” in ChampionX’s Annual Report on Form 10-K for the fiscal

year ended December 31, 2022, and in ChampionX’s other filings with

the SEC. Readers are cautioned not to place undue reliance on

ChampionX’s forward-looking statements. Forward-looking statements

speak only as of the day they are made and ChampionX

undertakes no obligation to update any forward-looking statement,

except as required by applicable law.

Investor Contact: Byron

Popebyron.pope@championx.com 281-602-0094

Media Contact: John

Breedjohn.breed@championx.com 281-403-5751

CHAMPIONX CORPORATIONCONDENSED

CONSOLIDATED STATEMENTS OF

INCOME(UNAUDITED)

| |

Three Months Ended |

|

Nine Months Ended |

| |

September 30, |

|

June 30, |

|

September 30, |

|

September 30, |

|

(in thousands, except per share amounts) |

|

2023 |

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

2022 |

| Revenue |

$ |

939,783 |

|

$ |

926,600 |

|

|

$ |

1,021,561 |

|

|

$ |

2,814,730 |

|

$ |

2,820,093 |

| Cost of goods and services |

|

647,923 |

|

|

644,394 |

|

|

|

825,018 |

|

|

|

1,957,309 |

|

|

2,204,052 |

| Gross

profit |

|

291,860 |

|

|

282,206 |

|

|

|

196,543 |

|

|

|

857,421 |

|

|

616,041 |

| Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expense |

|

162,317 |

|

|

162,484 |

|

|

|

153,736 |

|

|

|

485,617 |

|

|

445,447 |

|

Loss (gain) on disposal group |

|

— |

|

|

— |

|

|

|

(6,409 |

) |

|

|

12,965 |

|

|

16,515 |

|

Interest expense, net |

|

13,744 |

|

|

14,544 |

|

|

|

11,454 |

|

|

|

40,754 |

|

|

33,582 |

|

Other expense (income), net |

|

5,998 |

|

|

(3,104 |

) |

|

|

291 |

|

|

|

8,189 |

|

|

10,968 |

| Income before income

taxes |

|

109,801 |

|

|

108,282 |

|

|

|

37,471 |

|

|

|

309,896 |

|

|

109,529 |

| Provision for income taxes |

|

29,009 |

|

|

11,656 |

|

|

|

14,246 |

|

|

|

69,334 |

|

|

19,235 |

| Net income |

|

80,792 |

|

|

96,626 |

|

|

|

23,225 |

|

|

|

240,562 |

|

|

90,294 |

|

Net income attributable to noncontrolling interest |

|

3,081 |

|

|

829 |

|

|

|

157 |

|

|

|

3,522 |

|

|

3,182 |

| Net income attributable

to ChampionX |

$ |

77,711 |

|

$ |

95,797 |

|

|

$ |

23,068 |

|

|

$ |

237,040 |

|

$ |

87,112 |

| |

|

|

|

|

|

|

|

|

|

| Earnings per share attributable

to ChampionX: |

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.40 |

|

$ |

0.49 |

|

|

$ |

0.11 |

|

|

$ |

1.20 |

|

$ |

0.43 |

|

Diluted |

$ |

0.39 |

|

$ |

0.48 |

|

|

$ |

0.11 |

|

|

$ |

1.18 |

|

$ |

0.42 |

| |

|

|

|

|

|

|

|

|

|

| Weighted-average shares

outstanding: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

195,881 |

|

|

197,034 |

|

|

|

201,421 |

|

|

|

197,058 |

|

|

202,600 |

|

Diluted |

|

199,592 |

|

|

200,735 |

|

|

|

206,522 |

|

|

|

201,025 |

|

|

208,155 |

CHAMPIONX CORPORATIONCONDENSED

CONSOLIDATED BALANCE

SHEETS(UNAUDITED)

| (in

thousands) |

September 30, 2023 |

|

December 31, 2022 |

| ASSETS |

|

|

|

| Current Assets: |

|

|

|

|

Cash and cash equivalents |

$ |

285,006 |

|

|

$ |

250,187 |

|

|

Receivables, net |

|

520,106 |

|

|

|

601,061 |

|

|

Inventories, net |

|

588,800 |

|

|

|

542,543 |

|

|

Prepaid expenses and other current assets |

|

91,784 |

|

|

|

104,790 |

|

|

Total current assets |

|

1,485,696 |

|

|

|

1,498,581 |

|

| |

|

|

|

| Property, plant and equipment,

net |

|

763,559 |

|

|

|

734,810 |

|

| Goodwill |

|

666,108 |

|

|

|

679,488 |

|

| Intangible assets, net |

|

256,376 |

|

|

|

305,010 |

|

| Other non-current assets |

|

139,465 |

|

|

|

169,594 |

|

| Total

assets |

$ |

3,311,204 |

|

|

$ |

3,387,483 |

|

| |

|

|

|

| LIABILITIES AND

EQUITY |

|

|

|

| Current Liabilities: |

|

|

|

|

Current portion of long-term debt |

$ |

6,250 |

|

|

$ |

6,250 |

|

|

Accounts payable |

|

500,021 |

|

|

|

469,566 |

|

|

Other current liabilities |

|

287,605 |

|

|

|

383,160 |

|

|

Total current liabilities |

|

793,876 |

|

|

|

858,976 |

|

| |

|

|

|

| Long-term debt |

|

594,943 |

|

|

|

621,702 |

|

| Other long-term liabilities |

|

216,257 |

|

|

|

229,590 |

|

| Stockholders’ equity: |

|

|

|

|

ChampionX stockholders’ equity |

|

1,721,479 |

|

|

|

1,694,550 |

|

|

Noncontrolling interest |

|

(15,351 |

) |

|

|

(17,335 |

) |

| Total liabilities and

equity |

$ |

3,311,204 |

|

|

$ |

3,387,483 |

|

CHAMPIONX CORPORATIONCONDENSED

CONSOLIDATED STATEMENTS OF CASH

FLOWS(UNAUDITED)

| |

Nine Months Ended September 30, |

|

(in thousands) |

|

2023 |

|

|

|

2022 |

|

| Cash flows from

operating activities: |

|

|

|

| Net income |

$ |

240,562 |

|

|

$ |

90,294 |

|

|

Depreciation and amortization |

|

177,226 |

|

|

|

177,761 |

|

|

Loss on disposal group |

|

12,965 |

|

|

|

16,515 |

|

|

Deferred income taxes |

|

(15,380 |

) |

|

|

(37,505 |

) |

|

Gain on disposal of fixed assets |

|

(1,480 |

) |

|

|

(4,428 |

) |

|

Loss on debt extinguishment |

|

— |

|

|

|

4,043 |

|

|

Receivables |

|

85,181 |

|

|

|

(50,075 |

) |

|

Inventories |

|

(50,011 |

) |

|

|

(72,298 |

) |

|

Leased assets |

|

(38,597 |

) |

|

|

(20,947 |

) |

|

Other assets |

|

17,470 |

|

|

|

24,022 |

|

|

Accounts payable |

|

(7,018 |

) |

|

|

38,600 |

|

|

Other operating items, net |

|

(49,600 |

) |

|

|

52,285 |

|

| Net cash flows

provided by operating activities |

|

371,318 |

|

|

|

218,267 |

|

| |

|

|

|

| Cash flows from

investing activities: |

|

|

|

|

Capital expenditures |

|

(110,965 |

) |

|

|

(74,752 |

) |

|

Proceeds from sale of fixed assets |

|

12,328 |

|

|

|

16,424 |

|

|

Acquisitions, net of cash acquired |

|

— |

|

|

|

(3,198 |

) |

| Net cash used for

investing activities |

|

(98,637 |

) |

|

|

(61,526 |

) |

| |

|

|

|

| Cash flows from

financing activities: |

|

|

|

|

Proceeds from long-term debt |

|

15,500 |

|

|

|

995,038 |

|

|

Repayment of long-term debt |

|

(43,625 |

) |

|

|

(1,071,386 |

) |

|

Debt issuance costs |

|

(1,028 |

) |

|

|

(8,008 |

) |

|

Repurchases of common stock |

|

(159,730 |

) |

|

|

(100,090 |

) |

|

Dividends paid |

|

(48,309 |

) |

|

|

(30,480 |

) |

|

Other |

|

644 |

|

|

|

(275 |

) |

| Net cash used for

financing activities |

|

(236,548 |

) |

|

|

(215,201 |

) |

| |

|

|

|

| Effect of exchange rate

changes on cash and cash equivalents |

|

(1,314 |

) |

|

|

(5,746 |

) |

| |

|

|

|

| Net increase

(decrease) in cash and cash equivalents |

|

34,819 |

|

|

|

(64,206 |

) |

| Cash and cash equivalents at

beginning of period |

|

250,187 |

|

|

|

255,178 |

|

| Cash and cash

equivalents at end of period |

$ |

285,006 |

|

|

$ |

190,972 |

|

CHAMPIONX CORPORATIONBUSINESS SEGMENT

DATA(UNAUDITED)

| |

Three Months Ended |

| |

September 30, |

|

June 30, |

|

September 30, |

|

(in thousands) |

|

2023 |

|

|

|

2023 |

|

|

|

2022 |

|

| Segment

revenue: |

|

|

|

|

|

| Production Chemical

Technologies |

$ |

604,254 |

|

|

$ |

574,302 |

|

|

$ |

643,604 |

|

| Production & Automation

Technologies |

|

256,148 |

|

|

|

254,156 |

|

|

|

247,717 |

|

| Drilling Technologies |

|

54,869 |

|

|

|

57,324 |

|

|

|

60,965 |

|

| Reservoir Chemical

Technologies |

|

25,093 |

|

|

|

23,853 |

|

|

|

35,485 |

|

| Corporate and other |

|

(581 |

) |

|

|

16,965 |

|

|

|

33,790 |

|

|

Total revenue |

$ |

939,783 |

|

|

$ |

926,600 |

|

|

$ |

1,021,561 |

|

| |

|

|

|

|

|

| Income

before income taxes: |

|

|

|

|

| Segment operating

profit (loss): |

|

|

|

|

|

| Production Chemical

Technologies |

$ |

94,560 |

|

|

$ |

87,163 |

|

|

$ |

86,649 |

|

| Production & Automation

Technologies |

|

28,299 |

|

|

|

33,208 |

|

|

|

22,485 |

|

| Drilling Technologies |

|

12,255 |

|

|

|

12,660 |

|

|

|

14,856 |

|

| Reservoir Chemical

Technologies |

|

2,461 |

|

|

|

2,186 |

|

|

|

(61,711 |

) |

|

Total segment operating profit |

|

137,575 |

|

|

|

135,217 |

|

|

|

62,279 |

|

| Corporate and other |

|

14,030 |

|

|

|

12,391 |

|

|

|

13,354 |

|

| Interest expense, net |

|

13,744 |

|

|

|

14,544 |

|

|

|

11,454 |

|

|

Income before income taxes |

$ |

109,801 |

|

|

$ |

108,282 |

|

|

$ |

37,471 |

|

| |

|

|

|

|

|

| Operating profit

margin / income before income taxes margin: |

|

|

|

|

|

| Production Chemical

Technologies |

|

15.6 |

% |

|

|

15.2 |

% |

|

|

13.5 |

% |

| Production & Automation

Technologies |

|

11.0 |

% |

|

|

13.1 |

% |

|

|

9.1 |

% |

| Drilling Technologies |

|

22.3 |

% |

|

|

22.1 |

% |

|

|

24.4 |

% |

| Reservoir Chemical

Technologies |

|

9.8 |

% |

|

|

9.2 |

% |

|

(173.9)% |

| ChampionX Consolidated |

|

11.7 |

% |

|

|

11.7 |

% |

|

|

3.7 |

% |

| |

|

|

|

|

|

| Adjusted

EBITDA |

|

|

|

|

|

| Production Chemical

Technologies |

$ |

125,095 |

|

|

$ |

116,790 |

|

|

$ |

102,848 |

|

| Production & Automation

Technologies |

|

59,322 |

|

|

|

60,711 |

|

|

|

52,101 |

|

| Drilling Technologies |

|

13,786 |

|

|

|

14,376 |

|

|

|

16,526 |

|

| Reservoir Chemical

Technologies |

|

4,157 |

|

|

|

4,213 |

|

|

|

2,635 |

|

| Corporate and other |

|

(12,816 |

) |

|

|

(9,848 |

) |

|

|

(7,994 |

) |

|

Adjusted EBITDA |

$ |

189,544 |

|

|

$ |

186,242 |

|

|

$ |

166,116 |

|

| |

|

|

|

|

|

| Adjusted EBITDA

margin |

|

|

|

|

|

| Production Chemical

Technologies |

|

20.7 |

% |

|

|

20.3 |

% |

|

|

16.0 |

% |

| Production & Automation

Technologies |

|

23.2 |

% |

|

|

23.9 |

% |

|

|

21.0 |

% |

| Drilling Technologies |

|

25.1 |

% |

|

|

25.1 |

% |

|

|

27.1 |

% |

| Reservoir Chemical

Technologies |

|

16.6 |

% |

|

|

17.7 |

% |

|

|

7.4 |

% |

| ChampionX Consolidated |

|

20.2 |

% |

|

|

20.1 |

% |

|

|

16.3 |

% |

CHAMPIONX CORPORATIONRECONCILIATIONS OF

GAAP TO NON-GAAP FINANCIAL

MEASURES(UNAUDITED)

| |

Three Months Ended |

| |

September 30, |

|

June 30, |

|

September 30, |

|

(in thousands) |

|

2023 |

|

|

|

2023 |

|

|

|

2022 |

|

| Net income attributable

to ChampionX |

$ |

77,711 |

|

|

$ |

95,797 |

|

|

$ |

23,068 |

|

| Pre-tax adjustments: |

|

|

|

|

|

|

Loss (gain) on disposal group(1) |

|

— |

|

|

|

— |

|

|

|

(6,409 |

) |

|

Russia sanctions compliance and impacts(2) |

|

95 |

|

|

|

433 |

|

|

|

(1,620 |

) |

|

Restructuring and other related charges |

|

1,228 |

|

|

|

5,353 |

|

|

|

67,533 |

|

|

Merger integration costs |

|

— |

|

|

|

— |

|

|

|

652 |

|

|

Acquisition costs and related adjustments(3) |

|

— |

|

|

|

(2,341 |

) |

|

|

(3,512 |

) |

|

Intellectual property defense |

|

220 |

|

|

|

687 |

|

|

|

15 |

|

|

Merger-related indemnification responsibility |

|

722 |

|

|

|

— |

|

|

|

— |

|

|

Tulsa, Oklahoma storm damage |

|

1,895 |

|

|

|

607 |

|

|

|

— |

|

| Tax impact of adjustments |

|

(925 |

) |

|

|

(1,478 |

) |

|

|

(11,898 |

) |

| Adjusted net income

attributable to ChampionX |

|

80,946 |

|

|

|

99,058 |

|

|

|

67,829 |

|

| Tax impact of adjustments |

|

925 |

|

|

|

1,478 |

|

|

|

11,898 |

|

| Net income attributable to

noncontrolling interest |

|

3,081 |

|

|

|

829 |

|

|

|

157 |

|

| Depreciation and

amortization |

|

61,839 |

|

|

|

58,677 |

|

|

|

60,532 |

|

| Provision for income taxes |

|

29,009 |

|

|

|

11,656 |

|

|

|

14,246 |

|

| Interest expense, net |

|

13,744 |

|

|

|

14,544 |

|

|

|

11,454 |

|

| Adjusted

EBITDA |

$ |

189,544 |

|

|

$ |

186,242 |

|

|

$ |

166,116 |

|

_______________________

(1) Amounts represent the loss recorded to properly adjust the

carrying value of our Chemical Technologies operations in Russia to

the lower of carrying value or fair value less costs to sell. (2)

Includes charges incurred related to legal and professional fees to

comply with, as well as additional foreign currency exchange losses

associated with, the sanctions imposed in

Russia.(3) Includes revenue associated with the

amortization of a liability established as part of the merger

transaction with Ecolab Inc. to acquire the Chemical Technologies

business, representing unfavorable terms under the Cross Supply

Agreement, as well as costs incurred for the acquisition of

businesses.

| |

Three Months Ended |

| |

September 30, |

|

June 30, |

|

September 30, |

|

(in thousands) |

|

2023 |

|

|

|

2023 |

|

|

|

2022 |

|

| Diluted earnings per

share attributable to ChampionX |

$ |

0.39 |

|

|

$ |

0.48 |

|

|

$ |

0.11 |

|

| Per share adjustments: |

|

|

|

|

|

|

Loss (gain) on disposal group |

|

— |

|

|

|

— |

|

|

|

(0.03 |

) |

|

Russia sanctions compliance and impacts |

|

— |

|

|

|

— |

|

|

|

(0.01 |

) |

|

Restructuring and other related charges |

|

0.01 |

|

|

|

0.03 |

|

|

|

0.34 |

|

|

Merger integration costs |

|

— |

|

|

|

— |

|

|

|

— |

|

|

Acquisition costs and related adjustments |

|

— |

|

|

|

(0.01 |

) |

|

|

(0.02 |

) |

|

Intellectual property defense |

|

— |

|

|

|

— |

|

|

|

— |

|

|

Merger-related indemnification responsibility |

|

0.01 |

|

|

|

— |

|

|

|

— |

|

|

Tulsa, Oklahoma storm damage |

|

0.01 |

|

|

|

— |

|

|

|

— |

|

| Tax impact of adjustments |

|

(0.01 |

) |

|

|

(0.01 |

) |

|

|

(0.06 |

) |

| Adjusted diluted earnings

per share attributable to ChampionX |

$ |

0.41 |

|

|

$ |

0.49 |

|

|

$ |

0.33 |

|

CHAMPIONX CORPORATIONRECONCILIATIONS OF

GAAP TO NON-GAAP FINANCIAL MEASURES BY

SEGMENT(UNAUDITED)

| |

Three Months Ended |

| |

September 30, |

|

June 30, |

|

September 30, |

|

(in thousands) |

|

2023 |

|

|

|

2023 |

|

|

|

2022 |

|

| Production Chemical

Technologies |

|

|

|

|

|

|

Segment operating profit |

$ |

94,560 |

|

|

$ |

87,163 |

|

|

$ |

86,649 |

|

|

Non-GAAP adjustments |

|

1,073 |

|

|

|

3,944 |

|

|

|

(4,551 |

) |

|

Depreciation and amortization |

|

29,462 |

|

|

|

25,683 |

|

|

|

20,750 |

|

| Segment adjusted EBITDA |

$ |

125,095 |

|

|

$ |

116,790 |

|

|

$ |

102,848 |

|

| |

|

|

|

|

|

| Production &

Automation Technologies |

|

|

|

|

|

|

Segment operating profit |

$ |

28,299 |

|

|

$ |

33,208 |

|

|

$ |

22,485 |

|

|

Non-GAAP adjustments |

|

2,123 |

|

|

|

1,082 |

|

|

|

4,281 |

|

|

Depreciation and amortization |

|

28,900 |

|

|

|

26,421 |

|

|

|

25,335 |

|

| Segment adjusted EBITDA |

$ |

59,322 |

|

|

$ |

60,711 |

|

|

$ |

52,101 |

|

| |

|

|

|

|

|

| Drilling

Technologies |

|

|

|

|

|

|

Segment operating profit |

$ |

12,255 |

|

|

$ |

12,660 |

|

|

$ |

14,856 |

|

|

Non-GAAP adjustments |

|

(8 |

) |

|

|

212 |

|

|

|

15 |

|

|

Depreciation and amortization |

|

1,539 |

|

|

|

1,504 |

|

|

|

1,655 |

|

| Segment adjusted EBITDA |

$ |

13,786 |

|

|

$ |

14,376 |

|

|

$ |

16,526 |

|

| |

|

|

|

|

|

| Reservoir Chemical

Technologies |

|

|

|

|

|

|

Segment operating profit |

$ |

2,461 |

|

|

$ |

2,186 |

|

|

$ |

(61,711 |

) |

|

Non-GAAP adjustments |

|

31 |

|

|

|

428 |

|

|

|

60,756 |

|

|

Depreciation and amortization |

|

1,665 |

|

|

|

1,599 |

|

|

|

3,590 |

|

| Segment adjusted EBITDA |

$ |

4,157 |

|

|

$ |

4,213 |

|

|

$ |

2,635 |

|

| |

|

|

|

|

|

| Corporate and

other |

|

|

|

|

|

|

Segment operating profit |

$ |

(27,774 |

) |

|

$ |

(26,935 |

) |

|

$ |

(24,808 |

) |

|

Non-GAAP adjustments |

|

941 |

|

|

|

(927 |

) |

|

|

(3,842 |

) |

|

Depreciation and amortization |

|

273 |

|

|

|

3,470 |

|

|

|

9,202 |

|

|

Interest expense, net |

|

13,744 |

|

|

|

14,544 |

|

|

|

11,454 |

|

| Segment adjusted EBITDA |

$ |

(12,816 |

) |

|

$ |

(9,848 |

) |

|

$ |

(7,994 |

) |

Free Cash Flow

| |

Three Months Ended |

| |

September 30, |

|

June 30, |

|

September 30, |

|

(in thousands) |

|

2023 |

|

|

|

2023 |

|

|

|

2022 |

|

| Free Cash

Flow |

|

|

|

|

|

| Cash flows from operating

activities |

$ |

163,030 |

|

|

$ |

115,910 |

|

|

$ |

187,152 |

|

| Less: Capital expenditures,

net of proceeds from sale of fixed assets |

|

(48,469 |

) |

|

|

(27,143 |

) |

|

|

(19,719 |

) |

|

Free cash flow |

$ |

114,561 |

|

|

$ |

88,767 |

|

|

$ |

167,433 |

|

| |

|

|

|

|

|

| Cash From Operating

Activities to Revenue Ratio |

|

|

|

|

|

| Cash flows from operating

activities |

$ |

163,030 |

|

|

$ |

115,910 |

|

|

$ |

187,152 |

|

| Revenue |

$ |

939,783 |

|

|

$ |

926,600 |

|

|

$ |

1,021,561 |

|

| |

|

|

|

|

|

| Cash from operating activities

to revenue ratio |

|

17 |

% |

|

|

13 |

% |

|

|

18 |

% |

| |

|

|

|

|

|

| Free Cash Flow to

Revenue Ratio |

|

|

|

|

|

| Free cash flow |

$ |

114,561 |

|

|

$ |

88,767 |

|

|

$ |

167,433 |

|

| Revenue |

$ |

939,783 |

|

|

$ |

926,600 |

|

|

$ |

1,021,561 |

|

| |

|

|

|

|

|

| Free cash flow to revenue

ratio |

|

12 |

% |

|

|

10 |

% |

|

|

16 |

% |

| |

|

|

|

|

|

| Free Cash Flow to

Adjusted EBITDA Ratio |

|

|

|

|

|

| Free cash flow |

$ |

114,561 |

|

|

$ |

88,767 |

|

|

$ |

167,433 |

|

| Adjusted EBITDA |

$ |

189,544 |

|

|

$ |

186,242 |

|

|

$ |

166,116 |

|

| |

|

|

|

|

|

| Free cash flow to adjusted

EBITDA ratio |

|

60 |

% |

|

|

48 |

% |

|

|

101 |

% |

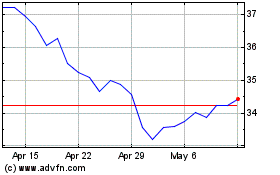

ChampionX (NASDAQ:CHX)

Historical Stock Chart

From Apr 2024 to May 2024

ChampionX (NASDAQ:CHX)

Historical Stock Chart

From May 2023 to May 2024