Q4 2023 Net Revenue Increased 376% to $8.6

million

Q4 Number of Vehicles Sold Increased by 148% to

1,135 Vehicles

Q4 Gross Profit Margin Increased 2,500 bps to

2.3% from a loss of -22.7%

Cenntro Inc. (NASDAQ: CENN) (“Cenntro” or “the Company”), a

leading electric vehicle technology company with advanced,

market-validated electric commercial vehicles, has reported its

financial and operational results for the fourth quarter and full

year ended December 31, 2023.

Fourth Quarter 2023 Financial and Operating

Highlights

- Fourth Quarter 2023 Net revenue of $8.6 million increased 376%

year over year.

- Sales volume increased by 827% year over year and 58.7%

sequentially quarter over quarter to 473 vehicles.

- Adjusted EBITDA for the quarter is a loss of $13.7 million

compared to a loss of $18.3 million for Q4 2022.

- Full Year 2023 Net revenue of $22.1 million increased 147% year

over year.

- Sales volume increased by 148% year over year to 1,135

vehicles.

- Adjusted EBITDA for the full year 2023 is a loss of $47.6

million compared to a loss of $43.2 million for 2022.

- Delivered more than 250 autonomous delivery vehicles in China

to Zelos (Suzhou) Technology Co., Ltd, which sells and operates

autonomous driving vehicles for urban delivery throughout various

cities in China.

- LS400 received approval from the California Air Resources Board

(“CARB”) to participate in California’s Hybrid and Zero-Emission

Truck and Bus Voucher Incentive Project (“HVIP”) in the state of

California, providing a $60,000 point-of-sale voucher for the

Company’s customers.

- Received a Certificate of Compliance for Cybersecurity

Management System (UN Regulation number: R155) and a Certificate of

Compliance for Software Update Management System (UN Regulation

number: R156). Both certifications are required for vehicle sales

in the European Union beginning in the second quarter of 2024.

- In February 2024, Cenntro redomiciled from Australia to the

United States of America to provide more opportunities to pursue

future corporate development and strategic growth initiatives.

Peter Z. Wang, Chief Executive Officer explained, “The fourth

quarter of 2023 was highlighted by a continuation of the year’s

sales momentum and distribution expansion. In the fourth quarter we

sold 473 vehicles compared to 298 vehicles in Q3 2023 and 51 in Q4

2022. We experienced positive sales momentum for our iChassis,

having sold 199 units in Q4, though these 199 units are not

inclusive of the number of vehicles sold because iChassis is not

considered a complete vehicle. During the quarter we delivered more

than 250 autonomous delivery vehicles in China to Zelos (Suzhou)

Technology Co. powered by iChassis and utilizing autonomous driving

software developed by Zelos. More importantly, to date the demand

for some of our newly launched vehicle models in Europe such as the

LS260® continued to outpace our estimates. Sales momentum in 2023

continued to build quarter to quarter with the effectiveness of our

sales process.”

“Throughout the quarter we continued to benefit from government

incentives in both the United States and the European Union for our

vehicles. In California, we received approval to participate in the

Hybrid and Zero-Emission Truck and Bus Voucher Incentive Project

(“HVIP”), providing a $60,000 point-of-sale voucher for our LS400

customers. HVIP approval not only accelerates our commercialization

of the LS400, but makes the model more affordable and attractive to

our customers by offering point-of-sale vouchers. In the EU, we

received a Certificate of Compliance for Cybersecurity Management

and a Certificate of Compliance for Software Update Management

System. Both certifications are required for vehicle sales in the

European Union beginning in the second quarter of 2024, stemming

from the growing technological complexity and interconnectedness of

today’s vehicles.”

“In California, with the LS400’s approval now for the HVIP,

Commercial Clean Vehicle Credit, California Air Resources Board

(“CARB”) certification, and Zero-Emission Powertrain Certification

(“ZEP”), we remain highly focused on scaling production at our U.S.

assembly and manufacturing facility in Ontario, California. The

facility has the capability to assemble and distribute the TeeMak,

Metro and Logistar series models with a focus on the Logistar 400®

and future models. We believe Ontario will also support strategic

growth and sales on the west coast and the entire western region of

the United States. California remains a strong market for EV sales

and infrastructure development, as such we believe Cenntro’s dealer

and distributor partnerships will strengthen sales and aftermarket

support. In addition, from a supply chain standpoint, we believe

California will serve as a very cost-effective point of entry for

our products from China to serve our customers on the West

Coast.”

“Our footprint in the European market continues to build in

scale with our EVC customer base looking for competitive products

to complete their local commerce needs and allowing them to

participate in Zero Emission initiatives. We have also determined

that providing a compatible charging solution to our customers that

is available for sale along with our product line is vital. We have

begun to develop relationships that will allow us to provide a

charging solution as part of the sales transaction.”

“Based on these developments, we are optimistic that our sales

momentum will continue to build in 2024 and beyond. With our recent

re-domicile to the U.S., we are now well positioned to capture

market share with our diverse and innovative lineup of all-electric

vehicles that are benefiting from a variety of government

incentives in the U.S. and Europe. Our focus in 2024 will be on

expanding our geographic footprint for production, distribution,

and service infrastructure, we believe this will position us to

efficiently scale as we enter the next phase of growth and create

additional value for our shareholders,” concluded Mr. Wang.

Edward Ye, Acting Chief Financial Officer, added, “Sales volume

in the fourth quarter of 2023 for our electric commercial vehicles

increased 827% year-over-year to 473 from 51 in the same period of

2022. At the same time, we achieved an increase of net revenue of

376% to approximately $8.6 million for the fourth quarter of 2023

compared to $1.8 million in the same period of 2022. For the full

year 2023, sales volume of commercial vehicles increased 148%

year-over-year to 1,135 from 458 in 2022. 2023 revenue increased

147% to $22.1 million from $8.9 million in the prior year. The

increase in net revenue is mainly attributable to an approximate

$12.1 million increase in vehicle revenue in 2023. More

importantly, we continue to experience quarter-to-quarter revenue

growth in 2023 as fourth quarter revenue grew 49% from the third

quarter of 2023 to $8.6 million and grew 376% from the prior year’s

quarter. We are cautiously optimistic that the growth momentum will

continue in the first quarter of 2024, reflecting our investment in

expanding our product offerings and strengthening our global

distribution capabilities.”

“We continue to benefit from the transition to an in-country

direct sales model and our launch of new models, particularly the

LS260 as mentioned by Peter. Also, our overall vehicles gross

margin for the year ended December 31, 2023 and 2022 was

approximately 11.7% and -0.27%, respectively. The increase in our

overall gross profit was the result of (i) the decrease in

inventory write-down of approximately $1.5 million; and (ii) the

realized gross margin of Logsitar®100 and our newly introduced

Logsitar®260 was approximately 25.4% and 18.8%, respectively, in

2023 compared with 2022.”

“As of December 31, 2023, we had approximately $29.4 million in

cash and cash equivalents on our balance sheet. We also had $6.5

million in accounts receivable, $43.9 million in inventory which

consisted of approximately $28.4 million in finished goods

inventory, and approximately $26.2 million in investments in equity

securities as of December 31, 2023,” concluded Mr. Ye.

Fourth Quarter 2023 Financial Results

Net Revenue

Net revenue was $8.6 million for the three months ended December

31, 2023, an increase of 376% from $1.8 million in the same period

of 2022. The increase was primarily due to an increase in vehicle

sales, spare parts sales, including 199 units of the iChassis.

Gross Profit

Gross Profit for the three months ended December 31, 2023 was

approximately $0.2 million, an increase of approximately $0.6

million from approximately $0.4 million of gross loss for the three

months ended December 31, 2022. For the three months ended December

31, 2023 and 2022, overall gross margin was approximately 2.3% and

-22.7%, respectively. Gross margin of vehicle sales for the three

months ended December 31, 2023 and 2022 was 4.2% and 15.1%,

respectively. The increase in our overall gross profit was caused

by the decrease in inventory write-down of approximately $0.9

million, offset by the decrease in vehicle revenue and other sales

of approximately $0.1 million and $0.1 million.

Operating Expenses

Total operating expenses were approximately $14.2 million in the

fourth quarter of 2023, compared with $20.4 million in the fourth

quarter of 2022.

Selling and marketing expenses for the three months ended

December 31, 2023 were approximately $0.6 million, a decrease of

approximately $1.6 million or approximately 72% from approximately

$2.3 million for the three months ended December 31, 2022. The

decrease in selling and marketing expenses in the fourth quarter of

2023 was primarily attributed to (i) the decrease in salary and

social insurance of approximately $0.9 million, and (ii) the

decrease in marketing expense of approximately $0.6 million.

General and administrative expenses for the three months ended

December 31, 2023 were approximately $10.4 million, an increase of

approximately $4.0 million or approximately 63% from approximately

$6.4 million for the three months ended December 31, 2022. The

increase in general and administrative expenses in the fourth

quarter 2023 was primarily attributed to the increase in legal and

professional fee, salary and social insurance and ROU amortization

of approximately $2.2 million, $1.3 million, and $0.7 million,

respectively, offset by the decrease in office expenses of

approximately $1.0 million.

Research and development expenses for the three months ended

December 31, 2023 were approximately $3.1 million, an increase of

approximately $0.4 million or approximately 13% from approximately

$2.8 million for the three months ended December 31, 2022. The

increase in research and development expenses in the fourth quarter

of 2023 was primarily attributed to the increase in design and

development expenses and salary and social expensed of

approximately $0.6 million and $0.4 million, respectively, offset

by the decrease in quality improvement measurement of approximately

$0.5 million.

Net Loss

Net loss was approximately $13.0 million in the fourth quarter

of 2023, compared with net loss of $73.3 million in the fourth

quarter of 2022.

Adjusted EBITDA

Adjusted EBITDA was approximately $(13.7) million in the fourth

quarter of 2023, compared with Adjusted EBITDA of $(18.3) million

in the fourth quarter of 2022.

Full Year 2023 Financial Results

Net Revenue

Net revenue was $22.1 million for the year ended December 31,

2023, an increase of 147% from $8.9 million in 2022. The increase

was primarily due to an increase in vehicle sales and spare parts

sales.

Gross Profit

Gross profit for the year ended December 31, 2023 was

approximately $2.3 million, an increase of approximately $2.8

million from approximately $0.5 million of gross loss for the year

ended December 31, 2022. For the years ended December 31, 2023 and

2022, overall gross margin was approximately 10.2% and -5.7%,

respectively. Gross margin of vehicle sales for years ended

December 31, 2023 and 2022 was 11.7% and -0.27%, respectively. The

increase in overall gross profit was caused by the decrease in

inventory write-down of approximately $1.5 million and realized

gross margin of Logsitar®100 and newly introduced Logsitar®260 of

approximately 25.4% and 18.8%, respectively. Both models began

sales in 2023.

Operating Expenses

Total operating expenses were approximately $52.5 million in

full year 2023, compared with $54.7 million in 2022.

Selling and marketing expenses for the year ended December 31,

2023, were approximately $7.9 million, an increase of approximately

$1.3 million or approximately 20.6% from approximately $6.5 million

for the year ended December 31, 2022. The increase in selling and

marketing expenses in 2023 was primarily attributed to the increase

in service fees related to European market and distribution channel

research and salary and social insurance of approximately $1.6

million and $0.7 million, respectively, offset by a decrease in

marketing expense of approximately $1.1 million.

General and administrative expenses for the year ended December

31, 2023 were approximately $35.7 million, an increase of

approximately $2.8 million or approximately 8.7% from approximately

$32.8 million for the year ended December 31, 2022. The increase in

general and administrative expenses in 2023 was primarily

attributed to an increase in share-based compensation, of

approximately $1.4 million, (ii) an increase in ROU amortization of

approximately $2.1 million, (iii) an increase in ROU interest

expense of approximately $1.0 million, offset by the decrease in

salary and social care expense and FOH stripping fee of

approximately $2.8 million and $1.8 million, respectively.

Research and development expenses for the year ended December

31, 2023 were approximately $8.5 million, an increase of

approximately $2.1 million or approximately 33.1% from

approximately $6.4 million for the year ended December 31, 2022.

The increase in research and development expenses in 2023 was

primarily attributed to the increase in design and development

expenditures and salary expense of approximately $1.0 million and

$1.4 million, respectively, offset by a decrease in development fee

related to enhancing quality of approximately $0.5 million.

Net Loss

Net loss was approximately $54.2 million in the year ended

December 31, 2023, compared with net loss of $110.1 million in

2022.

Balance Sheet

Cash and cash equivalents were approximately $29.4 million as of

December 31, 2023, compared with $154.0 million as of December 31,

2022.

Adjusted EBITDA

Adjusted EBITDA was approximately $(47.6) million in the year

ended December 31, 2023, compared with Adjusted EBITDA of $(43.2)

million in the year ended December 31, 2022.

We define Adjusted EBITDA as net income (or net loss) before net

interest expense, income tax expense, depreciation and amortization

as further adjusted to exclude the impact of stock-based

compensation expense and other non-recurring expenses including

expenses related to TME Acquisition, expenses related to one-off

payment inherited from the original Naked Brand Group, impairment

of goodwill, convertible bond issuance fee, loss on redemption of

convertible promissory notes, loss on exercise of warrants, and

change in fair value of convertible promissory notes and derivative

liability. We present Adjusted EBITDA because we consider it to be

an important supplemental measure of our performance and believe it

is frequently used by securities analysts, investors, and other

interested parties in the evaluation of companies in our industry.

Management believes that investors’ understanding of our

performance is enhanced by including this non-GAAP financial

measure as a reasonable basis for comparing our ongoing results of

operations.

US-GAAP NET INCOME (LOSS) TO ADJUSTED

EBITDA RECONCILIATION

Year Ended December

31,

2023

2022

(Unaudited)

Net loss

$

(54,360,755

)

$

(112,145,263

)

Interest expense, net

(402,414

)

844,231

Income tax expense

24,919

—

Depreciation and amortization

1,570,313

953,872

Share-based compensation expense

5,230,273

4,031,629

Expenses related to TME Acquisition

—

348,987

Expenses related to one-off payment

inherited from the original Naked Brand Group

—

8,299,178

Impairment of goodwill

—

11,111,886

Convertible bond issuance cost

—

5,589,336

Loss on redemption of convertible

promissory notes

(12,507

)

7,435

Loss on exercise of warrants

228,903

—

Change in fair value of convertible

promissory notes and derivative liability

(75,341

)

37,774,928

Loss from acquisition of Antric

136,302

—

Adjusted EBITDA

$

(47,575,571

)

$

(43,183,781

)

Represents a non-GAAP financial measure.

About Cenntro

Cenntro (NASDAQ: CENN) is a leading maker and provider of

electric commercial vehicles (“ECVs”). Cenntro's purpose-built ECVs

are designed to serve a variety of commercial applications

inclusive of its line of class 1 to class 4 trucks. Cenntro is

building a globalized supply-chain, as well as the manufacturing,

distribution, and service capabilities for its innovative and

reliable products. Cenntro continues to evolve its products

capabilities through advanced battery, powertrain, and smart

driving technologies. For more information, please visit Cenntro's

website at: www.cenntroauto.com.

Forward-Looking Statements

This communication contains "forward-looking statements" within

the meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995. Forward-looking

statements include all statements that are not historical facts.

Such statements may be, but need not be, identified by words such

as "may," "believe," "anticipate," "could," "should," "intend,"

"plan," "will," "aim(s)," "can," "would," "expect(s),"

"estimate(s)," "project(s)," "forecast(s)," "positioned,"

"approximately," "potential," "goal," "strategy," "outlook" and

similar expressions. Examples of forward-looking statements

include, among other things, statements regarding assembly and

distribution capabilities, decentralized production, and fully

digitalized autonomous driving solutions. All such forward-looking

statements are based on management's current beliefs, expectations

and assumptions, and are subject to risks, uncertainties and other

factors that could cause actual results to differ materially from

the results expressed or implied in this communication. For

additional risks and uncertainties that could impact Cenntro’s

forward-looking statements, please see disclosures contained in

Cenntro's public filings with the SEC, including the "Risk Factors"

in Cenntro's Annual Report on Form 10-K filed with the Securities

and Exchange Commission on April 1, 2024 and which may be viewed at

www.sec.gov.

CENNTRO INC. CONSOLIDATED

BALANCE SHEETS (Expressed in U.S. dollars, except for the number of

shares)

December 31,

2023

December 31,

2022

ASSETS

Current assets:

Cash and cash equivalents

$

29,375,727

$

153,966,777

Restricted cash

196,170

130,024

Short-term investment

4,236,588

-

Accounts receivable, net

6,530,801

565,398

Inventories

43,909,564

31,843,371

Prepayment and other current assets

20,391,150

16,138,330

Amounts due from related parties -

current

287,439

366,936

Total current assets

104,927,439

203,010,836

Non-current assets:

Long-term investments

4,685,984

5,325,741

Investment in equity securities

26,158,474

29,759,195

Property, plant and equipment, net

20,401,521

14,962,591

Goodwill

223,494

-

Intangible assets, net

6,873,781

4,563,792

Right-of-use assets

20,039,625

8,187,149

Other non-current assets, net

2,227,672

2,039,012

Total non-current assets

80,610,551

64,837,480

Total Assets

$

185,537,990

$

267,848,316

LIABILITIES AND EQUITY

LIABILITIES

Current liabilities:

Accounts payable

$

6,797,852

$

3,383,021

Accrued expenses and other current

liabilities

4,263,887

5,048,641

Contractual liabilities

3,394,044

2,388,480

Operating lease liabilities, current

4,741,599

1,313,334

Convertible promissory notes

9,956,000

57,372,827

Contingent liabilities

26,669

-

Deferred government grant, current

108,717

26,533

Amounts due to related parties

10,468

716,372

Total current liabilities

29,299,236

70,249,208

Non-current liabilities:

Contingent liabilities non-current

230,063

-

Deferred tax liabilities

228,086

-

Deferred government grant, non-current

1,929,733

497,484

Derivative liability - investor

warrant

12,189,508

14,334,104

Derivative liability - placement agent

warrant

3,456,578

3,456,404

Operating lease liabilities,

non-current

16,339,619

7,421,582

Total non-current liabilities

34,373,587

25,709,574

Total Liabilities

$

63,672,823

$

95,958,782

Commitments and contingencies

EQUITY

Ordinary shares (No par value; 30,828,778

and 30,084,200 shares issued and outstanding as of December 31,

2023 and 2022, respectively)

-

-

Additional paid in capital

402,337,393

397,497,817

Accumulated deficit

(274,023,501

)

(219,824,176

)

Accumulated other comprehensive loss

(6,444,485

)

(5,306,972

)

Total equity attributable to

shareholders

121,869,407

172,366,669

Non-controlling interests

(4,240

)

(477,135

)

Total Equity

$

121,865,167

$

171,889,534

Total Liabilities and Equity

$

185,537,990

$

267,848,316

CENNTRO INC. CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS (Expressed in U.S.

dollars, except for number of shares)

For the Years Ended December

31,

2023

2022

Net revenues

$

22,079,905

$

8,941,835

Cost of goods sold

(19,821,645

)

(9,455,805

)

Gross profit (loss)

2,258,260

(513,970

)

OPERATING EXPENSES:

Selling and marketing expenses

(7,868,773

)

(6,525,255

)

General and administrative expenses

(35,768,786

)

(32,822,709

)

Research and development expenses

(8,469,241

)

(6,362,770

)

Provision for doubtful accounts

-

(5,986,308

)

Impairment loss of right-of-use assets

-

(371,695

)

Impairment loss of intangible assets

-

(2,995,440

)

Reverse of deferred tax liabilities

-

898,632

Impairment loss of property, plant and

equipment

(431,319

)

(550,402

)

Total operating expenses

(52,538,119

)

(54,715,947

)

Loss from operations

(50,279,859

)

(55,229,917

)

OTHER EXPENSE:

Interest (income)/expense, net

402,414

(844,231

)

Gain (loss) on redemption of convertible

promissory notes

12,507

(7,435

)

(Loss) income from long-term

investments

(1,377,760

)

(12,651

)

Change in fair value of convertible

promissory notes and derivative liability

75,341

(37,774,928

)

Change in fair value of equity

securities

(2,600,721

)

(240,805

)

Convertible bond issuance cost

-

(5,589,336

)

Foreign currency exchange loss, net

(848,781

)

(409,207

)

Impairment loss of goodwill

-

(11,111,886

)

Loss from acquisition of Antric

(136,302

)

-

Loss on exercise of warrants

(228,903

)

-

Gain from cross-currency swaps

8,664

-

Other income/ (expense), net

621,633

(924,867

)

Loss before income taxes

(54,351,767

)

(112,145,263

)

Income tax expense

(8,988

)

-

Net loss

(54,360,755

)

(112,145,263

)

Less: net loss attributable to

non-controlling interests

(161,430

)

(2,057,022

)

Net loss attributable to the Company’s

shareholders

$

(54,199,325

)

$

(110,088,241

)

OTHER COMPREHENSIVE LOSS

Foreign currency translation

adjustment

(1,162,080

)

(3,889,706

)

Total comprehensive loss

(55,522,835

)

(116,034,969

)

Less: total comprehensive loss

attributable to non-controlling interests

(185,997

)

(2,032,455

)

Total comprehensive loss to the

Company’s shareholders

$

(55,336,838

)

$

(114,002,514

)

Weighted average number of shares

outstanding, basic and diluted *

30,424,686

26,332,324

Loss per share, basic and diluted

(1.78

)

(4.18

)

CENNTRO INC. CONSOLIDATED

STATEMENTS OF CASH FLOW (Expressed in U.S. dollars, except for

number of shares)

For the Year Ended December

31,

2023

2022

CASH FLOWS FROM OPERATING

ACTIVITIES:

Net loss

$

(54,360,755

)

$

(112,145,263

)

Adjustments to reconcile net loss to net

cash used in operating activities

Depreciation and amortization

1,670,980

953,872

Amortization and interest of operating

lease right-of-use asset

4,495,244

1,616,853

Impairment of property, plant and

equipment

431,319

550,402

Impairment of intangible assets

-

2,995,440

Reversal of deferred tax liabilities

-

(898,632

)

Impairment of right-of-use assets

-

371,695

Impairment of goodwill

-

11,111,886

Written-down of inventories

658,622

2,155,400

Provision for doubtful accounts

-

5,986,308

Convertible promissory notes issuance

costs

-

5,589,336

(Gain) Loss on redemption of convertible

promissory notes

(12,507

)

7,435

Loss on exercise of warrants

228,903

-

Changes in fair value of convertible

promissory notes and derivative liabilities

(75,341

)

37,774,928

Changes in fair value of equity

securities

2,600,721

240,805

Foreign currency exchange loss, net

1,527,077

409,207

Share-based compensation expense

5,230,273

4,031,629

Loss (Gain) from disposal of plant and

equipment

55,391

(10,334

)

Loss from long-term investments

1,377,760

12,651

Income from short-term investment

(22,918

)

-

Loss from acquisition of Antric Gmbh

136,302

-

Deferred income taxes

(15,930

)

-

Changes in operating assets and

liabilities:

Accounts receivable

(5,871,181

)

233,570

Inventories

(12,178,463

)

(20,483,127

)

Prepayment and other assets

(4,624,170

)

(6,753,851

)

Amounts due from/to related parties

11,799

(1,190,573

)

Accounts payable

3,100,835

(2,144,725

)

Accrued expense and other current

liabilities

(1,325,504

)

1,358,858

Contractual liabilities

2,516,789

633,825

Long-term payable

-

(700,000

)

Operating lease assets and liabilities

(4,012,410

)

(1,108,721

)

Net cash used in operating

activities

(58,457,164

)

(69,401,126

)

CASH FLOWS FROM INVESTING

ACTIVITIES

Purchase of equity investment

(880,932

)

(4,256,276

)

Purchase of convertible note from

Acton

(600,000

)

-

Purchase of wealth management products

purchased from banks

(4,236,740

)

-

Purchase of land, plant and equipment

(7,636,020

)

(3,285,072

)

Purchase of land use rights and

property

(1,114,943

)

(16,456,355

)

Acquisition of CAE’s equity interests

(1,924,557

)

(3,612,717

)

Payment of expense for acquisition of

CAE’s equity interests

-

(348,987

)

Cash acquired from acquisition of CAE

-

1,118,700

Acquisition of Antric Gmbh’s equity

interests

(1

)

-

Cash acquired from acquisition of Antric

Gmbh

1,376

-

Purchase of equity securities

-

(30,000,000

)

Proceeds from disposal of property, plant

and equipment

3,661

309

Loans provided to third parties

-

(1,323,671

)

Repayment of loans from related

parties

-

1,280,672

Net cash (used in) provided by

investing activities

(16,388,156

)

(56,883,397

)

CASH FLOWS FROM FINANCING

ACTIVITIES:

Repayment of loans to related parties

-

(1,726,614

)

Repayment of loans to third parties

-

(1,113,692

)

Repayments of bank loans

(601,476

)

-

Purchase of CAE’s loan

-

(13,228,101

)

Reduction of capital

-

(13,930,000

)

Proceed from issuance of convertible

promissory notes

-

54,069,000

Redemption of convertible promissory

notes

(47,534,119

)

(3,727,500

)

Proceed from exercise of share-based

awards

-

14,386

Payment of expense for the reverse

recapitalization

-

(904,843

)

Net cash provided by financing

activities

(48,135,595

)

19,452,636

Effect of exchange rate changes on

cash

(1,543,989

)

(736,274

)

Net (decrease)increase in cash, cash

equivalents and restricted cash

(124,524,904

)

(107,568,161

)

Cash, cash equivalents and restricted cash

at beginning of year

154,096,801

261,664,962

Cash, cash equivalents and restricted cash

at end of year

$

29,571,897

$

154,096,801

SUPPLEMENTAL DISCLOSURE OF CASH FLOW

INFORMATION:

Interest paid

$

1,468,397

$

369,410

Income tax paid

$

4,797

$

-

SUPPLEMENTAL DISCLOSURE OF NON-CASH

INVESTING AND FINANCING ACTIVITIES:

Cashless exercise of warrants

$

2,168,185

$

18,549,864

Non-cash capital injection to Robostreet

by i-Chassis

$

250,000

$

-

Convention from debt to equity interest of

HW Electro Co., Ltd.

$

1,000,000

$

-

Non-cash recognition of new leases

$

14,947,878

$

-

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240401614612/en/

Investor Relations Contact: MZ North America

CENN@mzgroup.us 949-491-8235

Company Contact: PR@cenntroauto.com

IR@cenntroauto.com

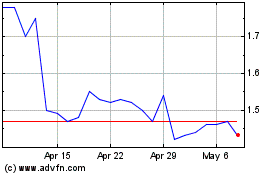

Cenntro (NASDAQ:CENN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Cenntro (NASDAQ:CENN)

Historical Stock Chart

From Nov 2023 to Nov 2024