Cassava Sciences Resolves SEC Investigation

September 26 2024 - 6:15PM

Cassava Sciences, Inc. (“Cassava” or the “Company”) (Nasdaq: SAVA),

a biotechnology company focused on Alzheimer’s disease, today

announced that it has reached a settlement with the U.S. Securities

and Exchange Commission (“SEC”) of negligence-based disclosure

charges that resolve a previously-disclosed SEC investigation into

statements made by the Company pertaining to the results of its

2020 Phase 2b clinical trial of simufilam and related matters. Two

former senior employees of the Company also settled

negligence-based disclosure charges brought by the SEC.

Cassava, without admitting or denying the SEC’s

allegations, agreed to pay a monetary penalty of $40 million. The

Company cooperated fully with the SEC’s investigation and has

implemented remedial measures.

In connection with the previously-disclosed

investigation by the Department of Justice (“DOJ”), the Company

does not currently anticipate that DOJ’s Criminal Division will

bring charges against or seek a resolution with the Company.

On July 17, 2024, Cassava announced the

appointment of Richard (Rick) Barry as Executive Chairman of the

Board as well as a series of actions designed to enhance corporate

governance, transparency, and accountability, consistent with the

Company’s commitment to the highest ethical business practices.

Mr. Barry became Chief Executive Officer of Cassava on

September 6, 2024.

“We would like to thank the staff of the

Division of Enforcement for its professionalism and its engagement

with the Company, which enabled the Board to conduct its own

internal investigation and to take decisive action,” said Mr.

Barry.

“Cassava is pleased to put this matter behind

us,” Mr. Barry said. “We can now focus all of our attention on

completion of the ongoing Phase 3 trials of simufilam. While no one

can accurately predict the future, we remain hopeful that the

trials will be successful and that, after a rigorous FDA review,

simufilam could become available to help those suffering from

Alzheimer’s disease.”

As previously announced, Cassava’s net cash use

in operations for the second half of 2024 is expected to be $80 to

$90 million, which includes the $40 million monetary penalty

related to this resolution. The Company maintains its estimate that

cash at year-end 2024 will be in a range of $117 to $127

million.

Cautionary Note Regarding

Forward-Looking Statements

This news release contains forward-looking

statements, including statements made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995,

that may include but are not limited to statements regarding: the

impact on the Company of its settlement with the SEC; the status

of, and developments related to, DOJ inquiries and investigations;

the implementation of remedial measures and actions to enhance

governance, transparency and accountability; the advancement and

outcome of our on-going Phase 3 clinical trials of simufilam in

patients with Alzheimer's disease; the safety or efficacy of

simufilam in people with Alzheimer’s disease dementia; potential

benefits, if any, of our product candidates; and expected cash

balances and cash use in future periods. These statements may be

identified by words such as “anticipate,” “believe,” “could,”

“expect,” “forecast,” “intend,” “may,” “plan,” “possible,”

“potential,” “will,” and other words and terms of similar

meaning.

Such statements are based largely on our current

expectations and projections about future events. Such statements

speak only as of the date of this news release and are subject to a

number of risks, uncertainties and assumptions, including, but not

limited to, risks relating to: any continuing investigation by DOJ,

including investigation of the conduct alleged in the indictment of

Dr. Hoau-Yan Wang announced by DOJ on June 28, 2024; approval by

the U.S. District Court of the settlement with the SEC; the ability

to conduct or complete clinical studies on expected timelines and

within expected budgets; the ability to demonstrate the

specificity, safety, efficacy, or potential health benefits of our

product candidates; our current expectations regarding timing of

clinical data for our Phase 3 clinical trials; any expected

clinical results of Phase 3 clinical trials; potential benefits, if

any, of our product candidates; and those described in the section

entitled “Risk Factors” in our Annual Report on Form 10-K for the

year ended December 31, 2023, in our Quarterly Report on Form 10-Q

for the period ended June 30, 2024, and in subsequent reports filed

with the SEC. The foregoing sets forth many, but not all, of the

factors that could cause actual results to differ from expectations

in any forward-looking statement. In light of these risks,

uncertainties and assumptions, the forward-looking statements and

events discussed in this news release are inherently uncertain and

may not occur, and actual results could differ materially and

adversely from those anticipated or implied in the forward-looking

statements. Accordingly, you should not rely upon forward-looking

statements as predictions of future events. Except as required by

law, we disclaim any intention or responsibility for updating or

revising any forward-looking statements contained in this news

release.

All our pharmaceutical assets under development

are investigational product candidates. These have not been

approved for use in any medical indication by any regulatory

authority in any jurisdiction and their safety, efficacy or other

desirable attributes, if any, have not been established in any

patient population. Consequently, none of our product candidates

are approved or available for sale anywhere in the world.

For more information:

Sitrick And CompanyMike Sitrick: Mike_Sitrick@Sitrick.comSeth

Lubove: slubove@sitrick.com1-800-550-7521NY:Rich Wilner:

rwilner@sitrick.com1-800-699-1481

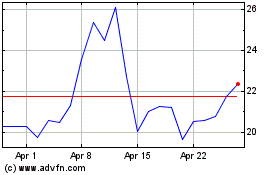

Cassava Sciences (NASDAQ:SAVA)

Historical Stock Chart

From Oct 2024 to Nov 2024

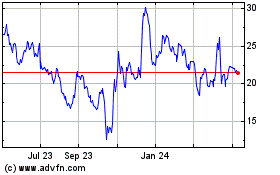

Cassava Sciences (NASDAQ:SAVA)

Historical Stock Chart

From Nov 2023 to Nov 2024