Casa Systems, Inc. (Nasdaq: CASA), a leading provider of

cloud-native software and physical broadband technology solutions

for access, cable, and cloud, today reported its financial results

for the second quarter ended June 30, 2023.

Second Quarter 2023 Financial & Operational

Highlights

- Revenue of $58.0 million

- GAAP net loss of $(51.1) million, including severance charges

of approximately $2.2 million and approximately $29.0 million of

non-cash charges related to successful debt refinancing in

June

- Non-GAAP net loss of $(24.9) million

- GAAP net loss per fully diluted share of $(0.53)

- Non-GAAP net loss per fully diluted share of $(0.26)

- Adjusted EBITDA of $(10.3) million

- Cash, cash equivalents and restricted cash of $65.9 million at

quarter end

- Amended and extended Term Loan B maturity date to December

2027

- Michael Glickman identified as new President and Chief

Executive Officer

“I am thrilled to join Casa Systems as the new

President and Chief Executive Officer at this pivotal moment for

the Company. The potential that lies ahead for Casa is

immense and rooted in our ability to uniquely exploit the global

market demand for cloud-based virtualized network functions,

including virtual CMTS, vCCAP, and 5G Core and MEC. With

Casa’s great technology and differentiated, proven product

portfolio, I am honored to lead this organization forward into its

exciting new chapter," said Michael Glickman. “Throughout my

career, I have always been passionate about the intersection of

large and rapidly growing market segments, disruptive technology,

and efficient global distribution strategies to capitalize on

market opportunities. I look forward to leading Casa Systems’

future success by building upon our distribution strategy and

capacity and delivering our innovative solutions efficiently to the

market while also addressing the evolving needs of our global

customers and starting to achieve sustainable growth and

profitability in the long term."

Edward Durkin, Chief Financial Officer said, “I

would first like to welcome Michael to the Casa Systems family. We

believe his accomplished background and considerable talents make

him the perfect person to lead the Company forward as our new

President and CEO. Related to the quarter, during Q2, we

achieved a 28% increase in revenue from the prior quarter, which

was driven by a 79% increase in our cable business and a 10%

increase in our access business, despite substantial deferred

revenue related to 2022 and 2023 billings for our 5G software

contract with Verizon based on the timing of formal software

acceptance, which was received after quarter end, in early

July. In addition to this top-line growth, we achieved

operating cash flow positive results for the quarter, and in

mid-June, we announced the successful completion of the refinancing

of approximately 98% of our Term Loan B debt, which will now mature

in December 2027. As part of this transaction, we used $40

million of cash on hand to reduce our outstanding debt principal

balance, as we continued with our plan to further de-lever, as

previously announced, and our working capital position at June 30,

2023 substantially improved versus March 31, 2023 and December 31,

2022. Over the past three quarters, we have paid down over

$90 million of our debt, and we remain focused on further reducing

our debt while continuing to invest in key strategic areas as we

work to return to top-line growth and attain our annual Net

Adjusted EBITDA profitability goals.”

Mr. Durkin continued, “Like many companies who

address the market segments we serve, we are modestly reducing our

2023 revenue guidance to a new range of $265 million to $290

million. That said, I am pleased to reiterate our 2023

positive Net Adjusted EBITDA guidance for the year as earlier

provided in March 2023. I would also like to highlight that

despite our GAAP net loss in the quarter, which includes

approximately $29.0 million of non-cash charges related to our

successful debt refinancing, we delivered $4.4 million of positive

operating cash flow in the quarter as a result of our strong

billings, excellent receivable collections and our reduced cost

structure.”

2023 Financial Outlook and Current Guidance

For the fiscal year 2023, the Company currently expects:

- Revenue between $265 million and $290 million

- Positive Net Adjusted EBITDA for the year

Conference Call Information

Casa Systems is hosting a conference call for

analysts and investors to discuss its financial results for the

second quarter ended June 30, 2023, and its business outlook at

5:00 p.m. Eastern Time today, August 8, 2023. The conference call

can be heard via webcast in the investor relations section of its

website at http://investors.casa-systems.com, or by dialing

1-800-267-6316 in the United States or 1-203-518-9814 from

international locations with Conference ID “CASA”. Shortly after

the conclusion of the conference call, a replay of the audio

webcast will be available in the investor relations section of Casa

Systems’ website for 90 days after the event.

Safe Harbor Statement

This press release contains forward-looking

statements within the meaning of The Private Securities Litigation

Reform Act of 1995. All statements other than statements of

historical fact contained in this press release, business strategy,

and plans and objectives for future operations, are forward-looking

statements. The words “anticipate,” “believe,” “continue,” “could,”

“estimate,” “expect,” “intend,” “may,” “are optimistic,” “plan,”

“potential,” “predict,” “project,” “target,” “should,” “will,”

“would,” and similar expressions are intended to identify

forward-looking statements, although not all forward-looking

statements contain these identifying words. We have based these

forward-looking statements on our current expectations and

projections about future events and financial trends that we

believe may affect our financial condition, results of operations,

business strategy, short-term and long-term business operations and

objectives, and financial needs as of the date of this press

release. A number of important risk factors could cause actual

results to differ materially from the results described, implied or

projected in these forward-looking statements. These factors

include, without limitation: (1) our ability to fulfill our

customers’ orders due to supply chain delays, access to key

commodities or technologies or events that impact our manufacturers

or their suppliers; (2) our ability to anticipate technological

shifts; (3) our ability to generate positive returns on our

research and development; (4) changes in the rate at which

communications service providers, or CSPs, deploy and invest in

ultra-broadband network capabilities; (5) the lack of

predictability of revenue due to lengthy sales cycles and the

volatility in capital expenditure budgets of CSPs; (6) our ability

to return to operating profitability in the future; (7) the

sufficiency of our cash resources and needs for additional

financing; (8) our ability to comply with all covenants, agreements

and conditions under our credit facility; (9) our ability to

further penetrate our existing customer base and obtain new

customers; (10) the amount and timing of operating costs and

capital expenditures related to the operation and expansion of our

business; (11) our ability to successfully expand our business

domestically and internationally, including our ability to maintain

the synergies we have realized from our acquisition of NetComm

Wireless Pty Ltd.; (12) increases or decreases in our expenses

caused by fluctuations in foreign currency exchange rates and

interest rates; and (13) other factors discussed in the “Risk

Factors” section of our public reports filed with the Securities

and Exchange Commission (the “SEC”), including our most recent

Quarterly Report on Form 10-Q and our most recent Annual Report on

Form 10-K, which are on file with the SEC and available in the

investor relations section of our website at

http://investors.casa-systems.com and on the SEC’s website at

www.sec.gov. In addition, we operate in a very competitive and

rapidly changing environment. New risks emerge from time to time.

It is not possible for our management to predict all risks, nor can

we assess the impact of all factors on our business or the extent

to which any factor, or combination of factors, may cause actual

results to differ materially from those contained in any

forward-looking statements that we may make. In light of these

risks, uncertainties and assumptions, the forward-looking events

and circumstances discussed in this press release are inherently

uncertain and may not occur, and actual results could differ

materially and adversely from those anticipated or implied in the

forward-looking statements. Accordingly, you should not rely upon

forward-looking statements as predictions of future events. We

disclaim any obligation to update publicly or revise any

forward-looking statements for any reason after the date of this

press release. Any reference to our website address in this press

release is intended to be an inactive textual reference only and

not an active hyperlink.

Non-GAAP Financial Measures

To supplement our financial results presented in

accordance with Generally Accepted Accounting Principles ("GAAP"),

we are presenting the following non-GAAP financial measures in this

press release and the related earnings conference call: non-GAAP

net income, non-GAAP diluted net income per share, adjusted EBITDA

and free cash flow. These non-GAAP financial measures are not based

on any standardized methodology prescribed by GAAP and are not

necessarily comparable to similarly titled measures presented by

other companies.

Non-GAAP net income and non-GAAP diluted

net income per share. We define non-GAAP net income as net

loss as reported in our condensed consolidated statements of

operations, excluding the impact of stock-based compensation

expense, amortization of acquired intangible assets, which are

non-cash charges; the impact of severance and restructuring

charges; the loss on extinguishment of debt incurred as part of our

term loan refinancing, as it is a significant non-cash charge; and

the tax effect on these excluded items. We believe that excluding

amortization expense of acquired intangible assets results in more

useful disclosure to investors and others as it is a significant

non-cash charge related to an event that is generally infrequent

based on our historical activities. We further note that while

amortization of acquired intangible assets is excluded from the

measures, the revenue of the acquired company is reflected in the

measures and the acquired assets contribute to revenue generation.

We believe that excluding severance and restructuring charges and

the loss on extinguishment of debt results in more useful

disclosure to investors and others as they are significant one-time

non-recurring charges. The tax effect of the excluded items was

calculated based on specific calculations of each item’s effect on

the tax provision. We believe that excluding these discrete tax

benefits from our effective income tax rate results in more useful

disclosure to investors and others regarding income tax effects of

excluded items as these amounts may vary from period to period

independent of the operating performance of our business. We define

non-GAAP diluted net income per share as diluted loss per share

reported in our condensed consolidated statements of operations,

excluding the impact of items that we exclude in calculating

non-GAAP net income. We have presented non-GAAP net income and

non-GAAP diluted net income per share because they are key measures

used by our management and board of directors to understand and

evaluate our operating performance, to establish budgets and to

develop operational goals for managing our business. The

presentation of non-GAAP net income and non-GAAP diluted net income

per share also allows our management and board of directors to make

additional comparisons of our results of operations to other

companies in our industry.

Adjusted EBITDA. We define

adjusted EBITDA as our net loss, excluding the impact of

stock-based compensation expense; amortization of acquired

intangible assets; severance and restructuring charges; the loss on

extinguishment of debt; other income (expense), net; depreciation

and amortization expense; and our provision for (benefit from)

income taxes. We have presented adjusted EBITDA because it is a key

measure used by our management and board of directors to understand

and evaluate our operating performance, to establish budgets and to

develop operational goals for managing our business. In particular,

we believe that, by excluding the impact of these expenses,

adjusted EBITDA can provide a useful measure for period-to-period

comparisons of our core operating performance.

Free cash flow. We define free

cash flow as net cash (used in) provided by operating activities

minus capital expenditures. We believe free cash flow to be a

liquidity measure that provides useful information to management

and investors about the amount of cash generated by our business

that, after purchases of property, equipment and software licenses,

can be used for strategic opportunities, including investing in our

business, making strategic acquisitions and strengthening our

balance sheet.

We use these non-GAAP financial measures to

evaluate our operating performance and trends and to make planning

decisions. We believe that each of these non-GAAP financial

measures helps identify underlying trends in our business that

could otherwise be masked by the effect of the expenses that we

exclude in the calculations of each non-GAAP financial measure.

Accordingly, we believe that these financial measures provide

useful information to investors and others in understanding and

evaluating our operating results and enhance the overall

understanding of our past performance and future prospects.

Our non-GAAP financial measures are not prepared

in accordance with GAAP and should not be considered in isolation

of, or as an alternative to, measures prepared in accordance with

GAAP. There are a number of limitations related to the use of these

non-GAAP financial measures rather than the most directly

comparable financial measures calculated and presented in

accordance with GAAP. Some of these limitations are:

- each of non-GAAP net income,

non-GAAP diluted net income per share, and adjusted EBITDA exclude

stock-based compensation expense and amortization of acquired

intangible assets because they have recently been, and will

continue to be for the foreseeable future, a significant recurring

non-cash expense for our business;

- each of non-GAAP net income,

non-GAAP diluted net income per share, and adjusted EBITDA exclude

severance and restructuring charges and the loss on extinguishment

of debt because they are one-time, non-recurring charges, although

they are included in our operating expenses;

- adjusted EBITDA excludes

depreciation and amortization expense, and although this is a

non-cash expense, the assets being depreciated and amortized may

have to be replaced in the future;

- adjusted EBITDA does not reflect

the cash requirements necessary to service interest on our debt or

the cash received from our interest-bearing financial assets, both

of which impact the cash available to us;

- adjusted EBITDA does not reflect

foreign currency transaction gains and losses, which are reflected

in other income (expense), net;

- adjusted EBITDA does not reflect

income tax payments that reduce cash available to us;

- free cash flow may not represent

our residual cash flow available for discretionary expenditures,

since we may have other non-discretionary expenditures that are not

deducted from this measure;

- free cash flow may not represent

the total increase or decrease in cash and cash equivalents for any

given period because it excludes cash provided by or used for other

investing and financing activities; and

- other companies, including

companies in our industry, may not use or report non-GAAP net

income, non-GAAP diluted net income per share, adjusted EBITDA or

free cash flow, or may calculate such non-GAAP financial measures

in a different manner than we do, or may use other non-GAAP

financial measures to evaluate their performance, all of which

could reduce the usefulness of these non-GAAP financial measures as

comparative measures.

For the reconciliations of these non-GAAP

financial measures to the most directly comparable GAAP financial

measures, please see the section of the accompanying tables titled,

“Reconciliation of Selected GAAP and Non-GAAP Financial Measures.”

We are not able to provide a reconciliation of non-GAAP adjusted

EBITDA guidance for future periods to net loss, the comparable GAAP

measure, because certain items that are excluded from non-GAAP

adjusted EBITDA cannot be reasonably predicted or are not in our

control, and these items could significantly impact, either

individually or in the aggregate, net income or loss in the

future.

About Casa Systems, Inc.

Casa Systems, Inc. (Nasdaq: CASA) delivers the

core-to-customer building blocks to speed 5G transformation with

future-proof solutions and cutting-edge bandwidth for all access

types. In today’s increasingly personalized world, Casa Systems

creates disruptive architectures built specifically to meet the

needs of service provider networks. Our suite of open,

cloud-native network solutions unlocks new ways for service

providers to build networks without boundaries and maximize

revenue-generating capabilities. Commercially deployed in more than

70 countries, Casa Systems serves over 475 Tier 1 and regional

communications service providers worldwide. For more information,

visit http://www.casa-systems.com.

CONTACT INFORMATION:IR

ContactsDennis DalyCasa Systems978-688-6706 ext.

6310investorrelations@casa-systems.com

or

Jackie Marcus or Josh CarrollAlpha IR

Group617-466-9257investorrelations@casa-systems.com

Source: Casa Systems

CASA SYSTEMS,

INC.CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(unaudited)(in thousands,

except per share amounts)

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Revenue |

|

$ |

58,003 |

|

|

$ |

70,836 |

|

|

$ |

103,300 |

|

|

$ |

135,235 |

|

| Cost of revenue |

|

|

34,187 |

|

|

|

44,201 |

|

|

|

61,329 |

|

|

|

81,921 |

|

|

Gross profit |

|

|

23,816 |

|

|

|

26,635 |

|

|

|

41,971 |

|

|

|

53,314 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

19,986 |

|

|

|

22,813 |

|

|

|

40,826 |

|

|

|

45,486 |

|

|

Selling, general and administrative |

|

|

20,985 |

|

|

|

21,970 |

|

|

|

45,442 |

|

|

|

44,299 |

|

|

Total operating expenses |

|

|

40,971 |

|

|

|

44,783 |

|

|

|

86,268 |

|

|

|

89,785 |

|

| Loss from operations |

|

|

(17,155 |

) |

|

|

(18,148 |

) |

|

|

(44,297 |

) |

|

|

(36,471 |

) |

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

853 |

|

|

|

274 |

|

|

|

1,819 |

|

|

|

308 |

|

|

Interest expense |

|

|

(5,976 |

) |

|

|

(3,820 |

) |

|

|

(11,184 |

) |

|

|

(7,508 |

) |

|

Loss on extinguishment of debt |

|

|

(28,955 |

) |

|

|

— |

|

|

|

(28,822 |

) |

|

|

— |

|

|

Loss on foreign currency, net |

|

|

680 |

|

|

|

816 |

|

|

|

388 |

|

|

|

543 |

|

|

Other income, net |

|

|

577 |

|

|

|

161 |

|

|

|

610 |

|

|

|

179 |

|

|

Total other expense, net |

|

|

(32,821 |

) |

|

|

(2,569 |

) |

|

|

(37,189 |

) |

|

|

(6,478 |

) |

| Loss before provision for

(benefit from) income taxes |

|

|

(49,976 |

) |

|

|

(20,717 |

) |

|

|

(81,486 |

) |

|

|

(42,949 |

) |

| Provision for (benefit from)

income taxes |

|

|

1,160 |

|

|

|

(4,020 |

) |

|

|

1,308 |

|

|

|

6,332 |

|

| Net loss |

|

$ |

(51,136 |

) |

|

$ |

(16,697 |

) |

|

$ |

(82,794 |

) |

|

$ |

(49,281 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

$ |

(0.53 |

) |

|

$ |

(0.18 |

) |

|

$ |

(0.86 |

) |

|

$ |

(0.56 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average shares used to

compute net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

96,816 |

|

|

|

92,504 |

|

|

|

96,307 |

|

|

|

88,565 |

|

CASA SYSTEMS,

INC.RECONCILIATION OF SELECTED GAAP AND NON-GAAP

FINANCIAL MEASURES(unaudited)(in

thousands)

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Reconciliation of Net

Loss to Non-GAAP Net Loss: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(51,136 |

) |

|

$ |

(16,697 |

) |

|

$ |

(82,794 |

) |

|

$ |

(49,281 |

) |

|

Stock-based compensation |

|

|

1,808 |

|

|

|

2,879 |

|

|

|

5,930 |

|

|

|

5,507 |

|

|

Amortization of acquired intangible assets |

|

|

1,343 |

|

|

|

1,426 |

|

|

|

2,686 |

|

|

|

2,852 |

|

|

Severance and restructuring charges |

|

|

2,151 |

|

|

|

— |

|

|

|

4,350 |

|

|

|

— |

|

|

Loss on extinguishment of debt |

|

|

28,955 |

|

|

|

— |

|

|

|

28,955 |

|

|

|

|

|

Tax effect of excluded items |

|

|

(7,974 |

) |

|

|

(1,091 |

) |

|

|

(10,230 |

) |

|

|

(2,123 |

) |

|

Non-GAAP net loss |

|

$ |

(24,853 |

) |

|

$ |

(13,483 |

) |

|

$ |

(51,103 |

) |

|

$ |

(43,045 |

) |

|

Non-GAAP net loss margin |

|

|

(42.8 |

)% |

|

|

(19.0 |

)% |

|

|

(49.5 |

)% |

|

|

(31.8 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of Diluted

Net Loss Per Share to Non-GAAP Diluted Net

Loss Per Share: |

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted net loss per share |

|

$ |

(0.53 |

) |

|

$ |

(0.18 |

) |

|

$ |

(0.86 |

) |

|

$ |

(0.56 |

) |

|

Non-GAAP adjustments to net loss |

|

|

0.27 |

|

|

|

0.03 |

|

|

|

0.33 |

|

|

|

0.07 |

|

|

Non-GAAP diluted net loss per share |

|

$ |

(0.26 |

) |

|

$ |

(0.15 |

) |

|

$ |

(0.53 |

) |

|

$ |

(0.49 |

) |

|

Weighted-average shares used in computing diluted net

loss per share |

|

|

96,816 |

|

|

|

92,504 |

|

|

|

96,307 |

|

|

|

88,565 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of Net

Loss to Adjusted EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(51,136 |

) |

|

$ |

(16,697 |

) |

|

$ |

(82,794 |

) |

|

$ |

(49,281 |

) |

|

Stock-based compensation |

|

|

1,808 |

|

|

|

2,879 |

|

|

|

5,930 |

|

|

|

5,507 |

|

|

Amortization of acquired intangible assets |

|

|

1,343 |

|

|

|

1,426 |

|

|

|

2,686 |

|

|

|

2,852 |

|

|

Severance and restructuring charges |

|

|

2,151 |

|

|

|

— |

|

|

|

4,350 |

|

|

|

— |

|

|

Depreciation and amortization |

|

|

1,509 |

|

|

|

2,099 |

|

|

|

3,052 |

|

|

|

4,288 |

|

|

Loss on extinguishment of debt |

|

|

28,955 |

|

|

|

— |

|

|

|

28,955 |

|

|

|

— |

|

|

Other expense |

|

|

3,866 |

|

|

|

2,569 |

|

|

|

8,234 |

|

|

|

6,478 |

|

|

Provision for (benefit from) income taxes |

|

|

1,160 |

|

|

|

(4,020 |

) |

|

|

1,308 |

|

|

|

6,332 |

|

|

Adjusted EBITDA |

|

|

(10,344 |

) |

|

|

(11,744 |

) |

|

|

(28,279 |

) |

|

|

(23,824 |

) |

|

Adjusted EBITDA margin |

|

|

(17.8 |

)% |

|

|

(16.6 |

)% |

|

|

(27.4 |

)% |

|

|

(17.6 |

)% |

CASA SYSTEMS,

INC.RECONCILIATION OF SELECTED GAAP AND NON-GAAP

FINANCIAL MEASURES(unaudited)(in

thousands)

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Reconciliation of Net

Cash Provided by (Used in) Operating Activities to

Free Cash Flow: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) operating activities |

|

$ |

4,358 |

|

|

$ |

(8,487 |

) |

|

$ |

(3,992 |

) |

|

$ |

9,610 |

|

|

Purchases of property and equipment and software licenses |

|

|

(397 |

) |

|

|

(1,144 |

) |

|

|

(1,076 |

) |

|

$ |

(2,110 |

) |

|

Free cash flow |

|

$ |

3,961 |

|

|

$ |

(9,631 |

) |

|

$ |

(5,068 |

) |

|

$ |

7,500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Summary of Stock-Based

Compensation Expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue |

|

$ |

11 |

|

|

$ |

26 |

|

|

$ |

37 |

|

|

$ |

61 |

|

|

Research and development |

|

|

552 |

|

|

|

694 |

|

|

|

1,252 |

|

|

|

1,289 |

|

|

Selling, general and administrative |

|

|

1,245 |

|

|

|

2,159 |

|

|

|

4,641 |

|

|

|

4,157 |

|

|

Total |

|

$ |

1,808 |

|

|

$ |

2,879 |

|

|

$ |

5,930 |

|

|

$ |

5,507 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Summary of

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

| Product revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Access devices |

|

|

26,984 |

|

|

|

35,005 |

|

|

|

51,892 |

|

|

|

66,753 |

|

|

Cable |

|

|

18,727 |

|

|

|

16,102 |

|

|

|

25,645 |

|

|

|

35,875 |

|

|

Cloud |

|

|

276 |

|

|

|

8,034 |

|

|

|

3,699 |

|

|

|

9,058 |

|

|

Product revenue |

|

$ |

45,987 |

|

|

$ |

59,141 |

|

|

$ |

81,236 |

|

|

$ |

111,686 |

|

| Service revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Access devices |

|

|

1,233 |

|

|

|

1,869 |

|

|

|

2,079 |

|

|

|

3,630 |

|

|

Cable |

|

|

8,766 |

|

|

|

9,097 |

|

|

|

17,182 |

|

|

|

17,953 |

|

|

Cloud |

|

|

2,017 |

|

|

|

729 |

|

|

|

2,803 |

|

|

|

1,966 |

|

|

Service revenue |

|

$ |

12,016 |

|

|

$ |

11,695 |

|

|

$ |

22,064 |

|

|

$ |

23,549 |

|

|

Total revenue |

|

$ |

58,003 |

|

|

$ |

70,836 |

|

|

$ |

103,300 |

|

|

$ |

135,235 |

|

CASA SYSTEMS,

INC.CONDENSED CONSOLIDATED BALANCE

SHEETS(unaudited)(in thousands)

|

|

|

June 30, |

|

|

December 31, |

|

|

|

|

2023 |

|

|

2022 |

|

| Assets |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

64,265 |

|

|

$ |

126,312 |

|

|

Accounts receivable, net |

|

|

47,400 |

|

|

|

74,484 |

|

|

Inventory |

|

|

84,085 |

|

|

|

81,795 |

|

|

Prepaid expenses and other current assets |

|

|

4,927 |

|

|

|

2,836 |

|

|

Prepaid income taxes |

|

|

3,421 |

|

|

|

6,352 |

|

|

Total current assets |

|

|

204,098 |

|

|

|

291,779 |

|

| Property and equipment, net |

|

|

17,601 |

|

|

|

19,518 |

|

| Right-of-use assets |

|

|

4,220 |

|

|

|

5,199 |

|

| Goodwill |

|

|

50,177 |

|

|

|

50,177 |

|

| Intangible assets, net |

|

|

22,833 |

|

|

|

25,759 |

|

| Other assets |

|

|

5,018 |

|

|

|

5,862 |

|

|

Total assets |

|

$ |

303,947 |

|

|

$ |

398,294 |

|

| Liabilities and

Stockholders’ (Deficit) Equity |

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

21,560 |

|

|

$ |

29,283 |

|

|

Accrued expenses and other current liabilities |

|

|

35,575 |

|

|

|

31,825 |

|

|

Warrant liability, current portion |

|

|

15,232 |

|

|

|

— |

|

|

Accrued income taxes |

|

|

1,067 |

|

|

|

4,298 |

|

|

Deferred revenue |

|

|

53,598 |

|

|

|

31,305 |

|

|

Lease liability |

|

|

1,715 |

|

|

|

2,040 |

|

|

Current portion of long-term debt, net of unamortized debt issuance

costs |

|

|

6,349 |

|

|

|

225,161 |

|

|

Total current liabilities |

|

|

135,096 |

|

|

|

323,912 |

|

| Accrued income taxes, net of

current portion |

|

|

6,426 |

|

|

|

6,640 |

|

| Deferred tax liabilities |

|

|

1,414 |

|

|

|

1,490 |

|

| Deferred revenue, net of current

portion |

|

|

4,599 |

|

|

|

5,529 |

|

| Long-term debt, net of current

portion |

|

|

171,918 |

|

|

|

— |

|

| Warrant liability, net of current

portion |

|

|

5,073 |

|

|

|

— |

|

| Lease liability, long-term |

|

|

2,741 |

|

|

|

3,416 |

|

| Other liabilities, net of current

portion |

|

|

7,768 |

|

|

|

7,906 |

|

|

Total liabilities |

|

|

335,035 |

|

|

|

348,893 |

|

|

|

|

|

|

|

|

|

| Stockholders’ (deficit)

equity: |

|

|

|

|

|

|

|

Common stock |

|

|

101 |

|

|

|

98 |

|

|

Treasury stock |

|

|

(14,837 |

) |

|

|

(14,837 |

) |

|

Additional paid-in capital |

|

|

247,609 |

|

|

|

244,675 |

|

|

Accumulated other comprehensive loss |

|

|

(2,937 |

) |

|

|

(2,305 |

) |

|

Accumulated deficit |

|

|

(261,024 |

) |

|

|

(178,230 |

) |

|

Total stockholders’ (deficit) equity |

|

|

(31,088 |

) |

|

|

49,401 |

|

|

Total liabilities and stockholders’

(deficit) equity |

|

$ |

303,947 |

|

|

$ |

398,294 |

|

CASA SYSTEMS,

INC.CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS(unaudited) (in

thousands)

|

|

|

Six Months Ended June 30, |

|

|

|

|

2023 |

|

|

2022 |

|

| Operating

activities: |

|

|

|

|

|

|

|

Net loss |

|

$ |

(82,794 |

) |

|

$ |

(49,281 |

) |

| Adjustments to reconcile net loss

to net cash (used in) provided by operating activities: |

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

5,739 |

|

|

|

7,140 |

|

|

Stock-based compensation |

|

|

5,930 |

|

|

|

5,507 |

|

|

Deferred income taxes |

|

|

(77 |

) |

|

|

(2,210 |

) |

|

Change in provision for doubtful accounts |

|

|

(487 |

) |

|

|

152 |

|

|

Change in provision for excess and obsolete inventory |

|

|

2,934 |

|

|

|

4,230 |

|

|

Gain on disposal of assets |

|

|

12 |

|

|

|

— |

|

|

Non-cash lease expense |

|

|

1,138 |

|

|

|

— |

|

|

Loss on extinguishment of debt |

|

|

28,822 |

|

|

|

— |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

Accounts receivable |

|

|

27,155 |

|

|

|

17,585 |

|

|

Inventory |

|

|

(5,251 |

) |

|

|

2,249 |

|

|

Prepaid expenses and other assets |

|

|

(2,746 |

) |

|

|

1,226 |

|

|

Prepaid income taxes |

|

|

2,943 |

|

|

|

21,441 |

|

|

Accounts payable |

|

|

(6,549 |

) |

|

|

(13,865 |

) |

|

Accrued expenses and other current liabilities |

|

|

2,352 |

|

|

|

(11,375 |

) |

|

Operating lease liability |

|

|

(1,055 |

) |

|

|

— |

|

|

Accrued income taxes |

|

|

(3,440 |

) |

|

|

3,839 |

|

|

Deferred revenue |

|

|

21,382 |

|

|

|

22,972 |

|

|

Net cash (used in) provided by operating activities |

|

|

(3,992 |

) |

|

|

9,610 |

|

| Investing

activities: |

|

|

|

|

|

|

| Purchases of property and

equipment |

|

|

(984 |

) |

|

|

(1,597 |

) |

| Purchases of software

licenses |

|

|

(92 |

) |

|

|

(513 |

) |

|

Net cash used in investing activities |

|

|

(1,076 |

) |

|

|

(2,110 |

) |

| Financing

activities: |

|

|

|

|

|

|

| Principal repayments of debt |

|

|

(41,988 |

) |

|

|

(1,500 |

) |

| Payments for debt issuance

costs |

|

|

(13,279 |

) |

|

|

— |

|

| Proceeds from exercise of stock

options |

|

|

2 |

|

|

|

254 |

|

| Employee taxes paid related to

net share settlement of equity awards |

|

|

(2,995 |

) |

|

|

(1,628 |

) |

| Proceeds from sale of common

stock, net of issuance costs |

|

|

— |

|

|

|

39,370 |

|

| Payments of dividends and

equitable adjustments |

|

|

— |

|

|

|

(1 |

) |

| Repurchases of common stock |

|

|

— |

|

|

|

(1,192 |

) |

|

Net cash (used in) provided by financing activities |

|

|

(58,260 |

) |

|

|

35,303 |

|

| Effect of exchange rate changes

on cash and cash equivalents |

|

|

(207 |

) |

|

|

(1,671 |

) |

| Net (decrease) increase

in cash, cash equivalents and restricted cash |

|

|

(63,535 |

) |

|

|

41,132 |

|

| Cash, cash equivalents and

restricted cash at beginning of period |

|

|

129,425 |

|

|

|

157,804 |

|

| Cash, cash equivalents and

restricted cash at end of period |

|

$ |

65,890 |

|

|

$ |

198,936 |

|

| Supplemental disclosures

of cash flow information: |

|

|

|

|

|

|

| Cash paid for interest |

|

$ |

9,114 |

|

|

$ |

6,999 |

|

| Cash paid for income taxes |

|

$ |

4,129 |

|

|

$ |

7,511 |

|

| Supplemental disclosures

of non-cash operating, investing and financing

activities: |

|

|

|

|

|

|

| Purchases of property and

equipment included in accounts payable |

|

$ |

20 |

|

|

$ |

469 |

|

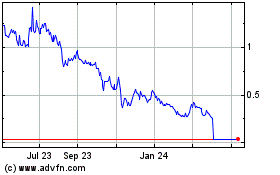

Casa Systems (NASDAQ:CASA)

Historical Stock Chart

From Dec 2024 to Jan 2025

Casa Systems (NASDAQ:CASA)

Historical Stock Chart

From Jan 2024 to Jan 2025