0001829576false00018295762024-01-252024-01-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20429

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 25, 2024

CARTER BANKSHARES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Virginia | 001-39731 | 85-3365661 |

(State or other jurisdiction

of incorporation) | (Commission

file number) | (IRS Employer

Identification No.) |

1300 Kings Mountain Road, Martinsville, Virginia 24112

(Address of Principal Executive Offices) (Zip Code)

(276) 656-1776

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which

registered |

| Common Stock, $1.00 par value | CARE | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02. RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

On January 25, 2024, Carter Bankshares, Inc. announced by press release its financial results for the three and twelve months ended December 31, 2023. A copy of the press release is attached hereto as Exhibit 99.1. The information contained in this Report on Form 8-K is furnished pursuant to Item 2.02 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Exchange Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing. ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits.

Exhibit No.

Exhibit 99.1 Press Release announcing Fourth Quarter and Full Year 2023 Financial Results. Important Note Regarding Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements made in Mr. Van Dyke’s quotes and statements relating to our financial condition, market conditions, results of operations, plans, objectives, outlook for earnings, revenues, expenses, capital and liquidity levels and ratios, asset levels, asset quality and nonaccrual and nonperforming loans. Forward looking statements are typically identified by words or phrases such as “will likely result,” “expect,” “anticipate,” “estimate,” “forecast,” “project,” “intend,” “ believe,” “assume,” “strategy,” “trend,” “plan,” “outlook,” “outcome,” “continue,” “remain,” “potential,” “opportunity,” “comfortable,” “current,” “position,” “maintain,” “sustain,” “seek,” “achieve” and variations of such words and similar expressions, or future or conditional verbs such as will, would, should, could or may. These statements are not guarantees of future results or performance and involve certain risks, uncertainties and assumption that are difficult to predict and often are beyond the Company’s control. Although we believe the assumptions upon which these forward-looking statements are based are reasonable, any of these assumptions could prove to be inaccurate and the forward-looking statements based on these assumptions could be incorrect. The matters discussed in these forward-looking statements are subject to various risks, uncertainties and other factors that could cause actual results and trends to differ materially from those made, projected, or implied in or by the forward-looking statements including, but not limited to the effects of: market interest rates and the impacts of market interest rates on economic conditions, customer behavior, and the Company’s loan and securities portfolios; inflation, market and monetary fluctuations; changes in trade, monetary and fiscal policies and laws of the U.S. government, including policies of the Federal Reserve, FDIC and Treasury Department; changes in accounting policies, practices, or guidance, for example, our adoption of Current Expected Credit Losses (“CECL”) methodology, including potential volatility in the Company’s operating results due to application of the CECL methodology; cyber-security threats, attacks or events; rapid technological developments and changes; our ability to resolve our nonperforming assets and our ability to secure collateral on loans that have entered nonaccrual status due to loan maturities and failure to pay in full; changes in the Company’s liquidity and capital positions; concentrations of loans secured by real estate, particularly commercial real estate, and the potential impacts of changes in market conditions on the value of real estate collateral; an insufficient allowance for credit losses; the potential adverse effects of unusual and infrequently occurring events, such as weather-related disasters, terrorist acts, war and other military conflicts (such as the war between Israel and Hamas and the ongoing war between Russia and Ukraine) or public health events (such as the COVID-19 pandemic), and of any governmental and societal responses thereto; these potential adverse effects may include, without limitation, adverse effects on the ability of the Company's borrowers to satisfy their obligations to the Company, on the value of collateral securing loans, on the demand for the Company's loans or its other products and services, on incidents of cyberattack and fraud, on the Company’s liquidity or capital positions, on risks posed by reliance on third-party service providers, on other aspects of the Company's business operations and on financial markets and economic growth; a change in spreads on interest-earning assets and interest-bearing liabilities; regulatory supervision and oversight, including our relationship with regulators and any actions that may be initiated by our regulators; legislation affecting the financial services industry as a whole (such as the Inflation Reduction Act of 2022), and the Company and the Bank, in particular; the outcome of pending and future litigation and/or governmental proceedings; increasing price and product/service competition; the ability to continue to introduce competitive new products and services on a timely, cost-effective basis; managing our internal growth and acquisitions; the possibility that the anticipated benefits from acquisitions cannot be fully realized in a timely manner or at all, or that integrating the acquired operations will be more difficult, disruptive or more costly than anticipated; the soundness of other financial institutions and any indirect exposure related to the closings of First Republic, Silicon Valley Bank (“SVB”), Signature Bank and Silvergate Bank

and their impact on the broader market through other customers, suppliers and partners or that the conditions which resulted in the liquidity concerns with SVB, Signature Bank, Silvergate Bank and First Republic Bank may also adversely impact, directly or indirectly, other financial institutions and market participants with which the Company has commercial or deposit relationships with; material increases in costs and expenses; reliance on significant customer relationships; general economic or business conditions, including unemployment levels, continuing supply chain disruptions and slowdowns in economic growth; significant weakening of the local economies in which we operate; changes in customer behaviors, including consumer spending, borrowing and saving habits; changes in deposit flows and loan demand; our failure to attract or retain key employees; expansions or consolidations in the Company’s branch network, including that the anticipated benefits of the Company’s branch network optimization project are not fully realized in a timely manner or at all; deterioration of the housing market and reduced demand for mortgages; and re-emergence of turbulence in significant portions of the global financial and real estate markets that could impact our performance, both directly, by affecting our revenues and the value of our assets and liabilities, and indirectly, by affecting the economy generally and access to capital in the amounts, at the times and on the terms required to support our future businesses. Many of these factors, as well as other factors, are described in our filings with the SEC including in the “Risk Factors” section of the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, Part II, Item 1A, “Risk Factors” in the Company’s Quarterly Report on Form 10-Q for the periods ended March 31, 2023, June 30, 2023, and September 30, 2023 and in other filings with the Securities and Exchange Commission. All risk factors and uncertainties described herein and therein should be considered in evaluating the Company’s forward-looking statements. Forward-looking statements are based on beliefs and assumptions using information available at the time the statements are prepared. We caution you not to unduly rely on forward-looking statements because the assumptions, beliefs, expectations and projections about future events are expressed in or implied by a forward-looking statement may, and often do, differ materially from actual results. Any forward-looking statement speaks only as to the date on which it is made, and we undertake no obligation to update, revise or clarify any forward-looking statement to reflect developments occurring after the statement is made.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| | CARTER BANKSHARES, INC. |

| | (Registrant) |

| | | | | | | | |

Date: January 25, 2024 | By: | /s/ Wendy S. Bell |

| Name: | Wendy S. Bell |

| Title: | Chief Financial Officer |

Exhibit 99.1

FOR IMMEDIATE RELEASE – January 25, 2024

Carter Bankshares, Inc. Announces Fourth Quarter and Full Year 2023 Financial Results

Martinsville, VA, January 25, 2024 – Carter Bankshares, Inc. (the “Company”) (NASDAQ:CARE), the holding company of Carter Bank & Trust (the “Bank”) today announced a net loss of $1.9 million, or $(0.08) earnings per share (“EPS”), for the fourth quarter of 2023 compared to net income of $3.6 million, or $0.16 diluted EPS, in the third quarter of 2023 and $15.6 million, or $0.65 diluted EPS, for the fourth quarter of 2022. The quarterly pre-tax pre-provision income1 was $1.6 million for the quarter ended December 31, 2023, $5.4 million for the quarter ended September 30, 2023 and $19.4 million for the quarter ended December 31, 2022.

For the year ended December 31, 2023, net income was $23.4 million, or $1.00 diluted EPS, compared to $50.1 million, or $2.03 diluted EPS for the year ended December 31, 2022. Pre-tax pre-provision income1 was $35.1 million for the full year 2023 and $64.6 million for December 31, 2022.

The Company’s financial results for the fourth quarter and year-to-date 2023, compared to the prior year quarter and year-to-date 2022, were significantly impacted by placing loans contained in the Bank’s Other segment with an aggregate principal value of $301.9 million on nonaccrual status during the second quarter of 2023. As a result, interest income was negatively impacted by $9.4 million during the fourth quarter of 2023, $9.3 million during the third quarter of 2023, and $11.3 million during the second quarter of 2023 totaling $30.0 million for the full year 2023. We are pursuing all remedies to resolve this matter in a manner that best protects the Company and its shareholders.

Fourth Quarter and Full Year 2023 Financial Highlights

•Net interest income remained consistent at $27.4 million compared to the third quarter of 2023 with an 18 basis point increase in the yield on earning assets, offset by a 28 basis point increase in funding costs and decreased $14.1 million, or 34.0% compared to the fourth quarter of 2022, primarily due to the negative impact of the aforementioned nonaccrual loan relationship, a 196 basis point increase in funding costs, as well as a three basis point decrease in the yield on earning assets;

•Net interest margin decreased five basis points to 2.47% compared to 2.52% for the third quarter of 2023, and decreased 157 basis points compared to 4.04% in the fourth quarter of 2022. Net interest margin, on a fully taxable equivalent basis3 (“FTE”), decreased five basis points to 2.49% compared to 2.54% for the third quarter of 2023 and decreased 158 basis points compared to 4.07% for the fourth quarter of 2022;

•Total portfolio loans increased $95.0 million, or 11.0%, on an annualized basis, to $3.5 billion at December 31, 2023 compared to $3.4 billion at September 30, 2023 and increased $357.0 million, or 11.3% at December 31, 2022;

•Total deposits increased $162.4 million, or 18.1%, on an annualized basis, to $3.7 billion at December 31, 2023 compared to September 30, 2023 with increases in all deposit categories except savings accounts and increased $89.4 million, or 2.5% compared to December 31, 2022 with increases in money market accounts and certificate of deposits (“CDs”);

•Nonperforming loans (“NPL”) as a percentage of total portfolio loans were 8.83% at December 31, 2023, 9.04% at September 30, 2023 and 0.21% at December 31, 2022. Nonperforming loans are primarily impacted by the Bank’s largest lending relationship that the Bank placed on nonaccrual status during the second quarter of 2023;

•The provision for credit losses increased $1.8 million to $2.9 million for the quarter ended December 31, 2023, compared to $1.1 million for the quarter ended September 30, 2023 and increased $2.8 million compared to December 31, 2022;

•The efficiency ratio was 94.8%, 83.5% and 58.7%, and the efficiency ratio (Non-GAAP)4 was 88.5%, 79.6%, and 59.5% for the quarters ended December 31, 2023, September 30, 2023 and December 31, 2022, respectively. The efficiency ratio was impacted primarily by the Bank’s largest lending relationship that the Bank placed on nonaccrual status during the second quarter of 2023.

“We continue to be disappointed that our largest lending relationship remains in nonaccrual status and continues to have a negative impact on our financial results. The fourth quarter was also impacted by several expenses and increased legal and other expenses related to our efforts dealing with the large nonaccrual loan, or (”NPL”). However, aside from this issue, our financial performance for the quarter was solid,” stated Litz Van Dyke, Chief Executive Officer.

Van Dyke continued, “the fourth quarter was also impacted by a loss of $1.5 million on the sale of $30 million of available-for-sale securities. The sale was executed to take advantage of market opportunities and reposition the securities portfolio. The realized loss is expected to be earned back in less than one year, as proceeds are reinvested in higher earning assets.”

“Additionally, we continue to feel positive about the structure of our balance sheet. Loan growth remains solid across the footprint. The bond portfolio is of very high credit quality, with a shorter average life and duration than peers. Deposits are showing modest growth, and capital and liquidity levels remain strong. As with many of our peers, we have seen pressure on funding costs during 2023. We believe this trend is beginning to stabilize as the Federal Reserve has kept interest rates steady. We do expect the net interest margin will return to a more normalized level once the large NPL is resolved.”

“In terms of loans, we experienced another strong quarter with annualized growth of 11.0%. Lending pipelines have moderated some, but we are still expecting respectable loan growth in the near term. We continue to invest in strong markets within the footprint, and opened a new flagship/full-service branch in Charlottesville, VA and a commercial production office in Raleigh, NC during the fourth quarter. Other than the large NPL relationship, our asset quality remains strong across all credit metrics,” stated Litz H. Van Dyke, Chief Executive Officer.

Van Dyke continued, “We remain confident in the condition and positioning of our Company. We are well prepared to navigate through any challenges that may emerge in our industry. We remain focused on resolving our large NPL and are committed to pursuing all remedies to resolve this matter in a manner that best protects the Company and its shareholders.”

Operating Highlights

Credit Quality

NPLs as a percentage of total portfolio loans were 8.83%, 9.04% and 0.21% as of December 31, 2023, September 30, 2023 and December 31, 2022, respectively. At December 31, 2023 NPLs increased $1.2 million to $309.5 million since September 30, 2023. The increase is primarily due to one residential mortgage loan that was placed into nonperforming status during the fourth quarter of 2023. The 21 basis point decline in the ratio of NPLs to total portfolio loans was primarily related to loan growth in the fourth quarter of 2023.

During the second quarter of 2023, the Company placed commercial loans in the other segment of the Company’s loan portfolio relating to the Bank’s largest lending relationship with an aggregate principal amount of $301.9 million on nonaccrual status due to loan maturities and failure to pay in full. This nonperforming relationship represents 97.5% of total nonperforming loans and 8.6% of total portfolio loans at December 31, 2023.

The Company continues to initiate collection processes and explore all alternatives for repayment with respect to such NPLs. The Company believes it is well secured based on the net carrying value of the credit relationship and appropriately reserved for potential losses with respect to all such NPLs based on information currently available. However, we cannot give any assurance as to the timing or amount of future payments or collections on such loans or that the Company will ultimately collect all amounts contractually due under the terms of such loans. The Company has specific reserves of $54.3 million at December 31, 2023 with respect to such loans.

The provision for credit losses increased $1.8 million and $2.8 million in the fourth quarter of 2023 compared to the third quarter of 2023 and the fourth quarter of 2022, respectively. The increase in the provision for credit losses was primarily driven by loan growth, net charge-offs and an increase in the other segment reserve related to the large NPL relationship. The provision (recovery) for unfunded commitments in the fourth quarter of 2023 was a provision of $0.6 million compared to a recovery of $0.1 million in the third quarter of 2023 and a provision of $0.3 million in the fourth quarter of 2022.

The provision for credit losses increased $3.1 million for the full year 2023 compared to the same period in 2022. The provision for unfunded commitments for the full year 2023 was $0.9 million compared to $0.5 million for the same period in 2022, primarily due to an increase in construction commitments.

Net Interest Income

Net interest income totaled $27.4 million, which was consistent compared to the third quarter of 2023 and decreased $14.1 million, or 34.0%, compared to the fourth quarter of 2022. The net interest margin decreased five basis points to 2.47% compared to the third quarter of 2023, and decreased 157 basis points compared to the fourth quarter of 2022. Net interest margin, on an FTE basis decreased 158 basis points to 2.49% compared to the fourth quarter of 2022, as the total cost of funds increased 196 basis points to 2.82% with a 169 basis point increase in interest-bearing deposit costs to 2.41% as well as an increase of 119 basis points in total borrowings. Between December 31, 2023 and December 31, 2022, the Federal Open Market Committee (“FOMC”) raised the target Federal Funds interest rate by 150 basis points. The yield on interest-earning assets increased 18 basis points and decreased three basis points compared to the quarters ended September 30, 2023 and December 31, 2022, respectively.

Interest income increased $3.0 million and $3.6 million during the fourth quarter of 2023 compared to the third quarter of 2023 and the fourth quarter of 2022, respectively. The increases were primarily due to increases in average interest-earning assets of $84.1 million and $330.8 million compared to the third quarter of 2023 and the fourth quarter of 2022, respectively primarily due to average loan growth at higher interest rates. The fourth quarter of 2023 increased despite the negative impact of the large NPL on interest income of $9.3 million.

Interest expense increased $3.0 million, or 13.7%, for the fourth quarter of 2023 compared to the third quarter of 2023 and increased $17.7 million, or 265.1%, as compared to the fourth quarter of 2022. Funding costs increased 28 basis points compared to the previous quarter and 196 basis points compared to the same quarter of 2022. The increase in interest expense is due to the high interest rate environment and customers migrating from lower-cost non-maturing deposits to higher-yielding money market and CD products.

Net interest income decreased $17.6 million, or 12.6%, to $122.3 million for the full year December 31, 2023 compared to the same period in 2022. The net interest margin decreased 63 basis points to 2.85% for the twelve months ended December 31, 2023 compared to 3.48% for the same period in 2022. Net interest margin, on an FTE basis3, decreased 64 basis points to 2.87% for the full year 2023 compared to 3.51% for the same period in 2022. The decline in net interest income and net interest margin was significantly driven by the aforementioned NPL relationship, which negatively impacted interest income by $30.0 million for the full year 2023. The yield on interest-earning assets increased 59 basis points and funding costs increased 156 basis points for the twelve months ended December 31, 2023 compared to the same period in 2022.

Interest expense increased $53.9 million, or 265.9%, to $74.1 million for the full year 2023 compared to the same period in 2022. The yield on total interest-bearing liabilities increased 156 basis points compared to the same period of 2022. The increase in interest expense is due to the high interest rate environment, the shift to higher cost borrowings to fund loan growth which exceeded the growth in deposits during 2023.

During 2023, there has been more pressure on our cost of funds due to the shift from non-maturing deposits to higher yielding money market and certificates of deposits and higher-cost borrowings, which has negatively impacted our net interest margin. We believe this trend is beginning to stabilize and will continue in the coming quarters. Our balance sheet is currently exhibiting characteristics of a slightly liability sensitive balance sheet due to the short-term nature of our deposit portfolio. Specifically, 79.7% of our time deposit portfolio will mature and reprice over the next twelve months which gives us flexibility to manage the structure and pricing of our deposit portfolio to reduce funding costs, should the FOMC begin cutting short-term rates during 2024.

Noninterest Income

For the fourth quarter of 2023, total noninterest income was $3.2 million, a decrease of $2.0 million, or 38.4%, from the third quarter of 2023 primarily due to net losses on sales of securities of $1.5 million and a decrease of $0.5 million in insurance commissions due to decreased activity. Total noninterest income decreased $2.3 million, or 41.5%, compared to the fourth quarter of 2022 also due to the $1.5 million net security losses as well as a decrease of $1.3 million in other noninterest income. The net losses on sales of securities were driven by the sale of approximately $30.0 million of available-for-sale securities during the fourth quarter of 2023 to reposition the securities portfolio and reinvest the proceeds in higher earning assets. The decline in other noninterest income relates to the unwind of two completed historic tax credit partnerships, which resulted in a gain of $1.2 million during the fourth quarter of 2022.

For the full year 2023, total noninterest income was $18.3 million, a decrease of $3.4 million, or 15.8%, from the same period in 2022. The decrease was primarily related to the aforementioned $1.5 million net security losses, a decrease of $1.6 million in other noninterest income, as well as, a $0.6 million in commercial loan swap fee income due to the changing interest rate environment. The decrease within other noninterest income related to the above mentioned unwind of two completed historic tax credit partnerships and higher fair value adjustment of our interest rate swap contracts with commercial customers. These decreases were offset by an increase of $0.4 million in debit card interchange fees due to higher volume during 2023.

Noninterest Expense

For the fourth quarter of 2023, total noninterest expense was $29.1 million, an increase of $1.8 million, or 6.6%, from the third quarter of 2023 and an increase of $1.5 million, or 5.3% from the fourth quarter of 2022.

The most significant variances compared to the third quarter of 2023 included increases of $0.8 million in FDIC insurance expense, $0.7 million in professional and legal fees, $0.6 million in salaries and employee benefits, $0.2 million in advertising expenses, offset by a $0.5 million decline within other noninterest expense. FDIC insurance expense increased due to the deterioration in asset quality as a direct result of the large NPL relationship, which is a component used to determine the assessment. The increase in professional and legal fees relates to higher legal expenses incurred related to the large NPL relationship and new consulting engagements. The increase in salaries and employee benefits is primarily related to higher base salaries, and discretionary bonuses, offset by lower performance based incentives. The decline of $0.5 million in other noninterest expense all relate to these variances recorded in the third quarter of 2023: $0.6 million write-downs on three legacy other real estate owned (“OREO”) properties that sold in the fourth quarter of 2023, a $0.2 million nonrecurring operating expense, and a $0.3 million in write-downs on two closed retail branch transferred to OREO and marketed for sale, offset by a $0.2 million write-down on one branch also transferred to OREO and marketed for sale during the fourth quarter of 2023.

The most significant variances for the fourth quarter of 2023 compared to the same quarter of 2022 related to an increase of $1.7 million in FDIC insurance expense, an increase of $0.1 million in debit card expense, offset by a decrease of $0.5 million in data processing expenses. The fluctuation within FDIC insurance expense is consistent to the previously mentioned variance and the increase in debit card expense was volume driven. The decline in data processing expenses is due to additional expenses incurred in the fourth quarter of 2022 related to our online banking platform.

For the full year 2023, total noninterest expense was $105.5 million, an increase of $8.5 million, or 8.7%, from the same period in 2022 primarily due to higher salaries and employee benefits of $3.5 million, an increase of $2.9 million in FDIC insurance expenses, an increase of $1.6 million in other noninterest expense, an increase in occupancy expenses of $0.5 million, an increase in professional and legal fees of $0.4 million, and an increase in advertising expenses of $0.3 million. Offsetting these increases was a decline in tax credit amortization of $0.6 million due to the early adoption of Accounting Standard Update 2023-02 Investments Equity Method and Joint Ventures (Topic 323): Accounting for Investments in Tax Credit Structures Using the Proportional Amortization Method. Under the proportional amortization modified retrospective basis, the amortization of tax credit investments is recorded as a component of income tax expense instead of through noninterest expense as previously recorded in 2022.

The increase in salaries and employee benefits was primarily related to higher salary expense due to fewer open positions in retail, job grade assessment increases, normal merit increases, higher medical claims, restricted stock expense, increased FICA expenses, offset by lower performance based incentives in 2023. The increase in FDIC insurance expenses was due to a final rule adopted by the FDIC to all insured depository institutions, to increase initial base deposit insurance assessment rate schedules uniformly by two basis points, beginning in the first quarterly assessment period of 2023 as well as the above mentioned deterioration in asset quality as a direct result of the large NPL relationship. The increase in other noninterest expense relates to a $0.6 million write-downs on three legacy OREO properties that sold in the fourth quarter of 2023, and a $0.5 million in write-downs on three closed retail branches. These branches were closed in 2023, transferred to OREO and are marketed for sale.

Financial Condition

Total assets were $4.5 billion at December 31, 2023 and $4.5 billion at September 30, 2023, increasing $60.4 million during the fourth quarter of 2023. Total portfolio loans increased $95.0 million, or 11.0%, on an annualized basis, to $3.5 billion at December 31, 2023 compared to $3.4 billion at September 30, 2023 primarily due to loan growth in construction, residential mortgage and the commercial & industrial (“C&I”) segments.

The securities portfolio decreased $14.4 million and is currently 17.3% of total assets at December 31, 2023 compared to 17.8% of total assets at September 30, 2023. The decrease is due to $30.0 million in security sales, curtailments and maturities deployed into higher yielding loan growth, partially offset by the positive changes in fair value of securities during the three months ended December 31, 2023. Federal Home Loan Bank (“FHLB”) stock, at cost, decreased $5.7 million to $21.6 million at December 31, 2023 compared to September 30, 2023.

Total deposits increased $162.4 million to $3.7 billion at December 31, 2023 compared to September 30, 2023. All deposit categories increased with the exception of savings accounts, which declined by $32.2 million. Money market accounts increased $87.5 million, CDs increased $75.1 million, which includes $50.0 million in brokered CDs, noninterest-bearing demand accounts increased $20.4 million and interest-bearing demand accounts increased $11.6 million. At December 31, 2023, noninterest-bearing deposits comprised 18.4% compared to 18.7% and 19.4% of total deposits at September 30, 2023 and December 31, 2022, respectively. CDs comprised 42.6%, 42.5% and 34.7% of total deposits at December 31, 2023, September 30, 2023 and December 31, 2022, respectively.

As of December 31, 2023, approximately 87.2% of our total deposits of $3.7 billion were insured under standard FDIC insurance coverage limits, and approximately 12.8% of our total deposits were uninsured deposits over the standard FDIC insurance coverage limit. As of September 30, 2023, approximately 88.9% of our total deposits of $3.6 billion were insured under standard FDIC insurance coverage limits, and approximately 11.1% of our total deposits were uninsured deposits over the standard FDIC insurance coverage limit.

Total FHLB borrowings decreased $120.7 million at December 31, 2023 to $393.4 million compared to $514.1 million at September 30, 2023 primarily due to deposit growth. The Company had no outstanding federal funds purchased at December 31, 2023 and September 30, 2023.

Capitalization and Liquidity

The Company remains well capitalized. The Company’s Tier 1 Capital ratio was 11.08% at December 31, 2023 as compared to 11.20% at September 30, 2023. The Company’s leverage ratio was 9.48% at December 31, 2023 as compared to 9.70% at September 30, 2023. The Company’s Total Risk-Based Capital ratio was 12.34% at December 31, 2023 as compared to 12.46% at September 30, 2023.

The Bank also remained well capitalized as of December 31, 2023. The Bank’s Tier 1 Capital ratio was 10.99% at December 31, 2023 compared to 11.08% at September 30, 2023. The Bank’s leverage ratio was 9.41% at December 31, 2023 compared to 9.59% at September 30, 2023. The Bank’s Total Risk-Based Capital ratio was 12.25% at December 31, 2023 compared to 12.34% at September 30, 2023.

Total capital of $351.2 million at December 31, 2023, reflects an increase of $20.6 million compared to September 30, 2023. The increase in equity during the quarter ended December 31, 2023 is primarily due to a $22.1 million increase in other comprehensive income due to changes in fair value of investment securities, offset by a net loss of $1.9 million for the three months ended December 31, 2023. The remaining difference of $0.4 million is related to restricted stock activity for the quarter ended December 31, 2023.

At December 31, 2023, funding sources accessible to the Company include borrowing availability at the FHLB, equal to 25.0% of the Company’s assets or approximately $1.1 billion, subject to the amount of eligible collateral pledged, of which the Company is eligible to borrow up to an additional $480.3 million. The Company has unsecured facilities with three other correspondent financial institutions totaling $50.0 million, a fully secured facility with one other correspondent financial institution totaling $45.0 million, and access to the institutional CD market. The Company did not have outstanding borrowings on these fed funds lines as of December 31, 2023. In addition to the above funding resources, the Company also has $563.5 million unpledged available-for-sale investment securities, at fair value, as an additional source of liquidity.

As of the date of this earning release, the Company has approximately $282.1 million in par value of securities that are eligible to be pledged under the Bank Term Funding Program (“BTFP”), but the Bank has not borrowed under or otherwise accessed the BTFP.

About Carter Bankshares, Inc.

Headquartered in Martinsville, VA, Carter Bankshares, Inc. (NASDAQ: CARE) provides a full range of commercial banking, consumer banking, mortgage and services through its subsidiary Carter Bank & Trust. The Company has $4.5 billion in assets and 65 branches in Virginia and North Carolina. For more information or to open an account visit www.CBTCares.com.

Important Note Regarding Non-GAAP Financial Measures

In addition to traditional measures presented in accordance with GAAP, our management uses, and this press release contains or references, certain non-GAAP financial measures and should be read along with the accompanying tables in our definitions and reconciliations of GAAP to non-GAAP financial measures. This press release and the accompanying tables discuss financial measures that we believe are useful because they enhance the ability of investors and management to evaluate and compare the Company’s operating results from period to period in a meaningful manner. Non-GAAP measures should not be considered as an alternative to any measure of performance as promulgated under GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Investors should consider the Company’s performance and financial condition as reported under GAAP and all other relevant information when assessing the performance or financial condition of the Company. Non-GAAP measures have limitations as analytical tools, and investors should not consider them in isolation or as a substitute for analysis of the Company’s results or financial condition as reported under GAAP.

Important Note Regarding Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements made in Mr. Van Dyke’s quotes and statements relating to our financial condition, market conditions, results of operations, plans, objectives, outlook for earnings, strategic initiatives and related earn-back periods, revenues, expenses, capital and liquidity levels and ratios, asset levels, asset quality and nonaccrual and nonperforming loans. Forward looking statements are typically identified by words or phrases such as “will likely result,” “expect,” “anticipate,” “estimate,” “forecast,” “project,” “intend,” “ believe,” “assume,” “strategy,” “trend,” “plan,” “outlook,” “outcome,” “continue,” “remain,” “potential,” “opportunity,” “comfortable,” “current,” “position,” “maintain,” “sustain,” “seek,” “achieve” and variations of such words and similar expressions, or future or conditional verbs such as will, would, should, could or may.

These statements are not guarantees of future results or performance and involve certain risks, uncertainties and assumption that are difficult to predict and often are beyond the Company’s control. Although we believe the assumptions upon which these forward-looking statements are based are reasonable, any of these assumptions could prove to be inaccurate and the forward-looking statements based on these assumptions could be incorrect. The matters discussed in these forward-looking statements are subject to various risks, uncertainties and other factors that could cause actual results and trends to differ materially from those made, projected, or implied in or by the forward-looking statements including, but not limited to the effects of:

•market interest rates and the impacts of market interest rates on economic conditions, customer behavior, and the Company’s loan and securities portfolios;

•inflation, market and monetary fluctuations;

•changes in trade, monetary and fiscal policies and laws of the U.S. government, including policies of the Federal Reserve, FDIC and Treasury Department;

•changes in accounting policies, practices, or guidance, for example, our adoption of Current Expected Credit Losses (“CECL”) methodology, including potential volatility in the Company’s operating results due to application of the CECL methodology;

•cyber-security threats, attacks or events;

•rapid technological developments and changes;

•our ability to resolve our nonperforming assets and our ability to secure collateral on loans that have entered nonaccrual status due to loan maturities and failure to pay in full;

•changes in the Company’s liquidity and capital positions;

•concentrations of loans secured by real estate, particularly commercial real estate, and the potential impacts of changes in market conditions on the value of real estate collateral;

•increased delinquency and foreclosure rates on commercial real estate loans;

•an insufficient allowance for credit losses;

•the potential adverse effects of unusual and infrequently occurring events, such as weather-related disasters, terrorist acts, war and other military conflicts (such as the war between Israel and Hamas and the ongoing war between Russia and Ukraine) or public health events (such as the COVID-19 pandemic), and of any governmental and societal responses thereto; these potential adverse effects may include,

without limitation, adverse effects on the ability of the Company's borrowers to satisfy their obligations to the Company, on the value of collateral securing loans, on the demand for the Company's loans or its other products and services, on incidents of cyberattack and fraud, on the Company’s liquidity or capital positions, on risks posed by reliance on third-party service providers, on other aspects of the Company's business operations and on financial markets and economic growth;

•a change in spreads on interest-earning assets and interest-bearing liabilities;

•regulatory supervision and oversight, including our relationship with regulators and any actions that may be initiated by our regulators;

•legislation affecting the financial services industry as a whole (such as the Inflation Reduction Act of 2022), and the Company and the Bank, in particular;

•the outcome of pending and future litigation and/or governmental proceedings, including the outcome of the lawsuit filed against the Bank and its directors by West Virginia Governor James C. Justice, II, his wife Cathy Justice, his son James C. Justice, III and various related entities that he and/or they own and control, concerning their lending relationship with the Bank;

•increasing price and product/service competition;

•the ability to continue to introduce competitive new products and services on a timely, cost-effective basis;

•managing our internal growth and acquisitions;

•the possibility that the anticipated benefits from acquisitions cannot be fully realized in a timely manner or at all, or that integrating the acquired operations will be more difficult, disruptive or more costly than anticipated;

•the soundness of other financial institutions and any indirect exposure related to the closings of First Republic, Silicon Valley Bank (“SVB”), Signature Bank and Silvergate Bank and their impact on the broader market through other customers, suppliers and partners or that the conditions which resulted in the liquidity concerns with SVB, Signature Bank, Silvergate Bank and First Republic Bank may also adversely impact, directly or indirectly, other financial institutions and market participants with which the Company has commercial or deposit relationships with;

•material increases in costs and expenses;

•reliance on significant customer relationships;

•general economic or business conditions, including unemployment levels, continuing supply chain disruptions and slowdowns in economic growth;

•significant weakening of the local economies in which we operate;

•changes in customer behaviors, including consumer spending, borrowing and saving habits;

•changes in deposit flows and loan demand;

•our failure to attract or retain key employees;

•expansions or consolidations in the Company’s branch network, including that the anticipated benefits of the Company’s branch network optimization project are not fully realized in a timely manner or at all;

•deterioration of the housing market and reduced demand for mortgages; and

•re-emergence of turbulence in significant portions of the global financial and real estate markets that could impact our performance, both directly, by affecting our revenues and the value of our assets and liabilities, and indirectly, by affecting the economy generally and access to capital in the amounts, at the times and on the terms required to support our future businesses.

Many of these factors, as well as other factors, are described in our filings with the SEC including in the “Risk Factors” section of the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, Part II, Item 1A, “Risk Factors” in the Company’s Quarterly Report on Form 10-Q for the periods ended March 31, 2023, June 30, 2023, and September 30, 2023, and in other filings with the Securities and Exchange Commission. All risk factors and uncertainties described herein and therein should be considered in evaluating the Company’s forward-looking statements. Forward-looking statements are based on beliefs and assumptions using information available at the time the statements are prepared. We caution you not to unduly rely on forward-looking statements because the assumptions, beliefs, expectations and projections about future events are expressed in or implied by a forward-looking statement may, and often do, differ materially from actual results. Any forward-looking statement speaks only as to the date on which it is made, and we undertake no obligation to update, revise or clarify any forward-looking statement to reflect developments occurring after the statement is made.

Carter Bankshares, Inc.

Wendy Bell, 276-656-1776

Senior Executive Vice President & Chief Financial Officer

wendy.bell@CBTCares.com

CARTER BANKSHARES, INC.

CONSOLIDATED SELECTED FINANCIAL DATA

BALANCE SHEETS | | | | | | | | | | | | | | | | | | | | |

| (Dollars in Thousands, except per share data) | | December 31,

2023 | | September 30,

2023 | | December 31,

2022 |

| | |

| (unaudited) | | (unaudited) | | (audited) |

| ASSETS | | | | | | |

Cash and Due From Banks, including Interest-Bearing Deposits of $14,853 at December 31, 2023, $17,438 at September 30, 2023 and $4,505 at December 31, 2022 | | $ | 54,529 | | | $ | 55,398 | | | $ | 46,869 | |

| | | | | | |

| | | | | | |

| | | | | | |

| Securities Available-for-Sale, at Fair Value | | 779,003 | | | 793,389 | | | 836,273 | |

| Loans Held-for-Sale | | — | | | — | | | — | |

| | | | | | |

| Portfolio Loans | | 3,505,910 | | | 3,410,940 | | | 3,148,913 | |

| Allowance for Credit Losses | | (97,052) | | | (94,474) | | | (93,852) | |

| Portfolio Loans, net | | 3,408,858 | | | 3,316,466 | | | 3,055,061 | |

| | | | | | |

| Bank Premises and Equipment, net | | 73,707 | | | 73,932 | | | 72,114 | |

| | | | | | |

| Other Real Estate Owned, net | | 2,463 | | | 3,765 | | | 8,393 | |

| Federal Home Loan Bank Stock, at Cost | | 21,626 | | | 27,361 | | | 9,740 | |

| Bank Owned Life Insurance | | 58,115 | | | 57,762 | | | 56,734 | |

| Other Assets | | 114,238 | | | 124,095 | | | 119,335 | |

| Total Assets | | $ | 4,512,539 | | | $ | 4,452,168 | | | $ | 4,204,519 | |

| | | | | | | |

| LIABILITIES | | | | | | |

| Deposits: | | | | | | |

| Noninterest-Bearing Demand | | $ | 685,218 | | | $ | 664,819 | | | $ | 705,539 | |

| Interest-Bearing Demand | | 481,506 | | | 469,904 | | | 496,948 | |

| Money Market | | 513,664 | | | 426,172 | | | 484,238 | |

| Savings | | 454,876 | | | 487,105 | | | 684,287 | |

| Certificates of Deposit | | 1,586,651 | | | 1,511,554 | | | 1,261,526 | |

| | | | | | |

| Total Deposits | | 3,721,915 | | | 3,559,554 | | | 3,632,538 | |

| Federal Home Loan Bank Borrowings | | 393,400 | | | 514,135 | | | 180,550 | |

| Federal Funds Purchased | | — | | | — | | | 17,870 | |

| Other Liabilities | | 45,981 | | | 47,858 | | | 44,934 | |

| Total Liabilities | | 4,161,296 | | | 4,121,547 | | | 3,875,892 | |

| | | | | | |

| SHAREHOLDERS’ EQUITY | | | | | | |

Common Stock, Par Value $1.00 Per Share, Authorized 100,000,000 Shares; | | | | | | |

Outstanding- 22,956,304 shares at December 31, 2023, 22,955,753 shares at September 30, 2023 and 23,956,772 shares at December 31, 2022 | | 22,957 | | | 22,956 | | | 23,957 | |

| Additional Paid-in Capital | | 90,642 | | | 90,254 | | | 104,693 | |

| Retained Earnings | | 309,083 | | | 310,971 | | | 285,593 | |

| Accumulated Other Comprehensive Loss | | (71,439) | | | (93,560) | | | (85,616) | |

| Total Shareholders’ Equity | | 351,243 | | | 330,621 | | | 328,627 | |

| Total Liabilities and Shareholders’ Equity | | $ | 4,512,539 | | | $ | 4,452,168 | | | $ | 4,204,519 | |

| | | | | | | |

| PERFORMANCE RATIOS | | | | | | |

| Return on Average Assets (QTD Annualized) | | (0.17) | % | | 0.33 | % | | 1.49 | % |

| Return on Average Assets (YTD Annualized) | | 0.53 | % | | 0.78 | % | | 1.21 | % |

| Return on Average Shareholders' Equity (QTD Annualized) | | (2.24) | % | | 4.19 | % | | 19.32 | % |

| Return on Average Shareholders’ Equity (YTD Annualized) | | 6.79 | % | | 9.71 | % | | 14.30 | % |

| Portfolio Loans to Deposit Ratio | | 94.20 | % | | 95.82 | % | | 86.69 | % |

| Allowance for Credit Losses to Total Portfolio Loans | | 2.77 | % | | 2.77 | % | | 2.98 | % |

| | | | | | | |

| CAPITALIZATION RATIOS | | | | | | |

| Shareholders' Equity to Assets | | 7.78 | % | | 7.43 | % | | 7.82 | % |

| Tier 1 Leverage Ratio | | 9.48 | % | | 9.70 | % | | 10.29 | % |

| Risk-Based Capital - Tier 1 | | 11.08 | % | | 11.20 | % | | 12.61 | % |

| Risk-Based Capital - Total | | 12.34 | % | | 12.46 | % | | 13.86 | % |

CARTER BANKSHARES, INC.

CONSOLIDATED SELECTED FINANCIAL DATA

(LOSS) INCOME STATEMENTS | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter-to-Date | | Year-to-Date |

| (Dollars in Thousands, except per share data) | | December 31,

2023 | | September 30,

2023 | | December 31,

2022 | | December 31,

2023 | | December 31,

2022 |

| | | | |

| (unaudited) | | (unaudited) | | (audited) | | (unaudited) | | (audited) |

| Interest Income | | $ | 51,863 | | | $ | 48,886 | | | $ | 48,216 | | | $ | 196,420 | | | $ | 160,182 | |

| Interest Expense | | 24,443 | | | 21,492 | | | 6,694 | | | 74,110 | | | 20,254 | |

| NET INTEREST INCOME | | 27,420 | | | 27,394 | | | 41,522 | | | 122,310 | | | 139,928 | |

| | | | | | | | | | |

| Provision for Credit Losses | | 2,895 | | | 1,105 | | | 52 | | | 5,500 | | | 2,419 | |

| Provision (Recovery) for Unfunded Commitments | | 587 | | | (130) | | | 319 | | | 901 | | | 509 | |

| NET INTEREST INCOME AFTER PROVISION (RECOVERY) FOR CREDIT LOSSES | | 23,938 | | | 26,419 | | | 41,151 | | | 115,909 | | | 137,000 | |

| | | | | | | | | | |

| NONINTEREST INCOME | | | | | | | | | | |

| (Losses) Gains on Sales of Securities, net | | (1,511) | | | (1) | | | (2) | | | (1,521) | | | 46 | |

| Service Charges, Commissions and Fees | | 1,775 | | | 1,783 | | | 1,716 | | | 7,155 | | | 7,168 | |

| Debit Card Interchange Fees | | 1,887 | | | 1,902 | | | 1,857 | | | 7,828 | | | 7,427 | |

| Insurance Commissions | | 395 | | | 868 | | | 248 | | | 1,945 | | | 1,961 | |

| Bank Owned Life Insurance Income | | 353 | | | 348 | | | 348 | | | 1,381 | | | 1,357 | |

| (Losses) Gains on Sales and Write-downs of Bank Premises, net | | — | | | — | | | (269) | | | — | | | 73 | |

| | | | | | | | | | |

| Commercial Loan Swap Fee Income | | 25 | | | — | | | — | | | 139 | | | 774 | |

| Other | | 321 | | | 370 | | | 1,646 | | | 1,351 | | | 2,912 | |

| Total Noninterest Income | | 3,245 | | | 5,270 | | | 5,544 | | | 18,278 | | | 21,718 | |

| | | | | | | | | | |

| NONINTEREST EXPENSE | | | | | | | | | | |

| Salaries and Employee Benefits | | 14,599 | | | 13,956 | | | 14,678 | | | 55,856 | | | 52,399 | |

| Occupancy Expense, net | | 3,480 | | | 3,547 | | | 3,467 | | | 14,028 | | | 13,527 | |

| FDIC Insurance Expense | | 2,193 | | | 1,368 | | | 475 | | | 4,904 | | | 2,015 | |

| Other Taxes | | 846 | | | 846 | | | 848 | | | 3,282 | | | 3,319 | |

| Advertising Expense | | 560 | | | 363 | | | 560 | | | 1,693 | | | 1,434 | |

| Telephone Expense | | 503 | | | 500 | | | 391 | | | 1,842 | | | 1,781 | |

| Professional and Legal Fees | | 2,205 | | | 1,512 | | | 2,087 | | | 6,210 | | | 5,818 | |

| Data Processing | | 1,066 | | | 1,076 | | | 1,535 | | | 3,920 | | | 4,051 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Debit Card Expense | | 809 | | | 816 | | | 661 | | | 2,875 | | | 2,750 | |

| Tax Credit Amortization | | — | | | — | | | 155 | | | — | | | 621 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Other | | 2,811 | | | 3,298 | | | 2,760 | | | 10,856 | | | 9,286 | |

| Total Noninterest Expense | | 29,072 | | | 27,282 | | | 27,617 | | | 105,466 | | | 97,001 | |

| | | | | | | | | | |

| (Loss) Income Before Income Taxes | | (1,889) | | | 4,407 | | | 19,078 | | | 28,721 | | | 61,717 | |

| Income Tax (Benefit) Provision | | (1) | | | 780 | | | 3,469 | | | 5,337 | | | 11,599 | |

| Net (Loss) Income | | $ | (1,888) | | | $ | 3,627 | | | $ | 15,609 | | | $ | 23,384 | | | $ | 50,118 | |

| | | | | | | | | | | |

| Shares Outstanding, at End of Period | | 22,956,304 | | | 22,955,753 | | | 23,956,772 | | | 22,956,304 | | | 23,956,772 | |

| Average Shares Outstanding-Basic & Diluted ** | | 22,956,114 | | | 22,946,179 | | | 23,907,447 | | | 23,240,543 | | | 24,595,789 | |

| | | | | | | | | | |

| PER SHARE DATA | | | | | | | | | | |

| Basic (Loss) Earnings Per Common Share* | | $ | (0.08) | | | $ | 0.16 | | | $ | 0.65 | | | $ | 1.00 | | | $ | 2.03 | |

| Diluted (Loss) Earnings Per Common Share* | | $ | (0.08) | | | $ | 0.16 | | | $ | 0.65 | | | $ | 1.00 | | | $ | 2.03 | |

| Book Value | | $ | 15.30 | | | $ | 14.40 | | | $ | 13.72 | | | $ | 15.30 | | | $ | 13.72 | |

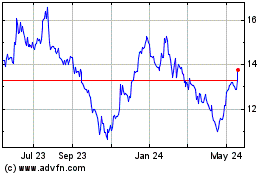

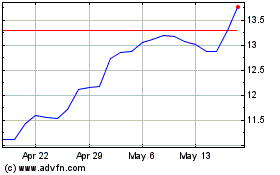

| Market Value | | $ | 14.97 | | | $ | 12.53 | | | $ | 16.59 | | | $ | 14.97 | | | $ | 16.59 | |

| | | | | | | | | | |

| PROFITABILITY RATIOS (GAAP) | | | | | | | | | | |

Net Interest Margin | | 2.47 | % | | 2.52 | % | | 4.04 | % | | 2.85 | % | | 3.48 | % |

Efficiency Ratio | | 94.81 | % | | 83.52 | % | | 58.68 | % | | 75.02 | % | | 60.01 | % |

| PROFITABILITY RATIOS (Non-GAAP) | | | | | | | | | | |

Net Interest Margin (FTE)3 | | 2.49 | % | | 2.54 | % | | 4.07 | % | | 2.87 | % | | 3.51 | % |

Efficiency Ratio (Non-GAAP)4 | | 88.48 | % | | 79.55 | % | | 59.49 | % | | 72.54 | % | | 60.67 | % |

*All outstanding unvested restricted stock awards are considered participating securities for the earnings per share calculation. As such, these shares have been allocated to a portion of net income and are excluded from the diluted earnings per share calculation.

CARTER BANKSHARES, INC.

CONSOLIDATED SELECTED FINANCIAL DATA

**As a result of the net loss for the three months ended December 31, 2023, all average participating shares outstanding are considered anti-dilutive to loss per share.

CARTER BANKSHARES, INC.

CONSOLIDATED SELECTED FINANCIAL DATA

NET INTEREST MARGIN (FTE) (QTD AVERAGES)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | December 31, 2023 | | September 30, 2023 | | December 31, 2022 |

| (Dollars in Thousands) | | Average

Balance | | Income/

Expense | | Rate | | Average

Balance | | Income/

Expense | | Rate | | Average

Balance | | Income/

Expense | | Rate |

| ASSETS | | | | | | | | | | | | | | | | | | |

| Interest-Bearing Deposits with Banks | | $ | 34,849 | | | $ | 479 | | | 5.45 | % | | $ | 12,652 | | | $ | 172 | | | 5.39 | % | | $ | 9,074 | | | $ | 84 | | | 3.67 | % |

Tax-Free Investment Securities3 | | 24,548 | | | 185 | | | 2.99 | % | | 27,594 | | | 203 | | | 2.92 | % | | 29,876 | | | 214 | | | 2.84 | % |

| Taxable Investment Securities | | 878,127 | | | 7,930 | | | 3.58 | % | | 893,386 | | | 7,793 | | | 3.46 | % | | 924,148 | | | 6,680 | | | 2.87 | % |

| Total Securities | | 902,675 | | | 8,115 | | | 3.57 | % | | 920,980 | | | 7,996 | | | 3.44 | % | | 954,024 | | | 6,894 | | | 2.87 | % |

Tax-Free Loans3 | | 115,744 | | | 937 | | | 3.21 | % | | 120,670 | | | 972 | | | 3.20 | % | | 136,441 | | | 1,084 | | | 3.15 | % |

| Taxable Loans | | 3,325,930 | | | 42,082 | | | 5.02 | % | | 3,243,663 | | | 39,578 | | | 4.84 | % | | 2,967,780 | | | 40,339 | | | 5.39 | % |

| Total Loans | | 3,441,674 | | | 43,019 | | | 4.96 | % | | 3,364,333 | | | 40,550 | | | 4.78 | % | | 3,104,221 | | | 41,423 | | | 5.29 | % |

| Federal Home Loan Bank Stock | | 25,260 | | | 486 | | | 7.63 | % | | 22,425 | | | 415 | | | 7.34 | % | | 6,304 | | | 88 | | | 5.54 | % |

| Total Interest-Earning Assets | | 4,404,458 | | | 52,099 | | | 4.69 | % | | 4,320,390 | | | 49,133 | | | 4.51 | % | | 4,073,623 | | | 48,489 | | | 4.72 | % |

| Noninterest Earning Assets | | 81,581 | | | | | | | 88,805 | | | | | | | 84,580 | | | | | |

| Total Assets | | $ | 4,486,039 | | | | | | | $ | 4,409,195 | | | | | | | $ | 4,158,203 | | | | | |

| | | | | | | | | | | | | | | | | | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | | | | | | | | | | | | | |

| Interest-Bearing Demand | | $ | 475,459 | | | $ | 853 | | | 0.71 | % | | $ | 475,939 | | | $ | 720 | | | 0.60 | % | | $ | 504,796 | | | $ | 496 | | | 0.39 | % |

| Money Market | | 470,944 | | | 3,261 | | | 2.75 | % | | 430,954 | | | 2,495 | | | 2.30 | % | | 493,700 | | | 853 | | | 0.69 | % |

| Savings | | 468,975 | | | 130 | | | 0.11 | % | | 504,697 | | | 140 | | | 0.11 | % | | 709,435 | | | 183 | | | 0.10 | % |

| Certificates of Deposit | | 1,546,968 | | | 13,755 | | | 3.53 | % | | 1,486,165 | | | 11,973 | | | 3.20 | % | | 1,249,717 | | | 3,804 | | | 1.21 | % |

| Total Interest-Bearing Deposits | | 2,962,346 | | | 17,999 | | | 2.41 | % | | 2,897,755 | | | 15,328 | | | 2.10 | % | | 2,957,648 | | | 5,336 | | | 0.72 | % |

| Federal Home Loan Bank Borrowings | | 469,893 | | | 6,361 | | | 5.37 | % | | 447,287 | | | 5,986 | | | 5.31 | % | | 106,617 | | | 1,116 | | | 4.15 | % |

| Federal Funds Purchased | | 969 | | | 14 | | | 5.73 | % | | 7,550 | | | 107 | | | 5.62 | % | | 16,227 | | | 161 | | | 3.94 | % |

| Other Borrowings | | 6,607 | | | 69 | | | 4.14 | % | | 6,131 | | | 71 | | | 4.59 | % | | 6,621 | | | 81 | | | 4.85 | % |

| Total Borrowings | | 477,469 | | | 6,444 | | | 5.35 | % | | 460,968 | | | 6,164 | | | 5.31 | % | | 129,465 | | | 1,358 | | | 4.16 | % |

| Total Interest-Bearing Liabilities | | 3,439,815 | | | 24,443 | | | 2.82 | % | | 3,358,723 | | | 21,492 | | | 2.54 | % | | 3,087,113 | | | 6,694 | | | 0.86 | % |

| Noninterest-Bearing Liabilities | | 711,975 | | | | | | | 707,445 | | | | | | | 750,620 | | | | | |

| Shareholders' Equity | | 334,249 | | | | | | | 343,027 | | | | | | | 320,470 | | | | | |

| Total Liabilities and Shareholders' Equity | | $ | 4,486,039 | | | | | | | $ | 4,409,195 | | | | | | | $ | 4,158,203 | | | | | |

Net Interest Income3 | | | | $ | 27,656 | | | | | | | $ | 27,641 | | | | | | | $ | 41,795 | | | |

Net Interest Margin3 | | | | | | 2.49 | % | | | | | | 2.54 | % | | | | | | 4.07 | % |

CARTER BANKSHARES, INC.

CONSOLIDATED SELECTED FINANCIAL DATA

NET INTEREST MARGIN (FTE) (YTD AVERAGES)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | December 31, 2023 | | December 31, 2022 |

| (Dollars in Thousands) | | Average

Balance | | Income/

Expense | | Rate | | Average

Balance | | Income/

Expense | | Rate |

| ASSETS | | | | | | | | | | | | |

| Interest-Bearing Deposits with Banks | | $ | 20,414 | | | $ | 1,066 | | | 5.22 | % | | $ | 50,797 | | | $ | 341 | | | 0.67 | % |

Tax-Free Investment Securities3 | | 27,271 | | | 803 | | | 2.94 | % | | 30,109 | | | 877 | | | 2.91 | % |

| Taxable Investment Securities | | 900,972 | | | 30,804 | | | 3.42 | % | | 950,557 | | | 20,330 | | | 2.14 | % |

| Total Securities | | 928,243 | | | 31,607 | | | 3.41 | % | | 980,666 | | | 21,207 | | | 2.16 | % |

Tax-Free Loans3 | | 123,847 | | | 3,978 | | | 3.21 | % | | 144,617 | | | 4,568 | | | 3.16 | % |

| Taxable Loans | | 3,200,992 | | | 159,317 | | | 4.98 | % | | 2,844,303 | | | 135,055 | | | 4.75 | % |

| Total Loans | | 3,324,839 | | | 163,295 | | | 4.91 | % | | 2,988,920 | | | 139,623 | | | 4.67 | % |

| Federal Home Loan Bank Stock | | 20,342 | | | 1,456 | | | 7.16 | % | | 3,251 | | | 154 | | | 4.74 | % |

| Total Interest-Earning Assets | | 4,293,838 | | | 197,424 | | | 4.60 | % | | 4,023,634 | | | 161,325 | | | 4.01 | % |

| Noninterest Earning Assets | | 89,833 | | | | | | | 117,135 | | | | | |

| Total Assets | | $ | 4,383,671 | | | | | | | $ | 4,140,769 | | | | | |

| | | | | | | | | | | | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | | | | | | | |

| Interest-Bearing Demand | | $ | 483,048 | | | $ | 2,729 | | | 0.56 | % | | $ | 489,298 | | | $ | 1,578 | | | 0.32 | % |

| Money Market | | 448,324 | | | 8,868 | | | 1.98 | % | | 521,269 | | | 1,842 | | | 0.35 | % |

| Savings | | 544,938 | | | 586 | | | 0.11 | % | | 720,682 | | | 742 | | | 0.10 | % |

| Certificates of Deposit | | 1,428,646 | | | 40,445 | | | 2.83 | % | | 1,271,548 | | | 14,454 | | | 1.14 | % |

| Total Interest-Bearing Deposits | | 2,904,956 | | | 52,628 | | | 1.81 | % | | 3,002,797 | | | 18,616 | | | 0.62 | % |

| Federal Home Loan Bank Borrowings | | 402,675 | | | 20,822 | | | 5.17 | % | | 29,849 | | | 1,163 | | | 3.90 | % |

| Federal Funds Purchased | | 7,023 | | | 368 | | | 5.24 | % | | 5,711 | | | 188 | | | 3.29 | % |

| Other Borrowings | | 6,337 | | | 292 | | | 4.61 | % | | 5,885 | | | 287 | | | 4.88 | % |

| Total Borrowings | | 416,035 | | | 21,482 | | | 5.16 | % | | 41,445 | | | 1,638 | | | 3.95 | % |

| Total Interest-Bearing Liabilities | | 3,320,991 | | | 74,110 | | | 2.23 | % | | 3,044,242 | | | 20,254 | | | 0.67 | % |

| Noninterest-Bearing Liabilities | | 718,113 | | | | | | | 746,117 | | | | | |

| Shareholders' Equity | | 344,567 | | | | | | | 350,410 | | | | | |

| Total Liabilities and Shareholders' Equity | | $ | 4,383,671 | | | | | | | $ | 4,140,769 | | | | | |

Net Interest Income3 | | | | $ | 123,314 | | | | | | | $ | 141,071 | | | |

Net Interest Margin3 | | | | | | 2.87 | % | | | | | | 3.51 | % |

LOANS AND LOANS HELD-FOR-SALE

(Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| (Dollars in Thousands) | | December 31,

2023 | | September 30,

2023 | | December 31,

2022 |

| Commercial | | | | | | |

| Commercial Real Estate | | $ | 1,670,631 | | | $ | 1,688,947 | | | $ | 1,470,562 | |

| Commercial and Industrial | | 271,511 | | | 264,329 | | | 309,792 | |

| Total Commercial Loans | | 1,942,142 | | | 1,953,276 | | | 1,780,354 | |

| Consumer | | | | | | |

| Residential Mortgages | | 787,929 | | | 738,368 | | | 657,948 | |

| Other Consumer | | 34,277 | | | 36,487 | | | 44,562 | |

| Total Consumer Loans | | 822,206 | | | 774,855 | | | 702,510 | |

| Construction | | 436,349 | | | 377,576 | | | 353,553 | |

| Other | | 305,213 | | | 305,233 | | | 312,496 | |

| Total Portfolio Loans | | 3,505,910 | | | 3,410,940 | | | 3,148,913 | |

| Loans Held-for-Sale | | — | | | — | | | — | |

| | | | | | |

| Total Loans | | $ | 3,505,910 | | | $ | 3,410,940 | | | $ | 3,148,913 | |

CARTER BANKSHARES, INC.

CONSOLIDATED SELECTED FINANCIAL DATA

ASSET QUALITY DATA

(Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | For the Periods Ended |

| (Dollars in Thousands) | | December 31,

2023 | | September 30,

2023 | | December 31,

2022 |

| Nonaccrual Loans | | | | | | |

| Commercial Real Estate | | $ | 1,324 | | | $ | 1,265 | | | $ | 2,304 | |

| Commercial and Industrial | | 52 | | | 70 | | | 204 | |

| Residential Mortgages | | 3,283 | | | 2,077 | | | 3,265 | |

| Other Consumer | | 59 | | | 22 | | | 8 | |

| Construction | | 2,904 | | | 2,954 | | | 864 | |

| Other | | 301,913 | | | 301,913 | | | — | |

| Total Nonperforming Loans | | 309,535 | | | 308,301 | | | 6,645 | |

| | | | | | |

| Other Real Estate Owned | | 2,463 | | | 3,765 | | | 8,393 | |

| Total Nonperforming Assets | | $ | 311,998 | | | $ | 312,066 | | | $ | 15,038 | |

| | | | | | | | | | | | | | | | | | | | |

| Nonperforming Loans to Total Portfolio Loans | | 8.83 | % | | 9.04 | % | | 0.21 | % |

| Nonperforming Assets to Total Portfolio Loans plus Other Real Estate Owned | | 8.89 | % | | 9.14 | % | | 0.48 | % |

| Allowance for Credit Losses to Total Portfolio Loans | | 2.77 | % | | 2.77 | % | | 2.98 | % |

| Allowance for Credit Losses to Nonperforming Loans | | 31.35 | % | | 30.64 | % | | 1,412.37 | % |

| Net Loan Charge-offs (Recoveries) QTD | | $ | 317 | | | $ | 775 | | | $ | 364 | |

| Net Loan Charge-offs (Recoveries) YTD | | $ | 2,300 | | | $ | 1,983 | | | $ | 4,506 | |

| Net Loan Charge-offs (Recoveries) (Annualized) to Average Portfolio Loans QTD | | 0.04 | % | | 0.09 | % | | 0.05 | % |

| Net Loan Charge-offs (Recoveries) (Annualized) to Average Portfolio Loans YTD | | 0.07 | % | | 0.08 | % | | 0.15 | % |

CARTER BANKSHARES, INC.

CONSOLIDATED SELECTED FINANCIAL DATA

ALLOWANCE FOR CREDIT LOSSES

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Quarter-to-Date | | Year-to-Date | | |

| (Dollars in Thousands) | | December 31,

2023 | | September 30,

2023 | | December 31,

2022 | | December 31,

2023 | | December 31,

2022 | | | | |

| Balance Beginning of Period | | $ | 94,474 | | | $ | 94,144 | | | $ | 94,164 | | | $ | 93,852 | | | $ | 95,939 | | | | | |

| | | | | | | | | | | | | | |

| Provision for Credit Losses | | 2,895 | | | 1,105 | | | 52 | | | 5,500 | | | 2,419 | | | | | |

| Charge-offs: | | | | | | | | | | | | | | |

| Commercial Real Estate | | — | | | — | | | — | | | — | | | — | | | | | |

| Commercial and Industrial | | 12 | | | 50 | | | 4 | | | 63 | | | 3,436 | | | | | |

| Residential Mortgages | | — | | | 133 | | | 1 | | | 203 | | | 46 | | | | | |

| Other Consumer | | 626 | | | 731 | | | 433 | | | 2,665 | | | 1,677 | | | | | |

| Construction | | — | | | — | | | — | | | 42 | | | — | | | | | |

| Other | | — | | | — | | | — | | | — | | | — | | | | | |

| Total Charge-offs | | 638 | | | 914 | | | 438 | | | 2,973 | | | 5,159 | | | | | |

| Recoveries: | | | | | | | | | | | | | | |

| Commercial Real Estate | | — | | | — | | | — | | | — | | | — | | | | | |

| Commercial and Industrial | | 83 | | | — | | | — | | | 88 | | | 1 | | | | | |

| Residential Mortgages | | 98 | | | 10 | | | 2 | | | 110 | | | 99 | | | | | |

| Other Consumer | | 140 | | | 129 | | | 72 | | | 475 | | | 404 | | | | | |

| Construction | | — | | | — | | | — | | | — | | | 149 | | | | | |

| Other | | — | | | — | | | — | | | — | | | — | | | | | |

| Total Recoveries | | 321 | | | 139 | | | 74 | | | 673 | | | 653 | | | | | |

| Total Net Charge-offs | | 317 | | | 775 | | | 364 | | | 2,300 | | | 4,506 | | | | | |

| Balance End of Period | | $ | 97,052 | | | $ | 94,474 | | | $ | 93,852 | | | $ | 97,052 | | | $ | 93,852 | | | | | |

CARTER BANKSHARES, INC.

CONSOLIDATED SELECTED FINANCIAL DATA

(Unaudited)

(Dollars in Thousands, except per share data)

DEFINITIONS AND RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

1 Pre-tax Pre-provision Income (Non-GAAP) | | Quarter-to-Date | | Year-to-Date | | |

| | | December 31,

2023 | | September 30,

2023 | | December 31,

2022 | | December 31,

2023 | | December 31,

2022 | | | | |

| Net Interest Income | | $ | 27,420 | | | $ | 27,394 | | | $ | 41,522 | | | $ | 122,310 | | | $ | 139,928 | | | | | |

| Noninterest Income | | 3,245 | | | 5,270 | | | 5,544 | | | 18,278 | | | 21,718 | | | | | |

| Noninterest Expense | | 29,072 | | | 27,282 | | | 27,617 | | | 105,466 | | | 97,001 | | | | | |

| Pre-tax Pre-provision Income | | $ | 1,593 | | | $ | 5,382 | | | $ | 19,449 | | | $ | 35,122 | | | $ | 64,645 | | | | | |

| | | | | | | | | | | | | | |

| Less: Losses (Gains) on Sales of Securities, net | | $ | 1,511 | | | $ | 1 | | | $ | 2 | | | $ | 1,521 | | | $ | (46) | | | | | |

| Losses (Gains) on Sales and Write-downs of Bank Premises, net | | 19 | | | 18 | | | 269 | | | 103 | | | (73) | | | | | |

| Losses on Sales and Write-downs of OREO, net | | 201 | | | 904 | | | 164 | | | 1,100 | | | 432 | | | | | |

Non-recurring one-time Operating Expense7 | | — | | | 193 | | | — | | | 193 | | | — | | | | | |

Non-recurring Fees5 | | — | | | — | | | — | | | — | | | (70) | | | | | |

| OREO Income | | (21) | | | (20) | | | (15) | | | (75) | | | (50) | | | | | |

| | | | | | | | | | | | | | |

| FHLB Prepayment Penalty | | — | | | — | | | — | | | — | | | 18 | | | | | |

| Associate Separations | | 192 | | | — | | | — | | | 192 | | | 40 | | | | | |

| Contingent Liability | | — | | | — | | | 35 | | | 115 | | | 185 | | | | | |

| Gain on Loans Held-for-Sale | | — | | | — | | | (295) | | | — | | | (295) | | | | | |

| Gain on Tax Credit Exits | | — | | | — | | | (1,209) | | | — | | | (1,209) | | | | | |

Tax Credit Amortization Reversal6 | | — | | | — | | | — | | | — | | | (1,379) | | | | | |

| | | | | | | | | | | | | | |

| Pre-tax Pre-provision Income (Non-GAAP) | | $ | 3,495 | | | $ | 6,478 | | | $ | 18,400 | | | $ | 38,271 | | | $ | 62,198 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

2 Net (Loss) Income (Non-GAAP) | | Quarter-to-Date | | Year-to-Date | | |

| | | December 31,

2023 | | September 30,

2023 | | December 31,

2022 | | December 31,

2023 | | December 31,

2022 | | | | |

| Net (Loss) Income | | $ | (1,888) | | | $ | 3,627 | | | $ | 15,609 | | | $ | 23,384 | | | $ | 50,118 | | | | | |

| Less: Losses (Gains) on Sales of Securities, net | | 1,511 | | | 1 | | | 2 | | | 1,521 | | | (46) | | | | | |

| Losses (Gains) on Sales and Write-downs of Bank Premises, net | | 19 | | | 18 | | | 269 | | | 103 | | | (73) | | | | | |

| Losses on Sales and Write-downs of OREO, net | | 201 | | | 904 | | | 164 | | | 1,100 | | | 432 | | | | | |

Non-recurring one-time Operating Expense7 | | — | | | 193 | | | — | | | 193 | | | — | | | | | |

Non-recurring Fees5 | | — | | | — | | | — | | | — | | | (70) | | | | | |

| OREO Income | | (21) | | | (20) | | | (15) | | | (75) | | | (50) | | | | | |

| | | | | | | | | | | | | | |

| FHLB Prepayment Penalty | | — | | | — | | | — | | | — | | | 18 | | | | | |

| Associate Separations | | 192 | | | — | | | — | | | 192 | | | 40 | | | | | |

| Contingent Liability | | — | | | — | | | 35 | | | 115 | | | 185 | | | | | |

| Gain on Loans Held-for-Sale | | — | | | — | | | (295) | | | — | | | (295) | | | | | |

| Gain on Tax Credit Exits | | — | | | — | | | (1,209) | | | — | | | (1,209) | | | | | |

Tax Credit Amortization Reversal6 | | — | | | — | | | — | | | — | | | (1,379) | | | | | |

| Total Tax Effect | | (399) | | | (230) | | | 220 | | | (661) | | | 514 | | | | | |

| | | | | | | | | | | | | | |

| Net (Loss) Income (Non-GAAP) | | $ | (385) | | | $ | 4,493 | | | $ | 14,780 | | | $ | 25,872 | | | $ | 48,185 | | | | | |

| | | | | | | | | | | | | | |

| Average Shares Outstanding - diluted | | 22,956,114 | | | 22,946,179 | | | 23,907,447 | | | 23,240,543 | | | 24,595,789 | | | | | |

| (Loss) Earnings Per Common Share (diluted) (Non-GAAP) | | $ | (0.02) | | | $ | 0.20 | | | $ | 0.62 | | | $ | 1.11 | | | $ | 1.96 | | | | | |

CARTER BANKSHARES, INC.

CONSOLIDATED SELECTED FINANCIAL DATA

3 Net interest income has been computed on a fully taxable equivalent basis ("FTE") using 21% federal income tax rate for the 2023 and 2022 periods.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Interest Income (FTE) (Non-GAAP) | | Quarter-to-Date | | Year-to-Date | | |

| | | December 31,

2023 | | September 30,

2023 | | December 31,

2022 | | December 31,

2023 | | December 31,

2022 | | | | |

| Interest and Dividend Income (GAAP) | | $ | 51,863 | | | $ | 48,886 | | | $ | 48,216 | | | $ | 196,420 | | | $ | 160,182 | | | | | |

Tax Equivalent Adjustment3 | | 236 | | | 247 | | | 273 | | | 1,004 | | | 1,143 | | | | | |

| Interest and Dividend Income (FTE) (Non-GAAP) | | 52,099 | | | 49,133 | | | 48,489 | | | 197,424 | | | 161,325 | | | | | |

| Average Earning Assets | | 4,404,458 | | | 4,320,390 | | | 4,073,623 | | | 4,293,838 | | | 4,023,634 | | | | | |

| Yield on Interest-earning Assets (GAAP) | | 4.67 | % | | 4.49 | % | | 4.70 | % | | 4.57 | % | | 3.98 | % | | | | |

| Yield on Interest-earning Assets (FTE) (Non-GAAP) | | 4.69 | % | | 4.51 | % | | 4.72 | % | | 4.60 | % | | 4.01 | % | | | | |

| | | | | | | | | | | | | | |

| Net Interest Income (GAAP) | | 27,420 | | | 27,394 | | | 41,522 | | | 122,310 | | | 139,928 | | | | | |

Tax Equivalent Adjustment3 | | 236 | | | 247 | | | 273 | | | 1,004 | | | 1,143 | | | | | |

| Net Interest Income (FTE) (Non-GAAP) | | $ | 27,656 | | | $ | 27,641 | | | $ | 41,795 | | | $ | 123,314 | | | $ | 141,071 | | | | | |

| Average Earning Assets | | $ | 4,404,458 | | | $ | 4,320,390 | | | $ | 4,073,623 | | | $ | 4,293,838 | | | $ | 4,023,634 | | | | | |

| Net Interest Margin (GAAP) | | 2.47 | % | | 2.52 | % | | 4.04 | % | | 2.85 | % | | 3.48 | % | | | | |

| Net Interest Margin (FTE) (Non-GAAP) | | 2.49 | % | | 2.54 | % | | 4.07 | % | | 2.87 | % | | 3.51 | % | | | | |

(Unaudited)

(Dollars in Thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

4 Efficiency Ratio (Non-GAAP) | | Quarter-to-Date | | Year-to-Date | | |

| | | December 31,

2023 | | September 30,

2023 | | December 31,

2022 | | December 31,

2023 | | December 31,

2022 | | | | |

| Noninterest Expense | | $ | 29,072 | | | $ | 27,282 | | | $ | 27,617 | | | $ | 105,466 | | | $ | 97,001 | | | | | |

| Less: Losses on sales and write-downs of Branch Premises, net | | (19) | | | (18) | | | — | | | (103) | | | — | | | | | |

| Less: Losses on Sales and write-downs of OREO, net | | (201) | | | (904) | | | (164) | | | (1,100) | | | (432) | | | | | |

Less: Non-recurring one-time Operating Expense7 | | — | | | (193) | | | — | | | (193) | | | — | | | | | |

| Less: FHLB Prepayment Penalty | | — | | | — | | | — | | | — | | | (18) | | | | | |

Add:Tax Credit Amortization Reversal6 | | — | | | — | | | — | | | — | | | 1,379 | | | | | |

| Less: Associate Separations | | (192) | | | — | | | — | | | (192) | | | (40) | | | | | |

| Less: Contingent Liability | | — | | | — | | | (35) | | | (115) | | | (185) | | | | | |

| Noninterest Expense (Non-GAAP) | | $ | 28,660 | | | $ | 26,167 | | | $ | 27,418 | | | $ | 103,763 | | | $ | 97,705 | | | | | |

| | | | | | | | | | | | | | |

| Net Interest Income | | $ | 27,420 | | | $ | 27,394 | | | $ | 41,522 | | | $ | 122,310 | | | $ | 139,928 | | | | | |

Plus: Taxable Equivalent Adjustment3 | | 236 | | | 247 | | | 273 | | | 1,004 | | | 1,143 | | | | | |

| Net Interest Income (FTE) (non-GAAP) | | $ | 27,656 | | | $ | 27,641 | | | $ | 41,795 | | | $ | 123,314 | | | $ | 141,071 | | | | | |

| Less: Losses (Gains) on Sales of Securities, net | | 1,511 | | | 1 | | | 2 | | | 1,521 | | | (46) | | | | | |

| Less: Losses (Gains) on Sales of Bank Premises, net | | — | | | — | | | 269 | | | — | | | (73) | | | | | |

Less: Non-recurring Fees5 | | — | | | — | | | — | | | — | | | (70) | | | | | |

| Less: OREO Income | | (21) | | | (20) | | | (15) | | | (75) | | | (50) | | | | | |

| | | | | | | | | | | | | | |

| Less: Gain on Loans Held-for-Sale | | — | | | — | | | (295) | | | — | | | (295) | | | | | |

| Less: Gain on Tax Credit Exits | | — | | | — | | | (1,209) | | | — | | | (1,209) | | | | | |

| Noninterest Income | | 3,245 | | | 5,270 | | | 5,544 | | | 18,278 | | | 21,718 | | | | | |

| Net Interest Income (FTE) (Non-GAAP) plus Noninterest Income | | $ | 32,391 | | | $ | 32,892 | | | $ | 46,091 | | | $ | 143,038 | | | $ | 161,046 | | | | | |

| Efficiency Ratio (GAAP) | | 94.81 | % | | 83.52 | % | | 58.68 | % | | 75.02 | % | | 60.01 | % | | | | |

| Efficiency Ratio (Non-GAAP) | | 88.48 | % | | 79.55 | % | | 59.49 | % | | 72.54 | % | | 60.67 | % | | | | |

5 The non-recurring fees include Paycheck Protection Program related fees.

6 Tax credit amortization was reversed due to the extension of the in-service date from 2022 to 2023.

7 The non-recurring includes a one-time operating expense.

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |